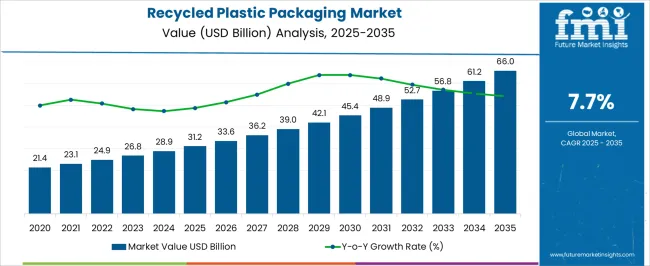

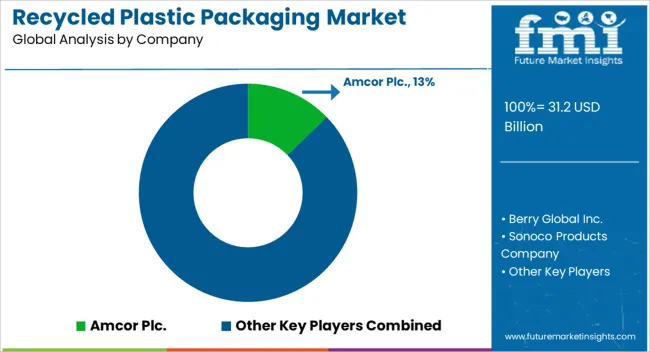

The Recycled Plastic Packaging Market is estimated to be valued at USD 31.2 billion in 2025 and is projected to reach USD 66.0 billion by 2035, registering a compound annual growth rate (CAGR) of 7.7% over the forecast period.

| Metric | Value |

|---|---|

| Recycled Plastic Packaging Market Estimated Value in (2025 E) | USD 31.2 billion |

| Recycled Plastic Packaging Market Forecast Value in (2035 F) | USD 66.0 billion |

| Forecast CAGR (2025 to 2035) | 7.7% |

The recycled plastic packaging market is gaining momentum, driven by rising regulatory pressures, corporate sustainability goals, and increasing consumer awareness of environmental concerns. Packaging producers are increasingly incorporating recycled content to reduce carbon footprints and comply with circular economy initiatives.

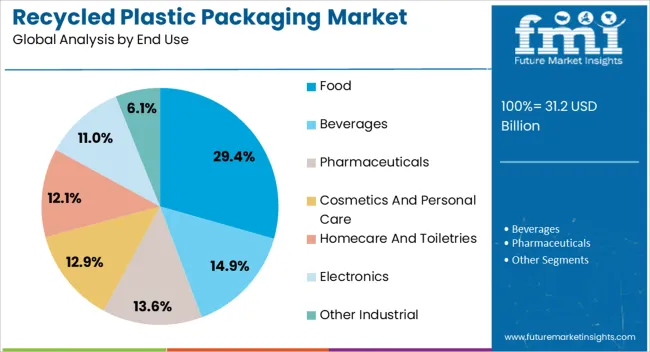

The current market reflects strong demand from food, beverage, and pharmaceutical industries, which are actively shifting toward eco-friendly packaging solutions. Technological advancements in recycling processes have improved material quality, enabling wider application without compromising performance.

Market growth is further supported by extended producer responsibility (EPR) programs and collaborations between packaging manufacturers and recyclers. With global emphasis on reducing plastic waste and achieving closed-loop systems, the recycled plastic packaging market is expected to expand steadily, offering long-term opportunities for innovation and investment.

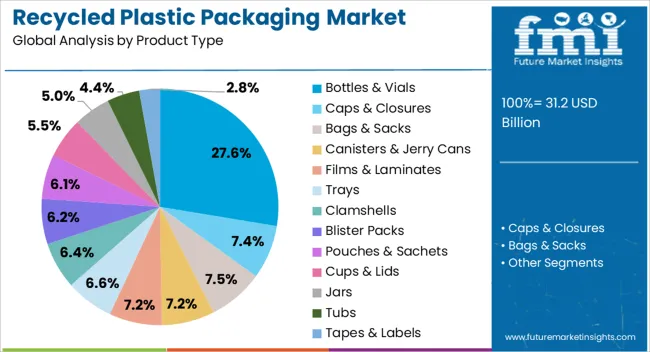

The bottles and vials segment leads the product type category, holding approximately 27.60% share. This dominance is driven by the high demand for recyclable containers in the beverage, pharmaceutical, and personal care industries.

Bottles and vials are among the most visible and widely collected plastic packaging formats, making them a priority for recycling initiatives. Manufacturers are increasingly incorporating recycled resins into bottle production to meet sustainability commitments and regulatory requirements.

With continuous improvements in recycling infrastructure and strong consumer preference for sustainable packaging, the bottles and vials segment is expected to retain its leading position in the product category.

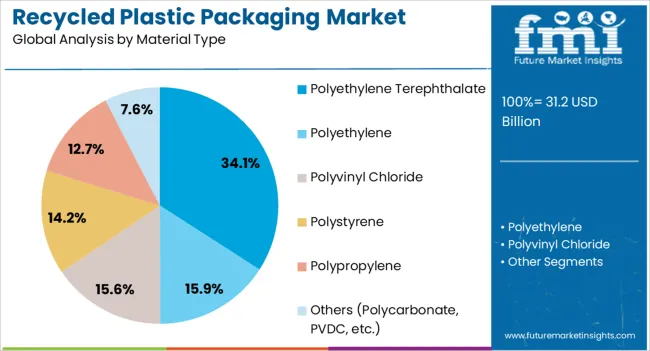

The polyethylene terephthalate (PET) segment dominates the material type category with approximately 34.10% share. PET’s recyclability, clarity, and mechanical strength make it the most widely used material in food, beverage, and pharmaceutical packaging.

Its well-established recycling stream and ability to be repeatedly reprocessed without significant degradation have reinforced its leadership. PET’s cost-effectiveness and lightweight nature further contribute to its broad adoption.

With increasing emphasis on closed-loop recycling and sustainable sourcing, PET is expected to remain the most dominant material type in the recycled plastic packaging market.

The food segment holds approximately 29.40% share in the end-use category, reflecting strong demand for sustainable packaging solutions in the global food industry. Rising consumer preference for environmentally friendly packaging, coupled with regulatory mandates to reduce single-use plastics, has accelerated adoption.

Recycled plastic is increasingly used in food-grade packaging formats such as bottles, trays, and containers. Manufacturers are investing in advanced recycling technologies to ensure safety and compliance with food contact standards.

With ongoing growth in packaged food consumption and heightened sustainability commitments, the food segment is expected to remain the leading end-use area in the recycled plastic packaging market.

The Rise of Recycled Plastic Consumption in Today's Market: Companies, recognizing environmental concerns, increasingly opt for recycled materials. Contrary to a common belief, sustainable packaging is not always pricier for retailers compared to less eco-friendly options. Also, consumers are crucial since they choose environmentally friendly products. As demand and sustainability converge, a more conscientious and environmentally conscious market is created. This is a sign of positive developments. Meeting sustainability commitments is likely to lead to a surge in demand for recycled plastic packaging by 2035.

Innovative Brands Lead the Way with Recycled Content in Packaging Solutions: Brand owners are actively launching new packaging formats and creating innovative solutions to increase product recyclability and the amount of recycled content. This is driven by their commitment to sustainable packaging, addressing consumer concerns, and adapting to the growing regulatory pressure. These innovative companies understand the importance of minimizing their ecological footprint and have adopted eco-friendly practices. For instance, Unilever's Love Beauty & Planet demonstrates a commitment to environmental stewardship by crafting the packaging for its hair and body care products entirely from 100% recycled plastic.

Governments are Crafting Regulations for Packaging to Redefine a Sustainable Future: Governments are making rules for recycled plastic packaging. They want to make sure it helps the environment. The goal is to reuse materials, stop waste, and encourage responsible production. For instance, in April 2025, plastic packaging taxation (PPT) was implemented with the aim of encouraging businesses to utilize recycled plastic in their plastic packaging. Businesses that import or manufacture 10 tons or more of plastic packaging into the United Kingdom during a rolling 12-month period are required to file paperwork with HMRC in order to pay PPT.

From 2020 to 2025, the recycled plastic packaging industry showed modest growth, boasting a 4.0% CAGR. During this period, the market witnessed a substantial increase in size, climbing from USD 21.4 billion in 2020 to reach USD 31.2 billion in 2025. All through these years, there has been a notable shift in consumer perceptions about sustainable packaging.

Recycled plastic packaging received a lot of attention from retailers, fast-moving consumer goods (FMCG) corporations, and regulatory agencies were taking significant action in this field. FMCG businesses and retailers have taken significant steps in response to public concerns over the waste of single-use packaging. With a growing recyclability ratio, companies are adapting their production processes to meet this eco-conscious demand. This led to substantial actions, fostering a notable trajectory in the growth of post-consumer recycled plastic packaging market.

| Historical CAGR (2020 to 2025) | 4.0% |

|---|---|

| Forecasted CAGR (2025 to 2035) | 7.8% |

Looking at the table above, it is clear that the projected CAGR for the recycled plastic packaging market is higher than its historical CAGR. This suggests positive growth trends. Recycled plastic packaging is becoming a versatile and eco-friendly choice across various industries. This global trends in recycled plastic packaging is expected to continue in the upcoming years. Its sustainable touch can be found in sectors ranging from food and beverage to personal care and beyond.

Companies in the consumer goods, retail, and electronics industries are also embracing recycled plastic packaging to reduce environmental impact. As a result, there is a notable increase in per capita packaging consumption, highlighting the positive shift toward environmentally friendly choices across various markets.

| Industry | Future Prospects |

|---|---|

| Food and Beverage | Governments are promoting the use of recycled plastic packaging across the food and beverage industry. For example, In India, the Food Safety and Standards Authority of India (FSSAI) recently circulated a directive concerning the implementation of the Draft FSS (Packaging) Amendment Regulations, 2025, which allow the implement of recycled plastic for food packaging. |

| Personal Care and Cosmetics | Several businesses have already adopted recycled plastic packaging. L'Oréal, for instance, employs post-consumer recycled plastics in its environmentally friendly cosmetic packaging. Furthermore, recyclable materials make up 80% of the plastic packaging used by Kiehl. As recycling processes become more efficient, the industry is likely to witness a further surge in recycled plastic packaging demand. |

| Retail and Consumer Goods | The future outlook in this industry suggests a shift toward a circular economy where the life cycle of plastic is extended through recycling. Companies with a strong commitment to creating a sustainable future include The Coca-Cola Company. It currently uses only recycled plastic for its 500 ml bottles, saving 29,000 tons of virgin plastic annually. |

| Electronics | The industry is increasingly recognizing the importance of sustainability, prompting a shift toward eco-friendly practices. The top smartphone manufacturer in the world, Samsung Electronics, has made the decision to stop utilizing plastic in packaging by 2025 and to employ recycled plastic components in all of its new flagship Galaxy devices. |

| Logistics and eCommerce | In the ever-evolving landscape of the eCommerce and logistics industry, the utilization of recycled content in packaging industry is gaining momentum. In addition to offering a line of clothes made of recycled materials, Patagonia distributes its goods in bags created from recycled plastic. Flipkart, a company owned by Walmart, likewise wants its supply chain to contain only recycled plastic. |

| Attributes | Details |

|---|---|

| Trends |

|

| Opportunities |

|

North America stands out as a dominant force in the recycled plastic packaging industry, with a substantial increase in demand for sustainable packaging solutions. Meanwhile, Asia Pacific is experiencing rapid growth, fueled by its growing commitment to environmentally friendly practices. These dynamics underscore a global shift toward ecological packaging solutions, with North America leading the way and the Asia Pacific emerging as a key player in this sprouting landscape.

North America's packaging sector has experienced significant transformation in recent years, driven by advancements in digital printing, sustainability, and eCommerce expansion. This has led to a rise in the demand for packaging made of recycled plastic. Since recycled plastics have a lower carbon footprint during production than virgin plastics, end-use industries are turning their attention to using recycled plastics for packaging.

| Countries | Forecasted CAGR (2025 to 2035) |

|---|---|

| United States | 5.3% |

| Canada | 6.5% |

The United States’ market is driven by ever-sophisticated and better processing methods of eco-friendly plastic packaging. Government agencies and other organizations work with the leading players in the recyclable packaging materials industry to promote their packaging.

Several businesses and brand houses have made promises to include 25% of post-consumer recycled plastic in their packaging by 2025 in response to growing investor and consumer scrutiny of the environmental effects of plastic packaging. For instance, Hamilton Perkins Collection took a sustainable leap by crafting Earth Bags exclusively from 100% recycled plastic bottles.

Canada is expected to expand at a faster rate since numerous sectors are implementing innovative packaging processes. The surge in exports of packaged foods is driving a growing demand for recycled plastic packaging. Canada exports processed food products to a staggering 190 countries, with a substantial portion reaching key markets such as the United States, China, Japan, Mexico, Russia, and South Korea. In October 2025, Coca-Cola declared that by early 2025, all 500 ml sparkling beverage bottles in Canada are going to be constructed entirely of recycled plastic.

In terms of sustainability, Europe is renowned for its rigorous regulations. Europe's expanding demand for packaged food and non-food products is driving growth in the retail sector. It generates an exclusive demand for environmentally friendly packaging options, which is anticipated to greatly boost the recycled plastic packaging market growth.

| Countries | Forecasted CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.3% |

| Germany | 5.0% |

The government of the United Kingdom has put laws into place to support recycling, cut down on single-use plastics, and increase the amount of recycled plastic that is used in packaging. As a result of these more stringent regulations, many firms are working toward incorporating eco-friendly plastic packaging.

These factors are likely to propel the expansion of the recycled plastic packaging market in the United Kingdom. Magnum wants 100% of their tubs to be composed of recycled plastic by 2025. In 2024, Magnum produced over 30 million tubs using 750MT of recycled plastic.

Consumers are becoming more health conscious, which is driving up demand for healthier food and beverages. This is one of the main factors propelling the Germany recycled plastic packaging market growth. Gutfried, BASF, SABIC, and SÜDPACK united to develop an eco-friendly recycled plastic packaging solution for sausages in Germany.

Packaging design for recycling and recyclability, as well as the use of recyclable and renewable materials, are imposed by German package law. Germany is going to enforce the 'Mehrwegpflicht,' or the requirement to provide reusable packaging, as of January 2025.

With a sizable middle class and rising population, Asia Pacific is becoming a hotspot for the recycled plastic packaging market, especially in the food and beverage industry, where there is a growing need for packaged goods. Growing consumption has made sustainable packaging solutions a top priority for local and global businesses in order to comply with regulations and address environmental issues.

| Countries | Forecasted CAGR (2025 to 2035) |

|---|---|

| China | 8.7% |

| India | 9.1% |

China is making significant investments in cutting-edge recycling technology, such as the recycling of biodegradable plastic and industrial composting. High-quality recyclable packaging materials are now more readily available as a result of their concentration on improving waste management and recycling infrastructure.

Recycled plastic packaging is becoming increasingly popular in China, a country with enormous development potential due to a move toward eco-friendly alternatives. Mengniu, a well-known dairy company in China, is the first company in the country's food business to employ recycled plastic shrink film for its dairy products' secondary packaging.

The growing food and beverage industry in India, together with the personal care and cosmetics sectors, is driving the recycled plastic packaging market expansion. In July 2025, Himalaya Herbals, a much-loved Indian brand known for its diverse range of personal care and wellness products, took significant strides toward environmental responsibility.

It has embraced sustainability by minimizing plastic packaging and instead opting for eco-friendly alternatives such as recyclable bottles and tubes crafted from post-consumer recycled plastic. The market in India has also benefited from the tremendous expansion of eCommerce sector.

As far as the material is concerned, the polyethylene terephthalate (PET) segment is likely to dominate the industry in 2025, accounting for a 43.7% market share. Similarly, the food segment is expected to take the lead when considering end use, commanding an 18.90% recycled plastic packaging market share in 2025.

| Segment | Market Share in 2025 |

|---|---|

| Polyethylene Terephthalate (PET) Material | 43.7% |

| Food End Use | 31.8% |

PET, or polyethylene terephthalate, is a common polymer used in packaging. The widespread usage of PET in beverage and food packaging is the main reason behind its dominance in the market. PET is a material that has several benefits, including a high strength-to-weight ratio, shatterproof nature, and non-reactivity when exposed to food or beverage. When items are transported in PET packaging, lightweightness also results in cost savings.

PET is more appealing since it can be recycled, which is compatible with the increasing emphasis on environmental conscience. The material's supremacy in the market is primarily due to its simplicity of processing, which offers solutions at a reasonable price without sacrificing quality. PET continues to set the standard for recycled plastic packaging in response to the growing sales of recycled plastic envelope.

The burgeoning food and beverage sector offers a substantial prospect for the recycled plastic packaging market. Companies are actively looking for sustainable packaging solutions worldwide to meet customer expectations and environmental aims as the world's food consumption rises. With its eco-friendly reputation and less carbon impact, recycled plastic packaging is well-positioned to satisfy this demand.

Several food businesses are switching to recycled plastic materials to show their dedication to sustainability and lessen their reliance on virgin plastics. One of the top food and beverage businesses in the world uses rPET (recycled plastic PET) food packaging, which is made in South America by New World Recycling. The company uses a method that complies with food contact regulations to recycle plastics for use in food packaging. About 300 million PET bottles are recycled in a closed-loop process and repurposed into useful containers as a consequence of their food packaging recycling program.

In a bid to dominate the market, start-ups leverage innovation by developing eco-friendly alternatives. They focus on cost-effective solutions, ensuring competitive pricing while maintaining high-quality standards. EcoPackables, a forward-thinking start-up rooted in the United States, is on a mission to craft sustainable packaging solutions from repurposed materials.

The company employs compostable and customizable raw materials, including polymers, recycled plastic, and recycled paper. Its product line encompasses compostable shipping labels made from post-consumer recycled white paper with a non-toxic adhesive. This showcases the commitment to environmentally friendly solutions.

Recycled plastic packaging market players deploy multiple strategies to hone down on their specialty. Certain emphasize state-of-the-art technical advancements that improve their longevity and performance. A strong eco-friendly brand image is established by those who value sustainable sourcing. A handful of them prioritize cost leadership by optimizing production procedures to provide competitive prices. Some companies' strong supply chains are a result of their strategic partnership with suppliers and relationships with important recycling industry players.

Recent Developments

The global recycled plastic packaging market is estimated to be valued at USD 31.2 billion in 2025.

The market size for the recycled plastic packaging market is projected to reach USD 66.0 billion by 2035.

The recycled plastic packaging market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in recycled plastic packaging market are bottles & vials, caps & closures, bags & sacks, canisters & jerry cans, films & laminates, trays, clamshells, blister packs, pouches & sachets, cups & lids, jars, tubs and tapes & labels.

In terms of material type, polyethylene terephthalate segment to command 34.1% share in the recycled plastic packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Recycled Ocean Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Post-Consumer Recycled (PCR) Plastic Packaging Market Analysis Size, Share & Forecast 2025 to 2035

Assessing Post-Consumer Recycled Plastic Packaging Market Share & Industry Trends

Recycled Concrete Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Recycled Metal Market Size and Share Forecast Outlook 2025 to 2035

Recycled Elastomers Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Market Size and Share Forecast Outlook 2025 to 2035

Recycled Asphalt Pavement Market Size and Share Forecast Outlook 2025 to 2035

Recycled Carbon Fiber Market Size and Share Forecast Outlook 2025 to 2035

Recycled Prescription Bag Market Size and Share Forecast Outlook 2025 to 2035

Recycled Fabric Bag Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Recycled Scrap Metal Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Recycled Prescription Bag Industry

Competitive Breakdown of Recycled Paper Suppliers

Recycled Polyethylene Terephthalate (rPET) Packaging Market Growth and Trends 2025 to 2035

Recycled Envelopes Market

Recycled PET Packaging Market Size, Share & Forecast 2025 to 2035

Recycled Paper Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Packaging Market Trends & Growth Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA