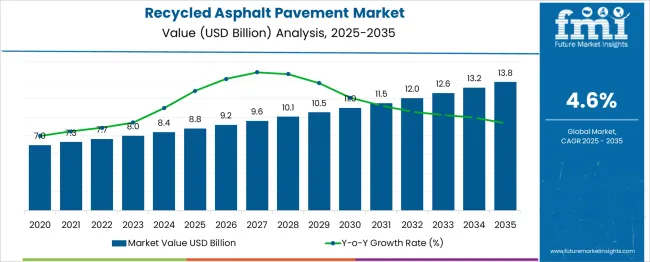

The Recycled Asphalt Pavement Market is estimated to be valued at USD 8.8 billion in 2025 and is projected to reach USD 13.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period. Scenario-based forecasting provides insight into how market trajectories may differ under varying conditions. In the base case scenario, consistent investments in road maintenance and infrastructure rehabilitation are assumed, supporting steady adoption of recycled asphalt pavement technologies.

Under this trajectory, the market grows gradually from USD 8.8 billion in 2025 to USD 13.8 billion in 2035, reflecting incremental gains driven by standardization of recycling practices, regulatory encouragement, and cost advantages over virgin asphalt. In an aggressive growth scenario, heightened regulatory incentives, such as stricter environmental mandates and carbon reduction targets, accelerate adoption of recycled asphalt pavement.

Rapid infrastructure projects and government-led sustainability initiatives push the market ahead of base expectations, potentially bringing forward the attainment of mid-term market milestones by several years. This scenario could see adoption rates in early years exceeding projections, with a sharper slope in market value growth between 2025 and 2030, reflecting stronger early penetration in both urban and regional road networks.

A conservative scenario accounts for potential delays in policy implementation, lower budget allocations, or supply chain constraints, which would temper growth. Under such conditions, annual increases remain subdued, with slower gains toward the 2035 forecast. Scenario-based forecasting highlights the market’s sensitivity to regulatory and infrastructure dynamics, emphasizing the impact of policy, investment, and operational efficiency on adoption patterns over the 2025–2035 horizon.

| Metric | Value |

|---|---|

| Recycled Asphalt Pavement Market Estimated Value in (2025 E) | USD 8.8 billion |

| Recycled Asphalt Pavement Market Forecast Value in (2035 F) | USD 13.8 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The Recycled Asphalt Pavement market is gaining strong traction, supported by the growing demand for sustainable and cost-effective construction materials. Escalating raw material costs and heightened environmental regulations have encouraged public and private stakeholders to adopt asphalt recycling solutions. The rising focus on circular construction practices and government-led infrastructure revitalization programs has enhanced the viability of recycled asphalt across developed and emerging economies.

Additionally, advancements in recycling equipment and on-site processing technologies have improved operational efficiency, making recycled asphalt a reliable alternative to virgin materials. The use of recycled asphalt also contributes to reduced landfill pressure and carbon emissions, aligning with the sustainability targets set by several countries.

The market is expected to experience steady expansion, fueled by increased investments in highway modernization, urban infrastructure, and resource conservation strategies. Long-term growth prospects remain favorable as recycled asphalt continues to offer both economic and environmental advantages in large-scale construction projects..

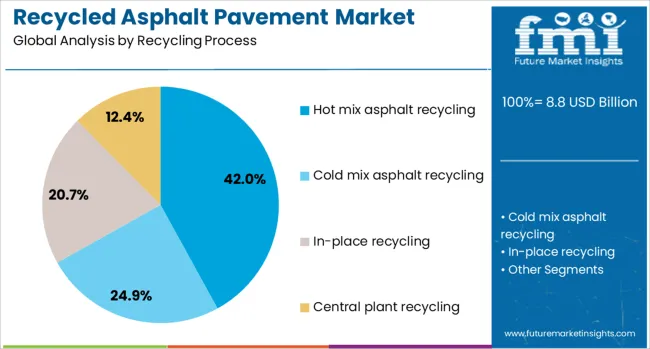

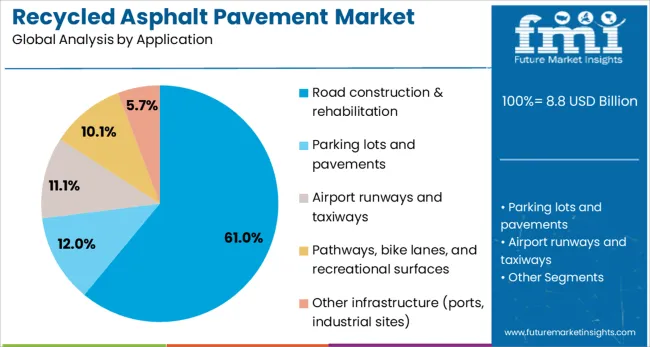

The recycled asphalt pavement market is segmented by recycling process, application end use, and geographic regions. The recycling process of the recycled asphalt pavement market is divided into Hot mix asphalt recycling, Cold mix asphalt recycling, In-place recycling, and Central plant recycling. In terms of application, the recycled asphalt pavement market is classified into Road construction & rehabilitation, Parking lots and pavements, Airport runways and taxiways, Pathways, bike lanes, and recreational surfaces, and Other infrastructure (ports, industrial sites).

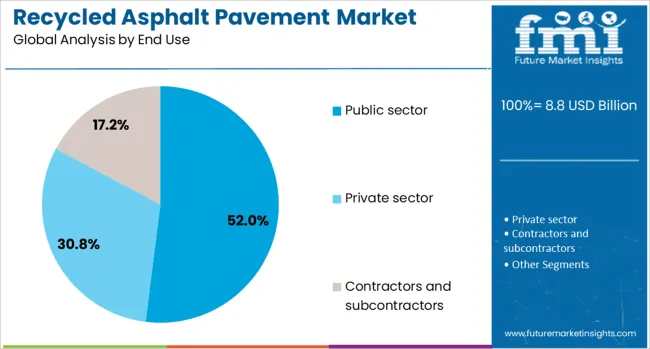

Based on end use, the recycled asphalt pavement market is segmented into the Public sector, Private sector, Contractors and subcontractors. Regionally, the recycled asphalt pavement industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hot mix asphalt recycling process is projected to account for 42% of the Recycled Asphalt Pavement market revenue share in 2025, establishing it as the leading recycling process. This dominance has been supported by the ability of hot mix recycling to restore performance characteristics close to those of virgin asphalt, making it highly suitable for heavy-duty pavement applications.

The process enables better blending of recycled materials with new binders, ensuring consistent strength and durability across large-scale road projects. Increased use of advanced drum and batch plant technologies has improved the efficiency and scalability of hot mix recycling, particularly in highway and expressway rehabilitation.

As governments and municipalities aim to reduce construction costs while meeting green infrastructure mandates, hot mix recycling has emerged as the preferred technique. Additionally, its compatibility with existing paving infrastructure and reduced need for new aggregates have contributed significantly to the segment’s widespread adoption..

The road construction and rehabilitation segment is estimated to capture 61% of the Recycled Asphalt Pavement market revenue share in 2025, positioning it as the dominant application segment. This leadership has been attributed to the extensive use of recycled asphalt in roadway resurfacing, lane expansion, and pavement restoration projects.

Rising investments in public infrastructure, along with increased traffic load and aging road networks, have intensified the demand for long-lasting and economical paving solutions. Recycled asphalt has been favored for its ability to reduce material costs, shorten project timelines, and minimize environmental impact without compromising structural performance.

The adoption of pavement preservation programs and maintenance budgets has also promoted the integration of recycled asphalt in ongoing and planned construction activities. Moreover, its ease of incorporation into conventional construction workflows has made it a strategic choice for contractors and government agencies aiming to deliver sustainable and budget-friendly transportation networks..

The public sector is anticipated to hold 52% of the Recycled Asphalt Pavement market revenue share in 2025, making it the leading end use segment. This growth has been driven by increased government funding for road rehabilitation, municipal infrastructure upgrades, and environmental conservation programs. Public agencies have adopted recycled asphalt as a key material in fulfilling mandates related to resource efficiency and circular economy goals.

The material’s proven cost-effectiveness and reduced ecological footprint have encouraged its widespread use in state and national highway projects. Additionally, regulatory support and procurement policies favoring sustainable materials have further boosted its adoption across city and regional development initiatives.

Municipalities are leveraging recycled asphalt to lower maintenance expenditures while achieving long-term durability in public roads, walkways, and parking areas. As sustainability becomes central to public infrastructure planning, recycled asphalt is expected to remain a primary material in addressing the dual goals of economic viability and environmental responsibility..

The market has been expanding due to the increasing focus on cost-effective road construction, resource efficiency, and environmental considerations. RAP has been utilized in highways, streets, and airport runways to reduce the consumption of virgin materials while maintaining pavement performance. Market growth has been supported by advancements in milling, crushing, and mixing technologies, as well as regulatory encouragement for circular construction practices. Increasing road maintenance activities, infrastructure development, and sustainability initiatives have further strengthened the adoption of recycled asphalt globally.

The growth of highways, urban roads, and airport runways has been a primary driver of the recycled asphalt pavement market. Municipalities and contractors have increasingly relied on RAP to reduce raw material costs and expedite construction timelines. Reuse of reclaimed asphalt has been preferred for base layers, intermediate layers, and surface courses due to its performance benefits and cost efficiency. Road maintenance programs, particularly in regions with aging infrastructure, have promoted RAP utilization to rehabilitate deteriorated pavements. Contractors have benefited from reduced procurement and transportation costs while ensuring compliance with engineering standards. The government initiatives supporting sustainable construction have encouraged the adoption of RAP, enabling long-term pavement performance and operational savings. This combination of cost reduction, infrastructure expansion, and policy support has reinforced the use of recycled asphalt in large-scale construction projects globally.

Technological improvements in milling, crushing, and mixing have significantly influenced the RAP market. Modern equipment has allowed for efficient removal of aged asphalt layers, precise particle sizing, and consistent blending with virgin aggregates. The development of warm-mix asphalt technologies has enabled lower energy consumption and improved workability while maintaining binder performance. Additives and rejuvenators have been incorporated to restore viscoelastic properties, enhancing durability and lifespan. Automated control systems and real-time monitoring have improved mix consistency and reduced variability in recycled asphalt performance. These advancements have facilitated the production of high-quality RAP suitable for critical applications such as highways and airport pavements. By increasing reliability and predictability, technological improvements have expanded the market for recycled asphalt across regions seeking sustainable and cost-effective construction solutions.

Environmental concerns have been a significant driver for the recycled asphalt pavement market. The reuse of asphalt reduces the extraction of virgin aggregates and bitumen, decreasing carbon emissions and conserving natural resources. Recycling asphalt also minimizes construction waste sent to landfills, contributing to sustainable construction practices. Regulations promoting circular economy principles and green infrastructure have encouraged the adoption of RAP in public and private projects. Life-cycle assessment studies have demonstrated the energy and environmental benefits of recycled asphalt compared to conventional materials. The use of RAP has been aligned with industry standards for sustainable construction certifications and reporting. As governments and contractors increasingly prioritize eco-friendly infrastructure development, the demand for recycled asphalt has continued to rise, supporting both economic and environmental objectives in pavement construction.

Emerging economies have presented significant growth opportunities for the recycled asphalt pavement market due to rapid urbanization, increased vehicle ownership, and large-scale road rehabilitation projects. Aging road networks in these regions have required cost-efficient and durable repair solutions. The adoption of RAP has allowed governments and contractors to optimize budgets while maintaining pavement quality. Training programs, equipment leasing options, and local manufacturing of recycling technologies have further facilitated RAP deployment. Investments in industrial-scale asphalt recycling plants have enabled consistent supply and quality control. With continued infrastructure expansion and the focus on sustainable construction practices, recycled asphalt is expected to see increasing adoption in road rehabilitation, new pavement construction, and airport projects, providing a strong growth trajectory in emerging markets globally.

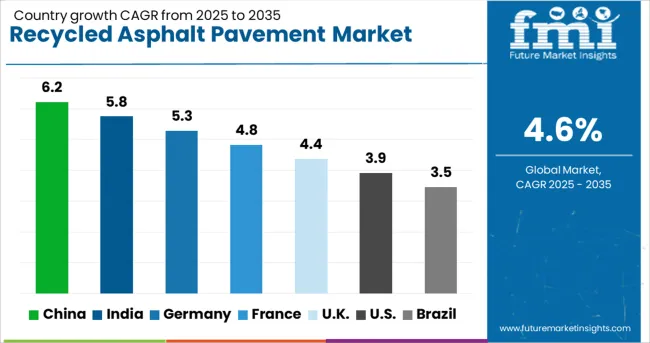

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

| USA | 3.9% |

| Brazil | 3.5% |

The market is set to expand at a CAGR of 4.6% between 2025 and 2035, driven by rising demand for sustainable road construction, cost-efficient paving solutions, and government initiatives promoting recycled materials. China leads with a 6.2% CAGR, supported by large-scale highway projects and urban road upgrades. India follows at 5.8%, with growth fueled by infrastructure development and resource-efficient construction practices. Germany, at 5.3%, benefits from stringent environmental regulations and recycling mandates. The UK, with a 4.4% CAGR, sees gradual adoption through sustainable urban road programs. The USA, at 3.9%, experiences steady growth due to highway maintenance and pavement rehabilitation projects. This report includes insights on 40+ countries; the top markets are shown here for reference.

The recycled asphalt pavement industry in China is anticipated to expand at a CAGR of 6.2% from 2025 to 2035, driven by government initiatives to promote circular construction materials and road rehabilitation projects. Municipal authorities are increasingly adopting recycled asphalt mixes to reduce raw material consumption and construction costs. Leading infrastructure firms have introduced advanced milling and overlay technologies to enhance road durability while minimizing environmental impact. Research collaborations between local universities and construction companies are advancing binder performance and aggregate recovery. The integration of automated paving systems has further optimized project efficiency, supporting broader adoption across urban highways and regional road networks.

India is projected to grow at a CAGR of 5.8% during 2025 to 2035, supported by expanding road construction and maintenance programs. State and central governments are increasingly mandating the use of recycled asphalt in national highways to optimize costs and enhance sustainability in transport infrastructure. Private contractors are adopting high-performance milling machines and modified binders to improve material longevity. Local research institutions are focused on improving performance in high-temperature climates. Tier 1 and Tier 2 cities have started implementing pilot projects to evaluate long-term durability and life cycle costs.

The recycled asphalt pavement industry in Germany is expected to grow at a CAGR of 5.3% over the forecast period, fueled by strict European Union construction material guidelines and climate protection policies. Road authorities prioritize reclaimed asphalt mixes for both urban and rural infrastructure projects to reduce carbon footprint. German engineering companies are developing enhanced recycling plants capable of producing higher quality asphalt with minimal additives. The adoption of performance-based specifications has increased focus on long-term durability and load-bearing capacity.

The United Kingdom is forecast to expand at a CAGR of 4.4% in recycled asphalt pavement adoption between 2025 and 2035, supported by road maintenance and resurfacing programs across urban and rural networks. Government strategies emphasize reducing raw material consumption while maintaining pavement performance. Local contractors are investing in advanced milling machines and recycled asphalt production plants. Research initiatives focus on optimizing binder formulations for variable weather conditions, particularly wet climates. Increasing collaborations between local councils and technology providers are expected to drive long-term industry growth.

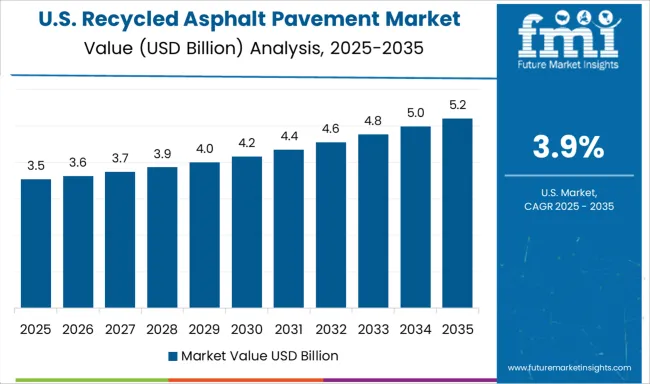

In the United States, recycled asphalt pavement sales are projected to grow at a CAGR of 3.9% from 2025 to 2035, driven by federal and state initiatives to promote sustainable construction materials. Transportation departments are adopting recycled asphalt in both highway and urban street projects to reduce environmental impact and construction costs. Private contractors increasingly utilize reclaimed asphalt for overlays and patching projects. Continuous research in binder modification and cold in-place recycling technologies supports higher efficiency and performance. Industrial collaborations between paving associations and material suppliers are further enhancing the adoption of recycled asphalt.

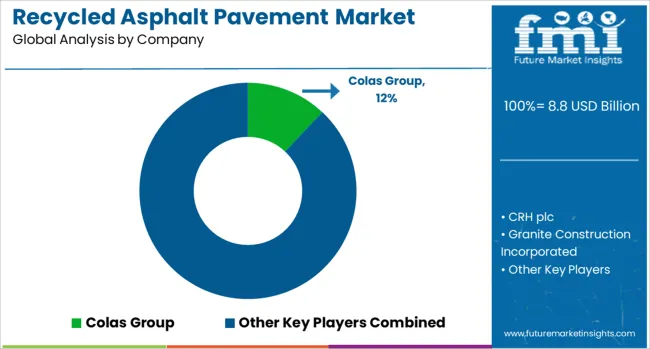

The market is increasingly influenced by the need for cost-effective and resource-efficient road construction solutions. Colas Group and CRH plc are key players, offering extensive RAP integration in highway and urban infrastructure projects while emphasizing long-lasting pavement performance. Granite Construction Incorporated provides advanced mixing and milling techniques, allowing higher%ages of reclaimed asphalt without compromising quality.

Eurovia, part of VINCI, delivers large-scale RAP projects with optimized asphalt blends that enhance durability and reduce environmental impact. The Lane Construction Corporation specializes in combining traditional asphalt with recycled materials for both residential and commercial roadworks, demonstrating versatility across project scales.

Emerging players focus on innovation in RAP processing, including enhanced binder rejuvenation, improved aggregate grading, and automated sorting technologies to maximize material reuse and maintain performance standards. Strategies such as collaborations with municipal authorities, investment in mobile recycling plants, and pilot programs for high-traffic applications are increasingly adopted to establish market presence.

Entry barriers remain significant, including regulatory compliance, technical know-how, and infrastructure for material collection and processing. Providers capable of delivering consistent quality, cost efficiency, and compliance with regional standards are positioned to capitalize on the growing adoption of sustainable asphalt solutions globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.8 Billion |

| Recycling Process | Hot mix asphalt recycling, Cold mix asphalt recycling, In-place recycling, and Central plant recycling |

| Application | Road construction & rehabilitation, Parking lots and pavements, Airport runways and taxiways, Pathways, bike lanes, and recreational surfaces, and Other infrastructure (ports, industrial sites) |

| End Use | Public sector, Private sector, and Contractors and subcontractors |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Colas Group, CRH plc, Granite Construction Incorporated, Eurovia (VINCI), The Lane Construction Corporation, and Others |

| Additional Attributes | Dollar sales by pavement type and end-use application, demand dynamics across highways, urban roads, and airport runways, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in warm-mix recycling, polymer-modified binders, and high-performance mix designs, environmental impact of reduced raw material extraction, energy savings, and lower greenhouse gas emissions, and emerging use cases in sustainable infrastructure projects, circular economy initiatives, and high-durability road construction. |

The global recycled asphalt pavement market is estimated to be valued at USD 8.8 billion in 2025.

The market size for the recycled asphalt pavement market is projected to reach USD 13.8 billion by 2035.

The recycled asphalt pavement market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in recycled asphalt pavement market are hot mix asphalt recycling, _batch plant, _drum plant, cold mix asphalt recycling, _in-place cold recycling, _central plant cold recycling, in-place recycling, _cold in-place recycling (cir), _full depth reclamation (fdr), _hot in-place recycling (hir) and central plant recycling.

In terms of application, road construction & rehabilitation segment to command 61.0% share in the recycled asphalt pavement market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Recycled Concrete Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Recycled Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Plastic Pipes Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Recycled Ocean Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Metal Market Size and Share Forecast Outlook 2025 to 2035

Recycled Elastomers Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Market Size and Share Forecast Outlook 2025 to 2035

Recycled Thermoplastic Market Size and Share Forecast Outlook 2025 to 2035

Recycled Materials Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Paper Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Carbon Fiber Market Size and Share Forecast Outlook 2025 to 2035

Recycled Prescription Bag Market Size and Share Forecast Outlook 2025 to 2035

Recycled PET Packaging Market Size, Share & Forecast 2025 to 2035

Recycled Fabric Bag Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Recycled Scrap Metal Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Recycled Prescription Bag Industry

Competitive Breakdown of Recycled Paper Suppliers

Recycled Polyethylene Terephthalate (rPET) Packaging Market Growth and Trends 2025 to 2035

Recycled Glass Packaging Market Trends & Growth Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA