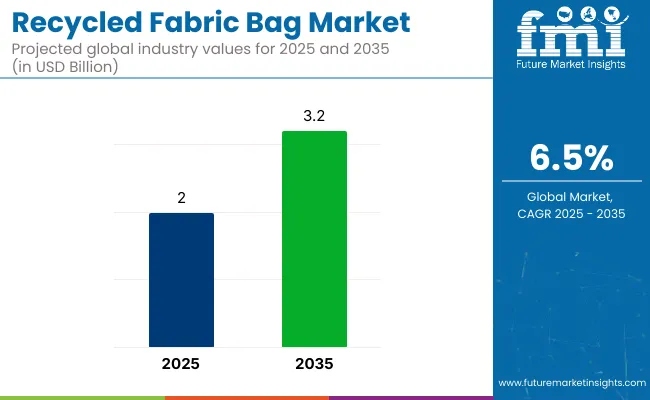

The global recycled fabric bag market is projected to grow from USD 2 billion in 2025 to USD 3.2 billion by 2035, registering a CAGR of 6.5% during the forecast period. This growth is being driven by the increasing demand for eco-friendly packaging solutions and rising consumer awareness about environmental responsibility.

As businesses and consumers alike move away from single-use plastic bags, these bags are gaining significant popularity as a durable and eco-conscious alternative. The demand for reusable bags across various industries such as retail, fashion, and food and beverage is accelerating, with a growing focus on reducing environmental impact.

The demand for eco-friendly packaging solutions is expected to further fuel industry growth. Recycled fabric bags, made from post-consumer and post-industrial recycled materials, offer a reusable and biodegradable alternative to traditional plastic packaging. The growing adoption of customized solutions and automated packaging systems is also contributing to the industry's expansion. As more regulations are introduced to promote green packaging, the industry is anticipated to experience continued growth through 2035.

Several USA states and cities have implemented or are planning to implement bans on single-use plastic bags, encouraging the adoption of reusable alternatives. For instance, California's statewide ban on plastic bags is set to take effect in 2026. As a result, community groups, such as Anne-Marie Bonneau's sewing bee in California, are upcycling fabric waste to create reusable produce bags as per an article published in The Guardian. These grassroots efforts not only reduce textile waste but also promote plastic-free practices at the local level.

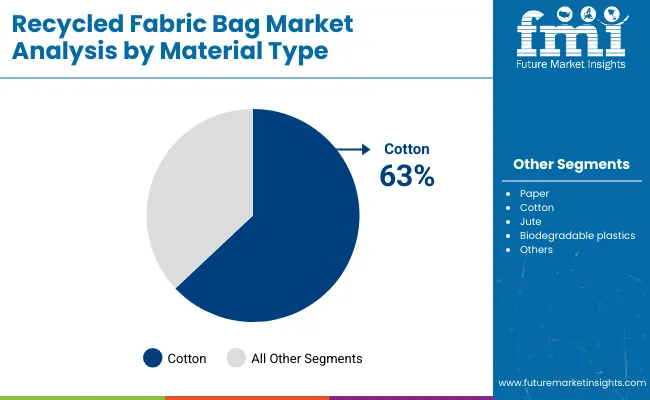

The market is expected to experience significant growth in 2025, with major investment areas such as cotton material, retail end-users, and supermarkets/hypermarkets as distribution channels driving this expansion.

Cotton is expected to dominate the industry in 2025, accounting for 63% of the industry share. This material is favored for its natural environmental benefits, biodegradability, and durability, making it an ideal alternative to plastic. As global environmental concerns grow, there is an increasing demand for eco-friendly materials, and cotton fabric bags offer a solution.

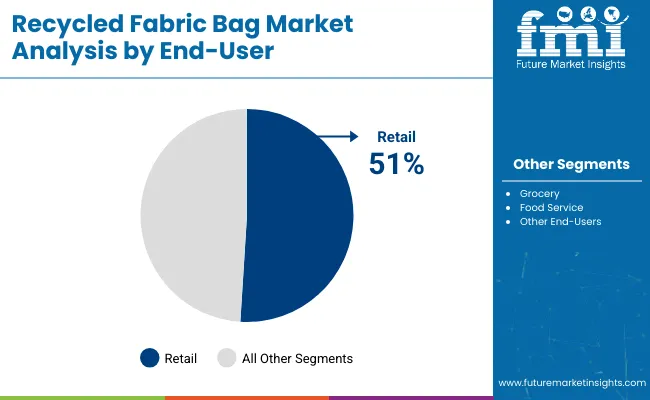

The retail sector is forecast to account for 51% of the industry share in 2025. Retailers are at the forefront of the shift toward eco-conscious packaging, increasingly adopting recycled fabric bags as part of their green strategies.

Supermarkets and hypermarkets are projected to hold 40% of the industry share in the distribution channel segment of the industry by 2025. Large retailers such as Walmart and Tesco are driving this growth by promoting recycled fabric bags in stores, offering them as affordable and eco-conscious alternatives to plastic bags.

The industry is growing due to rising consumer demand for eco-friendly products and environmentally responsible materials. However, high production costs and limited availability of recycled materials are challenging broader industry expansion.

Increasing consumer demand for eco-friendly products is driving growth

The growing awareness among consumers about environmental issues is significantly boosting the demand for eco-friendly products. These bags offer an alternative to traditional plastic bags, aligning with the increasing preference for products that contribute to environmental conservation.

As a result, manufacturers are focusing on producing fabric bags to meet consumer expectations and capitalize on the eco-conscious trend. This shift in consumer behavior is driving the growth of the recycled fabric bag industry, encouraging innovation and investment in environmentally friendly packaging solutions.

High production costs and limited availability of recycled materials are limiting industry growth

Despite the growing demand, the industry faces challenges related to high production costs and limited availability of recycled materials. The process of collecting, sorting, and processing recycled fabrics can be resource-intensive and costly, impacting the overall affordability of the bags.

Additionally, the supply of quality recycled materials may be inconsistent, affecting production efficiency and scalability. These factors can hinder the widespread adoption of recycled fabric bags, posing challenges for manufacturers aiming to meet industry demand while maintaining cost-effectiveness.

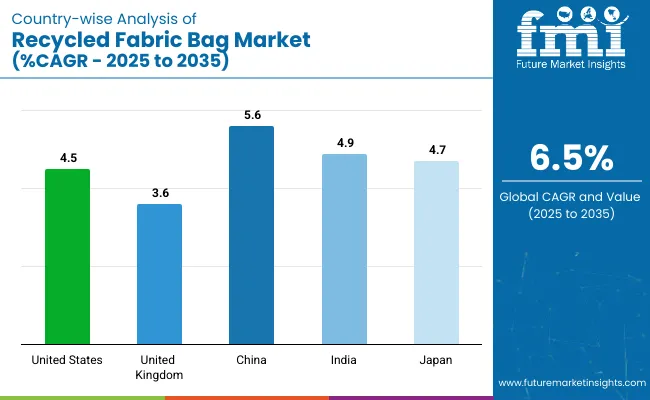

The industry is expected to grow steadily through 2035, driven by rising consumer demand for eco-friendly packaging, government regulations, and growing environmental awareness, with China and India leading expansion.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.5% |

| United Kingdom | 3.6% |

| China | 5.6% |

| India | 4.9% |

| Japan | 4.7% |

The industry in United States is expected to grow at a CAGR of 4.5% through 2035. Growth is supported by rising environmental awareness and consumer demand for eco-friendly packaging solutions.

The industry in United Kingdom is projected to grow at a CAGR of 3.6% through 2035. Growth is driven by an increasing preference for eco-conscious packaging solutions and growing consumer consciousness about the environmental impact of plastic waste.

The industry is expected to grow at a CAGR of 5.6% through 2035. Expansion is driven by rapid urbanization, growing disposable incomes, and increasing consumer preference for eco-friendly products.

The industry in India is expected to grow at a CAGR of 4.9% through 2035. Growth is driven by increasing urbanization, rising disposable income, and growing awareness about the environmental impact of plastic waste. Local companies like Jute India, Eco-Pak, and Super Green are expanding their portfolios.

The industry is projected to grow at a CAGR of 4.7% through 2035. Growth is supported by the country’s commitment to eco-friendly practices and environmental regulations. Leading companies like Mizuno, Lotte, and Sumitomo Chemical are developing innovative recycled bags for the packaging and retail industries.

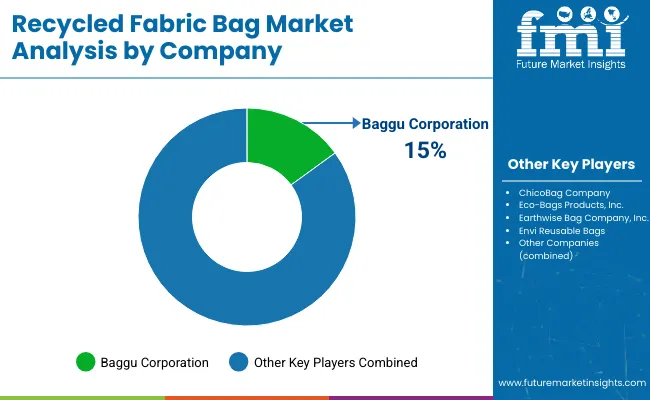

The industry is characterized by both well-established key players and emerging companies, each employing distinct strategies to drive growth. Major players like LeelineBags, Enviro-Tote, and Eco-Bags leverage their extensive product portfolios and focus on R&D to maintain industry leadership.

For instance, EcoSacks introduced a new range of durable, recyclable bags, responding to the growing demand for sustainable alternatives. Smaller, emerging players like Jinyabag and BagsGoGreen are carving niches by offering customizable, eco-friendly options, tapping into consumer preferences for unique and sustainable products.

The industry faces entry barriers such as high production costs and limited access to quality recycled materials, which can hinder new players. It remains fragmented, with numerous small to medium-sized companies vying for market share. However, consolidation is gradually taking place as companies pursue strategic alliances and acquisitions to expand their reach and improve operational efficiencies. Innovation and overcoming supply chain challenges are key to remaining competitive.

Recent Recycled Fabric Bags Industry News

| Report Attributes | Details |

|---|---|

| Current Total Industry Size (2025) | USD 2 billion |

| Projected Market Size (2035) | USD 3.2 billion |

| CAGR (2025 to 2035) | 6.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Material Types Analyzed | Paper; Cotton; Jute; Biodegradable plastics; Other materials |

| End-User Segments Covered | Retail; Grocery; Food service; Other end-users |

| Distribution Channels Covered | Online stores; Supermarkets/hypermarkets; Specialty stores; Other channels |

| Regions Covered | Asia Pacific; North America; Latin America; Europe; Middle East & Africa |

| Countries Covered | United States; Canada; Mexico; Germany; United Kingdom; France; Italy; Spain; Netherlands; China; India; Japan; South Korea; Brazil; Argentina; Australia; South Africa; Saudi Arabia; UAE |

| Key Players Influencing the Industry | LeelineBags, Enviro-Tote, Bags Manufacturer, EcoPackables, Chicobag, Eco-Bags, BagsGoGreen, EcoSacks, Jinyabag, and Orient. |

| Additional Attributes | Dollar sales by material type (paper, cotton, jute, biodegradable plastics); Growth in online sales vs traditional retail; Regional demand for eco-friendly packaging solutions; Trends in biodegradable materials and eco-consciousness in fabric bags |

The industry is segmented into paper, cotton, jute, biodegradable plastics, and others.

The industry includes retail, grocery, food service, and other end-users.

The industry is categorized by distribution channels into online stores, supermarkets/hypermarkets, specialty stores, and others.

The industry spans across Asia Pacific, North America, Latin America, Europe, and the Middle East & Africa.

The recycled fabric bag industry is expected to reach USD 3.2 billion by 2035.

The market size is projected to be USD 2 billion in 2025.

The recycled fabric bag industry is expected to grow at a CAGR of 6.5% from 2025 to 2035.

Key players include LeelineBags, Enviro-Tote, Bags Manufacturer, EcoPackables, Chicobag, Eco-Bags, BagsGoGreen, EcoSacks, Jinyabag, and Orient.

The demand for recycled fabric bags is driven by the increasing preference for eco-friendly, responsible alternatives to single-use plastic bags, along with rising environmental awareness and regulatory bans on plastic.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Recycled Concrete Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Recycled Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Plastic Pipes Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Recycled Ocean Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Metal Market Size and Share Forecast Outlook 2025 to 2035

Recycled Elastomers Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Market Size and Share Forecast Outlook 2025 to 2035

Recycled Thermoplastic Market Size and Share Forecast Outlook 2025 to 2035

Recycled Asphalt Pavement Market Size and Share Forecast Outlook 2025 to 2035

Recycled Materials Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Paper Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Carbon Fiber Market Size and Share Forecast Outlook 2025 to 2035

Recycled PET Packaging Market Size, Share & Forecast 2025 to 2035

Recycled Scrap Metal Market Growth - Trends & Forecast 2025 to 2035

Competitive Breakdown of Recycled Paper Suppliers

Recycled Polyethylene Terephthalate (rPET) Packaging Market Growth and Trends 2025 to 2035

Recycled Glass Packaging Market Trends & Growth Forecast 2024-2034

Recycled Aluminum Packaging Market Trends & Growth Forecast 2024-2034

Recycled Plastic Envelope Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA