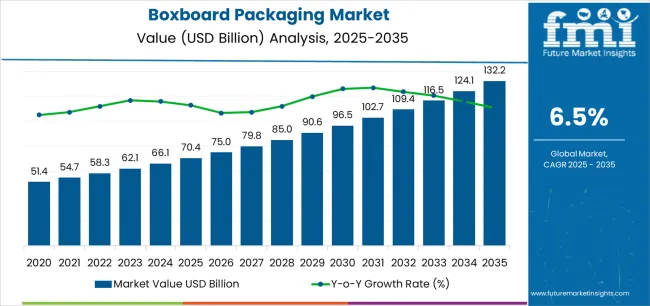

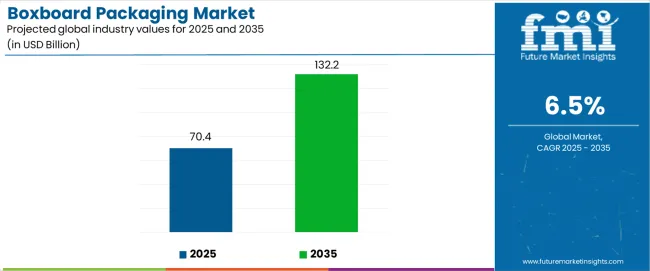

The global boxboard packaging market is poised for robust growth, projected to expand from USD 70.4 billion in 2025 to USD 132.2 billion by the conclusion of the forecast period, reflecting a strong CAGR of 6.5%. As per Future Market Insights, certified through ESOMAR corporate membership in global intelligence, this momentum is largely fueled by escalating demand for sustainable and versatile packaging solutions across key industries, most notably the food and beverage sector, which is expected to capture a commanding 50% market share throughout the outlook period.

The prevalence of packaged foods, ready-to-eat meals, and convenience beverages has sharpened the need for durable, lightweight, and environmentally sound boxboard packaging options globally. In parallel, the personal care segment is anticipated to hold a significant 20% share as consumers increasingly seek innovative, aesthetically pleasing, and eco-conscious packaging in products such as toiletries, hygiene, and beauty care items.

The boxboard packaging market is undergoing robust expansion, driven by increasing demand from diverse end-use sectors such as food and beverages, personal care, cosmetics, and pharmaceuticals. Market size is projected to grow from USD 70.4 billion in 2025 to USD 132.2 billion over the forecast period, at a CAGR of 6.5%. Major growth will be sustained by the rapid adoption of sustainable packaging, rising urbanization, and heightened focus on environmentally friendly materials in packaging.

During the 2025 to 2030 phase, the boxboard packaging market adds approximately USD 41.8 billion to its overall value, representing about 32% of the anticipated decade-long expansion, with the market rising from USD 70.4 billion to roughly USD 112.2 billion. Key factors driving market maturity include the widespread adoption of standardized packaging formats, the introduction of advanced manufacturing processes that reduce costs and waste, and rising brand and retailer mandates for recyclable and sustainable materials. The industry landscape during this period features established leaders such as International Paper and WestRock expanding their sustainable packaging portfolios, while agile regional companies introduce specialized boxboard grades and customization capabilities targeting niche segments like personal care and cosmetics.

From 2030 to 2035, market momentum advances as the industry grows from around USD 112.2 billion to USD 132.2 billion, marking an increment of approximately USD 20 billion or about 68% of the growth observed in the latter half. This pivotal phase is characterized by advanced technological integration across manufacturing, logistics, and recycling operations, as well as an industry-wide shift toward intelligent, digitally connected packaging management systems and value-added solutions such as smart labels and tamper detection. The competitive environment matures toward holistic supply chain integration, with market leaders and new entrants alike focusing on seamless digitalization, circular economy partnerships, and robust lifecycle assessment practices, transforming boxboard packaging into an essential component of global retail and e-commerce ecosystems.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 70.4 billion |

| Market Forecast | USD 132.2 billion |

| Growth Rate | 6.5% CAGR |

| Leading Product Type | Food and Beverages |

| Primary Application | Personal Care & Cosmetics Packaging |

Growth in the boxboard packaging market is propelled by three pivotal industry shifts

Despite these drivers, market expansion may encounter challenges from volatile raw material prices and capital intensity in upgrading manufacturing lines for new packaging innovations. Additionally, certain regions still lack adequate recycling infrastructure, and small-scale producers may struggle with compliance and rapid adaptation to evolving sustainability standards, posing risks to broader market adoption.

The boxboard packaging market presents transformative growth opportunities, projected to expand from USD 70.4 billion in 2025 to USD 132.2 billion by the end of the forecast period at a 6.5% CAGR. With industries worldwide prioritizing brand differentiation, supply chain efficiency, and sustainability, boxboard solutions have evolved from simple containment to integral assets enabling premium positioning and regulatory compliance across global retail, food service, and e-commerce applications.

The convergence of global sustainability mandates, consumer demand for recyclable packaging, cost-competitive manufacturing, and ongoing innovations underpin boxboard’s exceptional market adoption rates. Advanced barrier coatings, printable surfaces, and smart packaging features will secure premium pricing, while rapid expansion in Asia Pacific and scalable deployment in new end-use sectors will drive volume leadership. Government policies promoting recycling, product safety, and eco-friendly materials provide structural growth support.

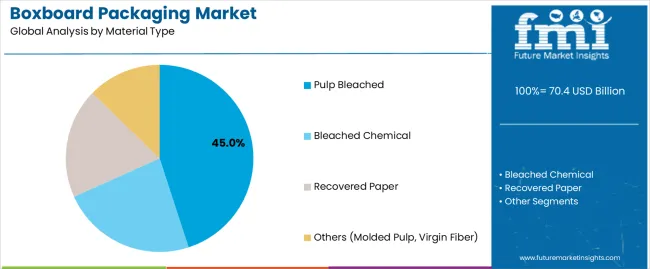

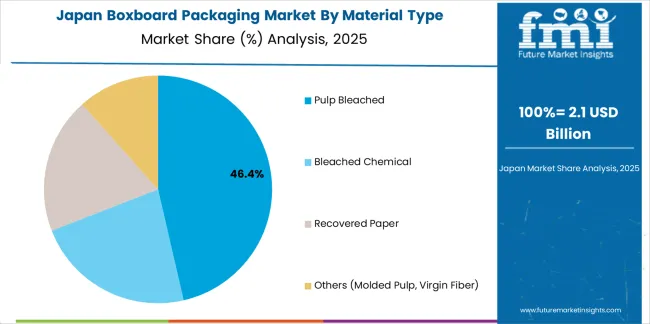

The boxboard packaging market features primary segmentation based on material composition, including pulp bleached, bleached chemical, recovered paper, and other specialty fibers (molded pulp, virgin fiber). This structure represents the transition from conventional board substrates to innovative, high-strength, and sustainable solutions tailored for enhanced barrier, printability, and end-product appeal across sectors.

Secondary Classification: By Grammage Weight

The market is further segmented by grammage weight: 160gsm to 200gsm, 201gsm to 300gsm, and above 301gsm, reflecting unique packaging durability, rigidity, and application requirements spanning retail cartons, luxury packaging, and heavy-duty trays. Manufacturers strategically select grammage to balance cost, performance, and branding impact.

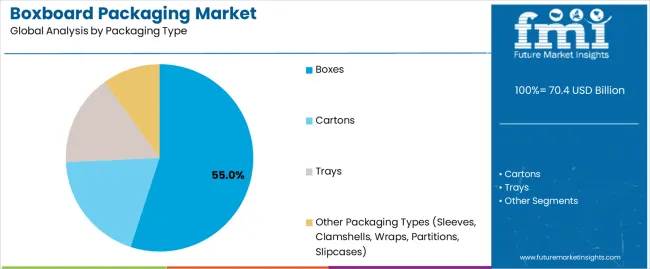

Segmented by packaging types, the market includes boxes, cartons, trays, sleeves, clamshells, wraps, partitions, and slipcases, demonstrating diversified evolution from standard food packaging toward sophisticated packaging solutions for electronics, luxury, and specialty goods.

Quaternary Classification: By End Use

By end-use, the market divides into food & beverages, personal care & cosmetics, household, food service, tobacco, and higher-end/general packaging (including electronics, luxury, gift items, stationery, and specialty retail). Food & beverages remain the largest share, benefiting from strict food safety, branding, and logistics optimization requirements, while personal care, cosmetics, and tobacco packaging drive premiumization and customization trends.

Regional Classification: By Geography

Geographically, the market spans North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa. Developed markets lead on sustainability adoption and regulation, while emerging regions exhibit accelerated growth due to retail expansion, infrastructure modernization, and rising consumer demand for packaged goods.

Key Market Characteristics:

The food & beverage segment retains dominant share (approximately 50%) owing to high standards for barrier protection, freshness preservation, and visual shelf appeal. Value drivers include consistent consumer demand, retailer requirements for sustainable sourcing, and efficiency gains in both bulk and retail settings.

Personal Care & Cosmetics Shows Specialized Growth

Personal care & cosmetics segments represent about 20-30%, driven by demand for high-quality packaging that enhances aesthetic appeal and protects product integrity from manufacturing through end use.

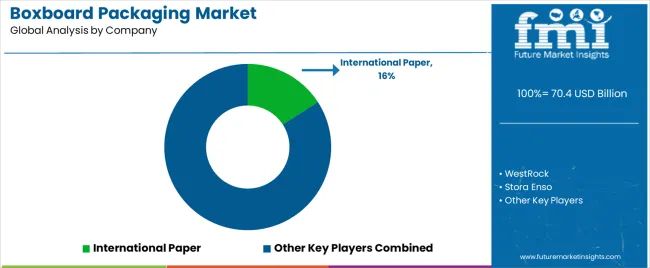

By Company, Market Leadership Remains Concentrated

International Paper, WestRock, and Stora Enso anchor market leadership, leveraging global manufacturing capacity and deep R&D investment. Other tier-one and emerging competitors, such as Smurfit Kappa, DS Smith, and Mondi Group, innovate through sustainability focus, diversified portfolios, and robust upstream-downstream integration.Segmental Analysis

Primary Classification: By Material Type

The boxboard packaging market is segmented by material into pulp bleached, bleached chemical, recovered paper, and specialty types such as molded pulp and virgin fiber. This segmentation highlights the evolution from classic pulp-based boards towards higher-performance and sustainable alternatives tailored to diverse packaging applications across industries.

Secondary Classification: By Grammage Weight

Classification by grammage includes 160gsm-200gsm, 201gsm-300gsm, and above 301gsm, reflecting unique needs in rigidity, barrier, and brand visibility for products ranging from lightweight cartons to robust trays and luxury boxes. Brand owners and manufacturers choose grammage ranges based on cost, function, and appearance.

Tertiary Classification: By Packaging Type

The market is further broken down into boxes, cartons, trays, and specialized forms such as sleeves, clamshells, wraps, partitions, and slipcases, representing a shift from bulk food service packaging to value-added formats for retail, electronics, specialty retail, and gift items.

Quaternary Classification: By End Use

End-use segmentation includes food & beverages, personal care & cosmetics, household, food service, tobacco/cigarette, and higher-end/general packaging for specialty, luxury, electronics, and stationery products. Food & beverages remain dominant, whereas personal care and cosmetics see strong growth from premiumization trends and eco-friendly packaging initiatives.

Regional Classification: Global Reach

The boxboard packaging market spans North America, Latin America, East and South Asia, Western and Eastern Europe, and the Middle East & Africa. Developed regions drive leadership in eco-friendly adoption and regulation, while emerging markets accelerate market growth through urbanization, infrastructure advances, and rising consumer packaged goods demand.

Key Market Highlights

Market Share Leaders

Food & beverages command the largest share (around 50%) owing to the need for freshness, safety, and brand visibility, followed by personal care and cosmetics, which prioritize premium aesthetics and protective function (20–30% share). International Paper, WestRock, Stora Enso, Smurfit Kappa, DS Smith, and Mondi Group lead the market through scale, product range, and continuous R&D investment.

Growth Accelerators:

Sustainability and regulatory shifts drive rapid adoption of boxboard packaging as global brands and retailers focus on recyclable, biodegradable, and low-carbon materials to reduce environmental impact and comply with mandates. The explosive growth of e-commerce and modern retail networks worldwide amplifies demand for durable, lightweight, and printable boxboard solutions that enable cost-effective distribution, high-impact branding, and secure product delivery. Advancements in boxboard barrier technologies, print finishes, and structural design enhance functional performance and shelf appeal, pushing premiumization trends across food, personal care, and luxury packaging sectors.

Growth Inhibitors:

Boxboard producers face profit-margin pressures and operational risk from fluctuating pulp and recovered fiber prices, which can raise input costs and slow investment in innovation, especially among small and regional suppliers. Limited recycling infrastructure in emerging markets truncates the circular potential of boxboard and may deter broader adoption by multinational brands committed to closed-loop supply chains. Compliance with rapidly evolving packaging standards and certification requirements imposes additional operational and technical challenges.

Market Evolution Patterns:

Adoption is most rapid in food and beverage, personal care, and e-commerce end uses these sectors justify packaging investments with strict safety, branding, and logistics needs. Developed markets in Asia Pacific, North America, and Europe set the pace for advanced, eco-designed packaging, while growth in emerging regions accelerates due to modernizing retail, rising consumer awareness, and supportive policy measures. The industry increasingly prioritizes smart packaging, digital print, and advanced structural features, with future disruption possible if alternative new materials or heightened regulatory restrictions reshape cost/benefit calculations for producers and brands.

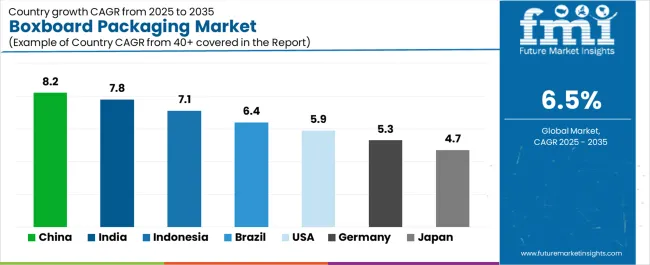

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.2% |

| India | 7.8% |

| USA | 5.9% |

| Germany | 5.3% |

| Indonesia | 7.1% |

| Brazil | 6.4% |

| Japan | 4.7% |

The boxboard packaging market is experiencing strong growth globally, with China leading at an 8.2% CAGR through 2035, driven by the expanding consumer goods industry, growing e-commerce penetration, and significant investment in packaging manufacturing infrastructure development. India follows at 7.8%, supported by rapid urbanization, increasing disposable incomes, and growing demand for branded consumer products. The USA shows growth at 5.9%, emphasizing plastic reduction initiatives and premium packaging development. Indonesia records 7.1%, focusing on consumer market expansion and retail modernization. Brazil demonstrates 6.4% growth, prioritizing food packaging development and retail distribution expansion. Germany exhibits 5.3% growth, emphasizing advanced printing technologies and circular economy compliance. Japan shows 4.7% growth, supported by premium packaging aesthetics and quality standards innovation.

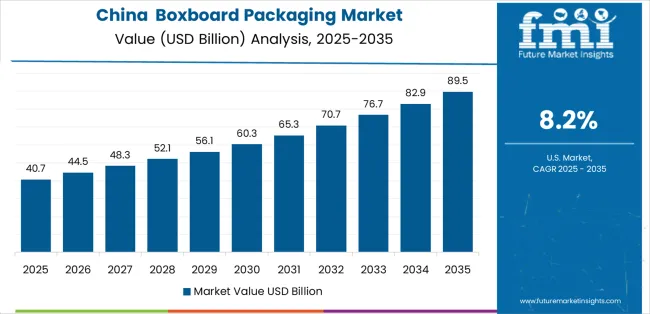

Revenue from boxboard packaging in China is projected to exhibit exceptional growth with a CAGR of 8.2% through 2035, driven by expanding consumer goods manufacturing capacity and rapidly growing e-commerce logistics infrastructure supported by government industrial modernization initiatives. The country's vast consumer market and increasing investment in automated packaging lines are creating substantial demand for advanced boxboard solutions. Major packaging manufacturers and converting operations are establishing comprehensive production capabilities to serve both domestic and international markets.

Revenue from boxboard packaging in India is expanding at a CAGR of 7.8%, supported by the country's growing middle class, increasing organized retail penetration, and rising demand for packaged consumer goods and branded products. The country's developing packaging industry and expanding manufacturing capabilities are driving demand for diverse boxboard formats. International packaging companies and domestic converters are establishing extensive production and distribution capabilities to address the growing demand for quality packaging solutions.

Revenue from boxboard packaging in the USA is expanding at a CAGR of 5.9%, supported by the country's mature consumer goods industry, strong emphasis on environmental stewardship, and robust demand for premium packaging aesthetics among discerning consumers. The nation's advanced packaging sector and high e-commerce adoption rates are driving sophisticated boxboard capabilities throughout the supply chain. Leading manufacturers and brand owners are investing extensively in premium substrate development and advanced finishing methods to serve both retail and direct-to-consumer channels.

Revenue from boxboard packaging in Germany is growing at a CAGR of 5.3%, driven by the country's leadership in printing technology innovation, stringent environmental regulations, and strong consumer demand for recyclable packaging materials. Germany's established packaging industry and technological expertise are supporting investment in digital printing capabilities and recycling infrastructure across major manufacturing centers. Industry leaders are establishing comprehensive circular economy systems to serve both domestic and export markets with certified recyclable packaging solutions.

Revenue from boxboard packaging in Indonesia is expanding at a CAGR of 7.1%, supported by the country's large and growing population, increasing urbanization rates, and rapid expansion of modern retail formats. Indonesia's developing consumer goods industry and rising disposable incomes are driving demand for packaged products and premium presentation formats. Packaging manufacturers are investing in domestic production capabilities to serve both local brands and multinational companies expanding throughout the archipelago.

Revenue from boxboard packaging in Brazil is growing at a CAGR of 6.4%, driven by expanding food processing industry, growing retail modernization, and increasing consumer preference for packaged goods. Brazil's large domestic market and developing packaging infrastructure are supporting investment in boxboard production and converting capabilities across major economic regions. Food manufacturers and consumer goods companies are establishing comprehensive packaging strategies to serve both traditional retail and emerging modern trade channels.

Revenue from boxboard packaging in Japan is expanding at a CAGR of 4.7%, supported by the country's focus on premium product presentation, meticulous quality standards, and strong consumer appreciation for packaging aesthetics. Japan's sophisticated consumer market and emphasis on detail-oriented packaging design are driving demand for high-quality coated boxboard and specialty printing capabilities. Leading packaging companies are investing in precision manufacturing to serve luxury goods, premium cosmetics, and high-value consumer electronics with exceptional packaging solutions.

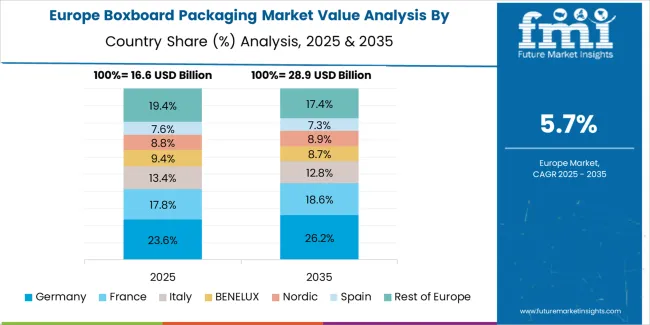

The boxboard packaging market in Europe is projected to grow from USD 38.7 billion in 2025 to USD 71.4 billion by 2035, registering a CAGR of 6.3% over the forecast period. Germany is expected to maintain its leadership position with a 29.0% market share in 2025, adjusting slightly to 28.5% by 2035, supported by its strong packaging manufacturing base, advanced coating and printing technologies, and comprehensive supply network serving major European consumer goods brands.

France follows with a 16.0% share in 2025, projected to reach 16.5% by 2035, driven by robust demand for luxury packaging in cosmetics and perfumery, combined with established food packaging requirements for dairy, confectionery, and frozen food applications. The United Kingdom holds a 14.0% share in 2025, expected to maintain 14.0% through 2035, supported by strong pharmaceutical packaging demand and premium consumer goods requirements, while navigating post-Brexit supply chain adjustments. Italy commands a 12.0% share in 2025, projected to reach 12.3% by 2035, while Spain accounts for 9.0% in 2025, expected to reach 9.2% by 2035. Sweden maintains a 4.5% share in 2025, growing to 4.7% by 2035, driven by leadership in recycling infrastructure and circular packaging initiatives. The Rest of Europe region, including Poland, Netherlands, Belgium, Austria, Switzerland, and other markets, is anticipated to gain momentum, expanding its collective share from 15.5% to 15.8% by 2035, attributed to increasing packaging manufacturing activities across Central and Eastern European countries and growing consumer goods production supporting regional economic development.

The boxboard packaging market operates with moderate concentration, featuring approximately 15-20 major participants, with the top companies controlling an estimated 55-60% of the global market share through integrated supply chains, diverse packaging portfolios, and long-standing relationships with global brands and retailers. Competitive dynamics are shaped by innovation in sustainable materials, advanced print and finishing capabilities, and the ability to serve fast-growing categories such as food, personal care, and e-commerce. Instead of merely competing on price, leading companies differentiate themselves by investing in R&D for lightweight, barrier-enhanced, and visually distinctive packaging solutions.

Market Leaders include International Paper, WestRock, Stora Enso, Smurfit Kappa, and Mondi Group, all of which leverage global reach, advanced manufacturing, vertical integration, and strong sustainability credentials to maintain premium positioning and create significant customer loyalty through consistent product quality and innovation. These companies invest heavily in digital print technology, circular economy initiatives, and advanced coatings to maximize shelf impact and recyclability.

Technology Challengers feature DS Smith, MM Group, and Cascades, who compete by focusing on rapid product development cycles, regionally tailored innovations, and specialty grades that serve high-growth segments such as luxury packaging and e-commerce fulfillment. Their agility enables them to respond quickly to new regulatory requirements and evolving customer needs.

Regional Specialists such as Nippon Paper Group, Oji Holdings, and Rengo Co., Ltd. dominate select Asian and regional markets by combining local market know-how, proximity to raw materials, and flexible manufacturing, providing both cost and customization advantages for domestic clients. These companies focus on regional retail, food service, and premium product packaging, targeting market niches underserved by global players.

| Item | Value |

|---|---|

| Quantitative Units | USD 70.4 billion (2025) |

| Material Types | Pulp Bleached, Bleached Chemical, Recovered Paper, Others (Molded Pulp, Virgin Fiber) |

| Packaging Types | Boxes, Cartons, Trays, Sleeves, Wraps, Partitions, Slipcases |

| End Uses | Food & Beverages, Personal Care & Cosmetics, Household, Food Service, Tobacco, Luxury & Specialty Retail, Electronics, Stationery |

| Regions Covered | North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Middle East & Africa |

| Countries Profiled | China, India, Germany, USA, UK, Japan, Brazil, more than 20 others |

| Key Companies Profiled | International Paper, WestRock, Stora Enso, Smurfit Kappa, Mondi Group, DS Smith, MM Group, Cascades, Nippon Paper Group, Oji Holdings, Rengo Co., Ltd. |

| Additional Attributes | Sales by material and end-use, regional adoption trends, competitive benchmarking by innovation and sustainability, supply chain integration, retailer and FMCG brand requirements, regulatory landscape, recycling infrastructure development, and smart packaging adoption. |

The global boxboard packaging market is estimated to be valued at USD 70.4 billion in 2025.

The market size for the boxboard packaging market is projected to reach USD 132.2 billion by 2035.

The boxboard packaging market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in boxboard packaging market are pulp bleached, bleached chemical, recovered paper and others (molded pulp, virgin fiber).

In terms of packaging type, boxes segment to command 55.0% share in the boxboard packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Insights of Boxboard Packaging Providers

Folding Boxboard Market Size and Share Forecast Outlook 2025 to 2035

Understanding Market Share Trends in Folding Boxboard Industry

Coated Recycled Boxboard Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Coated Recycled Boxboard Manufacturers

Clay Coated Recycled Boxboard Market Growth - Demand & Forecast 2024 to 2034

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Trends and Growth 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA