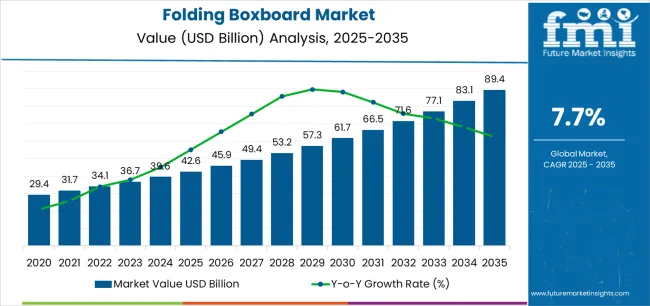

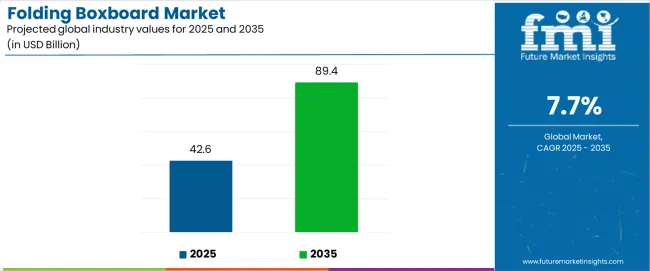

The global folding boxboard market is valued at USD 42.6 billion in 2025 and is slated to reach USD 89.4 billion by 2035, recording an absolute increase of USD 46.8 billion over the forecast period. This translates into a total growth of 109.9%, with the market forecast to expand at a CAGR of 7.7% between 2025 and 2035. Based on Future Market Insights (FMI)’s verified data on biopolymer, flexible, and rigid packaging adoption, the market size is expected to grow by nearly 2.10X during the same period, supported by increasing demand for premium packaging solutions, growing adoption of recyclable and biodegradable materials in consumer goods packaging, and rising preference for lightweight yet durable packaging substrates across diverse end-use applications.

Between 2025 and 2030, the folding boxboard market is projected to expand from USD 42.6 billion to USD 62.8 billion, resulting in a value increase of USD 20.2 billion, which represents 43.2% of the total forecast growth for the decade. This phase of development will be shaped by increasing e-commerce packaging requirements, rising adoption of advanced coating technologies, and growing demand for high-quality printable substrates in cosmetics and pharmaceutical packaging. Brand owners are expanding their folding boxboard specifications to address the growing demand for premium shelf appeal and enhanced product protection.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 42.6 billion |

| Forecast Value in (2035F) | USD 89.4 billion |

| Forecast CAGR (2025 to 2035) | 7.7% |

The packaging market is the largest contributor, accounting for 40-45% of the demand. Folding boxboard is widely used for packaging consumer goods, especially in sectors such as food and beverages, cosmetics, and pharmaceuticals, where durable and lightweight packaging solutions are crucial. As consumer demand for eco-friendly and cost-effective packaging continues to rise, the folding boxboard market benefits from these trends. The food and beverage market adds 20-25% to the folding boxboard market, as this material is extensively used in packaging products like ready-to-eat meals, snacks, beverages, and takeaway packaging. Its ability to protect products while maintaining a premium appearance makes it a preferred choice for food and beverage brands.

The cosmetics and personal care market contributes around 15-18%, where folding boxboard is used for packaging skincare, haircare, and beauty products. The lightweight yet sturdy nature of the material helps provide attractive packaging with a luxurious feel. The pharmaceutical market represents 10-12%, as folding boxboard is used to package over-the-counter medicines and health products, offering both protection and compliance with regulatory standards. The electronics market accounts for approximately 8-10%, where folding boxboard is used for packaging smaller electronic devices and accessories, offering protection during transport while being cost-effective.

Market expansion is being supported by the increasing global demand for premium consumer packaging and the corresponding need for high-quality printable substrates that can deliver superior graphics reproduction while maintaining structural integrity across various packaging applications. Modern brand owners are increasingly focused on implementing packaging solutions that can enhance shelf appeal, protect product integrity, and provide consistent performance in automated packaging lines. Folding boxboard's proven ability to deliver excellent printability, structural rigidity, and cost-effective production make it an essential substrate for contemporary consumer goods packaging and brand communication strategies.

The growing emphasis on packaging waste reduction and material circularity is driving demand for folding boxboard that can support recyclable packaging systems, reduce material consumption through lightweighting, and enable efficient recovery in existing paper recycling infrastructure. Converters' preference for substrates that combine printing versatility with processing efficiency and end-of-life recyclability is creating opportunities for innovative folding boxboard implementations. The rising influence of e-commerce growth and premium product positioning is also contributing to increased adoption of folding boxboard that can provide protective packaging solutions with enhanced visual appeal.

The folding boxboard market is poised for rapid growth and transformation. As brand owners across both developed and emerging markets seek packaging that is recyclable, printable, premium-looking, and structurally efficient, folding boxboard is gaining prominence not just as a commodity substrate but as a strategic differentiator in cosmetics, pharmaceuticals, food, confectionery, and consumer electronics packaging.

Rising incomes and urbanization in Asia-Pacific, Latin America, and Africa amplify demand, while manufacturers are investing in innovations in coating technologies, barrier treatments, and lightweighting capabilities.

Pathways like premium coatings, barrier technology, and digital printing integration promise strong margin uplift, especially in mature markets. Geographic expansion and local production will capture volume, particularly where import costs are high or supply chains are constrained. Regulatory pressures around recyclability, fiber sourcing, and packaging waste reduction give structural support.

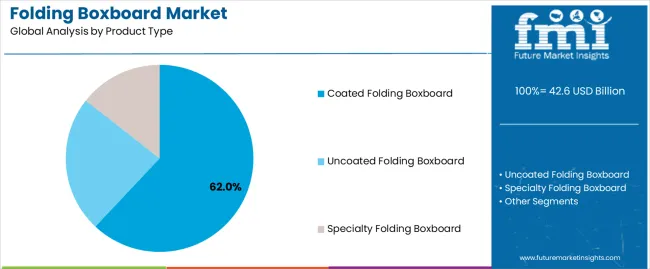

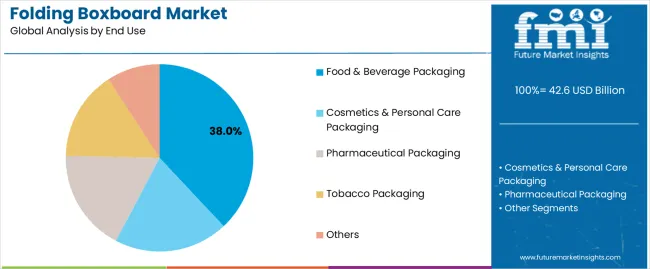

The market is segmented by product type, end use, thickness, distribution channel, and region. By product type, the market is divided into coated folding boxboard (CUK/CRB), uncoated folding boxboard, and specialty folding boxboard. By end use, it covers food & beverage packaging, cosmetics & personal care packaging, pharmaceutical packaging, tobacco packaging, and others. Based on thickness, the market is categorized into 200-300 gsm, 300-400 gsm, and above 400 gsm. By distribution channel, the market includes direct sales, distributors, and online channels. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The coated folding boxboard segment is projected to account for 62% of the folding boxboard market in 2025, reaffirming its position as the leading product category. Packaging converters increasingly utilize coated folding boxboard for its superior printing surface, enhanced visual appeal, and versatility in high-quality packaging applications across cosmetics, pharmaceuticals, and premium food products. Coated folding boxboard technology's advanced surface treatment capabilities and consistent quality output directly address the industrial requirements for excellent printability and brand differentiation in consumer goods packaging.

This product segment forms the foundation of modern premium packaging operations, as it represents the substrate with the greatest versatility and established market demand across multiple end-use categories requiring high-quality graphics reproduction. Converter investments in enhanced coating application systems and surface profiling technologies continue to strengthen adoption among brand owners. With consumer goods companies prioritizing shelf appeal and brand recognition, coated folding boxboard aligns with both marketing objectives and functional performance requirements, making it the central component of comprehensive packaging strategies.

Food & beverage packaging is projected to represent 38% of folding boxboard demand in 2025, underscoring its critical role as the primary application consuming premium paperboard substrates for confectionery boxes, cereal cartons, frozen food packaging, and beverage multipacks. Food and beverage companies prefer folding boxboard for its food-safe properties, excellent printability, and ability to deliver protective packaging while enabling attractive shelf presentation. Positioned as an essential substrate for modern food marketing, folding boxboard offers both functional advantages and consumer appeal benefits.

The segment is supported by continuous innovation in barrier coating technologies and the growing availability of specialized grades that enable grease resistance, moisture protection, and extended shelf life performance. Food manufacturers are investing in packaging differentiation to support premium product positioning and brand loyalty. As convenience food demand becomes more prevalent and packaging visual appeal requirements increase, food & beverage packaging will continue to dominate the end-use market while supporting advanced printing techniques and functional coating applications.

The folding boxboard market is advancing rapidly due to increasing brand owner demand for premium packaging substrates and growing adoption of recyclable materials that provide excellent printability and structural performance across diverse consumer goods applications. The market faces challenges, including raw material price volatility, competition from alternative packaging materials, and the need for significant capital investments in coating and finishing equipment. Innovation in barrier coating technologies and digital printing compatibility continues to influence product development and market expansion patterns.

The growing adoption of water-based barrier coatings and specialty surface treatments is enabling converters to produce folding boxboard grades with superior moisture resistance, grease resistance, and oxygen barrier properties. Advanced coating systems provide improved packaging performance while allowing more efficient processing and consistent quality across various basis weights and applications. Manufacturers are increasingly recognizing the competitive advantages of barrier coating capabilities for product differentiation and premium market positioning.

Modern folding boxboard producers are developing grades optimized for digital printing technologies to enable short-run production, variable data printing, and rapid market testing without traditional platemaking costs. These specialized grades improve production flexibility while enabling new applications, including personalized packaging and limited-edition product launches. Advanced surface optimization also allows converters to support premium brand positioning and consumer engagement beyond traditional offset printing capabilities.

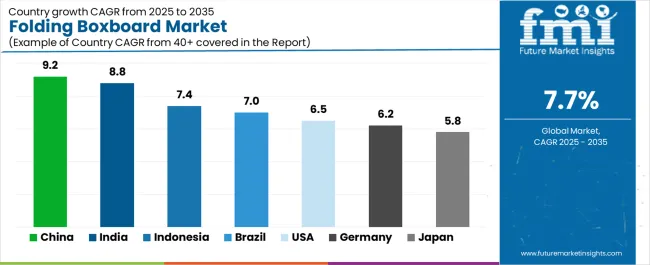

| Country | CAGR (2025-2035) |

|---|---|

| China | 9.2% |

| India | 8.8% |

| USA | 6.5% |

| Germany | 6.2% |

| Indonesia | 7.4% |

| Brazil | 7.0% |

| Japan | 5.8% |

The folding boxboard market is experiencing strong growth globally, with China leading at a 9.2% CAGR through 2035, driven by the expanding consumer goods packaging industry, growing domestic consumption, and significant investment in paperboard manufacturing capacity. India follows at 8.8%, supported by rapid urbanization, expanding food processing sector, and growing demand for branded packaged goods. The USA shows growth at 6.5%, emphasizing premium packaging innovation and e-commerce packaging solutions. Germany records 6.2%, focusing on high-quality printing substrates and pharmaceutical packaging applications. Indonesia demonstrates 7.4% growth, prioritizing domestic market expansion and regional export development. Brazil exhibits 7.0% growth, emphasizing food packaging modernization and cosmetics industry growth. Japan shows 5.8% growth, supported by premium product packaging and advanced coating technologies.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

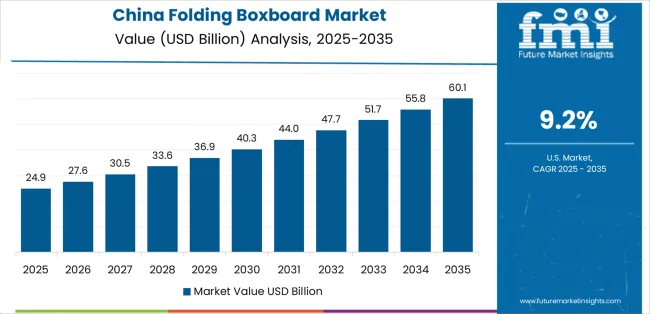

Revenue from folding boxboard in China is expected to grow exceptionally, at a CAGR of 9.2% through 2035, driven by expanding consumer goods manufacturing and rapidly growing domestic consumption supported by urbanization and rising middle-class purchasing power. The country's significant paperboard production capacity and increasing investment in coating technologies are creating substantial demand for advanced folding boxboard solutions. Major packaging converters and international paper companies are establishing comprehensive production capabilities to serve both domestic and export markets.

Demand for folding boxboard in India is expanding at a CAGR of 8.8%, supported by the country's rapidly growing consumer goods sector, expanding organized retail penetration, and increasing preference for branded packaged products. The country's developing paperboard manufacturing infrastructure and growing packaging converter base are driving demand for quality folding boxboard capabilities. International packaging companies and domestic manufacturers are establishing extensive production and distribution capabilities to address the growing demand for consumer packaging solutions.

Revenue from folding boxboard in the USA is growing at a CAGR of 6.5%, supported by the country's mature consumer goods industry, strong emphasis on packaging innovation, and robust demand for premium packaging solutions among brand-conscious consumers. The nation's advanced converting infrastructure and high consumption of specialty packaging are driving sophisticated folding boxboard capabilities throughout the supply chain. Leading paperboard manufacturers and converters are investing extensively in coating technology development and digital printing compatibility to serve both domestic and export markets.

Demand for folding boxboard in Germany is anticipated to grow at a CAGR of 6.2%, driven by the country's advanced packaging industry, emphasis on high-quality printing reproduction, and strong pharmaceutical packaging sector. Germany's sophisticated converting infrastructure and technological expertise are supporting investment in premium folding boxboard grades throughout major packaging production centers. Industry leaders are establishing comprehensive quality management systems to serve both domestic and European export markets with superior printing substrates.

Revenue from folding boxboard in Indonesia is expanding at a CAGR of 7.4%, supported by rapid urbanization, growing middle-class consumption, and increasing domestic paperboard production capacity. The country's developing consumer goods sector and expanding modern retail infrastructure are driving demand for quality packaging substrates across food, personal care, and household products. Manufacturers are investing in production capacity expansion to serve both domestic consumption and regional export opportunities.

Revenue from folding boxboard in Brazil is forecasted to grow at a CAGR of 7.0%, driven by the expanding food processing industry, increasing cosmetics sector growth, and modernization of retail packaging standards. The country's substantial forest resources and developing paperboard manufacturing capabilities are supporting demand for folding boxboard solutions across major consumption centers. Converters and brand owners are establishing comprehensive packaging capabilities to serve both domestic urban markets and regional export opportunities.

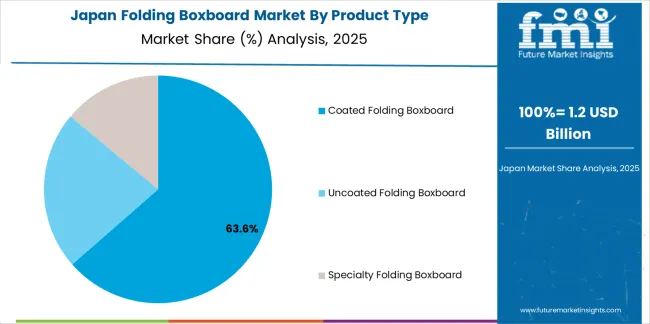

Demand for folding boxboard in Japan is expanding at a CAGR of 5.8%, supported by the country's emphasis on premium packaging presentation, advanced coating technologies, and strong consumer preference for high-quality product packaging. Japan's sophisticated packaging industry and emphasis on material efficiency are driving demand for specialized folding boxboard grades with superior printability and structural performance. Leading manufacturers are investing in advanced surface treatment technologies to serve premium consumer goods, cosmetics, and pharmaceutical sectors.

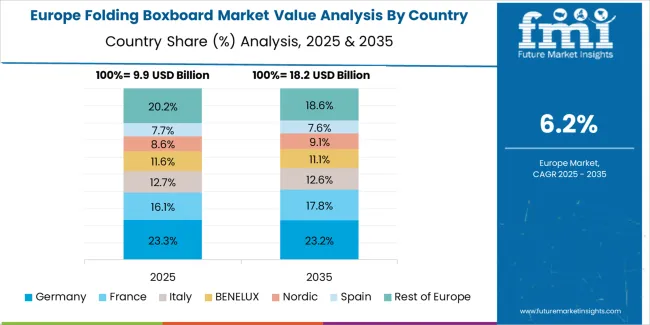

The folding boxboard market in Europe is projected to grow from USD 11.8 billion in 2025 to USD 24.9 billion by 2035, registering a CAGR of 7.8% over the forecast period. Germany is expected to maintain its leadership position with a 32.0% market share in 2025, adjusting to 31.5% by 2035, supported by its strong packaging industry, advanced coating facilities, and comprehensive paperboard manufacturing infrastructure serving major European consumer goods markets.

France follows with a 16.5% share in 2025, projected to reach 17.0% by 2035, driven by robust demand for cosmetics packaging, premium food cartons, and pharmaceutical applications, combined with established luxury goods packaging traditions. The United Kingdom holds a 14.5% share in 2025, expected to reach 14.8% by 2035, supported by strong consumer goods demand and e-commerce packaging growth. Italy commands a 12.0% share in 2025, projected to reach 12.3% by 2035, driven by fashion packaging, confectionery applications, and design-oriented packaging solutions. Spain accounts for 9.5% in 2025, expected to reach 9.8% by 2035, supported by food packaging modernization and cosmetics industry growth. Sweden maintains a 4.8% share in 2025, growing to 5.0% by 2035, driven by paperboard manufacturing expertise and export capabilities. The Rest of Europe region, including Poland, Netherlands, Finland, Austria, Belgium, and other markets, is anticipated to maintain steady presence, with its collective share adjusting from 10.7% to 9.6% by 2035, attributed to increasing local production capabilities in Eastern European markets and ongoing industry consolidation across smaller markets.

The folding boxboard market is characterized by competition among established paperboard manufacturers, integrated forest products companies, and specialized coating technology providers. Companies are investing in advanced coating system development, fiber engineering research, digital printing compatibility, and comprehensive grade portfolios to deliver consistent, high-performance, and cost-effective folding boxboard solutions. Barrier coating innovation, lightweighting, and advanced surface treatments are key to gaining a competitive edge in the market.

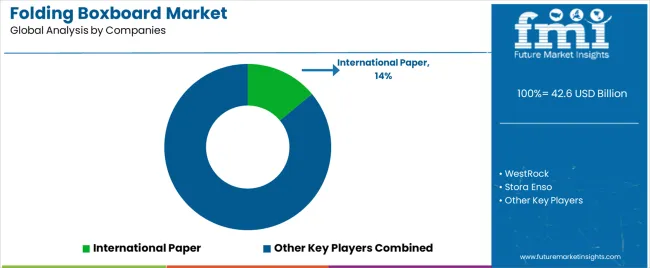

International Paper leads the market with a strong market share, offering comprehensive folding boxboard solutions with a focus on food packaging applications and premium printing substrates. WestRock provides vertically integrated paperboard manufacturing capabilities with emphasis on customer-specific grade development and converting integration. Stora Enso delivers innovative fiber-based packaging solutions with a focus on renewable materials and circular economy principles. Smurfit Kappa specializes in integrated packaging systems and folding boxboard production for European markets. Mayr-Melnhof Karton focuses on premium coated cartonboard and specialized surface treatments. Kotkamills offers high-barrier folding boxboard grades with emphasis on plastic replacement applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 42.6 billion |

| Product Type | Coated Folding Boxboard, Uncoated Folding Boxboard, Specialty Folding Boxboard |

| End Use | Food & Beverage Packaging, Cosmetics & Personal Care Packaging, Pharmaceutical Packaging, Tobacco Packaging, Others |

| Thickness | 200-300 gsm, 300-400 gsm, Above 400 gsm |

| Distribution Channel | Direct Sales, Distributors, Online Channels |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | International Paper, WestRock, Stora Enso, Smurfit Kappa, Mayr-Melnhof Karton, and Kotkamills |

| Additional Attributes | Dollar sales by product type and end use category, regional demand trends, competitive landscape, technological advancements in coating systems, barrier technology innovation, digital printing compatibility, and fiber engineering optimization |

The global folding boxboard market is estimated to be valued at USD 42.6 billion in 2025.

The market size for the folding boxboard market is projected to reach USD 89.4 billion by 2035.

The folding boxboard market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in folding boxboard market are coated folding boxboard, uncoated folding boxboard and specialty folding boxboard.

In terms of end use, food & beverage packaging segment to command 38.0% share in the folding boxboard market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Understanding Market Share Trends in Folding Boxboard Industry

Folding IBC Market Size and Share Forecast Outlook 2025 to 2035

Folding Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Folding Gluing Machines Market Insights and Trends 2025 to 2035

Competitive Overview of Folding Intermediate Bulk Container Companies

Folding E-Scooter Market Growth - Trends & Forecast 2024 to 2034

Folding Paperboard Boxes Market

Folding Plastic Crates Market

USA Folding IBC Market Analysis – Demand, Growth & Forecast 2025-2035

ASEAN Folding IBC Market Insights – Size, Share & Industry Trends 2025-2035

Japan Folding IBC Market Analysis – Trends, Innovations & Forecast 2025-2035

Carton Folding And Gluing Machine Market Size and Share Forecast Outlook 2025 to 2035

Digital Folding Cartons Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Digital Folding Cartons Suppliers

Germany Folding IBC Market Trends – Demand, Size & Industry Outlook 2025-2035

Metallized Folding Cartons Market Size and Share Forecast Outlook 2025 to 2035

Corrugated and Folding Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Boxboard Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Share Insights of Boxboard Packaging Providers

Coated Recycled Boxboard Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA