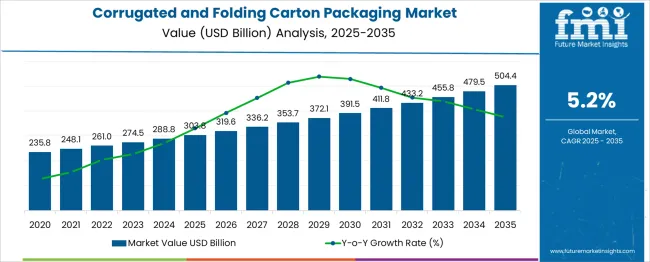

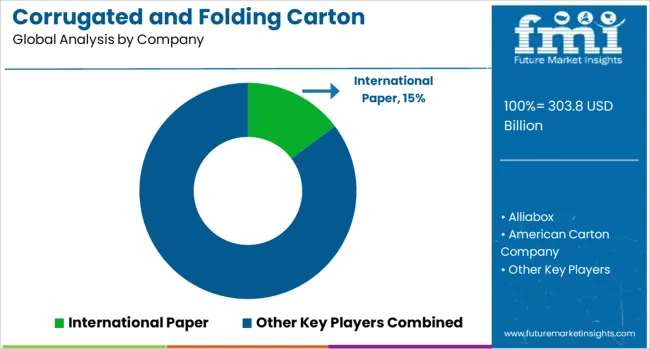

The Corrugated and Folding Carton Packaging Market is estimated to be valued at USD 303.8 billion in 2025 and is projected to reach USD 504.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

| Metric | Value |

|---|---|

| Corrugated and Folding Carton Packaging Market Estimated Value in (2025 E) | USD 303.8 billion |

| Corrugated and Folding Carton Packaging Market Forecast Value in (2035 F) | USD 504.4 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

Increasing consumer preference for eco-friendly materials and regulations promoting recyclable packaging have boosted the adoption of corrugated cartons. The rise in e-commerce and retail sectors has also contributed to the need for durable packaging that ensures product safety during transit. In addition, industries such as food and beverages are increasingly reliant on cartons that protect while maintaining shelf appeal.

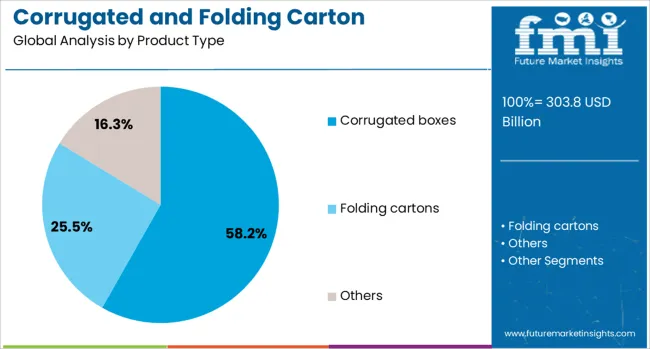

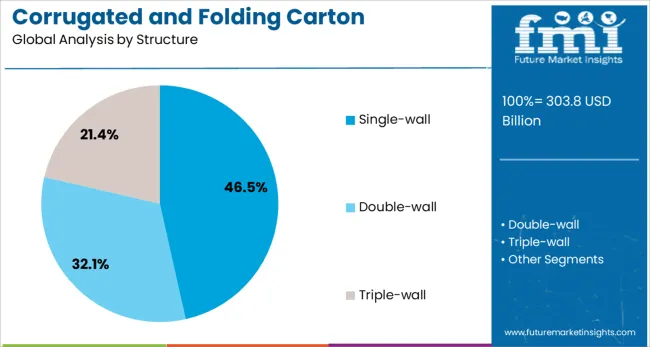

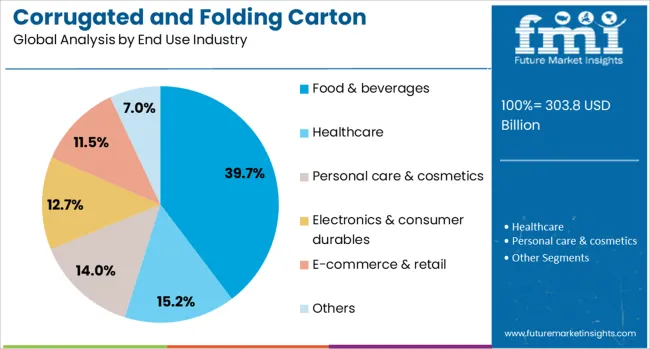

Advances in packaging design and printing technologies have enhanced the functionality and aesthetics of corrugated boxes, further driving their popularity. The market is expected to grow as manufacturers focus on lightweight, cost-effective, and customizable packaging solutions. Segmental growth is anticipated to be led by corrugated boxes in product type, single-wall structures for versatility and strength, and food and beverages as the dominant end-use industry.

The corrugated and folding carton packaging market is segmented by product type, structure, end-use industry, and geographic regions. The corrugated and folding carton packaging market is divided by product type into Corrugated boxes, Folding cartons, and Others. The corrugated and folding carton packaging market is classified into Single-wall, Double-wall, and Triple-wall. The corrugated and folding carton packaging market is segmented by end use industry into Food & beverages, Healthcare, Personal care & cosmetics, Electronics & consumer durables, E-commerce & retail, and Others. Regionally, the corrugated and folding carton packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The corrugated boxes segment is projected to hold 58.2% of the market revenue in 2025, maintaining its lead among product types. Growth has been driven by their superior strength-to-weight ratio, which offers excellent protection while reducing shipping costs. These boxes are highly versatile and can be customized to fit a variety of product shapes and sizes, making them popular across multiple industries.

The sustainability aspect with high recyclability and biodegradability has also resonated well with environmentally conscious businesses and consumers. Increased demand from sectors such as retail, e-commerce, and food packaging continues to support the dominance of corrugated boxes.

The single-wall structure segment is expected to account for 46.5% of the market revenue in 2025 due to its balance of strength, flexibility, and cost-effectiveness. This structure provides adequate protection for a wide range of products without excessive material use, making it the preferred choice for many manufacturers.

It is well suited for packaging light to medium-weight goods and is favored in sectors where cost control is crucial. The simplicity and efficiency of production also contribute to its widespread adoption. As demand for efficient and sustainable packaging grows, the single-wall segment is expected to sustain its leading position.

The food and beverages segment is projected to contribute 39.7% of the market revenue in 2025, positioning it as the largest end-use industry. The need for hygienic and protective packaging in this sector drives the demand for corrugated cartons that can preserve product integrity during transportation and storage.

Regulatory requirements for food safety and freshness have further increased the adoption of packaging that prevents contamination and extends shelf life. The growth of packaged and convenience foods has also led to higher packaging volumes. Consumer preference for sustainable and recyclable packaging options in food products supports the continued expansion of this segment.

The corrugated and folding carton packaging sector is driven by e-commerce growth, lightweight material demand, and retail-ready designs for product protection and branding. Opportunities arise from recyclable materials, advanced printing, and partnerships enhancing supply chain efficiency and regional expansion.

The corrugated and folding carton packaging sector is experiencing strong adoption due to its versatility in handling multiple product categories across food, beverages, and personal care segments. Growth is supported by the increasing reliance on e-commerce platforms, where robust protective packaging remains critical for product integrity during transit. Retail-ready designs and cost-efficient printing techniques are gaining traction, enabling brands to enhance shelf visibility and consumer engagement. The demand for lightweight materials and stackable formats is also rising, driven by operational efficiency in transportation and storage. Strategic procurement by brand owners and emphasis on reducing breakage losses have created favorable conditions for corrugated packaging solutions to remain a primary choice across diverse distribution channels.

Significant opportunities exist in the development of high-quality printing formats for packaging personalization, particularly within consumer goods and premium segments. Customized folding cartons are being leveraged to reinforce brand identity and enhance unboxing experiences, a trend becoming essential for retail differentiation. Demand for recyclable materials has opened pathways for fiber-based packaging to dominate new product launches, while innovation in barrier coatings is helping improve durability and moisture resistance. Emerging economies present notable growth prospects as manufacturers increase local production capacities to address regional consumption trends. Partnerships between converters and brand owners are enabling integrated supply chain models that reduce lead times and ensure consistency in quality standards across varied markets.

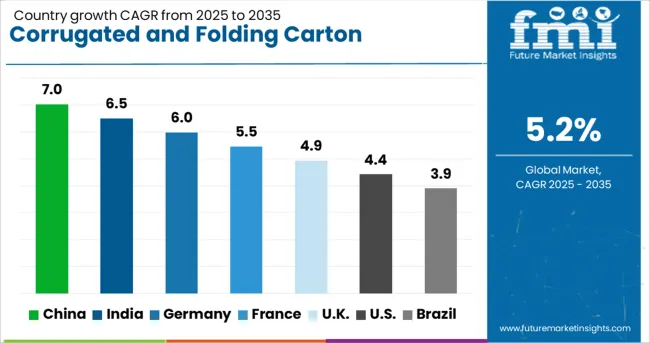

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

The corrugated and folding carton packaging industry, projected to expand at a global CAGR of 5.2% from 2025 to 2035, shows varied performance across major economies. A 7.0% CAGR is being recorded in China, a BRICS nation, driven by large-scale manufacturing and the strong presence of e-commerce-driven packaging needs. India, another BRICS member, is exhibiting a 6.5% CAGR as rising retail networks and quick-service food chains increase demand for folding cartons and corrugated formats. Germany, part of the OECD, is reporting a 6.0% CAGR, supported by advanced production capabilities and a strong focus on packaged consumer goods distribution. Moderate growth trends are evident in the United Kingdom and the United States, both OECD members, with 4.9% and 4.4% CAGRs, respectively. These markets maintain steady consumption levels, largely fueled by the retail and foodservice sectors, but are constrained by high market maturity and established supply chains. Opportunities for dynamic growth remain more prominent in Asian economies, where higher packaging penetration and diversification of consumer goods portfolios continue to shape market expansion. The report covers a detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

The CAGR in China improved from nearly 5.9% during 2020–2024 to 7.0% for 2025–2035, supported by significant retail and e-commerce-driven packaging requirements. Regional distribution hubs prioritized bulk procurement of corrugated formats to manage cost pressures while meeting fast-moving goods demand. Manufacturing clusters in Guangdong and Zhejiang increased capacity utilization through automation and expanded fiber-sourcing networks. Consumer-oriented folding cartons with high-quality graphics gained acceptance in premium food and beverage segments. Strategic supplier agreements between packaging converters and online retail giants enhanced lead-time efficiency. Export-focused production remained steady as global clients sought reliable suppliers from China.

The CAGR in India rose from almost 5.1% in 2020–2024 to 6.5% for 2025–2035, driven by rapid diversification in FMCG and quick-service restaurant chains. Folding cartons gained prominence in personal care and nutraceutical packaging due to demand for visual appeal and easy handling. Tier 2 and Tier 3 cities demonstrated increased consumption of corrugated packaging linked to retail expansion and regional warehousing. Local suppliers scaled up printing innovations, including water-based inks, to meet environmental compliance. Strategic partnerships with organized retailers supported bulk procurement models, which improved economies of scale for regional producers.

The CAGR in Germany shifted from about 4.9% in 2020–2024 to 6.0% during 2025–2035, underpinned by strong manufacturing demand for precision packaging formats. Folding cartons for pharmaceuticals and high-value goods have become central to compliance-driven packaging strategies. Industry players invested in advanced converting equipment to support cost-effective short runs for consumer-centric branding initiatives. Online retail penetration further accelerated requirements for corrugated boxes with enhanced structural integrity. Import-substitution programs and investments in regional pulp supply chains helped stabilize input costs for packaging producers in the OECD member states.

The CAGR in the United Kingdom increased from around 3.8% during 2020–2024 to 4.9% for the 2025–2035 period, supported by resilient demand from e-commerce logistics and specialized retail packaging. Folding carton designs for high-end cosmetics and confectionery experienced accelerated adoption due to branding requirements. The corrugated segment continued to dominate industrial applications, with innovations targeting lighter board grades for supply chain optimization. Strategic collaborations between packaging firms and retail chains enabled digital printing integration for personalized product promotions. Regulatory updates favoring fiber-based packaging over plastics added further momentum to the folding carton category.

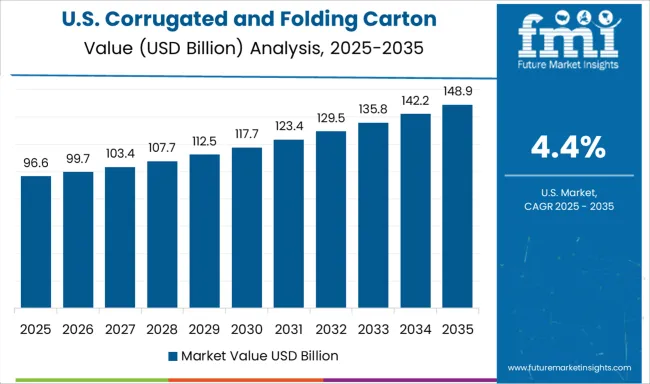

The CAGR in the United States advanced from approximately 3.6% in 2020–2024 to 4.4% for 2025–2035, fueled by continued growth in online grocery, personal care, and healthcare deliveries. Folding carton usage grew substantially in nutraceutical packaging, supported by consumer preference for visually appealing formats. Corrugated packaging retained its dominance in large-volume shipping, with higher investments directed toward production automation and recyclable raw material sourcing. Strategic supplier contracts with logistics and fulfillment centers bolstered high-volume procurement. Domestic converters adopted robotics-enabled systems to manage short-run printing for promotional campaigns while maintaining cost efficiency.

In the corrugated and folding carton packaging sector, dominant companies are strengthening their capabilities through vertical integration, capacity expansion, and the adoption of advanced printing technologies to meet diverse industry requirements. Players like International Paper, Smurfit Kappa, and WestRock are prioritizing fiber-based solutions for high-volume applications in food, beverage, and e-commerce segments. These firms are expanding design customization services to help brand owners enhance shelf visibility while ensuring cost efficiency and material optimization. Emerging participants such as American Carton Company, U-Pack, and Alliabox are focusing on niche areas, including premium folding cartons and lightweight corrugated designs, to cater to personalized retail and specialty goods markets. Global groups like Mondi, Huhtamaki, Stora Enso, and Klabin are accelerating investments in sustainable raw material sourcing and next-generation coatings for moisture and grease resistance. Strategic alliances with logistics and retail networks have become critical to secure long-term procurement contracts.

| Item | Value |

|---|---|

| Quantitative Units | USD 303.8 Billion |

| Product Type | Corrugated boxes, Folding cartons, and Others |

| Structure | Single-wall, Double-wall, and Triple-wall |

| End Use Industry | Food & beverages, Healthcare, Personal care & cosmetics, Electronics & consumer durables, E-commerce & retail, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | International Paper, Alliabox, American Carton Company, Cascades, CCL Industries, DS Smith, Georgia-Pacific, Huhtamaki, Klabin, Mondi Group, Nine Dragons Paper Holdings, Oji Holdings, Packaging Corporation of America, Pratt Industries, Rengo, SCG Packaging, Smurfit Kappa, Stora Enso, U-Pack, and WestRock |

| Additional Attributes | Dollar sales, share, growth by end-use sectors, regional demand outlook, pricing trends, raw material cost dynamics, competitive positioning, capacity expansions, and innovation opportunities in printing and coatings for value-added packaging solutions. |

The global corrugated and folding carton packaging market is estimated to be valued at USD 303.8 billion in 2025.

The market size for the corrugated and folding carton packaging market is projected to reach USD 504.4 billion by 2035.

The corrugated and folding carton packaging market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in corrugated and folding carton packaging market are corrugated boxes, folding cartons and others.

In terms of structure, single-wall segment to command 46.5% share in the corrugated and folding carton packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Corrugated Box Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Equipment Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Fanfold Market Analysis - Size, Share, and Forecast 2025 to 2035

Corrugated Pallet Wrap Market Growth - Demand & Forecast 2025 to 2035

Corrugated Plastic Box Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Market Size, Share & Forecast 2025 to 2035

Corrugated Bubble Wrap Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Paper Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Printer Slotter Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Pallet Containers Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Corrugated Mailers Market Size, Share & Forecast 2025 to 2035

Corrugated Open-head Drums Market Growth - Size & Forecast 2025 to 2035

Corrugated Fiberboard Market Analysis - Size, Demand & Forecast 2025 to 2035

Corrugated Bin Boxes Market by Dividers, Totes, Jumbo, Kraft Open Top Forecast 2025 to 2035

Corrugated Wraps Market Analysis from 2025 to 2035

Corrugated Plastic Trays Market Growth, Trends and Outlook from 2025 to 2035

Evaluating Corrugated Bin Boxes Market Share & Provider Insights

Breaking Down Market Share in the Corrugated Box Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA