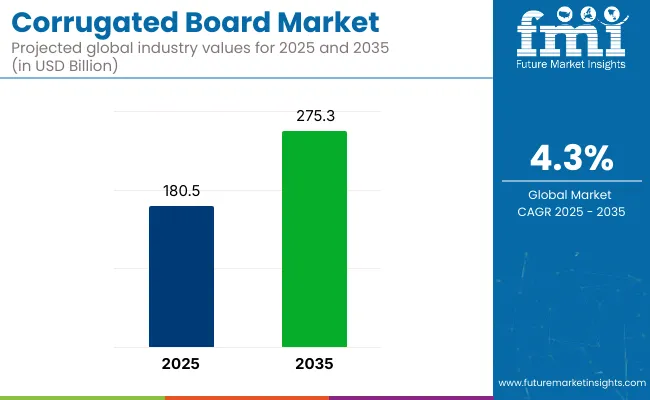

The corrugated board market is projected to grow from USD 180.5 billion in 2025 to USD 275.3 billion by 2035, registering a CAGR of 4.3% during the forecast period. Sales in 2024 reached USD 175.2 billion. This growth is driven by the expansion of e-commerce, organized retail, and the need for paper packaging solutions. The demand for corrugated boards is further propelled by their recyclability, cost-effectiveness, and adaptability to various industries, including food and beverage, electronics, and pharmaceuticals. Advancements in manufacturing technologies have enabled the production of lightweight yet durable corrugated boards, meeting the evolving requirements of consumers and businesses alike.

| Metric | Key Insights |

|---|---|

| Industry Size (2025E) | USD 180.5 billion |

| Industry Value (2035F) | USD 275.3 billion |

| CAGR (2025 to 2035) | 4.3% |

In May 2025, International Paper, a global leader in sustainable packaging, has announced the groundbreaking of its new state-of-the-art sustainable, packaging box plant in Waterloo, Iowa. "We are thrilled to break ground and invest in our company and the city of Waterloo," said John Berry, Group Vice President, International Paper. "This facility represents our dedication to growing in markets where we want to compete, advancing our capabilities and ensuring our customers receive quality and reliable products.

We look forward to our continued future in Waterloo and are very grateful to everyone who has made today possible." The Waterloo box plant will feature cutting-edge technology and equipment, enabling International Paper to deliver innovative and sustainable packaging solutions. The plant's design incorporates the latest safety.

The corrugated board industry is undergoing significant transformation driven by both sustainability efforts and technological progress. At the same time, the rapid growth of e-commerce has spurred the creation of robust, innovative packaging solutions designed to protect goods throughout the shipping process.

These advancements not only minimize the industry’s impact on the planet but also improve the practicality and visual appeal of corrugated packaging. As a result, the sector is better equipped to meet the changing demands and values of today’s environmentally conscious consumers.

By 2035, the corrugated board market is expected to witness strong competitive activity due to advancements in lightweight board formats, digital printing applications, and real-time logistics tracking. Increased demand from pharmaceutical, food delivery, and electronics sectors will be addressed through flexible packaging configurations.

Market players are likely to gain ground through investment in recyclable barrier coatings and regional capacity expansions, securing long-term contracts with Omni channel distributors. Government initiatives promoting eco-friendly packaging have also played a significant role in market expansion.

The table below shows the estimated CAGR for the global corrugated board market from 2025 to 2035 over semi-annual periods.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 4.5% |

| H2 (2024 to 2034) | 4.1% |

| H1 (2025 to 2035) | 3.9% |

| H2 (2025 to 2035) | 4.7% |

The industry is expected to grow at a CAGR of 4.5% in the first half (H1) of the decade from 2024 to 2034 while during the second half (H2) of the same decade, the growth rate is expected to be slightly lower (4.1%). The CAGR for H1 2025 to H2 2035 moves down marginally to 3.9% in the first half and up to 4.7% in the second half. The first half (H1) saw a decline of 60 BPS, while in the second half (H2), the market experienced a Growth of 80 BPS.

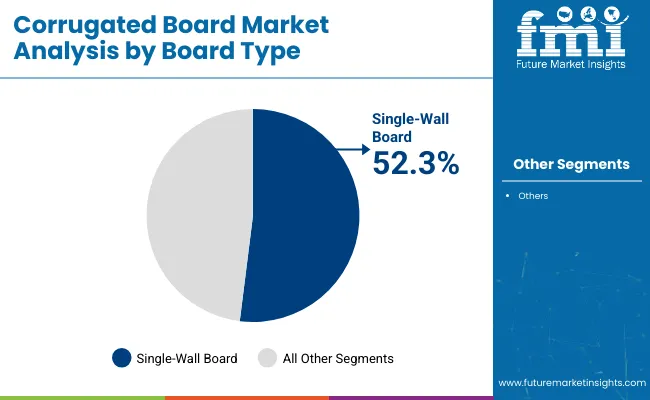

The market is segmented based on board type, product type, packaging type, end use, and region. By board type, the segmentation includes single face, single wall, double wall, and triple wall, each suited for specific stacking strength and shock absorption needs in corrugated packaging. Product types cover coreboard, grey chipboard, test liner, old corrugated cardboard, and corrugated medium, enabling diverse packaging applications across various load-bearing and durability requirements.

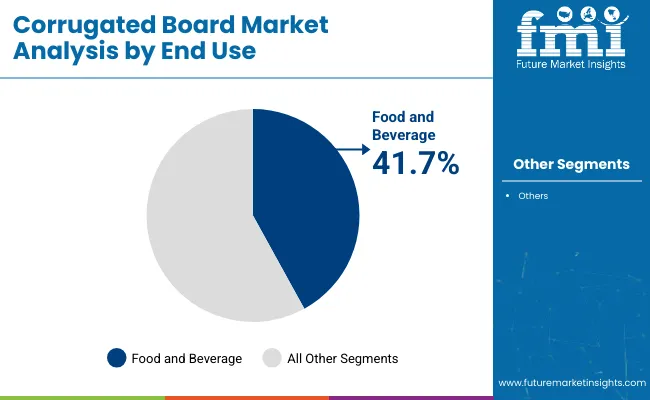

Packaging types include boxes, crates, trays, octabin, pallets, and others, with customization driven by weight, ventilation, and transport constraints. End-use industries comprise food & beverage, personal care & home care, electrical & electronics, industrial, textile, and others, where recyclable packaging and protective formats remain key. Regionally, the market spans North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and Middle East & Africa.

Single-wall corrugated board is projected to account for 52.3% of the global corrugated board market by 2025. This format has been widely adopted for its balance of durability, cost-efficiency, and lightweight profile. It has been used extensively for packaging fast-moving consumer goods and has supported automated packaging lines.

Superior printability and compatibility with die-cutting have enhanced branding capabilities. Logistics providers and retailers have relied on single-wall structures for protective secondary packaging. Boxes made from single-wall board have been favored for shelf-ready and e-commerce packaging formats. Recyclability and material flexibility have made it suitable for sustainable packaging strategies. Industrial and agricultural exporters have used it for efficient cube optimization.

Rapid growth in the food delivery, grocery retail, and cloud kitchen sectors has further expanded single-wall usage. Easy foldability, moisture resistance coatings, and rigidity under load have been leveraged in cold-chain transit packaging. FMCG brands have also favored it for seasonal promotional packaging. Lightweight construction has reduced freight cost and environmental impact.

Global demand for lean packaging formats has pushed manufacturers to expand single-wall offerings across regions. The board’s performance has been optimized through fluting and surface treatments. Its dominance is expected to continue due to cost constraints, automation compatibility, and regulatory support for recyclable packaging. Single-wall formats are expected to dominate future packaging upgrades.

The food and beverage sector is estimated to capture a 41.7% share of the global corrugated board market in 2025. High demand for protective, stackable, and recyclable transit packaging has driven adoption. Fresh produce, dairy, ready meals, and beverages have required board structures that balance rigidity and breathability.

Custom sizing and barrier enhancements have supported temperature-sensitive shipments. Retail-ready trays, fruit crates, pizza boxes, and beverage carriers have been manufactured using tailored corrugated designs. Leading foodservice and QSR chains have opted for corrugated solutions that meet hygiene, insulation, and branding needs. Growing regulatory emphasis on recyclable and biodegradable packaging in the food sector has supported board demand.

Packaging converters have worked with food producers to develop moisture-resistant and grease-resistant corrugated grades. Multi-color flexographic printing and QR coding have enabled supply chain tracking and consumer engagement. Shelf impact, tamper resistance, and portion-specific packaging have further enhanced value.

Industry consolidation has led to centralized procurement of standardized board formats. The surge in online grocery and meal kit subscriptions has resulted in higher usage of corrugated shippers and insulation inserts. Major players have invested in digital corrugated presses to service short-run SKUs. With perishable handling and export standards tightening, corrugated formats are expected to expand further in the food and beverages sector.

Market Driver: Growing E-commerce Sector

The boom in e-commerce has led to the high demand for corrugated board packaging owing to its protective and lightweight properties. As online retail activity continues to grow, the demand for efficient and sustainable packaging solutions is increasing as well.

Government Sustainability Policies Support Market Growth

The transition towards sustainable packages like corrugated board is also fuelled by strict regulations to lower plastic waste. All around the world, governments are implementing recycling programs and green materials in an effort to mitigate environmental impact.

Difficulties Arising from Volatile Raw Material Prices and Supply Chain Management

The fluctuations in the prices of Kraft paper and recycled paper pulp (among others) pose challenges for the corrugated board market. Moreover, supply chain disruptions, especially post-pandemic, have resulted in challenges to production and delivery schedules. Nonetheless, continued investments in automation and sustainable sourcing will help sustain long-term growth of the global corrugated board market.

| Key Investment Area | Why It’s Critical for Future Growth |

|---|---|

| Advanced Lightweight & High-Strength Corrugated Materials | To reduce material usage while maintaining durability and structural integrity. |

| Automation & AI in Corrugated Board Production | To enhance production speed, efficiency, and customization capabilities. |

| Sustainable & Recyclable Coatings | To meet global sustainability regulations and enhance moisture resistance without plastic. |

| Circular Economy & Reusable Corrugated Packaging | To align with zero-waste initiatives and reduce packaging waste. |

| Government Collaboration & Compliance | To ensure adherence to evolving packaging regulations and certifications. |

The global corrugated board market is highly consolidated, wherein the Tier 1 companies hold a prominent share. Also, these companies maintain high production capacities and offer a variety of products. They are known and recognized to produce and manufacture different formats of corrugated board and have a presence across the country and even internationally with a strong consumer base.

Such companies also invest diligently in cutting-edge technology, sustainable solutions, and regulatory alignment to deliver quality products. International Paper Company, West Rock Company, Smurfit Kappa Group, Mondi Group, and DS Smith Plc. are major companies in tier 1.

Tier 2 companies have moderate size and a fairly powerful regional presence that dominates local markets. These companies have good tech capabilities and regulatory compliance but do not have the leading edge techno capabilities and versatility of the tier 1 players. They specialise in niche applications and tailored corrugated board solutions. Rengo Co., Ltd., Packaging Corporation of America, Cascades Inc., Georgia-Pacific LLC, and Nine Dragons Paper (Holdings) Limited are among the well-known companies in tier 2.

Tier 3 includes small-scale enterprises working at a local level to meet regional needs. Tier 3 players, as they are called, serve local market needs and operate as an unorganized sector relative to tier 1 and tier 2 companies which run more structured operations.

The section below covers future projections for the corrugated board market in key countries across different regions. The United States is expected to remain a major market, with a CAGR of 5.4% through 2035. India is projected to lead South Asia with a CAGR of 7.1%.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 3.8% |

| India | 6.1% |

| Germany | 3.2% |

| China | 5.9% |

| Brazil | 3.6% |

| United Kingdom | 3.5% |

| Canada | 3.6% |

In the USA, demand for corrugated board is growing with the boom in e-commerce and industrial packaging. With increased overseas shipping volume, online retailers are beginning to adopt packaging solutions that are lightweight, durable, and cost-effective. Also, RFID tracking in corrugated boards and reinforced corrugated boards help in market growth.

The transition towards sustainable corrugated board solutions is spearheaded by Germany, which has strict recycling and waste management policies. There is a growing demand for biodegradable, compostable, and reusable packaging, especially in the food, beverage, and consumer goods sectors. To increase the efficiency of packaging with a low environmental impact, German manufacturers are investing in high-strength, lightweight materials.

These players in the global corrugated board market are also developing lightweight and durable corrugated materials and adopting sustainable manufacturing processes. Companies are diversifying their e-commerce-optimized packaging offerings, adding digital printing for bespoke branding.

Announcement: Smurfit Kappa launched a new range of lightweight and high-strength of corrugated board solutions tailored for the e-commerce and food packaging sectors. This development is both more sustainable and more cost-effective.DS Smith worked with Amazon to create bespoke recyclable corrugated packaging solutions. This collaboration will help to minimize packaging waste and do more with less, aligning to increasing sustainability trends.

M&As: Integration Paper acquired DS Smith for USD 7.2 billion, making them a clear leader in sustainable corrugated packaging Mondi Group also fortified its business in Western Europe by acquiring Schumacher Packaging's assets for USD 634 million.

FSC® certifications: West Rock obtained its FSC® certificates for its corrugated board products, as part of its commitment to promote sustainable forestry practices and deliver eco-friendly packaging solutions.

Product innovation: Pratts Industries introduced waterproof, corrugated board solutions for fresh food and agriculture packaging. As the food sector faces growing demand for long-lasting and sustainable materials, this innovation meets that need.

The market for corrugated board is expected to grow at a 4.3% CAGR during 2025 to 2035.

In 2024, the market for global corrugated board was estimated at USD 175.2 billion.

The market is projected to be worth USD 275.3 billion by 2035.

They include Smurfit Kappa, DS Smith, and International.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Corrugated Board Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Fiberboard Market Analysis - Size, Demand & Forecast 2025 to 2035

Corrugated Box Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Automotive Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Fanfold Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Equipment Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Fanfold Market Analysis - Size, Share, and Forecast 2025 to 2035

Corrugated and Folding Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Pharmaceutical Packaging Market Analysis Size, Share & Forecast 2025 to 2035

Corrugated Pallet Wrap Market Growth - Demand & Forecast 2025 to 2035

Corrugated Plastic Box Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Market Size, Share & Forecast 2025 to 2035

Corrugated Bubble Wrap Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Paper Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Printer Slotter Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Pallet Containers Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Mailers Market Size, Share & Forecast 2025 to 2035

Corrugated Open-head Drums Market Growth - Size & Forecast 2025 to 2035

Corrugated Bin Boxes Market by Dividers, Totes, Jumbo, Kraft Open Top Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA