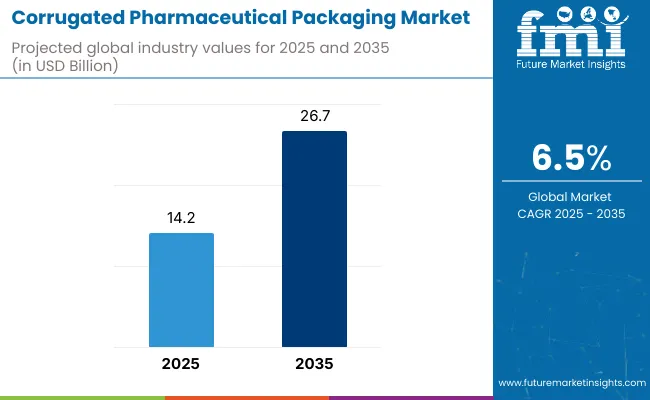

The corrugated pharmaceutical packaging market is projected to grow from USD 14.2 billion in 2025 to USD 26.7 billion by 2035, registering a CAGR of 6.5%. The 2024 sales value is estimated at approximately USD 13.3 billion.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 14.2 billion |

| Industry Value (2035F) | USD 26.7 billion |

| CAGR (2025 to 2035) | 6.5% |

Growth is being driven by the global expansion of vaccine logistics, temperature-sensitive biologics, and clinical trial shipments. Corrugated boxes with insulated liners and shock-resilient designs are preferred for transit, ensuring compliance with GDP (Good Distribution Practice) norms. E-commerce pharmaceutical models and specialty drug launches are further fueling demand for secondary packaging that protects against humidity, compression, and heat exposure.

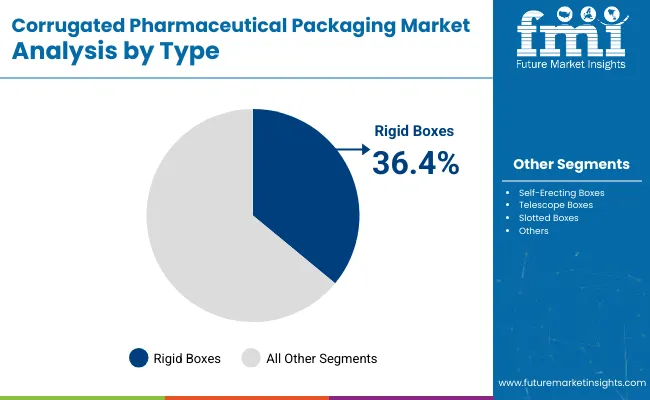

The market has been segmented based on box type, wall construction, material, end use, and region. Box types such as rigid boxes, telescope boxes, slotted boxes, and self-erecting formats have been employed to ensure pharmaceutical security, stacking strength, and compliance with cold chain requirements.

Wall construction includes single, double, and triple-wall corrugation, chosen based on drug sensitivity, transit risk, and regulatory shipping standards. Material types such as linerboard and corrugated medium are used to meet requirements for tamper evidence, structural rigidity, and sustainability.

Regional segmentation spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, capturing local compliance norms, pharmacy logistics infrastructure, and packaging automation maturity.

Rigid boxes are expected to hold a 36.4% share of the corrugated pharmaceutical packaging market in 2025 due to their superior durability, stacking strength, and product integrity. These formats have been widely adopted for packaging bulk APIs, clinical trial kits, and high-value therapeutics. Their structural rigidity has ensured protection during long-distance shipping and regulated handling procedures.

Customization has been enabled through inserts, cushioning, and tamper-evident seals. Compliance with Good Distribution Practices (GDP) and serialization standards has been facilitated through advanced printing and tracking features. Rigid boxes also accommodate temperature-control needs through insulation-friendly designs. Their reusability in controlled environments has further supported adoption in pharmaceutical logistics.

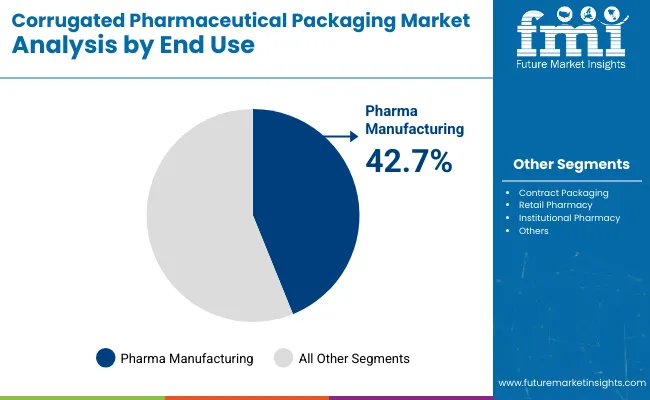

The pharma manufacturing segment is projected to account for 42.7% share of the market in 2025, supported by growing global production volumes and regulatory stringency. Corrugated packaging has been used to transport finished dosage forms, intermediate goods, and primary-packed items between facilities. Structural strength and ease of palletization have made it the preferred solution for pharmaceutical plants.

Batch-level packaging has been enhanced through pre-printed codes and barcoding systems for traceability. Compatibility with conveyor-based operations and automation equipment has improved production efficiency. Corrugated formats have helped manufacturers meet rigorous safety and cleanliness standards while maintaining cost control. Integration with cold chain packaging systems has also driven utility in specialized applications.

The rising prevalence of non-communicable and chronic diseases has established a strong demand for corrugated pharmaceutical packaging in the global market. As urbanization leads to affects the lifestyle of the population, several long term diseases are leading to a rise in demand for pharmaceuticals which is increasing in demand for corrugated pharmaceutical packaging owing to the rise in trade activities of these essential commodities.

Raising health consciousness among global population has led to growth in self-prescription behavior that has steered a proliferated demand for over-the-counter drugs and dietary supplements, owing to which trade activities of these pharmaceutical products are on the rise more than ever. This rise in demand is causing a considerable growth in demand for corrugated pharmaceutical packaging as a domino effect.

Customizable size of the packaging to small, medium, and large is one of the features of corrugated pharmaceutical packaging that has increased its demand across the global market. Rising demand for generics, and dietary supplements across the online retail platform in developed as well as emerging economies, the growth rate is further complemented. Based on the type of corrugated pharmaceutical packaging, rigid boxes are anticipated to hold a large market share in the forecast period.

Eco-friendly packaging solution has been the aim for the government of many countries across the globe. This aim combined with the initiatives with CPA (The Corrugated Packaging Alliance) aims to achieve and promote eco-friendly packaging solutions for pharmaceuticals for further growth of the market.

End users in the pharmaceutical industry also prefer corrugated pharmaceutical packaging as many researchers state that this packaging considerably reduces the growth of microbes and hence reduces risk related to contamination, maintaining the safety of the drug.

North America and Europe together secure a dominating share in the global corrugated pharmaceutical packaging market. As government bodies in the region strengthen the healthcare facilities, insurance, and infrastructure, it will further expand the demand for corrugated pharmaceutical packaging.

As pharmaceutical products need highly customized packaging solutions that are bounded by stringent regulations, corrugated pharmaceutical packaging has many lucrative opportunities that will enhance its demand in the global market. Owing to this reason, manufacturers are closely working with the R&D team to maintain hygiene, safety, and other precautionary compliance.

India is one of the largest exporters of generic pharmaceuticals in the global market and this is one of the largest consumers of corrugated pharmaceutical packaging. The country has a large number of manufacturers of corrugated pharmaceutical packaging located nearby the important ports across the western and eastern coast for maximum penetration and lucrative opportunities owing to the location.

Manufacturers in the region are striving to establish a partnership with prime exporting pharmaceutical manufacturers to provide customized corrugated pharmaceutical packaging.

The global corrugated pharmaceutical packaging market is fragmented and highly competitive with numerous players. Players are adopting several strategies that would help them to enhance market presence and penetration like product development, investments, acquisitions, and agreements with key pioneers in the local market.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

Key Companies

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Corrugated Box Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Equipment Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Fanfold Market Analysis - Size, Share, and Forecast 2025 to 2035

Corrugated Pallet Wrap Market Growth - Demand & Forecast 2025 to 2035

Corrugated Plastic Box Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Market Size, Share & Forecast 2025 to 2035

Corrugated Bubble Wrap Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Paper Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Printer Slotter Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Pallet Containers Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Corrugated Mailers Market Size, Share & Forecast 2025 to 2035

Corrugated Open-head Drums Market Growth - Size & Forecast 2025 to 2035

Corrugated Fiberboard Market Analysis - Size, Demand & Forecast 2025 to 2035

Corrugated Bin Boxes Market by Dividers, Totes, Jumbo, Kraft Open Top Forecast 2025 to 2035

Corrugated Wraps Market Analysis from 2025 to 2035

Corrugated Plastic Trays Market Growth, Trends and Outlook from 2025 to 2035

Evaluating Corrugated Bin Boxes Market Share & Provider Insights

Breaking Down Market Share in the Corrugated Box Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA