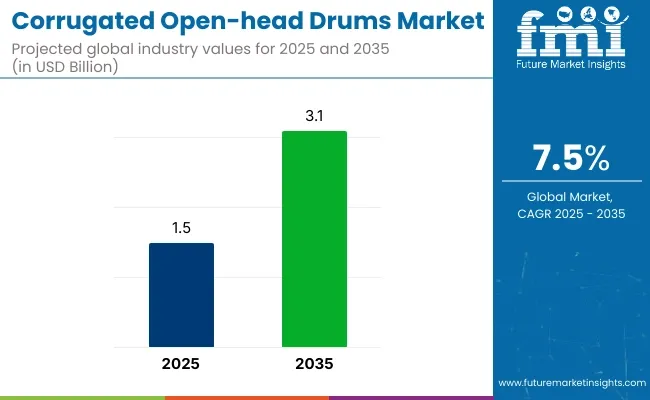

The corrugated open-head drums market is projected to grow from USD 1.5 billion in 2025 to USD 3.1 billion by 2035, registering a CAGR of 7.5% during the forecast period. Sales in 2024 reached USD 1.2 billion, underscoring the sector's resilience and growing demand across chemicals, pharmaceuticals, food & beverage, and agriculture industries. This growth is attributed to the increasing need for lightweight, recyclable, and sustainable packaging solutions that ensure product integrity during storage and transportation.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 1.5 billion |

| Projected Market Size in 2035 | USD 3.1 billion |

| CAGR (2025 to 2035) | 7.5% |

In August 2024, Mauser Packaging Solutions, a global industrial packaging producer and provider of solutions and services for the entire life cycle of packaging, has acquired a business of manufacturing, selling and supplying plastic drums including large rigid plastics drums in Pinetown, Kwa-Zulu Natal, South Africa.

The business was initially owned by Nampak Products Ltd and sold to Eliptotime PTY Ltd, who has in turn on-sold the business to Mauser. “This investment underscores our ongoing commitment to expanding our presence in this region and growing with our customers by delivering sustainable packaging solutions with unparalleled quality and customer service,” said Michael Steubing, President of Mauser’s International Packaging Business Unit.

The shift towards sustainable and eco-friendly packaging solutions is influencing the corrugated open-head drums market. Manufacturers are focusing on developing drums that are biodegradable, recyclable, and made from renewable resources. Innovations include the integration of moisture-resistant coatings, tamper-evident features, and the use of water-based inks for printing to reduce environmental impact. These advancements align with global sustainability goals and regulatory requirements, making corrugated open-head drums an attractive option for environmentally conscious industries.

The corrugated open-head drums market is poised for significant growth, driven by increasing demand in chemicals, pharmaceuticals, food & beverage, and agriculture industries. Companies investing in sustainable materials, innovative designs, and eco-friendly production processes are expected to gain a competitive edge. As global supply chains expand and environmental regulations become more stringent, the adoption of corrugated open-head drums is anticipated to rise, offering cost-effective and eco-friendly packaging solutions.

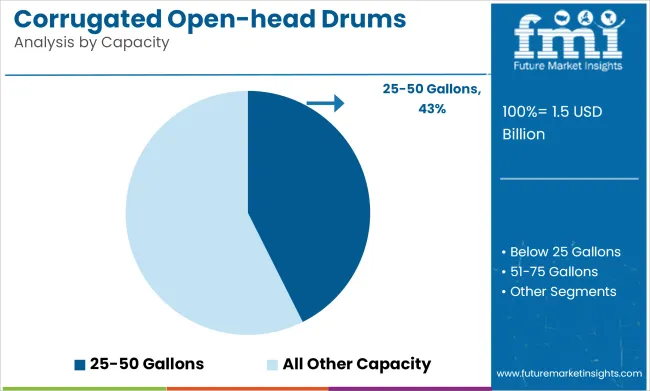

The 25-50 gallon capacity range is expected to account for approximately 42.6% of the corrugated open-head drums market by 2025, as this segment is widely adopted for transporting medium-volume goods across industrial, pharmaceutical, and chemical sectors. This range has been favored for offering an optimal balance between storage efficiency and manual handling convenience, particularly in applications where bulk yet maneuverable packaging is required.

These drums are being utilized extensively for powders, granules, and semi-viscous materials that do not demand rigid metal containment but require moisture-resistant, structurally sound packaging. Greater compatibility with palletization systems and material-handling equipment has also contributed to the segment’s growing preference.

Compliance with hazardous and non-hazardous packaging regulations has been maintained through the use of internal liners and reinforced corrugated materials. Demand for sustainable and lightweight bulk packaging formats has further accelerated their adoption across global distribution networks.

As operational flexibility, reduced transportation weight, and ease of recycling continue to be prioritized, corrugated open-head drums in the 25-50 gallon range are anticipated to remain the most utilized across industries requiring moderate-capacity bulk storage and shipment solutions.

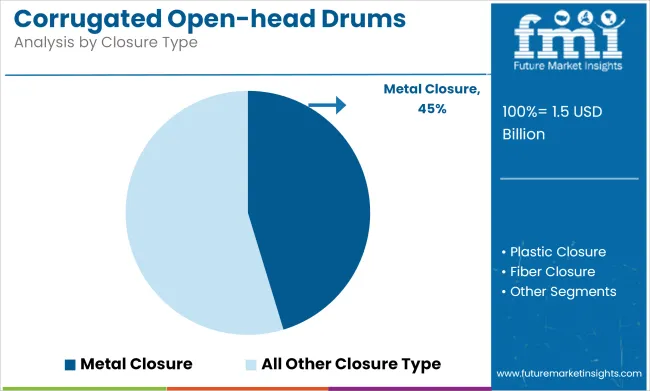

Metal closure are projected to dominate the closure type segment of the corrugated open-head drums market, holding an estimated 45.3% market share by 2025, driven by the secure sealing performance and high durability they provide. Their adoption has been reinforced by regulatory requirements for tamper evidence and hazardous material containment, especially in chemical, pharmaceutical, and agro-industrial applications.

Drums with metal closures have been preferred for their ability to withstand external stress, resist corrosion (when treated), and ensure an airtight seal even in harsh transport conditions. Their strength and reliability under varying temperature and humidity levels have positioned them as the closure of choice for both export and domestic use.

Metal rings, lever-locks, or bolt closures have been engineered to support repeat opening and resealing while maintaining integrity, especially in reuse scenarios. Their compatibility with internal lining systems and anti-contamination safeguards has been viewed favorably by quality assurance teams and regulatory bodies. As global packaging standards move toward safety-focused and cost-efficient solutions, corrugated drums with metal closures are expected to continue being selected where containment integrity, robustness, and regulatory compliance are non-negotiable.

Limited Durability, Regulatory Compliance, and Competition from Metal and Plastic Drums

The corrugated open-head drums market also faces several challenges as it is not as durable as standard metal and plastic drums. Corrugated fiber drums are lightweight and economical, but they have limited moisture resistance, load-bearing needs and the storage of hazardous materials over a long period of time.

Also, transporting chemicals, pharmaceuticals, or food-grade products requires rigorous regulatory compliance and certifications with the USA DOT (Department of Transportation) for UN (United Nations) FDA (Food and Drug Administration), making manufacturing very difficult. A significant market drawback is competition from metal and plastic drums that are stronger, reusable, and better suited to extreme conditions, making them a preferred option for heavy industrial applications.

Growth in Sustainable Packaging, E-Commerce Logistics, and Lightweight Industrial Solutions

The global corrugated open-head drums market is mainly being propelled by demand from end-users, which is characterized by multiple trends. While sectors move to adopt biodegradable, recyclable, and low-carbon packaging, corrugated fiber drums are gaining favor in bulk food packaging, pharmaceutical deliveries, and lightweight logistics applications.

Also, revolutionized moisture-resistant coatings, reinforced fiber structures, and biodegradable linings, enhance the strength and protective functions of corrugated drums. The growth in e-commerce-driven industrial shipping and AI-driven supply chain automation will also further contribute to the adoption of lightweight fiber-based bulk packaging solutions.

Corrugated open-head drums market investigates and has incorporated the vital information that provides the overview of the industry. Increasing use of corrugated fiberboard drums in the chemical, pharmaceutical and food industries is propelling the market growth. Moreover, stringent guidelines on plastic/metal drum usage are prompting enterprises to shift towards eco-friendly options, thus further spurring market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

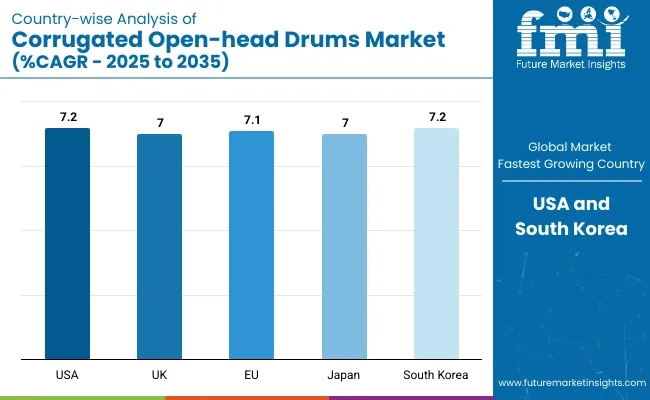

| USA | 7.2% |

Various drivers such as the increasing trend towards sustainable and economic packaging in various industries are driving the growth of corrugated open-head drums market in UK. Increased focus on recyclable and biodegradable packaging, along with stringent environmental regulations for hazardous waste disposal is expected to spur the market growth. Furthermore, the rising consumption of fiberboard drums for transporting dry and semi-liquid products is bolstering market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.0% |

The corrugated open-head drums market is growing in the European Union, driven by strict rules on packaging waste reduction and the rising use of fiber-based materials. Growing demand for durable, lightweight, and easy-to-handle packaging in food processing, chemicals, and pharmaceuticals sectors is likely to drive growth. Continuous advancements in moisture-resistant coatings and reinforced fiberboard drums offered in the market are enhancing product performance an influence expected to augment growth in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.1% |

Japan’s corrugated open-head drums market is also expected to grow moderately due to growing preference for sustainable and efficient packaging solutions in the respective country. In industry sectors such as chemical, food, and electronics, the adoption of fiberboard drums is at the forefront, as manufacturers in search for a cost-efficient substitute for traditional metal and plastic drums. Emerging trends toward sustainable and high-strength fiberboard packaging are further driving market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.0% |

The corrugated open-head drums market in the South Korea region is also predicted to grow faster owing to increasing focus on green packaging solutions and industrial safety regulations. The increasing consumption for fiberboard drums in the pharmaceuticals and food industries, increasing number of protective coatings and drum use life are among the major factors propelling the market growth. Furthermore, government initiatives that support the use of sustainable material for packaging are contributing to the growth of the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.2% |

The corrugated open-head drums market is experiencing growth due to the rising demand for lightweight, cost-effective, and environmentally friendly bulk packaging solutions. These drums are widely used in chemical, food & beverage, pharmaceutical, and hazardous waste management industries due to their high strength, easy handling, and sustainable composition.

Companies are focusing on AI-driven material optimization, advanced drum design, and recyclable drum production to enhance durability, cost-efficiency, and eco-friendly packaging solutions.

Greif Inc. (18-22%)

Greif leads the corrugated open-head drums market, offering fiber-based drum packaging solutions with AI-driven structural strength optimization and lightweight durability innovations.

Schutz Container Systems Inc. (12-16%)

Schutz specializes in recyclable corrugated drums, ensuring AI-enhanced drum performance, impact resistance, and compatibility with hazardous material storage.

Mauser Packaging Solutions (10-14%)

Mauser provides high-performance open-head fiberboard drums, optimizing AI-powered moisture resistance technology and cost-effective bulk transport solutions.

Sonoco Products Company (8-12%)

Sonoco focuses on fiber-based drum packaging, integrating AI-assisted compression strength analysis and sustainable material development.

Fibrestar Drums Ltd. (5-9%)

Fibrestar develops biodegradable fiber drums, ensuring AI-powered packaging resilience and environmentally friendly disposal options.

Other Key Players (30-40% Combined)

Several packaging material firms, industrial container manufacturers, and eco-friendly packaging solution providers contribute to next-generation open-head drum innovations, AI-powered structural reinforcement, and high-durability packaging solutions. These include:

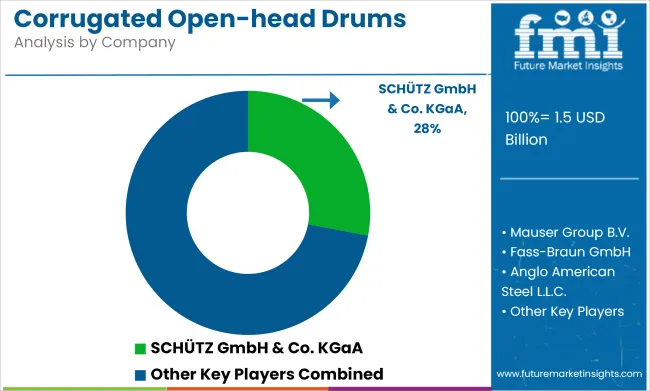

The overall market size for corrugated open-head drums market was USD 1.5 billion in 2025.

Corrugated open-head drums market is expected to reach USD 3.1 billion in 2035.

The demand for Corrugated Open-Head Drums is expected to rise due to increasing preference for lightweight and sustainable packaging solutions, growing demand in the chemical and pharmaceutical industries, and rising emphasis on cost-effective bulk packaging.

The top 5 countries which drives the development of corrugated open-head drums market are USA, UK, Europe Union, Japan and South Korea.

25-50 Gallon Drums and Metal Closure Systems to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Corrugated Automotive Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Fanfold Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Board Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Equipment Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Fanfold Market Analysis - Size, Share, and Forecast 2025 to 2035

Corrugated and Folding Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Pharmaceutical Packaging Market Analysis Size, Share & Forecast 2025 to 2035

Corrugated Pallet Wrap Market Growth - Demand & Forecast 2025 to 2035

Corrugated Plastic Box Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Market Size, Share & Forecast 2025 to 2035

Corrugated Bubble Wrap Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Paper Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Printer Slotter Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Pallet Containers Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Corrugated Mailers Market Size, Share & Forecast 2025 to 2035

Corrugated Fiberboard Market Analysis - Size, Demand & Forecast 2025 to 2035

Corrugated Plastic Trays Market Growth, Trends and Outlook from 2025 to 2035

Corrugated Bin Boxes Market by Dividers, Totes, Jumbo, Kraft Open Top Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA