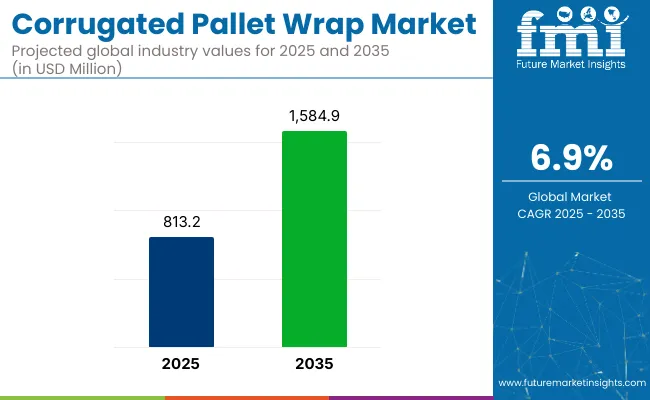

The global corrugated pallet wrap market is projected to grow from USD 813.2 million in 2025 to USD 1,584.9 million by 2035, registering a CAGR of 6.9% during the forecast period. Sales in 2024 were recorded at USD 765.5 million. This growth is primarily attributed to the rising emphasis on sustainable and recyclable packaging materials, increasing demand from logistics and warehousing sectors, and continued innovation in lightweight yet durable corrugated solutions.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 813.2 million |

| Projected Market Size in 2035 | USD 1,584.9 million |

| CAGR (2025 to 2035) | 6.9% |

Corrugated pallet wrap, as a protective outer layer for palletized goods, offers eco-friendly advantages over traditional stretch films, delivering strength, stackability, and improved printability for branding and supply chain visibility.

Smurfit Kappa, a global leader in fiber-based packaging, and expand its corrugated packaging operations across North America and Europe, with a dedicated focus on pallet-ready wrap technologies. The investment will support the installation of automated high-speed corrugators and converting equipment optimized for warehouse and distribution applications.

“This expansion reflects our commitment to circular packaging and addresses the accelerating shift toward sustainable, paper-based pallet solutions,” stated Tony Smurfit, CEO of Smurfit Kappa.

Recent innovations in corrugated pallet wrap manufacturing have resulted in enhanced structural performance, customization, and eco-design. Producers are prioritizing fiber optimization techniques, lightweight fluting geometries, and coated barrier linings to increase product integrity while reducing raw material use. Advancements in digital printing have enabled supply chain traceability and branding on pallet wrap, especially valuable in retail-ready applications.

Additionally, some companies are incorporating smart tracking elements into corrugated wraps using RFID-embedded tags, enabling automated warehouse management. These improvements support better pallet stability, reduced environmental impact, and lower cost-per-unit shipped. As global shipping regulations tighten around plastic waste, corrugated pallet wrap is gaining preference as a compliant and biodegradable solution.

The corrugated pallet wrap market is poised for robust growth in developing economies, particularly across the Asia-Pacific and Latin America regions, where infrastructure upgrades, e-commerce expansion, and industrial growth are fueling packaging demand.

Countries such as India, Vietnam, and Mexico are experiencing a shift from traditional stretch wrap to fiber-based alternatives, driven by cost optimization, sustainability mandates, and increasing awareness among manufacturers. Beyond warehousing and logistics, corrugated pallet wraps are gaining traction in agri-export packaging, automotive parts logistics, and pharmaceuticals. Producers are expected to invest in modular wrap designs, retail-ready corrugated systems, and regionally sourced kraft liners to meet varied performance and compliance needs across global markets.

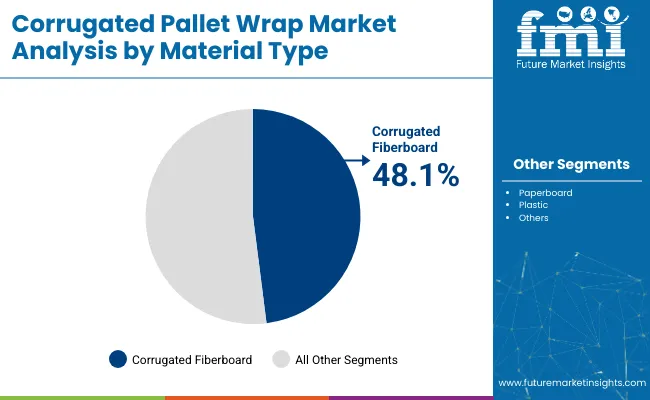

The market has been segmented based on material type, end-use industry, distribution channel, and region. By material type, paperboard, corrugated fiberboard, and plastic have been utilized to deliver cost-efficient, durable, and recyclable wrapping solutions tailored for securing palletized goods during transit and storage.

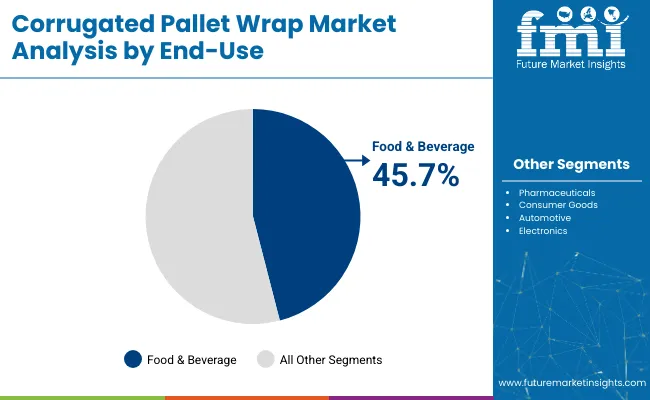

End-use industries include food & beverage, pharmaceuticals, consumer goods, automotive, and electronics, each representing specific needs in logistics, product protection, and regulatory compliance. Distribution channels encompass direct sales, distributors, and online retail-reflecting the strategic shift towards omnichannel packaging procurement across both B2B and B2C landscapes.

Regional segmentation spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, capturing variations in export volume, packaging standards, and sustainability mandates impacting pallet wrap adoption globally.

The corrugated fiberboard segment is expected to account for the highest share of 48.1% in the corrugated pallet wrap market by 2025, supported by its superior cushioning properties, high stacking strength, and cost-efficient profile. Corrugated fiberboard is widely preferred for pallet wrapping applications in logistics and shipping due to its rigidity, shock absorption, and recyclability.

With increasing regulatory and commercial pressure to phase out plastic-based pallet wraps, corrugated fiberboard has emerged as a leading alternative across distribution centers, export packaging hubs, and e-commerce fulfillment facilities. Its ability to prevent product shifting, protect against impact damage, and maintain load stability during long-haul shipments makes it indispensable in both domestic and international supply chains.

The corrugated wraps are often designed with perforations or breathable slots, enabling ventilation for perishables and reducing condensation. Recent innovations in laminated coatings and water-resistant adhesives have further enhanced their application versatility without compromising recyclability. Corrugated fiberboard’s compatibility with automated wrapping machinery and custom printability has increased its appeal in high-throughput environments.

The food & beverage segment is projected to dominate the end-use industry category with a 45.7% share in 2025, owing to its high demand for durable, hygienic, and eco-friendly palletization solutions. From bottled beverages and dairy cartons to processed food cartons and fresh produce trays, corrugated pallet wraps are widely used to secure secondary packaging during storage and transit.

This segment’s dominance is closely tied to the rapid expansion of cold chain logistics, organized retail, and international food exports. Corrugated wraps offer a clean, safe, and printable surface for SKU tracking, barcoding, and branding, which is critical for traceability and compliance in the food supply chain.

Pallet wraps made of corrugated fiberboard are particularly favored in sectors such as fruits and vegetables, bakery, dairy, and ready-to-eat foods, where product integrity, moisture resistance, and stacking performance are key. Their disposable yet recyclable nature aligns with industry sustainability goals, helping brands reduce carbon footprints and plastic waste.

With global food distribution becoming increasingly dynamic and sustainability-centric, the food & beverage sector will remain the prime end-user of corrugated pallet wraps, driving both innovation and volume demand through 2035.

Cost Constraints, Durability Issues, and Competition from Plastic-Based Wraps

The corrugated pallet wrap market also presents some challenges, mainly higher production costs in comparison to plastic stretch films and shrink wraps. Corrugated pallet wraps, being environmentally friendly and recyclable cannot match the stretch ability of the conventional plastic wraps or their load-securing strength which increases the risk of product moving during transportation.

Furthermore, moisture sensitivity and prolonged exposure to extreme weather conditions can weaken the structural integrity of corrugated wraps, preventing their widespread adoption in cold chain logistics and outdoor storage. The other significant challenge is competition against all plastic-based wraps, which are still predominant across sectors like food, pharma, and industrial packaging, where strength, moisture-proof performance, and transparency guarantees stock visibility and protection..

Growth in Sustainable Packaging, E-Commerce Logistics, and Smart Supply Chain Innovations

Nevertheless, the corrugated pallet wrap market is anticipated to witness robust growth owing to the surge in sustainable packaging solutions market, stringent regulations on plastic waste management, and the rise of e-commerce-centered logistics. With many governments no longer allowing single-use plastics, manufacturers are looking into biodegradable, recyclable and fiber-based pallet wraps.

Moreover, sustainability, through tech such as AI-powered supply chain optimization and automated pallet wrapping, leads to more load stabilization through the use of lesser, eco-friendly materials. Closed-loop recycling programs and sustainable logistics initiatives are forcing corrugated pallet wraps into the space eliminating more plastic-based pallet securing methods.

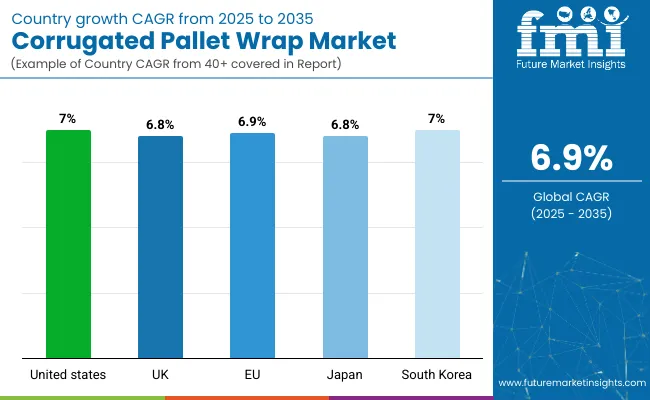

The USA corrugated pallet wrap market has grown steadily and is expected to maintain its growth during the forecast period, with more and more demand for economic, and sustainable protective packaging material observed in logistics and supply chain industries. Increasing use of sustainable materials and a shift away from plastic-based pallet wraps are driving market growth. Furthermore, changes such as the growth of e-commerce and demand for durable and recyclable packaging materials are also a driving force behind more demand in this industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.0% |

The UK market is growing for corrugated pallet wrap, as companies are looking for recyclable and biodegradable substitutes to plastic stretch films. Increasing emphasis on reduction of carbon footprints along with adherence to stringent environmental regulations are fueling adoption. Moreover, the growing investments in the advanced corrugated packaging development technologies and light-weight and high-strength materials are revitalizing the market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.8% |

Due to sustainability programs and stringent packaging waste legislation, the corrugated pallet wrap market is growing strongly across Europe and is expected to remain strong in the coming years. The growing preference for fiber-based, recyclable packaging solutions across logistics, retail, and manufacturing sectors is bolstering market growth. Moreover, the growing implementation of automation in packaging and the increasing need for innovative pallet protection materials are supporting growth in the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.9% |

Growth of the Japan corrugated pallet wrap market is moderate, which can be attributed to rising investments in sustainable packaging solutions in logistics and retail. Its commitment to cutting plastic waste and encouraging fiber-based packaging materials is boosting demand. Furthermore, high-strength and lightweight corrugated wraps are also advancing product penetration in export-oriented industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.8% |

The corrugated pallet wrap market in South Korea is gaining traction as there is increasing focus on using sustainable and recyclable packaging material in logistics and distribution. Demand in the market is driven by a surge in government policies favoring the uptake of environmentally-friendly packaging, and the emergence of automated warehouses. Moreover, growing exports and trade activities are also driving the adoption of corrugated pallet wrap solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.0% |

The corrugated pallet wrap market is growing, as sustainability and being lightweight, as well as affordability of packaging material in logistics, e-commerce, food & beverage, and industrial transportation. Sustainable manufacturers are developing AI enabled material optimization, high strength corrugated wraps and biodegradable substitutes for plastic stretch films for better load stability, impact resistance and recyclability for the businesses to adopt.

Technological advancements driven by key companies in this market span a range of sectors including corrugated packaging manufacturers, logistics packaging solution providers, and sustainable wrapping material companies that help customers achieve efficiency through pallet protection, AI-powered packaging quality control, and sustainable solutions in the supply chain.

The overall market size for corrugated pallet wrap market was USD 813.2 Million in 2025.

Corrugated pallet wrap market is expected to reach USD 1,584.9 Million in 2035.

The demand for corrugated pallet wrap is expected to rise due to increasing e-commerce and logistics activities, growing preference for eco-friendly packaging solutions, and rising demand for secure and cost-effective pallet stabilization.

The top 5 countries which drives the development of corrugated pallet wrap market are USA, UK, Europe Union, Japan and South Korea.

Food & Beverage Industry and Unbleached Kraft Liner to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Corrugated Box Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Automotive Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Fanfold Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Board Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Equipment Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Fanfold Market Analysis - Size, Share, and Forecast 2025 to 2035

Corrugated and Folding Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Pharmaceutical Packaging Market Analysis Size, Share & Forecast 2025 to 2035

Corrugated Plastic Box Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Market Size, Share & Forecast 2025 to 2035

Corrugated Paper Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Printer Slotter Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Corrugated Mailers Market Size, Share & Forecast 2025 to 2035

Corrugated Open-head Drums Market Growth - Size & Forecast 2025 to 2035

Corrugated Fiberboard Market Analysis - Size, Demand & Forecast 2025 to 2035

Corrugated Bin Boxes Market by Dividers, Totes, Jumbo, Kraft Open Top Forecast 2025 to 2035

Corrugated Plastic Trays Market Growth, Trends and Outlook from 2025 to 2035

Evaluating Corrugated Bin Boxes Market Share & Provider Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA