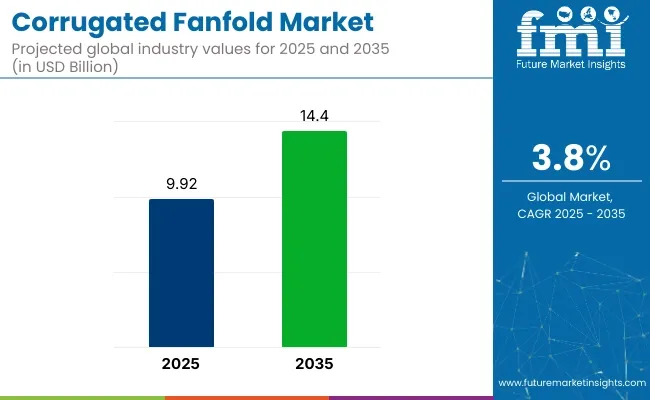

The global corrugated fanfold market is projected to grow from USD 9.92 billion in 2025 to USD 14.40 billion by 2035, reflecting a steady CAGR of 3.8% over the forecast period. Growth is driven by increasing demand in packaging applications across industries such as e-commerce, food and beverages, and electronics.

The shift toward sustainable and recyclable packaging materials is further fueling adoption of corrugated fanfold solutions. Manufacturers are investing in enhanced production capacities and eco-friendly raw materials to meet evolving customer expectations.

In 2025, corrugated fanfold is widely used in automated packaging lines due to its efficient material handling and reduced waste. Demand is rising for customizable fanfold sheets tailored to specific packaging needs. Innovations in lightweight, high-strength corrugated board are helping reduce transportation costs while maintaining product protection.

Regional expansion, particularly in Asia Pacific, is supported by growing industrialization and rising urban consumer markets. The use of corrugated fanfold in last-mile delivery packaging continues to increase due to its flexibility and cost-effectiveness.

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 9.55 billion |

| Estimated Size, 2025 | USD 9.92 billion |

| Projected Size, 2035 | USD 14.40 billion |

| Value-based CAGR (2025 to 2035) | 3.8% |

Sustainability regulations and corporate social responsibility initiatives are shaping market dynamics. The demand for recycled content and biodegradable packaging is pushing manufacturers to adopt greener production processes. Digital printing technologies are being integrated with fanfold sheets, enabling personalized branding and product information directly on the packaging. Collaborations between packaging converters and raw material suppliers are accelerating innovation in fiber-based materials to improve recyclability and performance.

A key development was announced by International Paper in 2024, with the launch of their “EcoFanfold” corrugated fanfold solution. This product uses a high percentage of recycled fiber combined with innovative linerboard technology to enhance strength while reducing carbon footprint.

According to International Paper, EcoFanfold reduces greenhouse gas emissions by up to 20% compared to traditional fanfold products, supporting sustainability goals without compromising performance. This innovation exemplifies how the market is moving toward eco-friendly, high-performance packaging.

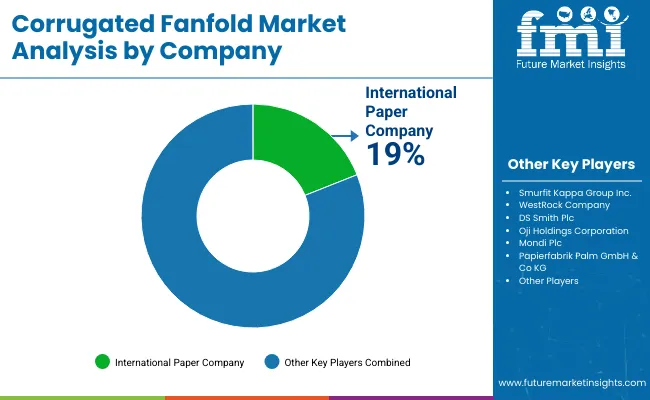

Key players in the corrugated fanfold market include International Paper Company and Smurfit Kappa Group, both of which lead in product innovation and sustainability efforts. These companies focus on expanding regional footprints and developing lightweight, durable packaging solutions. As environmental concerns mount and consumer preferences shift toward eco-friendly options, the corrugated fanfold market is expected to experience consistent, sustainability-driven growth through 2035.

Developed markets in North America and Europe show strong import activity due to their large consumer bases and stringent sustainability regulations. Meanwhile, emerging markets in Asia-Pacific are increasing both production and consumption, driving a more dynamic trade flow.

The corrugated fanfold market is increasingly influenced by a complex framework of government regulations and industry certifications aimed at promoting sustainability, safety, and quality. As environmental concerns rise globally, regulators are enforcing stricter rules to reduce packaging waste and encourage recycling. Manufacturers are required to comply with emissions standards to minimize their environmental footprint while maintaining high product durability and safety through quality management systems. Additionally, labeling and traceability requirements ensure transparency and accountability in the supply chain.

The below table presents the expected CAGR for the global corrugated fanfold market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 3.6%, followed by a slightly higher growth rate of 3.9% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 3.6% |

| H2 (2024 to 2034) | 3.9% |

| H1 (2025 to 2035) | 3.5% |

| H2 (2025 to 2035) | 4.1% |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 3.5% in the first half and increase to 4.1% in the second half. In the first half (H1) the market witnessed a decrease of 10 BPS while in the second half (H2), the market witnessed an increase of 20 BPS.

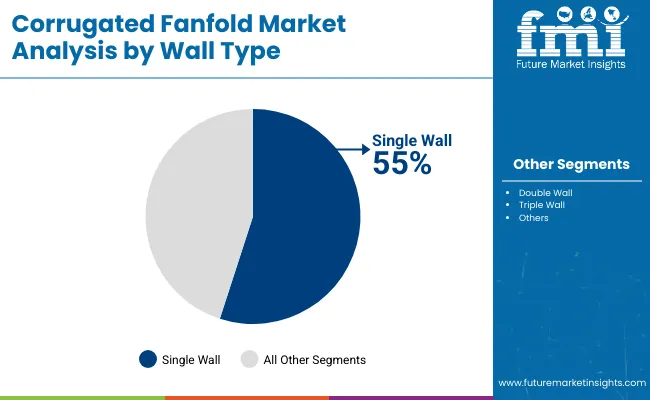

In 2025, the single wall corrugated fanfold segment is expected to lead the market with approximately 55% share. This type is popular due to its lightweight and cost-effective nature, which suits most standard packaging needs. Single wall sheets provide adequate strength for applications such as shipping boxes, retail packaging, and protective inserts. Its versatility makes it a preferred choice across several industries, including e-commerce, food & beverage, and consumer goods.

These sectors benefit from efficient and lightweight packaging that reduces shipping costs and simplifies handling. Major producers like International Paper, WestRock, and Smurfit Kappa manufacture single wall corrugated materials at large scale. The segment’s ease of handling and adaptability to various box designs have kept demand high. With online retail growing rapidly worldwide, the need for affordable and reliable packaging solutions is expected to further strengthen this segment’s dominance.

The double wall corrugated fanfold segment is projected to capture about 35% market share in 2025. It is favored for applications that require extra strength and durability, such as industrial shipping, heavy machinery packaging, and fragile product protection. Double wall fanfold has two layers of corrugated fluting, offering better resistance to crushing, punctures, and stress from long-distance transit. This makes it ideal for heavier or delicate items needing superior protection.

Leading manufacturers like Mondi Group, DS Smith, and Packaging Corporation of America supply double wall corrugated sheets to industries demanding reinforced packaging. Its enhanced durability ensures products reach customers safely, making double wall fanfold crucial for heavy-duty logistics and export packaging.

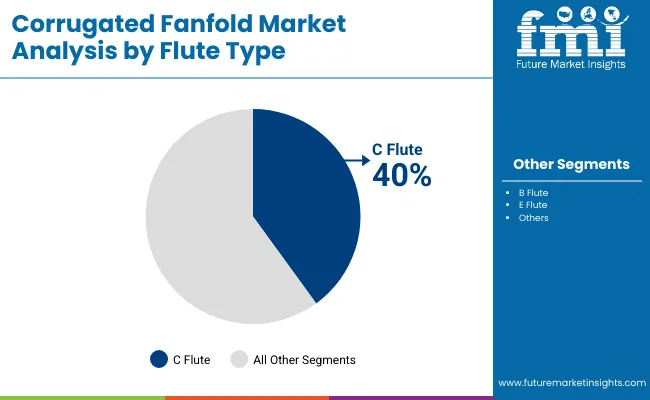

Regarding flute types, C flute corrugated fanfold is expected to hold the largest share of about 40% in 2025. Its thicker profile offers excellent cushioning and stacking strength, ideal for packaging fragile or bulky items like electronics, glassware, appliances, and automotive parts. Manufacturers such as WestRock, International Paper, and Smurfit Kappa produce C flute sheets widely, serving sectors that require reliable, high-performance packaging. C flute balances durability with material efficiency, supporting customized packaging through die-cutting and printing.

The B flute corrugated fanfold segment is forecasted to hold roughly 30% share in 2025. It is thinner and has a smooth surface that allows high-quality printing, making it perfect for retail boxes, display cartons, and luxury packaging.

Suppliers like Mondi Group, DS Smith, and Packaging Corporation of America serve markets focused on consumer-facing, visually appealing packaging. Despite being thinner, B flute provides sufficient protection for moderately heavy items such as electronics accessories, cosmetics, and pharmaceuticals. Its space-saving design and print compatibility support branding needs and sustainable packaging growth.

Smart packaging represents a burgeoning trend driving continued corrugated fanfold market expansion. This upward trend is fueled by the seamless integration of smart technologies such as radio frequency identification tags, QR codes, and near-field communication tags.

Novel advances might provide stakeholders with valuable capabilities such as comprehensive product traceability, robust authenticity verification mechanisms, and engaging interactive consumer experiences. The inclusion of temperature indicators into corrugated packaging might provide peace of mind about the quality and safety of products. Hence, this type of packaging solution is set to be demanded by perishables and pharmaceuticals manufacturers.

The overall growth of e-commerce in terms of online ordering and delivery has created an increased demand for more packaging materials that can cope with increased transportation volumes. Endless corrugated packaging provides a flexible and effective packaging solution for diverse products in the supply chain of e-commerce.

The reasons for this demand may be the growing popularity of home delivery services. A delivery service would require that the product be packed firmly so that it faces no damage in transit. Since corrugated cardboard provides strength and toughness that ensures protection against damage or tearing making it an ideal solution.

Corrugated fanfold is already recognized for cushioning and protecting products in shipping; however, it does not provide protection for delicate items that have delicate contents or small-sized, high-value items. This may discourage business dealing with electronics and luxury goods; such businesses need more robust packaging solutions for the sake of the product integrity.

With perceived fragility, consumer confidence and brand reputation are also affected. Packages that are damaged during delivery as a result of inadequate protection from corrugated fanfold may equate to customer dissatisfaction or even increased return rates which can have an effect on overall customer experience and loyalty.

The markets that value premium packaging the most or demand increased strength may opt for molded pulp, foam inserts, or even rigid boxes for superior protection against impact and compression forces.

These have prompted manufacturers to embrace innovative ideas, such as reinforced materials for corrugated, hybrid solutions for packaging, and advanced testing methods, towards improving the strength and protection properties of corrugated fanfold.

Tier 1 companies are market leaders characterized by high production of corrugated fanfold and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing and reconditioning across multiple processes and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series including recycling, and manufacturing utilizing the latest technology meeting regulatory standards providing the highest quality. Prominent companies within Tier 1 include Smurfit Kappa, DS Smith, International Paper, Westrock and Mondi Plc.

Tier 2 companies include mid-size players characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in Tier 2 include Nine Dragons Holdings Group and Menasha Packaging Company LLC.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment.

They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

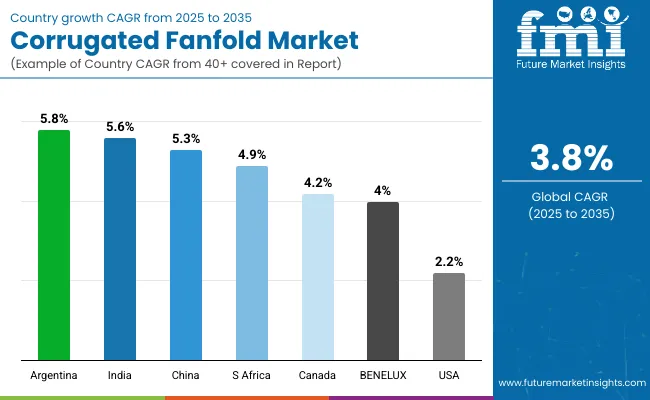

The section below covers the industry analysis for the corrugated fanfold market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided. Canada is anticipated to remain at the forefront in North America, with a CAGR of 4.2% through 2035. In East Asia, China is projected to witness a CAGR of 5.3% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 2.2% |

| Canada | 4.2% |

| Argentina | 5.8% |

| BENELUX | 4.0% |

| China | 5.3% |

| India | 5.6% |

| South Africa | 4.9% |

| Estonia | 3.4% |

According to the organization (IBEF), India is one of the emerging markets for corrugated fanfold due to the rapid industrialization in the country. The packaging sector in India uses paper as a leading source.

It is expected that demand for paper will rise continuously for ready-to-eat food and fast-moving consumer goods (FMCG) products. Growth in the paper packaging sector is projected to positively impact the Indian corrugated fanfold market by 2035. India is anticipated to generate 49.2% of market share in 2025, advancing at a 5.2% CAGR during the forecast years.

As per the organization (ITA), the market for e-commerce in Germany is blooming. Penetration of the internet and the rising number of e-commerce consumers are set to contribute to growth.

Total sales of e-commerce in the country were USD 127.5 billion in 2021, which is around 24% growth, as compared to 2020. Number of online consumers in Europe is expected to increase to 68.4 million in 2025.

The rising penetration of e-commerce in Germany was 77% in 2021, which might directly increase the demand for corrugated fanfold in the review period. Germany is set to create an incremental opportunity worth USD 12.27 million and expand at a CAGR of 0.6% through 2035.

Key players operating in the corrugated fanfold market are investing in new technology for improved sustainability and customization in products of corrugated fanfold to meet customer demand and the circular economy norms and also entering into partnerships. Key corrugated fanfold providers have also been acquiring smaller players to grow their presence to further penetrate the corrugated fanfold market across multiple regions.

| Report Attributes | Details |

|---|---|

| Market Size (2024) | USD 9.55 billion |

| Current Total Market Size (2025) | USD 9.92 billion |

| Projected Market Size (2035) | USD 14.40 billion |

| CAGR (2025 to 2035) | 3.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and million square meters for volume |

| Wall Types Analyzed (Segment 1) | Single Wall, Double Wall, Triple Wall |

| Flute Types Analyzed (Segment 2) | C Flute, B Flute, E Flute, Others |

| Widths Analyzed (Segment 3) | Below 500 mm, 501 to 1000 mm, 1001 to 1500 mm, Above 1500 mm |

| Printing Technologies Analyzed (Segment 4) | Digital Printing, Flexographic Printing, Lithographic Printing |

| End Uses Analyzed (Segment 5) | Shipping & Logistics, E-commerce, Electronics & Home Appliance, Pharmaceutical, Personal Care & Cosmetics, Furniture, Food & Beverage, Other Consumer Goods |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Corrugated Fanfold Market | Smurfit Kappa Group Inc., International Paper Company, WestRock Company, DS Smith Plc, Oji Holdings Corporation, Mondi Plc, Papierfabrik Palm GmbH & Co KG, Menasha Packaging Company LLC, Rondo Ganahl Aktiengesellschaft, Ribble Packaging Ltd., Come Sure Group (Holdings) Limited, Nine Dragons Paper (Holdings) Ltd |

| Additional Attributes | Sales trends by flute type and printing technology, Regional packaging mandates and sustainability pressures, Growing use in logistics and e-commerce fulfillment, Demand for high-durability multi-wall structures, Preference for flexo and digital printing in short-run applications |

| Customization and Pricing | Customization and Pricing Available on Request |

In terms of wall type, the industry is divided into single wall, double wall, and triple wall.

In terms of flute type, the industry is segregated into C flute, B flute, E flute, and others.

By width, the market is divided into below 500 mm, 501 to 1000 mm, 1001 to 1500 mm, and above 1500 mm.

By printing technology, the market is divided into digital printing, flexographic printing, and lithographic printing.

The market is classified by end uses such as shipping & logistics, e-commerce, electronics & home appliance, pharmaceutical, personal care & cosmetics, furniture, food & beverage, and other consumer goods.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Central Asia, Russia & Belarus, Balkan & Balkan Countries, and Middle East & Africa have been covered in the report.

The global corrugated fanfold industry is projected to witness a CAGR of 3.8% between 2025 and 2035.

The global corrugated fanfold industry stood at USD 9.55 billion in 2024.

The global corrugated fanfold industry is anticipated to reach USD 14.40 billion by 2035 end.

South Asia & Pacific region is set to record the highest CAGR of 5.4% in the assessment period.

The key players operating in the global corrugated fanfold industry include Smurfit Kappa Group Inc., International Paper Company, WestRock Company, DS Smith Plc, Oji Holdings Corporation, Mondi Plc, and Papierfabrik Palm GmbH & Co KG.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Corrugated Fanfold Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Positioning & Share in Corrugated Fanfold Industry

Corrugated Automotive Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Board Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Equipment Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated and Folding Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Pharmaceutical Packaging Market Analysis Size, Share & Forecast 2025 to 2035

Corrugated Pallet Wrap Market Growth - Demand & Forecast 2025 to 2035

Corrugated Plastic Box Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Market Size, Share & Forecast 2025 to 2035

Corrugated Bubble Wrap Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Paper Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Printer Slotter Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Pallet Containers Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Corrugated Mailers Market Size, Share & Forecast 2025 to 2035

Corrugated Open-head Drums Market Growth - Size & Forecast 2025 to 2035

Corrugated Fiberboard Market Analysis - Size, Demand & Forecast 2025 to 2035

Corrugated Bin Boxes Market by Dividers, Totes, Jumbo, Kraft Open Top Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA