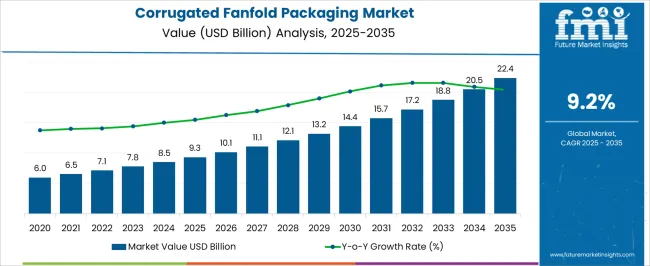

The corrugated fanfold packaging market, valued at USD 9.3 billion in 2025 and expected to reach USD 22.4 billion by 2035 at a CAGR of 9.2%, demonstrates a notable regional growth imbalance when comparing Asia-Pacific, Europe, and North America. The Asia-Pacific region is anticipated to lead market expansion, driven by high e-commerce penetration, rising demand for customizable packaging, and large-scale industrial manufacturing. The market trajectory, from USD 9.3 billion to USD 22.4 billion, reflects the Asia-Pacific region’s ability to absorb rapid demand growth due to lower production costs, expanding logistics networks, and increasing regional exports.

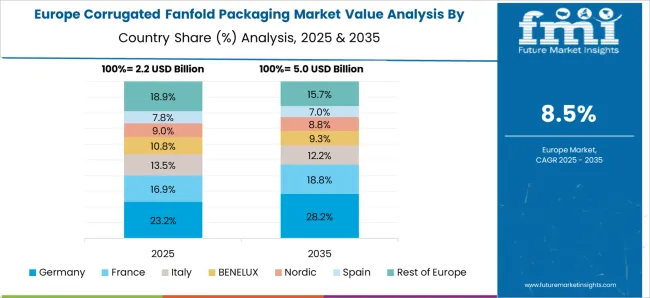

Europe, in contrast, will likely grow at a moderate pace, supported by regulatory emphasis on sustainable packaging materials and widespread adoption of fanfold solutions in retail and consumer goods. The region’s incremental annual gains highlight a preference for recyclable and lightweight materials, although higher material costs and stringent compliance standards constrain adoption speed. North America exhibits stable yet less aggressive growth, driven by the region’s mature packaging industry, high automation in production facilities, and a strong presence of multinational e-commerce players. While growth is consistent, it is slower compared to Asia-Pacific due to relatively higher operational costs and a more saturated demand base. The Asia-Pacific region dominates growth momentum, while Europe maintains a steady expansion driven by regulation, and North America contributes stable but slower growth, highlighting structural regional differences in adoption drivers.

| Metric | Value |

|---|---|

| Corrugated Fanfold Packaging Market Estimated Value in (2025 E) | USD 9.3 billion |

| Corrugated Fanfold Packaging Market Forecast Value in (2035 F) | USD 22.4 billion |

| Forecast CAGR (2025 to 2035) | 9.2% |

The corrugated fanfold packaging market represents a distinct segment within the global corrugated packaging and supply chain optimization industry, designed to enhance flexibility, reduce waste, and improve efficiency in shipping operations. Within the broader corrugated packaging sector, it holds about 4.1%, supported by rising demand for made-to-measure packaging. In the e-commerce packaging segment, its share is approximately 5.6%, reflecting the need for customized, protective, and sustainable shipping solutions.

Across the industrial packaging market, it contributes around 3.8%, addressing logistics efficiency and inventory reduction. Within the on-demand packaging machinery ecosystem, corrugated fanfold packaging accounts for 4.4%, highlighting integration with automated cutting and folding systems. In the sustainable packaging materials category, its share is 3.2%, with an emphasis on recyclability and reduced material usage. Recent developments in the corrugated fanfold packaging market have focused on automation, customization, and material efficiency. Groundbreaking trends include the integration of digital cutting and creasing systems, which enable packaging on demand and reduce the need for pre-stocked box sizes.

Key players are partnering with logistics providers, e-commerce platforms, and packaging equipment manufacturers to optimize supply chain operations. Lightweight but durable corrugated structures with high stacking strength are gaining adoption to reduce transportation costs. The eco-friendly adhesives and water-based coatings are being introduced to enhance recyclability. Strategic moves include investments in smart packaging solutions with barcoding and tracking integration.

The corrugated fanfold packaging market is experiencing steady expansion, fueled by the increasing need for customizable and cost-efficient packaging solutions in diverse industries. Demand growth is being supported by e-commerce proliferation, heightened focus on supply chain efficiency, and the preference for packaging formats that minimize waste and optimize storage. The market’s current scenario reflects a shift toward formats that allow on-demand packaging, reducing the need for multiple pre-sized boxes and enabling operational flexibility.

The outlook remains positive as automation in packaging lines, sustainability-driven initiatives, and innovations in corrugated board manufacturing enhance product appeal. Furthermore, recyclable and biodegradable properties of corrugated materials are aligning with regulatory frameworks and corporate sustainability commitments, strengthening adoption rates.

Technological advancements in board performance and printing capabilities are also enabling greater brand visibility and product protection. Over the forecast period, the market is expected to witness sustained adoption across retail, logistics, and manufacturing sectors, supported by cost efficiency, versatility, and environmental compliance.

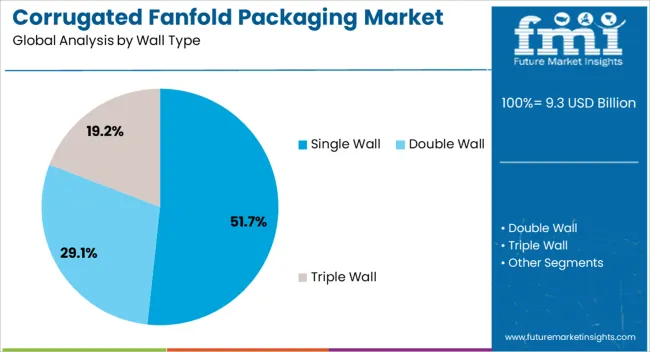

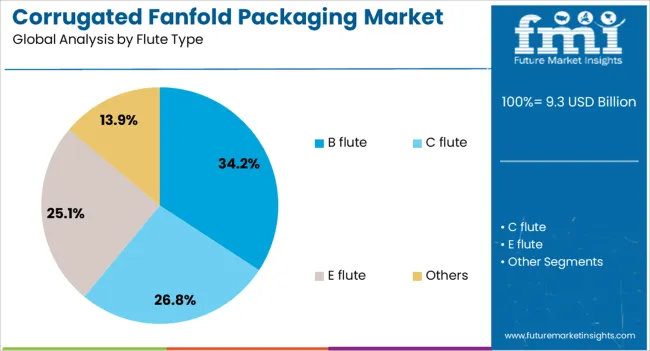

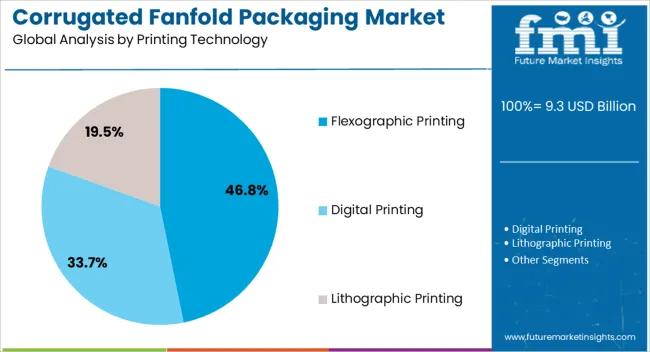

The corrugated fanfold packaging market is segmented by wall type, flute type, printing technology, application, and geographic regions. By wall type, corrugated fanfold packaging market is divided into Single Wall, Double Wall, and Triple Wall. In terms of flute type, corrugated fanfold packaging market is classified into B flute, C flute, E flute, and Others. Based on printing technology, corrugated fanfold packaging market is segmented into Flexographic Printing, Digital Printing, and Lithographic Printing. By application, corrugated fanfold packaging market is segmented into E-commerce & Retail, Consumer Electronics, Healthcare & Pharmaceuticals, Personal Care & Cosmetics, Automotive & Industrial Goods, and Food & Beverage. Regionally, the corrugated fanfold packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The single wall segment dominates the wall type category, accounting for approximately 51.7% of the corrugated fanfold packaging market. This leadership is attributed to its cost-effectiveness, lightweight nature, and adequate protective capabilities for a wide range of goods. The segment’s prevalence is reinforced by its suitability for high-volume packaging operations, where balancing protection and material economy is crucial.

Single wall configurations are preferred for products that require structural integrity without excessive weight, making them ideal for retail-ready and shipping applications. The segment has also benefited from the rise of e-commerce, where single wall boards offer a balance between durability and shipping cost optimization.

With the growing integration of automated packaging systems, single wall fanfold formats have gained further traction due to ease of processing and consistent performance. As companies continue to prioritize sustainability and efficiency, the segment is expected to maintain its dominant position, supported by its adaptability to various product dimensions and packaging requirements.

The B flute segment leads the flute type category, representing around 34.2% of the corrugated fanfold packaging market. Its dominance is driven by its fine flute structure, which offers an optimal balance between cushioning and print surface quality. This flute type is particularly valued in industries where product protection and brand presentation are equally important.

The segment’s growth is further reinforced by its compatibility with precision die-cutting and high-quality printing processes, enabling superior graphics and branding opportunities. B flute fanfold is widely adopted in retail and consumer goods packaging due to its relatively thin profile, which allows for efficient stacking and space utilization during transportation.

Additionally, the segment’s alignment with lightweight packaging trends has enhanced its acceptance in both domestic and international shipping applications. With expanding adoption in point-of-sale displays and e-commerce packaging, the B flute segment is positioned to retain its leadership in the coming years, supported by performance consistency and versatility in design applications.

The flexographic printing segment holds the largest share in the printing technology category, contributing about 46.8% of the corrugated fanfold packaging market. This dominance is linked to its high-speed production capability, adaptability to various substrates, and cost efficiency in large-volume runs. Flexographic printing is favored for producing durable, high-quality images on corrugated materials, meeting the branding needs of retail and e-commerce sectors.

The segment’s expansion is supported by advancements in plate-making technology, improved ink formulations, and better registration accuracy, which have collectively enhanced print quality and reduced waste. Its suitability for water-based inks aligns with sustainability goals, further increasing its adoption.

The process’s efficiency in handling variable print runs while maintaining consistent quality has made it an industry standard for fanfold packaging. As demand for visually appealing, eco-friendly, and custom-sized packaging continues to grow, the flexographic printing segment is expected to sustain its leadership, driven by its balance of speed, cost-effectiveness, and print versatility.

The market has been gaining attention as businesses seek flexible and customizable solutions for shipping diverse products. Unlike traditional fixed-size cartons, fanfold packaging enables right-sized boxes to be produced on demand, reducing void fill, material waste, and logistics costs. This adaptability makes it increasingly relevant in e-commerce, third-party logistics, and industrial distribution. Adoption has been driven by the need for efficiency in storage, transportation, and supply chain operations. Manufacturers have been investing in automation-friendly fanfold lines that integrate with box-making machines, improving throughput and minimizing downtime.

The rapid expansion of e-commerce has been one of the strongest demand drivers for corrugated fanfold packaging. Online retailers and fulfillment centers face challenges of diverse order sizes, return logistics, and sustainable packaging mandates. Fanfold corrugated sheets enable on-demand right-sized boxes, which lower shipping volumes and reduce damage rates during delivery. Packaging automation integrated with fanfold systems supports high-volume, variable-size operations, making them suitable for e-commerce fulfillment networks. Retailers benefit from reduced packaging SKUs and streamlined inventory management. With growing parcel volumes globally, e-commerce enterprises increasingly rely on fanfold packaging to achieve cost savings, environmental compliance, and improved customer satisfaction. This trend is expected to continue reshaping packaging strategies in alignment with dynamic online retail growth.

Sustainability has been a central factor influencing the corrugated fanfold packaging market. Companies are adopting this packaging method to minimize waste, optimize material utilization, and support recyclability initiatives. Fanfold solutions reduce excess void space in cartons, lowering material usage and overall shipping costs. The recyclability of corrugated fiberboard aligns with circular economy practices and regulatory requirements. Moreover, using fanfold enables streamlined logistics, leading to reduced emissions in transport. By enabling just-in-time box production, companies lower warehouse space requirements for multiple carton sizes. Sustainability considerations have been pushing businesses to invest in fanfold packaging as part of their environmental strategies, making it a key component of packaging innovation in logistics and manufacturing industries.

Corrugated fanfold packaging has been closely associated with the trend of automation in supply chains. Integration with automated box-making machines enables businesses to produce custom boxes at high speeds and in real-time. This capability improves packaging efficiency, supports higher throughput, and minimizes manual handling errors. Manufacturers are designing fanfold corrugated sheets to be compatible with robotics and smart logistics technologies, aligning with the trends of Industry 4.0. Businesses using automated packaging reduce labor dependency and achieve scalable solutions for fluctuating demand cycles. The compatibility of fanfold with digital printing and custom branding also strengthens its appeal in the retail and e-commerce industries, where efficiency and consumer experience are critical. Automation integration ensures fanfold packaging remains competitive in modern supply chain environments.

Adoption of corrugated fanfold packaging is expanding across multiple industries beyond e-commerce, including electronics, furniture, automotive parts, and industrial equipment. Its ability to accommodate irregular or oversized products makes it a versatile choice for manufacturers with diverse shipping needs. Logistics providers have been leveraging fanfold to optimize palletization, reduce transit costs, and ensure improved protection during long-haul shipping. The adaptability of fanfold enables regional customization, aligning packaging production with market-specific demands. Suppliers are focusing on lightweight yet durable corrugated grades, digital printing enhancements, and customized widths to cater to different industries. As companies seek adaptable, cost-effective, and sustainable packaging alternatives, fanfold corrugated is increasingly recognized as a solution for global market expansion and competitive differentiation.

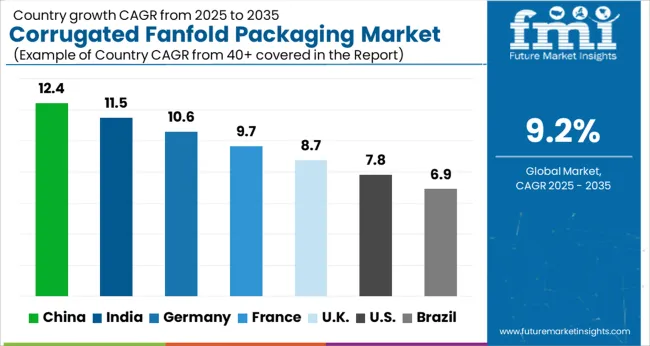

| Country | CAGR |

|---|---|

| China | 12.4% |

| India | 11.5% |

| Germany | 10.6% |

| France | 9.7% |

| UK | 8.7% |

| USA | 7.8% |

| Brazil | 6.9% |

The market is forecast to expand at a CAGR of 9.2% between 2025 and 2035, supported by increasing packaging efficiency requirements and demand for sustainable shipping solutions. China leads at 12.4%, driven by large-scale manufacturing and rising e-commerce logistics. India follows at 11.5%, where expanding industrial production and retail distribution fuel adoption. Germany secures 10.6%, supported by advanced packaging engineering and automation. The UK stands at 8.7%, with growth encouraged by online retail penetration and flexible packaging needs. The USA records 7.8%, influenced by logistics optimization and demand from large retail chains. The market is expected to strengthen as companies prioritize cost efficiency and customization in packaging operations. This report includes insights on 40+ countries; the top markets are shown here for reference.

China demonstrated a robust 12.4% CAGR, supported by large scale manufacturing expansion, diversified e commerce fulfillment, and intensive distribution requirements across multiple provinces. Packaging suppliers were observed to increase investments in high speed corrugation units and wider web production lines to meet bulk supply contracts. Demand was driven by consumer goods, electronics, and fresh produce sectors, where custom cut solutions were increasingly adopted to optimize carton size and reduce freight inefficiencies. Strategic partnerships between domestic converters and multinational brand owners were executed to secure long term supply reliability. Recycling regulations were shaping the industry with an emphasis on waste reduction and circular packaging adoption, which provided opportunities for companies offering lightweight and recyclable corrugated fanfold solutions at scale.

India registered an 11.5% CAGR, driven by growth in retail distribution, regional warehousing, and rising adoption of flexible supply chain packaging. Adoption of fanfold corrugated sheets was encouraged by the rise of omnichannel logistics, where customizable packaging formats reduced material wastage and shipment inefficiencies. Indian converters were investing in digital cutting equipment and sustainable adhesive technologies to address cost efficiency while improving recyclability. Packaging producers were also forming alliances with e commerce platforms to ensure faster design to delivery cycles. The competitive landscape was fragmented, with local converters strengthening presence alongside international packaging majors, while price competitiveness and supply reliability were key drivers for contract awards across leading industrial hubs in the country.

Germany advanced at a 10.6% CAGR, supported by its strong logistics network, industrial exports, and demand from automotive component distribution. The country emphasized precision packaging formats that supported both domestic and international shipments. German converters were integrating automation into corrugation and cutting processes, which ensured consistency and minimized waste. Demand was reinforced by strict environmental policies, which accelerated adoption of recyclable and lightweight fanfold variants. International suppliers collaborated with local converters to strengthen service across specialized industrial applications. Packaging players also prioritized innovation in structural design to optimize performance under heavy duty transport conditions, which was essential in the automotive and machinery sectors. Competitive strategies included strong supply contracts, advanced digital printing, and performance oriented board grades.

The United Kingdom posted an 8.7% CAGR, influenced by retail consolidation, omnichannel logistics, and heightened focus on material efficiency. British converters adopted fanfold formats to serve e commerce clients requiring right sized packaging with reduced void fill. Investment was directed towards digital cutting machinery and automated corrugators that supported small to mid volume batch runs. Packaging suppliers emphasized partnerships with major retail chains and courier firms to expand deployment of custom cut boxes. Environmental regulations and extended producer responsibility frameworks further encouraged recyclable board solutions. Competitive differentiation was achieved through sustainability certifications, faster turnaround times, and innovative packaging structures, which provided opportunities for both multinational and regional converters to secure long term contracts.

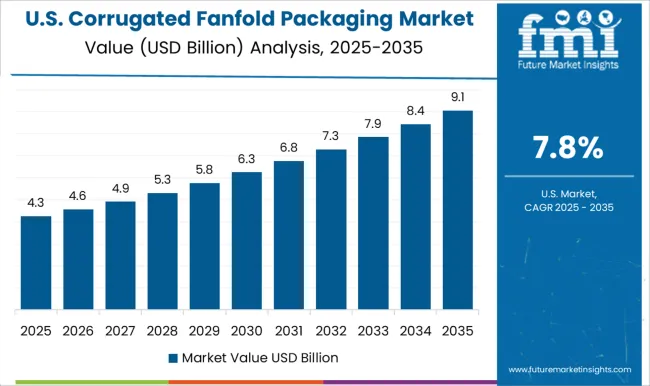

The United States expanded at a 7.8% CAGR, fueled by large scale retail distribution, extensive e commerce penetration, and rapid adoption of automated packaging systems. Demand was significantly influenced by high shipment volumes of consumer electronics, household goods, and industrial components. American converters invested in wide format corrugators, high speed cutting lines, and automation systems to ensure scalable operations for national retailers and logistics companies. Sustainability programs were emphasized through lightweight board innovations and recycling initiatives, supported by regulatory pressure and consumer demand. Competitive strategies included capacity expansion, long term contracts with retail giants, and integration of digital design services to customize packaging for diverse industries across multiple states.

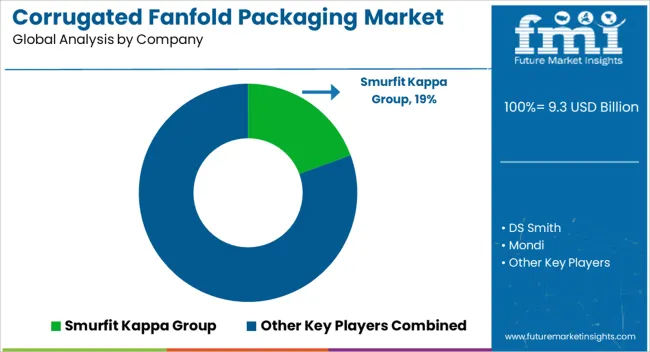

The market has been shaped by strong competition among global and regional players. Smurfit Kappa Group, DS Smith, Mondi, and International Paper Company have focused on expanding integrated packaging solutions. Their strategies have been centered on combining lightweight strength with efficient logistics applications. Stora Enso and Papierfabrik Palm have emphasized sustainable fiber sourcing and continuous improvements in recycled paper grades. Corrugated Supplies Company and Ribble Packaging have highlighted their adaptability by targeting custom lengths and short-run packaging requirements, which has positioned them as flexible partners for e commerce and industrial clients.

Regional leaders such as Abbe, Rondo Ganahl, Kite Packaging, and Hinojosa Packaging Group have enhanced competitiveness by investing in local manufacturing hubs. Papeles y Conversiones de Mexico has advanced its position through high capacity production lines tailored for regional distribution. Product brochures across these companies reveal a consistent emphasis on quick response manufacturing, automated handling compatibility, and machine friendly fanfold dimensions. Features such as edge crush resistance, reduced downtime in packing lines, and easy-to-store folded sheets are displayed as key selling points.

Differentiation has been created through product design narratives that highlight speed, flexibility, and operational savings. Smurfit Kappa and DS Smith showcase versatility in high volume corrugated fanfold, while Mondi promotes recyclable coatings as a core feature. Ribble Packaging highlights on demand fanfold to reduce warehouse waste, while Hinojosa emphasizes regional customization. The competition has therefore moved beyond price, with brochures communicating tailored performance attributes to distinct user segments. This has resulted in a market where branding, sustainability, and efficiency claims are positioned as primary drivers of customer preference.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.3 Billion |

| Wall Type | Single Wall, Double Wall, and Triple Wall |

| Flute Type | B flute, C flute, E flute, and Others |

| Printing Technology | Flexographic Printing, Digital Printing, and Lithographic Printing |

| Application | E-commerce & Retail, Consumer Electronics, Healthcare & Pharmaceuticals, Personal Care & Cosmetics, Automotive & Industrial Goods, and Food & Beverage |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Smurfit Kappa Group, DS Smith, Mondi, International Paper Company, Stora Enso, Corrugated Supplies Company, Ribble Packaging, Papierfabrik Palm, Abbe, Rondo Ganahl, Kite Packaging, Hinojosa Packaging Group, and Papeles y Conversiones de Mexico |

| Additional Attributes | Dollar sales by packaging type and application, demand dynamics across e-commerce, logistics, and retail sectors, regional trends in corrugated packaging adoption, innovation in on-demand box production, strength, and printability, environmental impact of recyclability and material sourcing, and emerging use cases in custom-sized shipping, supply chain efficiency, and sustainable packaging solutions. |

The global corrugated fanfold packaging market is estimated to be valued at USD 9.3 billion in 2025.

The market size for the corrugated fanfold packaging market is projected to reach USD 22.4 billion by 2035.

The corrugated fanfold packaging market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in corrugated fanfold packaging market are single wall, double wall and triple wall.

In terms of flute type, b flute segment to command 34.2% share in the corrugated fanfold packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Corrugated Box Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Equipment Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Pallet Wrap Market Growth - Demand & Forecast 2025 to 2035

Corrugated Plastic Box Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Market Size, Share & Forecast 2025 to 2035

Corrugated Bubble Wrap Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Paper Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Printer Slotter Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Pallet Containers Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Corrugated Mailers Market Size, Share & Forecast 2025 to 2035

Corrugated Open-head Drums Market Growth - Size & Forecast 2025 to 2035

Corrugated Fiberboard Market Analysis - Size, Demand & Forecast 2025 to 2035

Corrugated Bin Boxes Market by Dividers, Totes, Jumbo, Kraft Open Top Forecast 2025 to 2035

Corrugated Wraps Market Analysis from 2025 to 2035

Corrugated Plastic Trays Market Growth, Trends and Outlook from 2025 to 2035

Evaluating Corrugated Bin Boxes Market Share & Provider Insights

Breaking Down Market Share in the Corrugated Box Industry

Market Share Insights of the Corrugated Plastic Box Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA