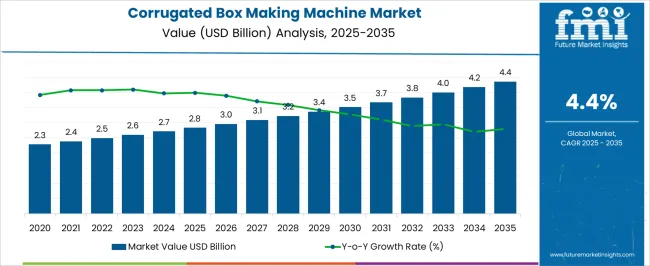

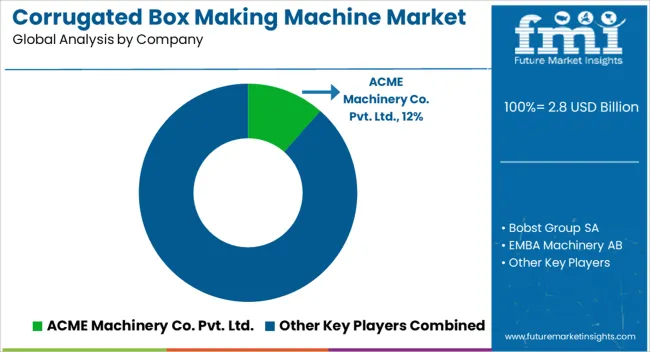

The corrugated box making machine market is estimated to be valued at USD 2.8 billion in 2025 and is projected to reach USD 4.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

The 5-year growth block analysis of the corrugated box making machine market indicates a steady increase in market value, from USD 2.8 billion in 2025 to USD 3.5 billion by 2030, reflecting a compound annual growth rate (CAGR) of 4.4%. Over this period, the market is expected to grow gradually, with values rising from USD 2.8 billion in 2025 to USD 3 billion in 2026, reaching USD 3.1 billion by 2027. This consistent growth highlights a steady demand for corrugated packaging solutions, particularly driven by industries such as e-commerce, food & beverage, and retail, where the need for protective, lightweight, and cost-effective packaging continues to rise.

As global consumption and trade volumes increase, the demand for corrugated box making machines is expected to expand, driven by the ongoing growth in packaging requirements. The market is likely to see increased investments in upgrading machinery to improve production efficiency and meet the evolving needs of high-volume industries.

By 2030, the market is projected to reach USD 3.5 billion, setting the stage for continued growth as companies look to streamline production and address the rising global demand for sustainable and customizable packaging solutions. This gradual expansion underscores the continued relevance of the corrugated box making machine market in the broader packaging industry.

E-commerce growth drives substantial demand for corrugated packaging equipment as fulfillment centers require diverse box sizes, custom dimensions, and rapid order processing capabilities that traditional packaging approaches cannot efficiently accommodate. Online retailers and third-party logistics providers invest in digital printing systems, die-cutting equipment, and automated folding machinery that enable on-demand box production and customization.

Production planning departments balance inventory costs against the flexibility benefits of smaller batch sizes, creating opportunities for manufacturers who provide equipment designed for quick changeovers and reduced setup times. Packaging engineers collaborate with machine suppliers to develop solutions that optimize material usage while meeting shipping protection requirements and branding specifications.

Manufacturing operations involve substantial capital investments in corrugator lines that combine paper feeding, adhesive application, heating, and pressing operations into integrated production systems. These installations require specialized facility infrastructure including steam generation, compressed air systems, and material handling equipment that supports continuous operation across multiple shifts. Maintenance departments establish preventive service schedules that address wearing components, calibration requirements, and system optimization needs that affect overall equipment effectiveness and production capacity utilization.

| Metric | Value |

|---|---|

| Corrugated Box Making Machine Market Estimated Value in (2025 E) | USD 2.8 billion |

| Corrugated Box Making Machine Market Forecast Value in (2035 F) | USD 4.4 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The corrugated box making machine market is witnessing notable expansion, supported by the rising global demand for sustainable packaging solutions and the continued growth of e-commerce, retail, and industrial sectors. Increasing emphasis on reducing environmental impact is driving the adoption of corrugated packaging, prompting manufacturers to invest in high-performance machinery that enhances efficiency and product quality. Advancements in automation, digital control systems, and precision engineering are enabling faster production cycles, reduced material wastage, and improved customization capabilities.

Regulatory pressures for eco-friendly packaging, coupled with consumer preference for recyclable materials, are influencing purchasing decisions across industries. Additionally, the growing need for cost-effective, high-volume packaging solutions in logistics, food and beverage, and consumer goods sectors is boosting market demand.

As global trade and supply chain activities expand, manufacturers are focusing on integrating advanced technologies such as IoT-enabled monitoring and predictive maintenance into their machinery These factors are expected to sustain market growth, with production capacity upgrades and operational efficiency remaining key priorities for industry stakeholders in the coming years.

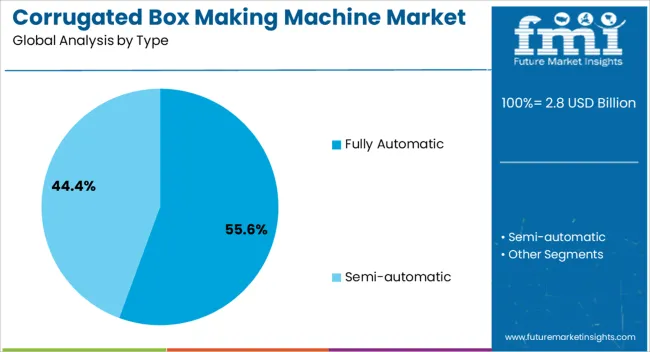

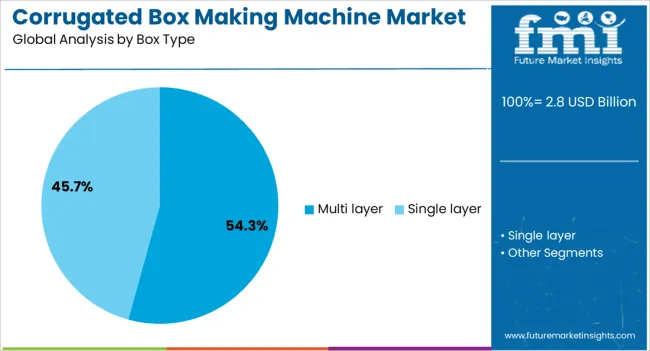

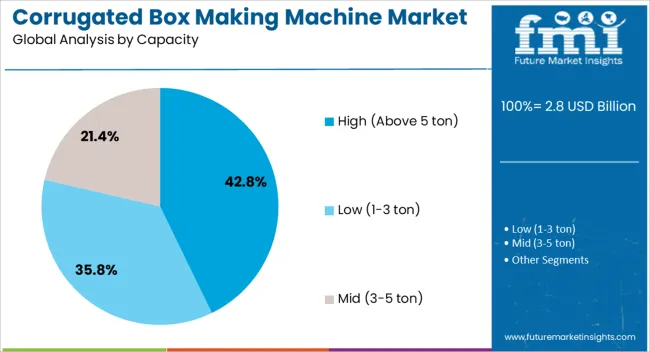

The corrugated box making machine market is segmented by type, box type, capacity, end-use, distribution channel, and geographic regions. By type, corrugated box making machine market is divided into Fully Automatic and Semi-automatic. In terms of box type, corrugated box making machine market is classified into Multi layer and Single layer. Based on capacity, corrugated box making machine market is segmented into High (Above 5 ton), Low (1-3 ton), and Mid (3-5 ton). By end-use, corrugated box making machine market is segmented into Food & Beverage, Electronics & Consumer Goods, Home & Personal Goods, Textile Goods, and Others. By distribution channel, corrugated box making machine market is segmented into Direct and Indirect. Regionally, the corrugated box making machine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fully automatic segment is projected to account for 55.6% of the corrugated box making machine market revenue share in 2025, positioning it as the leading machine type. This leadership is being driven by its ability to deliver high-speed, consistent, and precision-based production with minimal manual intervention. The integration of advanced automation technologies ensures reduced labor costs, enhanced safety, and greater operational efficiency, which are crucial for meeting large-scale production demands.

Fully automatic machines offer superior accuracy in cutting, folding, and printing, thereby improving product quality and reducing wastage. Their compatibility with diverse box designs and adaptability to varying production runs make them an attractive investment for large and medium-sized manufacturers.

The segment is also benefiting from the rising need for uninterrupted production capabilities to meet the growing demands of e-commerce and fast-moving consumer goods sectors As manufacturers increasingly prioritize efficiency, consistency, and scalability, the adoption of fully automatic machines is expected to remain dominant in the market.

The multi layer box type segment is anticipated to capture 54.3% of the corrugated box making machine market revenue share in 2025, making it the leading box type. Its dominance is supported by the increasing demand for durable and protective packaging solutions across industries such as electronics, heavy machinery, and food and beverage. Multi layer corrugated boxes provide superior strength, cushioning, and resistance to compression, making them ideal for transporting fragile, high-value, or bulky goods.

The segment’s growth is further driven by the rising need for packaging that can withstand long-distance transportation and varying environmental conditions. Manufacturers are investing in machines capable of producing multi layer boxes with precision and efficiency to cater to diverse industry needs.

The compatibility of multi layer designs with automated machinery ensures faster production rates and improved structural integrity As global trade volumes and e-commerce logistics expand, the preference for multi layer corrugated boxes is expected to reinforce this segment’s leadership position in the market.

The high capacity segment, representing machines with production capabilities above 5 tons, is expected to hold 42.8% of the corrugated box making machine market revenue share in 2025, establishing itself as the leading capacity category. This dominance is being driven by the demand from large-scale manufacturers requiring high-output machinery to meet substantial order volumes efficiently. High capacity machines enable faster turnaround times, reduced downtime, and enhanced cost efficiency through economies of scale.

Their ability to handle continuous, high-volume production without compromising quality makes them a preferred choice for packaging suppliers serving industries with high demand cycles. Technological advancements in heavy-duty machinery, including automated quality control and precision engineering, are improving reliability and performance.

The growing need for mass production to cater to expanding retail, e-commerce, and export markets is reinforcing the adoption of this segment As companies aim to increase throughput while maintaining consistent quality, high capacity machines are set to remain a cornerstone of large-scale corrugated box manufacturing operations.

The corrugated box making machine market is expanding rapidly, fueled by growing e-commerce and packaging demand. Opportunities are emerging with advancements in automation and the adoption of smart packaging technologies. Sustainability trends are also influencing the market, with businesses focusing on eco-friendly materials. However, challenges related to fluctuating raw material prices and supply chain disruptions could impact growth. Despite these hurdles, the market outlook remains positive, driven by the need for efficient, sustainable packaging solutions across multiple industries.

The demand for corrugated box making machines is being driven by the rapid growth of e-commerce and the increasing need for packaging solutions across various industries. As online retail continues to expand, the requirement for durable, customizable, and cost-effective packaging solutions has surged. Corrugated boxes are increasingly being used for product packaging due to their strength, lightweight nature, and recyclability. This shift towards online shopping and the expansion of global trade are expected to sustain growth in the market for corrugated box making machines.

There is significant opportunity in the market for the integration of automation and smart technology in corrugated box production. Manufacturers are increasingly adopting automated machines to reduce labor costs and enhance production efficiency. Additionally, advancements in smart packaging, such as barcode printing and RFID technology, are creating demand for more advanced corrugated box making machines that can incorporate these features. Automation in production lines is expected to drive cost efficiency and increase the scalability of operations, providing growth opportunities for suppliers.

As businesses face pressure to adopt environmentally friendly practices, the demand for corrugated box making machines that can handle eco-friendly materials is on the rise. Corrugated boxes are considered a sustainable alternative to plastic packaging due to their recyclability. The market is seeing an increase in the use of recycled paper and eco-friendly inks, which are becoming key trends in the packaging industry. Manufacturers that focus on sustainability and provide machines capable of processing these materials are likely to gain a competitive edge in the evolving market.

One of the main challenges in the corrugated box making machine market is the fluctuation in raw material prices, particularly paper and cardboard. Price volatility in the global supply chain is making it difficult for manufacturers to maintain stable production costs. Additionally, supply chain disruptions, such as delays in the delivery of raw materials or machine components, continue to create challenges. These cost pressures can lead to price hikes for end-users and may limit the accessibility of machines, especially for smaller packaging businesses.

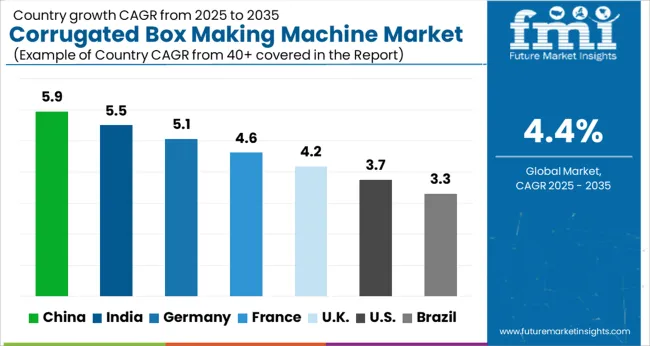

| Country | CAGR |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| France | 4.6% |

| UK | 4.2% |

| USA | 3.7% |

| Brazil | 3.3% |

The global corrugated box making machine market is projected to grow at a 4.4% CAGR from 2025 to 2035. China leads with a growth rate of 5.9%, followed by India at 5.5%, and France at 4.6%. The United Kingdom records a growth rate of 4.2%, while the United States shows the slowest growth at 3.7%. These varying growth rates are primarily driven by factors such as increasing demand for packaging solutions, the rise of e-commerce, and growing interest in sustainable packaging. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, the expansion of consumer goods sectors, and increasing demand for packaging machinery. In developed markets like the USA and the UK, steady growth is driven by advancements in automation, sustainable packaging regulations, and the need for more efficient production processes. This report includes insights on 40+ countries; the top markets are shown here for reference.

The corrugated box making machine market in China is projected to grow at a CAGR of 5.9%. China remains a global leader in manufacturing, and its growing industrial sector continues to drive the demand for packaging machinery. With the rise of e-commerce, retail, and export industries, the demand for corrugated boxes for packaging is increasing significantly. China’s robust manufacturing infrastructure, cost-effective labor, and government initiatives to support industrial growth further contribute to the market’s growth. Additionally, the ongoing modernization of production facilities and the growing demand for eco-friendly packaging solutions are expected to fuel the adoption of advanced corrugated box making machines.

The corrugated box making machine market in India is projected to grow at a CAGR of 5.5%. India’s rapidly expanding industrial sector, coupled with the increasing demand for packaged goods across industries such as food, beverages, and consumer goods, is driving market growth. The rise of the e-commerce industry in India is also significantly contributing to the demand for efficient and high-quality packaging solutions. Additionally, government initiatives like "Make in India" are fostering a more favorable environment for the packaging industry, which is expected to boost the demand for corrugated box making machines. With a growing middle class and shifting consumer preferences, the need for packaging machinery in India is likely to continue expanding.

The corrugated box making machine market in France is projected to grow at a CAGR of 4.6%. France, as one of the leading industrialized nations in Europe, continues to experience steady demand for packaging machinery due to its established manufacturing and logistics industries. The growing emphasis on sustainable and eco-friendly packaging solutions, driven by both consumer demand and regulations, is playing a key role in the market's growth. With the increasing popularity of e-commerce and demand for efficient packaging in the retail and food industries, the market for corrugated box making machines is poised to expand. The shift towards automation and modernization of manufacturing facilities in France is also contributing to the market’s growth.

The corrugated box making machine market in the United Kingdom is projected to grow at a CAGR of 4.2%. The UK market is benefiting from the increasing demand for efficient and customizable packaging solutions, particularly within the growing e-commerce and retail sectors. The push towards sustainability and the need for environmentally friendly packaging solutions are key drivers of demand for advanced corrugated box making machinery in the country. Additionally, the UK's focus on reducing carbon footprints in manufacturing and logistics, as well as the continued growth of the food and beverage industry, is contributing to market expansion. The rise of automation in manufacturing processes is also helping improve efficiency and drive adoption of new packaging machinery.

The corrugated box making machine market in the United States is projected to grow at a CAGR of 3.7%. While the growth rate is slower compared to emerging markets, the USA remains a key player in the global packaging machinery market. The demand for corrugated boxes is driven by the continued growth of e-commerce, retail, and the packaging of consumer goods. USA manufacturers are focusing on enhancing the efficiency of their production facilities and adopting advanced automation technologies to meet the growing demand for packaging solutions. Additionally, regulations aimed at promoting sustainable packaging practices and reducing waste are expected to support the adoption of eco-friendly and energy-efficient packaging machinery.

The corrugated box making machine market is led by global manufacturers developing high-performance, automated systems to meet rising packaging demands from e-commerce, logistics, and consumer goods industries. Bobst Group SA, ACME Machinery Co. Pvt. Ltd., and EMBA Machinery AB are at the forefront with advanced, energy-efficient machines designed for precision, speed, and versatility. Their technologies support high-volume production, cost efficiency, and sustainability, giving them a competitive advantage across diverse industrial applications.

ISOWA Corporation and KOLBUS GmbH & Co. KG emphasize productivity and quality consistency, supplying integrated systems that enhance throughput for modern packaging plants. Fosber Spa delivers corrugator lines and converting equipment known for automation and operational reliability. Mitsubishi Heavy Industries Ltd. and Packsize International LLC focus on flexible production systems, offering on-demand and custom packaging solutions that enable manufacturers to produce right-sized boxes in real time.

Saro Packaging Machine Industries Ltd., Serpa Packaging Solutions, and Zemat Technology Group Ltd. target specialized and regional segments through cost-effective, modular designs. Shinko Machine Mfg. Co. Ltd., Hebei Shengli Carton Equipment Manufacturing Co. Ltd., Shanghai PrintYoung International Industry Co. Ltd., and Wenzhou Zhongke Packaging Machinery Co. Ltd. strengthen regional supply with durable, adaptable machines. Competition centers on automation, customization, and sustainable production efficiency.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.8 Billion |

| Type | Fully Automatic and Semi-automatic |

| Box Type | Multi layer and Single layer |

| Capacity | High (Above 5 ton), Low (1-3 ton), and Mid (3-5 ton) |

| End-Use | Food & Beverage, Electronics & Consumer Goods, Home & Personal Goods, Textile Goods, and Others |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ACME Machinery Co. Pvt. Ltd., Bobst Group SA, EMBA Machinery AB, Fosber Spa, ISOWA Corporation, KOLBUS GmbH & Co. KG, Mitsubishi Heavy Industries Ltd., Packsize International LLC, Saro Packaging Machine Industries Ltd., Serpa Packaging Solutions, Shanghai PrintYoung International Industry Co. Ltd., Hebei Shengli Carton Equipment Manufacturing Co. Ltd., Shinko Machine Mfg. Co. Ltd., Wenzhou Zhongke Packaging Machinery Co. Ltd., and Zemat Technology Group Ltd. |

| Additional Attributes | Dollar sales by machine type (automatic, semi-automatic, manual) and production capacity (low, medium, high) are key metrics. Trends include increasing demand for high-speed and eco-friendly machines, along with the rise of e-commerce packaging needs. Regional demand patterns, technological advancements, and sustainability concerns are driving market growth. |

The global corrugated box making machine market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the corrugated box making machine market is projected to reach USD 4.4 billion by 2035.

The corrugated box making machine market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in corrugated box making machine market are fully automatic and semi-automatic.

In terms of box type, multi layer segment to command 54.3% share in the corrugated box making machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Corrugated Box Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Printer Slotter Machine Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Corrugated Box Printer Slotter Machine Providers

Corrugated Box Market Size, Share & Forecast 2025 to 2035

Breaking Down Market Share in the Corrugated Box Industry

Box Filling Machine Market from 2025 to 2035

Box Sealing Machines Market Trends – Growth & Forecast 2025 to 2035

Bag Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Bin Boxes Market by Dividers, Totes, Jumbo, Kraft Open Top Forecast 2025 to 2035

Evaluating Corrugated Bin Boxes Market Share & Provider Insights

Corrugated Paper Machine Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Corrugated Paper Machine Market Share

Corrugated Handle Box Market

Brick Making Machines Market Size and Share Forecast Outlook 2025 to 2035

Smart Boxing Machine Market Size and Share Forecast Outlook 2025 to 2035

Non-Corrugated Boxes Market Size and Share Forecast Outlook 2025 to 2035

Sauce Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Plastic Box Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of the Corrugated Plastic Box Industry

Paper Making Machines Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA