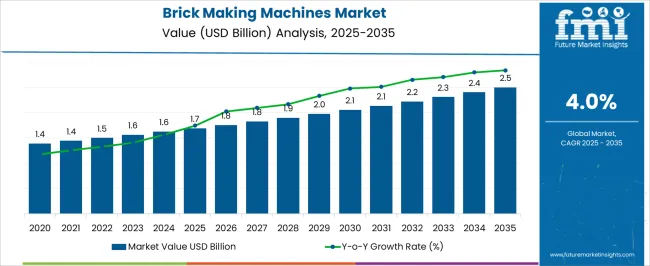

The brick making machines sector is projected to rise from USD 1.7 billion in 2025 to USD 2.5 billion by 2035 at a 4% CAGR. The market growth curve shape appears gradual and disciplined, with values stepping from 1.7 in 2025 to 1.9 by 2028 and 2.1 by 2030. Adoption is being driven by steady demand for pavers, hollow blocks, and clay or fly ash bricks serving housing, public works, and small industrial buildings. Equipment replacement is being encouraged as producers target lower cycle times, uniform compaction, and reduced rejects. The curve should be read as capacity led rather than hype, with uptime, mold changeover speed, and pallet handling efficiency viewed as decisive purchase factors.

From 2031 onward, the curve advances from 2.1 to 2.2 in 2032, 2.3 in 2033, 2.4 in 2034, and reaches 2.5 in 2035, indicating stable, compounding gains. Procurement is being influenced by the durability of mold sets, servo control accuracy, PLC-based line coordination, kiln and dryer compatibility, and reliable stacker or pallet return systems. Preference is being shown for turnkey supply, spare parts proximity, and operator training that locks in throughput. Disciplined capex and compliance with regional brick standards are set to keep momentum intact. The curve signals a practical market where reliability and total cost of ownership are rewarded over speculative capacity bets.

| Metric | Value |

|---|---|

| Brick Making Machines Market Estimated Value in (2025 E) | USD 1.7 billion |

| Brick Making Machines Market Forecast Value in (2035 F) | USD 2.5 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The brick making machines segment is estimated to account for about 9% of the construction machinery market, roughly 19% of the building materials production equipment market, close to 23% of the masonry and concrete equipment market, nearly 21% of the ceramic and clay processing equipment market, and around 11% of the infrastructure and civil works equipment market, giving an aggregated share of approximately 83% across these parent categories. This footprint is viewed as significant because brick presses, extruders, cutters, tunnel kilns, dryers, and green brick handling lines underpin continuous output for clay bricks, fly ash bricks, and paver units. Value is delivered through cycle time consistency, dimensional accuracy, and compressive strength outcomes that reduce scrap and rework at the yard. Procurement is guided by mixer horsepower, vacuum extrusion stability, die wear rates, kiln fuel efficiency, and PLC driven control logic that stabilizes moisture and firing curves. Operator safety features, palletizing robots, and spare parts availability are treated as gating factors for uptime. Demand has been reinforced by public works programs and private real estate pipelines where high throughput and predictable curing windows are required. It is considered that suppliers with field commissioning teams, operator training, and remote diagnostics secure preference during tenders. Feedstock flexibility for clay, shale, fly ash, and sand lime blends adds resilience to plants facing variable raw materials. On balance, brick making machinery is regarded as a production anchor within these parent markets, shaping specification standards and influencing cost per thousand bricks across integrated brickworks and mid scale yards alike.

The brick making machines market is witnessing steady growth, driven by the rising demand for cost-effective and sustainable building materials in residential, commercial, and infrastructure projects. Expanding urbanization, coupled with the growing emphasis on affordable housing initiatives, is creating strong demand for advanced and efficient brick production systems. Manufacturers are increasingly focusing on integrating automation, precision control systems, and improved mold designs to enhance productivity and quality consistency.

The shift towards environmentally friendly production methods, including reduced energy consumption and minimal waste generation, is influencing machine design and adoption patterns. Government investments in infrastructure development, especially in emerging economies, are accelerating the need for reliable and high-output brick making equipment.

Additionally, the market is benefiting from a surge in demand for customized brick sizes and shapes to meet modern architectural requirements As technology continues to advance and construction activity intensifies globally, the adoption of innovative brick making machines is expected to grow, with manufacturers prioritizing durability, operational efficiency, and flexibility in production.

The brick making machines market is segmented by machine type, type, operation, application, and geographic regions. By machine type, brick making machines market is divided into Concrete brick machines, Clay brick machines, Fly ash brick machines, Interlocking brick machines, and Others. In terms of type, brick making machines market is classified into Stationary and Mobile. Based on operation, brick making machines market is segmented into Automatic and Semi-automatic. By application, brick making machines market is segmented into Commercial and Residential. Regionally, the brick making machines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

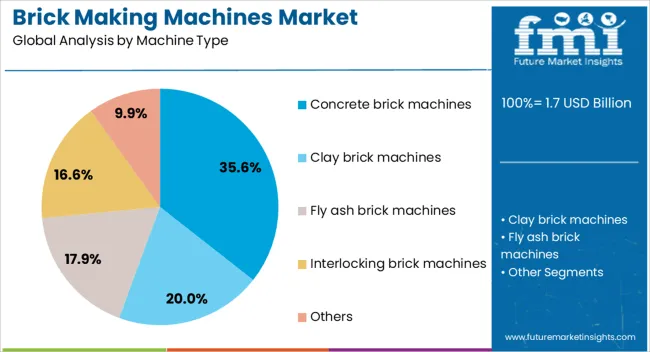

The concrete brick machines segment is projected to hold 35.6% of the brick making machines market revenue share in 2025, making it the leading machine type. Its dominance is being supported by the widespread use of concrete bricks in both structural and non-structural applications due to their durability, strength, and cost efficiency. These machines are capable of producing high volumes of uniform bricks with consistent quality, making them a preferred choice for large-scale construction projects.

The adaptability of concrete brick machines to accommodate various brick sizes and designs without significant operational changes is further enhancing their market appeal. Their compatibility with different raw material mixes, including recycled aggregates, aligns with the increasing focus on sustainable construction practices.

The growing demand for low-maintenance building materials and the ability of concrete bricks to offer long service life are reinforcing segment growth As urbanization accelerates and infrastructure projects expand, concrete brick machines are expected to maintain their leadership position by meeting high-volume production requirements with operational reliability.

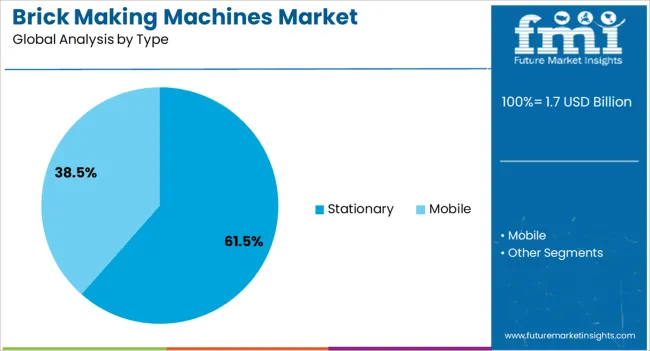

The stationary type segment is anticipated to account for 61.5% of the brick making machines market revenue share in 2025, establishing itself as the dominant machine type. This leadership is being driven by the ability of stationary machines to deliver high production output with superior dimensional accuracy, which is essential for large-scale and long-duration projects. The segment benefits from the stability and precision of stationary setups, which allow for consistent compaction and curing processes.

These machines are often integrated into fully equipped production lines, enabling continuous operation with minimal downtime. Their suitability for both manual and automated feeding systems offers operational flexibility to manufacturers. Additionally, stationary machines generally require less frequent maintenance due to their robust design, further enhancing cost-effectiveness.

The ability to produce a wide range of brick designs and sizes while maintaining consistent quality standards is reinforcing the preference for this type As demand for standardized, high-quality building materials grows, stationary brick making machines are expected to sustain their strong market position.

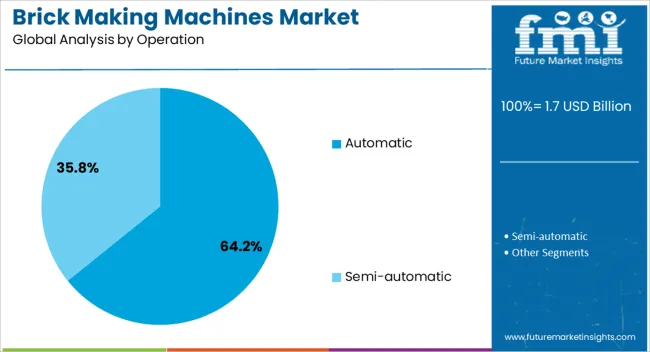

The automatic operation segment is expected to represent 64.2% of the brick making machines market revenue share in 2025, making it the leading operational category. Its growth is being supported by the increasing need for high-efficiency production processes that minimize labor dependency and operational costs. Automatic machines offer enhanced precision, faster cycle times, and reduced wastage, which collectively improve profitability for manufacturers.

The integration of advanced control systems, programmable settings, and automated quality checks is further improving output consistency and operational safety. These machines enable manufacturers to scale production rapidly in response to fluctuating demand without significant adjustments to labor requirements.

The segment’s expansion is also being driven by the rising adoption of Industry 4.0 practices in the construction materials sector, where data-driven optimization is improving machine performance and predictive maintenance The capability to operate continuously with minimal human intervention, while maintaining consistent quality across large volumes, is solidifying the dominance of automatic brick making machines in the global market.

The brick making machines market is expected to expand at a steady clip as residential projects, public works, and repair activity keep masonry demand resilient. Purchases are being supported by replacement of aging presses, capacity additions near quarry sites, and interest in fly ash and concrete paver formats. Opportunities are being seen in semi-automatic lines, die customization, and export of compact plants. Trends point to higher throughput, better mold life, and tighter quality control. Challenges persist around fuel and power costs, kiln compliance, skilled maintenance, and competition from alternative wall systems.

Demand has been reinforced by steady orders from contractors, block yards, and rural entrepreneurs where clay bricks, fly ash bricks, and concrete blocks remain staple materials for walls, pavements, and boundary work. Government housing schemes, school refurbishments, and road-side drainage projects have kept basic units moving, while private developers have specified pavers for parking and pathways. Replacement of older mechanical presses with hydraulic units has been prioritized as uptime and uniformity are valued more than peak speed. Compact plants located near clay pits or ash sources are being preferred because haulage is reduced and margins improve. Seasonal buffers are being built through inventory of molded green bricks and ready pallets, which stabilizes utilization during monsoon or freeze periods. With local dealers offering spares and on-call technicians, purchase confidence has been raised across both first-time buyers and established kilns.

Opportunities are being created in semi-automatic and automatic lines where feeders, mixers, and stackers are bundled with PLC controls for consistent cycle times and reduced scrap. Format expansion into perforated bricks, hollow blocks, curb stones, and interlocking pavers has opened higher-margin niches for landscaping and municipal work. Tooling customization for logo marks and special dimensions is being monetized through quick-change molds and hardened liners. Export-ready skids for Africa, Southeast Asia, and Latin America are attractive because simple commissioning and robust motor selections are requested. Leasing models, dealer-managed maintenance, and operator training packages are being adopted to overcome capex hesitation. Fuel-flexible kiln arrangements, hot air recirculation, and dryer optimization are positioning plants to cope with varying local energy prices. Partnerships with cement and ash suppliers are being used to secure input stability and preferential terms.

Trends have centered on longer-life molds with wear plates, upgraded bearings, and vibration tables that improve density and dimensional tolerance. Mix designs using fly ash, slag, and well-graded sand are being refined to cut breakage and deliver smoother edges for fast laying. Palletizing with automatic stackers, cube clamps, and shrink-wrapped bundles is being adopted to protect finished goods in transit and reduce site losses. Inline testers for compressive strength, moisture, and size variation are being requested by builders that demand consistent batches for project approvals. Layouts are being reworked for linear flow from raw material feeding to curing yards, minimizing forklift travel and idle time. Practical reliability beats headline stroke rate, since predictable output, quick mold swaps, and clean ejection reduce overtime and warranty claims, which matters more to yard owners than peak brochure values.

Challenges are being reported around electricity tariffs, kiln fuel prices, and spare part inflation that compress margins for small and mid-sized yards. Regional strength and dimension standards require documented testing, and failed audits can delay large site approvals. Skilled mechanics and electricians are in short supply, so preventive maintenance is not always performed, leading to vibration drift, oil leaks, and premature mold wear. Raw material variability in clay plasticity or ash fineness introduces cracking and warpage if mix control is weak. Credit access for plant upgrades remains tight in several markets, extending payback periods. Competition from AAC panels and precast wall systems is being felt on large jobs. Disciplined maintenance, verified mix recipes, and clear training on curing cycles will decide winners, because reduced downtime and fewer rejects lower true cost per thousand bricks far more than headline machine discounts.

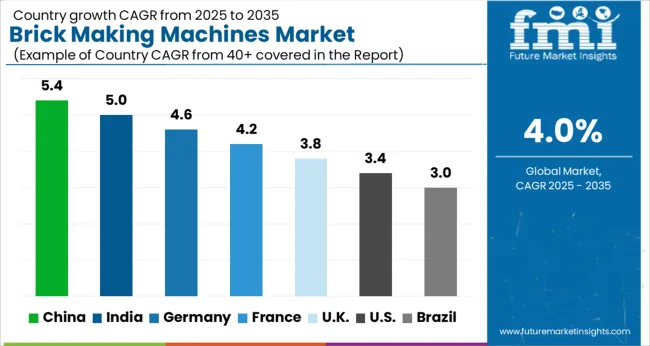

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

The global brick making machines market is projected to grow at 4% from 2025 to 2035. China leads at 5.4%, followed by India 5% and France 4.2%; the United Kingdom 3.8% and United States 3.4% follow. Demand is being pulled by housing build-outs, municipal paving, and plant upgrades aimed at higher throughput and tighter dimensional control. Servo presses, high-output extruders, faster dryers, and quick-change molds are being adopted to cut cycle times and scrap. Clay, fly-ash, and concrete blends are all in play, with buyers emphasizing line reliability, mold life, and energy use per brick. Asia is set to outpace on capacity additions and competitive pricing, Europe on premium façades and certification, and the USA on steady replacement and after-sales support across regional producers. This report includes insights on 40+ countries; the top markets are shown here for reference.

The brick making machines market in China is expected to expand at 5.4%. Growth is being underpinned by public works, large housing parcels, and industrial parks that require high volumes of clay and concrete units. Domestic OEMs are supplying servo-driven presses, pallet-less block lines, and automated cutters with inline gauging to improve consistency. Energy costs are prompting wider use of efficient dryers and heat-recovery kilns, while multi-cavity molds are raising pieces per hour. Provincial programs favor local sourcing, which keeps lead times short and spares readily available. Export shipments to Southeast Asia and Africa are supported through turnkey packages that include commissioning and operator training. It is assessed that China will retain a price-performance edge, with broader adoption of plant SCADA, predictive maintenance, and standardized QC logs to support high-duty production schedules.

The brick making machines market in India is projected to grow at 5%. Demand is being driven by affordable-housing programs, peri-urban plotting, and heavy use of pavers for roads and campuses. Transition from clamp kilns to mechanized lines is accelerating, with hydraulic presses and automated stackers favored for uniformity. Fly-ash utilization from power stations supports concrete and ash-brick formats, while local toolrooms supply molds tailored to regional sizes. Financing through term loans and leasing is improving access for mid-sized yards, and OEMs are spreading service depots across tier-2 clusters. It is expected that India will post steady line installations as builders insist on consistent strength classes, faster curing, and delivery reliability during peak construction seasons.

The brick making machines market in France is anticipated to rise at 4.2%. Orders are being shaped by façade-grade clay units, renovation work, and specialty colors where surface finish and dimensional accuracy are scrutinized. Producers are upgrading presses with force control, precision wire-cutters, and low-turbulence dryers to curb cracking and warpage. Compliance with masonry standards and traceable batch records is being prioritized for public projects. Family-owned plants are adding automated setting/stripping robots to address labor gaps and stabilize cycle times. Imports from nearby EU countries complement domestic capacity for niche formats. It is judged that France will maintain a premium profile as buyers weigh machine uptime, energy intensity per thousand bricks, and long-life tooling for architectural ranges.

The brick making machines market in the UK is forecast to expand at 3.8%. Activity is being led by housing refurbishments, regional homebuilding, and demand for façade bricks with consistent color and size. Producers are prioritizing fast-response dryers, upgraded extrusion screws, and automated setters to manage labor constraints. Planning-cycle variability is encouraging flexible molds and quick changeovers to handle short runs. Import reliance remains material in certain formats, yet domestic plants are investing in rebuilds of aging kilns and presses to lift reliability. It is expected that the UK will show stable replacement cycles, with procurement emphasizing energy per unit, verified compressive strength, and consistent pallet presentation for high-speed laying.

The brick making machines market in the United States is projected to grow at 3.4%. Demand is being supported by steady residential construction, hardscape pavers for landscaping, and selective commercial work. Plants are replacing legacy presses with servo units, adopting quick-change mold carousels, and adding automated packaging to improve throughput. Regional producers in the South and Midwest value rugged designs, available spares, and air-permit-compliant dryers. Service contracts with vibration checks and alignment audits are being used to prevent unplanned outages. It is assessed that growth will remain measured, with capex justified by lower scrap rates, faster setting, and reliable delivery during seasonal peaks.

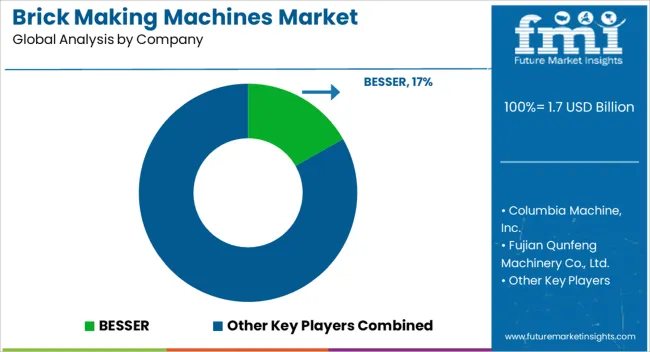

Competition in brick making machines has been shaped by how clearly brochures turn vibration, molding, handling, and curing into predictable outputs. BESSER and Columbia Machine are positioned with heavy duty vibrocompaction lines, large mold libraries, pallet handling, and fast mold exchange. HESS Group, Masa Group, and Rekers are emphasized for servo vibration, face mix stations, and automated curing chambers that stabilize strength and color. QGM Quangong Machinery, including Zenith, is promoted for multilayer systems with high hourly pallets, while Fujian Qunfeng is listed with fully automatic cells from batching to cubing. Poyatos Manufacturer is framed around turnkey plants with European compliance and compact footprints. Lontto and Hamac are packaged as entry and mid range options with containerized delivery, operator training, and simple maintenance. Quanzhou City Sanlian is highlighted for integration of mixers, conveyors, and stackers under one control domain. Brochures read like engineering dossiers. Cycle time per pallet, press force, vibration frequency, product height range, and dimensional tolerances are set out in tables. Energy per pallet, operator count, and line footprint are printed for transparent comparison. Strategy is centered on specification depth and lifecycle assurance presented up front. Mold changeover minutes, cement savings from optimized compaction, and expected compressive strength bands by mix class are quantified. Warranty terms, spare parts catalogs, and response times are made visible. Controls pages show recipe management, SCADA links, remote diagnostics, and production dashboards. KPIs are studied first. Pallets per hour, scrap rate, noise level, and kWh per pallet. Safety is documented through interlocks, guarding, and CE or UL markings. Financing, phased capacity upgrades, and site layout drawings are offered to lower adoption risk. Installation playbooks, commissioning checklists, and training curricula are published to reduce ramp time. Regional players win with nearby parts depots and mold refurbishment programs. Global brands secure trust with reference plants and audited product tests. Advantage is earned when a brochure reads like a plant playbook, letting teams forecast output, staffing, and unit cost before the first block leaves the line.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 Billion |

| Machine Type | Concrete brick machines, Clay brick machines, Fly ash brick machines, Interlocking brick machines, and Others |

| Type | Stationary and Mobile |

| Operation | Automatic and Semi-automatic |

| Application | Commercial and Residential |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BESSER, Columbia Machine, Inc., Fujian Qunfeng Machinery Co., Ltd., Hamac Automation Equipment Co., Ltd., HESS Group GmbH, Lontto, Masa Group, Poyatos Manufacturer, QGM Quangong Machinery Co., Ltd. (Zenith), Quanzhou City Sanlian Machinery Manufacture Co., Ltd, and Rekers GmbH |

| Additional Attributes | Dollar sales by machine type (manual, semi automatic, automatic, mobile), Dollar sales by output (clay bricks, concrete blocks, fly ash bricks, AAC), Trends in automation, servo control, pallet free systems, Role in energy efficient kilns and curing, Growth from housing and infrastructure, Regional demand across Asia Pacific, Africa, Latin America. |

The global brick making machines market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the brick making machines market is projected to reach USD 2.5 billion by 2035.

The brick making machines market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in brick making machines market are concrete brick machines, clay brick machines, fly ash brick machines, interlocking brick machines and others.

In terms of type, stationary segment to command 61.5% share in the brick making machines market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Brick Liquid Carton Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Brick Carton Packaging Industry

Competitive Overview of Brick Liquid Carton Companies

Brick Carton Packaging Market by Packaging Type from 2024 to 2034

Foam Bricks Market

Glazed Bricks Market Size and Share Forecast Outlook 2025 to 2035

Fly Ash Bricks Market

Automatic Clay Brick Making Machine Market

Bag Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Sauce Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Paper Making Machines Market

Flakes Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Popcorn Making Cart Market Growth - Demand & Forecast 2025 to 2035

Cigarette Making Equipment Market Size and Share Forecast Outlook 2025 to 2035

Corn Puff Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkin Making Machine Market Analysis, Size, Share & Forecast 2025 to 2035

Corrugated Box Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ice Making Machine market

Concrete Block Making Machines Market Size and Share Forecast Outlook 2025 to 2035

Fish Feed Pellet Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA