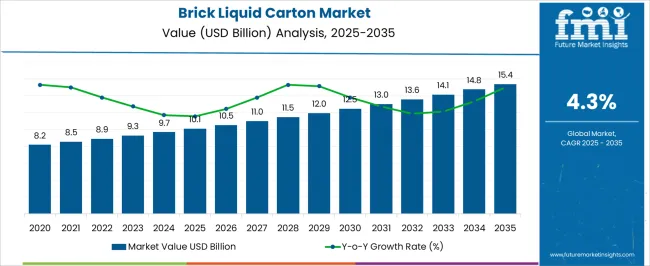

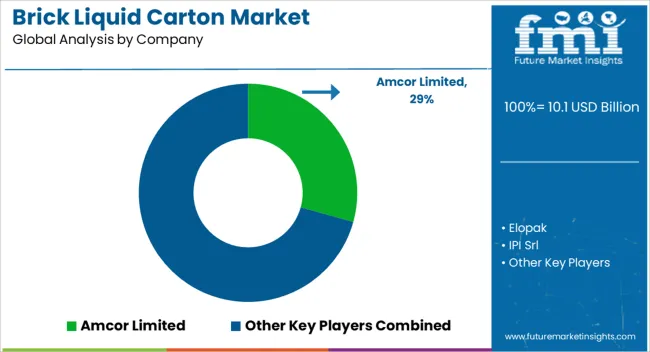

The Brick Liquid Carton Market is estimated to be valued at USD 10.1 billion in 2025 and is projected to reach USD 15.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

| Metric | Value |

|---|---|

| Brick Liquid Carton Market Estimated Value in (2025E) | USD 10.1 billion |

| Brick Liquid Carton Market Forecast Value in (2035F) | USD 15.4 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The brick liquid carton market is expanding steadily owing to the rising demand for compact, recyclable, and cost effective liquid packaging solutions across the food and beverage sector. Increasing environmental concerns and regulatory actions against plastic packaging have accelerated the shift toward paperboard based alternatives.

The brick format, known for its space efficiency and excellent stackability, is gaining traction especially in urban and retail centric markets. Technological improvements in sealing, barrier coatings, and aseptic processing have enabled longer shelf life for perishable liquids without refrigeration.

Additionally, changing consumption habits and the growing focus on single serve and on the go formats have created further growth opportunities. The market outlook remains positive as manufacturers invest in sustainable material sourcing, eco friendly printing, and packaging innovation to cater to both regulatory demands and consumer expectations.

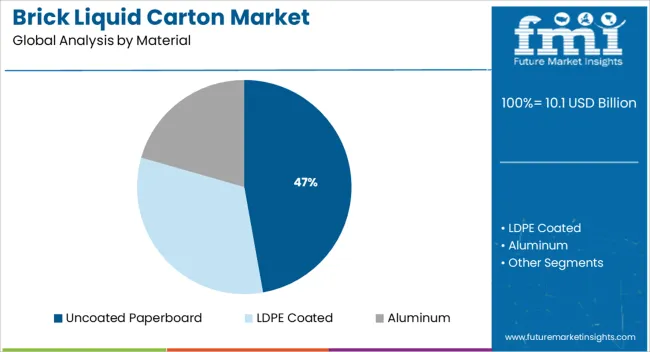

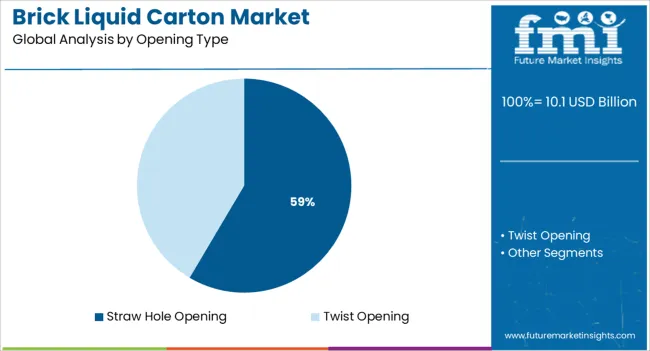

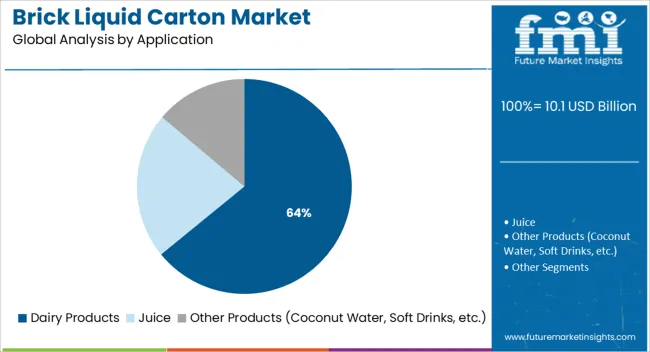

The market is segmented by Material, Opening Type, and Application and region. By Material, the market is divided into Uncoated Paperboard, LDPE Coated, and Aluminum. In terms of Opening Type, the market is classified into Straw Hole Opening and Twist Opening. Based on Application, the market is segmented into Dairy Products, Juice, and Other Products (Coconut Water, Soft Drinks, etc.). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The uncoated paperboard segment is projected to account for 47.20% of total revenue by 2025 within the material category, making it the leading material type. This is due to its lightweight composition, recyclability, and cost efficiency which align with increasing sustainability regulations and packaging reduction goals.

Uncoated paperboard provides adequate structural integrity and printability while minimizing environmental impact. Its compatibility with modern production technologies and adaptability across multiple printing techniques have enhanced its appeal among manufacturers.

As sustainability remains a central focus in packaging procurement strategies, this material continues to dominate due to its environmental credentials and manufacturing versatility.

The straw hole opening segment is anticipated to represent 58.50% of market revenue by 2025, making it the most widely adopted opening type. This preference is largely influenced by convenience, hygiene, and user familiarity, particularly in single serve beverage packaging.

Straw hole designs enable easy access and spill free consumption, which is especially important for products targeting school aged children and on the go consumers. Moreover, the design facilitates automated packaging processes and is compatible with tamper evidence features.

Its continued use is supported by strong consumer acceptance and operational efficiency during high volume production, securing its leading position in the opening type category.

The dairy products segment is expected to account for 64.10% of overall market revenue by 2025, establishing it as the dominant application area. This is driven by the widespread packaging of milk, flavored milk, cream, and dairy based beverages in brick cartons due to their protective properties and extended shelf life under ambient conditions.

The aseptic nature of these cartons ensures product integrity without the need for refrigeration, reducing logistical costs and supporting distribution in remote areas. Additionally, the carton format supports branding and nutritional labeling, which is critical in retail settings.

With the global dairy consumption trend remaining strong, particularly in emerging economies, this application continues to lead due to its alignment with efficiency, hygiene, and sustainability goals.

The global brick liquid carton market witnessed a CAGR of 3.7% during the historic period with a market value of USD 9.7 Billion in 2024.

The brick liquid carton is the best suitable packaging solution for on-the-go liquid products. The brick liquid carton is a sustainable packaging solution with an attractive style of packaging, which creates buzz around the customers. The brick liquid carton also has liquid-friendly features that help manufacturers to increase the shelf-life of the product.

Due to the packaging of beverages packed in a liquid carton, the shelf-life of the product increases by the high barrier offered by the carton. Innovation in beverage packaging makes the market more fluent in receiving substantial demand from consumers. Several key players capturing the market by launching innovative and protective liquid cartons create a growth opportunity for the global brick liquid carton.

Global players in the brick liquid carton market can capitalize on significant growth opportunities in the industrial and institutional sectors. Currently, a brick liquid carton is available with a maximum capacity of 2 liters, mainly targeting single individuals or households.

Manufacturers can offer large-capacity brick liquid cartons to target the aforementioned sectors that offer lucrative growth opportunities. Thus, all these opportunities are expected to grow the market share of brick liquid cartons significantly.

As one of the end-users of the brick liquid cartons, the dairy industry is standing in the front as the biggest customer for tetra packs. Tetra packs as one of the most preferred packaging solutions for liquid products is ruling the market. The dairy industry needs tetra packs for the easy and safe packaging of various dairy products.

Milk as a daily consumed food product also has some credentials from the consumers. Consumers demand highly protective packaging for milk and aligned products. The need for highly protective and secure packaging is creating a path for tetra packs in dairy packaging.

Dairy product producers are also concerned with packaging since packaging has become a representative to ensure the safety and quality of the product. The overall changes that are being noticed in the preference for liquid packaging are driving demand for brick-liquid cartons.

Adherence to stringent government regulations regarding food & beverage safety is influencing food & beverage manufacturers to adopt advanced packaging techniques to ensure the same. Brick liquid cartons significantly reduce contamination risk. Moreover, consumers are becoming more health-conscious, and therefore, prefer packaged and branded products rather than loose and unpackaged products.

Manufacturers in today’s market are developing packaging solutions according to the demands of marketers and consumers. The aforementioned factors are expected to drive the consumption of brick liquid cartons significantly.

On the basis of material type, the uncoated paperboard segment is anticipated to hold the major portion of the brick liquid carton market. The uncoated paperboard segment is projected to register a CAGR of 4.8% from 2025 to 2035.

Paper as a Sustainable and eco-friendly material has matching features as per the current need of the market. Environmental concerns attract customers to prefer paper-based cartons over other material types. Thus, the uncoated paperboard segment is projected to account for a major share of the global brick liquid carton market.

By application, the dairy product segment is anticipated to generate high demand for brick-liquid cartons. The target segment is projected to grow 1.8 times the current market value during the forecast period. The increased demand for packed dairy products such as flavored milk and others augment the sales of dairy packaging including brick liquid cartons.

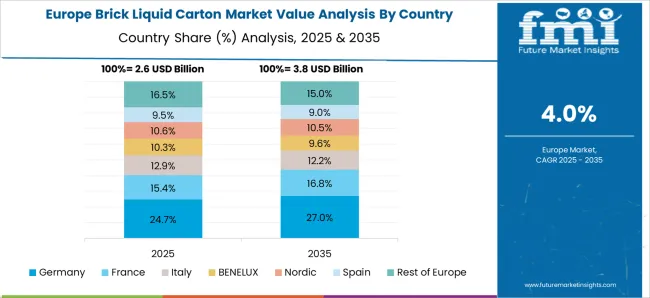

France's brick liquid carton market is projected to register a CAGR of 4.9% from 2025 to 2035. France is at the top of the list of country-wise soft drink consumption. France as a European country has substantial demand for soft drinks and also has production capacities for beverages.

According to the data provided by the Union of EU Soft Drinks Associations (UNESDA), the chances of France becoming a potential market for soft drinks. The data shows that France consumed 9.7 Million Litres of soft drinks in 2024.

Only 66% of the total French population has consumed this substantial amount of soft drinks. Brick liquid packaging is quite famous among soft-drink manufacturers. Due to the attractive features of the brick liquid cartons, soft-drink manufacturers are preferring tetra packs for soft-drink packaging over other packaging solutions. Thus, the increased consumption of soft drink in France fuel the demand for brick liquid carton

India is estimated to hold around 46% of the market value share of the South Asia Brick liquid carton market by the end of 2025. India is thriving to become one of the biggest economies in the world. The dairy sector which is the dominating sector in India is having a huge share in the overall growth of the country.

As per the data collected from the USA Department of Agriculture, milk production in India has constant average growth of 4.5% since 1980. India is the biggest milk producer in the world, which creates growth opportunities for dairy products also. Milk as a perishable food product required protective packaging for better shelf life. Tetra packs are the emerging packaging solution for milk packaging and hence creating opportunities for the brick liquid carton market.

The key players are focusing on innovative packaging solutions for liquid cartons. To achieve set goals, companies are merging with big players to increase their market share. The acquisition of small companies is also being done by big packaging giants. Investment in research and development amid strive for innovative packaging is also being done by the companies. Some of those fluctuations are as under

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.3% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion, Volume in Units, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Material, Opening Type, Application, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East and Africa; Oceania |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Germany, United Kingdom, France, Italy, Spain, Russia, China, Japan, India, GCC countries, Australia |

| Key Companies Profiled | Amcor Limited; Elopak; IPI Srl; Tetra Pak International S.A.; Uflex Ltd.; Agropur Inc.; SIG Combibloc Group Ltd.; Refresco Gerber N.V.; NIPPON PAPER INDUSTRIES CO., LTD.; Carton Service, Inc.; Greatview; ASEPTO; QHP packaging; Smurfit Kappa Group; Liqui-Box |

| Customization & Pricing | Available upon Request |

The global brick liquid carton market is estimated to be valued at USD 10.1 billion in 2025.

The market size for the brick liquid carton market is projected to reach USD 15.4 billion by 2035.

The brick liquid carton market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in brick liquid carton market are uncoated paperboard, ldpe coated and aluminum.

In terms of opening type, straw hole opening segment to command 58.5% share in the brick liquid carton market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of Brick Liquid Carton Companies

Brick Making Machines Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Brick Carton Packaging Industry

Brick Carton Packaging Market by Packaging Type from 2024 to 2034

Foam Bricks Market

Glazed Bricks Market Size and Share Forecast Outlook 2025 to 2035

Fly Ash Bricks Market

Automatic Clay Brick Making Machine Market

Liquid Processing Filter Market Size and Share Forecast Outlook 2025 to 2035

Liquid Mandrel Release Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Liquid Oxygen Generator Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Bag Market Size and Share Forecast Outlook 2025 to 2035

Liquid Desiccant Natural Gas Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Board Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Capsule Market Size and Share Forecast Outlook 2025 to 2035

Liquid Density Meters Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA