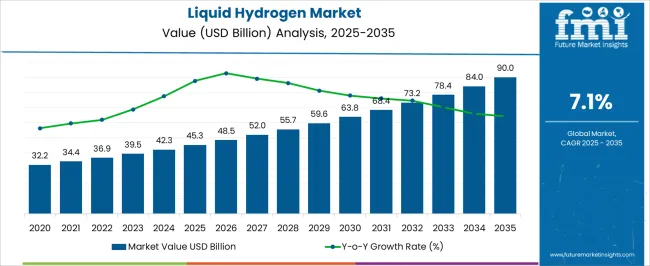

The liquid hydrogen market, valued at USD 45.3 billion in 2025 and projected to reach USD 90.0 billion by 2035 with a CAGR of 7.1%, reflects significant regulatory influence on market dynamics. Regulatory frameworks focusing on decarbonization, energy security, and clean fuel adoption have been pivotal in shaping production, storage, and distribution practices for liquid hydrogen.

Governments in key regions are implementing stringent emission reduction mandates, renewable energy targets, and incentives for hydrogen utilization in industrial, transportation, and power sectors, which collectively impact market growth and technology deployment. Safety and handling regulations are particularly critical for liquid hydrogen due to its low temperature and high volatility characteristics. Standards for storage tanks, transport vessels, and refueling infrastructure directly affect capital expenditures, operational planning, and market readiness for large-scale adoption. The regional regulatory differences create varying adoption rates, with regions having supportive policies, subsidies, and tax incentives witnessing faster market expansion compared to areas with stricter or inconsistent regulatory environments.

Environmental compliance mandates, such as limits on carbon-intensive hydrogen production and incentives for green hydrogen, further drive investments in renewable-based production technologies. The regulatory landscape acts as both a catalyst and a guiding framework, ensuring market growth aligns with safety, environmental, and policy objectives, while also encouraging technological innovation, infrastructure development, and cross-sector integration of liquid hydrogen solutions across global energy and mobility markets.

| Metric | Value |

|---|---|

| Liquid Hydrogen Market Estimated Value in (2025 E) | USD 45.3 billion |

| Liquid Hydrogen Market Forecast Value in (2035 F) | USD 90.0 billion |

| Forecast CAGR (2025 to 2035) | 7.1% |

The liquid hydrogen market represents a specialized segment within the global hydrogen and clean energy industry, emphasizing high energy density, low-emission fuel, and advanced storage and transport solutions. Within the broader hydrogen production and supply sector, it accounts for about 5.6%, driven by adoption in aerospace, fuel cell, and industrial applications. In the cryogenic storage and transportation equipment segment, it holds nearly 4.9%, reflecting demand for safe, low-temperature containment and handling systems. Across the fuel cell and green energy solutions market, the share is 4.3%, supporting use in mobility, power generation, and industrial processes.

Within the energy transition and decarbonization technology category, it represents 3.8%, highlighting integration with renewable energy and zero-emission initiatives. In the advanced materials and safety equipment sector, it secures 3.4%, emphasizing specialized tanks, pumps, and monitoring systems to ensure operational reliability and safety. Recent developments in this market have focused on production innovation, storage efficiency, and transportation safety. Innovations include electrolytic hydrogen production, liquefaction optimization, and insulated cryogenic storage solutions. Key players are collaborating with aerospace manufacturers, fuel cell developers, and renewable energy providers to enhance supply chain efficiency and reduce operational costs.

Adoption of modular liquefaction units, hydrogen refueling infrastructure, and digital monitoring for leak detection and pressure control is gaining traction to improve safety and reliability. The integration with renewable energy systems for green hydrogen production, hydrogen bunkering solutions, and international supply chain partnerships is being deployed to scale the market.

Rising investments influence current market dynamics in hydrogen production technologies and infrastructure to support the transition from fossil fuels to sustainable alternatives.

Increasing adoption in transportation, industrial applications, and energy storage is shaping the market’s future trajectory. Technological advancements in liquefaction and storage, combined with supportive government policies and climate goals, are creating opportunities for wider commercialization.

The demand for low-carbon fuels and growing interest in hydrogen as a versatile energy carrier are anticipated to sustain market growth over the coming decade. Continued improvements in efficiency and cost reduction across the value chain are expected to drive broader adoption and market scalability.

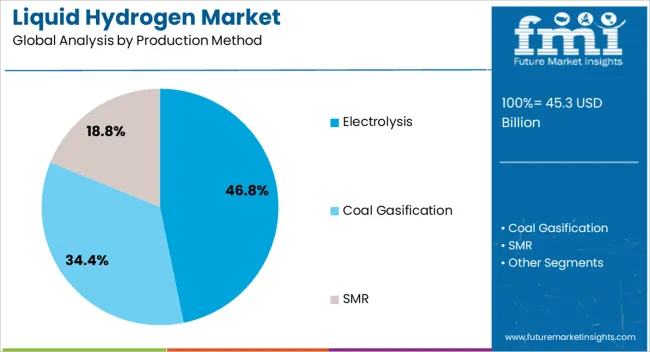

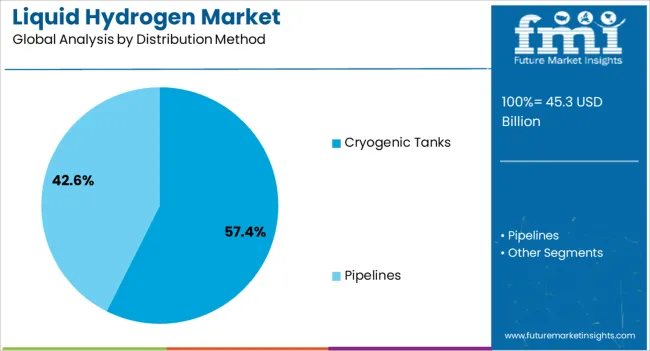

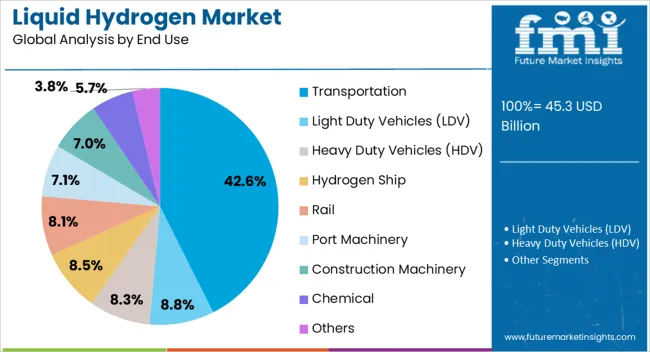

The liquid hydrogen market is segmented by production method, distribution method, end use, and geographic regions. By production method, liquid hydrogen market is divided into Electrolysis, Coal Gasification, and SMR. In terms of distribution method, liquid hydrogen market is classified into Cryogenic Tanks and Pipelines. Based on end use, the liquid hydrogen market is segmented into Transportation, light-duty vehicles (LDV), heavy-duty vehicles (HDV), Hydrogen Ship, Rail, Port Machinery, Construction Machinery, Chemical, and Others. Regionally, the liquid hydrogen industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The electrolysis production method segment is projected to hold 46.8% of the Liquid Hydrogen market revenue share in 2025, marking it as the leading production technique. This growth is attributed to the increasing focus on green hydrogen generation using renewable electricity, which aligns with sustainability goals and reduces carbon emissions compared to conventional methods.

Electrolysis offers the advantage of producing high-purity hydrogen with minimal environmental impact. The scalability and modularity of electrolyzers allow for flexible deployment in various geographic regions and facility sizes.

As renewable energy capacity expands globally, electrolysis-based production is being favored by stakeholders aiming to decarbonize energy systems Ongoing advancements in electrolyzer technology, improving efficiency and lowering operational costs, have further bolstered the adoption of this method in the liquid hydrogen market.

The cryogenic tanks distribution method segment is expected to command 57.4% of the market revenue share in 2025, making it the most widely used distribution technique. This dominance is due to the ability of cryogenic tanks to store and transport liquid hydrogen at extremely low temperatures, ensuring product stability and safety over long distances.

The infrastructure for cryogenic storage is well-established and continues to expand with growing demand in the industrial and transportation sectors. The adoption of cryogenic tanks has been facilitated by advancements in insulation materials and tank design, which improve efficiency and reduce boil-off losses.

As the liquid hydrogen supply chain develops to meet rising demand, cryogenic tanks remain the preferred solution for reliable and large-scale distribution.

The Transportation end-use segment is anticipated to hold 42.6% of the market revenue share in 2025, positioning it as the largest consumer sector. This leadership is driven by the increasing integration of hydrogen fuel in commercial vehicles, public transportation, and emerging sectors such as aviation and maritime transport.

The growing focus on reducing greenhouse gas emissions in the transport industry has accelerated investments in hydrogen-powered mobility solutions. Liquid hydrogen’s high energy density and suitability for long-distance travel have made it an attractive fuel for heavy-duty and long-haul applications.

Additionally, government incentives and regulations aimed at promoting zero-emission vehicles are supporting the expansion of hydrogen infrastructure. The transportation segment’s growth is expected to continue as technology matures and adoption scales globally.

The market has been expanding as energy, aerospace, and industrial sectors increasingly adopt hydrogen for fuel, storage, and chemical applications. Liquid hydrogen, maintained at cryogenic temperatures, enables higher energy density and efficient transportation compared to gaseous hydrogen, supporting large-scale energy storage and long-distance distribution. Investments in hydrogen infrastructure, including liquefaction plants, storage tanks, and fueling stations, have strengthened market growth. The push for decarbonization in transportation and industrial processes has intensified demand for clean energy alternatives. Technological innovations in liquefaction efficiency, insulation systems, and safety management have enhanced operational reliability.

Liquid hydrogen is increasingly utilized in industrial processes, chemical production, and emerging transportation sectors, driving market expansion. Aerospace applications, including rocket propulsion and high-altitude flight systems, require cryogenic hydrogen for high energy output and minimal environmental emissions. In transportation, fuel cell vehicles, including trucks, buses, and ships, leverage liquid hydrogen for extended range and refueling efficiency. Industrial sectors use liquid hydrogen as a feedstock for ammonia production, metal processing, and refining operations. The versatility of applications has encouraged investment in storage, supply chains, and distribution networks. Growing adoption in industrial and transportation domains has made liquid hydrogen a critical enabler for low-emission energy solutions, expanding market opportunities across multiple sectors.

Advances in cryogenic storage, insulation, and handling technologies have significantly improved the efficiency and safety of liquid hydrogen systems. Double-walled vacuum-insulated tanks and high-performance cryogenic pumps allow long-term storage and reduced boil-off rates. Safety sensors, leak detection systems, and automated monitoring enhance operational reliability. Developments in liquefaction technology have reduced energy consumption and improved throughput for large-scale production facilities. Transport vessels and pipelines are being designed to withstand extreme temperatures while minimizing losses. Integration with hydrogen refueling infrastructure, including rapid-fill stations and mobile delivery systems, enhances accessibility. These technological improvements increase the competitiveness of liquid hydrogen relative to other energy carriers, encouraging broader adoption across industrial and mobility applications.

Government initiatives and strategic investments have been pivotal in promoting liquid hydrogen adoption. Policies targeting carbon neutrality, decarbonization of transport, and renewable energy integration provide funding, tax incentives, and regulatory frameworks supporting hydrogen infrastructure. Collaborative projects between public authorities, industrial consortia, and private companies enable large-scale liquefaction, storage, and distribution networks. National hydrogen strategies in Europe, Asia, and North America prioritize liquid hydrogen for industrial use, aerospace, and transport. These policy measures ensure long-term market stability, attract investment, and accelerate technological adoption. Incentives for clean fuel usage and low-emission mobility solutions continue to drive market expansion, reinforcing the role of liquid hydrogen in achieving sustainable energy goals.

Despite growth potential, the market faces challenges related to high production, storage, and transportation costs, as well as safety management requirements. Cryogenic temperatures demand specialized equipment and energy-intensive liquefaction processes, increasing operational expenditure. Handling risks, including leakage, flammability, and pressure buildup, requires stringent safety protocols and regulatory compliance. Infrastructure limitations, such as scarcity of refueling stations and specialized transport vessels, restrict widespread adoption. Market players are addressing these challenges through modular liquefaction units, enhanced insulation materials, and safety automation systems. Reducing capital expenditure while ensuring operational reliability remains critical for scaling the market and enabling its integration into energy and transportation systems globally.

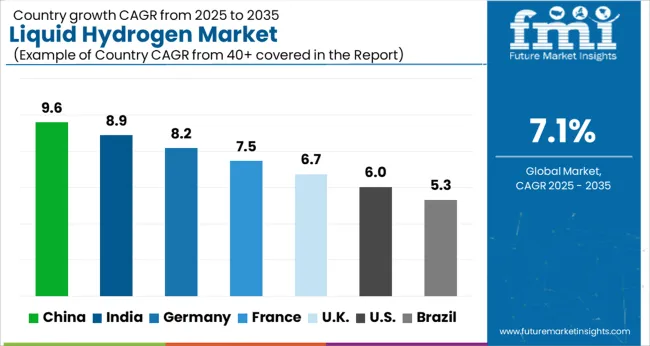

| Country | CAGR |

|---|---|

| China | 9.6% |

| India | 8.9% |

| Germany | 8.2% |

| France | 7.5% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

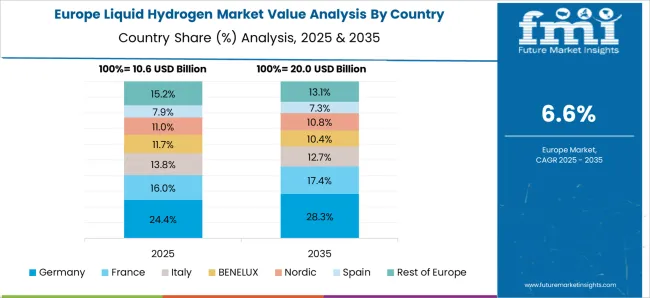

The market is projected to grow at a CAGR of 7.1% between 2025 and 2035, driven by expanding applications in energy, transportation, and industrial sectors. Germany registered 8.2, supported by investments in clean energy infrastructure and hydrogen storage facilities, while India follows with 8.9, propelled by government initiatives and industrial adoption. China leads with 9.6, reflecting large-scale production and research in hydrogen technologies. The United Kingdom recorded 6.7, emphasizing pilot projects and renewable energy integration, and the United States reached 6.0, driven by advancements in fuel cell applications and sustainable energy policies. These countries highlight the global movement toward efficient, large-scale deployment of liquid hydrogen solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to grow at a CAGR of 9.6%, driven by increasing adoption in industrial, aerospace, and energy sectors. Adoption has been reinforced by investments in hydrogen storage infrastructure, cryogenic transport solutions, and research into green hydrogen production. Domestic companies focus on high purity hydrogen production, safe storage systems, and efficient distribution networks. Industrial demand is rising from chemical processing, fuel cell applications, and steel production. The market outlook remains strong as China continues to prioritize hydrogen technology for decarbonization and energy transition initiatives across multiple sectors.

India is expected to record a CAGR of 8.9%, supported by growing industrial and energy sector adoption, including power generation and transportation. Adoption has been reinforced by government initiatives promoting hydrogen as a clean energy source and investments in production and storage technologies. Domestic manufacturers focus on liquid hydrogen storage, safety protocols, and distribution efficiency. Market expansion is also influenced by collaborations with global technology providers for production and supply chain optimization.

Germany is projected to expand at a CAGR of 8.2%, driven by adoption in fuel cell mobility, aerospace, and industrial sectors. Implementation has been reinforced by government support for hydrogen infrastructure, research and development, and renewable energy integration. German companies focus on cryogenic storage systems, high purity hydrogen production, and safety standards compliance. Market growth is supported by increasing demand for hydrogen in power generation, steel manufacturing, and chemical processing, with emphasis on efficiency and sustainability.

The United Kingdom market is expected to grow at a CAGR of 6.7%, supported by adoption in energy, industrial, and research applications. Implementation has been reinforced by government funding for hydrogen projects, renewable energy integration, and pilot programs for transportation and storage. Imported liquid hydrogen supplements domestic production to meet industrial demand. Market expansion is expected as technology advancements and infrastructure development increase the feasibility of widespread adoption across the U K.

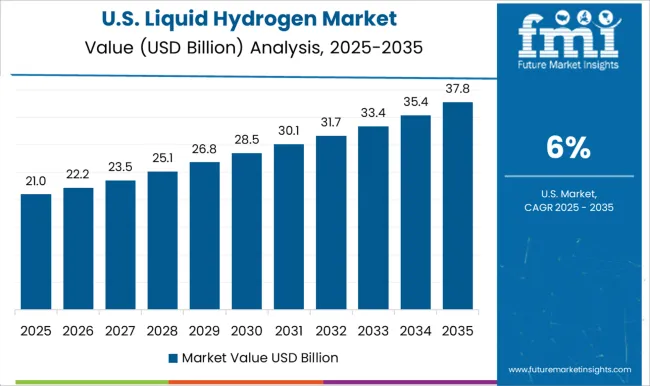

The United States market is projected to expand at a CAGR of 6.0%, driven by adoption in aerospace, energy, and chemical industries. Implementation has been reinforced by investments in cryogenic transport, storage infrastructure, and hydrogen fueling stations for fuel cell applications. Domestic manufacturers and technology providers focus on high purity hydrogen production, safety standards, and efficient supply chain integration. Market growth is expected to continue as industrial and transportation sectors adopt liquid hydrogen for decarbonization and operational efficiency.

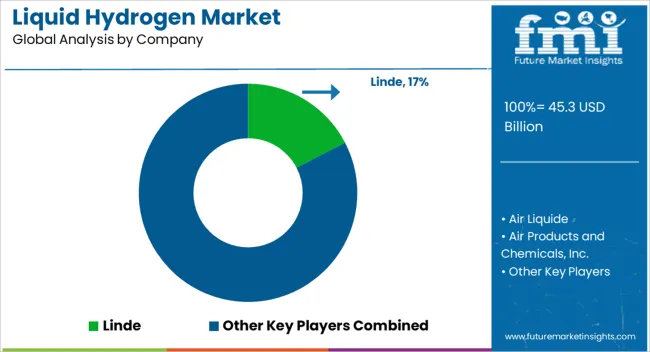

The market is highly competitive, with major industrial gas companies, energy solution providers, and technology specialists driving growth through innovations in storage, transportation, and distribution infrastructure. Leading players such as Linde, Air Liquide, Air Products and Chemicals, Inc., and Praxair Technology, Inc. hold significant market influence due to their advanced liquefaction technologies, global distribution networks, and integrated hydrogen supply solutions. Technology-focused companies, including Chart Industries, GENH2, INOXCVA, and Kawasaki Heavy Industries, are differentiating through specialized cryogenic storage systems, high-capacity transport solutions, and efficiency-optimized production processes.

Energy and industrial conglomerates such as Engie, Shell, Iwatani Corporation, Messer, and Wuxi Yuantong Gas leverage strategic partnerships, joint ventures, and regional expertise to expand market presence and meet growing demand for clean energy applications. Market competitiveness is shaped by regulatory compliance, technological innovation, safety standards, and investment in sustainable hydrogen infrastructure. Companies focusing on R&D for low-loss storage, advanced transport solutions, and seamless integration with fuel cell and industrial applications are best positioned to capture emerging opportunities in transportation, aerospace, and industrial hydrogen markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 45.3 Billion |

| Production Method | Electrolysis, Coal Gasification, and SMR |

| Distribution Method | Cryogenic Tanks and Pipelines |

| End Use | Transportation, Light Duty Vehicles (LDV), Heavy Duty Vehicles (HDV), Hydrogen Ship, Rail, Port Machinery, Construction Machinery, Chemical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Linde, Air Liquide, Air Products and Chemicals, Inc., Chart Industries, Engie, GE Appliances, GENH2, INOXCVA, Iwatani Corporation, Kawasaki Heavy Industries, Messer, Plug Power, Praxair Technology, Inc., Salzburger Aluminium Group, Shell, and Wuxi Yuantong Gas |

| Additional Attributes | Dollar sales by hydrogen type and application, demand dynamics across transportation, industrial, and energy sectors, regional trends in liquid hydrogen adoption, innovation in storage, cryogenic handling, and transportation efficiency, environmental impact of production and lifecycle emissions, and emerging use cases in fuel cell vehicles, aerospace propulsion, and large-scale energy storage. |

The global liquid hydrogen market is estimated to be valued at USD 45.3 billion in 2025.

The market size for the liquid hydrogen market is projected to reach USD 90.0 billion by 2035.

The liquid hydrogen market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in liquid hydrogen market are electrolysis, coal gasification and smr.

In terms of distribution method, cryogenic tanks segment to command 57.4% share in the liquid hydrogen market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chemical Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Electrolysis Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Coal Gasification Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Bag Market Size and Share Forecast Outlook 2025 to 2035

Liquid Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Liquid Desiccant Natural Gas Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Board Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Capsule Market Size and Share Forecast Outlook 2025 to 2035

Liquid Density Meters Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymers Market Size and Share Forecast Outlook 2025 to 2035

Liquid Embolic Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Liquid Nitrogen Purge Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Armor Materials Market Size and Share Forecast Outlook 2025 to 2035

Liquid Synthetic Rubber Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA