The chemical liquid hydrogen market is estimated to be valued at USD 18.5 billion in 2025 and is projected to reach USD 29.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

This period was characterized by technological experimentation, initial infrastructure investments, and limited industrial uptake, primarily by chemical and energy sectors exploring hydrogen applications. The scaling phase spans 2025 to 2030, with the market growing from USD 18.5 billion in 2025 to approximately USD 22.4 billion in 2030. This period represents accelerated adoption, driven by rising demand for cleaner energy solutions, government incentives for hydrogen-based technologies, and the expansion of supply chains. Industrial stakeholders increasingly integrate liquid hydrogen into production and energy systems, and market participants scale production and distribution capabilities to meet growing demand.

The consolidation phase occurs from 2030 to 2035, with the market maturing from USD 22.4 billion in 2030 to USD 29.8 billion by 2035. Growth slows compared to the scaling period as major players achieve market saturation, standardized processes emerge, and investments focus on efficiency improvements rather than rapid expansion. By 2035, the market reaches a stable and mature state, characterized by optimized operations, robust infrastructure, and widespread adoption across energy-intensive industries.

| Metric | Value |

|---|---|

| Chemical Liquid Hydrogen Market Estimated Value in (2025 E) | USD 18.5 billion |

| Chemical Liquid Hydrogen Market Forecast Value in (2035 F) | USD 29.8 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The chemical liquid hydrogen market is gaining significant traction driven by rising demand for clean fuel alternatives, industrial decarbonization, and expanding hydrogen infrastructure. Growing emphasis on energy transition strategies and net zero targets by governments and multinational corporations has amplified investments in hydrogen production, storage, and transportation.

The increasing application of liquid hydrogen across chemical manufacturing, refining, and energy sectors is reinforcing its importance as a key vector in the low carbon economy. Advancements in liquefaction technologies and scalable distribution channels are enabling cost competitiveness and improving supply chain reliability.

As liquid hydrogen continues to gain attention for its high energy density and utility in long haul transport and industrial processes, the market outlook remains robust with long term growth anticipated across both developed and emerging economies.

The chemical liquid hydrogen market is segmented by production, distribution, and geographic regions. By production, the market is divided into coal gasification, SMR, and electrolysis. In terms of distribution, the market is classified into pipelines and cryogenic tanks. Regionally, the chemical liquid hydrogen industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The coal gasification segment is expected to account for 45.60% of total market revenue by 2025 under the production category, making it the leading method. This prominence is due to the extensive availability of coal reserves, especially in countries with limited access to natural gas or renewable energy.

The process allows for hydrogen extraction at scale using existing industrial infrastructure, reducing initial investment costs. In regions where renewable energy integration remains a challenge, coal gasification serves as a dependable source for liquid hydrogen production.

Additionally, the compatibility of this method with carbon capture and storage technologies supports its continued relevance amid tightening emission norms. Its cost effectiveness and scalability position it as a key contributor to the global chemical liquid hydrogen supply.

The pipelines segment is projected to contribute 58.20% of total market revenue by 2025 within the distribution category, establishing it as the most dominant segment. This leadership is attributed to its efficiency in continuous supply, lower transportation costs over long distances, and reduced dependency on trucking or cryogenic tankers.

Pipelines offer a stable and high capacity solution for connecting production hubs with industrial end users, especially in regions with existing hydrogen or natural gas infrastructure. Moreover, safety advancements and regulatory support for hydrogen pipeline development have improved feasibility and accelerated implementation.

As liquid hydrogen consumption increases, pipelines remain the preferred mode of distribution due to their reliability, operational efficiency, and ability to support growing industrial demand.

The chemical liquid hydrogen market is witnessing robust growth driven by increasing industrial demand, energy transition initiatives, and growing adoption in fuel cell applications. Liquid hydrogen, with its high energy density and low environmental impact, is increasingly used in chemical processing, petroleum refining, aerospace, and clean energy sectors. Technological innovations in cryogenic storage, transportation, and liquefaction systems are enhancing safety and efficiency. North America and Europe lead adoption due to government incentives and stringent emission reduction targets, while Asia-Pacific is emerging as a key growth region due to industrial expansion and renewable energy projects. Market participants focus on advanced supply chain infrastructure, high-purity hydrogen production, and multi-sector collaborations. Strategic investments in storage, distribution, and safety technologies are enabling scalable applications in transportation, chemical processing, and energy sectors.

Producing and storing liquid hydrogen involves complex cryogenic processes requiring precise temperature and pressure control. Hydrogen’s low boiling point (-253°C) necessitates advanced insulation and specialized storage tanks, increasing capital and operational costs. Losses due to boil-off during storage and transport reduce overall efficiency. Production methods, including electrolysis and steam methane reforming, face energy intensity and cost concerns. Scaling up production for industrial or transportation applications requires significant infrastructure investments and safety protocols. Storage and transport regulations differ by region, adding compliance complexity. Companies that develop innovative insulation, boil-off reduction systems, and modular production units gain competitive advantage by improving reliability and reducing costs. Until storage and production efficiencies improve, widespread adoption in chemical, aerospace, and energy sectors will remain constrained.

Technological advancement is a major driver for the liquid hydrogen market. Innovations in liquefaction systems, cryogenic pipelines, and high-performance storage tanks improve energy efficiency and reduce operational losses. Advanced purification techniques enable high-purity hydrogen for sensitive industrial applications. Integration with renewable energy sources, such as wind and solar-powered electrolysis, supports green hydrogen production. Emerging developments in transportation, including hydrogen-powered vehicles and aircraft, are expanding end-use potential. Companies investing in automated monitoring, safety sensors, and boil-off recovery systems enhance operational reliability. Research collaborations and pilot projects are validating large-scale storage, handling, and transport technologies. As technology improves efficiency, scalability, and safety, market players can expand into diverse applications, including chemical processing, energy storage, aerospace, and fuel cell mobility solutions.

Regulatory compliance and safety considerations significantly influence the liquid hydrogen market. Handling, storage, and transport of cryogenic hydrogen are governed by stringent safety standards to prevent leaks, explosions, and material embrittlement. Different regions enforce varying codes for industrial use, transportation, and fuel cell applications, creating compliance complexity for global operators. Environmental regulations also dictate emission-free production methods and hydrogen purity levels. Certification requirements for storage tanks, pipelines, and cryogenic vehicles add to operational costs. Companies aligning with international safety standards, ISO codes, and local regulatory frameworks gain credibility and market access. Until global safety and regulatory harmonization is achieved, market expansion may be limited by legal compliance, operational risk, and the high cost of safe handling infrastructure.

The liquid hydrogen market is competitive, involving industrial gas manufacturers, energy companies, and specialized technology providers. Key differentiators include production capacity, storage and transport solutions, safety record, and integration with renewable energy. Supply chain challenges include securing raw materials, cryogenic equipment, and high-capacity storage infrastructure. Transportation is constrained by infrastructure availability and distance between production sites and end-users. Companies offering modular liquefaction units, localized production, or turnkey supply solutions strengthen their position. Strategic partnerships with industrial users, automotive OEMs, and renewable energy providers enhance market penetration. Until supply chains for high-volume, cryogenic hydrogen become more standardized, competition will remain driven by technological differentiation, reliability, and cost efficiency in delivering safe, high-purity liquid hydrogen to diverse applications.

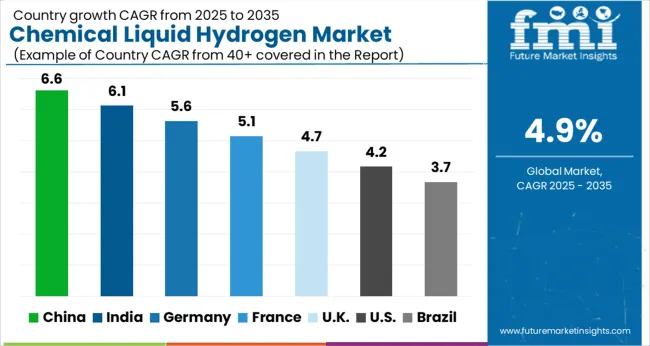

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

| USA | 4.2% |

| Brazil | 3.7% |

The global Chemical Liquid Hydrogen Market is projected to grow at a CAGR of 4.9% through 2035, supported by increasing demand across industrial, laboratory, and energy applications. Among BRICS nations, China has been recorded with 6.6% growth, driven by large-scale production and utilization in chemical and energy sectors, while India has been observed at 6.1%, supported by rising adoption in industrial and laboratory operations. In the OECD region, Germany has been measured at 5.6%, where production and deployment for industrial, laboratory, and energy applications have been steadily maintained. The United Kingdom has been noted at 4.7%, reflecting consistent use in chemical and energy sectors, while the USA has been recorded at 4.2%, with production and utilization across industrial and laboratory applications being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The chemical liquid hydrogen market in China is growing at a CAGR of 6.6%, driven by rising industrial applications, energy transition initiatives, and government support for hydrogen infrastructure. China’s focus on clean energy and decarbonization is increasing demand for liquid hydrogen in fuel cells, chemical manufacturing, and energy storage systems. Technological advancements in hydrogen production, liquefaction, and storage solutions enhance efficiency and reduce operational costs. Industrial sectors, including chemicals, metallurgy, and electronics, are adopting liquid hydrogen for high-purity applications. Government incentives, research funding, and large-scale hydrogen projects further fuel market expansion. Strategic partnerships between industrial players and technology providers promote innovation in production, storage, and transportation. As China aims to achieve carbon neutrality and transition toward hydrogen-based energy solutions, the demand for chemical liquid hydrogen is expected to grow steadily.

Chemical liquid hydrogen market in India is expanding at a CAGR of 6.1%, supported by growing industrial applications and energy transition initiatives. The chemical, electronics, and energy sectors increasingly adopt liquid hydrogen for high-purity chemical processes, fuel cells, and energy storage. Government policies promoting renewable energy, decarbonization, and hydrogen production infrastructure stimulate market growth. Technological advancements in liquefaction, transportation, and storage improve operational efficiency and safety. Rising awareness of clean energy and sustainability further drives adoption across industrial and research applications. Collaborations between domestic companies and international technology providers are accelerating the development of hydrogen production and supply chains. With India’s commitment to reducing carbon emissions and advancing renewable energy solutions, the chemical liquid hydrogen market is poised for steady growth.

The chemical liquid hydrogen market in Germany is growing at a CAGR of 5.6%, driven by stringent environmental regulations, industrial demand, and clean energy initiatives. Industrial sectors, including chemicals, automotive, and electronics, are increasingly adopting liquid hydrogen for high-purity processes and fuel cell applications. Germany’s focus on decarbonization, energy transition, and renewable hydrogen production promotes market expansion. Technological innovations in storage, liquefaction, and distribution systems enhance operational efficiency and safety. Research collaborations and investments in hydrogen infrastructure further support growth. The combination of regulatory compliance, sustainability targets, and technological advancements ensures steady adoption of chemical liquid hydrogen in Germany.

The UK chemical liquid hydrogen market is expanding at a CAGR of 4.7%, fueled by industrial, energy, and research applications. Adoption of liquid hydrogen in fuel cells, chemical processes, and energy storage is increasing due to government initiatives promoting low-carbon technologies. Technological improvements in production, storage, and transportation systems enhance efficiency and safety, while industrial and research sectors continue to explore hydrogen-based solutions. Collaborative projects and investments in hydrogen infrastructure further drive market growth. Sustainability goals, emission reduction targets, and decarbonization policies support the steady adoption of chemical liquid hydrogen.

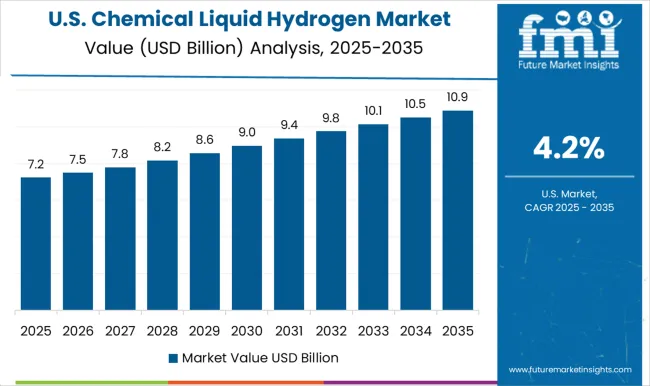

The USA chemical liquid hydrogen market is growing at a CAGR of 4.2%, driven by industrial, energy, and research applications. Liquid hydrogen is increasingly adopted for high-purity chemical processes, fuel cells, and energy storage solutions. Government support for hydrogen infrastructure, clean energy programs, and emission reduction initiatives promotes market expansion. Technological innovations in production, liquefaction, storage, and transportation improve efficiency, safety, and reliability. Industrial adoption across chemical manufacturing, electronics, and energy sectors continues to rise, supported by sustainability goals and regulatory compliance. Investment in research, development, and pilot hydrogen projects further accelerates market growth.

The chemical liquid hydrogen market is a rapidly expanding segment of the energy and industrial gases industry, driven by the growing adoption of hydrogen in clean energy, transportation, and chemical applications. Liquid hydrogen is valued for its high energy density and versatility, serving as a critical feedstock for refineries, fuel cells, and emerging green energy solutions. Air Liquide is a key player, providing industrial-scale liquid hydrogen production and distribution with advanced storage and transportation technologies. Air Products and Chemicals specializes in hydrogen liquefaction and supply chains for industrial and mobility applications. Ballard Power Systems focuses on hydrogen fuel cell solutions, supporting liquid hydrogen usage in transportation and backup power systems. Chart Industries offers cryogenic storage and transportation equipment for liquid hydrogen, ensuring safe and efficient handling.

ENGIE is actively involved in hydrogen energy projects, integrating liquid hydrogen into renewable energy and industrial processes. ENEOS Corporation and Iwatani Corporation contribute through hydrogen production, storage, and distribution networks in Asia. Linde provides comprehensive hydrogen solutions, including production, liquefaction, and infrastructure for industrial and mobility applications. Messer Group delivers tailored hydrogen supply solutions for industrial and chemical processes. Nel ASA and Plug Power focus on green hydrogen production, promoting liquid hydrogen adoption for clean energy. TotalEnergies and Taiyo Nippon Sanso Corporation are expanding liquid hydrogen production and transportation capabilities, supporting global hydrogen economy initiatives. Together, these companies are driving innovation in liquid hydrogen production, storage, and supply, fostering a sustainable energy transition and supporting industrial decarbonization worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 18.5 Billion |

| Production | Coal gasification, SMR, and Electrolysis |

| Distribution | Pipelines and Cryogenic tanks |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Liquide, Air Products and Chemicals, Ballard Power Systems, Chart Industries, ENGIE, ENEOS Corporation, Iwatani Corporation, Linde, Messer Group, Nel ASA, Plug Power, TotalEnergies, and Taiyo Nippon Sanso Corporation |

| Additional Attributes | Dollar sales by type including fixed, portable, and mobile devices, application across airport security, cargo inspection, and border control, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising security and surveillance requirements, increasing air travel, and advancements in imaging technologies for threat detection. |

The global chemical liquid hydrogen market is estimated to be valued at USD 18.5 billion in 2025.

The market size for the chemical liquid hydrogen market is projected to reach USD 29.8 billion by 2035.

The chemical liquid hydrogen market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in chemical liquid hydrogen market are coal gasification, smr and electrolysis.

In terms of distribution, pipelines segment to command 58.2% share in the chemical liquid hydrogen market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chemical Recycling Service Market Forecast Outlook 2025 to 2035

Chemical Dosing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Chemical Filling System Market Size and Share Forecast Outlook 2025 to 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Chemical Indicator Inks Market Size and Share Forecast Outlook 2025 to 2035

Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hardener Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Peel Market Size and Share Forecast Outlook 2025 to 2035

Chemical Protective Gloves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Injection Pump Market Size and Share Forecast Outlook 2025 to 2035

Chemical Sensors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant EVA Film Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Coating Market Size and Share Forecast Outlook 2025 to 2035

Chemical Distribution Market Size and Share Forecast Outlook 2025 to 2035

Chemical & Petrochemical IECS Market Size and Share Forecast Outlook 2025 to 2035

Chemical Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Chemicals And Petrochemicals Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Chemical Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA