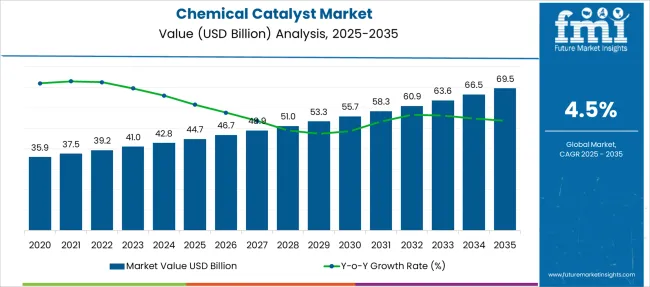

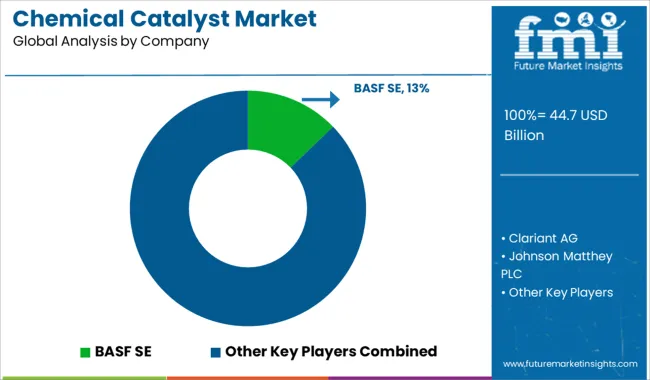

The Chemical Catalyst Market is estimated to be valued at USD 44.7 billion in 2025 and is projected to reach USD 69.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Chemical Catalyst Market Estimated Value in (2025 E) | USD 44.7 billion |

| Chemical Catalyst Market Forecast Value in (2035 F) | USD 69.5 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The chemical catalyst market is expanding steadily, driven by its critical role in enhancing reaction efficiency, selectivity, and yield across a wide range of chemical processes. Rising demand from industries such as petrochemicals, pharmaceuticals, and environmental applications is fueling the need for advanced catalysts that support energy efficiency and reduce byproduct generation.

Regulatory pressures aimed at curbing emissions and improving sustainability have accelerated the shift toward high-performance catalysts that enable cleaner production processes. Technological advancements in catalyst formulation, including nanostructuring and surface area optimization, are allowing manufacturers to deliver more targeted and reusable solutions.

Continued growth is expected as industrial sectors increasingly rely on catalytic technologies for cost-effective and environmentally compliant operations. Strategic investments in research and partnerships between chemical producers and catalyst developers are expected to reinforce innovation and commercial scalability in the global catalyst landscape.

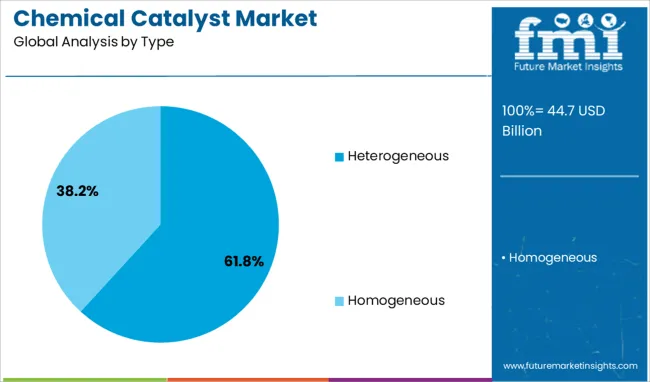

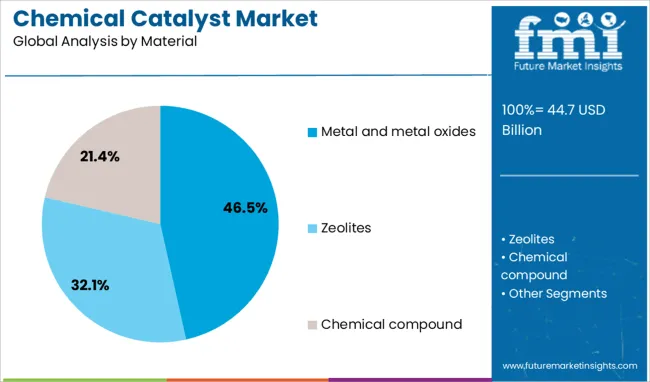

The chemical catalyst market is segmented by type, material, form, process, application, and geographic regions. The chemical catalyst market is divided by type into Heterogeneous and Homogeneous. In terms of materials, the chemical catalyst market is classified into Metal and metal oxides, Zeolites, and Chemical compounds.

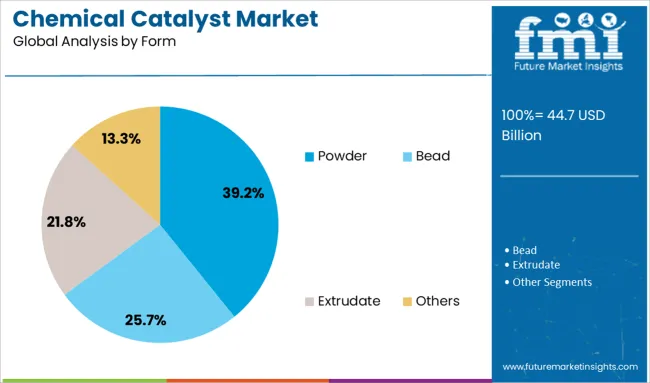

Based on the form, the chemical catalyst market is segmented into Powder, Bead, Extrudate, and Others. The chemical catalyst market is segmented by process into Fluid Catalytic Cracking (FCC), Hydrogenation, Oxidation, Isomerization, Alkylation, Polymerization, and Others. By application, the chemical catalyst market is segmented into Petrochemicals, Chemical Synthesis, Environmental Catalysis, Polymerization, Refining, Pharmaceuticals, and Others.

Regionally, the chemical catalyst industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The heterogeneous segment holds a dominant 61.8% market share in the catalyst type category, owing to its robust application in large-scale industrial processes where separation and reuse are critical. Heterogeneous catalysts are favored for their solid-phase nature, which allows for easy recovery and regeneration, making them cost-effective and operationally efficient.

Their application spans major chemical manufacturing processes, including refining, ammonia production, and environmental remediation. The segment’s growth is reinforced by increasing demand for processes that minimize waste and energy consumption.

Continued innovations aimed at improving catalyst surface properties and stability are enhancing the overall performance of heterogeneous systems. With industries placing greater emphasis on continuous flow processes and reducing operational downtime, this segment is expected to maintain its lead in both mature and emerging markets.

The metal and metal oxides segment leads the material category with a 46.5% share, driven by their superior catalytic activity, thermal stability, and versatility across various chemical transformations. These materials are extensively used in oxidation, hydrogenation, and reforming reactions, making them essential in industries such as petrochemicals and fine chemicals.

Their ability to operate under high-pressure and high-temperature conditions enhances their appeal for large-scale applications. Advancements in catalyst surface engineering and particle dispersion techniques have further improved the efficiency and durability of metal-based catalysts.

Additionally, ongoing research into noble and transition metals is yielding more selective and recyclable options that align with sustainability goals. This segment is expected to retain its leadership position as industrial users prioritize high-performance materials that support cleaner and more efficient production pathways.

The powder form segment accounts for 39.2% of the chemical catalyst market, highlighting its broad adoption due to ease of mixing, high surface area, and uniform dispersion in reaction environments. Powder catalysts are commonly used in fluidized bed reactors, batch processing, and laboratory-scale applications, offering flexibility in catalyst loading and handling.

Their porous nature supports high reaction rates and consistent catalytic performance, which is particularly beneficial in fine chemical synthesis and specialty applications. Manufacturers are developing advanced powdered formulations with controlled particle sizes and enhanced thermal resistance to meet the evolving needs of high-throughput operations.

The segment continues to benefit from demand in both R&D and commercial production settings where customizable and easily scalable catalyst forms are preferred. With ongoing improvements in formulation and delivery systems, the powder segment is expected to see steady growth across global industrial applications.

The chemical catalyst market is expanding steadily as demand rises in sectors such as petrochemicals, refining, chemical synthesis, pharmaceuticals and environmental control applications. Catalysts accelerate reactions and improve selectivity without being consumed. Established types include heterogeneous, homogeneous and biocatalysts.

Key regions such as Asia‑Pacific and North America drive market growth through refinery expansion, specialty chemical production and emission control initiatives. Rising interest in bio‑based chemical production and precision-driven catalyst discovery platforms supports demand for specialized catalyst formats and tailored deployment across multiple industries.

Catalyst manufacturers must meet strict environmental and emissions regulations across regions. Policies targeting air pollutants and industrial effluents require catalysts for selective cracking, reforming and emission control applications. Meeting evolving standards often requires reformulating catalyst compositions and deploying new catalyst systems for sulfur removal or nitrogen oxide reduction.

Certification processes for industrial installations and mobile applications vary by jurisdiction and often involve lengthy approvals and performance validation. These compliance demands add development cost and extend time to market for new catalyst types or upgraded formulations. Suppliers must navigate overlapping requirements across multiple industries and regions.

Companies servicing global clients must support diverse regulatory frameworks while ensuring product consistency. Managing reformulation cycles, recertification and regional regulatory alignment increases operational complexity and strains internal quality assurance and engineering teams.

Industrial growth in refining, polymer production and fine chemicals supports rising catalyst consumption. Petrochemical plants and refineries rely on catalysts in cracking, alkylation and hydrogenation steps. Polymer manufacturers use catalysts in polyethylene, polypropylene and specialty resin production.

Pharmaceutical and agrochemical sectors employ catalysts in synthesis processes. Expansion of biofuel and renewable chemical applications is also generating new needs for biocatalysts and heterogeneous systems. Emerging economies in Asia‑Pacific and Latin America offer expanding client bases as chemical and energy infrastructure grows.

Suppliers partnering with chemical and refining firms on process customization can win long‑term contracts. Development of catalysts tuned to specific feedstock or reaction conditions enhances value. Companies that align capabilities with end‑user technical needs in targeted sectors benefit as industrial activity rises worldwide.

Recent developments in catalyst innovation include use of nanostructured materials and artificial intelligence platforms to enhance performance. Nanocatalysts with high surface area and controlled porosity improve activity and selectivity in hydrogenation, oxidation and emission control processes. Machine learning and AI‑powered frameworks help identify promising formulations and composition spaces faster than trial‑and‑error methods.

These tools reduce development cycles and optimize materials for targeted industrial reactions. Early adopters of AI‑guided discovery platforms benefit through scalable, precise catalyst formulations tailored to performance goals. Some firms also use digital models to predict deactivation pathways, improving lifecycle planning and regeneration strategies.

This shift toward data‑driven catalyst design supports enhanced throughput, optimized selectivity and lower testing overhead for producers focused on advanced chemical processes.

Catalysts often rely on precious metals and rare materials whose prices fluctuate significantly. Metals such as palladium, platinum, rhodium and nickel feature in many formulations. Sudden price spikes affect raw material procurement costs and reduce profit margins. Supply disruptions due to geopolitical shifts or export restrictions add further uncertainty.

Smaller producers or regional suppliers may lack long-term contracts or hedging tools, making pricing volatile. High spot prices can dissuade end users from upgrading to premium catalysts or engaging with advanced formulations. In cost-sensitive segments like commodity chemicals or basic processing, buyers may favor lower-cost alternatives or delay investment. Until supply chains stabilize or alternatives reduce metal dependency, price sensitivity remains a key constraint on adoption of high-performance catalysts.

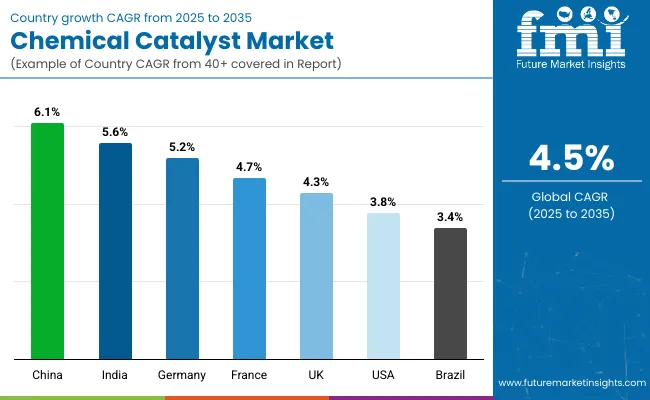

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The global chemical catalyst market is projected to grow at a CAGR of 4.5% through 2035, supported by consistent demand across petrochemicals, polymers, and fine chemicals production. Among BRICS nations, China leads with 6.1% growth, driven by widespread use in large-scale refining and bulk chemical synthesis. India follows at 5.6%, where catalyst application has been extended to fertilizer manufacturing and base chemical production. In the OECD region, Germany reports 5.2% growth, reflecting continued deployment in process intensification and high-throughput production facilities.

The United Kingdom, at 4.3%, maintains moderate growth supported by niche applications in specialty and pharmaceutical chemicals. The United States, at 3.8%, shows steady demand with emphasis on established catalyst life-cycle protocols and operational safety standards. Catalyst reusability metrics, reaction efficiency parameters, and compliance with reaction pathway regulations have shaped market growth. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Steady industrial growth has driven the chemical catalyst market in China to achieve a 6.1% CAGR. The expansion of the petrochemical and refinery sectors has been a major factor fueling demand. Catalysts used in methanol synthesis and polyethylene production have been in large-scale deployment. Local chemical producers have expanded capacity for zeolite and metal-based catalysts to support domestic production goals.

Environmental controls have led to increased adoption of emission control catalysts in power plants and automotive manufacturing. Research institutes have collaborated with industry to enhance catalyst efficiency and lifetime under industrial conditions. Export volumes of specialty catalysts to neighboring Asian countries have also increased. Continuous process optimization in fertilizer production has further supported market expansion.

In India, chemical catalyst market has registered a 5.6% CAGR due to rising demand in fertilizer and polymer manufacturing. Increased production of ammonia and urea fertilizers has necessitated steady catalyst supplies for synthesis gas and ammonia conversion processes. Local catalyst manufacturers have scaled up production of metal oxides and composite catalysts. Growth in the pharmaceutical and specialty chemical sectors has also influenced demand for tailored catalyst formulations. Industrial clusters in Gujarat and Maharashtra have been focal points for catalyst consumption and innovation. Investment in refinery modernization projects has led to higher uptake of hydrotreating and hydrocracking catalysts. Demand from emerging bio-refineries is expected to expand the market further.

Germany has recorded a 5.2% CAGR in the chemical catalyst market, supported by mature chemical and automotive industries. Catalysts for oxidation, hydrogenation, and carbonylation reactions have seen steady deployment. High-quality catalyst materials have been developed to meet stringent environmental regulations and efficiency standards. Demand from fine chemicals and pharmaceuticals has led to specialized catalyst formulations adapted for small-batch production. Recycling and regeneration technologies for spent catalysts have been increasingly integrated into industrial workflows. German catalyst manufacturers have focused on innovation to improve selectivity and durability. Adoption in emission control and renewable chemical processes has provided additional growth avenues.

The chemical catalyst market in the United Kingdom has grown at a 4.3% CAGR, supported by the pharmaceutical and specialty chemical sectors. Catalysts have been applied in pharmaceutical synthesis, polymerization, and environmental remediation processes. R&D centers in the UK have focused on developing catalysts that enable cleaner chemical processes and improve reaction efficiency. Small and medium-sized chemical enterprises have adopted advanced catalyst formulations to optimize production yields. The UK market has seen increasing interest in heterogeneous catalysts used in emission control systems for industrial exhausts. Export opportunities for high-performance catalysts to European markets have been developed. Government funding programs have supported pilot projects in catalyst innovation.

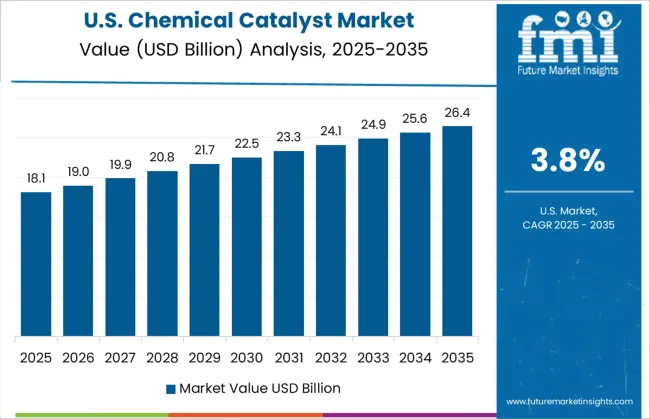

Growth of the chemical catalyst market in the United States has proceeded at a 3.8% CAGR driven by demand from petrochemical, refinery, and pharmaceutical industries. Advanced catalysts for hydroprocessing and catalytic cracking have been implemented extensively in refinery upgrades. Pharmaceutical companies have invested in catalysts that enable selective transformations and high-purity syntheses. New catalyst formulations supporting bio-based chemical production are under evaluation. Industrial catalyst recycling and regeneration services have seen increasing adoption. Supply chain consolidation and strategic partnerships between catalyst producers and end-users have optimized availability and reduced costs. Federal research grants have supported catalyst development for emerging chemical pathways.

The chemical catalyst market is led by a diverse group of multinational companies that provide essential catalytic materials used in refining, petrochemicals, polymers, and environmental applications. BASF SE holds a leading position through its extensive portfolio of base metal and precious metal catalysts tailored for hydrogenation, reforming, and emission control across various industrial sectors.

Clariant AG is recognized for its specialty catalysts that support polymerization, syngas production, and biofuel processing, with a strong global R&D and production presence. Johnson Matthey PLC is a major supplier of noble metal-based catalysts, particularly for emission control systems and fine chemical synthesis, offering high efficiency and recyclability.

Albemarle Corporation provides refinery catalysts, including fluid catalytic cracking (FCC) and hydroprocessing solutions, widely used in fuel upgrading. W. R. Grace & Co. specializes in FCC catalysts for gasoline and diesel production, known for their adaptability to changing crude feedstock compositions. Evonik Industries AG delivers heterogeneous catalysts used in specialty chemical manufacturing and oleochemical conversions.

Haldor Topsoe A/S is a key player in ammonia, hydrogen, and methanol catalysts, with technologies central to large-scale chemical processes. Arkema SA and UOP LLC (Honeywell) supply process-specific catalysts for polymer and petrochemical value chains, including paraffin isomerization and aromatics recovery. ExxonMobil, Sinopec Catalyst Company, and LyondellBasell integrate catalyst development into their refining and chemical operations.

Companies like Royal Dutch Shell, DuPont, and Chevron Phillips Chemical develop proprietary catalytic systems to enhance process yields and reduce environmental impact, ensuring competitive advantage in high-throughput industrial applications.

In August 2024, BASF officially launched Fourtiva™, an advanced FCC (Fluid Catalytic Cracking) catalyst featuring AIM and MFT technologies. Designed for gasoil to mild resid feedstocks, it enhances butylene yield, naphtha octane, and refining efficiency while reducing coke formation and emissions.

| Item | Value |

|---|---|

| Quantitative Units | USD 44.7 Billion |

| Type | Heterogeneous and Homogeneous |

| Material | Metal and metal oxides, Zeolites, and Chemical compound |

| Form | Powder, Bead, Extrudate, and Others |

| Process | Fluid Catalytic Cracking (FCC), Hydrogenation, Oxidation, Isomerization, Alkylation, Polymerization, and Others |

| Application | Petrochemicals, Chemical Synthesis, Environmental Catalysis, Polymerization, Refining, Pharmaceuticals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Clariant AG, Johnson Matthey PLC, Albemarle Corporation, W. R. Grace & Co., Evonik Industries AG, Haldor Topsoe A/S, Arkema SA, UOP LLC (Honeywell), ExxonMobil Corporation, Sinopec Catalyst Company, LyondellBasell Industries N.V., Royal Dutch Shell PLC, DuPont de Nemours, Inc., and Chevron Phillips Chemical Company LLC |

| Additional Attributes | Dollar sales by chemical catalyst type include heterogeneous, homogeneous, biocatalysts, and enzyme-based variants, applied in refining, petrochemicals, and polymers across North America, Europe, and Asia-Pacific. Demand is driven by green chemistry, emission norms, and energy efficiency. Innovation focuses on recyclable supports and nano-catalysts. Costs depend on metals, regeneration, and process lifespan. |

The global chemical catalyst market is estimated to be valued at USD 44.7 billion in 2025.

The market size for the chemical catalyst market is projected to reach USD 69.5 billion by 2035.

The chemical catalyst market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in chemical catalyst market are heterogeneous and homogeneous.

In terms of material, metal and metal oxides segment to command 46.5% share in the chemical catalyst market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chemical Hydraulic Valves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Vapor Deposition Market Forecast Outlook 2025 to 2035

Chemical Recycling Service Market Forecast Outlook 2025 to 2035

Chemical Dosing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Chemical Filling System Market Size and Share Forecast Outlook 2025 to 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Chemical Indicator Inks Market Size and Share Forecast Outlook 2025 to 2035

Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hardener Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Peel Market Size and Share Forecast Outlook 2025 to 2035

Chemical Protective Gloves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Injection Pump Market Size and Share Forecast Outlook 2025 to 2035

Chemical Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Chemical Sensors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant EVA Film Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Coating Market Size and Share Forecast Outlook 2025 to 2035

Chemical Distribution Market Size and Share Forecast Outlook 2025 to 2035

Chemical & Petrochemical IECS Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA