The chemical distribution market is estimated to be valued at USD 322.6 billion in 2025 and is projected to reach USD 530.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

This trajectory reflects the critical role of distributors in bridging chemical producers with end-use industries, ensuring supply reliability, regulatory compliance, and value-added services. Between 2025 and 2030, growth will be supported by rising consumption of specialty and commodity chemicals across construction, automotive, agriculture, and consumer goods, with market value projected to surpass USD 410 billion.

From 2030 to 2035, expansion will be driven by increasing demand for distribution networks in emerging economies, digitalization of supply chains, and emphasis on safe handling of hazardous materials. The incremental growth of USD 207.8 billion highlights consistent demand across both bulk and specialty chemicals. Competitive differentiation will stem from logistics capabilities, technical expertise, and integrated service models such as blending, packaging, and inventory management. Regional leaders like Asia-Pacific are expected to dominate due to industrialization and manufacturing growth, while North America and Europe will continue prioritizing compliance-heavy and specialty segments.

Transportation operations experience substantial operational complexity as chemical distribution requires coordination between specialized carrier networks, route planning systems, and emergency response capabilities that must comply with Department of Transportation regulations and international shipping requirements. Logistics coordinators work with carrier qualification departments to establish transportation procedures for different hazard classes while managing documentation requirements for manifests, safety data sheets, and emergency response information that accompanies chemical shipments across varying transportation modes.

Cross-functional coordination between sales teams and technical services creates ongoing dialogue about product specification verification and application support requirements. Customer service representatives work with technical specialists to provide product recommendations and compatibility guidance while coordinating with quality assurance departments about certificate of analysis preparation and product testing verification that may be required for specific customer applications or regulatory compliance.

Supply chain operations encounter sourcing complexity as chemical distribution requires coordination between multiple manufacturing suppliers, import logistics, and quality verification procedures that must maintain product integrity throughout the distribution network. Procurement teams work with supplier qualification departments to establish vendor approval processes while managing inventory planning considerations for products that may have seasonal demand variations, regulatory changes, or supply chain disruptions affecting availability and pricing.

Blending and repackaging operations within distribution facilities require coordination between production planning teams and quality control departments to ensure product consistency and regulatory compliance across different package sizes and customer specifications. Technical operations teams establish procedures for batch tracking, contamination prevention, and equipment cleaning validation while managing production scheduling requirements that accommodate both standard products and custom formulations requested by specific customers.

| Metric | Value |

|---|---|

| Chemical Distribution Market Estimated Value in (2025 E) | USD 322.6 billion |

| Chemical Distribution Market Forecast Value in (2035 F) | USD 530.4 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The chemical distribution market is undergoing structural transformation due to the growing complexity of downstream applications and the increasing reliance on specialized intermediaries for regulatory, safety, and technical support. Distributors are evolving from simple suppliers to strategic partners that bridge producers and end-users through formulation assistance, timely delivery, and compliance management.

Rising demand for customized chemical blends, safe handling of hazardous substances, and efficient warehousing and transport infrastructure supports the market’s growth. Digital transformation has enabled real-time inventory visibility, predictive planning, and sustainable logistics, making supply chains more resilient.

Shifts in manufacturing hubs, tighter import-export regulations, and environmental accountability are reinforcing the importance of regional distribution networks. Future growth will be influenced by integration with industry-specific needs across pharmaceuticals, agrochemicals, personal care, and electronics.

The chemical distribution market is segmented by product, end use, and geographic regions. By product, the chemical distribution market is divided into Specialty Chemicals and Commodity Chemicals. In terms of end use, the chemical distribution market is classified into Medical & Pharmaceutical, Construction, Automotive & transportation, Electronics, Agriculture, Packaging, Energy, Food & beverage, Textile, and Others. Regionally, the chemical distribution industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The specialty chemicals segment is projected to account for 54.6% of total revenue in 2025, making it the leading category. This dominance is driven by the growing demand for tailored chemical solutions for high-performance applications in coatings, personal care, construction, and electronics.

Specialty chemicals are favored for their formulation complexity and performance specificity, which require distributor expertise in safe storage, blending, and technical support. Growth is also supported by regulatory requirements, innovation in formulations, and customer preference for sustainable and differentiated products.

Distributors in this category increasingly use digital platforms to manage compliance, documentation, and delivery schedules. As end-use industries seek agile partners capable of managing technical and environmental challenges, the specialty chemicals segment is expected to maintain its leadership.

The medical and pharmaceutical segment is anticipated to contribute 28.3% of total revenue by 2025, making it a major end-use vertical. Growth is driven by demand for active pharmaceutical ingredients, excipients, and high-purity solvents used in drug formulation, diagnostics, and sterile processing.

Advancements in biologics, vaccines, and personalized medicine have intensified the need for reliable and compliant chemical supply chains. Distributors in this space must adhere to GDP and GMP standards, maintain validated cold chain logistics, and ensure traceability across delivery.

Expansion of pharmaceutical manufacturing hubs and rising healthcare investment in emerging markets reinforce demand for specialized distribution. As regulations tighten and formulations grow more complex, this segment will remain strong due to its focus on quality and safety.

The chemical distribution market thrives on regulatory compliance, industry demand, supply chain improvements, and environmental management. The sector’s future growth is fueled by its ability to adapt to changing market dynamics and regulatory requirements.

The chemical distribution market is strongly shaped by strict global regulations and safety standards. Government agencies enforce laws covering the storage, transport, and handling of chemicals to ensure worker safety and environmental protection. These regulations influence how distributors manage operations, often requiring significant investment in certifications, safety training, and compliance systems. With environmental awareness growing worldwide, safety and compliance have become central to business operations. Distributors are adopting best practices, maintaining transparent reporting, and aligning with evolving standards to remain competitive and credible in global supply chains.

Growth in the chemical distribution market is closely tied to the expansion of key industries such as pharmaceuticals, agriculture, and automotive manufacturing. These sectors rely on a steady and reliable chemical supply chain to support production. The rising demand for specialty chemicals in these industries increases the need for efficient, localized distribution networks. As manufacturing expands globally, distributors play a crucial role in managing complex chemical logistics, ensuring safe, timely, and compliant deliveries. Market success increasingly depends on a distributor’s ability to adapt quickly to shifting industrial requirements, consumer preferences, and regional dynamics.

Distributors are prioritizing supply chain efficiency to cut costs, shorten delivery times, and improve customer satisfaction. Investments in warehouse automation, digital tracking, and integrated logistics systems are enabling real-time visibility and better coordination across networks. These advancements support just-in-time delivery models and enhance inventory management. The complexity of global supply chains, combined with varied product categories, is driving the adoption of more agile and transparent distribution systems. Distributors that embrace digitalization and data-driven logistics are better positioned to minimize risks and maintain consistent service reliability.

Sustainability has become a key focus area in chemical distribution. Distributors face growing pressure to reduce environmental impact, particularly through responsible waste management and recycling practices. Managing the disposal of hazardous materials and packaging has become a critical operational priority. Many distributors are implementing circular economy principles, reusing materials where possible and minimizing waste. These initiatives align with broader industry efforts to reduce emissions, conserve resources, and promote safer, cleaner chemical logistics. Sustainability-driven strategies are not only improving environmental performance but also strengthening relationships with environmentally conscious customers.

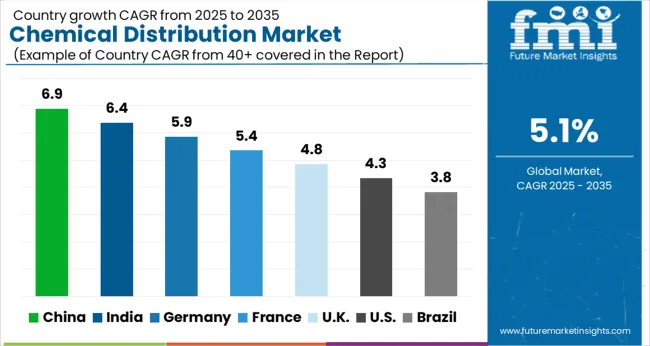

| Countries | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The chemical distibution market is projected to grow globally at a CAGR of 5.1% from 2025 to 2035, driven by rising demand for chemicals in industries such as pharmaceuticals, automotive, and agriculture. China leads the market with a CAGR of 6.9%, supported by its expanding industrial base, large-scale manufacturing capabilities, and increasing use of specialty chemicals. India follows at 6.4%, benefiting from industrial growth, government policies encouraging domestic manufacturing, and higher chemical demand across agriculture and pharmaceutical sectors.

France records a CAGR of 5.4%, supported by steady growth in the industrial and consumer goods sectors, along with tighter safety regulations that encourage regulated distribution practices. The UK grows at 4.8%, driven by demand from manufacturing, healthcare, and agriculture industries. The USA maintains a steady CAGR of 4.3%, backed by its mature chemical sector, strong regulatory framework for environmental safety, and sustained chemical consumption in automotive, energy, and healthcare applications.

This analysis includes over 40 countries, with these leading markets serving as benchmarks for capacity expansion, innovation, and competitive positioning in the global chemical distribution industry.

The chemical distribution market in the United Kingdom is projected to grow at a CAGR of 4.8% from 2025 to 2035, slightly below the global average of 5.1%. Between 2020 and 2024, the CAGR was 4.1%, supported by stable industrial demand but limited by supply chain disruptions and regulatory adjustments.

Over the next decade, market growth is expected to be driven by demand for sustainable chemicals, rising industrial output, and stricter regulatory compliance. The UK’s growing focus on green chemistry and eco-friendly production practices will further support the adoption of efficient and environmentally conscious distribution models. Manufacturers and distributors are likely to face increased competition, requiring innovation in logistics, customer service, and compliance strategies.

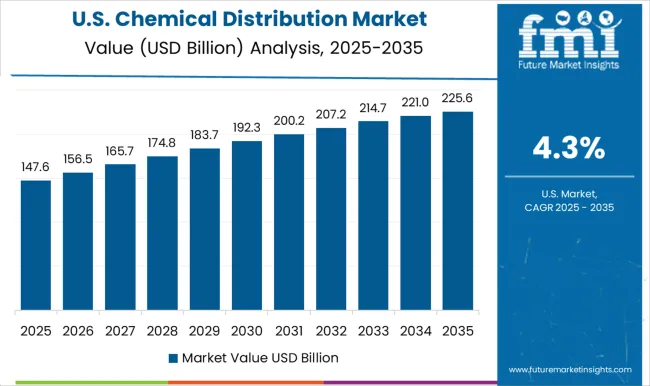

The USA chemical distribution market is expected to grow at a CAGR of 4.3% during 2025–2035, slightly below the global average of 5.1%. Between 2020 and 2024, it grew at a CAGR of 3.7%, supported by steady demand from pharmaceuticals, automotive, and agriculture industries. The earlier slowdown was due to logistical bottlenecks and economic headwinds.

The 2025–2035 outlook is more promising, led by technology adoption, stricter environmental regulations, and a shift toward sustainable distribution practices. Increased use of automation and digital tools in logistics will streamline operations and enhance productivity. Demand for specialty chemicals across healthcare, automotive, and manufacturing will ensure continued growth.

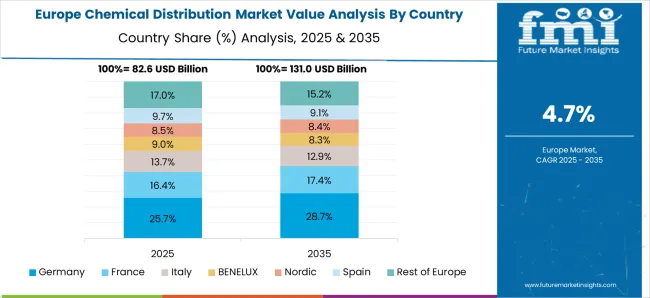

The chemical distribution market in France is projected to expand at a CAGR of 5.4% from 2025 to 2035, slightly above the global average. Between 2020 and 2024, growth averaged 4.8%, supported by demand from the automotive, pharmaceutical, and consumer goods sectors. Economic uncertainty and regulatory transitions had moderated earlier momentum.

The 2025–2035 outlook is more positive, driven by the transition toward sustainable chemicals, tighter environmental regulations, and rising demand for high-performance materials in healthcare, energy, and electronics. France’s ongoing efforts to reduce emissions and promote green chemistry are expected to create new opportunities for distributors. Greater integration of digital tools into supply networks will further enhance efficiency and transparency.

The China market is expected to grow at a CAGR of 6.9% during 2025–2035, outpacing the global average. Between 2020 and 2024, growth averaged 6.1%, driven by rapid industrialization, expanding manufacturing, and strong state support for sustainable chemical production.

As China modernizes its chemical industry, demand for eco-friendly and specialty products in textiles, automotive, and electronics continues to rise. The government’s focus on environmental protection and industrial safety is reshaping distribution networks, emphasizing efficiency and sustainability. New growth will also come from emerging sectors such as electric vehicles (EVs) and renewable energy, which require advanced chemical inputs.

The India chemical distribution market is forecast to grow at a CAGR of 6.4% during 2025–2035, slightly above the global average. Between 2020 and 2024, it expanded at 5.8%, supported by increasing chemical demand in agriculture, pharmaceuticals, and manufacturing. Earlier challenges included supply chain bottlenecks and evolving regulatory systems.

The 2025–2035 outlook is optimistic, underpinned by infrastructure development, government programs promoting domestic manufacturing, and export growth. Rising use of digital technology and automation in logistics is expected to improve distribution efficiency and visibility. India’s continued investment in sustainable and high-performance chemicals will strengthen its role in regional supply chains.

The global chemical distribution market is characterized by a mix of leading multinational distributors and regional specialists offering end-to-end supply, logistics, and formulation solutions across industrial, specialty, and performance chemical sectors. Brenntag SE leads the market, providing comprehensive chemical distribution and supply chain management services with a strong focus on sustainability, digital transformation, and value-added formulation support. Operating through its Brenntag Essentials and Brenntag Specialties divisions, the company maintains an extensive global footprint and continues to drive innovation in sustainable sourcing and circular logistics.

Univar Solutions Inc. follows as a major competitor, offering a diverse portfolio of industrial, food, personal care, and life science chemicals, emphasizing regulatory compliance, formulation expertise, and customer-driven innovation. Its digital platforms and sustainability programs strengthen its role as a trusted supply chain partner across North America, Europe, and Asia. Tricon Energy Ltd. remains a dominant global player in petrochemical and bulk chemical distribution, leveraging one of the world’s most extensive logistics and trading networks. Its focus on value-added services, efficient supply chain operations, and global reach positions it as a strategic supplier in the energy and industrial chemicals sector.

IMCD N.V. stands out for its specialization in high-value specialty chemicals and ingredients, delivering technical expertise, product innovation, and sustainable sourcing across industries such as pharmaceuticals, coatings, and food & nutrition. Azelis Group N.V. complements this with a strong emphasis on formulation development, technical support, and sustainability, serving diverse markets including personal care, agriculture, and food ingredients through its localized technical laboratories and innovation centers.

Nagase & Co., Ltd. maintains a solid position in the Asia-Pacific region, distributing a broad range of chemicals, plastics, and electronic materials through its integrated global logistics and manufacturing network. Kolmar Group AG holds a niche position with expertise in consumer goods and food-grade chemicals, offering customized, high-quality raw materials and end-to-end customer support. Sunrise Group of Companies continues to strengthen its influence in Asian petrochemical and solvent distribution, focusing on cost efficiency, localized warehousing, and regional market expansion.

Helm AG contributes with a diversified product portfolio spanning chemicals, fertilizers, crop protection, and pharmaceuticals, supported by a strong sustainability strategy and storage infrastructure. Czarnikow Group Limited, originally a sugar trading specialist, has successfully diversified into agricultural and food chemical distribution, emphasizing bio-based materials, renewable inputs, and value chain transparency.

Competitive strategies within the chemical distribution market increasingly center on digitalization, sustainability, and supply chain optimization. Key players are investing in data-driven inventory management, decarbonized logistics, and advanced formulation capabilities to enhance customer engagement and operational resilience. In addition, partnerships with chemical manufacturers, logistics providers, and technology firms are enabling distributors to expand market reach, improve regulatory compliance, and align with global ESG and circular economy goals. As demand for specialty and sustainable chemicals accelerates, the market is expected to consolidate further around players that combine technical expertise, localized support, and environmentally responsible distribution practices.

| Item | Value |

|---|---|

| Quantitative Units | USD 322.6 Billion |

| Product | Specialty Chemicals and Commodity Chemicals |

| End Use | Medical & Pharmaceutical, Construction, Automotive & transportation, Electronics, Agriculture, Packaging, Energy, Food & beverage, Textile, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Brenntag SE; Univar Solutions Inc.; Tricon Energy Ltd.; IMCD N.V.; Azelis Group N.V.; Nagase & Co., Ltd.; Kolmar Group AG; Sunrise Group of Companies; Helm AG; Czarnikow Group Limited. |

| Additional Attributes | Dollar sales, projected growth rates, and market share of key players. Insights on regional demand, regulatory impacts, and consumer trends towards eco-friendly chemicals are also crucial. |

The global chemical distribution market is estimated to be valued at USD 322.6 billion in 2025.

The market size for the chemical distribution market is projected to reach USD 530.4 billion by 2035.

The chemical distribution market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in chemical distribution market are specialty chemicals and commodity chemicals.

In terms of end use, medical & pharmaceutical segment to command 28.3% share in the chemical distribution market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chemical Hydraulic Valves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Vapor Deposition Market Forecast Outlook 2025 to 2035

Distribution Board Market Forecast Outlook 2025 to 2035

Chemical Recycling Service Market Forecast Outlook 2025 to 2035

Chemical Dosing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Chemical Filling System Market Size and Share Forecast Outlook 2025 to 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Distribution Components Market Size and Share Forecast Outlook 2025 to 2035

Chemical Indicator Inks Market Size and Share Forecast Outlook 2025 to 2035

Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Distribution Automation Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hardener Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Peel Market Size and Share Forecast Outlook 2025 to 2035

Chemical Protective Gloves Market Size and Share Forecast Outlook 2025 to 2035

Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

Chemical Injection Pump Market Size and Share Forecast Outlook 2025 to 2035

Chemical Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Chemical Sensors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant EVA Film Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA