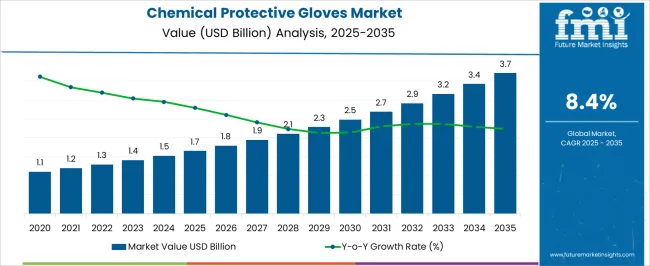

The chemical protective gloves market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 3.7 billion by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period.

Market growth is being driven by rising industrial safety regulations, the increasing need for worker protection in chemical processing and manufacturing sectors, and heightened awareness of occupational hazards. Over the forecast period, demand for gloves with superior chemical resistance, durability, and ergonomic design is anticipated to rise steadily. Market players are focusing on optimizing production capabilities, developing specialized glove variants, and reinforcing supply chain efficiency to capture incremental growth opportunities in diverse industrial applications.

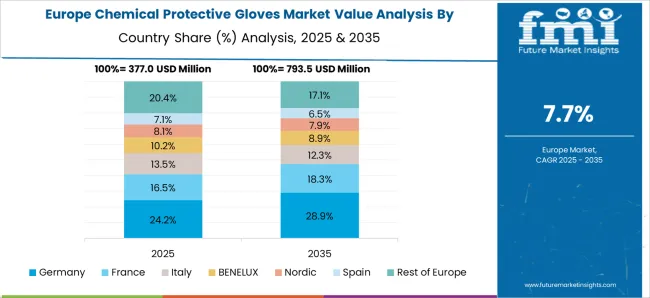

During 2025–2035, the chemical protective gloves market is expected to experience consistent revenue expansion, supported by regulatory enforcement, industrial safety compliance, and adoption across chemical, pharmaceutical, and laboratory segments. Regional variations are likely to influence market dynamics, with key markets showing stronger demand due to industrial density and compliance standards. The cumulative market value is expected to rise as manufacturers enhance material quality, introduce innovative glove types, and expand distribution channels. Overall, the market trajectory indicates sustained growth, with a focus on protective performance, workforce safety, and strategic industry penetration shaping the competitive landscape.

| Metric | Value |

|---|---|

| Chemical Protective Gloves Market Estimated Value in (2025 E) | USD 1.7 billion |

| Chemical Protective Gloves Market Forecast Value in (2035 F) | USD 3.7 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

The chemical protective gloves market is estimated to hold a notable proportion within its parent markets, representing approximately 12-15% of the personal protective equipment market, around 25-28% of the industrial safety gloves market, close to 8-10% of the chemical handling equipment market, about 6-7% of the occupational safety market, and roughly 4-5% of the protective apparel market. Collectively, the cumulative share across these parent segments is observed in the range of 55-65%, reflecting the critical role chemical protective gloves play in ensuring safety during hazardous material handling and industrial operations. The market has been driven by the rising need to protect workers from chemical exposure, cuts, and abrasions in industries such as pharmaceuticals, chemicals, oil and gas, and manufacturing.

Adoption is guided by procurement decisions that prioritize chemical resistance, durability, dexterity, and compliance with safety regulations. Market participants have focused on developing gloves with enhanced protective properties, comfort, and longer service life to address the demanding requirements of industrial work environments. As a result, the chemical protective gloves market has not only captured a significant share within industrial safety gloves and personal protective equipment markets but has also influenced chemical handling equipment, occupational safety, and protective apparel sectors, emphasizing its role in reducing workplace injuries, improving worker confidence, and maintaining operational safety standards.

The chemical protective gloves market is witnessing significant growth driven by heightened awareness of occupational safety and stringent regulatory requirements across industrial, healthcare, and laboratory settings. Rising industrialization and expansion of chemical, pharmaceutical, and manufacturing sectors are increasing the demand for protective handwear that ensures worker safety against hazardous substances. Advancements in glove material technology and design are enhancing resistance to chemicals, punctures, and abrasion while improving comfort and dexterity.

The disposable and reusable glove segments are benefiting from increased adoption due to hygiene and contamination prevention requirements in medical and laboratory environments. Regulatory standards and workplace safety guidelines are enforcing higher compliance, encouraging organizations to adopt certified protective gloves.

Growth is further being fueled by the need for ergonomic designs that reduce fatigue during prolonged use As industrial safety protocols become more rigorous and workplace health standards continue to evolve globally, the market is expected to experience sustained expansion, with continuous product innovation and material enhancements supporting long-term adoption.

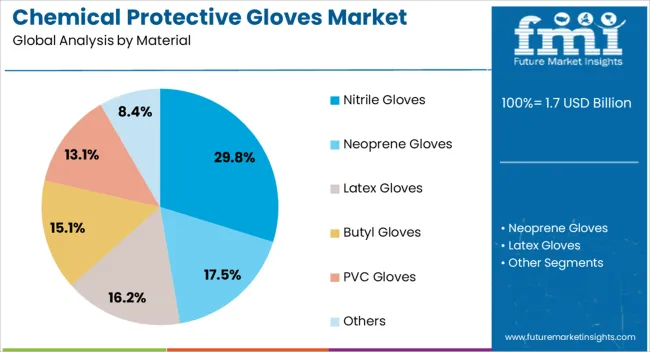

The nitrile gloves segment is projected to hold 29.8% of the chemical protective gloves market revenue share in 2025, positioning it as the leading material type. Its dominance is being driven by superior resistance to a wide range of chemicals, oils, and solvents compared with natural rubber or vinyl alternatives, making it highly suitable for chemical handling and industrial applications.

Nitrile gloves offer improved puncture resistance and durability while maintaining flexibility and comfort for prolonged use. They are increasingly preferred in industries where safety standards are critical, including pharmaceuticals, laboratories, and manufacturing units, due to their compatibility with sensitive procedures and hygienic environments.

Continuous advancements in nitrile formulation are further enhancing tactile sensitivity and reducing hand fatigue, which is promoting higher adoption rates As awareness of occupational safety grows and regulations regarding chemical exposure tighten globally, nitrile gloves are expected to maintain leadership as the most reliable and widely used glove material.

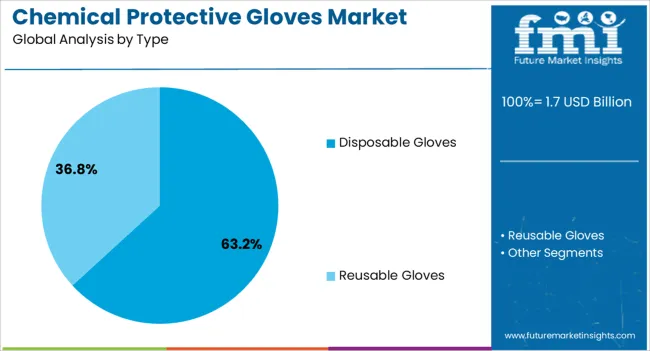

The disposable gloves segment is anticipated to account for 63.2% of the chemical protective gloves market revenue share in 2025, establishing it as the dominant type category. Its leadership is being driven by widespread adoption in medical, laboratory, food processing, and chemical handling applications where hygiene, contamination prevention, and single-use safety are critical. Disposable gloves allow organizations to reduce cross-contamination risks while ensuring consistent protection against hazardous substances.

Their ease of use and rapid replacement capabilities make them highly practical in high-turnover work environments and healthcare settings. Material advancements have enabled disposable gloves to deliver superior chemical resistance and tactile sensitivity, enhancing worker safety and operational efficiency.

Additionally, growing emphasis on occupational safety regulations and compliance standards globally is further encouraging adoption The ability to offer cost-effective protection without compromising performance is positioning disposable gloves as the preferred type in the market, driving continued growth across multiple industries.

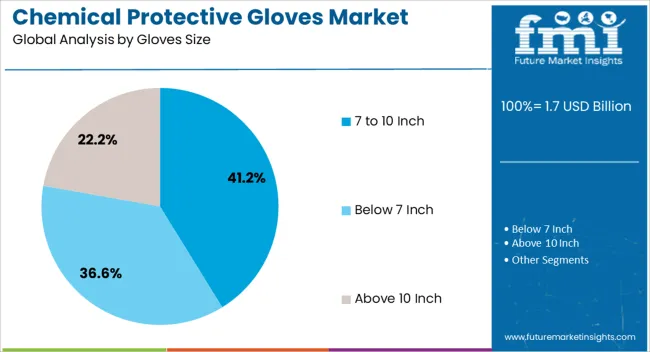

The 7 to 10 inch gloves size segment is projected to hold 41.2% of the chemical protective gloves market revenue share in 2025, making it the leading size category. Its dominance is being supported by compatibility with the majority of adult hand sizes, offering both comfort and full coverage for enhanced safety.

The size range ensures secure fit and dexterity during chemical handling, reducing the risk of exposure while allowing precision in tasks requiring fine motor control. Manufacturers are increasingly standardizing this size to simplify inventory management and meet workplace ergonomics requirements.

The segment is further reinforced by high adoption in industrial, laboratory, and medical environments where consistent fit and compliance with protective standards are essential Demand is being sustained by organizations prioritizing safety, comfort, and operational efficiency, and the availability of high-quality gloves in this size range continues to support its leadership in the market.

The chemical protective gloves market is segmented by material, type, gloves size, price range, end-use, and geographic regions. By material, chemical protective gloves market is divided into nitrile gloves, neoprene gloves, latex gloves, butyl gloves, PVC gloves, and others. In terms of type, chemical protective gloves market is classified into disposable gloves and reusable gloves. Based on gloves size, chemical protective gloves market is segmented into 7 to 10 inch, below 7 inch, and above 10 inch. By price range, chemical protective gloves market is segmented into medium (USD 3 to 5 USD), low (below USD 3), and high (above USD 3 to 5 USD). By end-use, chemical protective gloves market is segmented into healthcare, chemical processing, oil & gas, automotive, mining, food processing, paint & dye, and others. Regionally, the chemical protective gloves industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The nitrile gloves segment is projected to hold 29.8% of the chemical protective gloves market revenue share in 2025, positioning it as the leading material type. Its dominance is being driven by superior resistance to a wide range of chemicals, oils, and solvents compared with natural rubber or vinyl alternatives, making it highly suitable for chemical handling and industrial applications.

Nitrile gloves offer improved puncture resistance and durability while maintaining flexibility and comfort for prolonged use. They are increasingly preferred in industries where safety standards are critical, including pharmaceuticals, laboratories, and manufacturing units, due to their compatibility with sensitive procedures and hygienic environments.

Continuous advancements in nitrile formulation are further enhancing tactile sensitivity and reducing hand fatigue, which is promoting higher adoption rates As awareness of occupational safety grows and regulations regarding chemical exposure tighten globally, nitrile gloves are expected to maintain leadership as the most reliable and widely used glove material.

The disposable gloves segment is anticipated to account for 63.2% of the chemical protective gloves market revenue share in 2025, establishing it as the dominant type category. Its leadership is being driven by widespread adoption in medical, laboratory, food processing, and chemical handling applications where hygiene, contamination prevention, and single-use safety are critical. Disposable gloves allow organizations to reduce cross-contamination risks while ensuring consistent protection against hazardous substances.

Their ease of use and rapid replacement capabilities make them highly practical in high-turnover work environments and healthcare settings. Material advancements have enabled disposable gloves to deliver superior chemical resistance and tactile sensitivity, enhancing worker safety and operational efficiency.

Additionally, growing emphasis on occupational safety regulations and compliance standards globally is further encouraging adoption The ability to offer cost-effective protection without compromising performance is positioning disposable gloves as the preferred type in the market, driving continued growth across multiple industries.

The 7 to 10 inch gloves size segment is projected to hold 41.2% of the chemical protective gloves market revenue share in 2025, making it the leading size category. Its dominance is being supported by compatibility with the majority of adult hand sizes, offering both comfort and full coverage for enhanced safety.

The size range ensures secure fit and dexterity during chemical handling, reducing the risk of exposure while allowing precision in tasks requiring fine motor control. Manufacturers are increasingly standardizing this size to simplify inventory management and meet workplace ergonomics requirements.

The segment is further reinforced by high adoption in industrial, laboratory, and medical environments where consistent fit and compliance with protective standards are essential Demand is being sustained by organizations prioritizing safety, comfort, and operational efficiency, and the availability of high-quality gloves in this size range continues to support its leadership in the market.

The chemical protective gloves market is experiencing steady growth driven by regulatory compliance, rising industrial safety awareness, and ergonomic innovation. Strong demand is being supported by industries handling hazardous chemicals, while opportunities are expanding through advanced material formulations and user-centric designs. Challenges from raw material volatility and supply constraints are being addressed by strategic sourcing and quality improvements. Overall, the market is positioned for continued adoption as protective gloves become an essential component of occupational safety strategies across diverse industrial sectors, with innovation and compliance shaping competitive dynamics.

The chemical protective gloves market is being significantly influenced by the enforcement of stringent workplace safety regulations across multiple industries, including chemical manufacturing, pharmaceuticals, and oil and gas. Organizations are increasingly required to provide personal protective equipment (PPE) to mitigate occupational hazards and reduce chemical exposure risks. Demand for high-quality gloves with superior chemical resistance, durability, and comfort is being driven by these compliance requirements. In addition, industries handling corrosive, toxic, or reactive substances are prioritizing gloves that ensure both safety and operational efficiency. Procurement strategies are being revised to include long-lasting and multi-purpose glove options to optimize cost-effectiveness while ensuring regulatory adherence. These safety-driven mandates are fostering consistent demand growth, particularly in regions where industrial safety regulations are rigorously enforced, highlighting the direct relationship between compliance needs and protective glove adoption.

Opportunities in the chemical protective gloves market are being expanded through the introduction of advanced material formulations and ergonomic designs. Gloves made from nitrile, neoprene, butyl, and other synthetic polymers are being increasingly favored for their superior resistance to a wide range of chemicals and solvents. Innovative layering techniques and textured surfaces are being implemented to enhance grip, dexterity, and user comfort, making gloves suitable for extended wear in complex industrial tasks. Furthermore, opportunities are being created in the medical, laboratory, and specialty chemical sectors, where highly customized glove solutions are demanded for specific chemical interactions. Collaborations between manufacturers and safety consultants are driving product refinement to align with evolving hazard assessments. This focus on material innovation and ergonomic efficiency is positioning manufacturers to capture broader market share while addressing critical occupational safety challenges.

In the chemical protective gloves market, consumer preference is being shaped by ergonomic and comfort-related innovations that extend usability without compromising safety. Gloves with anatomical fit, breathability, and flexible cuff designs are being increasingly adopted to reduce hand fatigue and improve operational precision in chemical handling tasks. Industry players are leveraging user feedback to introduce gloves with reinforced fingers, textured palms, and stretchable materials that accommodate long-duration use in laboratory, industrial, and production settings. These comfort-centric improvements are being recognized as critical factors influencing procurement decisions, particularly among enterprises seeking to enhance workforce productivity while maintaining regulatory compliance. Consequently, ergonomic innovations are directly impacting market growth by making protective gloves more acceptable for continuous use across diverse applications.

The chemical protective gloves market is being challenged by volatility in raw material prices, including synthetic polymers and specialty coatings, which directly affect production costs. Supply chain disruptions and limited availability of high-performance materials are further complicating manufacturing operations, forcing manufacturers to seek alternative suppliers or adjust production volumes. Cost pressures are being reflected in end-user pricing, which can impact adoption rates, especially among small-scale industrial users. Additionally, the need for compliance with multiple chemical standards and certifications is being recognized as a hurdle that increases production complexity and regulatory scrutiny. These combined factors are presenting operational challenges that require careful risk management, sourcing strategies, and quality assurance measures to maintain consistent product supply and market competitiveness.

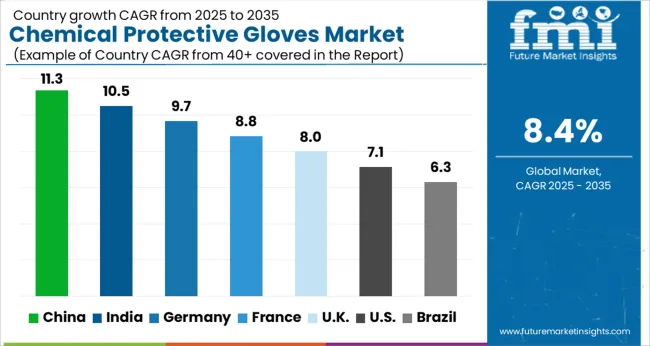

| Country | CAGR |

|---|---|

| China | 11.3% |

| India | 10.5% |

| Germany | 9.7% |

| France | 8.8% |

| UK | 8.0% |

| USA | 7.1% |

| Brazil | 6.3% |

The global chemical protective gloves market is projected to grow at a CAGR of 8.4% from 2025 to 2035. China leads with a growth rate of 11.3%, followed by India at 10.5%, and Germany at 9.7%. The United Kingdom records a growth rate of 8%, while the United States shows a comparatively moderate growth of 7.1%. Growth is driven by increasing industrial safety regulations, rising chemical manufacturing activities, and heightened awareness of worker protection standards. Emerging economies such as China and India are benefiting from expanding industrial sectors and strong occupational safety initiatives, while developed markets like Germany, UK, and USA are focusing on compliance, advanced glove materials, and innovative protective solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The chemical protective gloves market in China is expanding at a CAGR of 11.3%, driven by rapid industrial growth and stringent workplace safety regulations. Chemical, pharmaceutical, and manufacturing industries are increasingly adopting protective gloves to ensure employee safety and minimize exposure to hazardous substances. Chinese manufacturers are investing in advanced materials such as nitrile and neoprene, producing high-quality, durable gloves that meet both domestic and international safety standards. Additionally, growing awareness among businesses about occupational health, along with government-mandated safety protocols, is further accelerating market adoption. The rising demand for protective equipment in sectors like electronics, petrochemicals, and agriculture is creating sustained growth opportunities.

The chemical protective gloves market in India is growing at a CAGR of 10.5%, supported by expanding chemical, pharmaceutical, and industrial sectors. Increasing workplace safety awareness and enforcement of occupational health standards are encouraging widespread glove adoption. Indian manufacturers are producing high-quality gloves using nitrile, latex, and neoprene to meet stringent safety requirements. Rapid industrialization, particularly in chemicals and manufacturing hubs, is further increasing the need for protective gloves. Government initiatives promoting worker safety and corporate compliance policies are driving market expansion, while export opportunities for certified gloves are creating additional revenue streams for domestic producers.

The chemical protective gloves market in Germany is growing at a CAGR of 9.7%, driven by strict EU safety standards and strong regulatory frameworks for occupational health. Industries such as chemicals, pharmaceuticals, and automotive manufacturing are increasingly integrating protective gloves to safeguard employees. German manufacturers focus on high-performance materials, durability, and compliance with international safety certifications. Additionally, awareness about workplace safety and liability concerns is encouraging companies to adopt superior protective equipment. Industrial automation and handling of hazardous chemicals further contribute to the rising demand for chemical protective gloves. The market is also shaped by sustainable and ergonomic glove designs that enhance user comfort without compromising protection.

The chemical protective gloves market in the United Kingdom is expanding at a CAGR of 8%, supported by regulatory compliance and increased focus on industrial safety. Chemical manufacturing, laboratories, and pharmaceutical sectors are adopting advanced protective gloves to prevent exposure to hazardous substances. UK manufacturers and distributors are emphasizing ergonomics, chemical resistance, and quality certifications to enhance market appeal. Workplace safety training and corporate policies mandating personal protective equipment are also encouraging adoption. The rising demand for high-durability gloves and export-oriented production is further supporting market growth.

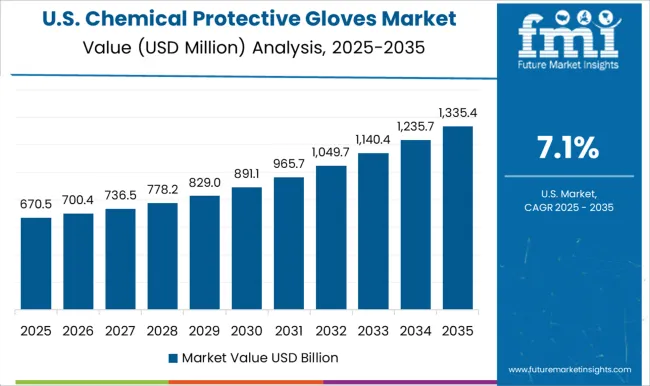

The chemical protective gloves market in the United States is growing at a CAGR of 7.1%, driven by stringent OSHA regulations and increasing awareness of workplace safety. Industrial sectors such as chemical manufacturing, oil and gas, pharmaceuticals, and laboratory services are investing in high-quality gloves made of nitrile, neoprene, and specialty polymers. USA manufacturers focus on durability, chemical resistance, and compliance with ANSI/ASTM standards. Expansion of industrial and chemical operations, coupled with liability concerns and risk management strategies, is fueling glove adoption. The market is also witnessing growth in ergonomic and reusable glove solutions, providing both protection and comfort for workers.

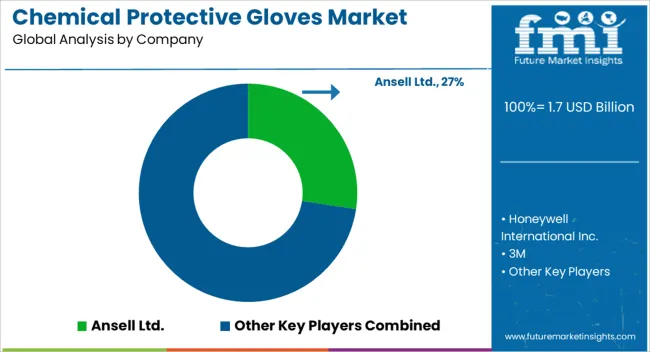

The chemical protective gloves market is experiencing steady growth as industries increasingly prioritize worker safety and compliance with stringent occupational health regulations. Leading companies such as Ansell Ltd., Honeywell International Inc., and 3M are at the forefront of manufacturing advanced protective gloves that provide superior resistance against hazardous chemicals, cuts, and punctures. These companies are focusing on the development of high-performance materials, ergonomic designs, and enhanced dexterity to ensure comfort and productivity for workers in chemical processing, pharmaceuticals, oil and gas, and manufacturing sectors.

Showa Group and MAPA Professional are also investing in research and development to create gloves that cater to specific industrial applications, including handling corrosive substances and exposure to toxic compounds. Rising awareness of workplace safety, coupled with global regulatory compliance requirements, is compelling organizations to adopt chemical protective gloves, thereby driving market expansion. The market is further supported by innovations in glove materials, such as nitrile, neoprene, and advanced polymer blends, which enhance durability, chemical resistance, and overall performance. Industry leaders are leveraging these advancements to introduce gloves that meet international safety standards while offering comfort and flexibility.

Collaborations between manufacturers and industrial enterprises are fostering the development of tailored protective solutions for complex operations, ensuring maximum protection against occupational hazards. Companies like Ansell Ltd., Honeywell, and 3M are also exploring sustainable and recyclable materials to address environmental concerns without compromising safety. With increasing industrial automation and stringent occupational health mandates, the chemical protective gloves market is expected to sustain robust growth. Continuous innovation, strategic partnerships, and expansion into emerging regions will play a crucial role in shaping the competitive landscape, establishing these leading players as key contributors to the global safety ecosystem.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 Billion |

| Material | Nitrile Gloves, Neoprene Gloves, Latex Gloves, Butyl Gloves, PVC Gloves, and Others |

| Type | Disposable Gloves and Reusable Gloves |

| Gloves Size | 7 to 10 Inch, Below 7 Inch, and Above 10 Inch |

| Price Range | Medium (USD 3 to 5 USD), Low (Below USD 3), and High (Above USD 3 to 5 USD) |

| End-Use | Healthcare, Chemical Processing, Oil & Gas, Automotive, Mining, Food Processing, Paint & Dye, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ansell Ltd., Honeywell International Inc., 3M, Showa Group, and MAPA Professional |

| Additional Attributes | Dollar sales by glove type (nitrile, latex, neoprene, PVC) and application (chemical handling, pharmaceuticals, laboratories, industrial) are key metrics. Trends include rising demand for high-performance, durable protective gloves, growth in chemical and pharmaceutical industries, and increasing focus on worker safety and compliance. Regional adoption, regulatory standards, and technological innovations are driving market growth. |

The global chemical protective gloves market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the chemical protective gloves market is projected to reach USD 3.7 billion by 2035.

The chemical protective gloves market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in chemical protective gloves market are nitrile gloves, neoprene gloves, latex gloves, butyl gloves, pvc gloves and others.

In terms of type, disposable gloves segment to command 63.2% share in the chemical protective gloves market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chemical Vapor Deposition Market Forecast Outlook 2025 to 2035

Chemical Recycling Service Market Forecast Outlook 2025 to 2035

Chemical Dosing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Chemical Filling System Market Size and Share Forecast Outlook 2025 to 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Chemical Indicator Inks Market Size and Share Forecast Outlook 2025 to 2035

Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hardener Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Peel Market Size and Share Forecast Outlook 2025 to 2035

Chemical Injection Pump Market Size and Share Forecast Outlook 2025 to 2035

Chemical Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Chemical Sensors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant EVA Film Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Coating Market Size and Share Forecast Outlook 2025 to 2035

Chemical Distribution Market Size and Share Forecast Outlook 2025 to 2035

Chemical & Petrochemical IECS Market Size and Share Forecast Outlook 2025 to 2035

Chemical Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Chemicals And Petrochemicals Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA