The Chemical Air Separation Unit Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period. The Growth Contribution Index (GCI) highlights the relative importance of different periods in driving market growth. Between 2025 and 2030, the market grows from USD 1.4 billion to USD 1.7 billion, contributing USD 0.3 billion in incremental growth.

This phase accounts for approximately 23% of the total growth over the forecast period. The market’s growth rate during this period is 5.5%, driven by increasing demand for air separation units in various industries such as oil and gas, chemicals, and healthcare, where the need for oxygen and nitrogen is expanding. From 2030 to 2035, the market continues its upward trajectory, adding USD 0.6 billion to reach USD 2.3 billion by 2035.

This period accounts for around 40% of the total growth, with an average growth rate of 6.1%. This phase shows stronger growth, likely fueled by technological advancements, increased industrial activity, and rising demand for air separation units in new applications. The GCI analysis indicates that while early-stage growth is steady, the latter half of the forecast period will contribute a larger share of the total market expansion, driven by increased adoption and technological improvements.

| Metric | Value |

|---|---|

| Chemical Air Separation Unit Market Estimated Value in (2025 E) | USD 1.4 billion |

| Chemical Air Separation Unit Market Forecast Value in (2035 F) | USD 2.3 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The chemical air separation unit market is witnessing steady growth, driven by increasing demand for high-purity industrial gases across steel manufacturing, electronics, healthcare, and chemical processing industries. Expansion in global energy infrastructure, rising natural gas processing, and growing investments in integrated air separation facilities are propelling capacity expansion.

Governments and private players are focusing on self-reliant gas sourcing strategies to reduce import dependency and ensure uninterrupted supply for critical industries. Advancements in cryogenic technology, energy efficiency measures, and modular ASU installations are shaping deployment trends.

Environmental regulations promoting clean steelmaking and low-carbon hydrogen are also enhancing the strategic relevance of air separation units. As global industrial output rebounds, the market is expected to benefit from capacity modernization, customized onsite installations, and integration with green energy projects.

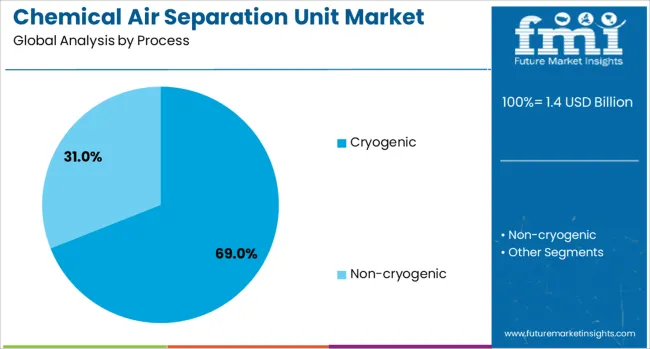

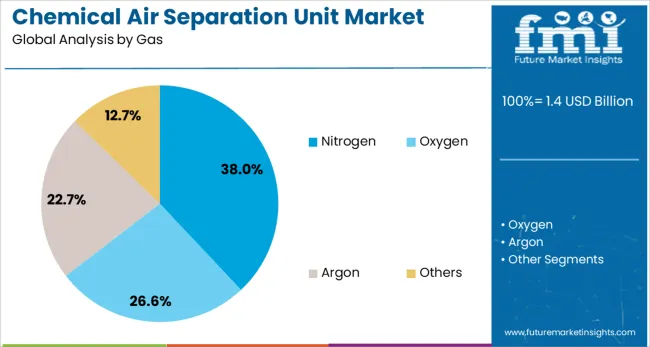

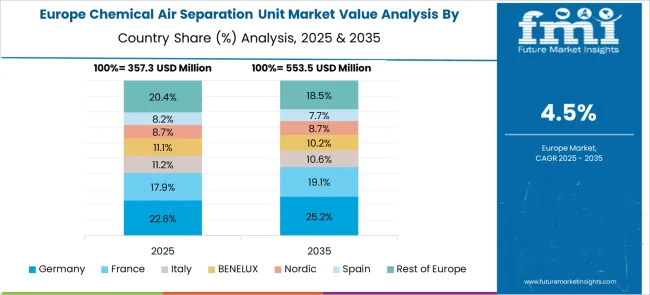

The chemical air separation unit market is segmented by process, gas, and geographic regions. By process, the chemical air separation unit market is divided into cryogenic and non-cryogenic. In terms of gases, the chemical air separation unit market is classified into Nitrogen, Oxygen, Argon, and others. Regionally, the chemical air separation unit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cryogenic process segment is anticipated to account for 69.0% of the total market revenue in 2025, making it the most dominant processing method. This leadership is being driven by its ability to deliver high-purity gas outputs at large scale, which is critical for sectors such as steel, electronics, and petrochemicals.

The cryogenic method enables simultaneous extraction of oxygen, nitrogen, and argon, enhancing operational efficiency and return on investment. Its scalability, proven reliability in continuous operations, and compatibility with integrated industrial systems have made it the preferred technology for large-volume production.

Additionally, improvements in cold box design, energy recovery systems, and plant automation are further reinforcing its adoption, especially in regions pursuing industrial decarbonization goals.

Nitrogen is projected to hold 38.0% of the revenue share by 2025, emerging as the leading gas segment within the chemical air separation unit market. Its dominance is attributed to widespread usage across food packaging, electronics manufacturing, pharmaceuticals, and inerting applications in chemicals and oil & gas sectors.

The role of nitrogen as a safety gas for blanketing, purging, and pressurization has elevated its demand across hazardous processing environments. The increasing application of nitrogen in cryopreservation, additive manufacturing, and laser cutting processes has further supported its market expansion.

As industries seek reliable sources of ultra-high purity gases for controlled environments and enhanced process stability, nitrogen continues to drive capacity additions in both standalone and integrated ASU installations.

The demand for chemical air separation units is driven by the growing need for industrial gases in sectors like chemicals, petrochemicals, and energy. These units provide high-purity gases such as oxygen, nitrogen, and argon, essential for various industrial processes. Despite high capital and operational costs, technological advancements and energy-efficient solutions are expanding the market. Opportunities lie in emerging markets and the adoption of modular and digitalized air separation units, which offer flexibility and improved efficiency. The market is poised for growth due to innovation in gas separation technologies and market expansion.

The demand for chemical air separation units (ASUs) is largely driven by the increasing need for industrial gases in sectors such as chemicals, petrochemicals, metallurgy, and energy. These units are essential for producing high-purity oxygen, nitrogen, and argon, which are crucial for various industrial processes, including combustion, gasification, and material refining. As industries focus on improving operational efficiency and reducing energy consumption, the demand for advanced air separation technologies has surged. The rise in environmental regulations and the push for reducing emissions have fueled the adoption of air separation units that offer energy-efficient solutions for producing industrial gases. This drive towards optimizing energy use in manufacturing processes continues to propel the growth of the chemical air separation unit market.

A significant challenge in the chemical air separation unit market is the high capital expenditure required for both the installation and maintenance of these complex systems. The large-scale infrastructure and specialized equipment required to separate gases at high purity levels come with significant upfront costs, which can deter smaller companies or those with limited budgets. Additionally, while air separation units are efficient, their operation can still be costly, particularly in energy-intensive applications. Maintaining these systems involves high operational expenses related to power consumption, as well as regular maintenance to ensure optimal performance. The need for highly skilled technicians to operate and repair these systems further increases the operational costs, especially in regions where labor expertise is limited.

The chemical air separation unit market offers ample opportunities driven by technological advancements and the global demand for industrial gases. Innovations in membrane technology and cryogenic processes are improving the efficiency and energy consumption of air separation units, making them more cost-effective for a wide range of applications. The growing use of air separation units in emerging markets, particularly in Asia and the Middle East, presents significant expansion opportunities. As industries in these regions, including oil & gas, chemicals, and manufacturing, continue to develop, the demand for high-purity gases is expected to rise, creating new opportunities for ASU manufacturers. Additionally, the integration of digital technologies, such as IoT-based monitoring and control systems, is enhancing operational efficiency and providing real-time data for predictive maintenance, creating a pathway for growth.

A key trend in the chemical air separation unit market is the increasing demand for energy-efficient systems. As industries face rising energy costs and environmental regulations, there is a growing shift toward adopting air separation units that optimize energy usage while maintaining high-performance levels. Modular ASUs are gaining popularity, particularly for smaller applications and in developing markets, as they offer more flexible, cost-effective solutions. These units are easier to install, maintain, and scale, providing companies with more adaptable options for their needs. Furthermore, the integration of automation and digital technologies, such as predictive maintenance and remote monitoring, is transforming the market. These innovations allow for better resource management, reduced downtime, and improved operational efficiency, contributing to the ongoing growth of the market.

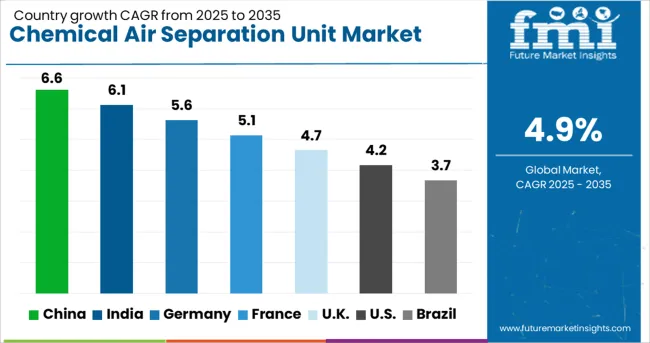

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

| USA | 4.2% |

| Brazil | 3.7% |

The chemical air separation unit market is projected to grow at a CAGR of 4.9% from 2025 to 2035. Among the top profiled markets, China leads at 6.6%, followed by India at 6.1%, France at 5.1%, the United Kingdom at 4.7%, and the United States at 4.2%. These growth rates represent a premium of +35% for China and +25% for India compared to the global baseline, while developed countries such as the USA and the UK show slower growth. The divergence in growth rates can be attributed to the rapid industrialization and infrastructure development in BRICS economies, particularly China and India, while OECD countries like the USA and the UK focus on market saturation, technological upgrades, and demand from established industrial sectors such as chemicals, energy, and steel. The report features insights from 40+ countries, with the top countries shown below.

China is expected to grow at a CAGR of 6.6% through 2035, supported by its rapid industrialization and significant demand for air separation units in sectors like steel, chemicals, and petrochemicals. The strong manufacturing base in China and increasing energy consumption are key factors driving the demand for air separation technologies. As the country continues to expand its industrial capacity, the need for oxygen, nitrogen, and argon in various processes, including in energy, metal production, and chemical manufacturing, is growing. The government’s ongoing push to modernize infrastructure and increase energy efficiency will further fuel demand for chemical ASUs across industries.

India is projected to grow at a CAGR of 6.1% through 2035, driven by growing industrialization, energy demands, and increasing investment in infrastructure. The demand for chemical air separation units (ASUs) is rising due to the country's expanding manufacturing sector, particularly in industries like steel, chemicals, and oil refining. As India continues to invest in its energy and industrial sectors, the need for efficient air separation solutions grows, especially in the production of oxygen, nitrogen, and argon for various industrial applications. Government support for infrastructure development and the rise in energy-intensive industries contribute significantly to the market's growth.

France is projected to grow at a CAGR of 5.1% through 2035, with the demand for chemical air separation units driven by its significant chemical manufacturing and industrial sectors. The growth of industries like pharmaceuticals, chemicals, and oil refining in France continues to support the demand for air separation systems, particularly for the production of industrial gases. France’s government-backed infrastructure projects and its focus on improving energy efficiency in industrial operations will also contribute to market growth. Moreover, as the country increases its emphasis on advancing industrial processes and reducing costs, air separation technologies become increasingly vital in these sectors.

The United Kingdom is expected to grow at a CAGR of 4.7% through 2035, supported by demand for air separation units in key industries like chemicals, steel, and oil refining. The UK’s energy-intensive sectors continue to require large volumes of gases such as oxygen and nitrogen, which drives the market for ASUs. Government policies aimed at improving energy efficiency in industrial sectors and enhancing infrastructure further support the growth of this market. As the UK continues to focus on reducing its carbon footprint and improving the operational efficiency of industrial processes, the demand for air separation technologies will remain steady.

The United States is projected to grow at a CAGR of 4.2% through 2035, with demand for air separation units driven by the country's large and diverse industrial base. The chemical, oil, and steel industries are key consumers of air separation technologies, particularly in the production of gases like oxygen, nitrogen, and argon. The steady demand for these gases in applications ranging from industrial processes to healthcare fuels the USA market. With continued infrastructure investment, particularly in the energy and manufacturing sectors, the USA market for chemical ASUs will grow at a steady pace, supported by both replacement and capacity expansion needs.

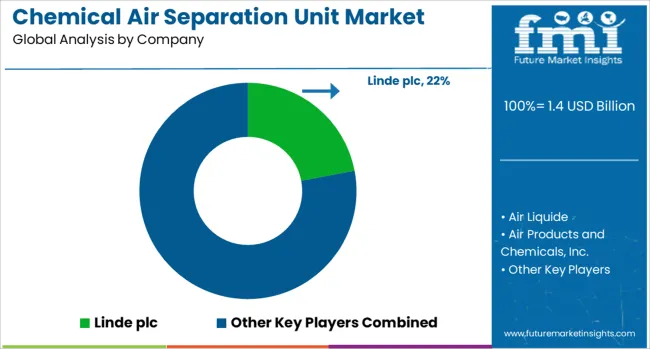

The chemical air separation unit (ASU) market is led by global industrial gas companies and engineering firms specializing in the production of oxygen, nitrogen, and other industrial gases. Linde plc and Air Liquide are key market players, offering comprehensive air separation systems for a wide range of applications, from chemical manufacturing to steel production.

Air Products and Chemicals, Inc. provides large-scale air separation units tailored for industrial use, with an emphasis on energy-efficient technologies and integrated gas supply solutions. Messer and Praxair Technology, Inc., now part of Linde, focus on large-scale ASU projects with a strong presence in North America and Europe, providing essential gases for the chemical, pharmaceutical, and food industries.

AIR WATER INC and TAIYO NIPPON SANSO CORPORATION serve the Asian market with air separation units designed to meet the specific demands of growing industrial sectors in Japan and China. KaiFeng Air Separation Group Co., Ltd. and Sichuan Air Separation Plant Group are prominent in the Chinese market, offering cost-effective and highly efficient air separation technologies for local industrial sectors.

AMCS Corporation and CRYOTEC Anlagenbau GmbH specialize in customized air separation solutions for the energy and petrochemical industries. Enerflex Ltd. provides modular air separation systems for oil and gas, while Ranch Cryogenics, Inc. focuses on providing smaller-scale, portable ASUs for specialized applications.

Technex and Universal Industrial Gases, Inc. offer tailored ASU solutions for smaller projects and niche industrial needs. Competitive differentiation relies on system efficiency, reliability, and integration capabilities with existing chemical and industrial processes.

Barriers to entry include high capital investment, technical expertise in cryogenic processes, and compliance with international industrial standards. Strategic priorities include enhancing ASU capacity, developing integrated gas solutions, and advancing control systems for real-time monitoring of production and quality.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Process | Cryogenic and Non-cryogenic |

| Gas | Nitrogen, Oxygen, Argon, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Linde plc, Air Liquide, Air Products and Chemicals, Inc., AIR WATER INC, AMCS Corporation, CRYOTEC Anlagenbau GmbH, Enerflex Ltd., KaiFeng Air Separation Group Co.,LTD., Messer, Praxair Technology, Inc., Ranch Cryogenics, Inc., Sichuan Air Separation Plant Group, TAIYO NIPPON SANSO CORPORATION, Technex, Universal Industrial Gases, Inc., and Yingde Gases |

| Additional Attributes | Dollar sales by unit type (large-scale ASUs, modular ASUs, small-scale ASUs) and end-use sectors (chemical manufacturing, steel production, oil and gas, pharmaceuticals). Demand dynamics are driven by increasing industrial production, rising demand for oxygen and nitrogen in various sectors, and growth in the chemical and steel industries. Regional trends show strong demand for air separation units in Asia-Pacific due to rapid industrialization, with Europe and North America focusing on high-efficiency systems for established industries. |

The global chemical air separation unit market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the chemical air separation unit market is projected to reach USD 2.3 billion by 2035.

The chemical air separation unit market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in chemical air separation unit market are cryogenic and non-cryogenic.

In terms of gas, nitrogen segment to command 38.0% share in the chemical air separation unit market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chemical Hydraulic Valves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Vapor Deposition Market Forecast Outlook 2025 to 2035

Chemical Recycling Service Market Forecast Outlook 2025 to 2035

Chemical Dosing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Chemical Filling System Market Size and Share Forecast Outlook 2025 to 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Chemical Indicator Inks Market Size and Share Forecast Outlook 2025 to 2035

Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hardener Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Peel Market Size and Share Forecast Outlook 2025 to 2035

Chemical Protective Gloves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Injection Pump Market Size and Share Forecast Outlook 2025 to 2035

Chemical Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Chemical Sensors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant EVA Film Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Coating Market Size and Share Forecast Outlook 2025 to 2035

Chemical Distribution Market Size and Share Forecast Outlook 2025 to 2035

Chemical & Petrochemical IECS Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA