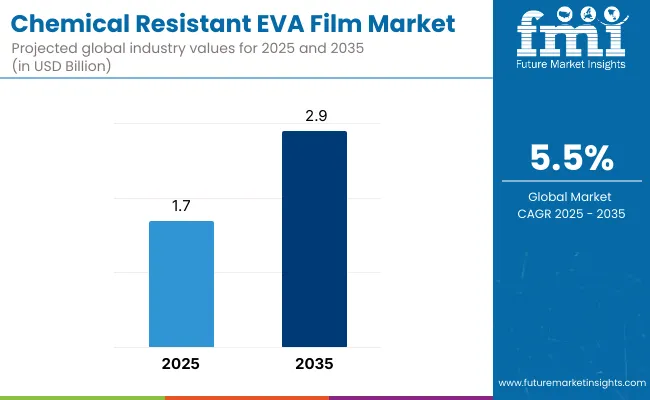

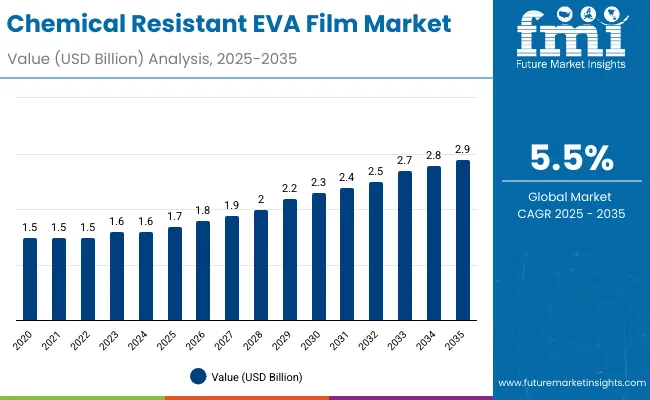

The chemical resistant EVA film market is expected to grow from USD 1.7 billion in 2025 to USD 2.9 billion by 2035, resulting in a total increase of USD 1.2 billion over the forecast decade. This represents a 70.6% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 5.5%. Over ten years, the market grows by a 1.7 multiple.

| Metric | Value |

|---|---|

| Chemical Resistant EVA Film Market Estimated Value in (2025 E) | USD 1.7 billion |

| Chemical Resistant EVA Film Market Forecast Value in (2035 F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

In the first five years (2025 to 2030), the market progresses from USD 1.7 billion to USD 2.2 billion, contributing USD 0.5 billion, or 41.7% of total decade growth. This phase is shaped by growing adoption in solar encapsulation, automotive glass lamination, and construction safety glazing. Demand is reinforced by regulations favoring durable, shatter-resistant materials.

In the second half (2030 to 2035), the market grows from USD 2.2 billion to USD 2.9 billion, adding USD 0.7 billion, or 58.3% of the total growth. This acceleration is supported by advances in modified EVA blends with enhanced resistance to chemicals and UV exposure. Expanding applications in electronics, renewable energy, and industrial packaging further strengthen the market outlook, positioning EVA films as essential protective materials.

From 2020 to 2024, the chemical resistant EVA film market expanded from USD 1.3 billion to USD 1.6 billion, driven by applications in solar panels, automotive glazing, and construction glass requiring durability against solvents and weathering. Nearly 70% of revenue was controlled by material manufacturers specializing in high-performance polymers.

Leaders such as Mitsui Chemicals, Bridgestone, and Sekisui Chemical emphasized cross-linked EVA formulations, high adhesion, and UV stability. Differentiation relied on chemical resistance, optical clarity, and mechanical strength, while integration with smart coatings was secondary. Service-driven models such as lamination audits accounted for less than 15% of revenues, with most buyers opting for material-based procurement.

By 2035, the chemical resistant EVA film market will reach USD 2.9 billion, growing at a CAGR of 5.50%, with sustainable and advanced modified EVA films representing over 40% of value. Competitive momentum will grow as providers introduce bio-based EVA variants, nanocomposite reinforcement, and IoT-linked durability monitoring.

Established players are pivoting toward hybrid models combining EVA films with automation-ready lamination processes. Emerging companies such as STR Holdings, Hangzhou First Applied Material, and Changzhou Sveck are expanding share with recyclable EVA films, improved encapsulation efficiency, and solutions tailored for renewable energy, automotive, and architectural applications.

The rising need for durable and protective films in automotive, construction, and electronics is driving growth in the chemical resistant EVA film market. These films provide strong resistance to solvents, oils, and corrosive substances, ensuring reliability in demanding applications. Expanding use in laminated glass, solar panels, and protective packaging further supports adoption.

Films engineered with enhanced cross-linking, UV stability, and superior adhesion are gaining popularity for their ability to maintain clarity and performance under harsh conditions. Their versatility across industrial and consumer applications, combined with lightweight properties, improves operational efficiency. Sustainability-focused developments in recyclable EVA formulations also align with environmental regulations and market demand.

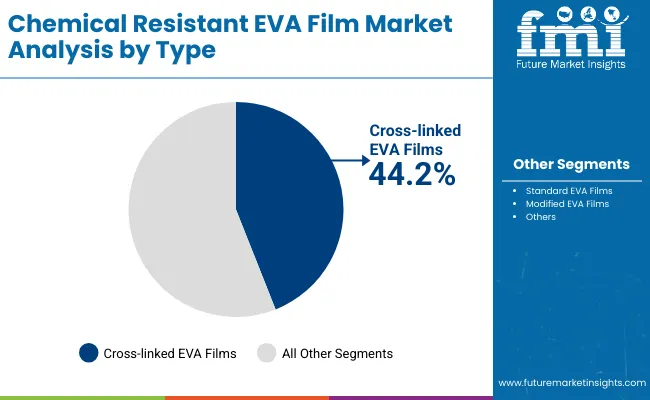

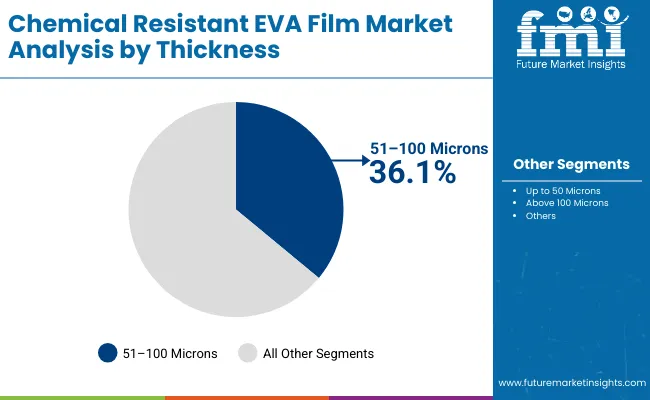

The market is segmented by type, thickness, application, end-use industry, and region. Type segmentation includes standard EVA films, cross-linked EVA films, and modified EVA films, offering varying levels of durability, adhesion, and chemical resistance. Thickness segmentation covers up to 50 microns, 51-100 microns, and above 100 microns, meeting requirements across safety, encapsulation, and industrial use.

Applications include solar panel encapsulation, safety and security glass lamination, automotive windshields and windows, construction glass and facades, electronics protection films, and industrial packaging, ensuring performance under harsh conditions. End-use industries include renewable energy, automotive, building and construction, electronics and electricals, and packaging and industrial goods. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Cross-linked EVA films are projected to hold 44.2% of the market in 2025, driven by their enhanced resistance to chemical degradation and thermal stress. Their cross-linked structure provides improved dimensional stability and adhesion, making them ideal for demanding applications such as solar panels and laminated safety glass. These properties ensure long-term performance in harsh environments.

Their growing adoption is supported by the renewable energy sector, where reliability is critical for solar panel encapsulation. Cross-linked EVA films reduce the risk of delamination and ensure consistent optical clarity. As global investment in clean energy rises, their dominance is reinforced by proven durability and safety performance.

Films in the 51–100 microns range are expected to capture 36.5% of the market in 2025, balancing strength and flexibility for multiple end-uses. This mid-range thickness offers enhanced handling characteristics without compromising barrier or adhesion performance. It is widely adopted across renewable energy, automotive, and construction sectors.

Manufacturers prefer this range for its cost-effectiveness and compatibility with automated lamination processes. Its ability to provide sufficient protection against chemicals and mechanical stress makes it a standard in large-volume applications. Continuous innovation in co-extrusion techniques further supports this segment’s market growth.

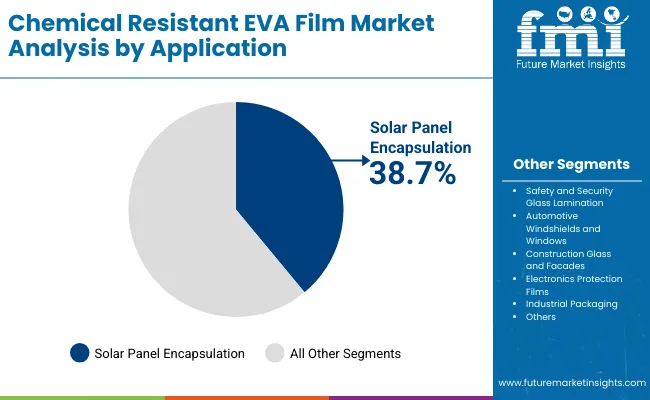

Solar panel encapsulation is forecast to hold 38.7% of the market in 2025, as EVA films are essential in protecting photovoltaic cells from moisture, UV radiation, and mechanical damage. Their transparency and adhesive strength enable efficient light transmission and durability of modules.

As solar adoption accelerates worldwide, EVA films ensure long-term stability and performance of panels. Their role in reducing power loss and extending service life is critical in utility-scale and residential solar projects. This application remains the largest demand driver for chemical-resistant EVA films.

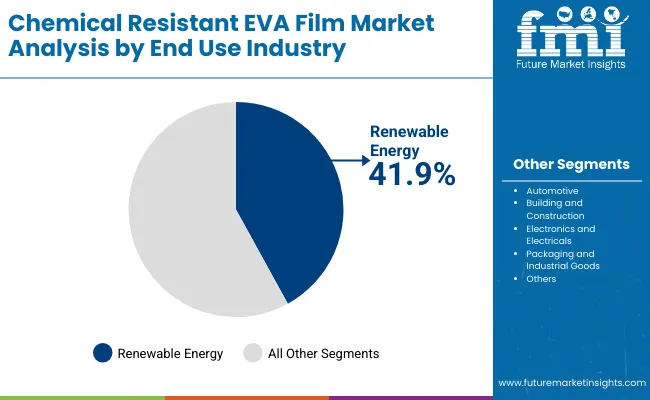

The renewable energy industry is expected to account for 41.9% of the market in 2025, reflecting the central role of EVA films in solar module production. Their chemical resistance, optical clarity, and reliability make them indispensable in energy applications where long operational lifespans are required.

Global policies promoting clean energy are accelerating EVA film adoption, particularly in emerging solar markets. Technological improvements in film formulation further support efficiency gains. As solar capacity continues to expand, renewable energy remains the dominant end-use sector for this market.

The chemical resistant EVA film market is expanding as industries demand durable, flexible films with strong chemical resistance for applications in solar, automotive, construction, and electronics. Growth is driven by rising adoption in laminated glass, protective coatings, and encapsulation solutions. However, high production costs and limited recycling options restrain adoption. Advancements in cross-linked EVA, multilayer structures, and sustainable formulations are shaping the market’s future.

Durability, Versatility, and Safety in End-use Applications Driving Adoption

Chemical resistant EVA films are widely used in laminated safety glass, automotive windshields, and solar panels due to their excellent adhesion, durability, and resistance to corrosive agents. Electronics and industrial sectors also rely on EVA films for encapsulating sensitive components. Their transparency, flexibility, and ability to withstand harsh conditions enhance performance across applications. Growth in renewable energy installations and rising automotive safety standards further fuel adoption, positioning EVA films as critical materials in multiple industries.

High Costs, Limited Recycling, and Compatibility Issues Restraining Growth

Despite strong utility, EVA film production involves specialized processes and high-quality resins, driving up costs compared to alternatives. Recycling poses challenges due to cross-linking and multilayer structures, raising environmental concerns in regions with strict waste regulations. Compatibility limitations with certain advanced coatings and substrates restrict their use in some high-performance applications. Volatile raw material prices add further instability, impacting profitability for manufacturers. These factors hinder widespread adoption in cost-sensitive markets.

Cross-linked EVA, Sustainable Materials, and High-performance Trends Emerging

Key trends include the development of cross-linked EVA films with enhanced durability, chemical resistance, and optical properties for demanding applications like solar panels. Manufacturers are exploring bio-based and recyclable EVA blends to meet sustainability goals. Multi-layer structures integrating EVA with advanced polymers are being developed to provide superior performance in safety glass and electronics. Energy-efficient production processes and smart film technologies are also gaining traction. These innovations are positioning chemical resistant EVA films as next-generation materials for safe, sustainable, and high-performance packaging and industrial applications.

The global chemical resistant EVA film market is expanding steadily, driven by applications in solar panels, construction glass, automotive glazing, and electronics. Asia-Pacific is emerging as the fastest-growing region, with India and China driving demand through renewable energy projects and infrastructure investments. Developed markets such as the U.S., Germany, and Japan are focusing on high-performance films with enhanced durability, UV resistance, and sustainability. EVA films are increasingly being engineered for compliance, recyclability, and long-term protection in industrial and consumer applications.

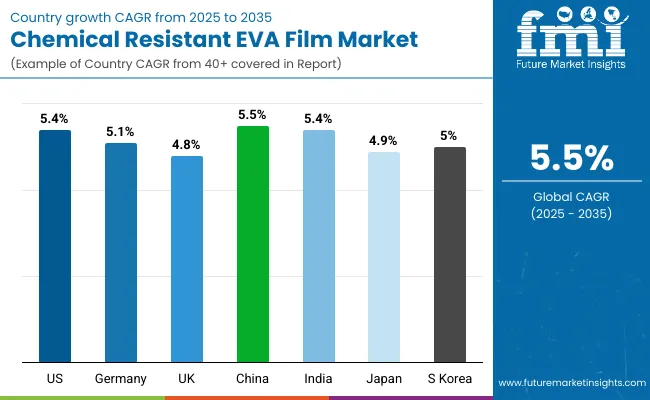

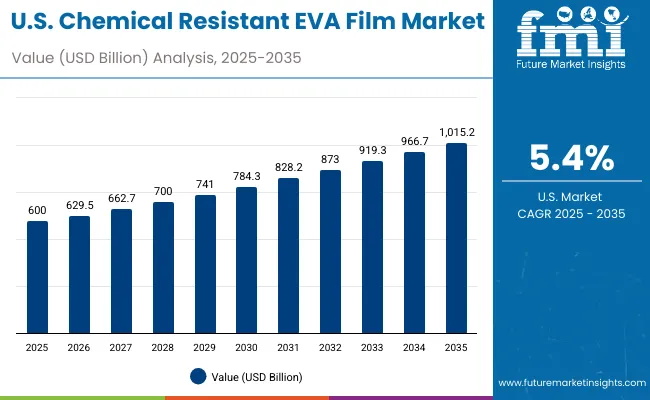

The USA market is projected to grow at a CAGR of 5.4% from 2025 to 2035, supported by strong adoption in solar energy and automotive sectors. EVA films are being increasingly used in photovoltaic module encapsulation and laminated safety glass. Growth is further driven by innovations in UV-resistant coatings and recyclable EVA materials. OEMs are investing in energy-efficient production and multi-layer EVA films to enhance performance, safety, and sustainability in diverse applications across industrial and consumer markets.

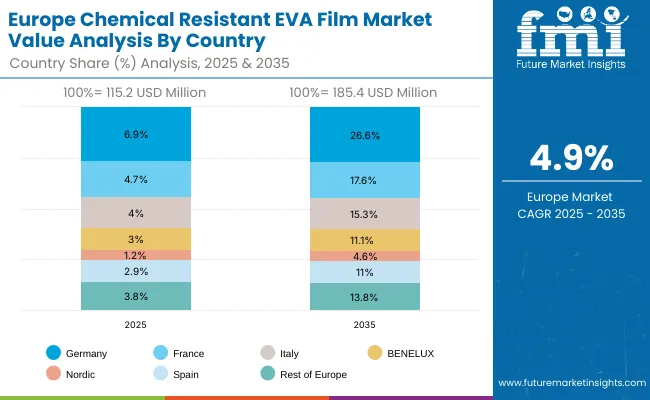

Germany’s market is expected to grow at a CAGR of 5.1%, anchored by demand in automotive, construction, and renewable energy. EU climate policies are encouraging wider adoption of EVA films in laminated glass and solar panels. Manufacturers are innovating with chemical-resistant and UV-stable EVA films to improve durability. High-end architectural projects are integrating EVA films for safety, energy efficiency, and aesthetics, reinforcing Germany’s role as a leader in advanced EVA applications in Europe.

The U.K. market is projected to grow at a CAGR of 4.8%, supported by growth in construction, automotive glazing, and renewable energy applications. EVA films are gaining traction in solar panel encapsulation projects encouraged by government energy policies. Adoption in premium architectural glass and safety glazing systems is also expanding. Local manufacturers are focusing on sustainable and high-clarity EVA film formulations, enabling compliance with energy efficiency and safety regulations across industries.

China’s market is forecast to grow at a CAGR of 5.5%, driven by large-scale renewable energy projects, infrastructure growth, and automotive demand. Domestic manufacturers are scaling EVA production for solar module encapsulation and construction glass. Rising investments in green building initiatives and EV adoption are pushing demand for durable EVA films. Government sustainability regulations are also encouraging development of eco-friendly EVA film formulations for diverse applications across consumer and industrial markets.

India is projected to grow at a CAGR of 5.4%, supported by rapid expansion in solar energy, construction, and automotive safety glass. Government-led renewable energy programs and infrastructure development are fueling demand. SMEs are adopting EVA films for cost-effective laminated glass solutions. With export growth in solar and construction materials, manufacturers are developing recyclable EVA films with high chemical resistance to meet global standards and sustainability initiatives.

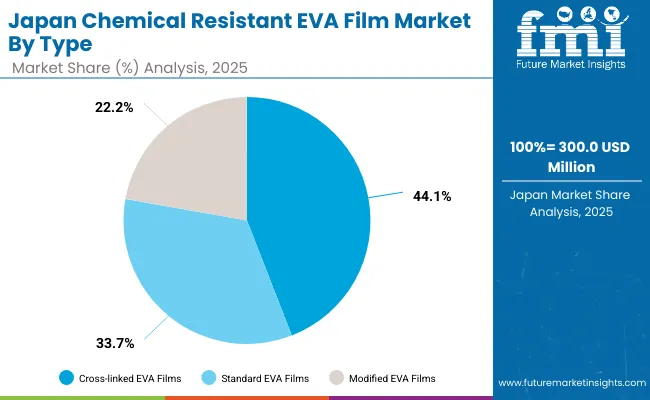

Japan’s market is projected to grow at a CAGR of 4.9%, led by demand in electronics, construction glass, and automotive industries. EVA films are being deployed for precision electronics encapsulation and architectural safety glazing. Manufacturers are innovating with moisture-resistant, UV-stable EVA films to ensure product reliability. With strong emphasis on safety and product performance, Japan’s market continues to invest in advanced EVA film technologies for long-term durability in consumer and industrial use cases.

South Korea’s market is expected to grow at a CAGR of 5.0%, supported by electronics, solar energy, and automotive applications. EVA films are being adopted in semiconductor packaging, laminated safety glass, and solar module encapsulation. Strong export orientation in electronics and renewable energy is fueling demand. Manufacturers are innovating compact, durable EVA films that align with international sustainability regulations and provide cost efficiency, enabling broader adoption in domestic and global industries.

Japan’s chemical resistant EVA film market, valued at USD 300 million in 2025, is led by cross-linked EVA films, which hold 42.4% share due to superior durability and performance in demanding applications. Standard EVA films follow with 36.7%, while modified EVA films account for 20.9%. Cross-linked films dominate in solar panels, automotive, and industrial packaging, where resistance to chemicals and heat is essential. Standard films remain cost-effective for general lamination needs. Modified EVA films, though smaller in share, are finding niche applications with customized formulations, reflecting Japan’s steady demand for specialized materials supporting innovation, sustainability, and advanced manufacturing.

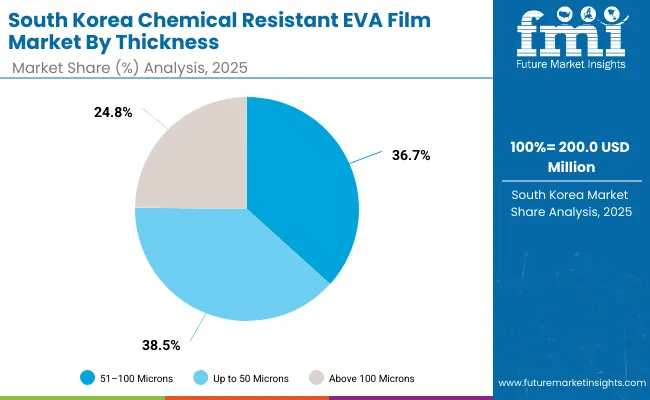

South Korea’s chemical resistant EVA film market in 2025, worth USD 200 million, is almost evenly split between 51-100 microns (37.9%) and up to 50 microns (38.3%). Films above 100 microns account for 23.8%, representing specialized use cases. Thin films up to 50 microns are widely adopted in flexible electronics and laminates, while mid-range 51-100 micron films dominate for balance of strength, durability, and cost. Thicker films above 100 microns, though smaller in share, cater to applications needing high structural integrity and protection. This distribution highlights South Korea’s diversified adoption across packaging, electronics, and construction sectors requiring chemical resistance.

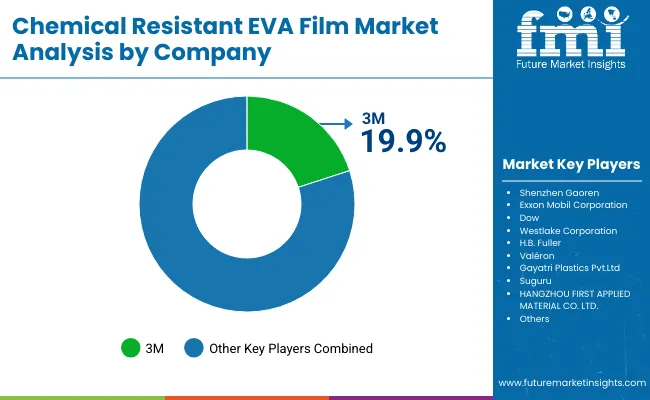

The chemical resistant EVA film market is moderately fragmented, with polymer producers, specialty film manufacturers, and adhesive solution providers competing across automotive, construction, solar, and electronics sectors. Global leaders such as 3M, Exxon Mobil Corporation, and Dow hold notable market share, driven by advanced polymer formulations, high chemical resistance, and compliance with international safety and durability standards. Their strategies increasingly emphasize renewable energy integration, lightweight designs, and eco-friendly resin innovation.

Established mid-sized players including Westlake Corporation, H.B. Fuller, and Valéron are supporting adoption of EVA films featuring cross-linked structures, enhanced adhesion, and long-term stability under harsh environments. These companies are especially active in solar encapsulation, laminated safety glass, and industrial protection films, offering tailored performance, consistent supply, and innovations that improve end-use durability and cost efficiency.

Specialized regional manufacturers such as Gayatri Plastics Pvt. Ltd., Suguru, and Hangzhou First Applied Material Co., Ltd. focus on customized EVA film solutions for regional industries. Their strengths lie in cost-efficient production, rapid customization, and flexible thickness offerings, while also investing in chemical-resistant technologies for electronics, packaging, and construction markets to address evolving global demand.

Key Developments

| Item | Value |

| Quantitative Units | USD 1.7 Billion |

| By Type | Standard EVA Films, Cross-linked EVA Films, Modified EVA Films |

| By Thickness | Up to 50 Microns, 51-100 Microns, Above 100 Microns |

| By Application | Solar Panel Encapsulation, Safety and Security Glass Lamination, Automotive Windshields and Windows, Construction Glass and Facades, Electronics Protection Films, Industrial Packaging |

| By End-Use Industry | Renewable Energy, Automotive, Building and Construction, Electronics and Electricals, Packaging and Industrial Goods |

| Key Companies Profiled | 3M, Shenzhen Gaoren , Exxon Mobil Corporation, Dow, Westlake Corporation, H.B. Fuller, Valéron , Gayatri Plastics Pvt. Ltd, Suguru, Hangzhou First Applied Material Co., Ltd. |

| Additional Attributes | Cross-linked EVA films are projected to dominate with a 44.2% share in 2025 due to superior chemical resistance and durability, rising demand from solar panel encapsulation driving renewable energy applications, increasing use in automotive windshields and construction glass laminations, growing electronics sector requiring protection films, and packaging industries adopting EVA films for industrial-grade safety and longevity. |

The global chemical resistant EVA film market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the chemical resistant EVA film market is projected to reach USD 2.9 billion by 2035.

The chemical resistant EVA film market is expected to grow at a CAGR of 5.5% between 2025 and 2035.

The key types in the chemical resistant EVA film market include standard EVA films, cross-linked EVA films, and modified EVA films.

The cross-linked EVA films segment is expected to account for the highest share of 44.2% in the chemical resistant EVA film market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chemical Dosing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Chemical Filling System Market Size and Share Forecast Outlook 2025 to 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Chemical Indicator Inks Market Size and Share Forecast Outlook 2025 to 2035

Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hardener Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Peel Market Size and Share Forecast Outlook 2025 to 2035

Chemical Protective Gloves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Injection Pump Market Size and Share Forecast Outlook 2025 to 2035

Chemical Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Chemical Sensors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Distribution Market Size and Share Forecast Outlook 2025 to 2035

Chemical & Petrochemical IECS Market Size and Share Forecast Outlook 2025 to 2035

Chemical Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Chemicals And Petrochemicals Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Chemical Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Chemical Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Chemical Detector Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA