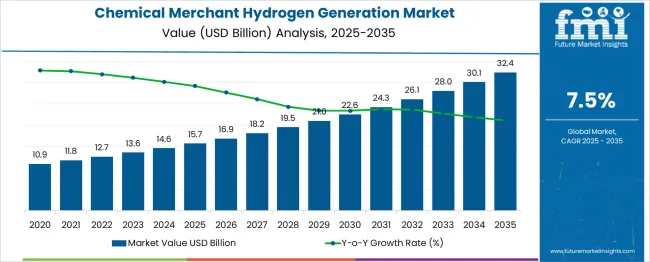

The chemical merchant hydrogen generation market is estimated to be valued at USD 15.7 billion in 2025 and is projected to reach USD 32.4 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period. CAGR analysis highlights a sustained growth trajectory across the forecast period, underpinned by accelerating adoption of hydrogen as a feedstock in refining, ammonia production, and methanol synthesis, along with emerging roles in decarbonization initiatives.

In the early phase (2025 to 2030), the market grows from USD 15.7 billion to USD 22.6 billion, adding USD 6.9 billion or roughly 41% of total incremental growth, supported by investments in natural gas-based hydrogen production with integrated carbon capture systems to meet tightening emission regulations.

The second half (2030 to 2035) contributes a higher gain of USD 9.8 billion, taking the market to USD 32.4 billion, reflecting 59% of growth, as green hydrogen technologies scale up, leveraging renewable-powered electrolysis and hybrid production pathways.

The compounding effect of 7.5% CAGR signals not only consistent demand but also improvements in cost competitiveness driven by economies of scale and process optimization. Companies focusing on low-carbon hydrogen, modular generation units, and strategic collaborations for distributed supply models will capitalize on the long-term CAGR-driven momentum shaping the global hydrogen economy.

| Metric | Value |

|---|---|

| Chemical Merchant Hydrogen Generation Market Estimated Value in (2025 E) | USD 15.7 billion |

| Chemical Merchant Hydrogen Generation Market Forecast Value in (2035 F) | USD 32.4 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The chemical merchant hydrogen generation market occupies a significant yet specialized role within its broader parent segments. It accounts for about 14-16% share of the hydrogen generation market, as merchant supply complements on-site captive production and pipeline delivery. Within the industrial gases market, its contribution is estimated at around 5-6%, since hydrogen is one of several gases alongside oxygen, nitrogen, and argon.

For the chemical processing market, the share stands near 2-3%, reflecting its role as a feedstock supplier for ammonia, methanol, and specialty chemical production. In the energy and fuel market, the share is relatively modest at approximately 1-2%, given the early-stage adoption of hydrogen as an energy vector.

Within the oil refining and petrochemicals market, the contribution is roughly 3-4%, as merchant hydrogen supports hydroprocessing and desulfurization needs. Growth momentum for chemical merchant hydrogen is driven by outsourcing trends, where chemical producers avoid capital-intensive on-site hydrogen generation and rely on merchant suppliers for flexibility and reliability.

Increasing adoption of low-carbon hydrogen solutions, combined with regulatory pressures on emission-intensive sectors, reinforces demand. This market remains a key enabler for decarbonizing chemical value chains and advancing green and blue hydrogen integration across industrial operations.

The rising global emphasis on decarbonization, energy diversification, and chemical process efficiency has influenced growth in the market. Merchant hydrogen generation has emerged as a critical pathway for sectors lacking onsite production capabilities, offering a flexible and scalable supply model.

The market is benefiting from both government-led sustainability mandates and industrial investments targeting cleaner energy systems. Advancements in hydrogen purification, compression, and delivery technologies are further streamlining merchant supply chains. Additionally, strategic collaborations between chemical producers and industrial gas suppliers are enhancing distribution capabilities across regions.

A growing preference for centralized production units that ensure cost efficiency and supply reliability is helping to expand the merchant model. These combined forces are shaping a promising outlook for the Chemical Merchant Hydrogen Generation market, particularly as hydrogen plays an increasingly central role in the global clean energy transition..

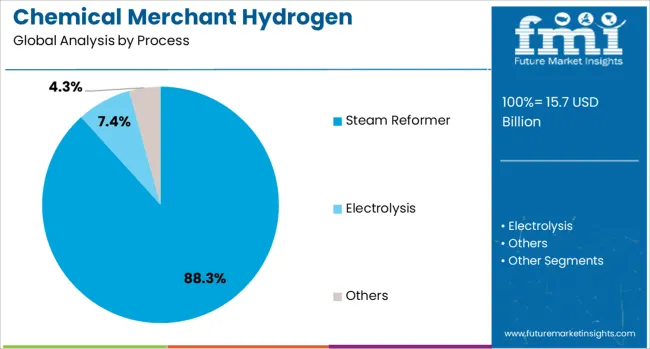

The chemical merchant hydrogen generation market is segmented by process and geographic regions. In the chemical merchant hydrogen generation market, the process is divided into Steam Reformer, Electrolysis, and Others. Regionally, the chemical merchant hydrogen generation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The steam reformer process segment is projected to hold 88.30% of the Chemical Merchant Hydrogen Generation market revenue share in 2025, positioning it as the dominant process type. This leadership has been attributed to the long-established efficiency, scalability, and economic viability of steam reforming for producing hydrogen at large volumes. Natural gas has remained the most common feedstock due to its widespread availability and compatibility with existing infrastructure, which has further reinforced adoption of this process.

The ability of steam reformers to deliver high-purity hydrogen at competitive costs has made them the preferred choice for merchant suppliers servicing the chemical industry. Additionally, recent innovations in carbon capture integration with steam reformers have made this method more environmentally acceptable, aligning it with evolving emissions standards.

The infrastructure maturity, combined with robust engineering know-how and global supply chain compatibility, has ensured the continued dominance of the steam reformer process. This has positioned it as a critical enabler of merchant hydrogen delivery in both established and emerging markets..

The chemical merchant hydrogen generation market is witnessing increased adoption driven by industrial demand for hydrogen in refining, ammonia production, and methanol synthesis. Centralized production facilities using steam methane reforming (SMR) dominate the landscape, with pipeline and bulk delivery models preferred by large industrial clients. Market participants are focused on improving efficiency, reducing operational risks, and expanding distribution networks to ensure reliable supply. Developments in cryogenic storage, advanced purification systems, and modular production units are shaping competitiveness. Growing collaboration between chemical companies and merchant producers has strengthened long-term contract-based business models for large-scale hydrogen procurement.

Market adoption has been driven by the rising requirement for hydrogen in refining operations to meet stringent fuel specifications and enhanced efficiency in hydrocracking and desulfurization processes. Increased ammonia and methanol production in the chemical sector has strengthened hydrogen demand, creating steady consumption across established markets. Expansion of merchant supply networks offering pipeline delivery, cryogenic storage, and cylinder-based distribution has enabled broader accessibility for industrial clients. Growing focus on low-carbon footprints in industrial processes is reinforcing investment in centralized large-scale hydrogen plants. Reliability of bulk supply, cost-effectiveness, and ability to ensure high-purity hydrogen for sensitive applications have maintained strong demand for merchant-based generation models across multiple geographies.

Market penetration has been restrained by high capital investment required for centralized hydrogen production facilities, which impacts entry for smaller producers. Volatility in natural gas prices significantly influences production economics for steam methane reforming, the dominant technology in merchant hydrogen generation. Limited infrastructure for pipeline distribution in emerging economies creates logistical complexities and reliance on road-based transport, increasing operational costs. Stringent safety protocols for high-pressure storage and transportation of hydrogen raise compliance expenditure. Long-term contract obligations between suppliers and industrial buyers may hinder flexibility in pricing models. Additionally, fluctuations in regulatory frameworks regarding emissions and energy usage standards add uncertainty for project planning and cost recovery.

Opportunities exist in expanding merchant hydrogen supply for emerging fuel cell applications in mobility and distributed energy sectors, where reliability and high-purity hydrogen are critical. Strategic partnerships with industrial clusters for dedicated pipeline networks can reduce distribution costs and secure recurring demand. Adoption of advanced purification technologies enhances competitiveness by meeting stricter process requirements for chemical synthesis and electronics manufacturing. Merchant producers exploring integration with carbon capture and storage in reforming processes can strengthen long-term viability. Increasing investment in port and logistics hubs for bulk hydrogen delivery enables access to new geographic markets. Tailored supply agreements and on-site storage solutions create differentiated value propositions for industrial buyers.

Digital monitoring and predictive analytics in hydrogen supply chains are emerging to optimize operational efficiency and minimize downtime for industrial clients. Modular production units designed for scalability are gaining attention for remote locations and decentralized industrial clusters. Blending of renewable hydrogen through electrolysis into merchant supply chains is being explored to enhance environmental compliance. Advances in liquefaction technology and cryogenic storage systems are supporting long-distance transportation of hydrogen at competitive cost. Hybrid contractual models combining fixed and variable pricing structures are evolving to manage volatility in feedstock costs. Strategic alliances between chemical companies and merchant producers for long-term supply security remain a growing practice in the global market.

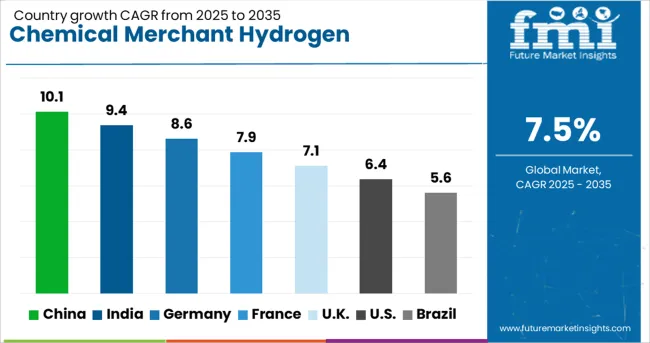

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

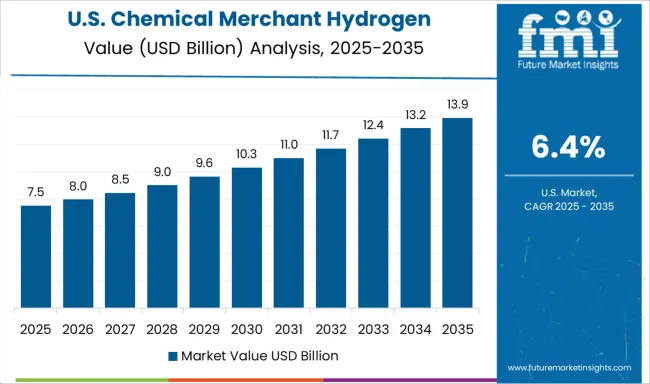

| USA | 6.4% |

| Brazil | 5.6% |

The chemical merchant hydrogen generation market is projected to grow at a CAGR of 7.5% through 2035, supported by industrial hydrogen demand, decarbonization goals, and the expansion of chemical feedstock applications. China leads with 10.1%, driven by large-scale refining and ammonia production projects aligned with clean energy programs.

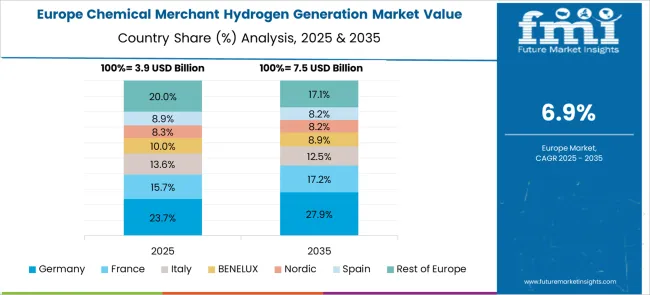

India follows at 9.4%, supported by government-backed green hydrogen initiatives and integration into fertilizer and petrochemical sectors. Among OECD nations, France posts 7.9%, while the United Kingdom records 7.1% and the United States grows at 6.4%, reflecting investments in low-carbon hydrogen production technologies. The analysis includes more than 40 countries, with the top five detailed below.

China is projected to grow at a CAGR of 10.1% through 2035, supported by expanding demand for hydrogen in refining, methanol, and ammonia production. Large-scale merchant hydrogen facilities are being established to cater to chemical and petrochemical complexes. Government programs promoting clean hydrogen production through renewable energy integration and carbon-neutral targets have accelerated the adoption of advanced generation technologies.

Domestic suppliers are investing in steam methane reforming units equipped with carbon capture systems, alongside growing deployment of electrolysis-based plants for green hydrogen output. Strategic partnerships between energy companies and industrial firms are strengthening supply chains for industrial hydrogen applications.

India is expected to post a CAGR of 9.4% through 2035, driven by the rising need for hydrogen in fertilizers, petrochemicals, and steel manufacturing. National hydrogen mission programs and renewable energy deployment are creating a favorable ecosystem for merchant hydrogen generation.

Indian manufacturers are focusing on steam methane reforming units with carbon capture technologies while accelerating plans for electrolyzer-based plants to produce green hydrogen for industrial clients. Strategic collaborations between energy utilities and chemical companies are enabling large-scale infrastructure development. Export-oriented hydrogen production projects and integration with port-based industrial clusters are further supporting market growth.

France is projected to grow at a CAGR of 7.9% through 2035, driven by decarbonization strategies in chemical production and energy-intensive industries. Merchant hydrogen suppliers are focusing on renewable-powered electrolysis projects to reduce carbon intensity and meet national emission reduction targets. Investments in hydrogen infrastructure for industrial clusters and integration with chemical feedstock operations are accelerating. Public-private partnerships are supporting pilot projects for large-scale green hydrogen generation, enhancing competitiveness within the European hydrogen economy. Demand from ammonia and methanol production segments is rising as industries transition toward low-carbon processes, strengthening the role of merchant hydrogen suppliers in France.

The United Kingdom is forecasted to grow at a CAGR of 7.1% through 2035, supported by policy-driven hydrogen adoption in chemical and refining industries. Merchant hydrogen facilities are expanding to cater to industrial decarbonization programs and hydrogen blending initiatives in existing energy networks. Electrolyzer deployment using offshore wind power is gaining traction as part of the UK’s hydrogen economy roadmap.

Companies are investing in low-carbon hydrogen generation technologies integrated with carbon capture and storage solutions to comply with emission reduction goals. Strategic collaborations between energy firms and industrial users are enabling large-scale hydrogen delivery infrastructure.

The United States is projected to grow at a CAGR of 6.4% through 2035, supported by expanding hydrogen applications in chemicals, refining, and emerging low-carbon industries. Merchant hydrogen producers are investing in SMR units with carbon capture systems while scaling renewable-powered electrolysis facilities in line with federal clean energy incentives.

The USA market benefits from advanced infrastructure, strong industrial demand, and government programs supporting hydrogen hubs for chemical production and heavy industries. Strategic partnerships among energy companies, technology developers, and industrial users are accelerating project execution and improving supply chain resilience for hydrogen distribution.

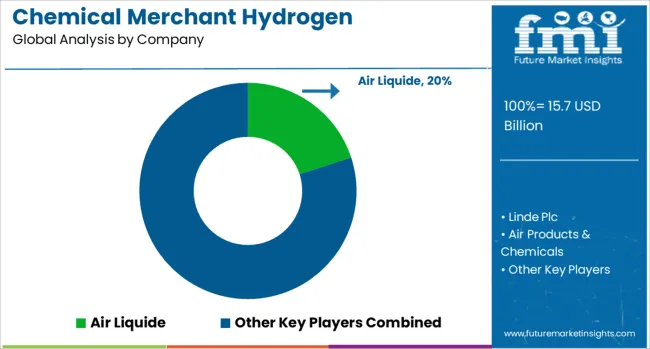

The chemical merchant hydrogen generation market is defined by large industrial gas companies and technology providers delivering hydrogen through centralized production and merchant supply models. Air Liquide and Linde plc dominate with vast infrastructure for steam methane reforming (SMR) and advanced integration of carbon capture to meet decarbonization targets.

Air Products & Chemicals leads in North America with large-scale hydrogen plants and pipeline networks. ADNOC utilizes abundant natural gas resources in the Middle East for low-cost production, reinforcing its competitive position in bulk supply. Nel ASA specializes in modular electrolyzer solutions for green hydrogen projects, targeting industrial customers seeking renewable energy integration.

Cummins Inc. expands through hydrogen technology acquisitions, focusing on electrolyzer systems and packaged solutions for chemical applications. Thyssenkrupp and KBR Inc. provide EPC expertise for SMR and electrolysis plant construction, while Ballard Power Systems contributes with hydrogen solutions supporting distributed production strategies.

Uniper SE invests in large-scale hydrogen hubs to secure industrial decarbonization projects in Europe. Competitive differentiation is determined by technology portfolio, geographic reach, cost efficiency, and regulatory compliance capabilities.

High entry barriers exist due to capital intensity, engineering complexity, and the need for long-term supply contracts. Strategic priorities include scaling up green hydrogen through renewable-powered electrolysis, integrating carbon capture in SMR processes, and forming partnerships with chemical producers to secure steady offtake. Future competitiveness will be shaped by innovation in hybrid hydrogen generation systems and digital plant control platforms for optimized efficiency.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.7 Billion |

| Process | Steam Reformer, Electrolysis, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Liquide, Linde Plc, Air Products & Chemicals, ADNOC, Nel ASA, Cummins Inc, Thyssenkrupp, KBR Inc, Ballard Power Systems, and Uniper SE |

The global chemical merchant hydrogen generation market is estimated to be valued at USD 15.7 billion in 2025.

The market size for the chemical merchant hydrogen generation market is projected to reach USD 32.4 billion by 2035.

The chemical merchant hydrogen generation market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in chemical merchant hydrogen generation market are steam reformer, electrolysis and others.

In terms of , segment to command 0.0% share in the chemical merchant hydrogen generation market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Captive Chemical Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Electrolysis Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Chemical Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Metal Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refining Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Electrolysis Captive Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Captive Petroleum Refinery Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hydraulic Valves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Vapor Deposition Market Forecast Outlook 2025 to 2035

Chemical Recycling Service Market Forecast Outlook 2025 to 2035

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Hydrogen Detection Market Forecast Outlook 2025 to 2035

Chemical Dosing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Chemical Filling System Market Size and Share Forecast Outlook 2025 to 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Hydrogenated Dimer Acid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA