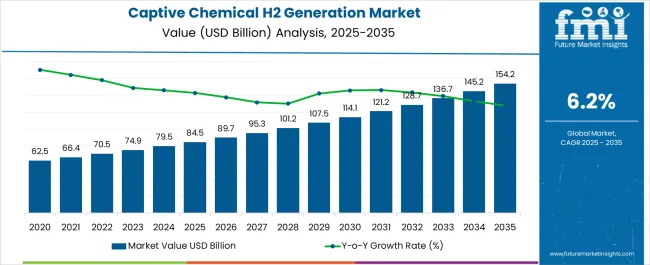

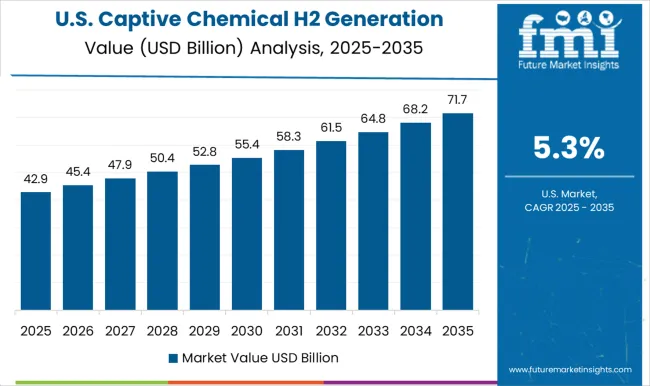

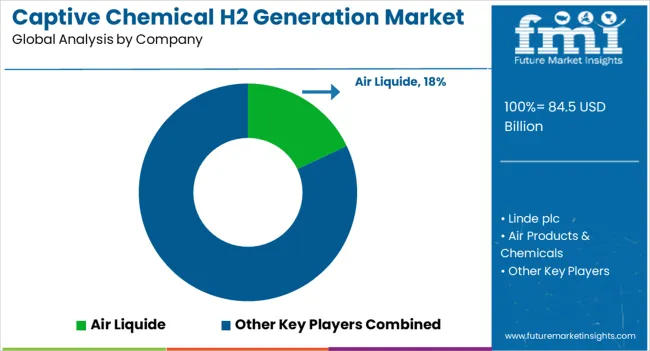

The Captive Chemical Hydrogen Generation Market is estimated to be valued at USD 84.5 billion in 2025 and is projected to reach USD 154.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period. Examining the rolling CAGR over smaller intervals within this decade reveals steady growth throughout the period. Between 2025 and 2030, the market increases from USD 84.5 billion to approximately USD 107.5 billion, corresponding to a CAGR of about 5.0%.

This phase is characterized by growing adoption of chemical hydrogen generation solutions to meet the demand for reliable and on-site hydrogen supply across industrial applications. Expansion of existing facilities and replacement of less efficient systems contribute to this steady growth. From 2030 to 2035, growth accelerates, with the market rising from USD 107.5 billion to USD 154.2 billion, reflecting a CAGR near 7.5%.

This faster growth is supported by increased investments in captive hydrogen generation to improve supply chain security and reduce dependency on external sources. Replacement cycles for equipment installed earlier also play a role in sustaining the market’s momentum. Overall, the rolling CAGR analysis highlights consistent and strengthening growth, with the latter half of the decade showing a more dynamic expansion driven by rising demand and operational needs in various sectors.

| Metric | Value |

|---|---|

| Captive Chemical Hydrogen Generation Market Estimated Value in (2025 E) | USD 84.5 billion |

| Captive Chemical Hydrogen Generation Market Forecast Value in (2035 F) | USD 154.2 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

Strategic interest has been growing around captive solutions as they offer improved control over hydrogen purity, production rates, and cost optimization. The rising integration of hydrogen into refining, petrochemicals, and fertilizers has intensified the need for flexible and efficient generation systems.

Market growth is further supported by favorable policies promoting clean energy alternatives and reduced dependency on externally supplied hydrogen. As industries target greater operational resilience and lower carbon footprints, captive chemical hydrogen systems are emerging as a preferred choice.

Investment in advanced reforming technologies, digital monitoring systems, and plant-level hydrogen infrastructure is expected to shape future growth. The continued modernization of industrial energy strategies and the shift toward green hydrogen pathways have placed captive generation at the forefront of industrial energy innovation..

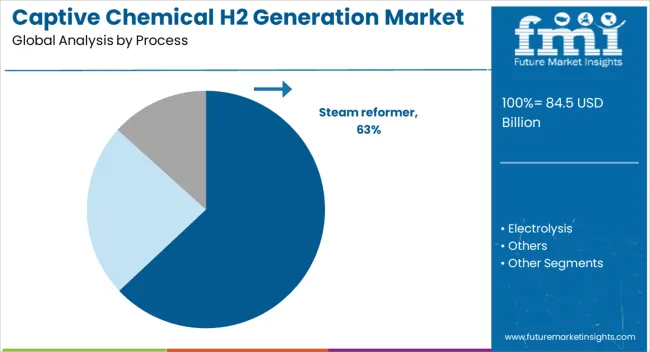

The captive chemical hydrogen generation market is segmented by process and geographic regions. By process, the captive chemical hydrogen generation market is divided into Steam reformer, Electrolysis, and Others. Regionally, the captive chemical hydrogen generation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The steam reformer subsegment within the process segment is projected to account for 63% of the Captive Chemical Hydrogen Generation market revenue share in 2025, making it the dominant method of hydrogen production. This leadership position has been supported by the widespread applicability and operational efficiency of steam reforming technology in large-scale industrial settings. The method enables continuous hydrogen generation using hydrocarbon feedstocks like natural gas, which remain readily available and cost-effective.

High hydrogen yield, scalability, and maturity of the process have contributed to its broad industrial adoption. Industries have favored steam reforming due to its compatibility with existing plant infrastructure and its ability to deliver high-purity hydrogen for downstream applications.

Additionally, advancements in catalyst performance and process integration have reduced emissions and improved energy efficiency, reinforcing the subsegment’s prominence. As more industries seek reliable and on-site hydrogen supply, the steam reformer process continues to serve as a cornerstone technology, supporting both current demands and future scalability needs..

The captive chemical hydrogen generation market is growing as industries seek reliable, on-site hydrogen production solutions to support fuel cell applications and clean energy initiatives. Captive systems provide controlled hydrogen supply, reducing dependency on external sources and transportation risks. Growth drivers include increasing adoption of hydrogen in industrial processes and transportation. Challenges such as high initial investment and handling safety exist. Innovations in chemical formulations and reactor designs improve efficiency and scalability. Expanding energy transition policies and demand for decentralized hydrogen generation present substantial growth opportunities globally.

Captive chemical hydrogen generation offers industries a convenient way to produce hydrogen on-site, ensuring a consistent and secure supply. This is especially important in sectors like power generation, refineries, and fuel cell electric vehicles where uninterrupted hydrogen availability is critical. On-site systems eliminate the need for complex logistics involved in transporting hydrogen, which is costly and hazardous. Increasing interest in clean fuel alternatives boosts the need for decentralized hydrogen production to support emerging hydrogen infrastructure. The ability to tailor chemical generation methods to specific industrial needs enhances adoption. As companies aim to reduce carbon footprints, captive generation supports sustainable energy strategies.

The initial investment required for captive hydrogen generation systems can be significant, limiting adoption, particularly for small and medium enterprises. The handling and storage of reactive chemicals involved in hydrogen generation present safety risks requiring strict protocols and specialized equipment. Maintaining operational safety while achieving high output efficiency is a complex balance. Regulatory compliance regarding chemical use and emissions adds to operational complexity. Additionally, scaling captive systems to meet fluctuating demand without incurring prohibitive costs remains a challenge. Manufacturers must focus on designing compact, safe, and cost-effective systems while providing adequate training and support to end users to overcome these hurdles.

Innovations in chemical catalysts, reactor designs, and process control have significantly improved the efficiency and output capacity of captive hydrogen generators. New formulations allow faster reaction rates and reduced by-products, enhancing system performance. Modular and scalable system designs enable users to expand capacity based on demand without extensive infrastructure changes. Advances in automation and real-time monitoring improve operational reliability and safety. Integration with renewable energy sources to power chemical processes supports greener hydrogen production. Collaborative research efforts continue to optimize materials and technologies, broadening application potential across industries. These technological improvements attract investment and drive market growth.

Regions actively promoting hydrogen economy development, such as parts of Asia Pacific, Europe, and North America, are key markets for captive hydrogen generation. Supportive government policies, incentives, and infrastructure development encourage industrial adoption. Growing fuel cell vehicle markets and decarbonization targets increase hydrogen demand in transportation and industrial sectors. Emerging economies invest in captive systems to enhance energy security and reduce dependence on imported hydrogen. Local manufacturing and supply chain development improve accessibility and reduce costs. Tailoring systems to regional regulations and energy profiles helps companies expand market presence. As global focus on clean energy intensifies, captive chemical hydrogen generation gains importance worldwide.

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

| USA | 5.3% |

| Brazil | 4.7% |

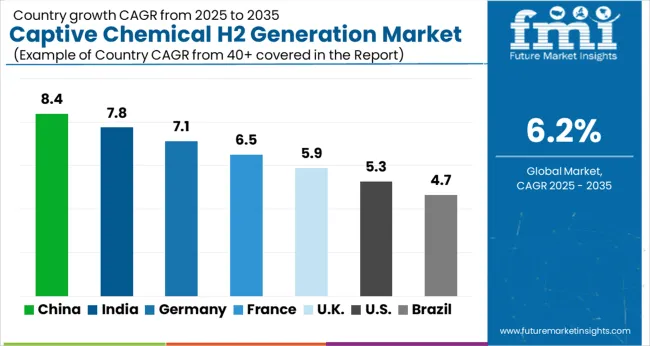

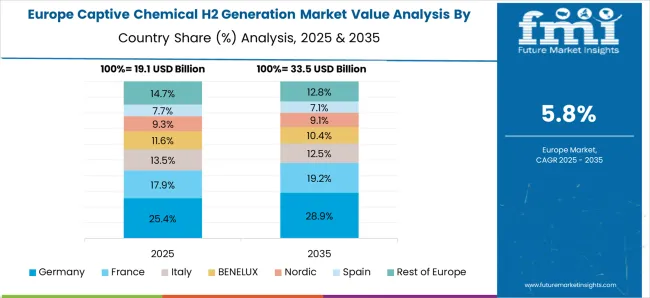

The global captive chemical hydrogen generation market is growing steadily at a 6.2% CAGR, with notable contributions from key regions. Among BRICS nations, China leads with 8.4% growth, driven by increased adoption of on-site hydrogen production technologies. India follows at 7.8%, supported by expanding industrial applications and government initiatives. Within the OECD group, Germany reports 7.1% growth, reflecting advanced technological integration and stringent regulations.

The United Kingdom grows at 5.9%, fueled by investments in sustainable energy solutions. The United States, as a mature market, records 5.3% growth, shaped by focus on safety standards and system reliability. These countries collectively influence market trends through innovations in efficiency, scalability, and environmental compliance. This report includes insights on 40+ countries; the top countries are shown here for reference.

The captive chemical hydrogen generation market in China is growing rapidly at an 8.4% CAGR. Industrial growth and increasing demand for clean energy solutions are key drivers. China’s focus on reducing carbon emissions encourages adoption of hydrogen as an alternative fuel in chemical manufacturing and energy sectors. Domestic companies invest in advanced chemical hydrogen generation technologies to enhance efficiency and reduce costs. The expansion of industries such as refining, electronics, and power generation boosts demand for captive hydrogen production systems. Government incentives and policies supporting green energy further accelerate market growth.

India’s market is expanding at a 7.8% CAGR, fueled by increasing industrialization and efforts to diversify energy sources. Growing chemical, petrochemical, and power industries create demand for onsite hydrogen generation to improve supply security and reduce transportation risks. Indian companies focus on cost-effective captive hydrogen solutions to meet rising consumption. The government promotes hydrogen production as part of its energy transition plans and environmental goals. Collaboration with international technology providers helps enhance local capabilities and technology adoption.

Germany’s market is growing at a 7.1% CAGR with emphasis on sustainability and innovation. The country’s stringent environmental regulations drive adoption of cleaner hydrogen production methods. German industries integrate captive chemical hydrogen generation to ensure reliable and eco-friendly supply for manufacturing and energy applications. There is strong investment in research and development for advanced catalysts and process optimization. Collaboration between industry and research institutions fosters innovation and improves operational efficiency. Market growth is also supported by government funding and strategic energy policies.

The United Kingdom’s market grows at a 5.9% CAGR, supported by government initiatives targeting hydrogen as a key energy source. Industrial sectors adopt captive hydrogen generation to improve energy efficiency and reduce carbon footprints. The market benefits from technological advancements and increased awareness about clean energy benefits. UK companies seek partnerships with technology providers to implement onsite hydrogen solutions. Policy frameworks encourage investments in hydrogen infrastructure and production capabilities.

The USA market is growing steadily at a 5.3% CAGR. Increasing focus on clean energy and reducing greenhouse gas emissions supports adoption of captive hydrogen generation systems. Key industries such as refining, chemicals, and power generation invest in onsite hydrogen production to improve safety and supply stability. Technological innovation and growing infrastructure development contribute to market growth. Federal and state programs offer incentives and funding to promote hydrogen technologies. Collaboration between private and public sectors accelerates research and deployment of efficient hydrogen generation methods.

Competition in the captive chemical hydrogen generation market is being shaped by industrial gas producers, chemical technology firms, and integrated energy solution providers who are aligning strategies with the growing demand for localized, reliable hydrogen supply in refineries, fertilizer production, and specialty chemical applications. Air Liquide and Linde dominate through their extensive portfolios of on-site hydrogen plants designed to provide a continuous supply for large-scale customers. Their competitive strength lies in turnkey project execution, strong engineering expertise, and the ability to integrate hydrogen generation with broader industrial gas services. Air Products leverages its leadership in hydrogen technologies by offering modular and scalable captive systems that support both conventional applications and transition pathways toward low-carbon production.

Companies such as HyGear, a subsidiary of Xebec Adsorption, specialize in compact steam methane reforming units that provide decentralized hydrogen generation tailored for mid-sized industrial users, emphasizing efficiency and cost reduction. Cummins, through its hydrogen division, is pursuing advanced reforming and electrochemical processes that can complement chemical hydrogen generation in captive settings, positioning itself as a hybrid provider of traditional and emerging solutions. Iwatani Corporation and Showa Denko serve as strong regional competitors in Asia, leveraging local partnerships and decades of chemical expertise to secure long-term supply contracts with chemical and electronics manufacturers. Strategic approaches across the market are centered on modularization of plant design to reduce installation timelines, integration of carbon capture systems to meet evolving emissions regulations, and development of flexible feedstock solutions ranging from natural gas and naphtha to refinery byproducts. Companies are also emphasizing lifecycle services, including maintenance and performance optimization, to reinforce customer retention in captive arrangements.

| Item | Value |

|---|---|

| Quantitative Units | USD 84.5 Billion |

| Process | Steam reformer, Electrolysis, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Liquide, Linde plc, Air Products & Chemicals, Cummins Inc., and Nel ASA |

| Additional Attributes | Dollar sales vary by process, including steam reforming and electrolysis; by application, spanning petroleum refining, chemical production, and metal processing; and by region, led by Asia‑Pacific volume growth, and Europe and North America prioritizing sustainability. Growth is driven by on‑site supply efficiency, carbon‑efficient hydrogen pathways, and industrial decarbonization mandates. |

The global captive chemical hydrogen generation market is estimated to be valued at USD 84.5 billion in 2025.

The market size for the captive chemical hydrogen generation market is projected to reach USD 154.2 billion by 2035.

The captive chemical hydrogen generation market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in captive chemical hydrogen generation market are steam reformer, electrolysis and others.

In terms of , segment to command 0.0% share in the captive chemical hydrogen generation market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chemical Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Chemical Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Captive Petroleum Refinery Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Electrolysis Captive Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Chemical Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Metal Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refining Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Electrolysis Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hydraulic Valves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Vapor Deposition Market Forecast Outlook 2025 to 2035

Chemical Recycling Service Market Forecast Outlook 2025 to 2035

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Hydrogen Detection Market Forecast Outlook 2025 to 2035

Chemical Dosing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Chemical Filling System Market Size and Share Forecast Outlook 2025 to 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Hydrogenated Dimer Acid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA