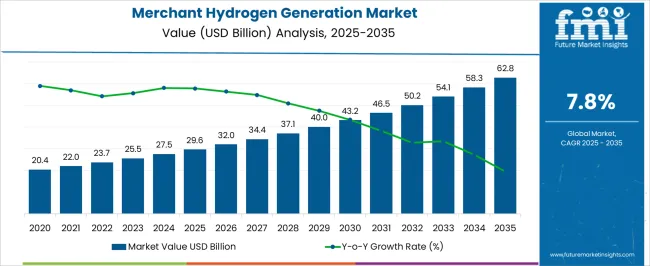

The Merchant Hydrogen Generation Market is estimated to be valued at USD 29.6 billion in 2025 and is projected to reach USD 62.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.8% over the forecast period.

This trajectory reflects a strong shift toward hydrogen as a traded energy commodity, with industrial sectors, mobility applications, and power generation driving purchasing outside of captive production models. Between 2025 and 2030, demand growth will be underpinned by refining, steel, and ammonia industries, which continue to rely heavily on merchant hydrogen supply chains for flexibility and cost management.

From 2030 to 2035, expansion is expected to accelerate as transportation fleets, fuel cell applications, and regional hydrogen hubs create a broader merchant ecosystem. The absolute growth of USD 33.2 billion highlights the growing importance of third-party hydrogen supply, supported by large-scale production facilities, liquefaction plants, and pipeline infrastructure.

Competition is expected to intensify, with producers emphasizing low-carbon hydrogen routes such as electrolysis powered by renewable energy and blue hydrogen with carbon capture. Regional policies in Europe, Asia, and North America will remain decisive, encouraging cross-border trade and long-term contracts. The market outlook positions merchant hydrogen generation as a critical enabler of the global energy transition, bridging industrial demand with emerging clean energy pathways.

| Metric | Value |

|---|---|

| Merchant Hydrogen Generation Market Estimated Value in (2025 E) | USD 29.6 billion |

| Merchant Hydrogen Generation Market Forecast Value in (2035 F) | USD 62.8 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

The merchant hydrogen generation market is gaining strong momentum due to increasing global emphasis on clean energy solutions, decarbonization goals, and the transition away from traditional fossil fuel sources. The growing need for high purity hydrogen across refining, chemical processing, and mobility applications is shaping commercial production methods.

Technological advancements in reforming and electrolysis processes, coupled with supportive government policies and infrastructure development, are fueling industry expansion. Additionally, rising demand from sectors such as petrochemicals, steel, and electronics is pushing suppliers toward scalable and economically viable hydrogen production models.

Market dynamics are being further influenced by energy security concerns and the need for distributed generation capabilities. With sustainability and energy diversification becoming critical priorities across industries, the merchant model of hydrogen supply is expected to play a pivotal role in supporting downstream applications.

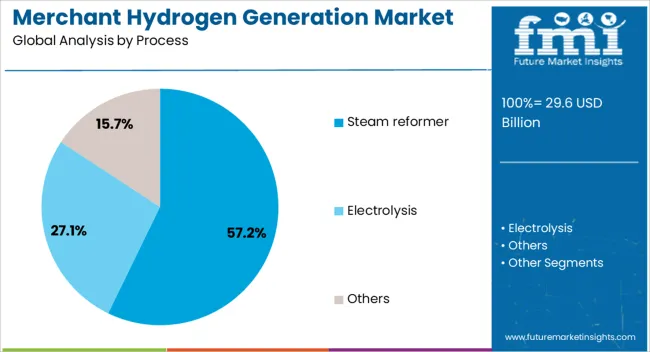

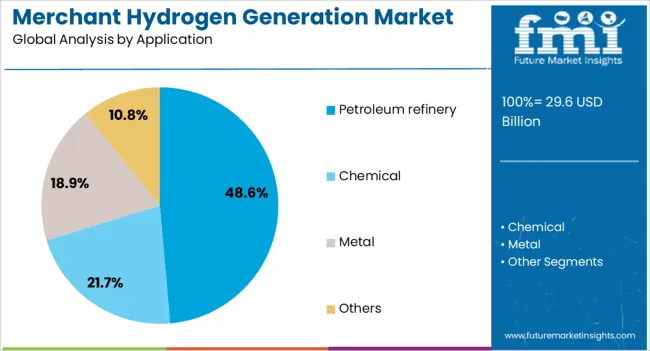

The merchant hydrogen generation market is segmented by process, application, and geographic regions. By process, the merchant hydrogen generation market is divided into Steam reformer, Electrolysis, and Others. In terms of application, the merchant hydrogen generation market is classified into petroleum refining, Chemicals, Metals, and Others.

Regionally, the merchant hydrogen generation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The steam reformer segment is projected to hold 57.20% of total market revenue by 2025 within the process category, establishing it as the dominant segment. This leadership position is attributed to its cost efficiency, high hydrogen yield, and maturity as an industrial process.

Steam reforming of natural gas remains the most widely adopted method for hydrogen production due to its established infrastructure, scalability, and ability to meet large volume demands in industrial settings. The process also benefits from ongoing optimization in catalyst technology and carbon capture integration, which enhances performance while reducing environmental impact.

Its reliability, widespread availability of feedstock, and compatibility with refinery and chemical operations continue to reinforce the steam reformer's stronghold in the merchant hydrogen generation landscape.

The petroleum refinery segment is expected to contribute 48.60% of total market revenue by 2025 under the application category, making it the leading consumer of merchant hydrogen. The dominance of this segment stems from its dependence on hydrogen for desulfurization, hydrocracking, and other refining processes essential for producing low-sulfur fuels.

Rising regulatory pressures around clean fuel standards and emissions reductions are intensifying hydrogen consumption in refineries worldwide. Merchant hydrogen supply offers flexibility and cost advantages to refiners seeking to augment or replace captive production.

As global demand for cleaner transportation fuels increases, the reliance of refineries on externally sourced hydrogen is projected to rise, sustaining this segment's leading position within the market.

The merchant hydrogen generation market is growing due to rising demand for clean energy solutions, supported by regulatory policies and infrastructure development. However, high production costs and infrastructure challenges remain significant barriers to broader adoption.

The merchant hydrogen generation market is driven by rising demand for hydrogen in various industries, including refining, ammonia production, and transportation. As governments and industries seek cleaner alternatives to fossil fuels, hydrogen has gained attention as a low-emission fuel. The growing adoption of hydrogen in fuel cells for electric vehicles and energy storage is further propelling the market's growth. Efforts to decarbonize sectors with heavy emissions, such as steel and cement, are creating a significant demand for merchant hydrogen. Continued investment in hydrogen infrastructure, including pipelines and storage, will also contribute to the market's expansion.

Government policies are playing a crucial role in driving the growth of the merchant hydrogen generation market. Regulations aimed at reducing carbon emissions, such as carbon taxes and emission reduction targets, are encouraging the adoption of hydrogen as a cleaner energy alternative. Many countries are also offering financial incentives and subsidies for hydrogen production projects to meet their energy transition goals. These regulatory frameworks are accelerating investments in hydrogen infrastructure and research into efficient production methods. As more governments commit to carbon neutrality goals, the role of merchant hydrogen generation in the global energy mix will continue to expand.

The merchant hydrogen generation market is highly competitive, with key players such as Air Products and Chemicals, Linde, and Air Liquide leading the charge. These companies are focusing on expanding their hydrogen production capacity and entering new markets. They are adopting cost-effective methods to produce hydrogen from both renewable and non-renewable sources. Smaller companies are also entering the market, focusing on niche applications like hydrogen fueling stations and small-scale production. The competition is intensifying as companies strive to secure long-term contracts with industrial consumers and to establish themselves as leaders in the growing hydrogen economy.

Despite its growth potential, the merchant hydrogen generation market faces several challenges. High production costs remain a major barrier, especially for hydrogen produced through electrolysis and renewable methods. The lack of a widespread infrastructure for hydrogen distribution and storage also hinders market development. The market is challenged by the dominance of traditional fossil fuel-based technologies in many industries. While hydrogen's potential as a clean fuel is well recognized, the market still faces hurdles in scaling up production, reducing costs, and building the necessary infrastructure to make hydrogen widely accessible for commercial use.

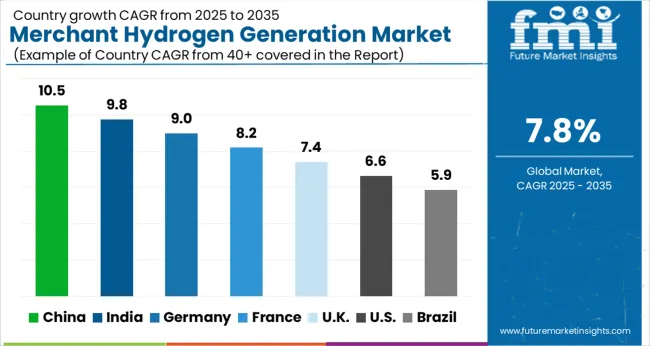

| Countries | CAGR |

|---|---|

| China | 10.5% |

| India | 9.8% |

| Germany | 9.0% |

| France | 8.2% |

| UK | 7.4% |

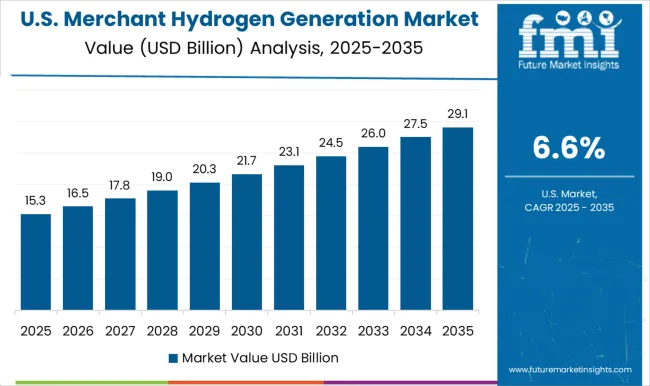

| USA | 6.6% |

| Brazil | 5.9% |

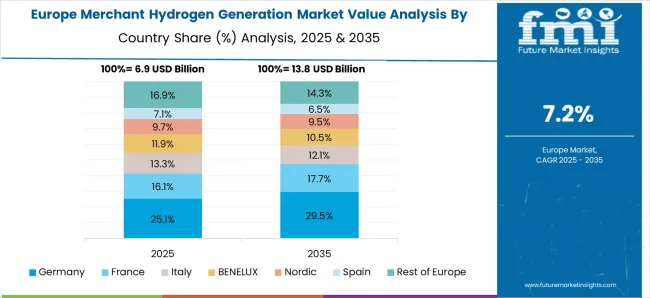

The merchant hydrogen generation market is projected to grow globally at a CAGR of 7.8% from 2025 to 2035, driven by increasing demand for clean and sustainable energy solutions. China leads the market with a CAGR of 10.5%, fueled by large-scale investments in renewable energy, government policies promoting green hydrogen, and industrial decarbonization initiatives. India follows with a 9.8% CAGR, supported by the country’s expanding hydrogen infrastructure and renewable energy adoption. France records a growth of 8.2%, driven by government-backed hydrogen projects in the transport and industrial sectors. The UK maintains a 7.4% CAGR, aided by strong regulatory support for hydrogen energy, while the USA shows steady growth at 6.6%, focusing on hydrogen for energy storage and transportation solutions. This outlook highlights China and India as key drivers in Asia-Pacific, with strong growth in Europe and North America supported by regulatory frameworks and decarbonization goals.

The UK is expected to achieve a CAGR of 7.4% during 2025–2035, slightly below the global average of 7.8%. During 2020–2024, the CAGR for the UK merchant hydrogen generation market was approximately 6.0%, driven by early-stage government support for hydrogen infrastructure and key policy frameworks. The rise in CAGR is attributed to the UK's increasing focus on reducing carbon emissions through hydrogen adoption, expanding hydrogen infrastructure, and government incentives. The market will likely experience stronger growth as hydrogen technologies become more integrated into industrial sectors like transportation, energy storage, and utilities. The UK's regulatory push toward clean hydrogen solutions and growing private sector investments will significantly drive this expansion.

China’s merchant hydrogen generation market is projected to achieve a CAGR of 10.5% during 2025–2035, surpassing the global average of 7.8%. Between 2020–2024, the CAGR was approximately 9.0%, reflecting China’s aggressive push toward renewable energy and its growing hydrogen infrastructure. The rise in CAGR is attributed to government initiatives, such as the National Hydrogen Strategy, and massive investments in hydrogen production technologies. China’s rapid expansion in industrial applications, including fuel cells and energy storage, as well as its push for clean hydrogen in various sectors, positions the country as a leader in the global hydrogen market. With a large domestic market and a booming hydrogen manufacturing industry, China will continue to set the pace for global hydrogen adoption.

India is projected to achieve a CAGR of 9.8% during 2025–2035, a substantial increase from its growth rate of 8.1% during 2020–2024. This rise can be attributed to India's commitment to increasing its renewable energy capacity and decarbonizing industrial sectors. The earlier period saw slower adoption due to initial investment challenges and lower hydrogen infrastructure development. However, with increased global focus on clean energy and a growing demand for hydrogen in transport and energy storage, India’s market for merchant hydrogen generation will see accelerated growth. Government policies, such as the National Hydrogen Mission, and investments in hydrogen infrastructure will further contribute to this rapid expansion.

France is expected to grow at a CAGR of 8.2% during 2025–2035, up from 7.4% during 2020–2024. France’s slower earlier growth is attributed to initial infrastructure challenges and its focus on strengthening the energy transition. However, from 2025 onward, increased government support, coupled with a push toward hydrogen in transportation and industrial applications, will fuel market growth. France’s participation in the European hydrogen strategy and its investment in hydrogen research and development will help expand the market. The country's focus on clean hydrogen as a fuel for heavy industries and transportation is expected to drive growth.

The USA is expected to grow at a CAGR of 6.6% during 2025–2035, up from a CAGR of 5.5% during 2020–2024. The slower growth in the earlier period can be attributed to varying state-level regulations and the dominance of fossil fuels in the energy mix. However, with increasing federal support for renewable hydrogen, the adoption of hydrogen technologies in energy storage, and the expansion of hydrogen fuel cell technologies, the USA market is set to accelerate in the coming years. The USA is also seeing investments in hydrogen infrastructure and projects targeting carbon neutrality, which will drive market expansion.

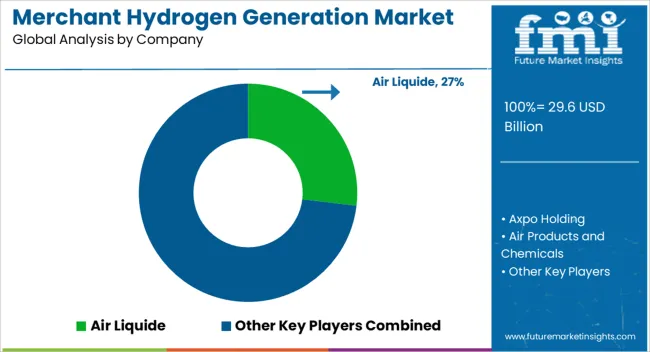

The merchant hydrogen generation market is shaped by global players and specialized firms offering innovative solutions for hydrogen production, storage, and distribution. Air Liquide stands as a leader in the hydrogen market, providing advanced technologies for hydrogen production and fueling infrastructure for industrial and transportation applications.

Air Products and Chemicals also maintains a significant presence, focusing on hydrogen production for both industrial and clean energy uses, with a strong emphasis on fueling infrastructure and hydrogen storage solutions.

Linde is another key player, known for its hydrogen plants and commitment to renewable hydrogen generation through electrolysis and other sustainable methods. Nel Hydrogen specializes in electrolyzer systems and hydrogen fueling solutions, contributing to the growing hydrogen infrastructure for both commercial and industrial sectors. Plug Power focuses on fuel cell systems and hydrogen as a clean energy solution, catering to industries such as transportation, logistics, and energy storage. Messer Group and Coregas also play important roles, supplying hydrogen for industrial use while developing new hydrogen generation methods.

Sumitomo Corporation and TotalEnergies are expanding their hydrogen investments, focusing on large-scale hydrogen production projects. Uniper is actively pursuing hydrogen as part of its decarbonization strategy, aiming to deliver clean energy solutions.

Key competitive strategies in this market include the development of efficient hydrogen production methods, strategic partnerships for infrastructure expansion, and the growing focus on green hydrogen. Companies are investing in the development of improved hydrogen generation technologies to meet the growing demand for clean energy solutions and to play a crucial role in decarbonizing industrial processes and transportation.

| Item | Value |

|---|---|

| Quantitative Units | USD 29.6 Billion |

| Process | Steam reformer, Electrolysis, and Others |

| Application | Petroleum refinery, Chemical, Metal, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Liquide, Axpo Holding, Air Products and Chemicals, Cummins, Coregas, Linde, Messer Group, Nel Hydrogen, Plug Power, Sumitomo Corporation, TotalEnergies, and Uniper |

| Additional Attributes | Dollar sales projections, market share across regions, competitive landscape, key drivers like government policies, demand from industrial sectors, and adoption rates of green hydrogen. |

The global merchant hydrogen generation market is estimated to be valued at USD 29.6 billion in 2025.

The market size for the merchant hydrogen generation market is projected to reach USD 62.8 billion by 2035.

The merchant hydrogen generation market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in merchant hydrogen generation market are steam reformer, electrolysis and others.

In terms of application, petroleum refinery segment to command 48.6% share in the merchant hydrogen generation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chemical Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Electrolysis Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Merchant Banking Services Market Size and Share Forecast Outlook 2025 to 2035

Nuclear Powered Merchant Vessel Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Hydrogen Detection Market Forecast Outlook 2025 to 2035

Hydrogenated Dimer Acid Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fluoride Gas Detection Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks and Transportation Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Refueling Station Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Peroxide Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fuel Cell Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Generator Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Combustion Engine Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA