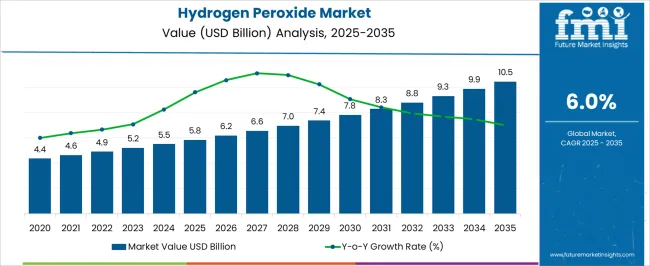

The hydrogen peroxide market, estimated at USD 5.8 billion in 2025 and projected to reach USD 10.5 billion by 2035 at a CAGR of 6.0%, exhibits notable regional growth imbalances driven by industrial demand, production capacity, and regulatory landscapes. Asia-Pacific is anticipated to dominate the market owing to the rapid expansion of end-use sectors such as pulp and paper, textiles, and chemicals. China, India, and Southeast Asian countries are witnessing increased production of hydrogen peroxide for bleaching and oxidation processes, supported by government initiatives to enhance chemical manufacturing infrastructure.

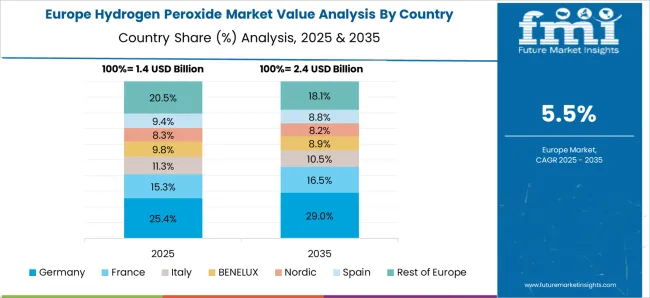

The region’s relatively lower production costs and favorable energy availability contribute to its accelerated adoption and consumption compared with other regions. Europe presents steady growth, underpinned by stringent environmental regulations that encourage the use of hydrogen peroxide as a green oxidizing agent in pulp bleaching, wastewater treatment, and chemical synthesis. Countries such as Germany, France, and Italy are emphasizing sustainable chemical practices, which creates demand stability but moderates rapid expansion due to high compliance costs and mature industrial infrastructure.

North America shows moderate growth relative to Asia-Pacific, driven by established chemical and paper industries in the United States and Canada. While technological advancements in production efficiency and process integration contribute to market expansion, slower industrial growth and stringent regulatory compliance slightly temper adoption rates. The regional demand imbalances reflect Asia-Pacific’s rapid industrialization and cost advantages, Europe’s regulation-driven stable demand, and North America’s steady but mature market trajectory, shaping a heterogeneous global growth landscape.

| Metric | Value |

|---|---|

| Hydrogen Peroxide Market Estimated Value in (2025 E) | USD 5.8 billion |

| Hydrogen Peroxide Market Forecast Value in (2035 F) | USD 10.5 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The hydrogen peroxide market represents a specialized segment within the industrial chemicals and oxidation agents’ industry, emphasizing bleaching, disinfecting, and environmental applications. Within the overall oxidizing chemicals market, it accounts for about 6.2%, driven by demand from pulp and paper, textiles, and wastewater treatment sectors. In the pulp and paper bleaching segment, it holds nearly 7.1%, reflecting its efficiency in producing high-quality, environmentally compliant paper products. Across the personal care and cleaning products market, the segment captures 4.5%, supporting disinfectants, oral care, and household cleaners. Within the chemical processing and synthesis category, it represents 3.8%, highlighting its role in epoxidation and oxidation reactions.

In the environmental and water treatment solutions sector, it secures 4.1%, emphasizing use in effluent treatment, odor control, and remediation applications. Recent developments in this market have focused on concentration optimization, process efficiency, and sustainability. Innovations include stabilized formulations, high purity grades, and advanced catalytic processes for on-site generation. Key players are collaborating with industrial users to enhance dosing control, safety, and operational efficiency.

Hydrogen peroxide based advanced oxidation processes are gaining traction in wastewater treatment, improving pollutant degradation and regulatory compliance. The integration with eco-friendly and green chemistry initiatives is increasing, including hydrogen peroxide in textile bleaching, pulp processing, and chemical synthesis to reduce environmental impact. These trends demonstrate how performance enhancement, safety, and environmental compliance are shaping the hydrogen peroxide market.

Industry updates and company press releases highlight growing consumption in both industrial and specialty applications due to its efficiency, cost-effectiveness, and environmentally benign decomposition byproducts.

Stringent regulations promoting sustainable and non-toxic chemicals have further strengthened its market position. Manufacturers are also focusing on high-purity grades and tailored formulations to meet end-user specifications in healthcare, food processing, and electronics manufacturing.

Technological advancements in production processes are improving yield efficiency and reducing operational costs, making hydrogen peroxide more competitive. With industries increasingly seeking sustainable chemical solutions, demand is expected to remain strong, particularly in sectors emphasizing hygiene, environmental compliance, and high-performance oxidation processes.

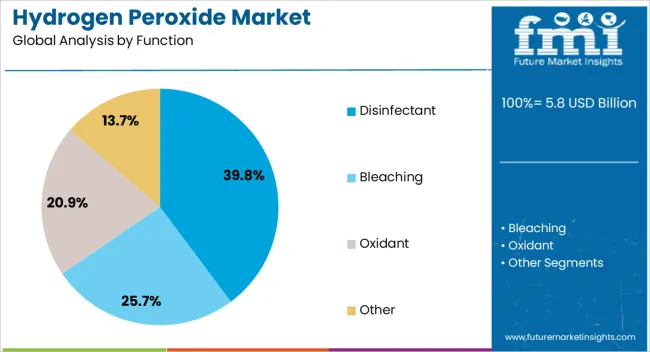

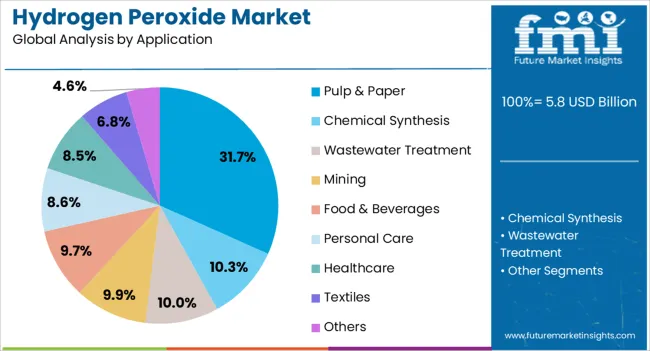

The hydrogen peroxide market is segmented by function, application, and geographic regions. By function, hydrogen peroxide market is divided into Disinfectant, Bleaching, Oxidant, and Other. In terms of application, hydrogen peroxide market is classified into Pulp & Paper, Chemical Synthesis, Wastewater Treatment, Mining, Food & Beverages, Personal Care, Healthcare, Textiles, and Others. Regionally, the hydrogen peroxide industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Disinfectant segment is projected to account for 39.8% of the hydrogen peroxide market revenue in 2025, maintaining its lead as the dominant functional application. This growth is driven by hydrogen peroxide’s effectiveness as a broad-spectrum antimicrobial agent that leaves no toxic residue, making it suitable for healthcare, food processing, and sanitation uses.

The compound’s strong oxidizing capability enables effective surface disinfection, water treatment, and sterilization processes. Global public health initiatives and heightened hygiene awareness have accelerated its adoption, particularly in high-touch and high-risk environments.

Additionally, its compatibility with eco-friendly cleaning protocols has made it a preferred alternative to chlorine-based disinfectants. As industries continue to adopt stricter safety and hygiene standards, the Disinfectant segment is expected to sustain its leadership in functional applications.

The Pulp & Paper segment is projected to contribute 31.7% of the hydrogen peroxide market revenue in 2025, holding its place as the leading industrial application. The segment’s strength stems from hydrogen peroxide’s widespread use as a bleaching agent in paper manufacturing, where it delivers high brightness levels while minimizing environmental impact compared to chlorine-based chemicals.

Industry reports note that mills favor hydrogen peroxide for its ability to improve pulp quality, reduce chemical oxygen demand (COD) in effluents, and comply with stringent environmental regulations.

Its versatility allows for use in both mechanical and chemical pulping processes, supporting diverse paper product outputs. Growing demand for recycled paper and sustainable production methods has also reinforced the segment’s expansion. With the paper industry investing in greener technologies and higher-quality output, the Pulp & Paper segment is expected to remain a primary driver of hydrogen peroxide consumption.

The market has been expanding steadily due to its versatile applications across industrial, healthcare, and consumer sectors. It is widely used as a bleaching agent in paper, pulp, and textile industries, as well as in chemical synthesis, water treatment, and sanitation processes. The increasing demand for eco-friendly oxidizing agents has positioned hydrogen peroxide as a preferred alternative to chlorine-based chemicals, owing to its rapid decomposition into water and oxygen. Growth is also driven by rising hygiene awareness, especially in hospitals, laboratories, and food processing units. Technological advancements in high-purity production and stabilized formulations have enhanced efficiency and storage stability.

Hydrogen peroxide has become a crucial oxidizing agent in industrial applications due to its efficiency and environmentally friendly profile. In the pulp and paper industry, it is used extensively for bleaching processes, providing high whiteness without introducing harmful chlorinated compounds. In textiles, it serves as a bleaching and disinfecting agent, ensuring color accuracy and hygiene. The chemical industry leverages hydrogen peroxide for epoxidation reactions, peroxide-mediated syntheses, and intermediate production in fine chemicals. Water and wastewater treatment facilities increasingly use hydrogen peroxide for disinfection and contaminant degradation, replacing conventional chemicals. Growing demand in industrial cleaning, electronics manufacturing, and chemical processing has further expanded its market footprint. The combination of versatility, eco-friendliness, and regulatory acceptance has reinforced industrial sectors as significant consumers of hydrogen peroxide.

The healthcare and sanitation sectors have become major consumers of hydrogen peroxide due to its disinfectant and antiseptic properties. Hospitals, clinics, and laboratories use it for surface sterilization, medical instrument cleaning, and wound care. In the pharmaceutical industry, hydrogen peroxide acts as an oxidizing agent in drug synthesis and as a sterilizing medium for packaging. The food and beverage industry applies hydrogen peroxide for aseptic packaging, cleaning, and microbial control. Rising awareness of hygiene and stringent regulations on microbial contamination have increased the demand for hydrogen peroxide-based sanitation products. Its decomposition into harmless byproducts makes it ideal for applications requiring safety and environmental compliance. Consequently, the healthcare and sanitation sectors are expected to sustain steady consumption, significantly contributing to overall market growth.

Technological developments have improved production efficiency, storage stability, and applicability of hydrogen peroxide. Advanced catalytic processes, membrane-based purification, and stabilized formulations have increased yield, concentration control, and shelf-life. Innovations in high-purity hydrogen peroxide enable its use in sensitive applications such as semiconductor cleaning, electronics fabrication, and specialty chemical synthesis. Stabilization techniques and improved packaging materials have reduced decomposition risks during transportation and storage. Additionally, research into microreactor-based production and continuous processing systems has optimized operational efficiency and reduced energy consumption. These advancements have strengthened hydrogen peroxide’s position as a reliable, high-performance oxidizing agent across industries. Enhanced efficiency, safety, and versatility are driving adoption in both traditional and emerging applications, expanding market opportunities globally.

Despite its widespread use, the hydrogen peroxide market faces challenges from regulatory frameworks, safety considerations, and storage constraints. As a strong oxidizer, it poses risks of corrosion, explosion, and health hazards, requiring strict handling, labeling, and transport compliance. Regional regulations dictate maximum permissible concentrations for commercial and industrial use, influencing packaging and formulation strategies. Fluctuating raw material prices, including hydrogen and oxygen sources, can affect production costs and market pricing. Additionally, market participants must ensure compliance with environmental standards for discharge and disposal in chemical processes. Balancing regulatory requirements, safety protocols, and operational efficiency remains a critical factor for manufacturers, ensuring sustainable growth while maintaining product quality and market reliability.

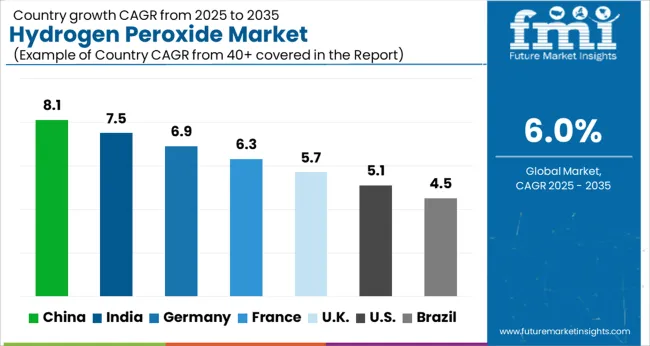

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

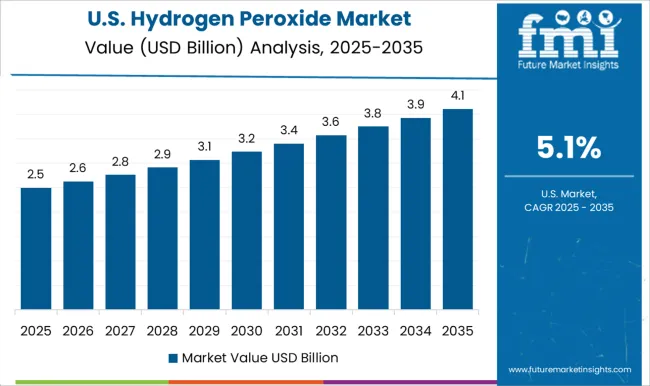

| USA | 5.1% |

| Brazil | 4.5% |

China leads the market with a forecast growth rate of 8.1%, supported by its extensive use in chemical processing, paper bleaching, and environmental applications. India follows at 7.5%, where rising industrial demand and expanding manufacturing capacities contribute to steady growth. Germany records 6.9%, driven by adoption in pharmaceuticals, textiles, and sustainable chemical processes. The United Kingdom reaches 5.7%, supported by research and implementation in industrial and environmental sectors. The United States maintains 5.1%, with consistent usage across manufacturing, healthcare, and water treatment applications. Together, these countries represent a diversified landscape of production, deployment, and technological integration shaping the global hydrogen peroxide market. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to expand at a CAGR of 8.1%, driven by rising demand across paper and pulp, textile, and chemical processing industries. Industrial players are increasingly adopting hydrogen peroxide for bleaching, oxidation, and wastewater treatment applications. Growth is supported by rapid industrialization and rising emphasis on cleaner chemical alternatives. The chemical is also gaining traction in healthcare and hygiene sectors for sterilization and disinfection purposes. Investments in modern manufacturing plants and advancements in production technologies are enhancing capacity and efficiency. China’s focus on sustainable and environmentally friendly chemicals is contributing to steady demand across multiple industries.

India is expected to grow at a CAGR of 7.5%, supported by increasing applications in textiles, paper, and chemical manufacturing. Demand is also rising in the healthcare sector for disinfection and sterilization purposes. Indian manufacturers are implementing modern production processes to improve output and maintain quality standards. Expansion of industrial clusters and increasing regulatory focus on eco-friendly chemicals are encouraging adoption. Hydrogen peroxide is also used in water treatment plants to enhance water quality. The growing focus on sustainable industrial operations and hygiene standards across commercial and industrial facilities is driving the market.

Germany is anticipated to grow at a CAGR of 6.9%, propelled by industrial modernization and rising adoption in chemical and pulp & paper sectors. Emphasis on green chemical alternatives and low environmental impact processes is increasing the preference for hydrogen peroxide. The market is driven by demand in healthcare, personal care, and water treatment applications. German manufacturers are incorporating advanced production technologies to meet stringent quality and safety standards. Expansion in industrial automation and sustainable production methods further supports market growth. Government regulations promoting eco-friendly chemicals are also creating opportunities for market players.

The market in the United Kingdom is projected to grow at a CAGR of 5.7%, supported by rising demand across healthcare, chemical processing, and paper manufacturing industries. Increasing use in disinfection, sterilization, and water treatment applications is driving market adoption. Manufacturers are leveraging innovative production processes to improve efficiency and reduce environmental impact. Government regulations favoring eco-friendly chemicals and sustainable operations are encouraging market penetration. Industrial and commercial sectors are increasingly adopting hydrogen peroxide to enhance productivity and maintain compliance with hygiene and environmental standards. Growing awareness of environmentally safe bleaching and oxidation alternatives further boosts demand.

The United States is expected to expand at a CAGR of 5.1%, supported by demand in chemical, pulp & paper, and textile industries. Increased applications in sterilization, healthcare, and water treatment are boosting market growth. Manufacturers are adopting advanced technologies to improve production efficiency and ensure consistent quality. The market benefits from initiatives promoting sustainable and environmentally friendly chemical alternatives. Industrial players are leveraging hydrogen peroxide to enhance energy efficiency and reduce chemical waste. Focus on compliance with environmental standards, along with rising awareness of green chemicals, is encouraging adoption across multiple industrial and commercial sectors.

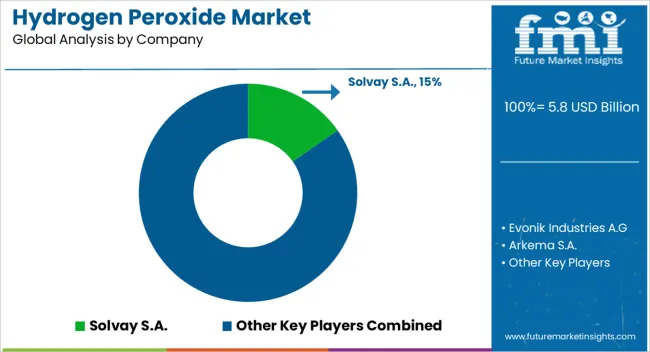

The market is witnessing substantial growth driven by its versatile applications in chemical synthesis, pulp and paper bleaching, water treatment, and healthcare sectors. Solvay S.A. and Evonik Industries A.G. are key global players, offering high-purity and stabilized hydrogen peroxide products suitable for industrial and laboratory applications. Arkema S.A. and Mitsubishi Gas Chemical Company Inc. provide tailored solutions focusing on environmentally friendly processes and high efficiency, meeting stringent regulatory standards across different markets.

Kemira Oyj and Merck supply hydrogen peroxide with specialized formulations for water treatment and pharmaceutical applications, ensuring consistent quality and safety compliance. Tokyo Chemical Industries, Taekwang Industrial Co., Ltd., and Hansol Chemical Co. Ltd. focus on regional manufacturing and distribution, ensuring reliable supply chains in Asia and other emerging markets. OCI COMPANY Ltd., Nouryon, Thai Peroxide Ltd., and Indian Peroxide Ltd. offer a range of grades suitable for industrial bleaching, sanitation, and chemical synthesis purposes. These providers are advancing hydrogen peroxide production technologies, promoting sustainable and energy-efficient processes, while expanding accessibility across diverse industrial and consumer applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.8 Billion |

| Function | Disinfectant, Bleaching, Oxidant, and Other |

| Application | Pulp & Paper, Chemical Synthesis, Wastewater Treatment, Mining, Food & Beverages, Personal Care, Healthcare, Textiles, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Solvay S.A., Evonik Industries A.G, Arkema S.A., Mitsubishi Gas Chemical Company Inc., Kemira Oyj, Merck, Tokyo Chemical Industries, Taekwang Industrial Co., Ltd., Thai Peroxide Ltd, Hansol Chemical Co. Ltd., OCI COMPANY Ltd., Nouryon, and Indian Peroxide Ltd. |

| Additional Attributes | Dollar sales by concentration and application, demand dynamics across healthcare, chemical, and industrial sectors, regional trends in oxidizer adoption, innovation in stability, formulation, and packaging, environmental impact of production and wastewater management, and emerging use cases in disinfection, bleaching, and green chemical processes. |

The global hydrogen peroxide market is estimated to be valued at USD 5.8 billion in 2025.

The market size for the hydrogen peroxide market is projected to reach USD 10.5 billion by 2035.

The hydrogen peroxide market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in hydrogen peroxide market are disinfectant, bleaching, oxidant and other.

In terms of application, pulp & paper segment to command 31.7% share in the hydrogen peroxide market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Hydrogen Peroxide Market

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Hydrogen Detection Market Forecast Outlook 2025 to 2035

Hydrogenated Dimer Acid Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fluoride Gas Detection Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks and Transportation Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Refueling Station Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fuel Cell Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Generator Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Combustion Engine Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Hubs Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Buses Market Growth – Trends & Forecast 2025 to 2035

Hydrogen Truck Market Growth – Trends & Forecast 2024 to 2034

Hydrogen Fueling Station Market Growth – Trends & Forecast 2024-2034

Hydrogenerators Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA