The hydrogen detection market is expanding steadily as hydrogen gains prominence as a clean energy carrier and industrial feedstock. Growing emphasis on safety across hydrogen production, storage, and transportation facilities is driving widespread deployment of detection systems. Market demand is being shaped by the global energy transition, government-led initiatives supporting hydrogen infrastructure, and increased investment in fuel cell technologies.

Manufacturers are focusing on enhancing sensor accuracy, durability, and response time to ensure reliability in high-risk environments. Integration of smart and connected detection systems is further improving real-time monitoring and predictive maintenance capabilities.

The future outlook remains positive as industrial decarbonization, automotive electrification, and renewable hydrogen projects continue to scale Growth rationale is underpinned by the need for precise leak detection to ensure operational safety, compliance with stringent regulatory frameworks, and technological advancements that enhance sensor sensitivity and stability, collectively driving consistent market adoption across industrial and commercial sectors.

| Metric | Value |

|---|---|

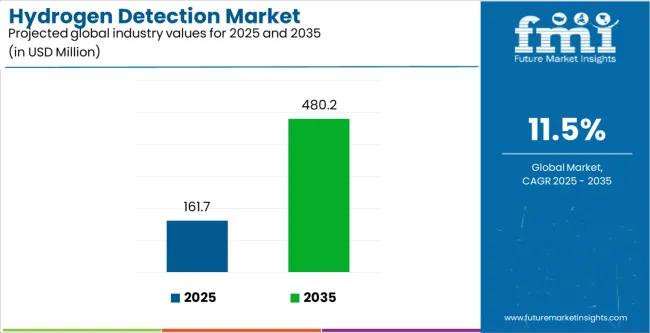

| Hydrogen Detection Market Estimated Value in (2025 E) | USD 161.7 million |

| Hydrogen Detection Market Forecast Value in (2035 F) | USD 480.2 million |

| Forecast CAGR (2025 to 2035) | 11.5% |

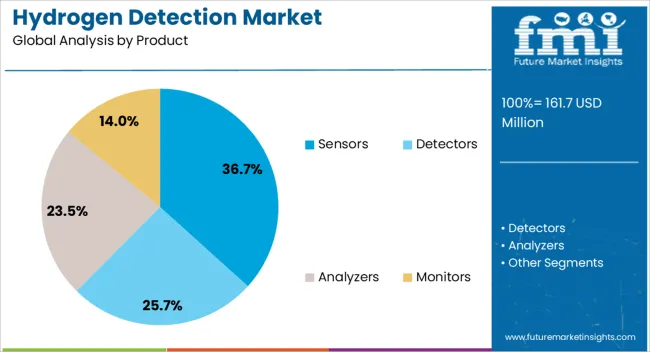

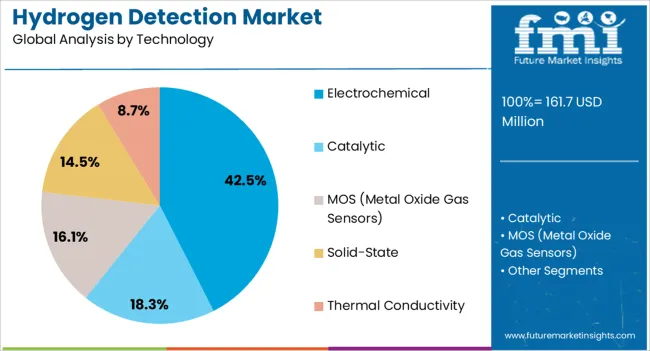

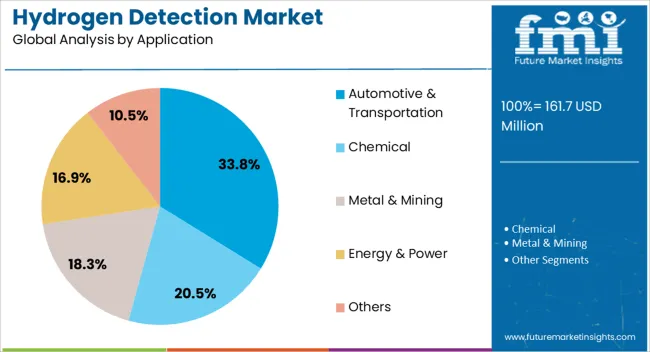

The market is segmented by Product, Technology, Application, Implementation, and Detection Range and region. By Product, the market is divided into Sensors, Detectors, Analyzers, and Monitors. In terms of Technology, the market is classified into Electrochemical, Catalytic, MOS (Metal Oxide Gas Sensors), Solid-State, and Thermal Conductivity. Based on Application, the market is segmented into Automotive & Transportation, Chemical, Metal & Mining, Energy & Power, and Others. By Implementation, the market is divided into Fixed and Portable. By Detection Range, the market is segmented into 0-1000 PPM, 0-5000 PPM, 0-20000 PPM, and > 0-20000 PPM. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

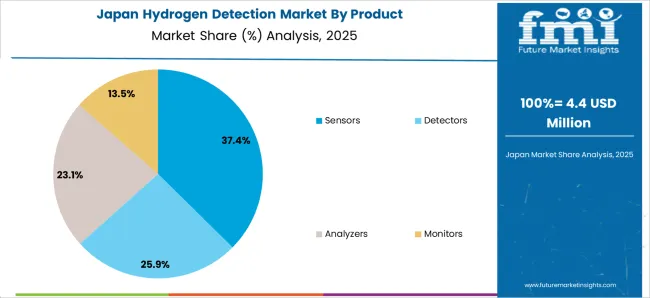

The sensors segment, accounting for 36.70% of the product category, has maintained its dominance due to its crucial role in continuous monitoring and early leak detection across hydrogen infrastructure. Its widespread use in manufacturing facilities, storage units, and fuel stations has supported sustained demand.

The segment’s performance is being reinforced by advancements in miniaturization and sensor response time, ensuring greater accuracy and reduced maintenance needs. Integration with IoT-based systems has enabled real-time detection and data analytics, improving safety management.

Manufacturers are prioritizing the development of cost-effective, durable, and high-sensitivity sensors to meet industrial standards and regulatory requirements Continued investments in hydrogen refueling infrastructure and the adoption of fuel cell vehicles are expected to sustain the segment’s market leadership and drive further technological progress.

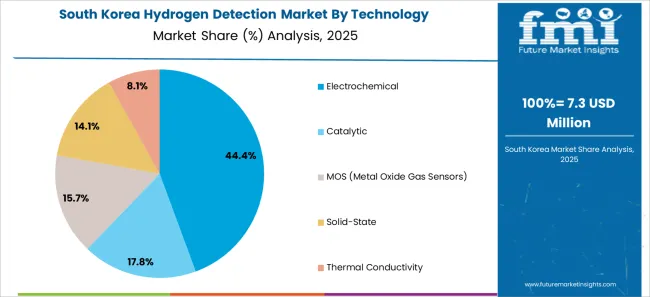

The electrochemical technology segment, holding 42.50% of the technology category, has emerged as the leading approach due to its high sensitivity and selectivity for hydrogen gas detection. This technology is favored for its low power consumption, stability, and ability to deliver precise readings in both industrial and environmental conditions.

Market growth is being driven by its integration into portable detectors and fixed monitoring systems used across energy, manufacturing, and transportation sectors. Advances in electrode materials and sensor calibration methods have improved performance and reduced response time.

The segment’s prominence is further supported by its scalability for large installations and compliance with global safety standards Increasing adoption of electrochemical sensors in renewable hydrogen projects and energy storage systems is expected to reinforce its dominant position throughout the forecast period.

The automotive and transportation segment, representing 33.80% of the application category, has secured its leading position due to the expanding adoption of hydrogen fuel cell vehicles and refueling networks. The segment’s growth is being propelled by government initiatives promoting zero-emission mobility and stringent safety norms governing hydrogen handling and storage.

Continuous monitoring for leak prevention within vehicles and refueling stations has elevated the use of detection systems across this sector. Manufacturers are integrating advanced hydrogen detection modules into onboard safety systems to enhance vehicle reliability and passenger protection.

Increasing investment in public and commercial hydrogen mobility infrastructure, coupled with growing fuel cell bus and truck deployments, is expected to sustain the segment’s market share and support long-term growth in alignment with global clean energy transportation goals.

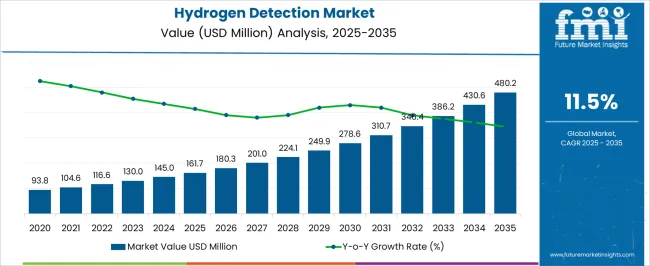

The hydrogen detection market generated an estimated revenue of USD 93.8 million in 2020. In four years, the market grew at a pace of 13.50% CAGR and added revenue of USD 1125.30 million. Several reasons can be attributed to this growth:

The hydrogen detection market is anticipated to surpass a valuation of USD 480.2 million by 2035, growing at a CAGR of 11.50% over the forecast period. While the market is expected to experience remarkable growth, several factors could adversely affect its development:

Depending on the product, the hydrogen detection market is bifurcated into sensors, detectors, analyzers, and monitors. The sensors segment is anticipated to grow at a CAGR of 11.30% through 2035

| Attributes | Details |

|---|---|

| Top Product | Sensors |

| CAGR (2025 to 2035) | 11.30% |

The hydrogen detection market is categorized by technology into catalytic, electrochemical, MOS, solid-state, and thermal conductivity. The catalytic segment dominates the market and is anticipated to grow at a CAGR of 11.1% through 2035.

| Attributes | Details |

|---|---|

| Top Technology | Catalytic |

| CAGR (2025 to 2035) | 11.1% |

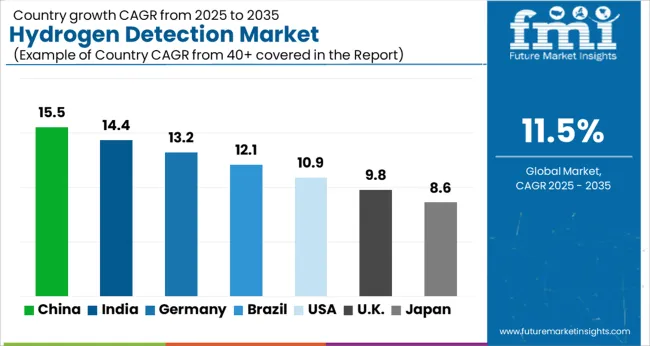

The section provides an analysis of the market in major economies, including India, China, China, Germany and the United States. The table presents the CAGRs for each country through 2035.

Japan dominates the hydrogen detection market and it is anticipated to grow at a CAGR of 12.80% through 2035.

South Korea is also one of the leading countries in the hydrogen detection market. The Korean market for hydrogen detections is anticipated to grow at a CAGR of 12.60% over the forecast period.

Over the next ten years, the United Kingdom's demand for hydrogen detections is projected to rise at a 12.10% CAGR through 2035.

The Chinese hydrogen detection market is anticipated to retain its dominance by progressing at a CAGR of 11.80% through 2035.

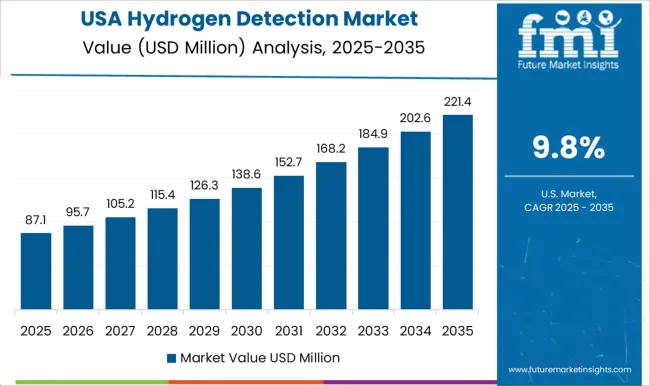

The United States also dominates the hydrogen detection market. The United States hydrogen detection market is anticipated to retain its dominance by progressing at a CAGR of 11.60% until 2035.

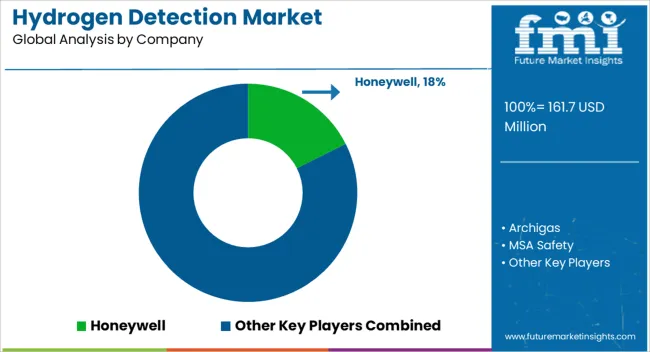

The hydrogen detection market comprises international as well as domestic players that cater to factory units and production settings across a broad spectrum of industries. Some of the most prominent companies in the hydrogen detection market are MSA Safety Incorporated, Drägerwerk AG & Co. KGaA, Honeywell International Inc., RAE Systems Inc., Emerson Electric Co., etc.

These companies have made a good reputation in the global marketplace by offering qualitative solutions to their consumers. To make their offerings more sustainable, these companies are also investing in greener methodologies, right from manufacturing to the final delivery of hydrogen detection equipment to their consumers.

Recent Developments

The global hydrogen detection market is estimated to be valued at USD 161.7 million in 2025.

The market size for the hydrogen detection market is projected to reach USD 480.2 million by 2035.

The hydrogen detection market is expected to grow at a 11.5% CAGR between 2025 and 2035.

The key product types in hydrogen detection market are sensors, detectors, analyzers and monitors.

In terms of technology, electrochemical segment to command 42.5% share in the hydrogen detection market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydrogen Fluoride Gas Detection Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Hydrogenated Dimer Acid Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks and Transportation Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Refueling Station Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Peroxide Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fuel Cell Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Generator Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Combustion Engine Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Hubs Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Buses Market Growth – Trends & Forecast 2025 to 2035

Hydrogen Truck Market Growth – Trends & Forecast 2024 to 2034

Hydrogen Fueling Station Market Growth – Trends & Forecast 2024-2034

Hydrogenated Palm Oil Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA