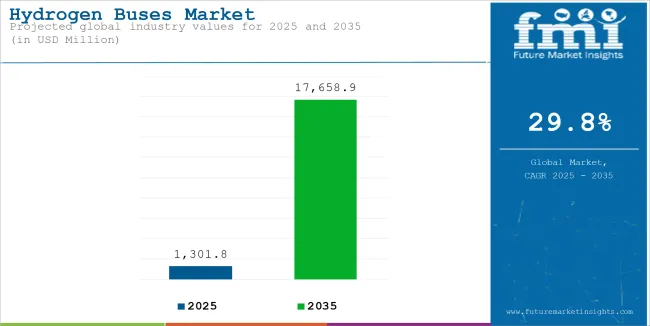

The global hydrogen buses market size is estimated to reach a value of USD 1,037.1 million in 2024. With a strong year-on-year growth projected at 25.5%, the market is expected to grow to USD 1,301.8 million in 2025. This market is expected to record a compound annual growth rate (CAGR) of 29.8% from 2025 to 2035, achieving a market size of USD 17,658.9 million by the end of 2035.

The Hydrogen Buses Market encompasses the global industry involved in the design, manufacturing, distribution, and servicing of buses powered by hydrogen fuel cells. These types of buses are mainly for public passenger transportation within the cities and in the countryside, with the buses offering a zero-emission alternative to diesel and gas powered vehicles.

The hydrogen fuel cell powered buses are rapidly gaining attention as a possible solution to the pollution and environmental challenges faced by heavily populated urban areas.

These buses have the advantages of long driving distances, quick refueling time, and high passenger capacity, making them ideal for high-volume public transport. While governments and cities aim to cut down carbon emissions, hydrogen buses are actively being included in their sustainable transportation solutions.

The hydrogen fuel cell technology is emerging as the fuel of choice in the ‘post diesel’ era for long distance heavy-duty truck transport according to the strategic marketing plans of most truck makers.

A few players like MAN appear to have a different viewpoint today, but the overall movement of the market indicates support for hydrogen in long range transport Around 74% of the coaches in the EMEA region are expected to be non-electrified by 2030, meaning that hydrogen or electric alternatives will not gain traction in this segment until there are pilot projects, targets, and action plans in place for it.

| Attributes | Details |

|---|---|

| Estimated Size (2025) | USD 1,301.8 million |

| Projected Value (2035) | USD 17,658.9 million |

| Value-based CAGR (2025 to 2035) | 29.8% |

The demand for hydrogen buses is expected to grow by 13.6 times its current level by 2035 due to stringent emission regulations, infrastructure expansion, and advancements in hydrogen technology. Governments worldwide are enforcing stricter emission norms, phasing out diesel buses to achieve net-zero carbon targets.

For instance, the European Union’s “Fit for 55” package mandates that all new city buses must be zero-emission by 2030, accelerating hydrogen bus adoption.

With the greatest fleet of hydrogen fuel cell vehicles, China has an official goal of deploying 50,000 hydrogen fuel cell buses by 2035. Ensuring even more adoption of them is through improvements in fuel cell efficiency and green hydrogen production, which significantly increase competitiveness over battery-electric buses by lowering operational costs.

As with the order of 10 Rampini fuel cell buses in July 2024, cities like Vienna are switching to hydrogen buses for their longer ranges and faster refueling times

The table below presents the annual growth rates of the global hydrogen buses industry from 2025 to 2035. With a base year of 2024 extending to the current year 2025, the report examines how the sector's growth trajectory evolves from the first half of the year (January to June, H1) to the second half (July to December, H2).

This analysis offers stakeholders insights into the industry's performance over time, highlighting potential developments that may emerge.

These figures indicate the growth of the sector in each half year, between the years 2024 and 2034. The industry is expected to grow at a CAGR of 25.1% in H1-2024. In H2, the growth rate increases.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 25.1% (2024 to 2034) |

| H2 2024 | 28.3% (2024 to 2034) |

| H1 2025 | 28.1% (2025 to 2035) |

| H2 2025 | 31.4% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2025, the CAGR is projected to slightly decrease to 28.1% in the first half and relatively increase to 31.4% in the second half. In the first half (H1), the sector saw an increase of 300 BPS while in the second half (H2), there was a slight increase of 310 BPS.

The expansion of hydrogen refueling infrastructure is a key driver in the large-scale adoption of hydrogen buses

The expansion of hydrogen refueling infrastructure is a key driver in the large-scale adoption of hydrogen buses, making them a practical alternative to conventional diesel buses. Countries like Japan, Germany, and South Korea are investing heavily in hydrogen fueling stations, ensuring a reliable supply chain for hydrogen-powered public transport.

Germany market leads Europe’s hydrogen infrastructure development with the H2 Mobility initiative, aiming to establish 400 hydrogen refueling stations by 2025. Berlin and Hamburg have already deployed hydrogen buses with dedicated fueling stations, significantly reducing downtime.

Similarly, Japan’s Green Growth Strategy aims to install 1,000 hydrogen stations by 2030, supporting the mass deployment of hydrogen fuel cell vehicles, including buses.

In North America, the USA Department of Energy’s Hydrogen Fuel Initiative has provided substantial funding to expand hydrogen fueling networks, particularly in California.

The California Energy Commission has allocated over USD 200 million to build and maintain hydrogen stations, benefiting transit agencies such as AC Transit in Oakland, which operates a growing fleet of hydrogen buses.

South Korea has also launched a nationwide hydrogen fueling network, with the government targeting 310 hydrogen refueling stations by 2025.

Cities like Seoul and Busan have introduced hydrogen-powered public transportation, supported by this infrastructure expansion. Meanwhile, China’s National Hydrogen Strategy includes the construction of 1,000 hydrogen refueling stations by 2030, ensuring widespread hydrogen bus deployment.

Governments globally are implementing stringent emission regulations to reduce carbon footprints

Governments globally are implementing stringent emission regulations to reduce carbon footprints and improve air quality, leading to the rapid adoption of hydrogen buses.

The European Union’s “Fit for 55” package requires all new city buses to be zero-emission by 2030, compelling transit operators to transition from diesel to alternative fuel solutions like hydrogen. This regulatory push aligns with Europe’s broader climate neutrality goal by 2050.

China has also set ambitious hydrogen mobility goals, aiming for 50,000 hydrogen fuel cell buses on the road by 2035 as part of its Hydrogen Industry Development Plan.

Cities like Beijing and Shanghai are already rolling out hydrogen-powered fleets to meet emission reduction targets. Similarly, the United States is promoting hydrogen buses through initiatives like the Federal Transit Administration’s (FTA) Low or No Emission Vehicle Program, which funds state and local governments to procure hydrogen fuel cell buses.

Apart from national-level initiatives, local governments are enforcing low-emission zones that prohibit diesel buses from entering city centers. London, for instance, introduced the Ultra-Low Emission Zone (ULEZ) to reduce urban pollution, resulting in a significant increase in hydrogen and battery-electric bus fleets. Likewise, South Korea’s Green New Deal mandates phasing out diesel buses in favor of hydrogen models to achieve carbon neutrality by 2050.

Continuous technological advancements in hydrogen fuel cells are significantly improving their efficiency, durability, and cost-effectiveness

Continuous technological advancements in hydrogen fuel cells are significantly improving their efficiency, durability, and cost-effectiveness, making hydrogen buses a more attractive option for public transit. Innovations in proton exchange membrane (PEM) fuel cells, which offer higher energy efficiency and lower operating costs, have accelerated the commercial viability of hydrogen buses.

Toyota’s second-generation fuel cell system, used in the Sora hydrogen bus, provides enhanced power output while reducing fuel consumption. Similarly, Ballard Power Systems has introduced next-generation fuel cell stacks with longer lifespans and improved efficiency, making hydrogen buses more cost-competitive.

Green hydrogen production advancements have also contributed to lower fuel costs. Electrolysis-based hydrogen production, powered by renewable energy, is becoming more widespread, reducing reliance on fossil-fuel-derived hydrogen. Countries like Australia and Germany are investing in large-scale green hydrogen projects to support sustainable hydrogen bus operations.

Operational benefits are also driving adoption. Vienna’s public transit authority replaced 12 battery-electric buses with 10 hydrogen-powered Rampini buses in July 2024, citing faster refueling times and lower fleet requirements. Unlike battery-electric buses, which require overnight charging infrastructure, hydrogen buses can refuel within minutes, ensuring high-frequency operations.

Government incentives and public-private collaborations are playing a crucial role in scaling up hydrogen bus adoption

Government incentives and public-private collaborations are playing a crucial role in scaling up hydrogen bus adoption. Many countries are offering subsidies, tax benefits, and grants to transit agencies for procuring hydrogen buses and developing the necessary infrastructure.

The European Union’s Clean Hydrogen Partnership has allocated €2 billion to hydrogen-related projects, with a focus on fuel cell buses. Germany’s National Hydrogen Strategy provides direct subsidies to public transit operators for purchasing hydrogen buses, covering up to 80% of the additional costs compared to diesel alternatives. Similarly, the UK’s Hydrogen Transport Program offers financial assistance to cities transitioning to hydrogen-powered public transport.

In China, the central government provides up to USD 65,000 in subsidies per hydrogen bus, with additional incentives from regional governments. The city of Foshan, a hydrogen hub, offers local grants to transit companies adopting hydrogen buses. Likewise, South Korea’s Hydrogen Economy Roadmap includes significant funding for hydrogen bus fleet expansion and infrastructure development.

Public-private partnerships are also accelerating market growth. Daimler and Volvo have formed a joint venture to develop hydrogen fuel cell systems for commercial vehicles, including buses. In North America, New Flyer and Ballard Power Systems are collaborating to expand hydrogen bus production, ensuring widespread availability for transit operators.

From 2020 to 2024, the global hydrogen bus market witnessed steady growth, primarily driven by early adoption in key regions like Europe, China, and South Korea.

However, large-scale deployments remained limited due to infrastructure constraints, high initial costs, and the early-stage development of hydrogen fuel cell technology.

Many transit agencies conducted pilot projects rather than full-scale fleet conversions, while hydrogen refueling stations were still in the expansion phase, slowing adoption. Additionally, despite strong policy support, battery-electric buses remained a more developed alternative with a lower upfront cost, leading many cities to prioritize them over hydrogen buses.

From 2025 to 2035, hydrogen bus demand is projected to grow significantly, expanding by 13.6 times its 2024 levels. This acceleration will be fueled by stringent emission regulations, such as the European Union’s mandate for all new city buses to be zero-emission by 2030, alongside China’s ambitious target of deploying 50,000 hydrogen buses by 2035.

The expansion of hydrogen refueling infrastructure in countries like Germany, Japan, and South Korea will also play a critical role in making fleet operations more practical, addressing one of the major barriers to adoption. At the same time, advancements in hydrogen fuel cell technology and the scaling of green hydrogen production will reduce costs, making hydrogen buses more competitive with diesel and battery-electric alternatives.

Tier 1 companies include industry leaders with annual revenues exceeding USD 40 million. These companies are currently capturing a significant share of 50-% to 55%.

These frontrunners are characterized by high production capacity and a wide product portfolio. They are distinguished by extensive expertise in manufacturing and a broad geographical reach, underpinned by a robust consumer base. The firms provide a wide range of products and utilize the latest technology to meet regulatory standards.

Prominent companies within this tier I players include Tata Motors Limited, Thor Industries, Hyundai, Ballard Power Systems, NovaBus Corporation and Others.

Tier 2 companies encompass most of the small-scale enterprises operating within the regional sphere and catering to specialized needs with revenues between USD 20-40 million.

These businesses are notably focused on meeting local demand and are hence categorized within the Tier 2 segment. They are small-scale participants with limited geographical presence. In this context, Tier 2 is acknowledged as an informal sector, indicating a segment distinguished by a lack of extensive organization and formal structure in comparison to the structured one.

Tier II Players such as New Flyer Industries Ltd, EvoBus, New Flyer And others have been considered in this tier where they are projected to account for 20-25% of the overall market.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche having revenue below USD 20 million. These companies are notably oriented towards fulfilling local demands and are consequently classified within the tier 3 share segment.

They are small-scale players and have limited geographical reach. The manufacturers such as Tier III Players such as Hino Motors Ltd., SunLine Transit Agency and others are expected to hold 15-20% of the share.

The below table shows the estimated growth rates of the top three countries. China, India, and Germany are set to record higher CAGRs of 37.1%, 36.6%, and 35.7% respectively, through 2035.

| Country | CAGR, 2025 to 2035 |

|---|---|

| China | 37.1% |

| India | 36.6% |

| Germany | 35.7% |

| UK | 34.1% |

| USA | 29.9% |

The United States hydrogen buses market is poised to exhibit a CAGR of 29.9% during the assessment period. It is expected to attain a valuation of USD 3,531.8 Million by 2035.

The United States takes the lead in scaling its hydrogen ecosystem with the hydrogen mobility-promoting laws that have been passed at the federal level. Transits in states like California are deploying hydrogen buses these times to not only meet the net-zero pollution goal but also have the full backing of the state with the hydrogen refueling network.

The central funding goes towards steps like the delivery of hydrogen refueling stations under initiatives like the Inflation Reduction Act.

China is at the surge of the hydrogen supply system with its prevalent manufacturing establishment and access to hydrogen refilling sites. Their huge ambition of finding 50,000 hydrogen buses on the road will be accomplished by 2035, which means, it generally, draws the parade for clean transportation. Cities like Beijing and Shanghai are quickly adopting hydrogen buses in the struggle against urban air pollution.

As per the estimates released by the China Association of Automobile Manufacturers (CAAM), China manufactured 1,742 units of hydrogen fuel cell automotive in 2021, an increase of 48.2% y-o-y. In the same year, 1,586 units of these vehicles were sold, representing an increase of 34.7% y-o-y.

The growing demand for hydrogen fuel cell buses due to their high reliability, ability to be quickly refueled with hydrogen, and continuous and consistent driving capacity over long distances is resulting in a positive market outlook for hydrogen buses in China.

Sales of hydrogen buses in china are projected to soar at a CAGR of around 37.1% during the assessment period. The total valuation in the country is anticipated to reach USD 4,238.1 Million by 2035.

The India hydrogen buses market size is projected to reach USD 2,195.7 Million by 2035. Over the assessment period, Hydrogen Buses in the United Kingdom is set to rise at 36.6% CAGR

The Indian market for hydrogen buses is the new revenue channel, and it comes along with government efforts driving the National Hydrogen Mission. Initiation of pilot programs in cities including Delhi and Bengaluru are signals to the market showing hydrogen bus demand and grossing scale of bus infrastructure.

The hydrogen will be used in the newly expanded renewable hydrogen production while the countries will depend less on oil and have a greener urban environment.

Increasing government initiatives to realize the ‘Hydrogen Vision’ of the country to develop a self-reliant India by meeting weather change goals, creating employment in the respective sector, and promoting the adoption of clean energy, are collectively driving the hydrogen buses market in India.

In August 2022, India’s first-ever indigenously produced Hydrogen fuel cell bus, backed by the Union Minister of State for Science and Technology, was revealed in Pune. The rising demand for eco-friendly modes of transportation is projected to facilitate the Indian hydrogen buses market in the coming years.

The section explains the growth trends of the leading segments in the industry. In terms of Product Type, the Boom Lifts will likely disseminate and generate a share of around 51.7% in 2035.

Based on End-Use, the Construction segment is projected to hold a share of 33.2% in 2035. The analysis would enable potential clients to make effective business decisions for investment purposes.

| Segment | Value Share |

|---|---|

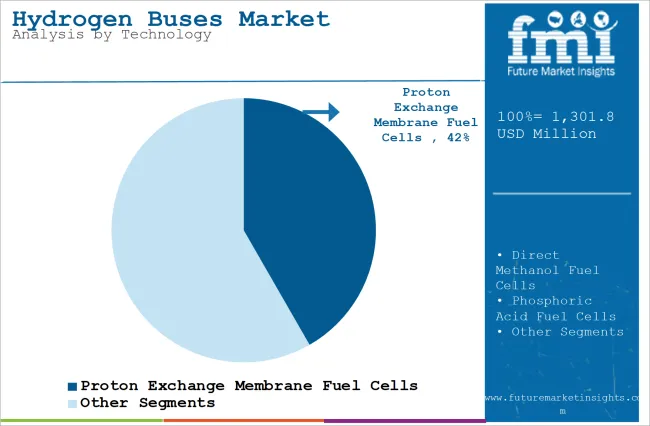

| Proton Exchange Membrane Fuel Cells (Technology) | 41.7% |

The rising demand for Proton Exchange Membrane Fuel Cells (PEMFC) in the hydrogen bus market is largely attributed to their superior efficiency, fast start-up time, and compact design, making them ideal for urban public transportation systems.

PEMFCs operate at relatively low temperatures compared to other fuel cell types, ensuring quicker response times, which is crucial in high-frequency, stop-and-go environments like city buses. These features make PEMFCs a top choice for cities looking to meet stringent emission regulations, as they offer an environmentally friendly alternative to diesel and battery-electric buses.

Furthermore, ongoing advancements in PEM technology are driving down the overall cost of production, making hydrogen-powered buses more economically viable.

As manufacturers refine the technology, efficiency improvements and reduced costs are enabling wider adoption of hydrogen buses. Countries like Germany, Japan, and the United States are already investing heavily in hydrogen infrastructure, including refueling stations, to support the growing hydrogen fleet.

| Segment | Value Share |

|---|---|

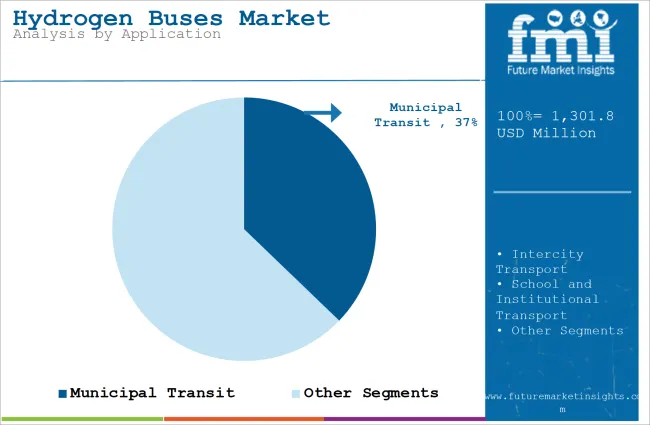

| Municipal Transit (Application) | 37.2% |

Municipal transit systems have the highest share of hydrogen bus applications. Cities everywhere are adding hydrogen buses to their public transportation systems to replace diesel buses and comply with imposed emission norms.

The increase in the number of refueling stations has helped hydrogen buses to be deployed better in urban areas. Newer markets like Vietnam and Brazil have taken the initiative in piloting hydrogen buses to stay in line with their sustainable targets.

Hydrogen Bus Market's main actors like Toyota Motor Corporation, Hyundai Motor Group, Ballard Power Systems, Cummins Inc., and Daimler AG are sprouting the innovation sector via strategic partnerships tying to R&D. These corporations are fuels cell technologies and drive costs down while making it easier for transit companies to adopt buses.

Toyota introduced a new fleet of buses in Japan market that run on renewable hydrogen, providing higher fuel efficiency and better range. Ballard Power Systems has joined forces with Euro-transit companies on the fuel cell urban bus program. New entrants are replenishing the market, producing goods locally, and providing cutting-edge solutions, thereby injecting competition into the market as well as its expansion..

Significant players are further introducing new products to address the increasing need for cutting-edge solutions in various end-use sectors. Geographic expansion is another important strategy that is being embraced by reputed companies.

Start-ups are likely to emerge in the sector through 2035, thereby making it more competitive. Key companies are investing in continuous research for producing new products and increasing their production capacity to meet end-user demand. They are also showing an inclination toward adopting strategies, including acquisitions, partnerships, mergers, and facility expansions to strengthen their footprint.

Industry Updates

Technology included in the study are Proton Exchange Membrane Fuel Cells, Direct Methanol Fuel Cells, Phosphoric Acid Fuel Cells, Zinc-Air Fuel Cells, and Solid Oxide Fuel Cells.

Power Output included in the study are <150 kW, 150–250 kW and >250 kW.

By Transit Bus Models included in the study are below 30-Foot Transit Buses, 40-Foot Transit Buses and 60-Foot Transit Buses.

By Application included in the study are below Municipal Transit, Intercity Transport, School and Institutional Transport and Others.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global market was valued at USD 1,037.1 million in 2024.

The global market is set to reach USD 1,301.8 million in 2025.

Global demand is anticipated to rise at 29.8% CAGR.

The industry is projected to reach USD 17,658.9 million by 2035.

Tata Motors Limited, Thor Industries, Hyundai, Ballard Power Systems and NovaBus Corporation are prominent companies.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Power Output, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Power Output, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Transit Bus Models, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Transit Bus Models, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Power Output, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Power Output, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Transit Bus Models, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Transit Bus Models, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Power Output, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Power Output, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Transit Bus Models, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Transit Bus Models, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Power Output, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by Power Output, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Transit Bus Models, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Transit Bus Models, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Power Output, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by Power Output, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Transit Bus Models, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by Transit Bus Models, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Power Output, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by Power Output, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Transit Bus Models, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by Transit Bus Models, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Power Output, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Transit Bus Models, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Power Output, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Power Output, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Power Output, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Power Output, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Transit Bus Models, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Transit Bus Models, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Transit Bus Models, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Transit Bus Models, 2023 to 2033

Figure 21: Global Market Attractiveness by Technology, 2023 to 2033

Figure 22: Global Market Attractiveness by Power Output, 2023 to 2033

Figure 23: Global Market Attractiveness by Transit Bus Models, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Power Output, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Transit Bus Models, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Power Output, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Power Output, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Power Output, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Power Output, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Transit Bus Models, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Transit Bus Models, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Transit Bus Models, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Transit Bus Models, 2023 to 2033

Figure 45: North America Market Attractiveness by Technology, 2023 to 2033

Figure 46: North America Market Attractiveness by Power Output, 2023 to 2033

Figure 47: North America Market Attractiveness by Transit Bus Models, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Power Output, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Transit Bus Models, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Power Output, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Power Output, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Power Output, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Power Output, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Transit Bus Models, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Transit Bus Models, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Transit Bus Models, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Transit Bus Models, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Power Output, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Transit Bus Models, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Power Output, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Transit Bus Models, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Power Output, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Power Output, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Power Output, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Power Output, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Transit Bus Models, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by Transit Bus Models, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Transit Bus Models, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Transit Bus Models, 2023 to 2033

Figure 93: Europe Market Attractiveness by Technology, 2023 to 2033

Figure 94: Europe Market Attractiveness by Power Output, 2023 to 2033

Figure 95: Europe Market Attractiveness by Transit Bus Models, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Technology, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Power Output, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Transit Bus Models, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Power Output, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by Power Output, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Power Output, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Power Output, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Transit Bus Models, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by Transit Bus Models, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Transit Bus Models, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Transit Bus Models, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Power Output, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Transit Bus Models, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Technology, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Power Output, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Transit Bus Models, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Power Output, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by Power Output, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Power Output, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Power Output, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Transit Bus Models, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by Transit Bus Models, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Transit Bus Models, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Transit Bus Models, 2023 to 2033

Figure 141: MEA Market Attractiveness by Technology, 2023 to 2033

Figure 142: MEA Market Attractiveness by Power Output, 2023 to 2033

Figure 143: MEA Market Attractiveness by Transit Bus Models, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Hydrogen Detection Market Forecast Outlook 2025 to 2035

Hydrogenated Dimer Acid Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fluoride Gas Detection Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks and Transportation Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Refueling Station Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Peroxide Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fuel Cell Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Generator Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Combustion Engine Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Hubs Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Truck Market Growth – Trends & Forecast 2024 to 2034

Hydrogen Fueling Station Market Growth – Trends & Forecast 2024-2034

Hydrogenerators Market

Hydrogenated Palm Oil Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA