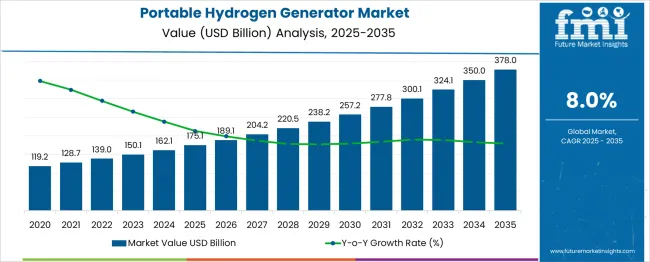

The Portable Hydrogen Generator Market is estimated to be valued at USD 175.1 billion in 2025 and is projected to reach USD 378.0 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period. Across the timeline, growth follows a smooth compounding pattern without displaying any saturation indicators. Early-year increments from 2025 to 2029 average USD 15-18 billion annually, reflecting consistent technology adoption and mobility demand.

By 2030, the yearly growth reaches USD 19.0 billion, and this figure continues to increase slightly, demonstrating scalable uptake rather than demand fatigue. From 2031 to 2035, year-on-year additions rise from USD 22.3 billion to USD 28.0 billion, indicating that the market maintains its compounding character throughout the period.

The absence of tapering growth, leveling slopes, or declining annual increments confirms that no saturation point is reached within the current forecast window. End-use diversification in off-grid and mobile power generation settings appears to sustain upward momentum.

The market continues to add larger volumes year after year without exhibiting curvature flattening or asymptotic tendencies. The value curve retains a steep gradient through 2035, suggesting that product maturity and infrastructure constraints have yet to dampen total addressable demand across major consumer and industrial segments.

| Metric | Value |

|---|---|

| Portable Hydrogen Generator Market Estimated Value in (2025 E) | USD 175.1 billion |

| Portable Hydrogen Generator Market Forecast Value in (2035 F) | USD 378.0 billion |

| Forecast CAGR (2025 to 2035) | 8.0% |

The biogas‑to‑hydrogen market using steam methane reforming is expanding as sectors move toward low carbon energy transitions. Key innovators include Air Products & Chemicals, Linde, Technip Energies, FuelCell Energy, Cummins‑Hydrogenics, Proton Onsite, SFC Energy, GenCell, and startups such as H2Pro and GeoPura. These firms are advancing compact on‑site SMR systems integrated with carbon capture for renewable hydrogen production.

Increasing investment targets modular electrochemical units that support remote power and backup applications. Strategic trends encompass pilot deployments across event, construction and industrial sites, integration with hydrogen fuel cells for off‑grid power, and expansion driven by incentives and infrastructure scaling in Europe, North America and Asia Pacific.

The portable hydrogen generator market is fueled by the clean energy sector (35%), driven by demand for zero-emission power solutions. The industrial & manufacturing segment (25%) uses these generators for backup power and mobile applications. The military & defense industry (20%) adopts them for field operations and portable energy needs.

The transportation sector (15%) leverages hydrogen generators for fuel cell vehicles and remote charging, while consumer electronics (5%) explores compact power alternatives. Together, clean energy and industrial applications dominate, accounting for 60% of demand, with growth propelled by decarbonization trends and advancements in hydrogen storage tech.

Growing demand from the transportation, defense, and off-grid power sectors has accelerated interest in compact and scalable hydrogen production technologies. Focus has been placed on sustainable alternatives to fossil fuels, supported by government incentives, carbon-neutral policies, and rising investments in hydrogen infrastructure.

The market is being further driven by technological advancements that have improved energy conversion efficiency and reduced system weight and cost. Increased deployment of fuel cell vehicles and the expansion of temporary or remote power requirements have underscored the value of portable hydrogen generation systems. Continued innovation in micro-reformer designs, compact electrolyzers, and hybrid power modules is expected to shape future growth.

Market participants are actively engaged in improving the portability, safety, and production rates of hydrogen generators to meet diverse operational needs. With decarbonization targets becoming more aggressive globally, this market is expected to expand across both developed and developing regions..

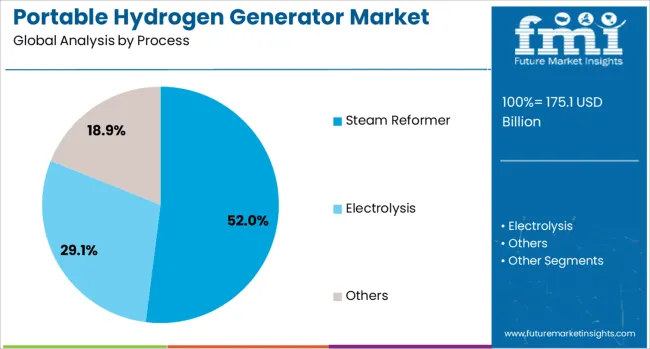

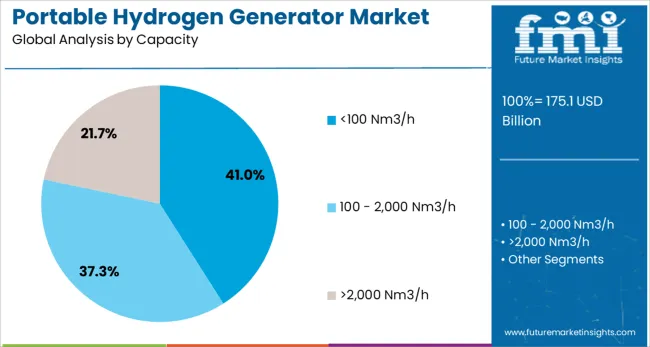

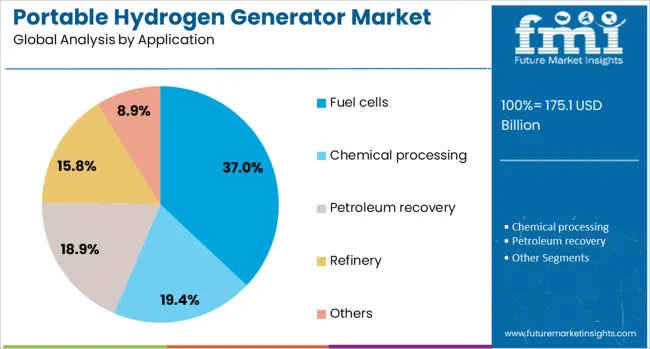

The portable hydrogen generator market is segmented by process, capacity, application, and geographic regions. The portable hydrogen generator market is divided into Steam Reformer, Electrolysis, and Others. The portable hydrogen generator market capacity is classified into <100 Nm3/h, 100 - 2,000 Nm3/h, and >2,000 Nm3/h. Based on application of the portable hydrogen generator market is segmented into Fuel cells, Chemical processing, Petroleum recovery, Refinery, and Others. Regionally, the portable hydrogen generator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The steam reformer process segment is projected to account for 52% of the Portable Hydrogen Generator market revenue share in 2025, making it the dominant production process. Growth in this segment has been supported by the process’s efficiency in producing hydrogen at a lower operational cost compared to other methods. Steam reformers have been widely utilized due to their ability to generate high-purity hydrogen from hydrocarbon fuels such as methane and methanol, making them suitable for on-demand applications in the field or off-grid environments.

Their compatibility with existing fuel logistics and relatively simple thermal integration have contributed to consistent adoption across portable systems. The scalability of steam reforming systems to operate at smaller capacities has further increased their relevance in portable use cases.

Additionally, ongoing advancements in catalyst design and heat recovery technologies have enhanced the energy efficiency and emission profiles of these units. As industries seek more reliable and compact hydrogen sources, steam reformers have continued to establish their leadership within the portable segment..

The segment with a capacity of less than 100 Nm3/h is estimated to hold 41% of the Portable Hydrogen Generator market revenue share in 2025, positioning it as the leading capacity category. This segment’s leadership has been driven by demand from mobile, emergency, and small-scale operations that require reliable hydrogen production in compact formats. Systems within this capacity range have proven highly suitable for rapid deployment and transportation, making them ideal for military, disaster relief, and remote energy generation use cases.

The flexibility and reduced energy input required for units under 100 Nm3/h have made them cost-effective and efficient for temporary setups. Advances in miniaturization and system integration have allowed these generators to achieve higher performance while maintaining portability.

Additionally, increased use in developing hydrogen refueling stations for micro-mobility and off-grid applications has further enhanced segment demand. As industries continue to favor flexible and decentralized power solutions, the below 100 Nm3/h category is expected to retain its growth momentum..

The fuel cells application segment is anticipated to command 37% of the Portable Hydrogen Generator market revenue share in 2025, making it the largest application segment. This segment’s prominence has been supported by the growing use of hydrogen in portable fuel cell systems for transportation, backup power, and field operations. Fuel cells have become increasingly attractive due to their zero-emission operation, quiet performance, and high energy conversion efficiency.

Portable hydrogen generators have been paired with fuel cells to deliver uninterrupted power in scenarios where grid connectivity is absent or unreliable. The ability to produce hydrogen on-site for direct use in fuel cells has reduced logistical complexity and increased energy resilience in mobile applications.

Rising adoption of fuel cell-powered vehicles, drones, and portable electronics has reinforced the need for dependable hydrogen supply solutions. As the push for clean and autonomous energy intensifies, the role of portable hydrogen generators in supporting fuel cell technology is expected to expand further..

In 2024, approximately 38% of newly deployed portable generators used hydrogen or hydrogen–hybrid fuel formats. Units capable of 5–50 kW output were preferred in approximately 45% of remote industrial infrastructure use cases. Growth has been strongest in North America and Europe, followed by the Asia Pacific. Expansion was supported by mobile applications such as telecom tower backup, remote medical units, and camping power modules.

Portable hydrogen generators have been adopted due to their silent operation, zero tailpipe emissions, and scalable energy output. In roughly 44% of pilot emergency response deployments, generators were substituted for diesel models to eliminate particulate emissions. Portable units with compressed hydrogen cylinders supported rapid refueling in 32% of remote telecommunication tower installations. For field service vehicles and mobile labs, hydrogen generators reduced refueling supply chain complexity by 29% compared to diesel logistics. Weight-optimized fuel cell systems improved deployment efficiency, reducing field support requirements. Government deployments used these systems in disaster recovery zones. The driver appeal has been strongest where air quality compliance and fuel handling safety protocols are enforced.

Cost and infrastructure limitations are restraining the adoption of portable hydrogen generators. Unit retail prices were approximately 21% higher than equivalent diesel generators in 2024. Compressed hydrogen cylinder availability was limited, supporting only 19 % of rural or grid-isolated installations. Refueling logistics added 12% to overall operating expense for smaller organizations. Maintenance and service networks remained sparse, with spare parts stockouts reported in 7% of deployments. Safety concerns for handling high-pressure gas were cited in 9% of field training feedback. Warranty costs were higher due to the risk of fuel-cell stack degradation. These constraints slowed adoption by smaller commercial fleets and rural developer initiatives where low-cost power alternatives remain dominant.

Market opportunities are emerging in hydrogen generator rentals and hybrid energy systems combining battery, solar, and fuel cells. Rental service providers are offering short-term hydrogen generator access in 23 % of off-grid event and construction project contracts. Mobile charge carts combining solar panels, battery storage, and hydrogen backup supported 28 % more uptime in telecom microgrid pilots. Unit configurations with automatic switchover between fuel cell and battery operations allowed smoother operation in intermittent power zones. OEM partnerships with renewable generator suppliers facilitated turnkey packages. Integration into smart grid load-balancing systems enabled parametric scaling of generator output. These models helped lower initial capital outlay and support sustainable backup solution projects.

Portable hydrogen generators featuring wireless monitoring and fuel-level alerts were adopted in 34 % of new commercial units. Lightweight composite hydrogen tanks and foldable fuel-cell stacks reduced unit weight by approximately 15 % in newer designs. Touchscreen UIs and app-based operation modules appeared in 29 % of advanced models for status display and fault diagnosis. Smart refill stations with digital matching to tank pressure and temperature sensors were piloted in 18 % of European installations. Some units support plug-and-play stack cartridge exchanges for field service. Adaptive hydrogen consumption profiling and refueling countdown timers support operational predictability in mission-critical environments.

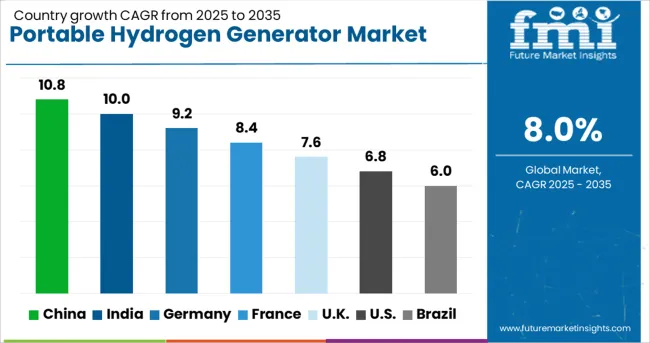

| Country | CAGR |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| France | 8.4% |

| UK | 7.6% |

| USA | 6.8% |

| Brazil | 6.0% |

The Portable Hydrogen Generator Market is expected to grow at a global CAGR of 8% from 2025 to 2035, with major countries surpassing the global average due to varied industrial and mobility use cases. China leads with a CAGR of 10.8%, about 1.35 times higher than the global growth rate, attributed to expanding fuel cell applications and mobile hydrogen deployment.

India follows at 10.0%, benefiting from rural energy decentralization and public sector hydrogen projects. Germany registers 9.2%, supported by adoption in emergency power and military-grade hydrogen systems. The UK and the USA lag slightly behind, with 7.6% and 6.8%, respectively. The report covers over 40 countries, with the top five shared here for comparative clarity.

China’s portable hydrogen generator market is projected to expand at a CAGR of 10.8% from 2025 to 2035. Higher adoption across field laboratories, construction sites, and remote telecom towers has increased demand for compact and high-output units. Equipment with PEM electrolysis technology is being prioritized due to minimal footprint and continuous generation capacity.

Military-grade systems with ruggedized enclosures are gaining orders for border surveillance and defense field use. The rise in portable fuel cell usage has also contributed to increased deployment of hydrogen generators integrated with real-time control interfaces. Local manufacturing hubs in provinces such as Jiangsu and Zhejiang have scaled up output to serve domestic and Southeast Asian demand.

India’s portable hydrogen generator market is forecasted to witness a CAGR of 10.0% during 2025 to 2035. On-site gas generation has been increasingly preferred over bulk cylinder supply in research labs and quality inspection units. Demand has been shifting toward lightweight designs that support variable pressure outputs in multi-location industrial operations.

Miniaturized alkaline and proton exchange membrane systems have gained traction in pharma and food testing labs operating under decentralized setups. Engineering institutes and renewable pilot plants are adopting portable systems for mobility and convenience during field trials. Partnerships between generator suppliers and solar EPC firms have supported the hybridization of hydrogen generation modules with existing off-grid setups.

Germany’s portable hydrogen generator market is estimated to grow at a CAGR of 9.2% through 2035. Industrial sectors have begun integrating portable hydrogen units for calibration and materials analysis in field operations. Increased use in fuel cell maintenance, grid simulation, and pilot mobility projects has elevated unit demand.

Compact PEM electrolyzers with integrated safety control systems are being selected for mobile analytical equipment. Demand from the automotive sector has contributed to rising adoption in vehicle diagnostic and R&D centers. University-led hydrogen innovation clusters have created consistent need for transportable gas generation systems to support educational and prototype testing initiatives.

The United Kingdom’s portable hydrogen generator market is expected to expand at a CAGR of 7.6% from 2025 to 2035. Use in temporary industrial setups, mobile lab stations, and emergency field units has fueled demand for plug-and-play hydrogen sources. Configurations with pressure stabilization and modular stack integration are being utilized in short-cycle energy storage projects.

Partnerships with disaster recovery agencies have also contributed to portable generator usage in field power restoration activities. Compact generators are being customized for rapid deployment in transportation fleet pilot programs and on-site maintenance projects. Several UK-based engineering consultancies have included mobile hydrogen units as part of their energy infrastructure toolkits.

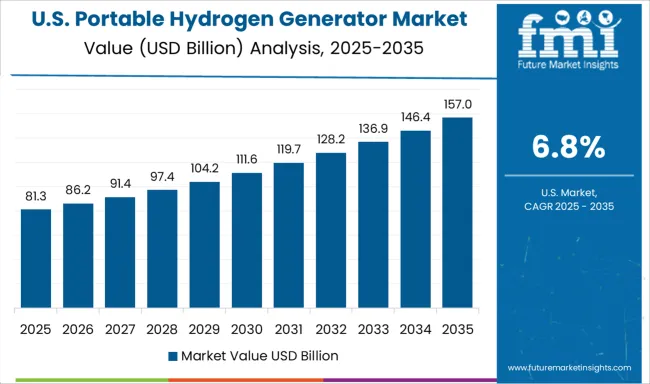

The United States portable hydrogen generator market is set to record a CAGR of 6.8% between 2025 and 2035. Interest has been growing across environmental testing, oil and gas exploration, and field-based diagnostics requiring compact and transportable hydrogen sources. Government-backed research contracts have supported the adoption of PEM systems for mobile labs in clean energy research.

Oilfield operators have utilized these units to support downhole tool maintenance and sample testing. Commercial utility service providers are also leveraging portable hydrogen for localized equipment calibration. Integration with solar trailer systems and battery arrays has emerged as a preferred setup for off-grid mobile operations in remote areas.

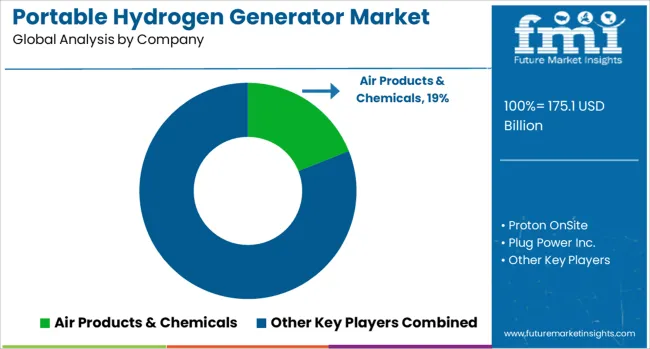

The portable hydrogen generator market involves manufacturers focused on compact, on-site hydrogen production units tailored for mobility, off-grid power, and field applications. Air Products & Chemicals has introduced mobile hydrogen solutions targeting transportation and defense sectors. Proton OnSite, now part of Nel ASA, specializes in PEM-based systems with scalable configurations for laboratories and emergency backup. Plug Power Inc. deploys mobile fuel cell systems integrated with hydrogen generation for material handling and stationary power.

These firms are advancing modular platforms with reduced footprint, enabling deployment in remote industrial and energy operations without dependence on centralized hydrogen distribution. Nel ASA continues to expand its PEM-based containerized solutions across Europe and North America. Enapter AG focuses on standardized AEM electrolyzer modules for decentralized and portable use cases, including backup telecom power.

Hydrogenics, under Cummins, supports portable hydrogen fueling solutions with industrial-grade efficiency. Portability and operational uptime remain primary differentiators among manufacturers. Entry challenges stem from the cost of certification, system miniaturization expertise, and integration with downstream fuel cell stacks. As portable applications increase across mining, construction, and military logistics, suppliers with proven reliability, integrated controls, and maintenance services maintain competitive positioning in this segment.

Panasonic developed pure‑hydrogen gensets for harsh environments starting mid‑2024, while Nuvera launched its zero‑emission 30 kVA mobile power unit combining EV charging and generator functions. Portable systems tailored to construction, defense, and recreational sectors gained traction, especially in Asia-Pacific and North America. Demand rose as generators offered clean, quiet power alternatives in remote sites, emergencies, and field operations. Key players like Plug Power, Ballard, Horizon, HyGear, and Panasonic led market momentum.

| Item | Value |

|---|---|

| Quantitative Units | USD 175.1 Billion |

| Process | Steam Reformer, Electrolysis, and Others |

| Capacity | <100 Nm3/h, 100 - 2,000 Nm3/h, and >2,000 Nm3/h |

| Application | Fuel cells, Chemical processing, Petroleum recovery, Refinery, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Products & Chemicals, Proton OnSite, Plug Power Inc., Nel ASA, Enapter AG, and Hydrogenics |

| Additional Attributes | Dollar sales by generator type (PEM electrolyzers, metal hydride storage, on-demand reformers) and application (remote power, industrial backup, mobile fueling), demand driven by off-grid energy and remote operations, led by Asia‑Pacific with North America catching up, innovation in compact modular stacks, high-pressure delivery systems, and rapid recharge cycles. |

The global portable hydrogen generator market is estimated to be valued at USD 175.1 billion in 2025.

The market size for the portable hydrogen generator market is projected to reach USD 378.0 billion by 2035.

The portable hydrogen generator market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in portable hydrogen generator market are steam reformer, electrolysis and others.

In terms of capacity, <100 nm3/h segment to command 41.0% share in the portable hydrogen generator market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Portable Hydrogen Powered Generator Market Size and Share Forecast Outlook 2025 to 2035

Hydrogenerators Market

Hydrogen Generator Market Size and Share Forecast Outlook 2025 to 2035

Portable Inverter Generators Market Analysis by Power Rating, Power Source, Application, and Region through 2035

Portable Conventional Generator Market Size and Share Forecast Outlook 2025 to 2035

Onsite Hydrogen Generator Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Portable Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Portable Generators Market Size and Share Forecast Outlook 2025 to 2035

Residential Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel-Fired Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Construction Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Portable Audiometer Calibration System Market Size and Share Forecast Outlook 2025 to 2035

Generator Bushing Market Size and Share Forecast Outlook 2025 to 2035

Portable Crushers Market Size and Share Forecast Outlook 2025 to 2035

Portable Filtration System Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Portable Toilet Rental Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Detection Market Forecast Outlook 2025 to 2035

Portable NIR Moisture Meter Market Forecast and Outlook 2025 to 2035

Hydrogenated Dimer Acid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA