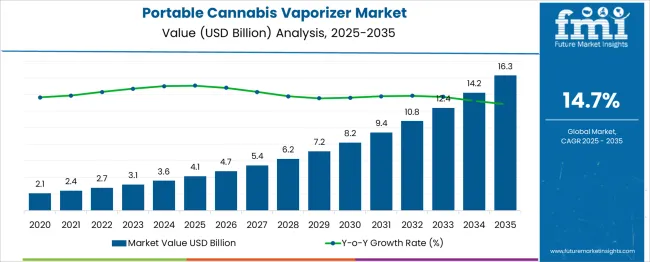

The Portable Cannabis Vaporizer Market is estimated to be valued at USD 4.1 billion in 2025 and is projected to reach USD 16.3 billion by 2035, registering a compound annual growth rate (CAGR) of 14.7% over the forecast period. This growth trajectory reflects a significant gain in market share within the broader global cannabis consumer products market, which itself is expanding due to increased legalization and normalization of cannabis use.

In 2025, portable vaporizers account for approximately 11.5% of the global cannabis consumer products market, which is valued at around USD 35.5 billion. By 2035, with the total consumer products segment expected to reach approximately USD 105 billion, the share of portable vaporizers will increase to roughly 15.5%, signaling a clear market share gain of 4 percentage points over the decade. Several factors contribute to this upward shift: consumers are increasingly favoring smoke-free, discreet, and tech-integrated consumption methods, while manufacturers are innovating with longer battery life, temperature control, and portability. Regulatory support in key markets such as the USA, Canada, and parts of Europe further boosts adoption. As a result, portable vaporizers are not only retaining relevance but actively eroding the share of traditional combustion-based cannabis products, highlighting their emergence as a mainstream and dominant sub-category within the cannabis ecosystem.

| Metric | Value |

|---|---|

| Portable Cannabis Vaporizer Market Estimated Value in (2025 E) | USD 4.1 billion |

| Portable Cannabis Vaporizer Market Forecast Value in (2035 F) | USD 16.3 billion |

| Forecast CAGR (2025 to 2035) | 14.7% |

The portable cannabis vaporizer market is experiencing strong momentum, driven by evolving cannabis legalization frameworks, increasing medical cannabis prescriptions, and rising consumer demand for discreet, efficient consumption methods. The shift away from traditional smoking is supported by growing awareness of the health risks associated with combustion-based inhalation.

Technological advancements in vaporizer heating systems, temperature control, and device portability have improved user experience and dosing precision. Healthcare professionals are increasingly endorsing vaporizers for controlled therapeutic use, especially for chronic pain, anxiety, and sleep disorders.

Moreover, the growing availability of compact, rechargeable units is fostering adoption among new users, including medical patients and wellness consumers. Regulatory clarity in major markets, combined with enhanced product innovation and rising acceptance of cannabis in wellness regimes, is expected to sustain long-term market expansion.

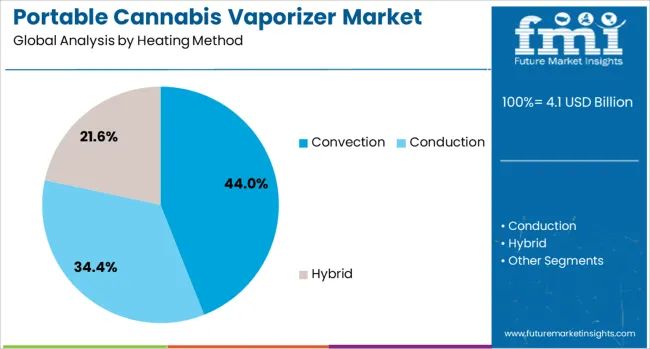

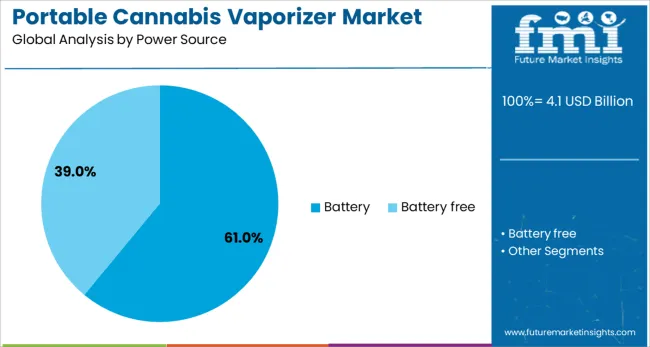

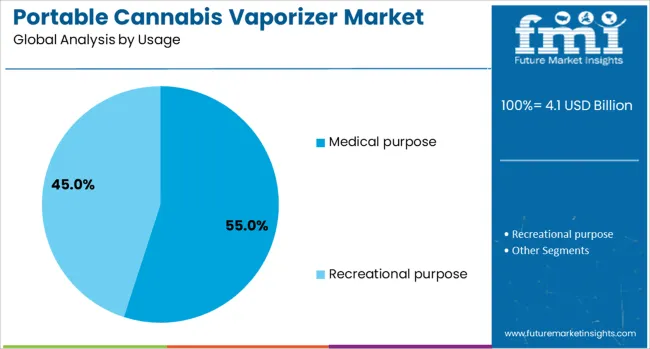

The portable cannabis vaporizer market is segmented by heating method, power source, usage, price range, distribution channel, and geographic regions. The heating method of the portable cannabis vaporizer market is divided into Convection, Conduction, and Hybrid. In terms of power source, the portable cannabis vaporizer market is classified into battery and battery-free. The portable cannabis vaporizer market is segmented into Medical and recreational purposes. The price range of the portable cannabis vaporizer market is segmented into Medium, Low, and High. The distribution channel of the portable cannabis vaporizer market is segmented into online and offline. Regionally, the portable cannabis vaporizer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Convection-based heating methods are projected to dominate with a 44.0% share of the portable cannabis vaporizer market in 2025. This leadership is supported by the method’s ability to deliver uniform heating without direct contact between cannabis and the heating element, preserving cannabinoid and terpene profiles.

Convection vaporizers produce smoother, more flavorful vapor, which is gaining traction among health-conscious and medicinal users seeking consistent therapeutic benefits. Additionally, the technology minimizes charring and combustion risks, aligning with demand for cleaner inhalation.

Device manufacturers are enhancing airflow efficiency and thermal control in convection models, boosting their performance appeal. As consumers prioritize safety, purity, and vapor quality over initial cost, convection continues to emerge as the preferred method among discerning users.

Battery-powered vaporizers are expected to lead the market with a 61.0% revenue share in 2025, owing to their unmatched portability, convenience, and rapid heating capabilities. The proliferation of lithium-ion battery technology has enabled longer operational time, faster recharge cycles, and compact device designs.

These advantages make battery-operated vaporizers highly suitable for on-the-go usage, especially for medical patients requiring timely symptom management. Moreover, technological integration such as USB-C charging, app connectivity, and battery status indicators has elevated user expectations and product functionality.

Brands are increasingly focusing on offering lightweight, ergonomically designed vaporizers with variable heat settings—features enabled efficiently by battery systems. Growing consumer inclination toward reusable, rechargeable devices over butane or corded units further solidifies this segment’s dominance.

Usage for medical purposes is projected to account for 55.0% of the total portable cannabis vaporizer market by 2025. This trend is driven by increasing acceptance of cannabis as a viable therapeutic agent, particularly for managing chronic conditions such as neuropathic pain, epilepsy, and anxiety.

Physicians and healthcare providers are recommending vaporization due to its rapid onset, ease of dose titration, and reduced exposure to harmful byproducts compared to smoking. The preference for portable vaporizers among patients is reinforced by their discreetness, precise control mechanisms, and hygienic delivery systems.

Regulatory pathways enabling access to medical cannabis in jurisdictions across North America, Europe, and parts of Asia-Pacific are further accelerating adoption. Additionally, device manufacturers are aligning their product offerings with medical compliance standards, enhancing credibility and trust within the healthcare ecosystem.

The portable cannabis vaporizer market is growing rapidly due to widespread legalization of cannabis, evolving consumption preferences, and the appeal of discrete, on-the-go devices. Users favor compact, battery-powered vaporizers compatible with dry herb, oils, and concentrates. Technological refinements in heating mechanisms and temperature control continue to enhance user experience. Pen devices and pod-based systems are particularly popular for their convenience. As more markets mature and regulatory frameworks adapt, the demand for well-designed, reliable portable vaporizers remains robust.

The rising availability of legal cannabis for medical and recreational use is directly influencing consumer demand for portable vaporizer products. Users are increasingly looking for smokeless and efficient ways to consume cannabis, favoring vaporizers that offer precise heating control and more discreet usage. These devices provide flexibility in usage, whether at home or on the go, making them more attractive than traditional methods such as joints or pipes. Shifts in user behavior, especially among health-conscious consumers, reinforce the move away from combustion-based products. Brands that focus on intuitive interfaces, reliable battery performance, and sleek aesthetics are gaining traction. As legal markets mature, product quality and compliance play a more central role in purchasing decisions. Consumers now expect consistent experiences and safety assurances, giving well-established brands with clean production practices a competitive edge. Overall, rising access and preference for modern, health-aligned cannabis consumption formats are major growth drivers.

Despite market momentum, inconsistent cannabis regulations across jurisdictions present a persistent challenge for portable vaporizer brands. Each region may have different rules around cannabis product classification, permissible hardware components, and marketing practices. This lack of uniformity complicates product development and market entry, especially for companies operating internationally. In addition, the vaporizer category is still recovering from negative perceptions tied to past health incidents involving unregulated vape cartridges. Although most issues were linked to illegal or counterfeit products, public concerns continue to affect legitimate manufacturers. These concerns highlight the importance of stringent quality assurance and full transparency in manufacturing. Furthermore, customs regulations and import restrictions can delay product launches or complicate supply chain logistics. To overcome these issues, companies must invest in regional compliance strategies, third-party product validation, and consumer education to rebuild trust. Without addressing these regulatory and reputational barriers, full-scale market expansion remains limited.

Opportunities in the portable cannabis vaporizer market are emerging through creative product design and direct sales strategies. Devices with customizable heat settings, hybrid compatibility for oils and herbs, and minimalist designs continue to attract a wide user base. Advanced battery systems and quick heating mechanisms enhance user satisfaction and foster brand loyalty. At the same time, the growing use of digital retail platforms allows manufacturers to reach consumers directly, bypassing traditional retail limitations. E-commerce also supports subscription services and targeted marketing based on user preferences. As more regions legalize cannabis products, newer consumer segments become available to reach with niche and high-end offerings. Offering accessories, replacement parts, and limited-edition designs creates further engagement. Brands that combine appealing design with strong online visibility and compliance can scale effectively. The market remains open to companies that deliver dependable, user-friendly, and well-branded devices that meet evolving consumer expectations.

Environmental concerns related to battery waste and disposable cartridges present a growing restraint in the portable cannabis vaporizer market. Many devices use non-replaceable lithium-ion batteries that contribute to electronic waste once the product reaches end-of-life. Similarly, the increasing popularity of single-use pods and cartridges raises concerns around plastic usage and recyclability. In markets where environmental regulations are tightening, such as parts of Europe and North America, manufacturers may face added pressure to adapt their designs to meet new disposal or sustainability standards. These concerns are compounded by consumer preferences shifting toward environmentally responsible products. Brands that fail to address these expectations risk losing relevance or facing operational constraints. Companies that develop modular or recyclable device formats, provide recycling programs, or use biodegradable components may be better positioned. Without improvements in environmental performance, especially regarding battery safety and reuse, long-term acceptance of vaporizer devices could face resistance in eco-conscious markets.

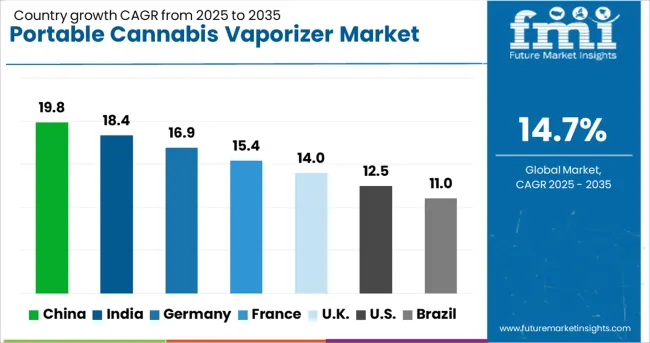

| Country | CAGR |

|---|---|

| China | 19.8% |

| India | 18.4% |

| Germany | 16.9% |

| France | 15.4% |

| UK | 14.0% |

| USA | 12.5% |

| Brazil | 11.0% |

The global portable cannabis vaporizer market is expanding at a CAGR of 14.7%, driven by increasing legalization, consumer preference for smokeless consumption, and innovations in vaporizer technology. China leads with 19.8% growth, supported by its dominance in electronics manufacturing and growing export of vaporizer components. India follows at 18.4%, driven by rising consumer interest, evolving regulatory conversations, and expansion in wellness-based cannabis applications. Germany reports 16.9% growth, reflecting its strong medical cannabis framework and preference for controlled, high-quality devices. The United Kingdom shows consistent growth at 14.0%, influenced by wellness trends and a maturing consumer base. The United States, growing at 12.5%, remains a key player, shaped by regulatory shifts, brand competition, and product innovation. Market dynamics are influenced by battery efficiency, dosage control, material safety, and regional legalization policies. This report includes insights on 40+ countries; the top countries are shown here for reference.

China is leading the portable cannabis vaporizer market with a remarkable 19.8% CAGR, driven by the growth of herbal wellness products and rising interest in vaporizer technology. Although cannabis remains restricted, the use of hemp-derived and non-psychoactive products is gaining popularity, supporting a parallel vaporizer segment. Chinese manufacturers are producing high-performance, low-cost devices that are being exported globally. Technological innovation in battery life, temperature control, and ceramic heating elements is positioning China as a global production hub. Domestic demand is also growing in wellness and aromatherapy channels, which often use similar vaporizer hardware. Cross-border e-commerce platforms are enabling direct-to-consumer sales of Chinese-made devices in North America and Europe. Private label production and ODM services are expanding rapidly.

India is witnessing an 18.4% CAGR in the portable cannabis vaporizer market, supported by increasing awareness of alternative wellness products and ayurvedic applications. While cannabis use remains tightly regulated, the medicinal and therapeutic cannabis industry is emerging under licensed frameworks. Vaporizer demand is being driven by young urban consumers seeking smoke-free alternatives for herbal blends and essential oils. Indian startups are launching compact, battery-operated devices targeting wellness and personal care markets. Government-approved cannabis research is gradually opening the door for regulated product segments. Domestic manufacturers are exploring partnerships with technology firms to design locally adapted vaporizers. Online platforms and influencer-led marketing are creating early consumer interest in premium and health-aligned products.

Germany is registering a strong 16.9% CAGR in the portable cannabis vaporizer market, fueled by expanding medical cannabis programs and patient awareness. Vaporization is the preferred method for prescribed cannabis consumption, driving demand for medically approved and precision-controlled devices. Regulatory clarity and physician guidance have led to higher adoption among registered patients. German manufacturers and importers are focusing on safety, dosing accuracy, and discreet product designs. Pharmacies are key distribution points, offering certified vaporizers alongside medical prescriptions. Increasing public discussion around recreational legalization is also influencing consumer behavior. Online marketplaces are reporting growing demand for premium and modular vaporizers. Device compatibility with dry flower and concentrate formats is enhancing utility across user groups.

The United Kingdom is experiencing a 14.0% CAGR in the portable cannabis vaporizer market, supported by wellness adoption, discreet usage preferences, and growing medical cannabis prescriptions. While recreational cannabis remains restricted, the medical sector is gradually expanding, especially through private clinics. Portable vaporizers are being used for both CBD products and prescribed formulations, with a focus on odor-free and easy-to-use designs. British consumers are increasingly looking for health-conscious alternatives to smoking, boosting demand for dry herb vaporizers. Online retailers are leading in product variety and education, offering guides on proper usage and device care. New entrants in the market are focusing on design, battery optimization, and clean heating technologies. Regulatory scrutiny remains high, influencing packaging and safety certifications.

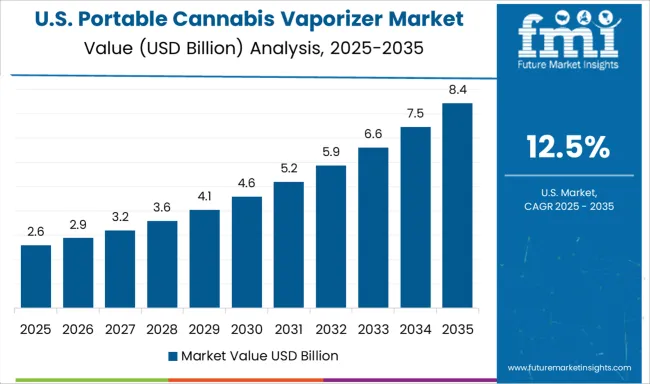

The United States is seeing a 12.5% CAGR in the portable cannabis vaporizer market, driven by widespread legalization and consumer shift toward smokeless consumption methods. Recreational and medical markets across multiple states are fueling rapid product innovation and variety. Vaporizers for dry herb, wax, and oil cartridges are in high demand, especially among health-conscious and mobile consumers. Major brands are competing on temperature precision, vapor quality, and compact design. Retail dispensaries and online platforms offer extensive product ranges, often bundled with cartridges and accessories. Safety and compliance standards are shaping product labeling and materials used. Consumers are showing growing interest in portable devices with app-based controls and reusable components. The market is benefiting from high user retention and repeat purchases.

The portable cannabis vaporizer market has gained momentum in recent years, fueled by increased cannabis consumption for both medical and recreational purposes across several countries. Portability, ease of use, and discreet operation have made vaporizers a preferred alternative to traditional smoking methods. Users are increasingly drawn to compact devices that offer precise temperature control, longer battery life, and efficient extraction of active ingredients, making them suitable for both novice and experienced consumers. The market features a broad mix of players, with Grenco Science Inc., Puff Corporation, and Dr. Dabber Inc. leading in terms of product range, design innovation, and brand recognition. These companies focus on sleek, durable hardware with customizable features to appeal to a tech-savvy audience. Meanwhile, Atmos Nation LLC, Boundless Technology LLC, and Kandy Pens Incorporation maintain a strong presence through affordability, reliable performance, and widespread availability. Manufacturers are increasingly investing in materials that enhance vapor quality and offer safer, more consistent user experiences. Smaller and niche players like Linx Vapor, Mig Vapor, and Tronian Company compete by offering specialized products for dry herb or concentrate use, often targeting wellness-focused or eco-conscious users. Companies such as Yocan Technology Co., Vuber Technologies, and Vivant Inc. also focus on international expansion and product differentiation. As regulations evolve and consumer demand grows, competition will center on product reliability, design appeal, and the ability to navigate varying legal landscapes in different regions.

Recent Development

As mentioned in Artrix’s April 2025 press release, the company launched the Lilcube and Lilcube Pro portable vaporizers, integrating postless design and high-conductivity ceramic heating for safer, smoother cannabis vaping. The Pro version includes a display for user control. This innovation targets premium, on-the-go consumer experiences.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.1 Billion |

| Heating Method | Convection, Conduction, and Hybrid |

| Power Source | Battery and Battery free |

| Usage | Medical purpose and Recreational purpose |

| Price Range | Medium, Low, and High |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Grenco Science Inc., Apollo Air Vape Incorporation, Atmos Nation LLC, Boundless Technology LLC, Chief Botanicals Inc., Dip Devices Inc., Dr. Dabber Inc., Kandy Pens Incorporation, Linx Vapor Incorporation, Mig Vapor LLC, Puff Corporation, Tronian Company, Vivant Inc., Vuber Technologies, and Yocan Technology Co. |

| Additional Attributes | Dollar sales vary by device type and heating method, with portable models dominating and induction and convection units growing fastest. North America leads value, while Europe and Asia‑Pacific show strongest growth. Pricing fluctuates with battery and heating tech costs. Growth accelerates via smart features, discreet design, regulatory tailwinds, and eco‑friendly materials. |

The global portable cannabis vaporizer market is estimated to be valued at USD 4.1 billion in 2025.

The market size for the portable cannabis vaporizer market is projected to reach USD 16.3 billion by 2035.

The portable cannabis vaporizer market is expected to grow at a 14.7% CAGR between 2025 and 2035.

The key product types in portable cannabis vaporizer market are convection, conduction and hybrid.

In terms of power source, battery segment to command 61.0% share in the portable cannabis vaporizer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Portable Audiometer Calibration System Market Size and Share Forecast Outlook 2025 to 2035

Portable Crushers Market Size and Share Forecast Outlook 2025 to 2035

Portable Filtration System Market Size and Share Forecast Outlook 2025 to 2035

Portable Toilet Rental Market Size and Share Forecast Outlook 2025 to 2035

Portable NIR Moisture Meter Market Forecast and Outlook 2025 to 2035

Portable Appliance Tester (PAT) Market Size and Share Forecast Outlook 2025 to 2035

Portable Boring Machines Market Size and Share Forecast Outlook 2025 to 2035

Portable Charging Units Market Size and Share Forecast Outlook 2025 to 2035

Portable Electronic Analgesic Pump Market Size and Share Forecast Outlook 2025 to 2035

Portable Ramps Market Size and Share Forecast Outlook 2025 to 2035

Portable Buffet and Drop-In Ranges Market Size and Share Forecast Outlook 2025 to 2035

Portable Cancer Screen Devices Market Size and Share Forecast Outlook 2025 to 2035

Portable Hydrogen Powered Generator Market Size and Share Forecast Outlook 2025 to 2035

Portable Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Portable Power Quality Meter Market Size and Share Forecast Outlook 2025 to 2035

Portable Sandwich Maker Market Size and Share Forecast Outlook 2025 to 2035

Portable Conventional Generator Market Size and Share Forecast Outlook 2025 to 2035

Portable Projector Market Size and Share Forecast Outlook 2025 to 2035

Portable Printer Market Size and Share Forecast Outlook 2025 to 2035

Portable Video Wall Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA