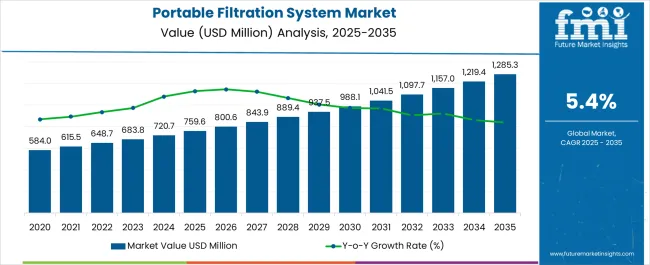

The Portable Filtration System Market is estimated to be valued at USD 759.6 million in 2025 and is projected to reach USD 1285.3 million by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

The Portable Filtration System market is witnessing strong growth, driven by the increasing need for efficient fluid filtration across diverse industrial sectors, including oil and gas, chemical processing, and water treatment. Rising concerns regarding equipment reliability, operational safety, and environmental compliance are accelerating the adoption of portable filtration solutions. Advanced filtration technologies, including centrifugal and mechanical systems, enable effective removal of impurities and contaminants, thereby extending equipment life and improving operational efficiency.

Portability allows for deployment in remote or temporary locations where permanent filtration infrastructure is unavailable, supporting flexible operations. Increasing regulatory requirements for fluid quality, environmental protection, and safety standards are further reinforcing market growth. Continuous innovation in filtration media, energy-efficient systems, and maintenance optimization is enhancing performance while reducing total cost of ownership.

As industries increasingly prioritize sustainability, operational efficiency, and process reliability, portable filtration systems are becoming an integral component of fluid management strategies The market is expected to sustain long-term expansion, driven by technological innovation and rising industrial demand.

| Metric | Value |

|---|---|

| Portable Filtration System Market Estimated Value in (2025 E) | USD 759.6 million |

| Portable Filtration System Market Forecast Value in (2035 F) | USD 1285.3 million |

| Forecast CAGR (2025 to 2035) | 5.4% |

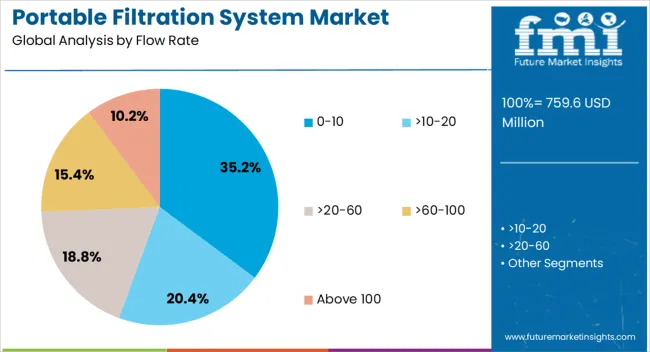

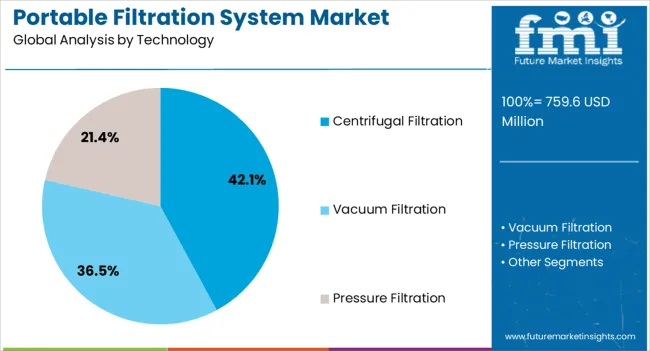

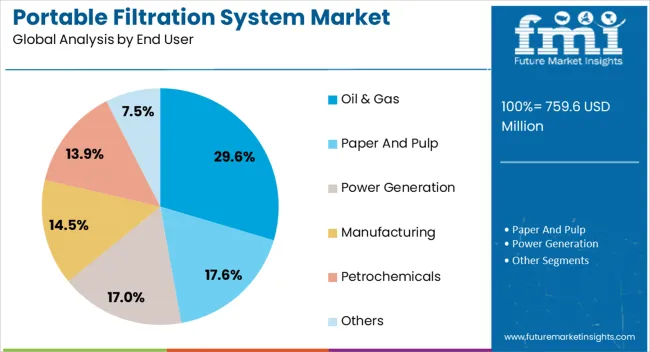

The market is segmented by Flow Rate, Technology, and End User and region. By Flow Rate, the market is divided into 0-10, >10-20, >20-60, >60-100, and Above 100. In terms of Technology, the market is classified into Centrifugal Filtration, Vacuum Filtration, and Pressure Filtration. Based on End User, the market is segmented into Oil & Gas, Paper And Pulp, Power Generation, Manufacturing, Petrochemicals, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 0-10 flow rate segment is projected to hold 35.2% of the market revenue in 2025, making it the leading category in terms of capacity. This segment is preferred due to its suitability for small- to medium-scale operations, where precise filtration and controlled flow rates are critical. Portable systems with this flow rate offer high operational flexibility, enabling deployment in confined spaces or temporary setups without compromising filtration efficiency.

The segment’s adoption is further supported by its ability to integrate advanced filtration technologies, ensuring reliable contaminant removal for sensitive processes. Maintenance simplicity, low energy consumption, and ease of transport make these systems attractive to end users who require rapid deployment and consistent performance.

Industrial sectors, particularly oil and gas, chemical, and water treatment, leverage these systems to minimize downtime, protect equipment, and meet quality standards As industries continue to demand versatile and efficient filtration solutions, the 0-10 flow rate segment is expected to maintain market leadership, supported by technological advancements and operational efficiency enhancements.

The centrifugal filtration technology segment is anticipated to account for 42.1% of the market revenue in 2025, positioning it as the leading technology category. Growth in this segment is being driven by the high separation efficiency, reduced maintenance requirements, and energy-efficient operation provided by centrifugal systems. These systems are particularly effective in handling large volumes of fluids containing solid contaminants, ensuring continuous and reliable filtration in demanding industrial environments.

Portability combined with centrifugal technology allows for deployment in both on-site and remote applications, offering operational flexibility and time savings. The technology is favored in industries such as oil and gas, chemical, and manufacturing, where consistent fluid quality is critical for equipment protection and process optimization.

Ongoing innovations in rotor design, energy efficiency, and automation are enhancing system performance and reliability, further boosting adoption As industrial operations increasingly focus on minimizing downtime and maintaining fluid quality standards, centrifugal filtration is expected to continue leading the market due to its proven effectiveness and operational advantages.

The oil and gas end user segment is projected to hold 29.6% of the market revenue in 2025, establishing it as the leading industry segment. Growth in this sector is driven by the critical need for maintaining fluid quality in extraction, refining, and transport operations, where contamination can lead to equipment damage and operational inefficiencies. Portable filtration systems are deployed to ensure compliance with stringent industry standards, reduce downtime, and extend equipment life.

The adaptability and mobility of these systems make them suitable for offshore platforms, remote wells, and temporary installations where fixed filtration infrastructure is impractical. Continuous innovation in filtration technology, including centrifugal and modular designs, enhances performance and reliability, supporting adoption in this demanding industry.

As global energy demand rises and operational efficiency becomes increasingly critical, the oil and gas sector is expected to remain the primary driver of portable filtration system deployment The focus on reducing maintenance costs and ensuring environmental compliance further strengthens market growth in this end-user segment.

| Attributes | Details |

|---|---|

| Top Flow Rate | 0-10 |

| CAGR from 2025 to 2035 | 5.1% |

The 0-10 segment is leading the market growth during the forecast period owing to the increasing use in industrial areas. The popularity of small filtration systems has been gaining traction over the years. The need for a cost-effective portable filtration system is further contributing to the growth of the segment. The affordability and versatility is making them popular among consumers. As 0-10 flow rate is also suitable for the emergency situations such as on the go conditions and others.

| Attributes | Details |

|---|---|

| Top Solution | Centrifugal Filtration |

| CAGR through 2035 | 4.9% |

The demand for removing high concentration of suspended solids in the industries is expected to create significant opportunities for market players. Having the compact size and portability is making centrifugal filtration system is an ideal choice among the consumers. Factors such as easy operating and maintaining making it popular choice in the market.

| Countries | CAGR through 2025 to 2035 |

|---|---|

| United States | 5.7% |

| China | 4.5% |

| United kingdom | 6.6% |

| Japan | 4.5% |

| South Korea | 7.7% |

Escalating innovation and development has been observed in the United States. Several concerns regarding the filtration of oil, water, and others are contributing to the growth of the portable filtration system market.

Characteristics such as offering convenient and effective solutions to people who want to filter their water on the go, and portable filtration gaining popularity among the people in the United States. The need for water filtration in home and commercial settings in the United States.

The incidents regarding waterborne illness are on the rise in the United States owing to people demanding portable filtration systems for their safety and hygiene. Upsurge in activities such as hiking, camping, and backpacking in the United States.

The aging population in China. With easy use and portability of portable filtration systems getting much attention in China. Moreover, manufacturers are investing in the filtration system making them more accessible and easy to use.

A middle-class segment is seeking out high-quality products that improve the quality of the lifestyle in China. Thus, the portable filtration system is an emerging aspect of a healthy lifestyle in China. Furthermore, water scarcity is leading the market growth in China. Allowing the reuse of water from various sources, portable filtration systems gaining traction in China.

Government initiatives toward the promotion of portable water filtration in the United Kingdom drive demand for these systems. With the offering of several benefits including improvising water quality and ensuring access to safe drinking water, potable water filtration systems are emerging as an important aspect among consumers.

The sudden upsurge in outdoor recreation and travel is anticipated to create lucrative opportunities for the market in the United Kingdom. Moreover, sports activities and fitness activities are projected to gain the maximum share of the market in the region.

Japan is at the forefront of technological development and innovations among the nations. Several companies are developing innovative portable filtration systems for residential and commercial settings. Using advanced materials such as activated carbon and ceramic filters and other, Japanese portable filtration systems gaining popularity across the world.

The partnership and collaboration between companies for the development of innovative products have been seen in South Korea. Several companies are looking for the incorporation of advanced technologies to make their filters smarter, allowing better control of the filtration process through their smartphones or other devices in South Korea.

The market is seen in rapid development and evaluation. Several strategies are changing the market landscape by disrupting traditional asset management methods and introducing unique methods. Key players are investing in their tools to gain maximum market share in the market.

The market is anticipated to gain exponential growth during the forecast period owing to innovations and research. Many governments and governmental bodies are incorporating the manufacturers to boost their research and development activities. Manufacturers are looking to improvising consumer experience by implementing new marketing strategies.

Recent Developments

The global portable filtration system market is estimated to be valued at USD 759.6 million in 2025.

The market size for the portable filtration system market is projected to reach USD 1,285.3 million by 2035.

The portable filtration system market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in portable filtration system market are 0-10, >10-20, >20-60, >60-100 and above 100.

In terms of technology, centrifugal filtration segment to command 42.1% share in the portable filtration system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Portable Toilet Rental Market Size and Share Forecast Outlook 2025 to 2035

Portable NIR Moisture Meter Market Forecast and Outlook 2025 to 2035

Portable Appliance Tester (PAT) Market Size and Share Forecast Outlook 2025 to 2035

Portable Boring Machines Market Size and Share Forecast Outlook 2025 to 2035

Portable Charging Units Market Size and Share Forecast Outlook 2025 to 2035

Portable Electronic Analgesic Pump Market Size and Share Forecast Outlook 2025 to 2035

Portable Ramps Market Size and Share Forecast Outlook 2025 to 2035

Portable Buffet and Drop-In Ranges Market Size and Share Forecast Outlook 2025 to 2035

Portable Cancer Screen Devices Market Size and Share Forecast Outlook 2025 to 2035

Portable Hydrogen Powered Generator Market Size and Share Forecast Outlook 2025 to 2035

Portable Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Portable Power Quality Meter Market Size and Share Forecast Outlook 2025 to 2035

Portable Sandwich Maker Market Size and Share Forecast Outlook 2025 to 2035

Portable Conventional Generator Market Size and Share Forecast Outlook 2025 to 2035

Portable Projector Market Size and Share Forecast Outlook 2025 to 2035

Portable Printer Market Size and Share Forecast Outlook 2025 to 2035

Portable Video Wall Market Size and Share Forecast Outlook 2025 to 2035

Portable Gas Detection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Portable Band Saws Market Size and Share Forecast Outlook 2025 to 2035

Portable Cannabis Vaporizer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA