The Portable Chopper Market is estimated to be valued at USD 291.0 million in 2025 and is projected to reach USD 526.1 million by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

Between 2025 and 2030, the market is estimated to reach approximately USD 391.0 million, creating a five-year absolute gain of USD 100 million, over 42% of the total value growth projected for the decade.

The bulk of this absolute dollar opportunity stems from evolving consumer preferences toward time-saving and space-efficient food preparation tools. In regions such as North America, Europe, and parts of Asia-Pacific, the increase in single-person and small-family households supports the demand for compact kitchen solutions. Product upgrades, such as cordless operation, USB charging, and safety-lock systems, are also pushing average selling prices upward. Manufacturers capturing the mid-premium segment with high-durability motors and BPA-free designs are expected to lead value creation. Overall, the market's absolute dollar opportunity points to strong incremental revenue potential for brands targeting portability, convenience, and modern kitchen utility.

| Metric | Value |

|---|---|

| Portable Chopper Market Estimated Value in (2025 E) | USD 291.0 million |

| Portable Chopper Market Forecast Value in (2035 F) | USD 526.1 million |

| Forecast CAGR (2025 to 2035) | 6.1% |

The Portable Chopper Market is dominated by residential/home kitchen use, representing about 71% of total demand. As consumers increasingly prepare fresh meals at home, compact choppers offer convenience in dicing vegetables, nuts, fruits, and herbs. The electric segment leads usage with advanced features like pulse operation, detachable containers, and ergonomic design. The commercial kitchens segment accounts for around 20–25%, driven by small-scale foodservice outlets, cafés, and catering businesses that require reliable, space-saving chopping tools for ingredient prep. Outdoor and portable use, such as for RVs, picnics, and camping, captures approximately 5–7% of the market. USB-rechargeable and cordless mini-choppers are popular choices for these scenarios, offering lightweight and compact functionality. Food processing and catering services, overlapping with commercial usage, make up another ~18–25%, utilizing higher-capacity portable choppers in preparatory stages of bulk cooking and meal delivery services. Distribution channels also play a key role: offline retail accounted for 71.2% of total sales in 2023, with the remainder handled via online and direct-to-consumer platforms, which facilitate rapid product access and adoption. Overall, the market is shaped by a strong residential focus supported by growing e-commerce access, while smaller but meaningful demand stems from commercial and portable-use segments.

A surge in urbanization, rising disposable incomes, and the growth of nuclear households are influencing purchasing behaviors, with consumers favoring tools that offer both functionality and space efficiency. Portable choppers are being widely adopted for their utility in quick food preparation, particularly in urban kitchens, dormitories, and for outdoor or travel use.

The trend toward health-conscious home cooking is also fueling the demand for manual food preparation tools that retain nutritional value. Innovation in blade design, material composition, and ergonomic features is enhancing product appeal, while digital platforms are expanding market reach through influencer marketing and e-commerce.

As consumer demand aligns with sustainable and reusable kitchenware, manufacturers are responding with more durable and aesthetically pleasing options. Material innovation, improved product ergonomics, and region-specific culinary needs will shape future growth.

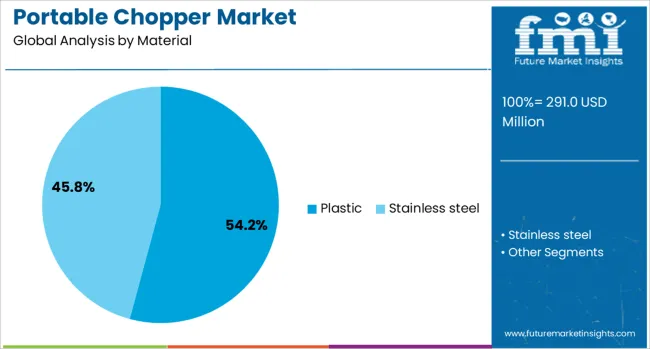

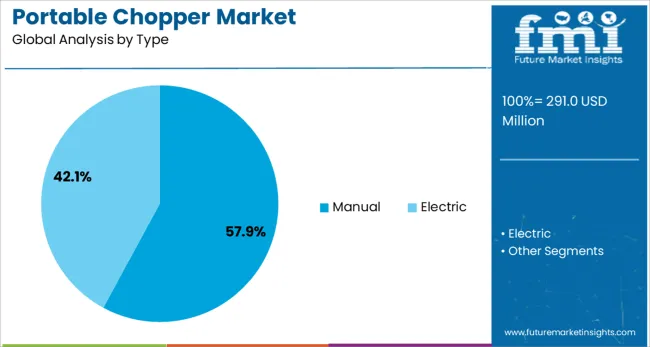

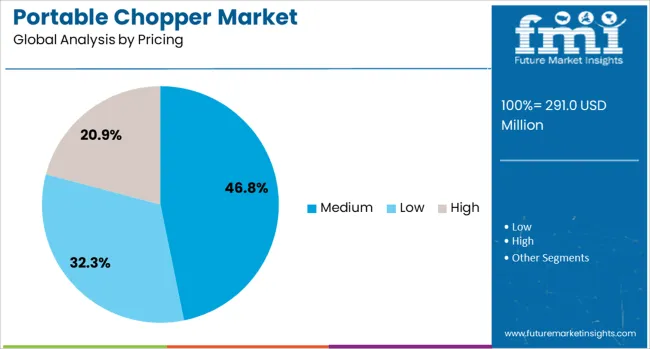

The portable chopper market is segmented by material, type, pricing, end usage, distribution channel and geographic regions. The portable chopper market is divided by material into Plastic and Stainless steel. The portable chopper market is classified into Manual and Electric Types. The portable chopper market is segmented based on pricing into Medium, Low, and High. The end usage of the portable chopper market is segmented into residential and commercial kitchens. The distribution channel of the portable chopper market is segmented into Offline, E-Commerce, Company website, Online, Specialty stores, Mega retail stores, and Others (individual stores, etc.). Regionally, the portable chopper industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Plastic material is expected to account for 54.2% of the total revenue share in the portable chopper market in 2025, maintaining its lead as the most preferred material type. This dominance is attributed to the affordability, lightweight properties, and versatility of plastic in everyday kitchen applications. Plastic choppers have been widely accepted due to their ease of handling, resistance to corrosion, and ability to be molded into ergonomic and space-saving designs.

The segment’s growth has also been supported by advancements in BPA-free and food-grade plastics that meet health and safety standards while maintaining durability. Manufacturers have increasingly focused on transparent plastic bodies to enhance product visibility and consumer convenience.

The lower manufacturing cost of plastic compared to alternatives has allowed brands to price products competitively without compromising on aesthetics or functionality. These attributes have positioned plastic as a practical choice for cost-conscious consumers seeking convenience and design flexibility in modern kitchen environments.

Manual choppers are projected to hold 57.9% of the total revenue share in the portable chopper market in 2025, establishing themselves as the leading product type. The segment’s growth is being driven by consumer demand for electricity-independent, easy-to-clean, and space-saving tools suited for everyday kitchen use.

Manual choppers are favored for their simple mechanism and minimal maintenance requirements, which appeal particularly to users in regions with unreliable power supply or smaller kitchen setups. Enhanced blade efficiency and improved pull-string, push-press, or rotary mechanisms have contributed to better chopping precision and speed, encouraging higher user satisfaction.

The increased popularity of outdoor cooking, travel-friendly kitchen gear, and low-noise food prep tools has also influenced the preference for manual choppers. With their ability to function without power and deliver reliable results, manual variants are aligning well with consumer trends emphasizing sustainability, mobility, and practical convenience.

Medium-priced portable choppers are anticipated to contribute 46.8% of the overall market revenue in 2025, emerging as the most favored pricing tier. This segment’s leadership is attributed to the optimal balance it offers between cost, quality, and product features. Consumers are increasingly opting for choppers that deliver dependable performance without the premium pricing associated with high-end models.

The medium segment is benefiting from an influx of well-designed, durable, and user-friendly products that incorporate essential features such as sharp stainless-steel blades, ergonomic grips, and multiple blade configurations. Manufacturers are focusing on value-driven innovation within this price bracket, making products more accessible to middle-income households while maintaining aesthetic appeal.

Additionally, the medium segment caters well to gifting and first-time buyers, which expands its addressable customer base. As awareness of kitchen utility products grows through digital platforms and word-of-mouth endorsements, the medium-priced category continues to attract a broad spectrum of value-conscious consumers.

Consumers and culinary professionals are adopting portable choppers for efficient food prep in constrained environments or mobile setups. Niche use cases in outdoor cooking, small-scale meal production, and urban kitchens are creating new adoption opportunities.

Portable choppers are being chosen by cooking subscription services, outdoor caterers, and food delivery kitchens where quick chopping and easy cleanup are essential. Compact, battery- or USB-powered units are designed to handle vegetables, fruits, nuts, and herbs in small batches—ideal for recipe box assembly, camping, or food truck operations. Consumers in compact apartments and shared kitchens also value devices that save countertop space and eliminate bulky appliances.

Safety features such as locking lids and automatic shut-off are being emphasized. Ease of assembly, dishwasher-safe parts, and container size variety support versatile use across breakfast prep, smoothie blending, and fresh salsa making. Qualitative reviews find these units reduce meal prep time and simplify ingredient handling in tight-cooking scenarios.

New opportunities are emerging through accessory sets offering multiple blade types, portable battery packs, and dishwasher-safe containers tailored for specific food functions. Subscription programs for replacement blades, herb-cutting discs, or snack-size attachments help improve longevity and performance. Partnerships with meal kit companies allow branding alignment and inclusion of choppers in ingredient boxes for recipe-focused home cooking.

Equipment rental platforms and cooking school packages featuring portable choppers enable chefs or event caterers to test premium models without full purchase. Incorporating smart measurement technology and app-guided recipes expands functionality for health-conscious users. Bundled pop-up kitchen kits including chopper, portable scale, and cutting surface provide turn-key solutions for urban cooking studios and food events.

Portable chopper users increasingly require consistent chopping quality across both small and larger batch sizes. Manual models excel at small-volume tasks but often fail with denser items or larger quantities. Electric variants offer more power but risk over-processing or inconsistent particle sizes in mixed ingredients. Manufacturers must balance blade speed, bowl capacity, and motor torque to maintain performance across multiple food types—from soft vegetables to nuts and meats.

Consumers expect uniform chop without puree or uneven pieces. Without precise blade geometry and torque control, chopped volume performance may vary across units. Inconsistent outcomes undermine brand trust and limit repeat sales. Suppliers must invest in multi-speed control, stainless steel blades, and sealed operation systems to meet both kitchen speed and precision needs.

Consumer demand is mounting for kitchen tools that handle multiple tasks in minimal space and time. Portable choppers with attachments for slicing, whisking, or whipping save counter clutter and deliver value. Compact form factors and cordless designs appeal to urban households and foodservice startups. Electric segment leads growth, offering consistent chopping and expanded functionality beyond manual pull-string models.

Offline retail remains dominant for consumers who prefer to inspect appliance performance firsthand, but online channels steadily gain due to convenience and variety in features. Brands introducing modular chopper kits perform better in both residential and small commercial sectors. These multifunction packages drive average selling prices upward and attract shoppers seeking all-in-one food prep tools.

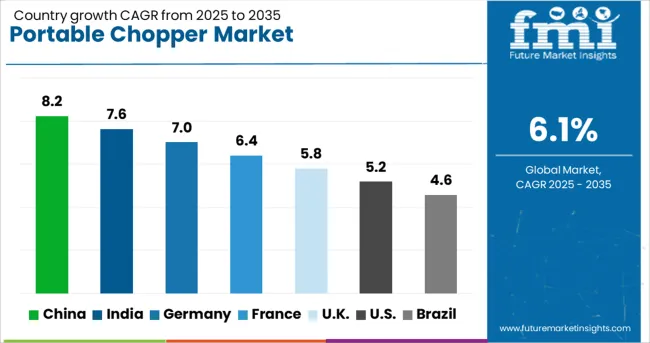

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

| USA | 5.2% |

| Brazil | 4.6% |

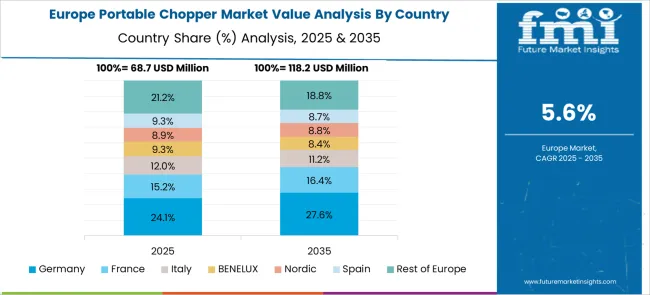

China, a BRICS member, is set to grow at an 8.2% CAGR from 2025 to 2035, driven by mass-scale kitchen appliance production and rising domestic sales through digital retail channels. India, also in BRICS, follows at 7.6%, where demand is expanding in urban and semi-urban households due to affordability and wide availability through regional distributors. Among OECD countries, Germany is expected to grow at 7.0%, with consistent demand from premium small appliance brands and integration of portable choppers into multifunction kitchen systems. France, growing at 6.4%, shows market stability through strong brick-and-mortar retail activity and growing consumer preference for space-saving culinary tools. The United Kingdom, at 5.8%, maintains volume through online marketplaces and sustained adoption among students and small families in urban centers. The report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

China is experiencing robust growth in the portable chopper market, with expansion estimated at a CAGR of 8.2%. The increasing demand for compact food processing tools across residential and semi-commercial kitchens is a key contributor. The market is being supported by widespread adoption of electric and manual choppers for vegetable, meat, and nut preparation. Mass production capabilities are being enhanced to serve large domestic and export requirements. Compact designs with detachable blades and spill-proof lids are being preferred. Retailers are expanding distribution in both urban and smaller regional centers. Low-voltage electric variants are being promoted for home and dormitory use. Product durability and cleaning ease are being prioritized in design updates.

In India, portable chopper market is gaining momentum, advancing steadily with a CAGR of 7.6%. Growing interest in portable kitchen appliances across urban and semi-urban homes is fueling this progress. The use of choppers is being extended beyond vegetables to include herbs, fruits, and dry ingredients. Domestic brands are expanding their presence with competitive pricing and regional language packaging. Compact storage and ease of use are being emphasized by manufacturers. Rural penetration is being achieved through local retail channels and e-commerce discounts. The demand for unpowered choppers is increasing in areas with limited electricity access. Multi-blade options and lock-safe lids are being added to support user safety.

In Germany, portable chopper market is showing strong expansion, with a CAGR estimated at 7%. Increased interest in space-saving food preparation tools for apartments and shared kitchens is driving demand. Product selection is being influenced by functionality, ease of cleaning, and compact form factors. Local suppliers are expanding their offerings with options made of BPA-free materials and reinforced blades. Manual rotary and pull-style units are being used in low-noise environments such as offices and shared flats. Recyclable packaging and modular part construction are becoming more common. Buyers are responding to consistent chopping performance across both soft and hard foods. Stores are promoting choppers as utility tools for varied meal prep needs.

France is recording stable growth in its portable chopper market, projected to reach a CAGR of 6.4%. Rising use of kitchen aids that simplify ingredient processing for home cooks is driving interest. The market is being shaped by demand for quiet, quick, and portable options that reduce meal prep time. Emphasis is being placed on products with simple operation and low maintenance. Domestic brands are developing ergonomic designs with non-slip bases and safety lock features. Sales are being driven by lifestyle retailers and supermarket chains. Multi-compartment models are being introduced for simultaneous chopping and storing. Greater preference is being shown for units with minimal parts and dishwasher-safe assemblies.

In the United Kingdom, the portable chopper market is experiencing moderate yet consistent expansion, with a CAGR of 5.8%. A growing number of consumers are seeking compact kitchen tools for quick chopping and mixing tasks. Emphasis is being placed on convenience and storage efficiency, especially in apartments and student accommodations. Retailers are offering a range of models featuring interchangeable blades and high-impact plastic housings. Online channels are enabling rapid expansion of lesser-known brands. Manual variants are being promoted for energy-free operation and low-noise usage. Compact choppers with transparent bodies are being used for basic meal prep across households. Cleaning-friendly designs with detachable units are receiving favorable reviews.

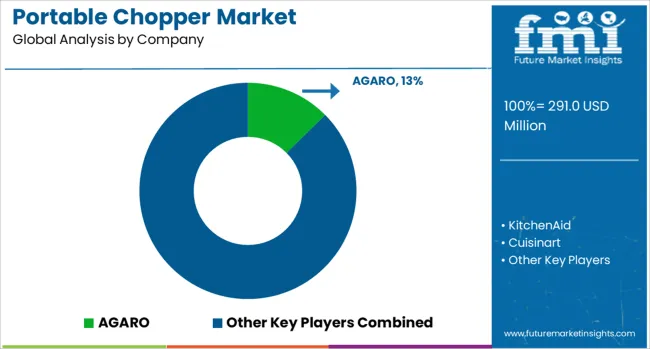

The portable chopper market is moderately fragmented and consists of a diverse mix of global consumer appliance brands, regional kitchenware manufacturers, and niche household product companies. Tier 1 suppliers are established brands known for their reliability, innovation, and wide market penetration. Companies like AGARO, KitchenAid, Cuisinart, and Black+Decker lead this segment by offering compact, multifunctional choppers designed for modern kitchens. These brands focus on product durability, user-friendly interfaces, and aesthetic design, appealing to urban consumers who value convenience and performance in daily food preparation.

Their offerings often include multiple speed settings, safety locks, BPA-free materials, and powerful motors suited for chopping vegetables, nuts, herbs, and more. Tier 2 suppliers such as INALSA, Pigeon, and Hamilton Beach target mid-range customers with a strong focus on value-for-money. These companies emphasize practical features like USB recharging, detachable stainless steel blades, one-touch operation, and compact form factors ideal for small kitchens.

They cater to households looking for efficiency without a premium price tag and often gain traction through a combination of online retail presence and competitive pricing. Tier 3 suppliers, including Farberware, Borosil, Proctor Silex, and Royal Kitchenwares, serve localized markets and budget-conscious consumers. These players emphasize affordability, simplicity, and seasonal or promotional availability through e-commerce channels and local retailers. Niche manufacturers like Crompton, JD Products, Hobart, and Longbehn contribute to the segment through private-label offerings and specialized models for unique user needs.

| Item | Value |

|---|---|

| Quantitative Units | USD 291.0 Million |

| Material | Plastic and Stainless steel |

| Type | Manual and Electric |

| Pricing | Medium, Low, and High |

| End Usage | Residential kitchen and Commercial kitchen |

| Distribution Channel | Offline, E-Commerce, Company website, Online, Specialty stores, Mega retail stores, and Others (individual stores, etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AGARO, KitchenAid, Cuisinart, INALSA, Black+Decker, Pigeon, Hamilton Beach, Farberware, Borosil, Proctor Silex, Crompton, Hobart, Royal Kitchenwares, JD Products, and Longbehn |

| Additional Attributes | Dollar sales by device type including manual and electric choppers, capacity and blade configurations, and end-user segment such as residential or commercial kitchens; demand boosted by home cooking trends, food safety focus, and convenience-driven lifestyles; innovation in multi-functional modular design and cordless models; cost shaped by component sourcing and brand positioning; and rising use in meal prep apps, catering, and small-scale operations. |

The global portable chopper market is estimated to be valued at USD 291.0 million in 2025.

The market size for the portable chopper market is projected to reach USD 526.1 million by 2035.

The portable chopper market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in portable chopper market are plastic and stainless steel.

In terms of type, manual segment to command 57.9% share in the portable chopper market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Portable Audiometer Calibration System Market Size and Share Forecast Outlook 2025 to 2035

Portable Crushers Market Size and Share Forecast Outlook 2025 to 2035

Portable Filtration System Market Size and Share Forecast Outlook 2025 to 2035

Portable Toilet Rental Market Size and Share Forecast Outlook 2025 to 2035

Portable NIR Moisture Meter Market Forecast and Outlook 2025 to 2035

Portable Appliance Tester (PAT) Market Size and Share Forecast Outlook 2025 to 2035

Portable Boring Machines Market Size and Share Forecast Outlook 2025 to 2035

Portable Charging Units Market Size and Share Forecast Outlook 2025 to 2035

Portable Electronic Analgesic Pump Market Size and Share Forecast Outlook 2025 to 2035

Portable Ramps Market Size and Share Forecast Outlook 2025 to 2035

Portable Buffet and Drop-In Ranges Market Size and Share Forecast Outlook 2025 to 2035

Portable Cancer Screen Devices Market Size and Share Forecast Outlook 2025 to 2035

Portable Hydrogen Powered Generator Market Size and Share Forecast Outlook 2025 to 2035

Portable Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Portable Power Quality Meter Market Size and Share Forecast Outlook 2025 to 2035

Portable Sandwich Maker Market Size and Share Forecast Outlook 2025 to 2035

Portable Conventional Generator Market Size and Share Forecast Outlook 2025 to 2035

Portable Projector Market Size and Share Forecast Outlook 2025 to 2035

Portable Printer Market Size and Share Forecast Outlook 2025 to 2035

Portable Video Wall Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA