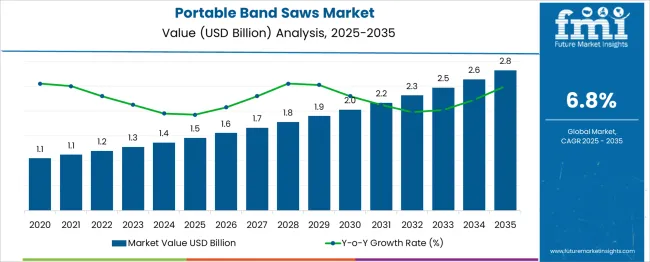

The Portable Band Saws Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 2.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period. The market’s cost structure is shaped primarily by raw material expenses, manufacturing processes, distribution, and after-sales service. Steel, alloys, and motor components account for a significant share of input costs, with price volatility in metals directly influencing production economics. Labor, tooling precision, and compliance with safety standards further add to manufacturing overhead. Within the value chain, upstream activities involve sourcing quality metals, electronic components, and blade materials from specialized suppliers. Midstream manufacturing integrates cutting mechanisms, ergonomic designs, and durability testing, which are crucial to market competitiveness.

Branding, dealer networks, and logistics play a central role in the downstream segment, where product differentiation relies on durability, portability, and maintenance efficiency. The period from 2025 to 2030, when values rise from USD 1.5 billion to USD 2.3 billion, reflects efficiency improvements in procurement and assembly. From 2030 to 2035, growth from USD 2.5 billion to USD 2.8 billion is increasingly driven by aftermarket services, replacement blades, and value-added features. Strategic control over the supply chain remains essential for cost optimization and sustained profitability in this moderately competitive market.

| Metric | Value |

|---|---|

| Portable Band Saws Market Estimated Value in (2025 E) | USD 1.5 billion |

| Portable Band Saws Market Forecast Value in (2035 F) | USD 2.8 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The Portable Band Saws market is advancing steadily due to growing demand across construction, manufacturing, and metal fabrication sectors. Increasing emphasis on mobility, energy efficiency, and precision cutting in both industrial and commercial settings is driving adoption. The market is witnessing a shift toward lightweight yet durable tools that support on-site operations without compromising on performance.

Improvements in battery technology and tool ergonomics are further expanding usage across remote and constrained environments. Manufacturers are focusing on designing versatile cutting solutions compatible with a wide range of materials, which is opening new opportunities across small and medium enterprises. Demand is also being strengthened by the resurgence in infrastructure projects, modernization of workshops, and the need for cost-effective solutions that reduce material wastage.

As a result, product innovation, enhanced portability, and integration with smart safety features are expected to remain key growth enablers in the forecast period. Overall, the market outlook remains optimistic as end users increasingly prefer compact, efficient, and powerful cutting solutions..

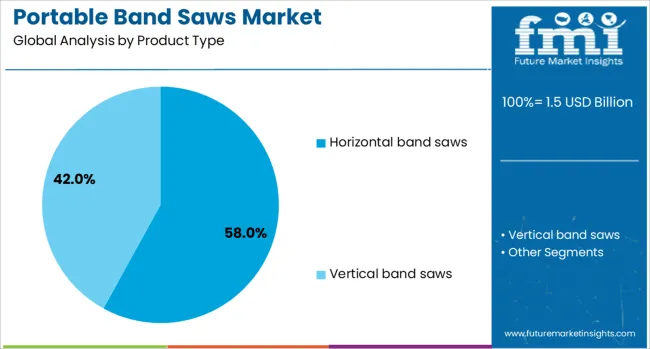

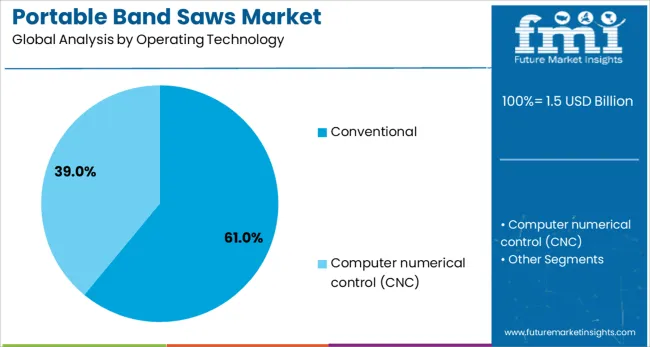

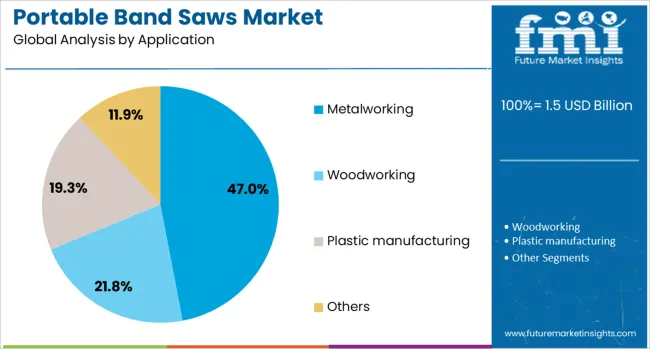

The portable band saws market is segmented by product type, operating technology, application, end-use, distribution channel, and geographic regions. By product type, the portable band saws market is divided into Horizontal band saws and Vertical band saws. In terms of operating technology, the portable band saws market is classified into Conventional Computer Numerical Control (CNC). Based on the application, the portable band saws market is segmented into Metalworking, Woodworking, Plastic manufacturing, and Others. The end use of the portable band saws market is segmented into Automotive, Aerospace & defense, Energy & power, Electronics & semiconductor, Building & construction, and Others. The distribution channel of the portable band saws market is segmented into Indirect sales and Direct sales. Regionally, the portable band saws industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The horizontal band saws product type segment is expected to account for 58% of the Portable Band Saws market revenue share in 2025, positioning it as the leading product category. This leadership has been driven by the segment’s capability to provide high-precision cuts for heavy-duty applications, particularly in industrial metalworking. Horizontal band saws have been widely preferred for their ability to deliver uniform cuts across thick and large workpieces, making them suitable for structural materials and dense metals.

Their design supports steady feed rates and enhanced operator safety, which contributes to higher efficiency in professional environments. Additionally, horizontal models have been adopted extensively in workshops and fabrication units where consistent output and production speed are crucial.

Manufacturers have continued to refine these saws to ensure longer blade life, minimal vibration, and ergonomic operation. As users increasingly prioritize accuracy, reduced material loss, and enhanced productivity, horizontal band saws have sustained their dominant role in shaping market demand..

The conventional operating technology segment is projected to hold 61% of the Portable Band Saws market revenue share in 2025, highlighting its leading position. The dominance of this segment has been supported by its proven reliability, ease of maintenance, and affordability compared to advanced variants. Conventional systems have been widely adopted in small and medium-scale operations due to their straightforward functionality and robust build, which ensures stable performance in demanding environments.

These saws have remained preferred among operators who value mechanical simplicity and operational familiarity. The lower acquisition and operational costs associated with conventional band saws have reinforced their presence in cost-sensitive markets and applications.

Furthermore, their adaptability to both indoor and outdoor environments has made them a staple in construction and repair jobs. With consistent demand from users prioritizing dependability over complex digital features, conventional technology continues to drive substantial market share, especially in regions with limited access to advanced machinery..

The metalworking application segment is anticipated to represent 47% of the Portable Band Saws market revenue share in 2025, making it the largest application segment. Growth in this segment has been driven by increasing requirements for precision cutting, shaping, and fabrication of various metals across manufacturing and construction industries. Portable band saws have been adopted widely in metalworking due to their ability to cut through steel, aluminum, copper, and other alloys with speed and accuracy.

Their portability has enabled use in both factory floors and field environments, supporting operations such as pipe fitting, structural fabrication, and customized part production. As the metal fabrication sector continues to modernize, demand for cutting tools that balance power with maneuverability has grown.

The flexibility of portable band saws to perform complex cuts while minimizing material loss has further enhanced their utility. The segment continues to benefit from rising infrastructure investments and industrial expansion, ensuring sustained relevance in metal-centric applications.

The market has been growing steadily due to rising demand from construction, metal fabrication, and woodworking sectors. These tools have been valued for their ability to deliver precise cuts on-site with enhanced mobility and efficiency. Growth has been supported by infrastructure development, industrial maintenance activities, and home renovation trends. Technological enhancements, such as variable speed control, cordless designs, and improved blade durability, have expanded product appeal. Demand from emerging economies and increased adoption in industrial repair operations have further strengthened the market outlook.

The construction and metal fabrication sectors have been primary drivers for portable band saw adoption. The ability of these saws to perform accurate and smooth cuts on steel beams, pipes, and structural components has been crucial for construction projects. Portability enables workers to operate directly at the job site, improving workflow efficiency. In metal fabrication, these tools have been used for both heavy-duty and precision tasks, supporting industrial assembly lines and repair work. The increasing demand for prefabricated metal structures, industrial frameworks, and steel-based infrastructure has contributed to market expansion. Lightweight and cordless models have been favored for remote and confined workspaces. These saws have also gained traction in shipbuilding and heavy machinery maintenance. Industrial operators value the combination of cutting precision, portability, and operational safety, which has reinforced their adoption across large-scale projects and daily operations.

Advancements in portable band saw technology have significantly influenced the market trajectory. Features such as brushless motors, adjustable cutting speeds, and ergonomic designs have improved performance and user comfort. Enhanced blade materials, including bi-metal and carbide-tipped options, have increased cutting efficiency and extended service life. Cordless models powered by high-capacity lithium-ion batteries have provided extended run times and operational flexibility. Integrated LED lighting, blade tracking adjustments, and vibration reduction mechanisms have further improved cutting accuracy. Manufacturers have been focusing on compact designs without compromising on cutting depth and capacity. Smart sensors for overload protection and maintenance alerts have also been integrated into advanced models. These innovations have expanded the user base to include professionals in industrial maintenance, plumbing, HVAC, and electrical installation, while also appealing to hobbyists and DIY enthusiasts seeking efficient and portable cutting solutions.

Maintenance and repair services in industries such as oil and gas, mining, and transportation have been contributing to the growing demand for portable band saws. These sectors often require cutting and modification of pipes, beams, and structural elements in locations without access to stationary machinery. Portable band saws provide the flexibility to carry out precise work in challenging environments. Equipment downtime in these industries can lead to significant losses, making quick and efficient repair essential. The compact nature of portable band saws allows operators to access confined spaces, including ship engine rooms, plant interiors, and industrial platforms. Their adaptability for cutting various materials such as stainless steel, aluminum, and composite materials has increased their utility. As global industries prioritize operational efficiency and reduced downtime, the adoption of high-performance portable band saws for field-based maintenance is expected to remain strong.

Emerging economies have been witnessing increasing adoption of portable band saws due to rapid industrialization, infrastructure expansion, and a growing base of skilled trade workers. Availability of affordable, entry-level models has made these tools accessible to small workshops, contractors, and independent craftsmen. In addition, the rise in do-it-yourself culture and home improvement activities has broadened the market reach beyond industrial users. Lightweight, user-friendly designs have been developed to meet the needs of hobbyists and occasional users. Distribution through online channels has expanded market access in rural and semi-urban regions. Manufacturers have been targeting these markets with promotional offers, bundled accessories, and training support. The dual appeal to professional and consumer segments has been reinforcing steady growth, while aftermarket sales of blades and accessories continue to provide recurring revenue streams for industry players.

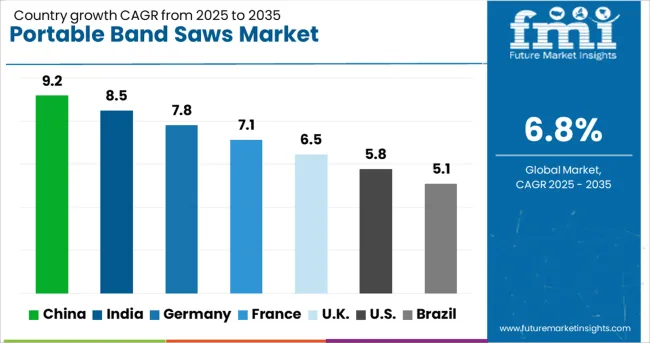

| Country | CAGR |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| France | 7.1% |

| UK | 6.5% |

| USA | 5.8% |

| Brazil | 5.1% |

The market is forecast to expand at a CAGR of 6.8% from 2025 to 2035, supported by rising demand in construction, metalworking, and maintenance applications. China leads with a 9.2% CAGR, driven by expanding industrial manufacturing and adoption of efficient cutting tools. India follows at 8.5%, benefitting from growth in fabrication industries and increased infrastructure projects. Germany, with a 7.8% CAGR, sees consistent demand from precision engineering and manufacturing sectors. The UK, at 6.5%, records growth through rising adoption in small-scale workshops and repair services. The USA, growing at 5.8%, is supported by steady replacement demand in construction and industrial operations. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China, forecast to register a CAGR of 9.2% from 2025 to 2035, is expanding due to the rise in precision cutting requirements across manufacturing, construction, and metal fabrication sectors. The shift toward compact, high-performance cutting tools is encouraging both small-scale workshops and large industrial facilities to invest in advanced models. Increased infrastructure development, along with a strong base of domestic tool manufacturers, is contributing to competitive pricing and broader accessibility. Technological upgrades such as brushless motors, enhanced battery efficiency, and variable speed control are further improving operational capabilities, promoting higher adoption rates in both professional and DIY segments.

India’s market is projected to expand at a CAGR of 8.5% through 2035, is benefitting from increasing use in metal cutting, plumbing, and fabrication works. The proliferation of small and medium-scale industries is driving higher demand for affordable yet efficient cutting solutions. The market is witnessing a gradual transition toward cordless and lightweight band saws to cater to on-site work needs. Growing infrastructure investments and the spread of modular construction techniques are also boosting tool adoption. Local manufacturing initiatives are enabling cost-effective production and reducing dependency on imports, thereby supporting the market’s long-term stability.

Germany’s market is set to grow at a CAGR of 7.8% between 2025 and 2035, is evolving with the integration of precision engineering and ergonomic designs. High demand from automotive, aerospace, and metal fabrication industries is fueling product upgrades with enhanced safety features and durability. The adoption of battery-powered models with longer runtimes is gaining traction, especially in remote job site applications. Manufacturers are focusing on low-vibration mechanisms to reduce operator fatigue, ensuring consistent performance in high-volume cutting operations. Increased emphasis on quality and compliance with EU standards is further supporting market growth.

The United Kingdom’s industry, projected to grow at a CAGR of 6.5% from 2025 to 2035, is witnessing advancements in compact and high-power models catering to construction, plumbing, and renovation projects. Contractors are increasingly opting for tools with quick blade-change systems and adjustable speed settings for versatile applications. The market is also seeing demand for low-noise and low-vibration models to meet workplace safety regulations. Product innovation, supported by the entry of international tool brands, is expanding availability and enhancing competitive offerings. These factors are expected to maintain steady growth momentum in the coming years.

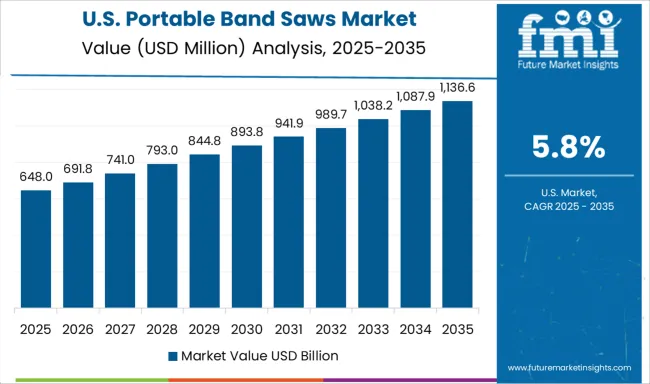

The United States market, expected to register a CAGR of 5.8% through 2035, is advancing with strong uptake in industrial maintenance, fabrication, and HVAC installation sectors. Demand is rising for lightweight, high-capacity saws with enhanced battery performance for fieldwork. Tool rental services are becoming a key driver, enabling contractors to access premium equipment without large upfront costs. Product innovation is focused on improving blade durability and integrating smart sensors to optimize cutting performance. This combination of technological upgrades and diversified end-user demand is reinforcing the market’s growth outlook.

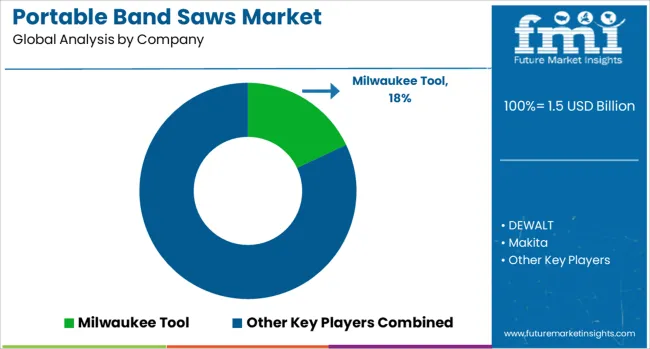

The market features established power tool manufacturers known for delivering precision cutting solutions for construction, metalworking, and maintenance applications. Milwaukee Tool is a dominant player, recognized for producing heavy-duty cordless and corded band saws with advanced battery technology to enhance mobility and performance. DEWALT offers a versatile range designed for durability and ergonomic handling, catering to both professional and industrial users. Makita stands out for integrating efficient brushless motors and compact designs that ensure portability without compromising cutting power.

Bosch emphasizes innovation in blade design and safety features, enabling accurate cutting across various materials while maintaining operational ease. Metabo HPT delivers robust portable band saw models optimized for demanding work environments, focusing on precision, longevity, and user comfort. These manufacturers are driving competition through advancements in lithium-ion battery performance, variable speed controls, and enhanced blade durability. They also address the growing demand for lightweight and vibration-reduced designs that improve operator efficiency in field operations. With rising adoption in fabrication shops, maintenance crews, and construction sites, these companies continue to expand their product offerings to meet evolving industry requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Product Type | Horizontal band saws and Vertical band saws |

| Operating Technology | Conventional and Computer numerical control (CNC) |

| Application | Metalworking, Woodworking, Plastic manufacturing, and Others |

| End Use | Automotive, Aerospace & defense, Energy & power, Electronics & semiconductor, Building & construction, and Others |

| Distribution Channel | Indirect sales and Direct sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Milwaukee Tool, DEWALT, Makita, Bosch, and Metabo HPT |

| Additional Attributes | Dollar sales by product type and end-use industry, demand dynamics across construction, metal fabrication, and maintenance sectors, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in blade technology, cordless battery efficiency, and ergonomic designs, environmental impact of material waste, energy usage, and component disposal, and emerging use cases in precision on-site cutting, remote field repairs, and customized manufacturing operations. |

The global portable band saws market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the portable band saws market is projected to reach USD 2.8 billion by 2035.

The portable band saws market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in portable band saws market are horizontal band saws and vertical band saws.

In terms of operating technology, conventional segment to command 61.0% share in the portable band saws market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Portable Audiometer Calibration System Market Size and Share Forecast Outlook 2025 to 2035

Portable Crushers Market Size and Share Forecast Outlook 2025 to 2035

Portable Filtration System Market Size and Share Forecast Outlook 2025 to 2035

Portable Toilet Rental Market Size and Share Forecast Outlook 2025 to 2035

Portable NIR Moisture Meter Market Forecast and Outlook 2025 to 2035

Portable Appliance Tester (PAT) Market Size and Share Forecast Outlook 2025 to 2035

Portable Boring Machines Market Size and Share Forecast Outlook 2025 to 2035

Portable Charging Units Market Size and Share Forecast Outlook 2025 to 2035

Portable Electronic Analgesic Pump Market Size and Share Forecast Outlook 2025 to 2035

Portable Ramps Market Size and Share Forecast Outlook 2025 to 2035

Portable Buffet and Drop-In Ranges Market Size and Share Forecast Outlook 2025 to 2035

Portable Cancer Screen Devices Market Size and Share Forecast Outlook 2025 to 2035

Portable Hydrogen Powered Generator Market Size and Share Forecast Outlook 2025 to 2035

Portable Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Portable Power Quality Meter Market Size and Share Forecast Outlook 2025 to 2035

Portable Sandwich Maker Market Size and Share Forecast Outlook 2025 to 2035

Portable Conventional Generator Market Size and Share Forecast Outlook 2025 to 2035

Portable Projector Market Size and Share Forecast Outlook 2025 to 2035

Portable Printer Market Size and Share Forecast Outlook 2025 to 2035

Portable Video Wall Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA