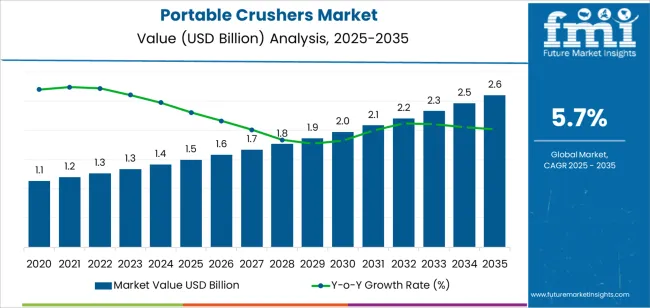

The global portable crushers market is projected to reach USD 2,601.6 million by 2035, recording an absolute increase of USD 1,107.1 million over the forecast period. The portable crushers market is valued at USD 1,494.5 million in 2025 and is set to rise at a CAGR of 5.7% during the assessment period. The overall market size is expected to grow by nearly 1.7 times during the same period, supported by increasing demand for mobile crushing solutions in mining operations worldwide, driving demand for efficient material processing systems and increasing investments in infrastructure development and quarrying projects globally. High initial capital costs and maintenance requirements compared to stationary alternatives may pose challenges to market expansion.

The portable crushers market exhibits distinct regional growth dynamics from 2025 to 2035. Asia Pacific is expected to remain the dominant regional market, driven by rapid expansion in mining, construction, and aggregate processing activities across China, India, and Australia. The region benefits from large-scale infrastructure investment programs and mineral resource extraction, which continue to generate consistent demand for mobile crushing systems. Manufacturers in the region are focusing on compact, fuel-efficient, and easily transportable crushers suited for remote construction and mining sites, leading to widespread equipment deployment across both public and private sector projects.

North America is anticipated to register steady growth due to increasing infrastructure redevelopment, particularly in the United States and Canada. Demand is shaped by highway expansion, quarrying, and construction waste recycling initiatives. The portable crushers market is transitioning toward hybrid and electric crushers to comply with emission regulations, while integration of IoT-based monitoring and predictive maintenance systems is improving operational efficiency and uptime.

In Europe, moderate growth is projected as the region witnesses modernization of quarrying operations and recycling plants. The shift toward low-noise, plug-in electric crushers is prominent in countries such as Germany, the UK, and the Nordic nations. Strict environmental norms are encouraging adoption of mobile crushing systems capable of meeting recycling and emission targets. Equipment manufacturers are emphasizing energy-efficient designs and automation compatibility to cater to urban redevelopment and resource recovery applications.

Latin America is set to experience gradual expansion, supported by mining activities in Chile, Peru, and Brazil. The portable crushers market benefits from the rising demand for portable crushing systems in copper, iron ore, and aggregate processing operations, where mobility and rapid setup are crucial. However, import tariffs and uneven access to advanced machinery may restrict faster adoption. Local partnerships with global equipment suppliers are becoming a strategic approach to expand regional access to modern crusher technologies.

The Middle East and Africa region is projected to post strong growth, driven by infrastructure development and resource diversification projects in Saudi Arabia, the UAE, and South Africa. Portable crushers are increasingly deployed in large-scale mining, cement production, and quarrying projects, favored for their adaptability in remote or arid environments. Growing utilization of diesel-electric hybrid crushers and the rise in government-funded construction initiatives are expected to strengthen market penetration through 2035.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1,494.5 million |

| Market Forecast Value (2035) | USD 2,601.6 million |

| Forecast CAGR (2025-2035) | 5.7% |

The portable crushers market grows by enabling mining and construction operators to achieve superior operational flexibility and material processing efficiency while reducing transportation costs for aggregates and minerals. Industrial operators face mounting pressure to improve site productivity and reduce environmental footprint, with portable crushing solutions typically providing 20-30% cost savings compared to fixed plant operations through on-site material processing, making mobile equipment essential for remote mining operations and temporary construction projects. The infrastructure development movement's need for flexible aggregate production creates demand for advanced portable solutions that can deliver consistent output quality, adapt to varying material hardness, and ensure rapid deployment across diverse operational environments.

Government initiatives promoting infrastructure investment and mining sector modernization drive adoption in quarrying, demolition waste recycling, and road construction applications, where crushing flexibility has a direct impact on project economics and operational efficiency. The global shift toward sustainable construction practices and circular economy principles accelerates portable crusher demand as operators seek equipment that enables material reuse and reduces aggregate transportation distances. Limited availability of skilled operators and higher maintenance costs compared to stationary systems may limit adoption rates among smaller contractors and regions with underdeveloped service networks for mobile crushing equipment.

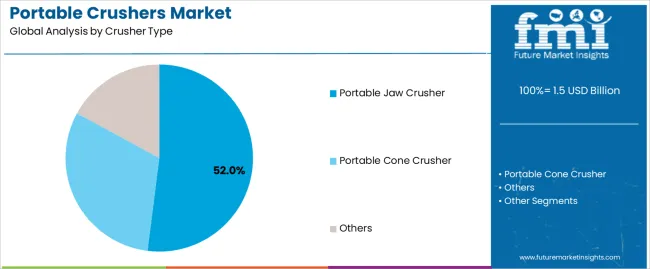

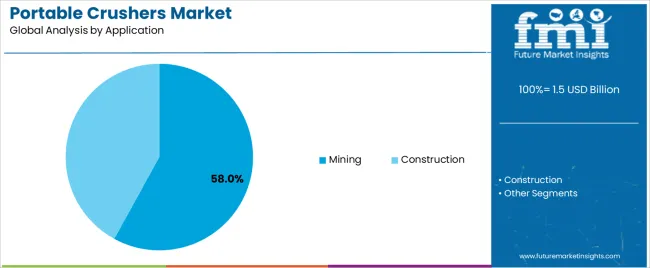

The portable crushers market is segmented by crusher type, application, and region. By crusher type, the portable crushers market is divided into portable jaw crusher, portable cone crusher, and others. Based on application, the portable crushers market is categorized into mining and construction. Regionally, the portable crushers market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

The portable jaw crusher segment represents the dominant force in the portable crushers market, capturing approximately 52.0% of total market share in 2025. This advanced category delivers primary crushing capabilities with robust design features, high reduction ratios, and versatility across diverse material types, including hard rock, ore, and recycled concrete. The portable jaw crusher segment's market leadership stems from its exceptional reliability in heavy-duty applications, wide feed opening accommodating large material sizes, and proven performance in mining operations requiring high throughput capacity.

The portable cone crusher segment maintains a substantial 35.0% market share, serving operators who require secondary and tertiary crushing capabilities through advanced crushing chamber designs optimized for producing uniform aggregate gradations. The others segment accounts for 13.0% market share, featuring impact crushers and specialty mobile crushing units designed for specific material processing requirements.

Key advantages driving the portable jaw crusher segment include:

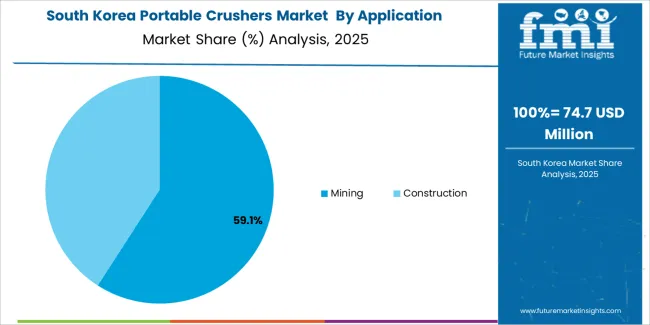

Mining applications dominate the portable crushers market with approximately 58.0% market share in 2025, reflecting the critical role of mobile crushing equipment in mineral extraction operations, remote mine sites, and ore processing activities across diverse geographical locations. The mining segment's market leadership is reinforced by widespread adoption in surface mining operations, underground material handling, and exploration projects requiring flexible crushing solutions that can be relocated as mining fronts advance.

The construction segment represents 42.0% market share through deployment in road building projects, demolition waste processing, and quarrying operations where temporary crushing plants provide economic advantages over permanent installations. This segment benefits from increasing infrastructure development activities, recycled concrete aggregate production, and urban construction projects requiring on-site material processing capabilities.

Key market dynamics supporting application preferences include:

The portable crushers market is driven by three concrete demand factors tied to operational efficiency and economic outcomes. First, mining sector expansion creates increasing requirements for flexible crushing solutions, with global mineral production growing 4-6% annually in emerging markets, requiring portable equipment for accessing remote deposits and adapting to changing mining conditions. Second, infrastructure development initiatives drive demand for aggregate production equipment, with portable crushers reducing material transportation costs by 25-35% through on-site processing while enabling contractors to serve multiple project sites efficiently. Third, construction waste recycling regulations accelerate adoption across Europe, North America, and Asia-Pacific regions where environmental compliance and circular economy principles receive priority policy support.

Market restraints include high initial capital investment ranging from USD 200,000 to USD 1.5 million depending on capacity and specifications, creating barriers for small to medium-sized contractors operating on limited equipment budgets. Maintenance complexity and parts availability challenges in remote locations pose operational risks, particularly for specialized crushing components requiring skilled technicians and genuine replacement parts. Fuel consumption costs during operation and transportation create additional financial pressures, especially during periods of elevated diesel prices that impact total cost of ownership calculations for mobile crushing fleets.

Key trends indicate accelerated adoption in Asia-Pacific markets, particularly China and India, where government infrastructure programs and mining sector growth incentivize mobile crushing equipment through favorable financing terms and domestic manufacturing development. Technology advancement trends toward hybrid-electric power systems with 30-40% fuel savings, intelligent automation reducing operator skill requirements, and integrated dust suppression systems meeting stringent emission standards are enabling next-generation equipment development. The portable crushers market thesis could face disruption if autonomous hauling systems and centralized crushing facilities achieve cost parity with mobile operations while delivering superior environmental performance.

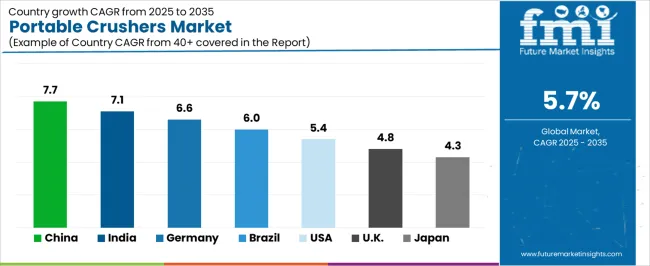

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Brazil | 6.0% |

| USA | 5.4% |

| UK | 4.8% |

| Japan | 4.3% |

| Germany | 6.6% |

The portable crushers market is gaining momentum worldwide, with China taking the lead due to aggressive infrastructure development programs and mining sector expansion initiatives. Close behind, India benefits from government road construction projects and mineral extraction growth, positioning itself as a strategic growth hub in the Asia-Pacific region. Brazil shows strong advancement, where expanding mining operations and construction activity strengthen its role in South American industrial equipment markets. The USA demonstrates robust growth through mining modernization and construction sector recovery, signaling continued investment in mobile crushing infrastructure. Meanwhile, Japan stands out for its recycling and demolition waste management focus with environmental regulation compliance, while Germany and UK continue to record consistent progress driven by sustainability initiatives and aggregate production optimization. Together, China and India anchor the global expansion story, while established markets build stability and diversity into the portable crushers market's growth path.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

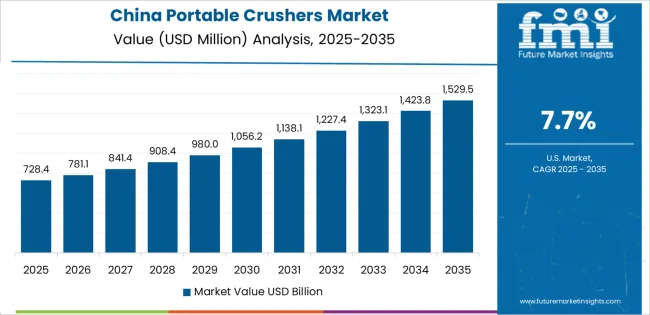

China demonstrates the strongest growth potential in the Portable Crushers Market with a CAGR of 7.7% through 2035. The country's leadership position stems from comprehensive Belt and Road infrastructure initiatives, intensive mining development programs, and aggressive urbanization targets driving adoption of mobile crushing systems. Growth is concentrated in major industrial regions, including Inner Mongolia, Shanxi, Hebei, and Shandong, where mining, quarrying, and construction operators are implementing portable crushing programs for mineral processing and aggregate production. Distribution channels through domestic equipment manufacturers, international brand partnerships, and direct sales relationships expand deployment across mining clusters and infrastructure development sites. The country's Made in China 2025 initiative provides policy support for crushing equipment manufacturing, including subsidies for advanced mobile machinery adoption and emission-compliant crushing systems.

Key market factors:

In Maharashtra, Rajasthan, Karnataka, and Odisha regions, the adoption of portable crushing systems is accelerating across mining operations, road construction projects, and quarrying activities, driven by National Infrastructure Pipeline requirements and government mining sector initiatives. The portable crushers market demonstrates strong growth momentum with a CAGR of 7.1% through 2035, linked to comprehensive infrastructure expansion and increasing focus on domestic aggregate production. Indian operators are implementing mobile crushing programs and equipment modernization platforms to improve operational efficiency while meeting environmental compliance standards for dust and noise emissions. The country's Bharatmala and Sagarmala infrastructure programs create sustained demand for flexible crushing solutions, while increasing emphasis on mineral processing drives adoption of advanced mobile equipment that enhances productivity.

Brazil's advanced mining sector demonstrates sophisticated implementation of portable crushing systems, with documented case studies showing 20-25% operational cost reduction through mobile processing in remote mining locations. The country's industrial infrastructure in major mineral-producing regions, including Minas Gerais, Pará, Goiás, and Bahia, showcases integration of portable crushing technologies with existing mining operations, leveraging expertise in iron ore, gold, and aggregate production. Brazilian operators emphasize equipment reliability and operational flexibility, creating demand for robust portable crushing solutions that support large-scale mining commitments and infrastructure development requirements. The portable crushers market maintains strong growth through focus on mining sector modernization and construction activity expansion, with a CAGR of 6.0% through 2035.

Key development areas:

What Role Does Technology Innovation Play in the United States Portable Crushers Market?

The USA market leads in advanced portable crusher innovation based on integration with telematics systems and sophisticated equipment monitoring for enhanced operational efficiency. The country shows solid potential with a CAGR of 5.4% through 2035, driven by mining sector modernization and increasing aggregate demand across major industrial regions, including Nevada, Arizona, Wyoming, and Texas mining corridors. American operators are adopting advanced portable crushing equipment for compliance with EPA emission standards, particularly in surface mining operations requiring flexible processing and in recycling applications supporting sustainable construction practices. Technology deployment channels through equipment dealers, rental companies, and direct mining equipment suppliers expand coverage across diverse crushing applications.

Leading market segments:

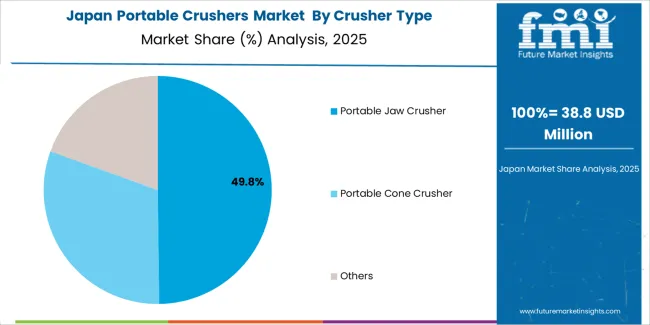

Japan's portable crushers market demonstrates sophisticated implementation focused on construction waste recycling and demolition material processing, with documented integration of mobile crushing programs achieving 80-85% material recovery rates in urban redevelopment projects. The country maintains steady growth momentum with a CAGR of 4.3% through 2035, driven by stringent environmental regulations and emphasis on circular economy principles aligned with national sustainability objectives. Major construction regions, including Tokyo, Osaka, Aichi, and Fukuoka, showcase advanced deployment of compact portable crushers and specialized recycling equipment that integrate seamlessly with existing waste management infrastructure and material separation systems.

Key market characteristics:

In Bavaria, North Rhine-Westphalia, Baden-Württemberg, and Lower Saxony regions, construction and quarrying operators are implementing portable crushing programs to meet environmental protection requirements and resource efficiency targets, with documented case studies showing sustained aggregate quality improvements. The portable crushers market shows solid growth potential with a CAGR of 6.6% through 2035, linked to European Union circular economy directives, emission reduction standards, and increasing demand for recycled construction materials. German operators are adopting advanced portable crushing equipment and intelligent monitoring systems to maintain operational efficiency while complying with stringent noise and dust emission regulations in sensitive environmental zones.

Market development factors:

The UK's portable crushers market demonstrates mature implementation focused on aggregate production efficiency and construction material recycling, with documented integration achieving 70-75% use of recycled aggregates in specific infrastructure projects. The country maintains steady growth through sustainability commitments and construction sector activity, with a CAGR of 4.8% through 2035, driven by government infrastructure investment and policy support for recycled material utilization. Major quarrying regions, including Wales, Scotland, and Southwest England, showcase established portable crushing operations where equipment programs integrate primary jaw crushers with secondary cone units and screening systems.

Key market characteristics:

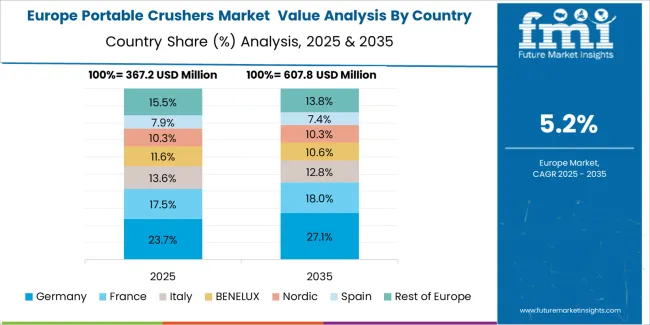

The portable crushers market in Europe is projected to grow from USD 441.3 million in 2025 to USD 762.3 million by 2035, registering a CAGR of 5.6% over the forecast period. Germany is expected to maintain its leadership position with a 24.5% market share in 2025, declining slightly to 24.2% by 2035, supported by its extensive quarrying infrastructure and major aggregate production centers, including Bavaria, North Rhine-Westphalia, and Baden-Württemberg regions.

The United Kingdom follows with a 19.5% share in 2025, projected to reach 19.3% by 2035, driven by comprehensive construction sector recovery programs and aggregate production expansion. France holds a 16.5% share in 2025, expected to rise to 16.7% by 2035 through ongoing infrastructure investment and quarrying modernization. Italy commands a 13.5% share in both 2025 and 2035, backed by construction activity and marble quarrying operations. Spain accounts for 10.5% in 2025, rising to 10.8% by 2035 on infrastructure development and aggregate production expansion. The Rest of Europe region is anticipated to hold 15.5% in 2025, expanding to 15.7% by 2035, attributed to increasing portable crusher adoption in Nordic countries and emerging Central & Eastern European mining and construction programs.

The Japanese portable crushers market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of compact mobile crushing systems with existing demolition waste management infrastructure across urban construction projects, recycling facilities, and specialized aggregate production operations. Japan's emphasis on environmental compliance and resource efficiency drives demand for advanced portable crushers that support circular economy commitments and stringent emission standards in densely populated urban environments. The portable crushers market benefits from strong partnerships between international crusher manufacturers and domestic construction equipment distributors including Komatsu and local rental companies, creating comprehensive service ecosystems that prioritize emission control and noise reduction capabilities. Construction centers in Tokyo, Osaka, Nagoya, and other major metropolitan areas showcase advanced recycling implementations where portable crushing programs achieve 85-90% material recovery through integrated crushing and screening systems with dust suppression technologies.

The South Korean portable crushers market is characterized by growing international equipment provider presence, with companies maintaining significant positions through comprehensive after-sales support and technical services capabilities for mining and construction applications. The portable crushers market is seeing increased emphasis on infrastructure development and aggregate production efficiency, as Korean contractors increasingly demand advanced portable crushing equipment that integrates with domestic construction practices and sophisticated project management systems deployed across major infrastructure complexes. Regional equipment distributors are gaining market share through strategic partnerships with international manufacturers, offering specialized services including Korean safety certification support and equipment customization programs for intensive quarrying operations. The competitive landscape shows increasing collaboration between multinational crusher companies and Korean construction equipment specialists, creating hybrid service models that combine international manufacturing expertise with local technical knowledge and rapid parts availability systems.

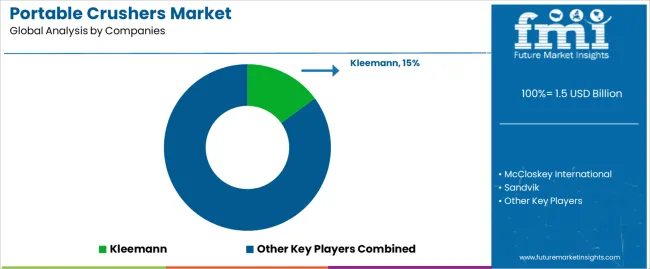

The portable crushers market features approximately 10-15 meaningful players with moderate concentration, where the top three companies control roughly 35-40% of global market share through established distribution networks and comprehensive product portfolios. Competition centers on equipment reliability, crushing efficiency, and after-sales service capabilities rather than price competition alone. Kleemann maintains strong market positioning with approximately 15.0% market share through its comprehensive mobile crushing and screening portfolio.

Market leaders include Kleemann, McCloskey International, and Sandvik, which maintain competitive advantages through global service infrastructure, vertical integration in component manufacturing, and deep expertise in crushing technology across multiple applications, creating reliability and performance advantages with mining and construction operations. These companies leverage research and development capabilities in hybrid power systems and ongoing technical support relationships to defend market positions while expanding into recycling and specialized mineral processing applications.

Challengers encompass Terex Corporation and Metso, which compete through diversified equipment offerings and strong regional presence in key industrial markets. Product specialists, including Shibang Industry & Technology Group, Rubble Master, and Astec Industries, focus on specific crusher types or application segments, offering differentiated capabilities in compact designs, recycling solutions, and customized crushing configurations.

Regional players and emerging equipment providers create competitive pressure through localized service advantages and rapid response capabilities, particularly in high-growth markets including China and India, where proximity to mining clusters provides advantages in parts availability and technical support. Market dynamics favor companies that combine proven crushing performance with comprehensive service offerings that address the complete operational cycle from equipment commissioning through maintenance optimization, while increasingly emphasizing emission reduction and fuel efficiency improvements that address environmental regulations and operator cost pressures in global mining and construction markets.

Portable crushers represent mobile material processing solutions that enable mining and construction operators to achieve 20-30% cost reduction compared to stationary crushing plants through on-site material processing, delivering superior operational flexibility and reduced transportation expenses in demanding industrial applications. With the portable crushers market projected to grow from USD 1,494.5 million in 2025 to USD 2,601.6 million by 2035 at a 5.7% CAGR, these mobile crushing systems offer compelling advantages - operational flexibility, reduced logistics costs, and rapid deployment capabilities - making them essential for mining applications (58.0% market share), construction projects (42.0% share), and operations requiring adaptable crushing solutions that can be relocated as project requirements evolve. Scaling market adoption and technology development requires coordinated action across industrial policy, equipment manufacturing standards, mining operators, construction contractors, and infrastructure investment capital.

How Governments Could Spur Local Manufacturing and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 1,494.5 million |

| Crusher Type | Portable Jaw Crusher, Portable Cone Crusher, Others |

| Application | Mining, Construction |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Brazil, USA, UK, Japan, Germany, and 40+ countries |

| Key Companies Profiled | Kleemann, McCloskey International, Sandvik, Terex Corporation, Metso, Shibang Industry & Technology Group, Rubble Master, Astec Industries, Komatsu, Eagle Crusher |

| Additional Attributes | Dollar sales by crusher type and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with equipment manufacturers and distribution networks, service facility requirements and specifications, integration with mining operations and construction projects, innovations in crushing technology and power systems, and development of specialized portable equipment with enhanced efficiency and environmental performance capabilities. |

The global portable crushers market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the portable crushers market is projected to reach USD 2.6 billion by 2035.

The portable crushers market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in portable crushers market are portable jaw crusher, portable cone crusher and others.

In terms of application, mining segment to command 58.0% share in the portable crushers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Portable Filtration System Market Size and Share Forecast Outlook 2025 to 2035

Portable Toilet Rental Market Size and Share Forecast Outlook 2025 to 2035

Portable NIR Moisture Meter Market Forecast and Outlook 2025 to 2035

Portable Appliance Tester (PAT) Market Size and Share Forecast Outlook 2025 to 2035

Portable Boring Machines Market Size and Share Forecast Outlook 2025 to 2035

Portable Charging Units Market Size and Share Forecast Outlook 2025 to 2035

Portable Electronic Analgesic Pump Market Size and Share Forecast Outlook 2025 to 2035

Portable Ramps Market Size and Share Forecast Outlook 2025 to 2035

Portable Buffet and Drop-In Ranges Market Size and Share Forecast Outlook 2025 to 2035

Portable Cancer Screen Devices Market Size and Share Forecast Outlook 2025 to 2035

Portable Hydrogen Powered Generator Market Size and Share Forecast Outlook 2025 to 2035

Portable Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Portable Power Quality Meter Market Size and Share Forecast Outlook 2025 to 2035

Portable Sandwich Maker Market Size and Share Forecast Outlook 2025 to 2035

Portable Conventional Generator Market Size and Share Forecast Outlook 2025 to 2035

Portable Projector Market Size and Share Forecast Outlook 2025 to 2035

Portable Printer Market Size and Share Forecast Outlook 2025 to 2035

Portable Video Wall Market Size and Share Forecast Outlook 2025 to 2035

Portable Gas Detection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Portable Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA