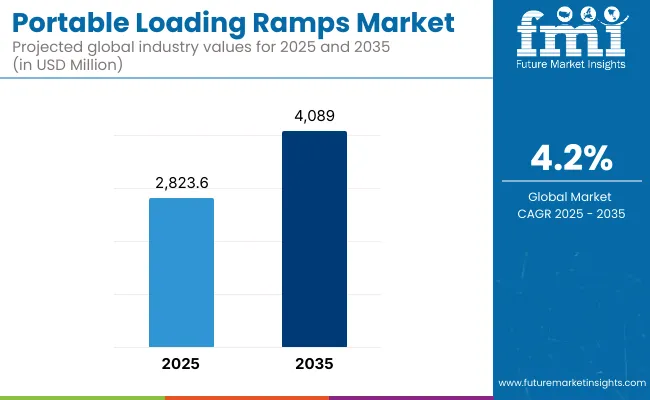

The portable loading ramps market is expected to grow at a steady pace with a CAGR of 4.2% during of which the market is expected to reach USD 2,823.6 Million in 2025 and further growing at a CAGR of 4.2% during 2025 to 2035 period to reach USD 4,089.0 Million by 2035. This growth is fueled by the demand for flexible and mobile loading solutions in warehousing, logistics, construction and agricultural sectors.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 2,823.6 Million |

| Market Value (2035F) | USD 4,089.0 Million |

| CAGR (2025 to 2035) | 4.2% |

Amid a shift in global supply chains towards increased decentralization and responsiveness, the demand for rapid deployment and relocation of the loading infrastructure has skyrocketed. In the case of loading and unloading heavy loads in non-standardized or open environments, portable loading ramps provide a scale solution, which is cost-effective to meet the need.

Apart from logistics and warehousing, the construction sector is also proving to be a prolific user of portable loading ramps to accommodate the stream of construction materials and machinery being shuttled across temporary job sites. Due to their design, they can be used with forklifts, trailers, and containers without permanent installation, allowing you to adapt to dynamic operations.

Manufacturers are also coming up with foldable, height-adjustable, and heavy-duty designs that are more suitable for terrain conditions and load capacity. In addition, increased focus on workplace safety and regulatory compliance is propelling demand for high-strength, anti-slip ramp surfaces, enabling dependable use in tough conditions.

North America is expected to remain a strong market for portable loading ramps, owing to well-developed logistics infrastructure and warehousing operations. Demand growth is led by the USA due to its extensive e-commerce fulfilment network and advanced distribution hub.

The industry across the region is investing heavily in mobile loading equipment for faster supply chain flexibility and lower truck waiting times. Strict occupational safety regulations by OSHA are driving enterprises to upgrade to efficient and ergonomic loading systems. This increasing trend of pop-up logistics and last-mile delivery stations only adds to the demand for portable and rapidly deployable ramp solutions.

Increasing automation and modernization in warehousing practices is witnessing steady growth in the portable loading ramps market in Europe. Germany, the Netherlands and the UK etc. are focused on the efficiency improvements in the freight handling and the intermodal logistics.

A major SME base in the manufacturing and distribution sectors has created demand for cost effective loading ramp solutions, which are mobile in nature and do not require extensive installation time. The wheels of the circular economy and sustainability are also turning towards aluminium that is very recyclable and has a lower carbon footprint during its production and transportation.

The Asia Pacific is expected to witness the fastest growth during the forecast period and be the market leader in terms of growth rate, followed by China, India, and countries in the Southeast Asian region. Increasing demand for portable loading systems is expected with rapid expansion of industrial zones, special economic regions, and cross-border trade infrastructure.

With urbanization and infrastructure development on the rise, construction companies are opting for mobile ramps to ease the process at the site of work. The emergence of organized retail and cold chain logistics in India is also driving ramp adoption, especially among 3PLs. Local manufacturers are coming up with low-cost, customized solutions for rugged and high-load applications.

Operational Limitations in Extreme Conditions

Portable loading ramps have a challenging issue in Extreme working conditions such as uneven ground, heavy rainfall, or snow-prone areas. In such conditions, standard ramp designs cannot provide the level of stability or traction resulting in high accidents and less productivity.

On top of that, some industries reliant on specific types of equipment may make demand for ramps with specialized dimensions or layouts, which will increase production costs and limit mass-market potential. Manufacturers should continue innovating what they produce with an eye toward the diverse needs for application-specific variants without sacrificing durability or ease of deployment.

Growth in Small and Medium Enterprises (SMEs) and Urban Logistics

With the rise of SMEs and urban delivery hubs around the world, portable loading ramps market has a lucrative growth potential. Many of these businesses function in space-limited environments where permanent infrastructure is prohibitively expensive or impractical.

Portable loading ramps provide a fast solution for effective material handling without the need for large capital expenditures. And as urban logistics grows with the increasing number of micro-fulfilment centres and dark stores, lightweight ramps are likely to be in higher demand. It enables compact, modular-designs, and rapid delivery models aimed at urban logistics operators.

During the period between 2020 and 2024, warehousing & construction industries were increasingly utilizing automated guided vehicles as more cost-effective material handling solutions, as logistics demand changes. The rising interest in temporary logistics locations, field ops and mobile warehousing made portable ramp solutions a logical choice. But with many smaller enterprises postponing capital expenditures during uncertain times, high-end ramp deployments were largely limited to the biggest operators, which had stable cash flows.

In 2025 to 2035, the market is predicted to shift towards sustainability, personalization, and smart ramp designs. Lightweight composites, corrosion-resistant coatings, and IoT-enabled condition monitoring are expected to gain ground. Manufacturers are likely to roll out digital tools for ramp load monitoring, wellness alerts for predictive maintenance and smart alignment systems to improve productivity and safety.

As industries follow the path towards agility and lean operations, the adoption of smart features in ramps will be a strategic differentiator. Additionally, localized manufacturing and rental-oriented distribution models will drive growth in emerging markets as the change in ownership dynamics reduces ownership barriers and improves availability.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Key Users | Warehousing, construction |

| Technology Adoption | Steel-based, fixed-length ramps |

| Distribution Model | Direct purchase and OEM supply |

| Design Focus | High load-bearing, low customization |

| Growth Regions | USA, China, Germany |

| Market Shift | 2025 to 2035 |

|---|---|

| Key Users | Logistics hubs, urban delivery, SMEs, infrastructure projects |

| Technology Adoption | Modular, foldable, IoT -enabled, lightweight material ramps |

| Distribution Model | Hybrid of sales and short-term rentals through digital platforms |

| Design Focus | Smart ramps, ergonomic designs, high terrain adaptability |

| Growth Regions | India, Southeast Asia, Eastern Europe, South America |

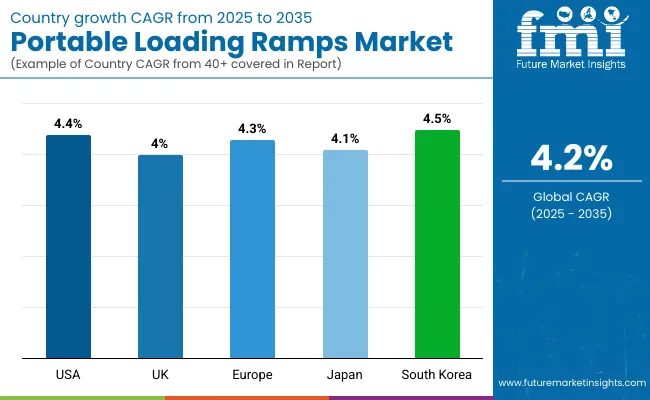

The USA Portable Loading Ramps Market is projected to grow at a CAGR of 4.4% during the forecast period (2025 to 2035). Growth is driven by greater warehouse automation, logistics infrastructure upgrades, and the booming e-commerce and retail sectors. USA-based manufacturers are developing durable, mobile, and safety-enhanced ramp systems that address the need for flexible loading solutions for last-mile delivery operations and industrial facilities. The demand is high especially in regional distribution centres and port logistics environments.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.4% |

The UK Market is at a CAGR of 4.0% over the forecast duration. Increasing online retail activity is creating ever-growing warehousing demand in the UK, which is investing in modular and space-efficient loading equipment. Portable loading ramps have been deployed in urban warehouses, logistic hubs, and transport terminals. Meanwhile, the adoption of these ramps in public and private freight operations is further driven by health and safety regulations in material handling processes.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.0% |

European Union will have a CAGR of 4.3% from 2025 to 2035 Intraregional trade, along with increasing freight volumes, and a mature industrial logistics base, have, thus, enabled demand for portable ramps globally across warehouses, factories and cross-docking stations, among others.

Countries like Germany, France, or Italy are providing a strong ground for establishing the mobile loading infrastructure used for automotive logistics and cold chains. Sustainability trends are likewise driving potential ramp materials that are recyclable and light-weight.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.3% |

Japan is expected to witness a CAGR of 4.1% over the forecast period. However, given the country’s focus on efficiency in its warehousing and transport logistics, demand for space-saving and adjustable loading ramps is on the rise. New developments in small hydraulic ramps and corrosion-resistive materials are taking hold throughout small warehouses and the urban centres of fulfilment. Its focus on safety and ergonomics also helps determine product development.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

The market is anticipated to grow at a CAGR of 4.5% from 2025 to 2035 in South Korea. Due to increasing investments in warehousing and high throughput in the container terminals, demand for mobile & height-adjustable loading ramps is increasing. The nation’s emphasis on automation and lean logistics systems has led to more customized portable loading equipment for manufacturing and transport applications. Domestic manufacturers have other prospects in Southeast Asia as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.5% |

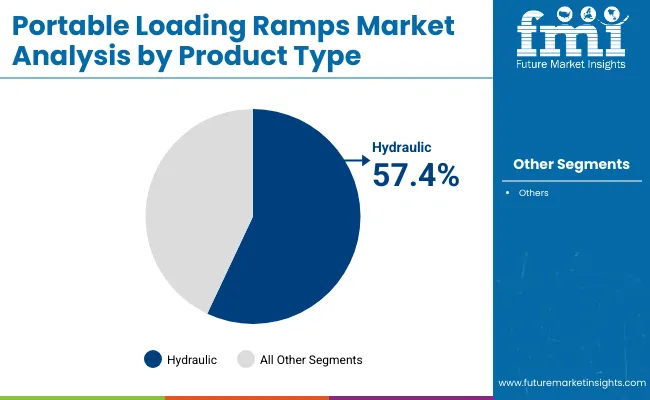

| By Product Type | Market Share (2025) |

|---|---|

| Hydraulic | 57.4% |

The hydraulic portable loading ramps capture the market strongly as the their superior lifting mechanisms, ease of operation and performing well in heavy loads make them the typical choice of users in logistics and industrial sector. These ramps utilize hydraulic cylinders and pumps for height adjustment to match the vehicle's height, facilitating the smooth transfer of cargo in these docks, trucks, and containers. Operators save time and do less manual work with hydraulic systems, particularly in high-volume environments.

In modern times, warehouses and manufacturing plants increasingly depend on hydraulic ramps to facilitate forklift traffic and heavy equipment movement. The power to lift heavy weights often at least 10,000 kg makes them perfect for loading large pallets, metal components and machines.

This is where hydraulic mobile ramps are popular among users who appreciate the measures taken to ensure safety in hydraulic ramps, such as non-slip surfaces, side guards, and locking mechanisms that prevent slippage during operations.

From portable wheel systems to adjustable heights and corrosion-resistant coatings, with the robust demand in outdoor and industrial environments, manufacturers are continuing to innovate. Among different product types, hydraulic rams offer the most optimal balance of power, safety, and mobility, contributing to their leading position in the market.

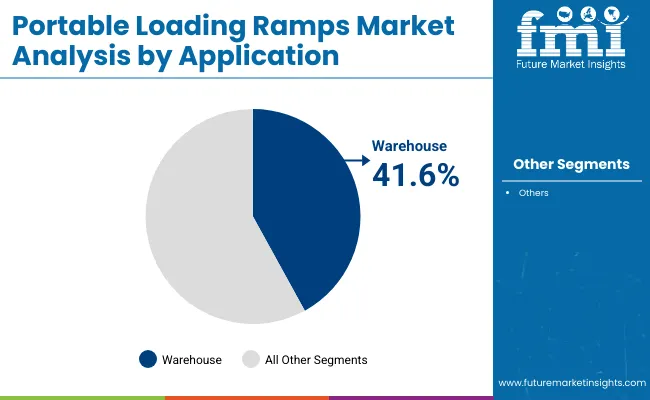

| By Application | Market Share (2025) |

|---|---|

| Warehouse | 41.6% |

Logistics executives and third-party fulfilment providers are increasingly investing in mobile and flexible loading solutions to aid material handling, resulting in the leading share of the portable loading ramps market being held by warehouse applications. Timing and flexibility are vital in warehouse conditions as e-commerce boom leads to the demand for the nonstop loading and unloading of products at a range of dock doors.

Portable loading ramps offer warehouses the flexibility needed to establish temporary or multi-use loading zones without requiring permanent infrastructure modifications. Operators utilize these ramps to manage incoming shipments, inter-warehouse transfers and outbound logistics. Ramps can then be positioned according to the availability of space and type of vehicles, thereby boosting floor productivity and better utilization of floor space.

Portable ramps are also useful in warehouses when pedestrians and different vehicle types must be loaded or offloaded from standard delivery trucks to semi-trailer freight trucks as these ramps can adjust to various load heights.

Their deployment is in support of a lean, just-in-time logistics model that minimizes bottlenecks and maximizes operational throughput. With global supply chains becoming increasingly complex and warehouses becoming increasingly high-speed fulfilment hubs, demand for reliable, mobile loading infrastructure continues to grow ensuring that warehouse applications remain a staple in the ramp community for the time being.

The global Portable Loading Ramps is growing due to increasing demand from the transportation, shipping, construction, and agricultural sectors. Growth and expansion of e-commerce and global trade, has been fuelling demand for portable loading ramps, as efficient and effective loading and unloading solutions are necessary. To fortify their foothold in the business, companies are concentrating on product innovation, strategic partnerships, and capacity expansion.

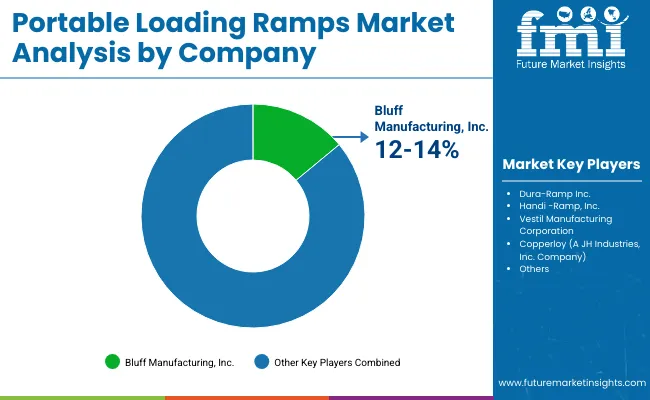

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Bluff Manufacturing, Inc. | 12-14% |

| Dura-Ramp Inc. | 10-12% |

| Handi -Ramp, Inc. | 8-10% |

| Vestil Manufacturing Corporation | 6-8% |

| Copperloy (A JH Industries, Inc. Company) | 5-7% |

| Other Companies (combined) | 49-59% |

| Company Name | Key Offerings/Activities |

|---|---|

| Bluff Manufacturing, Inc. | In 2024 , Introduced new series of mobile loading ramps with upgraded safety features and increased weight capacities. |

| Dura-Ramp Inc. | In 2025 , Expanded their product line in 2024 to include customizable portable ramps for various industrial needs. |

| Handi -Ramp, Inc. | In 2024 , developed versatile loading ramps for various industries, including transport and warehousing. |

| Vestil Manufacturing Corporation | In 2025 , they had developed versatile loading ramps for different industries like transportation and warehousing. |

| Copperloy (A JH Industries, Inc. Company) | In 2024 , Specialized in manufacturing mobile loading ramps that provide solid and dependable support for industrial and commercial applications |

Key Company Insights

Bluff Manufacturing, Inc. (12-14%)

Bluff Manufacturing leads the market with innovative heavy-duty loading ramps tailored for the construction industry, emphasizing durability and safety.

Dura-Ramp Inc. (10-12%)

Dura-Ramp focuses on mobile loading ramps featuring enhanced safety measures and increased weight capacities, catering to diverse industrial needs.

Handi-Ramp, Inc. (8-10%)

Handi-Ramp offers customizable portable ramps, addressing specific requirements across various industrial applications.

Vestil Manufacturing Corporation (6-8%)

Vestil provides versatile loading ramps suitable for multiple industries, including transportation and warehousing, focusing on adaptability and user-friendliness.

Copperloy (A JH Industries, Inc. Company) (5-7%)

Copperloy specializes in durable and reliable mobile loading ramps designed for both industrial and commercial applications, ensuring operational efficiency.

Other Key Players (49-59% Combined)

Several other companies contribute significantly to the portable loading ramps market through specialized offerings:

The overall market size for the Portable Loading Ramps Market was USD 2,823.6 Million in 2025.

The overall market size for the Portable Loading Ramps Market was anticipated to reach USD 4,089.0 Million by 2035.

The increasing demand from industries such as oil & gas, aluminium & steel manufacturing, and construction is expected to drive the Portable Loading Ramps Market.

The top 5 countries driving market growth are the USA, UK, Europe, Japan, and South Korea.

The Hydraulic segment is expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Portable NIR Moisture Meter Market Forecast and Outlook 2025 to 2035

Portable Appliance Tester (PAT) Market Size and Share Forecast Outlook 2025 to 2035

Portable Boring Machines Market Size and Share Forecast Outlook 2025 to 2035

Portable Charging Units Market Size and Share Forecast Outlook 2025 to 2035

Portable Electronic Analgesic Pump Market Size and Share Forecast Outlook 2025 to 2035

Portable Buffet and Drop-In Ranges Market Size and Share Forecast Outlook 2025 to 2035

Portable Cancer Screen Devices Market Size and Share Forecast Outlook 2025 to 2035

Portable Hydrogen Powered Generator Market Size and Share Forecast Outlook 2025 to 2035

Portable Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Portable Power Quality Meter Market Size and Share Forecast Outlook 2025 to 2035

Portable Sandwich Maker Market Size and Share Forecast Outlook 2025 to 2035

Portable Conventional Generator Market Size and Share Forecast Outlook 2025 to 2035

Portable Projector Market Size and Share Forecast Outlook 2025 to 2035

Portable Printer Market Size and Share Forecast Outlook 2025 to 2035

Portable Video Wall Market Size and Share Forecast Outlook 2025 to 2035

Portable Gas Detection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Portable Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Portable Band Saws Market Size and Share Forecast Outlook 2025 to 2035

Portable Cannabis Vaporizer Market Size and Share Forecast Outlook 2025 to 2035

Portable Cardiology Ultrasound Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA