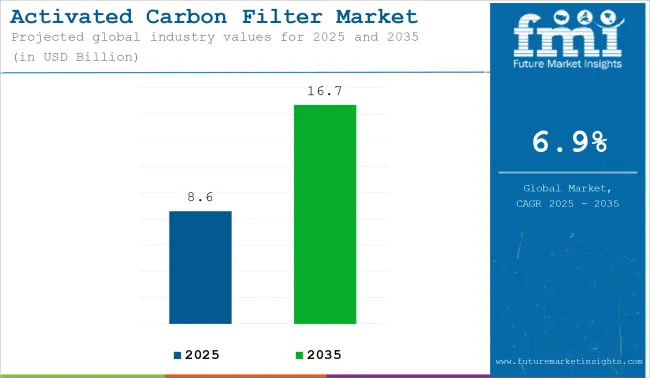

The global activated carbon filter market is estimated to be valued at USD 8.6 billion in 2025 and is projected to reach USD 16.7 billion by 2035, reflecting a CAGR of 6.9% during the forecast period. Activated carbon filters are being incorporated across water treatment, air purification, pharmaceuticals, and food & beverage industries due to their capacity to adsorb organic contaminants, heavy metals, and volatile compounds.

Water treatment remains the leading application, where activated carbon filters are being used to remove pesticides, microplastics, chlorine, and industrial pollutants. The USA Environmental Protection Agency (EPA) and the World Health Organization (WHO) have established quality benchmarks for potable water, which have resulted in mandatory adoption of granular and powdered activated carbon filters across municipal and industrial water treatment plants. Growing public awareness of waterborne diseases and harmful contaminants such as PFAS has accelerated household-level installation of carbon filtration units.

Air purification represents another fast-growing segment. Activated carbon filters are being utilized in HVAC systems, industrial exhausts, and commercial air purifiers to control VOCs, sulfur compounds, and odors. In 2023, the European Environmental Agency (EEA) reported that over 96% of urban populations in Europe were exposed to PM2.5 levels above WHO guidelines. In response, carbon filter adoption has been supported by indoor air quality standards and emission control norms across North America, Europe, and parts of Asia.

Market penetration is being supported by innovation in filter structure and activation processes. According to Filtration+Separation Magazine, new product developments include bio-based carbon sources, microwave-activated carbon, and nanostructured filter media that enhance adsorption efficiency while reducing replacement frequency. Brands such as Hayward, 3M, and Pentair are investing in next-generation systems targeting both consumer and industrial segments.

Product customization, improved regeneration techniques, and extended service lifespans are enabling filter solutions to meet evolving user requirements. In parallel, public sector procurement in wastewater treatment and industrial effluent management is driving large-scale demand for activated carbon filtration systems globally.

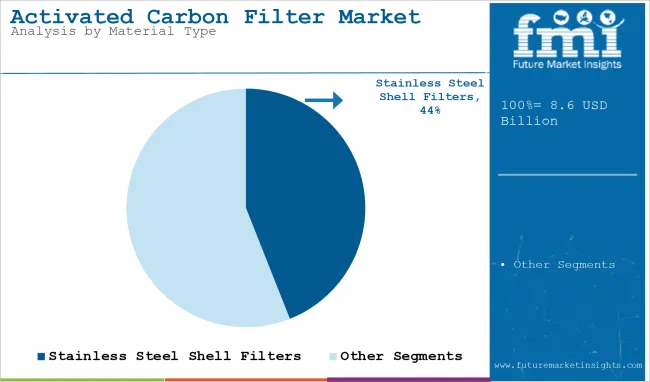

Stainless steel shell activated carbon filters are estimated to account for approximately 44% of the global market share in 2025 and are projected to grow at a CAGR of 7.1% through 2035. Their usage is prominent in industries requiring long service life, chemical compatibility, and hygiene assurance-particularly in food & beverage, pharmaceutical, and ultrapure water applications.

Stainless steel construction supports high-pressure operations and ensures compliance with sanitary standards, making it suitable for both hot and cold filtration systems. As regulatory oversight intensifies across water and process filtration sectors, demand for high-grade stainless steel shell filters continues to rise across North America, Europe, and industrial hubs in East Asia.

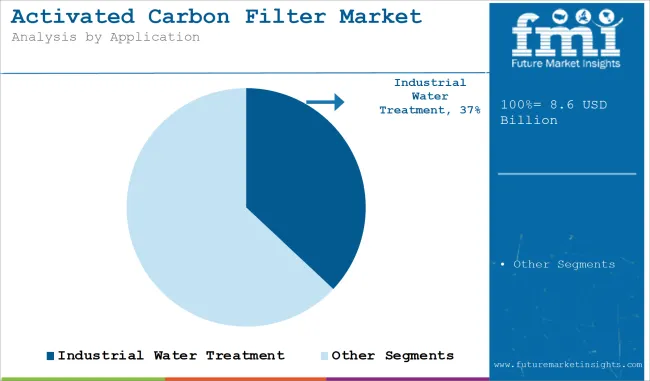

Industrial water treatment is projected to hold approximately 37% of the global activated carbon filter market share in 2025 and is expected to grow at a CAGR of 7.0% through 2035. Activated carbon filters are widely deployed across manufacturing, power generation, chemicals, and mining industries to remove organic compounds, chlorine, heavy metals, and odor-causing substances from process water and discharge streams.

As environmental regulations tighten and water reuse practices gain traction, industrial users are increasingly adopting carbon filtration systems as part of multi-stage water treatment frameworks. With growing investment in wastewater recycling and zero-liquid discharge (ZLD) systems across Asia-Pacific and the Middle East, activated carbon filters play a critical role in ensuring environmental compliance and operational efficiency.

High Production Costs and Raw Material Dependency

High prices of raw materials such as coal, coconut shells, and wood are some of the factors adversely affecting the Activated Carbon Filter Market. Production cost and market stability rely heavily on these materials which can experience frequent changes in availability and price.

Moreover, the manufacturing process involved in activated carbon filters is energy hungry driving up operational costs. Manufacturers also face compliance challenges from regulatory requirements for sustainable production and disposal.

Rising Demand for Water and Air Purification Solutions

Stringent government regulations on clean air and clean water and growing global environmental sustainability awareness are contributing to the activated carbon filter market growth. This widespread adoption in municipal, industrial and residential sector has been initiated by increasing concerns towards industrial pollution, increasing urbanization and the introduction of safe drinking water.

Moreover, along with this a rapid growth in pharma, food & beverage and chemical industries has also provided traction for filtration. Biomass-derived powdered activated carbon production methods and smart filtration systems provide market participants with an opportunity to grow in the USA

The increasing demand for water purification, air treatment, and emissions control from blowing is also driving the growth of activated carbon filters in the United States. The activated carbon filter market is also expected to prosper with the adoption of stringent environmental regulations, such as those established by the Environmental Protection Agency (EPA) and Occupational Safety and Health Administration (OSHA). Therefore, varied industries such as pharmaceuticals and chemicals to food & beverages and manufacturing are adopting activated carbon filtration systems to meet air and water quality standards.

Rosetta to PFAS compounds in municipal water systems vigilant growing concern of contaminating municipal water systems with PFAS (per- and polyfluoroalkyl substances) has driven increased use of activated carbon filtration at municipal water treatment facilities.

Additionally, stringent emissions regulations for industrial facilities are propelling the adoption of air filtration systems that utilize activated carbon filters for volatile organic compound (VOC) and hazardous contaminants removal.

Moreover, because everyone has a better understanding of indoor air quality and personal health, the activated carbon use in home and commercial air purification has gradually increased. The increasing use of activated carbon in automotive end use industries such as EV battery systems and cabin air filters is also expected to contribute significantly to the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

The growing awareness of pollutants have led to the growth of the activated carbon filter market in both the USA and UK as competitive filtered technologies are at forefront of regulatory, environmental, and consumer interest creating pressure for sustained market growth. Stricter emissions controls from the UK Environment Agency (EA) and DEFRA (Department for Environment, Food & Rural Affairs), will also cause increased adoption of activated carbon filters in factories, power plants, and wastewater treatment facilities.

The growing pharmaceutical and food & beverage industries in the UK is also pushing the demand for high-quality water filtration solutions using activated carbon. In addition, rising awareness regarding air pollution in urban hotspots such as London, Manchester, and Birmingham are stimulating the demand for activated carbon-based air purification solutions in both residential and industrial sectors.

Also, the shift of the UK towards green energy and electric vehicles (EVs) is supporting the adoption of the activated carbon filtration in hydrogen fuel cells and the battery cooling systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.8% |

Demand for EU carbon filters has been increasing at a meteoric rate owing to stringent EU environmental protection policies, industrial safety regulations, and relatively high consumer demand for clean air and water. The market is led by countries like Germany, France and Italy with developed structure related to the industry and stringent rules governing air and water consideration.

Legislation such as the EU’s Industrial Emissions Directive (IED) and Water Framework Directive include requirements that industries adopt advanced filtration technologies to meet compliance. In industrial-scale municipal drinking water treatment plants across Europe, activated carbon filtration is being installed to remove pollutants, micro plastics and pharmaceutical residues.

Furthermore, the period to achieve sustainable production of activated carbon filtration products respectively is advancing through proactive changes to carbon-neutral and green filtration solutions. Automotive: Activated carbon filters are becoming increasingly popular in the automotive industry, especially in electric vehicles (EVs) and hydrogen fuel cells.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.9% |

The active filters of carbon has the most advanced regulation framework in the world for air and water purification, leading industries to adopt high-efficiency activated carbon filters.

With air pollution problems in Tokyo and Osaka, acceptance of activated carbon-based air purification systems has expanded in commercial buildings, residential areas, and terminals. Japan’s pharmaceutical and semiconductor industries also need ultra-pure water for manufacturing processes, helping to drive demand for industrial activated carbon filtration.

In Japan, activated carbon filters are integrated into electric and hydrogen fuel cell vehicles, paving the way for automotive innovation. Furthermore, the expansion of smart cities and sustainable infrastructure projects is propelling the investment in eco-friendly filtration technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.1% |

Driven by stringent air pollution regulations, rapid industrialization in South Korea, and investments in sustainable water treatment solutions, the demand for activated carbon filter is also growing significantly in the country. In South Korea, aggressive emission reduction policies have led to extensive deployment of air and gas filtration technologies throughout power plants, petrochemical industries, and manufacturing sites.

Developments by the country’s smart city creations, as well as increasing consumer demand for clean indoor air, are also boosting sales of home and commercial air purifiers featuring activated carbon filters. Moreover, the increasing dominance of South Korea in EV battery production is boosting the penetration of activated carbon in battery cooling and filtration systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.0 |

The activated carbon filter market is characterized by moderate competition, with a mix of large multinational corporations and regional players. The market is regulated, with stringent standards on performance, material safety, and environmental impact, especially in water and air purification applications.

Companies are focusing on product innovation, including the development of filters with higher adsorption capacity and longer lifespan to meet increasing demand across industries like water treatment, air purification, and automotive. Competitive strategies include vertical integration to control the supply chain, partnerships with end-users for tailored solutions, and expanding product lines to cater to diverse industrial requirements

The overall market size for activated carbon filter market was USD 86.18 billion in 2025.

The activated carbon filter market is expected to reach USD 167.96 billion in 2035.

The activated carbon filter market will rise due to increasing concerns over water and air pollution, driven by the growing emphasis on environmental sustainability, rising regulatory standards for industrial emissions, and the expanding adoption of filtration systems across various industries. Additionally, the shift toward advanced purification technologies, the integration of activated carbon filters in residential and commercial water treatment, and the rising demand from the pharmaceutical and food & beverage sectors for high-quality filtration solutions will further propel market growth during the forecast period.

The top 5 countries which drives the development of activated carbon filter market are USA, European Union, Japan, South Korea and UK

Industrial and drinking water demand supplier to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Activated Alumina Market Size and Share Forecast Outlook 2025 to 2035

Activated Cake Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Activated Bleaching Earth Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Activated Cake Emulsifier Suppliers

Activated Partial Thromboplastin Test Market

Activated Charcoal Supplements Market Trends - Sales & Industry Insights

Activated Carbon for Sugar Decolorization Market Size and Share Forecast Outlook 2025 to 2035

Activated Carbon Fiber Market Size and Share Forecast Outlook 2025 to 2035

Activated Carbon Bags Market Size and Share Forecast Outlook 2025 to 2035

Assessing Activated Carbon Market Share & Industry Trends

Heat-Activated Beauty Masks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Heat Activated Tear Tape Market

Wood Activated Carbon Market Size and Share Forecast Outlook 2025 to 2035

Light-Activated Anti-Pollution Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Water Activated Tape Dispensers Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Water Activated Tape Dispensers

Water-Activated Tape Market Trends & Industry Forecast 2024-2034

Pelletized Activated Carbon Market Analysis - Size & Industry Trends 2025 to 2035

Food Grade Activated Carbon Market Report - Applications & Growth 2025 to 2035

Fluorescence-Activated Cell Sorting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA