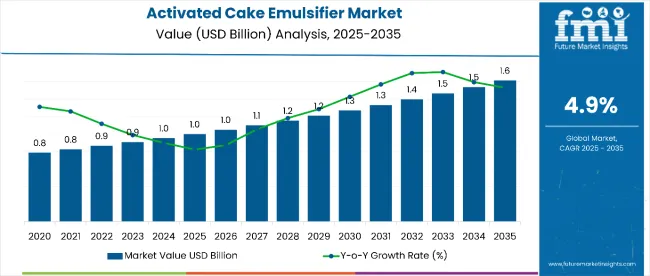

The activated cake emulsifier market is estimated to be valued at USD 1 billion in 2025 and is projected to reach USD 1.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period. This expansion will generate an incremental opportunity of USD 600 million, marking a 1.6x increase over the decade.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 1 billion |

| Projected Value (2035F) | USD 1.6 billion |

| CAGR (2025 to 2035) | 4.9% |

Growth is expected to be underpinned by expanding usage in premium bakery formulations, improved whipping properties, and rising preference for natural and clean-label ingredients in baked goods.

By 2030, the activated cake emulsifier market is projected to reach around USD 1.35 billion, indicating a gain of approximately USD 350 million during the first half of the forecast period. The subsequent five years (2030 to 2035) are projected to contribute an additional USD 250 million, indicating an accelerated, back‑loaded growth trajectory during the latter half of the decade.

Companies such as Palsgaard A/S, Corbion N.V., and Kerry Group plc are intensifying investments in non-GMO, plant-based emulsifier innovations to meet the rising demand for functional cake ingredients. Strategic collaborations with regional bakery chains and introduction of enzyme-activated emulsifier blends are enabling these firms to scale efficiently. Performance will remain tied to shelf-life extension, foam stability, and texture uniformity in industrial and artisanal baking applications.

The activated cake emulsifier market represents a niche yet essential subset within its broader parent markets. It accounts for approximately 6.5% of the global bakery ingredients market, 4.2% of the emulsifiers market, and around 3.8% of the overall food additives sector.

Within the cake ingredients segment, its share rises to about 9.1%, given its specialized application in improving cake texture, volume, and shelf life. Owing to rising demand for clean-label and high-performance bakery products, the share of activated cake emulsifiers is expected to grow across all parent categories between 2025 and 2035.

Over the past two years, the activated cake emulsifier market has been influenced by rising demand for bakery mixes with extended shelf life, consumer shifts toward gluten-free and allergen-free formulations, and the push for palm oil-free solutions. Innovations are being observed in enzyme-activated emulsifier platforms and fat-replacement blends with enhanced foam stability. Regulatory clarity in Europe and cleaner ingredient declarations in North America are further propelling demand.

The market is segmented by product type, form, source, application, and region. By product type, the market is divided into polyglycerol esters, monoglycerides, lactic acid esters, polysorbates, and others (citrate esters, acetylated monoglycerides, and blended systems). Based on form, the market is classified into powder, paste, and liquids.

In terms of source, the market is bifurcated into dairy and non-dairy. By application, the market is characterized into pound cake, butter cake, sponge cake, dorayaki (bean-jam pancakes), castella and others (frozen desserts and microwaveable products). Regionally, the market is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, the Middle East & Africa.

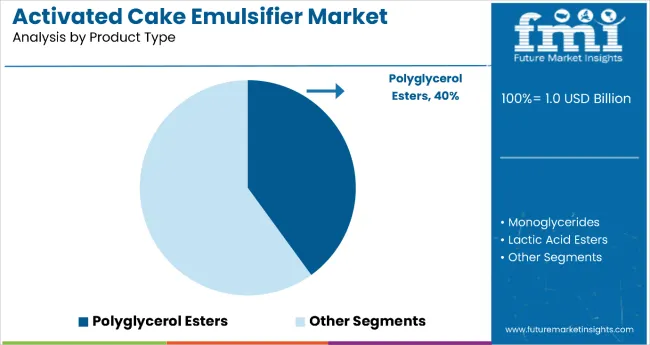

The polyglycerol esters segment leads the product type category with a 40% market share in 2025. These emulsifiers are favored for their superior aeration, stability, and emulsifying efficiency in cake batter systems. Their multifunctionality allows for enhanced crumb structure, increased volume, and better moisture retention across a variety of cake formulations, particularly in high-fat and low-fat bakery recipes.

Polyglycerol esters have gained momentum due to their clean-label acceptance and ability to meet both industrial and artisanal production needs. Manufacturers are leveraging these ingredients to formulate vegan and allergen-free cakes while maintaining softness and texture consistency.

Growing demand for emulsifiers that improve shelf life without altering flavor profiles has also supported the expanded use of polyglycerol esters. Regulatory recognition as safe and widespread availability across developed markets have further cemented their dominance in the emulsifier landscape.

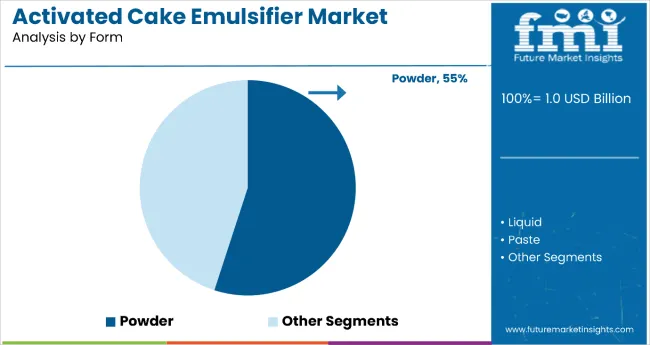

The powder form holds the largest share in the form segment, accounting for 55% of the activated cake emulsifier market share in 2025. Its dominance is attributed to exceptional shelf stability, ease of handling in automated bakery processes, and better compatibility with dry mixes. Powdered emulsifiers offer consistent dispersion in batters and facilitate accurate dosing, which is crucial for maintaining texture, volume, and mouthfeel in cakes.

The segment’s expansion has been supported by technological advancements in spray-drying and microencapsulation, allowing for the development of highly soluble, dust-free, and pre-activated powdered emulsifiers. These improvements have enabled their integration into clean-label and organic cake formulations, further increasing appeal among health-conscious and premium product consumers.

Given their reduced transportation weight and longer shelf life, powdered emulsifiers are well-suited for both large-scale industrial production and long-distance export, securing their position as the most preferred form in the market.

Activated cake emulsifiers’ ability to enhance batter stability, improve texture, and extend the shelf life of bakery products make them a preferred choice for industrial and artisanal bakers seeking consistent, high-quality outcomes.

Growing demand for convenient, ready-to-eat, and premium baked goods is driving adoption across bread, cakes, muffins, and pastry segments. Technological advancements in emulsification processes, along with clean-label and allergen-free innovations, are expanding product applications and meeting evolving consumer preferences.

As bakery manufacturers increasingly focus on production efficiency, reduced waste, and product consistency, the market outlook remains positive. With strong potential in both large-scale manufacturing and small-scale bakery operations, activated cake emulsifiers are poised for significant growth across global bakery and confectionery industries.

In 2024, global demand for activated cake emulsifiers rose steadily, with Europe and Asia-Pacific accounting for over 60% of total consumption. Their primary applications lie in volume enhancement, crumb softening, and shelf-life extension in cakes and sponge-based bakery products. Manufacturers have increasingly adopted enzyme-activated and plant-based emulsifier systems to comply with clean-label trends and allergen-free regulations.

These systems improve batter aeration, provide uniform cell structure, and offer consistency across high-speed production lines. As consumer demand rises for premium-quality baked goods with fewer synthetic additives, activated emulsifiers are being positioned as essential functional ingredients.

Health-Driven Reformulation and Clean-Label Baking Fuel Market Expansion

The push toward trans-fat elimination, palm-free labeling, and reduction of chemical additives in packaged food is driving growth in the activated cake emulsifier market. Food brands are incorporating powdered emulsifier blends that meet clean-label criteria while delivering functional benefits like prolonged softness and moisture retention.

A shift in consumer preference toward natural-origin bakery ingredients is pushing adoption of emulsifiers derived from sunflower lecithin, polyglycerol esters, and mono- and diglycerides sourced from non-GMO oils. These trends are encouraging bakery manufacturers to reformulate products without compromising sensory quality, especially in gluten-free and low-fat cakes.

Processing Limitations and Cost Pressures Restrain Growth

Despite growing demand, market expansion is challenged by cost volatility in raw materials like vegetable oils and food-grade esters. Complex activation processes involving spray drying and enzymatic treatment increase production costs and lengthen formulation timelines.

Small-to-mid-scale bakeries often lack the infrastructure for integrating pre-activated emulsifier systems, reducing adoption. Additionally, labeling ambiguities across regions, particularly in Asia and Latin America, complicate marketing for clean-label claims, restraining growth in certain consumer segments.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.5% |

| UK | 5.2% |

| Germany | 5.1% |

| France | 5.0% |

| Japan | 4.8% |

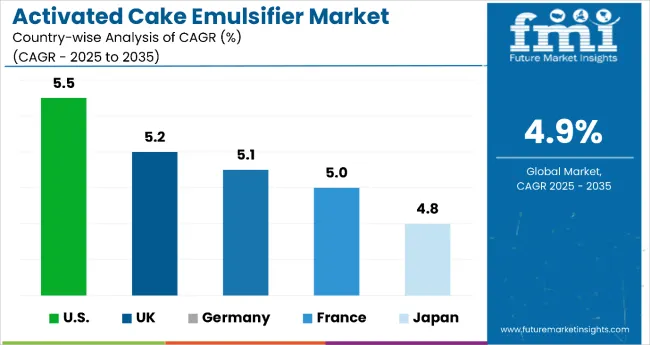

Between 2025 and 2035, the activated cake emulsifier market is set to expand steadily across key global economies. The USA is forecasted to lead with a CAGR of 5.5%, followed closely by the UK at 5.2%, Germany at 5.1%, and France at 5.0%. Japan, while slightly behind at 4.8%, continues to demonstrate healthy growth.

These trends reflect increased investment in clean-label baking, growing consumer demand for longer shelf-life products, and regional shifts toward plant-based emulsification technologies. Market maturity, regulatory stringency, and industrial baking infrastructure influence these varying growth rates.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

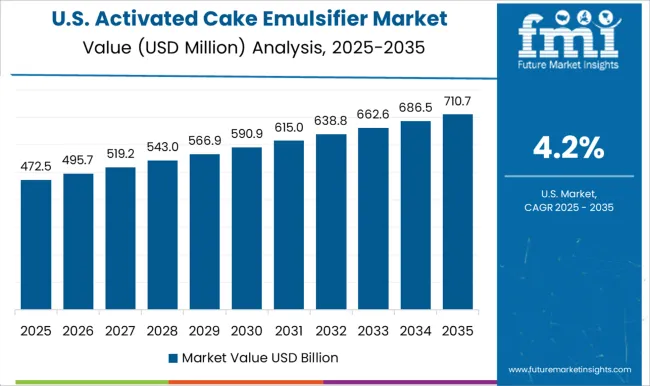

The activated cake emulsifier market in the USA is projected to expand at a CAGR of 5.5% from 2025 to 2035. Growth is driven by the robust expansion of in-store bakery formats and the demand for shelf-stable, clean-label cakes in states such as California, Texas, and Illinois.

USA food processors are adopting powdered emulsifier blends that offer extended softness and moisture retention in finished products. Regulatory clarity and investments in enzymatic activation technologies are improving formulation efficiency and shelf-life performance in industrial bakeries.

Key Statistics:

The revenue from activated cake emulsifier in the UK is expected to grow at a CAGR of 5.2% from 2025 to 2035. This growth is led by demand for natural-origin emulsifiers in premium cakes, supported by retailers in London, Birmingham, and Manchester.

Brexit-led import challenges have prompted a shift toward domestic formulation and enzyme activation technologies. Consumers are increasingly drawn to trans-fat-free and palm-free baked products, which is pushing bakery producers to adopt functional, powdered emulsifier blends.

Key Statistics:

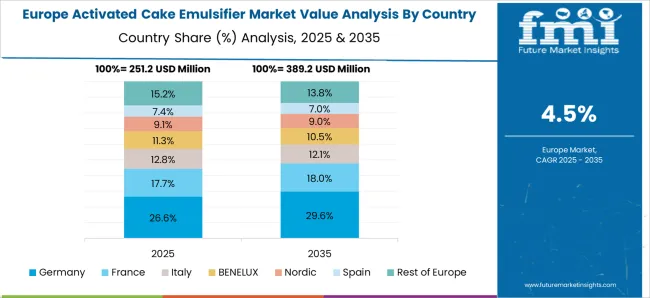

The sales of activated cake emulsifier in Germany are estimated to flourish at a CAGR of 5.1% between 2025 and 2035. German bakeries prioritize quality enhancement and product differentiation, particularly in regions like Bavaria and North Rhine-Westphalia. Strong partnerships between food tech firms and bakery cooperatives have driven innovation in emulsifier solutions that comply with EU clean-label mandates. The integration of powdered emulsifiers in hybrid and vegan baked goods has also intensified.

Key Statistics:

The demand for activated cake emulsifier in France is forecasted to rise at a CAGR of 5.0% from 2025 to 2035. Growth is supported by the artisanal bakery renaissance and rising demand for vegan pâtisserie and gluten-free cakes in Paris, Lyon, and Marseille. French bakeries are integrating polyglycerol esters and lactic acid esters into cake formulations to enhance softness and shelf life. Domestic ingredient manufacturers are scaling up pre-activated blends with reduced allergen load, tailored to French nutritional labeling norms.

Key Statistics:

The activated cake emulsifier market in Japan is projected to strengthen at a CAGR of 4.8% from 2025 to 2035. Urban consumers in Tokyo, Osaka, and Fukuoka are driving demand for cleaner, lower-fat, and longer-lasting bakery products. Japanese baking manufacturers are adopting microencapsulated powdered emulsifiers that deliver consistent aeration and superior moisture control. A rising elderly population is also creating opportunities for softer, easily digestible sponge cakes, further boosting demand.

Key Statistics:

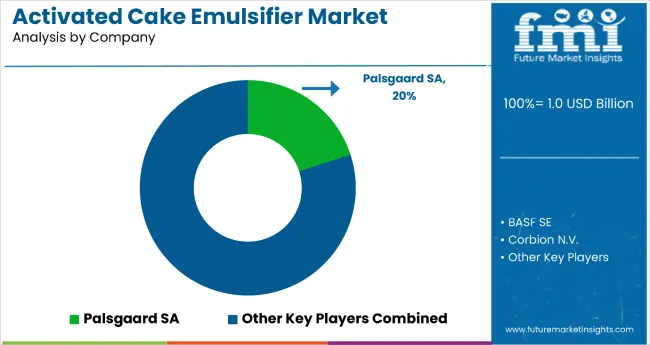

The activated cake emulsifier market is moderately consolidated, with key players ranging from global chemical and ingredient manufacturers to specialized emulsifier producers. Leading companies such as Palsgaard A/S, Corbion N.V., and Kerry Group plc dominate the market by leveraging advanced emulsification technologies and robust global supply chains.

Their strengths lie in extensive research and development capabilities, allowing them to innovate enzyme-activated emulsifiers that enhance cake volume, texture, and shelf life while meeting clean-label and non-GMO demands. These companies maintain strong partnerships with major bakery ingredient suppliers and benefit from broad distribution networks across North America, Europe, and Asia-Pacific.

Specialized players including Riken Vitamin Co. Ltd. and Danisco A/S differentiate themselves through tailored product portfolios focused on niche applications such as vegan and allergen-free bakery products. These firms invest in proprietary spray-drying and microencapsulation processes to improve powder solubility and functional performance.

Regional manufacturers in Europe and Asia also contribute by adapting formulations to local consumer preferences and regulatory frameworks, especially in markets with stringent clean-label and sustainability requirements.

High entry barriers persist in the activated cake emulsifier space due to the complexity of enzymatic activation, the need for food safety compliance, and significant capital investment in production infrastructure. Competitive advantage increasingly depends on technological innovation, regulatory adherence, and ability to deliver customized emulsifier blends that cater to evolving bakery trends such as gluten-free, organic, and plant-based products. Sustainability and clean-label credentials are becoming critical factors influencing market competitiveness and long-term growth potential.

| Item | Value |

|---|---|

| Quantitative Units | USD 1 Billion (Estimated Market Size in 2025) |

| Product Type | Polyglycerol Esters, Monoglycerides, Lactic Acid Esters, Polysorbates, Others |

| Application | Pound Cake, Butter Cake, Sponge Cake, Dorayaki (Bean-Jam Pancakes), Castella, Others |

| Source | Dairy, Non-Dairy |

| Form | Powder, Liquid, Paste |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, Canada, Australia, Brazil, South Korea and 40+ countries |

| Key Companies Profiled | Palsgaard SA, PentaCake, BASF SE, United Food Industries, SensoryEffects, Wacker Chemie AG, Masson Group Company Limited, Corbion N.V., Rich Products Corporation, The Bakels Group, Molkerei MEGGLE Wasserburg GmbH & Co.KG, Ingredion Inc., Guangzhou Kegu Food, FrieslandCampina Kievit, Danisco A/S |

| Additional Attributes | Market size by product type and form, regional consumption patterns, regulatory framework overview, technological advancements in enzyme activation, sustainability practices in ingredient sourcing, innovations in powder formulation, competitive landscape analysis, and clean-label trends impacting product development |

The global activated cake emulsifier market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the activated cake emulsifier market is projected to reach USD 1.6 billion by 2035.

The activated cake emulsifier market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in activated cake emulsifier market are polyglycerol esters, monoglycerides, lactic acid esters, polysorbates and others.

In terms of source, dairy segment to command 57.3% share in the activated cake emulsifier market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Activated Cake Emulsifier Suppliers

Activated Carbon for Sugar Decolorization Market Forecast and Outlook 2025 to 2035

Activated Alumina Market Size and Share Forecast Outlook 2025 to 2035

Activated Carbon Fiber Market Size and Share Forecast Outlook 2025 to 2035

Activated Carbon Bags Market Size and Share Forecast Outlook 2025 to 2035

Activated Bleaching Earth Market Growth - Trends & Forecast 2025 to 2035

Activated Carbon Filter Market Growth - Trends & Forecast 2025 to 2035

Assessing Activated Carbon Market Share & Industry Trends

Activated Partial Thromboplastin Test Market

Activated Charcoal Supplements Market Trends - Sales & Industry Insights

Heat-Activated Beauty Masks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wood Activated Carbon Market Size and Share Forecast Outlook 2025 to 2035

Heat Activated Tear Tape Market

Light-Activated Anti-Pollution Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Water Activated Tape Dispensers Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Water Activated Tape Dispensers

Water-Activated Tape Market Trends & Industry Forecast 2024-2034

Medical Activated Carbon Dressing Market Size and Share Forecast Outlook 2025 to 2035

Pelletized Activated Carbon Market Analysis - Size & Industry Trends 2025 to 2035

Food Grade Activated Carbon Market Report - Applications & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA