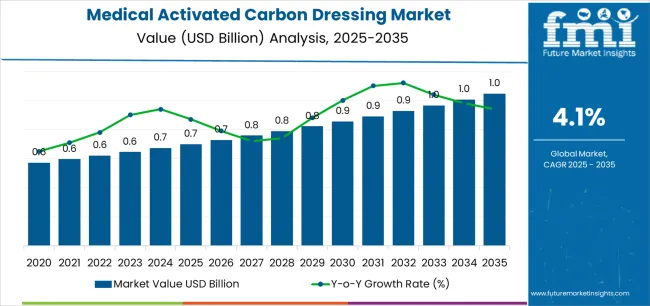

The global medical activated carbon dressing market is projected to reach USD 1.1 billion by 2035, recording an absolute increase of USD 375.0 million over the forecast period. The medical activated carbon dressing market is valued at USD 0.7 billion in 2025 and is set to rise at a CAGR of 4.1% during the assessment period. The medical activated carbon dressing market size is expected to grow by nearly 1.5 times during the same period, supported by increasing demand for advanced wound care solutions in chronic disease management and post-surgical applications, driving demand for efficient odor control and infection prevention systems and increasing investments in healthcare infrastructure and wound care technology development projects globally.

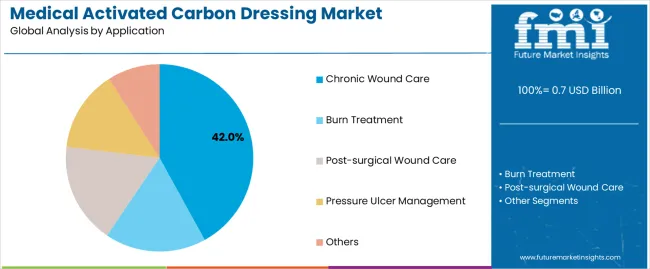

The chronic wound care segment demonstrates the strongest demand trajectory, accounting for substantial market share as aging populations and diabetes prevalence create growing requirements for specialized wound management products that combine antimicrobial properties with odor absorption capabilities. Burn treatment facilities maintain significant adoption rates through critical care protocols requiring products that prevent infection while managing exudate and malodor in severe trauma cases. Post-surgical wound care growth reflects surgical volume expansion and infection prevention emphasis, while pressure ulcer management addresses long-term care facility needs for products that support healing in immobile patients. However, higher product costs compared to traditional dressings and reimbursement limitations in emerging markets may pose challenges to market expansion.

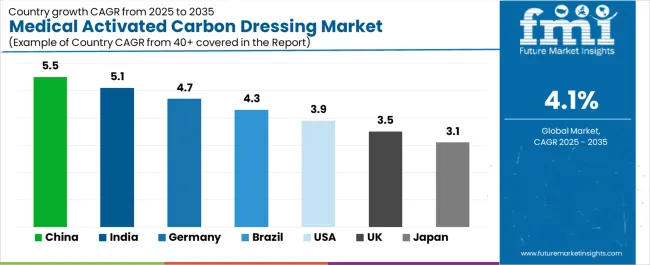

Regional dynamics show Asia Pacific emerging as the fastest-growing market, driven by healthcare infrastructure expansion in China and India where rising middle-class populations demand advanced medical technologies and chronic disease prevalence increases with demographic transitions. North America maintains the largest market share through comprehensive reimbursement infrastructure and established wound care protocols supporting activated carbon dressing utilization across hospital acute care, outpatient wound clinics, and home healthcare settings. Europe demonstrates steady growth through evidence-based clinical guidelines and aging population demographics requiring specialized wound care products in community health services and long-term care facilities.

Product innovation focuses on multi-functional composite designs that integrate activated carbon with foam layers for enhanced exudate management, silver compounds for sustained antimicrobial release, and adhesive borders for simplified application procedures. Manufacturing advances enable cost reduction through improved production efficiency, while clinical evidence generation supports formulary inclusion and reimbursement approval in key markets. Distribution channel expansion through hospital group purchasing organizations, retail pharmacy networks, and home healthcare service providers broadens market access across diverse care settings. However, higher product costs compared to traditional dressings and reimbursement limitations in emerging markets may pose challenges to market expansion in cost-sensitive healthcare systems and regions with developing wound care infrastructure.

Between 2025 and 2030, the medical activated carbon dressing market is projected to expand from USD 0.7 billion to USD 926.9 million, resulting in a value increase of USD 168.7 million, which represents 45.0% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for infection control and odor management in chronic wound treatment, product innovation in antimicrobial formulations and multi-layer dressing technologies, as well as expanding integration with negative pressure wound therapy systems and advanced wound care protocols. Companies are establishing competitive positions through investment in clinical evidence generation, healthcare professional education programs, and strategic market expansion across hospital acute care, long-term care facilities, and home healthcare applications.

From 2030 to 2035, the market is forecast to grow from USD 926.9 million to USD 1.1 billion, adding another USD 206.3 million, which constitutes 55.0% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized activated carbon systems, including advanced silver-impregnated formulations and integrated foam-based composite designs tailored for specific wound types and patient populations, strategic collaborations between wound care manufacturers and healthcare delivery organizations, and an enhanced focus on clinical outcomes optimization and cost-effectiveness demonstration. The growing emphasis on infection prevention and patient quality of life improvement will drive demand for advanced medical activated carbon dressing solutions across diverse healthcare settings.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 0.7 billion |

| Market Forecast Value (2035) | USD 1.1 billion |

| Forecast CAGR (2025-2035) | 4.1% |

The medical activated carbon dressing market grows by enabling healthcare providers to achieve superior odor management and infection control while supporting optimal healing environments in complex wound care situations. Healthcare facilities face mounting pressure to improve patient comfort and clinical outcomes, with activated carbon dressing solutions typically providing 85-95% odor reduction compared to standard dressings, making these products essential for maintaining patient dignity and quality of life in chronic wound management. The chronic disease epidemic creates demand for advanced wound care solutions that can address malodorous wound conditions, provide antimicrobial protection through silver incorporation, and maintain moisture balance while absorbing volatile organic compounds responsible for unpleasant odors.

Clinical guidelines emphasizing infection prevention and patient-centered care drive adoption in hospital acute care, long-term care facilities, and home healthcare applications, where wound odor management has a direct impact on patient psychological wellbeing and social interaction capability. The global aging population and diabetes prevalence increase accelerate medical activated carbon dressing demand as healthcare systems address growing numbers of chronic wounds requiring specialized management products that combine multiple therapeutic functions. However, premium pricing compared to basic wound dressings and limited awareness among healthcare providers in some regions may limit adoption rates among budget-constrained facilities and markets with developing wound care infrastructure.

Key advantages driving market adoption include:

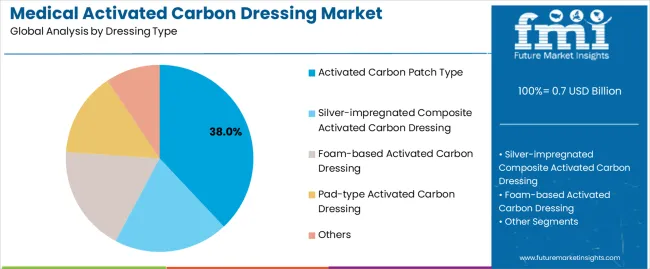

The market is segmented by dressing type, application, and region. By dressing type, the market is divided into activated carbon patch type, silver-impregnated composite activated carbon dressing, foam-based activated carbon dressing, pad-type activated carbon dressing, and others. Based on application, the market is categorized into chronic wound care, burn treatment, post-surgical wound care, pressure ulcer management, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

The activated carbon patch type segment represents the dominant force in the medical activated carbon dressing market, capturing approximately 38.0% of total market share in 2025. This established category encompasses basic activated carbon cloth dressings providing fundamental odor absorption functionality through carbon fiber construction, delivering cost-effective odor management for various wound types without additional antimicrobial or foam layer components. The activated carbon patch type segment's market leadership stems from its widespread clinical familiarity, straightforward application procedures, and affordability for facilities requiring basic odor control without premium features associated with composite or foam-based systems.

The silver-impregnated composite activated carbon dressing segment maintains a substantial 26.0% market share, serving applications requiring combined antimicrobial protection and odor management through silver ion incorporation. The foam-based activated carbon dressing segment accounts for 19.0% market share, featuring multi-layer constructions that combine exudate absorption with odor control. The pad-type activated carbon dressing segment holds 11.0% market share, while others represent 6.0% market share including specialized formats and emerging product configurations.

Key advantages driving the activated carbon patch type segment include:

Chronic wound care dominates the medical activated carbon dressing market with approximately 42.0% market share in 2025, reflecting the substantial patient populations suffering from diabetic foot ulcers, venous leg ulcers, and arterial ulcers requiring extended treatment periods where odor management becomes critical for patient quality of life maintenance. The chronic wound care segment's market leadership is reinforced by widespread adoption in outpatient wound clinics, home healthcare settings, and long-term care facilities where patients experience wound-related odor that impacts social interaction and psychological wellbeing.

The burn treatment segment represents 23.0% market share through applications in burn units and trauma centers where infection prevention and odor control prove essential during healing processes. Post-surgical wound care accounts for 18.0% market share, driven by infection prevention protocols in surgical site management. Pressure ulcer management holds 11.0% market share, serving immobile patient populations in hospitals and nursing facilities. Other applications represent 6.0% market share including oncology wound care and traumatic wound management.

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to demographic trends and clinical requirements. First, global aging population expansion creates increasing requirements for chronic wound management products, with individuals over 65 representing 15-20% of populations in developed markets and experiencing wound healing complications at rates 3-4 times higher than younger adults, requiring specialized dressing products that address odor and infection concerns during extended healing periods. Second, diabetes prevalence growth drives demand toward advanced wound care solutions, with diabetic foot ulcer incidence affecting 15-25% of diabetic patients during their lifetime and creating needs for products that provide antimicrobial protection while managing malodorous compounds associated with infected wounds. Third, infection prevention emphasis accelerates adoption across surgical and trauma applications, where healthcare-associated infection reduction initiatives drive specification of antimicrobial dressings that combine silver technology with activated carbon odor control in comprehensive wound management protocols.

Market restraints include premium pricing compared to traditional wound dressings affecting adoption in cost-sensitive healthcare systems, particularly where activated carbon products cost 3-5 times more than basic gauze or foam dressings without generating proportional reimbursement premiums in markets with fixed payment schedules. Limited clinical awareness among healthcare providers poses adoption barriers as many clinicians lack familiarity with activated carbon dressing benefits and appropriate usage indications, requiring extensive education programs to drive specification behavior change. Reimbursement challenges in emerging markets create additional obstacles, as government healthcare programs and private insurance systems often maintain restrictive formularies that exclude advanced wound care products or impose documentation requirements that discourage provider utilization.

Key trends indicate accelerated adoption in Asia-Pacific markets, particularly China and India, where healthcare infrastructure development and rising middle-class populations drive demand for advanced wound care products through private hospital expansion and medical tourism growth. Product innovation trends toward multi-functional composite dressings combining activated carbon with foam layers, hydrocolloid borders, and sustained silver release mechanisms are enabling performance enhancement and simplified wound care protocols. However, the market thesis could face disruption if alternative odor management technologies or bioengineered wound care products emerge that deliver superior clinical outcomes at reduced costs, potentially displacing activated carbon systems in applications where odor control represents the primary product benefit rather than antimicrobial or exudate management functionality.

| Country | CAGR (2025-2035) |

|---|---|

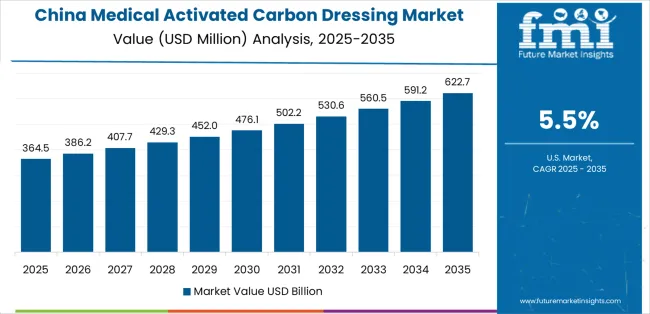

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| Brazil | 4.3% |

| USA | 3.9% |

| UK | 3.5% |

| Japan | 3.1% |

The medical activated carbon dressing market is gaining momentum worldwide, with China taking the lead thanks to aggressive healthcare infrastructure expansion and rising chronic disease prevalence. Close behind, India benefits from medical tourism growth and increasing healthcare spending, positioning itself as a strategic growth hub in the Asia-Pacific region. Brazil shows strong advancement, where expanding private healthcare sector and aging population demographics strengthen its role in South American medical device markets.

The USA demonstrates robust growth through advanced wound care protocol adoption and comprehensive reimbursement infrastructure, signaling continued investment in clinical outcome optimization. Meanwhile, Japan stands out for its aging society and advanced healthcare delivery systems, while Germany and the UK continue to record consistent progress driven by evidence-based wound care guidelines and infection prevention initiatives. Together, China and India anchor the global expansion story, while established markets build stability and clinical evidence into the market's growth path.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

China demonstrates the strongest growth potential in the medical activated carbon dressing market with a CAGR of 5.5% through 2035. The country's leadership position stems from comprehensive healthcare system reform, intensive hospital infrastructure development programs, and aggressive chronic disease management initiatives driving adoption of advanced wound care products in public and private facilities. Growth is concentrated in major urban regions, including Beijing, Shanghai, Guangdong, and Jiangsu, where tertiary hospitals, specialized wound care centers, and private medical facilities are implementing activated carbon dressing programs for diabetic foot ulcer management, burn treatment, and post-surgical wound care applications.

Distribution channels through medical device distributors, hospital procurement systems, and pharmacy retail networks expand deployment across hospital acute care departments, community health centers, and home healthcare service providers. The country's Healthy China 2030 initiative provides policy support for advanced medical technology adoption, including requirements for improved infection control and patient care quality standards.

Key market factors:

In Maharashtra, Karnataka, Tamil Nadu, and Delhi NCR regions, the adoption of medical activated carbon dressing systems is accelerating across corporate hospitals, specialty wound care clinics, and medical tourism facilities, driven by rising healthcare spending and increasing awareness of advanced wound management technologies. The market demonstrates strong growth momentum with a CAGR of 5.1% through 2035, linked to comprehensive healthcare infrastructure development and increasing focus on infection prevention and patient care quality enhancement solutions.

Indian healthcare providers are implementing activated carbon dressing programs and clinical protocol standardization initiatives to improve wound care outcomes while meeting international accreditation standards in medical tourism destination hospitals. The country's healthcare reform programs create sustained demand for advanced medical technologies, while increasing emphasis on non-communicable disease management drives adoption of specialized wound care products for diabetic complications and pressure ulcer prevention.

Brazil's expanding healthcare sector demonstrates growing implementation of medical activated carbon dressing systems, with documented adoption in private hospitals and specialized wound care services supporting improved patient outcomes and infection control performance. The country's healthcare infrastructure in major urban regions, including São Paulo, Rio de Janeiro, Minas Gerais, and Rio Grande do Sul, showcases integration of advanced wound care technologies with existing clinical protocols, leveraging expertise in burn treatment and plastic surgery applications.

Brazilian healthcare providers emphasize clinical effectiveness and patient comfort, creating demand for activated carbon dressing products that support infection prevention commitments and quality care standards in private healthcare delivery systems. The market maintains strong growth through focus on private health insurance expansion and medical facility modernization, with a CAGR of 4.3% through 2035.

Key development areas:

The USA market leads in medical activated carbon dressing utilization based on comprehensive reimbursement infrastructure and evidence-based wound care protocols supporting advanced product adoption across diverse healthcare settings. The country shows solid potential with a CAGR of 3.9% through 2035, driven by chronic disease prevalence and healthcare quality improvement initiatives across major healthcare markets, including California, Texas, Florida, and the Northeast corridor.

American healthcare providers adopt activated carbon dressing products for compliance with infection prevention guidelines and wound care best practices, particularly in hospital wound care teams, outpatient wound clinics, and home healthcare agencies serving aging populations with chronic wound conditions. Product utilization channels through group purchasing organizations, integrated delivery networks, and retail pharmacy systems expand coverage across acute care hospitals, long-term care facilities, and community-based care settings.

Leading market segments:

Japan's medical activated carbon dressing market demonstrates sophisticated implementation focused on geriatric care facilities and home healthcare services, with documented integration supporting elderly patient populations experiencing chronic wounds and requiring odor management for quality of life maintenance. The country maintains steady growth momentum with a CAGR of 3.1% through 2035, driven by super-aged society demographics and healthcare providers' emphasis on patient dignity principles aligned with comprehensive care philosophies. Major healthcare regions, including Tokyo, Osaka, Nagoya, and Fukuoka, showcase advanced wound care programs integrating activated carbon dressing technologies with existing long-term care infrastructure and home-visit nursing service delivery models.

Key market characteristics:

In North Rhine-Westphalia, Bavaria, Baden-Württemberg, and Lower Saxony regions, hospitals and wound care centers implement medical activated carbon dressing programs based on clinical evidence and quality improvement initiatives, with documented protocols supporting infection prevention and patient comfort optimization in complex wound management. The market shows solid growth potential with a CAGR of 4.7% through 2035, linked to healthcare quality standards, demographic aging trends, and comprehensive wound care specialist training programs. German healthcare providers adopt activated carbon dressing technologies within structured wound care pathways designed to national clinical guidelines, requiring demonstrated clinical effectiveness and cost-effectiveness evidence for formulary inclusion.

Market development factors:

The UK medical activated carbon dressing market demonstrates mature implementation focused on community nursing services and primary care wound management, with established utilization patterns supporting chronic wound patients in home settings through National Health Service delivery systems. The country maintains steady growth through formulary expansion and clinical guideline updates, with a CAGR of 3.5% through 2035, driven by aging population demographics and NHS cost-effectiveness initiatives promoting appropriate advanced wound care product selection. Major healthcare regions, including London, Northwest England, West Midlands, and Scotland, showcase activated carbon dressing deployment in community nurse-led wound clinics and general practitioner surgeries where chronic wound management constitutes significant clinical workload.

Key market characteristics:

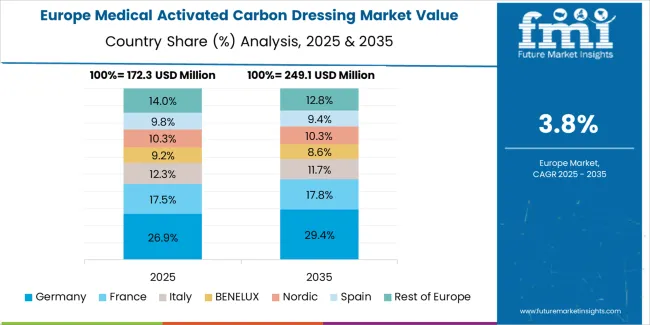

The medical activated carbon dressing market in Europe is projected to grow from USD 262.3 million in 2025 to USD 378.4 million by 2035, registering a CAGR of 3.8% over the forecast period. Germany is expected to maintain its leadership position with a 26.5% market share in 2025, declining slightly to 26.2% by 2035, supported by its comprehensive wound care infrastructure and major healthcare centers, including North Rhine-Westphalia, Bavaria, and Baden-Württemberg regions.

The United Kingdom follows with a 22.0% share in 2025, projected to reach 21.7% by 2035, driven by comprehensive community wound care programs and NHS formulary expansion initiatives. France holds a 18.5% share in 2025, expected to rise to 18.8% by 2035 through ongoing hospital quality improvement and aging population wound care requirements.

Italy commands a 13.0% share in both 2025 and 2035, backed by hospital-based wound care services and long-term care facility utilization. Spain accounts for 10.0% in 2025, rising to 10.3% by 2035 on healthcare system modernization and chronic disease management expansion. The Rest of Europe region is anticipated to hold 10.0% in 2025, expanding to 10.0% by 2035, attributed to increasing medical activated carbon dressing adoption in Nordic countries and emerging Eastern European healthcare system development programs.

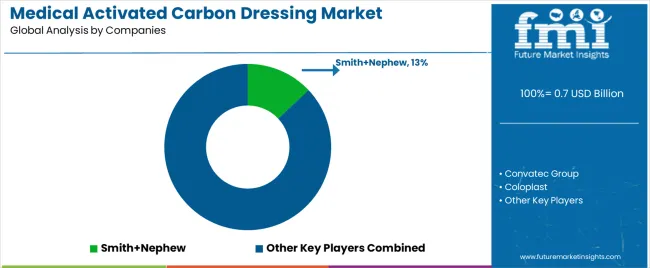

The medical activated carbon dressing market features approximately 20-25 meaningful players with moderate fragmentation, where the top three companies control roughly 32-36% of global market share through established clinical evidence portfolios and comprehensive distribution networks serving healthcare facilities worldwide. Competition centers on clinical effectiveness documentation, healthcare professional relationships, and product line breadth rather than price competition alone. Smith+Nephew leads with approximately 13.0% market share through its comprehensive advanced wound care portfolio and global market presence across hospital and community care settings.

Market leaders include Smith+Nephew, Convatec Group, and Coloplast, which maintain competitive advantages through extensive clinical evidence generation, global distribution infrastructure, and deep expertise in wound care management protocols across multiple care settings, creating specification preference and formulary inclusion advantages with hospital wound care committees, procurement organizations, and clinical guideline development bodies. These companies leverage research and development capabilities in advanced dressing formulations and ongoing clinical education relationships to defend market positions while expanding into emerging markets and home healthcare applications.

Challengers encompass Molnlycke Health Care and Paul Hartmann AG, which compete through specialized wound care expertise and strong regional presence in key healthcare markets. Product specialists, including 3M Health Care, B. Braun Melsungen AG, and Medline Industries, focus on specific product configurations or care settings, offering differentiated capabilities in composite dressing designs, hospital supply chain integration, and clinical application support services.

Regional manufacturers and emerging wound care companies create competitive pressure through localized market knowledge and cost-competitive product offerings, particularly in high-growth markets including China and India, where domestic manufacturers leverage distribution relationships and regulatory familiarity to gain market share. Market dynamics favor companies that combine robust clinical evidence with comprehensive healthcare professional education programs and distribution coverage that addresses hospital acute care, long-term care facilities, and expanding home healthcare channels serving chronic wound patient populations.

| Item | Value |

|---|---|

| Quantitative Units | 0.7 USD billion |

| Dressing Type | Activated Carbon Patch Type, Silver-impregnated Composite Activated Carbon Dressing, Foam-based Activated Carbon Dressing, Pad-type Activated Carbon Dressing, Others |

| Application | Chronic Wound Care, Burn Treatment, Post-surgical Wound Care, Pressure Ulcer Management, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Smith+Nephew, Convatec Group, Coloplast, Molnlycke Health Care, Paul Hartmann AG, 3M Health Care, B. Braun Melsungen AG, Medline Industries, Lohmann & Rauscher, Cardinal Health, Winner Medical, Zhejiang Longterm Medical Technology, Jiyuan Hengsheng Pharmaceutical, Shanghai Sunstone Development, Zhende Medical |

| Additional Attributes | Dollar sales by dressing type and application categories, regional adoption trends across Asia Pacific, North America, and Europe, competitive landscape with wound care manufacturers and healthcare distribution networks, clinical indication specifications and usage protocols, integration with wound care management programs and infection prevention initiatives, healthcare reimbursement considerations and formulary positioning, and development of advanced composite dressing systems with enhanced antimicrobial and odor control capabilities supporting diverse patient populations across hospital, long-term care, and home healthcare settings. |

The global medical activated carbon dressing market is estimated to be valued at USD 0.7 billion in 2025.

The market size for the medical activated carbon dressing market is projected to reach USD 1.0 billion by 2035.

The medical activated carbon dressing market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in medical activated carbon dressing market are activated carbon patch type, silver-impregnated composite activated carbon dressing, foam-based activated carbon dressing, pad-type activated carbon dressing and others.

In terms of application, chronic wound care segment to command 42.0% share in the medical activated carbon dressing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Latex Protective Suit Market Size and Share Forecast Outlook 2025 to 2035

Medical Coated Roll Stock Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Medical Pressure Mapping System Market Size and Share Forecast Outlook 2025 to 2035

Medical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Face Shield Market Forecast and Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Trays Market Size and Share Forecast Outlook 2025 to 2035

Medical Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Medically Supervised Weight Loss Services Market Size and Share Forecast Outlook 2025 to 2035

Medical Smart Drug Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Medical EMR Input Device Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA