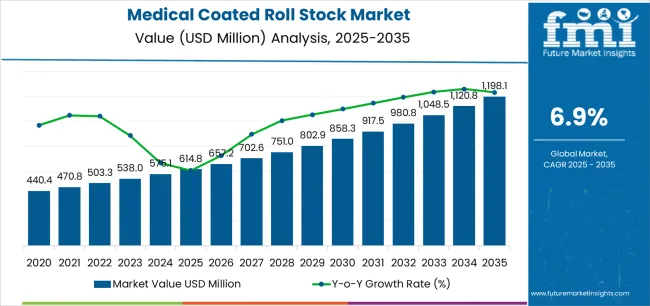

The global medical coated roll stock market is projected to grow from USD 614.8 million in 2025 to approximately USD 1,198.1 million by 2035, recording an absolute increase of USD 583.3 million over the forecast period. Demand is expected to grow by 94.9%, with the market forecast to expand at a CAGR of 6.9% between 2025 and 2035. Key trends in the medical coated roll stock market are shaped by material performance needs, sterility assurance requirements, and increasing compatibility with automated packaging lines. One prominent trend is the shift toward high-integrity sterile barrier formats, where roll stock materials must support validated microbial protection during storage, transport, and clinical handling. This is reinforcing demand for Tyvek and medical-grade coated papers in sterilization packaging for surgical instruments, implantable devices, and diagnostic kits.

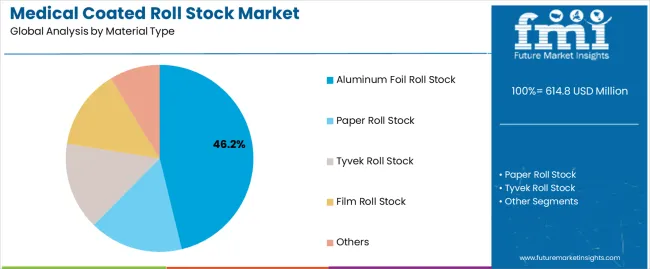

Another trend is the expanding use of aluminum foil-based roll stock in pharmaceutical blister systems, driven by the growing global focus on medication stability, moisture protection, and dosage integrity. Multi-layer foil laminates with enhanced seal performance and puncture resistance are gaining preference to maintain product shelf life in varied climate conditions. Automation in pharmaceutical and device manufacturing is also shaping market behavior, increasing the need for consistent coating uniformity, stable roll handling properties, and precise seal activation characteristics to support high-speed form-fill-seal and pouching systems. Additionally, manufacturers are introducing print-ready and traceability-compatible coated roll stock, supporting serialization, unit identification, and supply chain security requirements. The increasing emphasis on packaging material sustainability is prompting interest in recyclable and reduced-plastic laminate structures, provided they maintain regulatory compliance and sterility performance benchmarks.

Regional growth patterns demonstrate particular strength in Asian markets, where expanding pharmaceutical manufacturing and medical device production drive consistent coated roll stock consumption. European markets maintain steady growth through stringent medical packaging regulations and pharmaceutical quality standards, while North American markets show increasing activity in combination device packaging leveraging advanced barrier technology requirements. Medical device industry consolidation and ISO 11607 compliance requirements continue to support demand for validated packaging materials with comprehensive technical documentation.

Technology advancement in coating formulations, substrate engineering, and sealing compatibility continues to improve packaging performance while reducing material thickness requirements. The integration of peelable seal layers and sterilization-resistant coatings enhances material functionality for diverse medical packaging applications. Manufacturers are developing eco-friendly substrate alternatives and recyclable coating systems to address environmental compliance objectives while maintaining sterile barrier integrity.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 614.8 million |

| Market Forecast Value (2035) | USD 1,198.1 million |

| Forecast CAGR (2025-2035) | 6.9% |

| HEALTHCARE INDUSTRY EXPANSION | PACKAGING PERFORMANCE REQUIREMENTS | REGULATORY & QUALITY STANDARDS |

|---|---|---|

| Pharmaceutical Production Growth | Sterile Barrier Standards | ISO 11607 Compliance |

| Continuous expansion of pharmaceutical manufacturing capacity across emerging markets driving demand for barrier packaging materials and medication protection solutions. | Modern medical packaging requiring validated materials delivering proven microbial barrier and seal integrity performance documentation. | Regulatory requirements establishing sterile barrier packaging standards favoring tested materials with comprehensive validation protocols. |

| Medical Device Manufacturing | Sterilization Compatibility Demands | FDA Material Approvals |

| Growing emphasis on single-use medical devices and surgical instrument packaging creating demand for sterilization-compatible roll stock materials. | Device manufacturers investing in packaging materials offering consistent sterilization resistance while maintaining barrier integrity and seal performance. | Quality standards requiring material biocompatibility testing and manufacturing documentation for direct medical device contact applications. |

| Combination Product Development | Shelf Life Protection | Pharmacopoeia Compliance |

| Superior barrier characteristics and hermetic sealing making coated roll stocks essential for drug-device combination packaging applications. | Certified manufacturers with proven material stability records required for pharmaceutical and medical device packaging warranty provision. | Material extractables and leachables requirements driving need for validated coating formulations and substrate compatibility verification. |

| Category | Segments Covered |

|---|---|

| By Material Type | Aluminum Foil Roll Stock, Paper Roll Stock, Tyvek Roll Stock, Film Roll Stock, Others |

| By Application | Pharmaceutical Packaging, Medical Supplies, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Aluminum Foil Roll Stock |

|

| Paper Roll Stock |

|

| Tyvek Roll Stock |

|

| Film Roll Stock |

|

| Others |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Pharmaceutical Packaging |

|

| Medical Supplies |

|

| Others |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Pharmaceutical Manufacturing Expansion | Raw Material Cost Volatility | Eco-friendly substrate development |

| Global pharmaceutical production capacity growth and generic medication manufacturing driving sterile barrier packaging material consumption across established and emerging markets. | Aluminum and polymer resin price fluctuations affecting material manufacturing costs and converter margin predictability. | Development of recyclable coating systems and bio-based substrates providing environmental compliance while maintaining barrier performance and sterilization compatibility. |

| Single-Use Device Adoption | Regulatory Complexity | Thin-Gauge Engineering |

| Healthcare infection prevention and surgical efficiency driving single-use medical device adoption requiring sterile packaging solutions. | Extensive material qualification requirements and regional regulatory variations creating market entry barriers and product development costs. | Integration of advanced coating technologies and substrate engineering reducing material thickness while maintaining barrier integrity and seal performance. |

| Sterilization Method Diversity | Environmental pressure | Digital Printing Integration |

| Multiple sterilization modality requirements mandating packaging materials compatible with gamma radiation, ethylene oxide, and steam sterilization. | Environmental regulations and healthcare eco-responsibility initiatives pressuring single-use packaging materials and creating demand for circular economy solutions. | Incorporation of digital printing capabilities and variable data requirements for serialization compliance and product identification on sterile barrier packaging. |

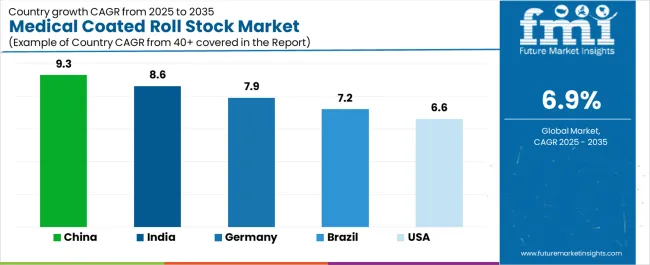

| Country | CAGR (2025-2035) |

|---|---|

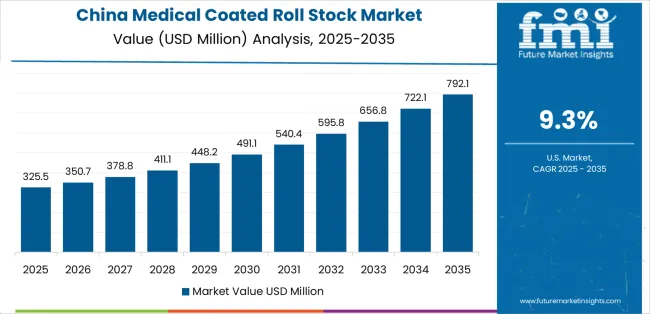

| China | 9.3% |

| India | 8.6% |

| Germany | 7.9% |

| Brazil | 7.2% |

| United States | 6.6% |

Revenue from medical coated roll stock in China is projected to grow with a CAGR of 9.3% through 2035, driven by expanding pharmaceutical manufacturing capacity and comprehensive medical device production infrastructure creating substantial opportunities for barrier packaging material suppliers across pharmaceutical blister packaging operations, surgical device packaging facilities, and diagnostic product sectors. The country's established pharmaceutical manufacturing tradition and expanding GMP compliance capabilities are creating significant demand for aluminum foil and film roll stock materials. Major pharmaceutical manufacturers and medical device producers are establishing comprehensive packaging material procurement programs to support large-scale production operations and meet growing quality standards.

Pharmaceutical manufacturing expansion programs are supporting widespread adoption of coated roll stock materials across production facilities, driving demand for cost-effective barrier packaging solutions. Medical device production capacity development initiatives and pharmaceutical export growth are creating substantial opportunities for material suppliers requiring reliable barrier performance and competitive manufacturing costs. Regional pharmaceutical cluster development and provincial GMP facility construction are facilitating adoption of certified packaging materials throughout major manufacturing regions.

Revenue from medical coated roll stock in India is expanding with a CAGR of 8.6% through 2035, supported by extensive pharmaceutical manufacturing development and comprehensive generic medication production creating continued demand for barrier packaging materials across diverse pharmaceutical categories and medical device segments. The country's rapidly growing pharmaceutical industry and expanding contract manufacturing capabilities are driving demand for roll stock materials that provide consistent barrier performance while supporting cost-effective packaging requirements. Pharmaceutical manufacturers and packaging converters are investing in material supply relationships to support growing production volumes and export market requirements.

Generic pharmaceutical production expansion and contract packaging capability development are creating opportunities for coated roll stock materials across diverse application segments requiring reliable barrier performance and competitive material costs. Pharmaceutical export market growth and medical device manufacturing advancement are driving investments in packaging material supply chains supporting quality consistency requirements throughout major pharmaceutical manufacturing regions. Material certification programs and regulatory compliance development are enhancing demand for validated roll stock systems throughout Indian pharmaceutical markets.

Demand for medical coated roll stock in Germany is projected to grow with a CAGR of 7.9% through 2035, supported by the country's leadership in pharmaceutical manufacturing and advanced medical device production requiring high-performance barrier packaging materials for sterile and pharmaceutical applications. German pharmaceutical companies are implementing roll stock materials that support comprehensive validation protocols, barrier integrity verification, and stringent GMP compliance requirements. The market is characterized by focus on material consistency, extractables control, and adherence to European pharmaceutical packaging standards.

Pharmaceutical industry investments are prioritizing packaging materials that demonstrate superior barrier properties and stability performance while meeting German environmental protection and material safety standards. Medical device packaging leadership programs and quality excellence initiatives are driving adoption of premium-grade roll stock materials that support advanced sterilization processes and shelf-life requirements. Research and development programs for eco-friendly packaging are facilitating adoption of environmentally responsible material technologies throughout major pharmaceutical production centers.

Revenue from medical coated roll stock in the United States is growing with a CAGR of 6.6% through 2035, driven by medical device innovation programs and pharmaceutical packaging modernization creating persistent opportunities for barrier material suppliers serving both device manufacturers and pharmaceutical packaging contractors. The country's extensive medical device manufacturing infrastructure and expanding combination product sector are creating demand for roll stock materials that support diverse barrier requirements while maintaining regulatory compliance standards. Material suppliers and packaging converters are developing supply strategies to support device manufacturer specifications and pharmaceutical validation requirements.

Medical device packaging programs and pharmaceutical blister packaging modernization are facilitating adoption of coated roll stock materials capable of supporting diverse sterilization requirements and competitive performance standards. Combination product development and biologics packaging expansion are enhancing demand for specialized barrier materials that support operational stability and regulatory compliance. Drug delivery device packaging and diagnostic test kit applications are creating opportunities for engineered roll stock capabilities across American medical manufacturing facilities.

Demand for medical coated roll stock in Brazil is projected to grow with a CAGR of 7.2% through 2035, driven by pharmaceutical manufacturing development and generic production capabilities supporting healthcare infrastructure growth and comprehensive medication packaging applications. The country's expanding pharmaceutical industry and growing packaging converter market segments are creating demand for barrier materials that support operational performance and quality consistency standards. Pharmaceutical manufacturers and packaging suppliers are maintaining comprehensive material sourcing capabilities to support diverse production requirements.

Generic pharmaceutical production programs and medication packaging expansion are supporting demand for coated roll stock materials that meet contemporary barrier performance and regulatory compliance standards. Healthcare infrastructure development and pharmaceutical access programs are creating opportunities for packaging materials that provide comprehensive medication protection support. Manufacturing quality enhancement and GMP compliance programs are facilitating adoption of certified roll stock capabilities throughout major pharmaceutical production regions.

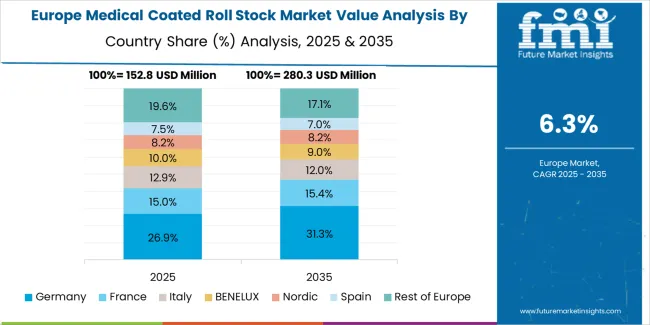

The medical coated roll stock market in Europe is projected to grow from USD 184.4 million in 2025 to USD 359.1 million by 2035, registering a CAGR of 6.9% over the forecast period. Germany is expected to maintain its leadership position with a 32.7% market share in 2025, projected to reach 33.4% by 2035, supported by its extensive pharmaceutical manufacturing infrastructure and medical device production capabilities.

Switzerland follows with a 21.4% share in 2025, expected to reach 22.1% by 2035, driven by comprehensive pharmaceutical industry concentration and medical device manufacturing excellence. Ireland holds a 16.8% share in 2025, projected to reach 17.3% by 2035 due to pharmaceutical production investment. France commands a 13.9% share, while the United Kingdom accounts for 10.2% in 2025. The Rest of Europe region is anticipated to maintain its collective share at approximately 5.0% through 2035, reflecting established market patterns in Eastern European pharmaceutical packaging centers and Nordic medical device manufacturing facilities.

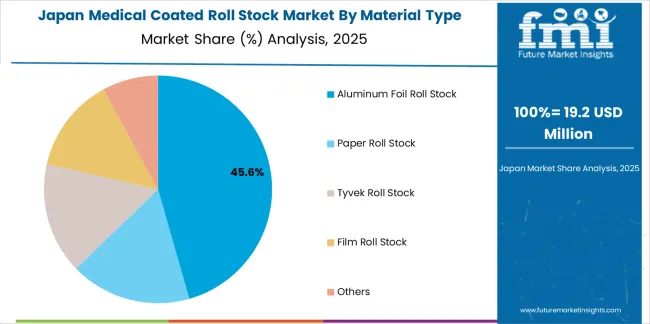

Japanese medical coated roll stock operations reflect the country's emphasis on pharmaceutical quality excellence and precision medical device manufacturing. Major pharmaceutical companies including Takeda and Daiichi Sankyo maintain rigorous packaging material qualification processes requiring extensive barrier property testing, extractables and leachables analysis, and comprehensive stability study documentation. This creates barriers for material suppliers but ensures packaging integrity for critical pharmaceutical applications.

The Japanese market demonstrates preference for thin-gauge aluminum foil constructions with optimized coating formulations suitable for high-speed blister packaging lines. Companies require specific heat seal characteristics that address compatibility with Japanese pharmaceutical packaging equipment and validation protocols. Performance specifications emphasize moisture barrier consistency and aging stability, driving demand for premium coating technologies and quality control systems.

Regulatory oversight through the Pharmaceuticals and Medical Devices Agency emphasizes material safety standards and packaging validation requirements. The pharmaceutical packaging approval system supports material specification through comprehensive testing protocols, creating advantages for suppliers with detailed technical documentation and local technical support capabilities.

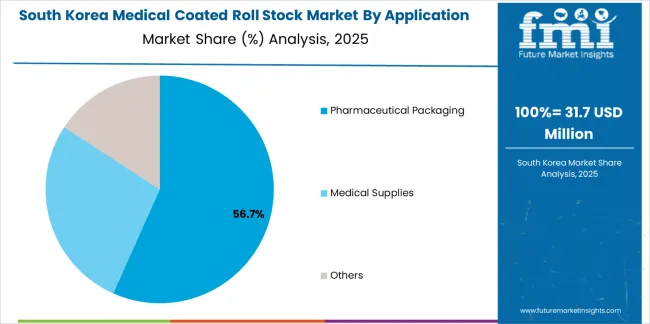

South Korean medical coated roll stock operations reflect the country's advanced pharmaceutical manufacturing sector and medical device production capabilities. Major pharmaceutical companies including Samsung Biologics and Celltrion drive packaging material procurement strategies, establishing relationships with certified suppliers to support large-scale biopharmaceutical production and sterile packaging requirements.

The Korean market demonstrates strength in combination product packaging, with material requirements emphasizing multi-layer barrier structures for drug-device integration. Companies integrate coated roll stocks with automated packaging lines requiring precise dimensional tolerances and seal consistency. This sophistication creates demand for engineered materials with documented performance characteristics and process compatibility verification.

Regulatory frameworks emphasize packaging validation and shelf-life verification standards. Korea Ministry of Food and Drug Safety oversight establishes material testing requirements that favor suppliers with comprehensive barrier property documentation and accelerated aging study capabilities. This benefits established material manufacturers with robust technical support programs and validation expertise.

Profit pools are consolidating around established medical packaging material suppliers with comprehensive validation documentation and regulatory approval portfolios. Value is migrating from commodity substrate supply to engineered barrier systems offering custom coating formulations, sterilization compatibility verification, and technical support services that reduce device manufacturer qualification timelines. Several archetypes set the pace: global flexible packaging converters defending share through pharmaceutical relationships and material science expertise; specialty medical packaging suppliers offering validated material platforms for sterile barrier applications; substrate manufacturers with vertical integration into coating operations; and regional converters capturing market share through local technical support and rapid prototype capabilities.

Switching costs remain significant due to material qualification requirements, stability study investments, and regulatory submission dependencies that stabilize incumbent relationships. However, technology differentiation around eco-friendly substrates, thin-gauge engineering, and sterilization compatibility creates openings for innovative suppliers to capture new product development projects. Material standardization in pharmaceutical blister applications and customization demands in medical device packaging create divergent competitive dynamics across market segments.

Consolidation continues as larger flexible packaging companies acquire medical packaging specialists to expand capabilities and customer access. Vertical integration accelerates with coating companies developing converting operations and converters investing in coating technology to capture value chain margins. Green initiatives for recyclable materials and reduced thickness constructions are becoming important differentiators, requiring research investment that pressures smaller material suppliers.

Market dynamics favor suppliers who can demonstrate material consistency through validation study portfolios, offer comprehensive technical support throughout qualification processes, and maintain manufacturing controls that ensure supply reliability for critical medical applications. Price competition intensifies in generic pharmaceutical blister stock where material specifications are well-defined, while medical device applications offer opportunities for premium positioning through engineered barrier solutions. Establish pharmaceutical manufacturer validation support with comprehensive stability study documentation and regulatory expertise; develop green material alternatives with maintained barrier performance for environmental compliance; invest in thin-gauge engineering capabilities and coating technology innovation for material differentiation.

| Items | Values |

|---|---|

| Quantitative Units | USD 614.8 million |

| Material Type | Aluminum Foil Roll Stock, Paper Roll Stock, Tyvek Roll Stock, Film Roll Stock, Others |

| Application | Pharmaceutical Packaging, Medical Supplies, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | China, India, Germany, Switzerland, Ireland, United States, and other 40+ countries |

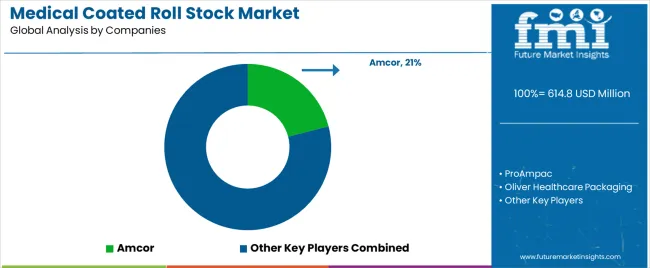

| Key Companies Profiled | Amcor, ProAmpac, Oliver Healthcare Packaging, Tekni-Plex, Pak Pack, Mitsubishi Paper, Tomoegawa Corporation, SIGMA Medical, Granton Medical, Sabre Medical, American Printpak, Nelipak Healthcare Packaging, Westfield Medical, Technipaq, Shanghai Pumao Packaging Material, Dongguan Safe Secure Medical Packing |

| Additional Attributes | Dollar sales by material type/application, regional demand (NA, EU, APAC, LATAM, MEA), competitive landscape, pharmaceutical vs medical device adoption, sterilization compatibility, and material innovations driving barrier performance, environmental responsibility compliance, and manufacturing efficiency |

The global medical coated roll stock market is estimated to be valued at USD 614.8 million in 2025.

The market size for the medical coated roll stock market is projected to reach USD 1,198.1 million by 2035.

The medical coated roll stock market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in medical coated roll stock market are aluminum foil roll stock, paper roll stock, tyvek roll stock, film roll stock and others.

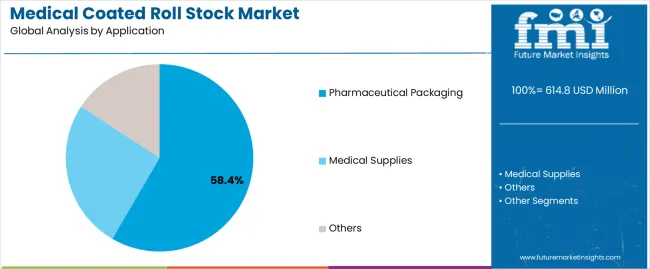

In terms of application, pharmaceutical packaging segment to command 58.4% share in the medical coated roll stock market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Latex Protective Suit Market Size and Share Forecast Outlook 2025 to 2035

Medical Activated Carbon Dressing Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Medical Pressure Mapping System Market Size and Share Forecast Outlook 2025 to 2035

Medical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Face Shield Market Forecast and Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Trays Market Size and Share Forecast Outlook 2025 to 2035

Medical Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Medically Supervised Weight Loss Services Market Size and Share Forecast Outlook 2025 to 2035

Medical Smart Drug Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Medical EMR Input Device Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA