The medical spa market is expanding steadily due to rising consumer interest in aesthetic wellness, preventive skincare, and non-invasive cosmetic procedures. Growth is being supported by increasing disposable income, advancements in aesthetic technologies, and growing acceptance of personalized beauty treatments across demographics. Current industry trends indicate strong demand for medical-grade skincare solutions that combine clinical efficacy with luxury experiences.

The market is being shaped by the integration of dermatological expertise, digital consultation platforms, and tailored treatment plans that enhance patient outcomes. Strategic collaborations between dermatologists, plastic surgeons, and wellness professionals are enhancing credibility and customer retention.

The future outlook remains positive as consumers increasingly prioritize self-care and minimally invasive rejuvenation treatments Continuous technological innovations, coupled with expanding medical spa networks and adoption of advanced devices, are expected to sustain revenue growth and strengthen market competitiveness across key regions.

| Metric | Value |

|---|---|

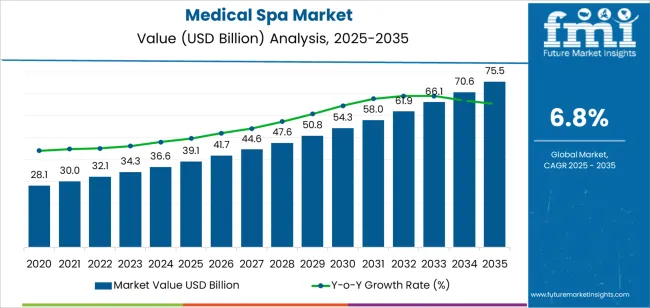

| Medical Spa Market Estimated Value in (2025 E) | USD 39.1 billion |

| Medical Spa Market Forecast Value in (2035 F) | USD 75.5 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

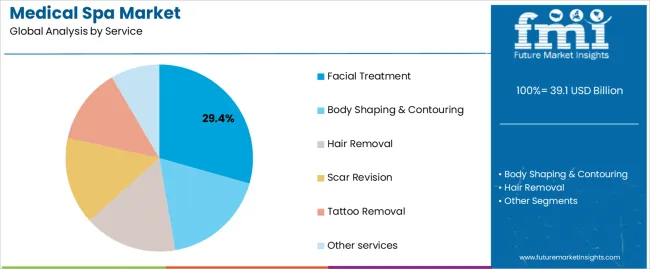

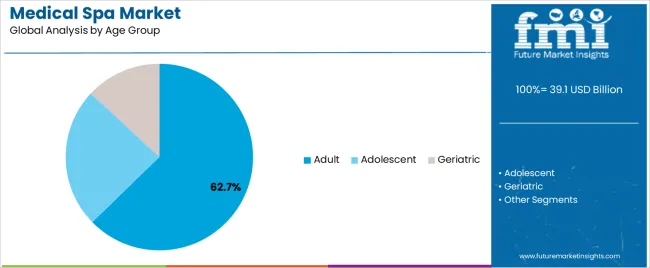

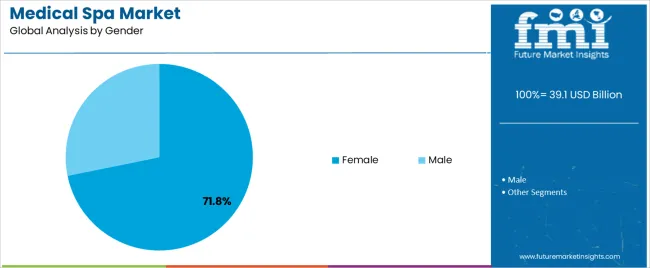

The market is segmented by Service, Age Group, Gender, and Provider and region. By Service, the market is divided into Facial Treatment, Body Shaping & Contouring, Hair Removal, Scar Revision, Tattoo Removal, and Other services. In terms of Age Group, the market is classified into Adult, Adolescent, and Geriatric. Based on Gender, the market is segmented into Female and Male. By Provider, the market is divided into Single Ownership, Group Ownership, Free-Standing, and Medical Practice Associated Spas. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The facial treatment segment, accounting for 29.40% of the service category, has emerged as the leading offering due to its consistent demand and wide range of aesthetic and dermatological benefits. The segment’s dominance is being driven by growing adoption of anti-aging, hydration, and skin-repair procedures that provide visible results with minimal downtime.

Advanced technologies such as LED therapy, microdermabrasion, and oxygen facials have enhanced treatment precision and client satisfaction. Increased awareness regarding skin health and the availability of customizable facial packages have expanded consumer reach.

The popularity of preventive skincare and premium facial treatments in urban centers has reinforced the segment’s position, while partnerships with cosmetic brands and device manufacturers are enabling medical spas to offer differentiated, high-margin services that support sustained market growth.

The adult segment, representing 62.70% of the age group category, continues to dominate the market due to high awareness of aesthetic procedures and willingness to invest in wellness and rejuvenation. Demand is being fueled by a growing working-age population seeking stress-relief and age-prevention treatments.

The segment’s performance is supported by affordability improvements and the integration of targeted skincare therapies catering to lifestyle-induced concerns such as pigmentation, acne, and early aging. Enhanced access to medical spas through urban and suburban expansion has further strengthened engagement.

Ongoing promotional campaigns, loyalty programs, and the availability of personalized packages are helping retain adult clientele This group’s consistent spending behavior and preference for advanced, low-risk procedures are expected to ensure sustained leadership in the coming years.

The female segment, holding 71.80% of the gender category, has maintained its dominant position owing to strong demand for aesthetic enhancement and skincare services. The segment’s leadership is reinforced by the growing cultural acceptance of cosmetic treatments and the increasing influence of social media and beauty awareness campaigns.

Medical spas have responded by expanding service portfolios to address diverse needs, including anti-aging, body contouring, and wellness-based therapies. Female consumers are increasingly opting for scientifically backed procedures performed in clinical yet relaxing environments, contributing to repeat visits and long-term loyalty.

The segment’s stability is supported by product innovation, flexible pricing models, and the integration of dermatological consultation into spa offerings Continuous expansion of women-focused service lines and promotional engagement are expected to sustain the segment’s share and further strengthen its role in overall market development.

Rise of Non-Invasive Procedures

There is a growing preference for non-invasive cosmetic procedures among consumers seeking aesthetic enhancements with minimal downtime and risks. Key trends include the adoption of treatments such as Botox injections, dermal fillers, and laser skin rejuvenation, driving the growth of the medical spa market.

Medical Spa Providers Investing in the Latest Technology

Medical spas are increasingly incorporating advanced technologies into their service offerings to enhance treatment efficacy and patient satisfaction. Trends include the use of laser therapy, radiofrequency devices, and ultrasound treatments for skin tightening, body contouring, and hair removal, providing clients with innovative and effective aesthetic solutions.

Holistic Wellness Approach

There is a shift towards a holistic wellness approach in the medical spa industry, with an emphasis on promoting overall health and well-being alongside aesthetic procedures. Trends include the integration of services such as nutritional counseling, stress management techniques, and mindfulness practices, catering to clients' desire for comprehensive wellness solutions.

Personalized Treatment Plans

Medical spas focus on providing personalized treatment plans tailored to individual client needs and goals. Trends include thorough consultations, customized procedures, and ongoing support throughout the client's journey, ensuring optimal results and patient satisfaction.

Wellness Tourism

The rise of wellness tourism has led to an increase in medical spa destinations catering to travelers seeking rejuvenation and relaxation experiences. Trends include the development of luxury spa resorts, wellness retreats, and medical tourism packages combining aesthetic treatments with leisure activities, attracting a global clientele seeking wellness-focused vacations.

This section provides detailed insights into specific segments in the medical spa industry.

| By Services | Facial Injectable |

|---|---|

| Market Share in 2025 | 45% |

Facial injectable services segment is projected to capture a share of 45% in 2025.

| By Providers | Single Ownership Spa |

|---|---|

| Market Share in 2025 | 42.0% |

The single ownership spa segment is expected to secure a significant share of 42.0% in 2025.

The section analyzes the medical spa market across key countries, including the United States, United Kingdom, India, Thailand, and Germany. The analysis points toward specific factors driving the adoption of medical spa in these countries.

| Countries | CAGR |

|---|---|

| United States | 5.4% |

| United Kingdom | 2.90% |

| Germany | 3.10% |

| Thailand | 6.9% |

| India | 7.60% |

The medical spa industry in the United States is anticipated to rise at a CAGR of 5.4% through 2035.

The medical spa industry in the United Kingdom is projected to rise at a CAGR of 2.90% through 2035. This stable growth reflects the market's maturity and its focus on:

Germany’s medical spa industry is likely to witness expansion at a CAGR of 3.10% through 2035.

Thailand's medical spa industry is projected to rise at a healthy CAGR of 6.9% through 2035.

India's medical spa market is anticipated to record a remarkable CAGR of 7.60% through 2035.

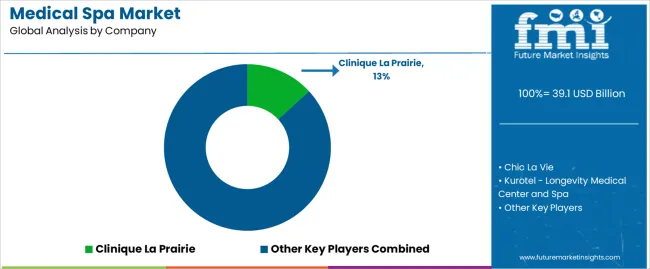

The competition within the medical spa industry is intensifying as the demand for non-invasive cosmetic procedures continues to surge. Established players are striving to maintain their market positions by offering a comprehensive range of services, including laser treatments, injectables, and skin rejuvenation therapies. Moreover, they focus on enhancing customer experience through personalized treatment plans and luxurious spa amenities to retain clientele loyalty amidst growing competition.

Emerging trends in the medical spa industry, such as the integration of advanced technologies like artificial intelligence and virtual reality, are reshaping the competitive dynamics. Market entrants are leveraging these innovations to differentiate their services, attract new customers, and stay ahead of competitors. Additionally, strategic partnerships with cosmetic brands and healthcare providers are becoming increasingly common, enabling medical spas to expand their service offerings and reach a broader market segment.

Players in the medical spa industry are ramping up their marketing efforts and investing in staff training to ensure high-quality service delivery. They are also focusing on creating unique selling propositions, such as specialized treatment packages and exclusive membership benefits, to stand out in the market.

Recent Developments in the Medical Spa Industry

The global medical spa market is estimated to be valued at USD 39.1 billion in 2025.

The market size for the medical spa market is projected to reach USD 75.5 billion by 2035.

The medical spa market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in medical spa market are facial treatment, body shaping & contouring, hair removal, scar revision, tattoo removal and other services.

In terms of age group, adult segment to command 62.7% share in the medical spa market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Pressure Mapping System Market Size and Share Forecast Outlook 2025 to 2035

Medical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Medical Face Shield Market Forecast and Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Trays Market Size and Share Forecast Outlook 2025 to 2035

Medical Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Medically Supervised Weight Loss Services Market Size and Share Forecast Outlook 2025 to 2035

Medical Smart Drug Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Medical EMR Input Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Anti-Decubitus Air Mattress Market Size and Share Forecast Outlook 2025 to 2035

Medical Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Medical Biodegradable Magnesium Alloy Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA