The medical bed market encompasses adjustable beds designed for healthcare settings, including manual, semi-electric, and fully electric beds used in hospitals, clinics, long-term care facilities, ambulatory centers, and homecare environments.

These beds facilitate patient mobility, safety, comfort, and caregiver efficiency, often integrating advanced features like side rails, weight sensors, adjustable height, Trendelenburg positioning, and pressure-relieving surfaces. The market is driven by rising hospital admissions, aging populations, increasing prevalence of chronic conditions, and expansion of healthcare infrastructure globally.

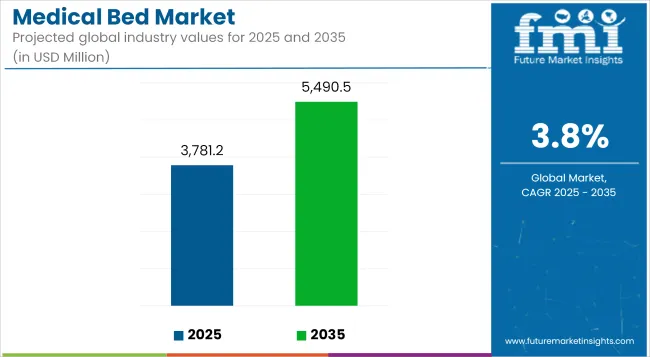

In 2025, the global medical bed market is projected to reach approximately USD 3,781.2 million, with expectations to grow to around USD 5,490.5 million by 2035, reflecting a Compound Annual Growth Rate (CAGR) of 3.8% during the forecast period.

The projected growth is bolstered by rising demand for ICU beds, growth in home-based care, and ongoing innovation in smart beds equipped with digital health monitoring systems, especially in the context of post-pandemic preparedness.

Key Market Metrics

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 3,781.2 Million |

| Projected Market Size in 2035 | USD 5,490.5 Million |

| CAGR (2025 to 2035) | 3.8% |

The North America medical bed market has a major share, owing to their strong clinic networks, growing demand for bariatric and long-term care beds, and increasing connectivity in smart medical beds. The USA and Canada are investing in upgrading ICU infrastructure, telemedicine-compatible homecare beds, and beds with fall-prevention and patient monitoring systems. Growing trends such as the aging population support expansion in nursing home and palliative care beds.

In Europe, a more mature but rapidly changing market, Germany, France, the UK and the Nordic countries are focused on geriatric care, hospital modernization and rehabilitation bed expansion. The surge in the elderly population and the growing demand for electrically adjustable beds in public and private hospitals, together with EU healthcare reforms, are major drivers of growth.

The Asia-Pacific region is likely to witness the fastest growth, supported by quick development of healthcare infrastructure, increasing chronic diseases burden, and higher government spending on public hospitals, particularly in China, India, Japan, and ASEAN countries.

Cost-effective and smart beds are also being introduced by domestic manufacturers, alongside the ongoing trend of urbanization and homecare services, contributing to demand for multi-function beds for the aging-in-place population.

Challenges

High Cost and Uneven Distribution of Advanced Hospital Beds

High cost of hospital beds particularly electrical adjustment, pressure relief systems and remote monitoring associated with advanced hospital beds is expected to act as a persistent challenge for the Medical Bed Market.

Many healthcare facilities in rural or low-income areas do not have modern beds, with most facilities depending on manual or basic models. Supply chain constraints, as well as gaps in the economic development across the world, also feature and slow the penetration of premium beds in the market.

Opportunities

Growth in Elderly Care, Smart Hospital Infrastructure, and Home Healthcare

Demand for specialized and ergonomic medical beds is increasing due to rising geriatric population and increasing prevalence of chronic diseases, as well as a growing preference for home-based care.

A better management of comfort, recovery and safety of the in-patient population is being led by innovations revolving around the use of IoT-integrated beds with patient monitoring devices, pressure ulcer sequences, height adjustable features, smart mobility and other such trends in the healthcare sector. New market segments are also being driven by modular bed designs that facilitate telemedicine integration, and hospital-at-home models.

A surge in demand in the market between 2020 and 2024 was witnessed owing to the COVID-19 pandemic, which resulted in the procurement of ICU and emergency beds. After the pandemic, the emphasis turned to long-term care, rehabilitation beds, and home-use medical beds. Many facilities, especially in emerging economies, continued non-automated or semi-electric models because of cost constraints.

From 2025 to 2035, the market is expected to gravitate towards hospital beds that are digitally connected, AI-driven and sustainability-focused. Priorities will change from capacity-building to quality improvement, and demand will grow for intelligent patient positioning, fall detection system, wireless-resourced computer integration and work flow in hospital-three newcomers of this industry.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Focused on emergency preparedness, CE/FDA standards for hospital beds |

| Technology Innovations | Growth in electric beds, ICU beds with basic monitoring features |

| Market Adoption | Demand from public hospitals, COVID response units, and long-term care |

| Sustainability Trends | Focus on durable materials and low-maintenance designs |

| Market Competition | Dominated by Hillrom (Baxter), Stryker, Invacare, Arjo , Linet , Paramount Bed, Medline |

| Consumer Trends | Prioritization of infection control, patient comfort, and mobility |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of standards for homecare beds, smart device interoperability, and AI-based safety systems |

| Technology Innovations | Rise of smart beds with integrated sensors, AI-based repositioning, and real-time vitals tracking |

| Market Adoption | Expansion into home healthcare, smart hospitals, and elderly care communities |

| Sustainability Trends | Adoption of eco-friendly materials, modular beds with recyclable components, and energy-efficient actuators |

| Market Competition | Entry of AI-integrated bed startups , IoT -connected care platforms, and homecare furnishing innovators |

| Consumer Trends | Growth in voice-controlled, remote-monitored, personalized positioning beds for patient-centric care |

The United States medical bed market is experiencing steady growth due to rising hospitalization rates, an aging population, and increasing demand for long-term and home healthcare. Hospitals, rehabilitation centers, and nursing homes are upgrading to advanced, motorized, and pressure-relief beds to enhance patient comfort and reduce caregiver burden.

The expansion of outpatient surgical centers and home care services is further driving demand for adjustable and multifunctional beds. Government funding for healthcare infrastructure and emphasis on post-acute care are also supporting market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.1% |

The market for medical beds in the UK is growing at moderate levels, supported by the National Health Service (NHS) with investments for upgrading healthcare infrastructure in the UK. Middle Demand for Lazarus beds in aged care, intensive care unit (ICU) use and bariatric care is increasing.

Market growth is driven by the growing demand for electric beds that offer fall prevention and ergonomic design features. Additionally, smart bed technologies that monitor patient conditions in real-time are being increasingly adopted across public and private facilities.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.7% |

The European Union (EU) medical bed market is growing at a very fast pace and is highly pervading and high in demand These are just a few of the reasons the European Union (EU) Medical Bed market is on the rise as people search for any way to avoid potential illness or disability. Germany, France, and Italy lead the way in adoption of high-tech ICU beds, maternity beds and home care solutions.

The EU-driven push toward digital health transformation is facilitating the adoption of sensor-enabled, connected medical beds in hospital environments. Moreover, the focus of regulations on patient safety and comfort is catalyzing demand for customizable and low-height hospital beds.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 3.6% |

Japan medical bed market has shown a steady growth because of its super-aging population and strong government focus for enhancing the elder care facility. Growing need for electric home-use beds, mobility assist beds, and pressure redistributing systems

Japan's innovations in robotics and mechatronics are particularly improving medical bed functionality, especially in long-term care and rehabilitation centers. Growing emphasis on patient independence is expected to drive demand for smart, compact, and multifunctional beds.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.8% |

The medical bed market in South Korea is growing owing to increased healthcare expenditures, rise in the number of private hospitals, and increasing demand for technologically advanced equipment. Increased demand for ICU beds, pediatric beds, and automated hospital beds are being driven by ICU renovations as well as government funding for aging-related healthcare.

Growth is also strong in home healthcare, buoyed by greater interest in remote-controlled adjustable beds and features such as dedicated inputs for long-term mobility support.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.9% |

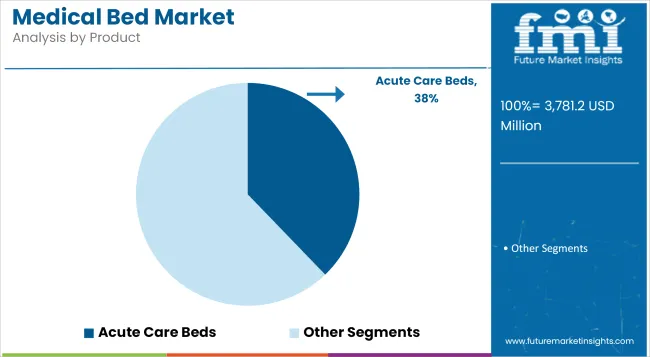

Acute care beds are vital resources that assist hospitals, ICUs, Emergency departments, and trauma centers. These beds are intended to take care of patients with acute, short-term, and frequently life-threatening illness who need constant observation, frequent interventions, and complex support equipment.

Emphasis on acute care bed investment relative to unnecessary bed supply to hospitals fuels global emergency planning, throughput, and crowding emergency service consultation. Whether for post-surgical recovery, cardiovascular events, sepsis, respiratory failure or complex infectious disease management, acute care beds are the building blocks of 21st-century inpatient care delivery.

Manufacturers have designed acute care beds to meet the needs of high-acuity patients through enhanced mobility, safety and therapy functions. Allows caregivers to manage patients with hemodynamic instability, impaired consciousness, and mobility limitations with features such as multi-zone pressure redistribution mattresses, in-bed scales, trendelenburg and reverse trendelenburg capability, and automatic head elevation settings.

Today’s acute care beds typically have programmable side rails and bed exit alarms, along with quick-flattening modes for CPR - increasing safety in higher-risk units. These features also minimize caregiver injury risks and optimize clinical interventions, especially in high-pressure ICU settings.

In addition, the majority of acute care beds now feature modular architecture, enabling facilities to refresh certain elements, including patient monitoring displays, oxygen delivery panels or mobility aids, without having to replace the entire bed frame.

ICU modernization and bed procurement are getting funded at an unprecedented scale by governments, NGOs, and multilateral development banks. This resulted in an increased demand for acute care beds, followed by a continued increase in the post-pandemic era.

It has informed strategy for expanding ICU capacity that now use dedicated zones of acute care beds with improved infection control characteristics, including antimicrobial surfaces, negative pressure modules, and frames compatible with airflow. These specifications enable safe provision of care in both pandemic response and normal «operational» infectious disease management.

In disaster preparedness planning, countries have begun storing acute care beds (the sort that can be rolled into any available space) in field hospital deployment kits, which can expand hospital capacity during public health emergencies, mass casualty incidents, or natural disasters.

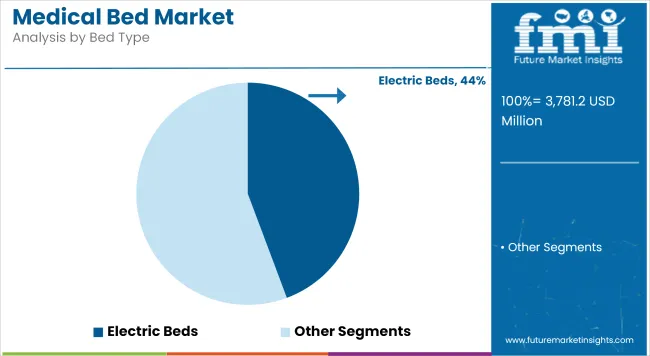

Electric medical beds represent a significant advancement in hospital infrastructure, offering automation, intelligent controls, and integrated patient support technologies. These beds use electric actuators to adjust height, backrest, leg rest, and tilting positions at the push of a button-allowing precise, effortless configuration that enhances both patient comfort and caregiver efficiency.

Electric beds are increasingly favored over manual or semi-electric alternatives in modern hospitals, specialty clinics, and long-term care facilities due to their ability to support fast clinical decisions, reduce caregiver injury, and improve overall treatment quality.

Electric beds allow for automated reposition of patients-this is vital for prevention of pressure sores, pulmonary drainage, and musculoskeletal support. They also help patients move from prone to sitting or standing positions - improving independence and lowering fall risk.

Integrated memory functions retain the comfortable preferred positions of every patient- staff can return the bed to such a configuration after cleaning or repositioning the patient post-treatment. Certain models offer automated sleep posture optimization, employing micro-adjustments overnight to facilitate rest and recovery.

Features that would benefit to bed mobility-namely height adjustment and auto-contouring-assist clinicians to better position patients for catheterization, X-rays, wound dressing and food without being a strain on themselves or the patient.

Some of the electric bed platforms disguised IoT connectivity, RFID-based patient ID recognition and wireless monitoring interfaces as standard features. These systems integrate with HIS and EHR for clinical workflows around care coordination, real-time location tracking, predictive maintenance scheduling, etc.

Smart beds can gather detailed data on patients' mobility, vital signs, efforts to exit the bed, and position changes, allowing for proactive fall prevention, early deterioration detection, and alarm reduction. These insights enable acuity-based workflow support, better patient throughput, and improved satisfaction scores.

Some beds today include voice control, touchscreen interfaces, or app-enabled controls that allow patients to adjust their bed position, communicate with staff, or order infotainment services - which increases engagement and improves morale in recovery.

The medical bed market is growing demand for expanding hospital infrastructure, increase in surgical procedures, and aging population with long-term care needs are acting as drivers for medical bed market growth.

Used from hospitals to ambulatory surgery centers to nursing homes to home care, medical beds are the primary means for positioning, mobilizing, monitoring, and recovering patient populations, and they vary from manual to fully automated smart bed systems. High-density ICU bed technology, design advances in infection control, and expanding home healthcare usage fuel the market.

Market Share Analysis by Key Players

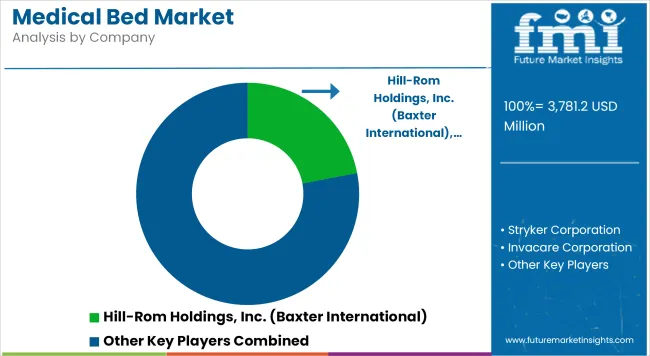

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Hill-Rom Holdings, Inc. (Baxter International) | 18-22% |

| Stryker Corporation | 14-18% |

| Invacare Corporation | 12-16% |

| LINET Group SE | 10-14% |

| Getinge AB | 8-12% |

| Others | 26-32% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Hill-Rom (Baxter) | Offers ICU, med- surg , and bariatric beds with smart sensors, bed-exit alarms, and patient repositioning support. |

| Stryker Corporation | Provides electric and manual hospital beds with easy mobility, hydraulic positioning, and integrated nurse call systems. |

| Invacare Corporation | Manufactures home care and long-term care beds, including adjustable electric beds with easy controls. |

| LINET Group SE | Produces intensive care and maternity beds with advanced ergonomics and pressure ulcer prevention features. |

| Getinge AB | Offers specialty surgical and ICU beds with hygiene-focused surfaces and infection control design. |

Key Market Insights

Hill-Rom Holdings, Inc. (Baxter) (18-22%)

Hill-Rom leads the medical bed market with its VersaCare®, Progressa®, and Centrella® smart bed systems, offering real-time patient monitoring, pressure injury prevention, and mobility support.

Stryker Corporation (14-18%)

Stryker delivers versatile hospital and transport beds with safety alarms, powered adjustments, and intuitive nurse interfaces, making them highly preferred in ICU and emergency units.

Invacare Corporation (12-16%)

Invacare is prominent in home care and assisted living, offering cost-effective, lightweight, and ergonomic medical beds that cater to non-hospital settings.

LINET Group SE (10-14%)

LINET supplies modular and specialty beds equipped with automatic CPR positioning, anti-decubitus surfaces, and trendelenburg/reverse trendelenburg features, with a strong footprint in Europe and Asia.

Getinge AB (8-12%)

Getinge focuses on infection control and surgical care beds, integrating cleanable surfaces, emergency access features, and advanced braking systems.

Other Key Players (26-32% Combined)

A number of specialized and regional companies are offering innovative and customized solutions across public hospitals, private clinics, and rehabilitation centers, including:

The overall market size for medical bed market was USD 3,781.2 million in 2025.

The medical bed market is expected to reach USD 5,490.5 million in 2035.

Increasing hospital admissions, rising prevalence of chronic diseases, and growing demand for advanced, adjustable, and homecare-friendly medical beds will drive market growth.

The top 5 countries which drives the development of medical bed market are USA, European Union, Japan, South Korea and UK.

Acute care beds expected to grow to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Usage, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Usage, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Usage, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Usage, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Usage, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Usage, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Usage, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Usage, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Usage, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Usage, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Usage, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Usage, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Usage, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Usage, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Usage, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Usage, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by End-User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Usage, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End-User, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Usage, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Usage, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Usage, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Usage, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 26: Global Market Attractiveness by Usage, 2023 to 2033

Figure 27: Global Market Attractiveness by Application, 2023 to 2033

Figure 28: Global Market Attractiveness by Type, 2023 to 2033

Figure 29: Global Market Attractiveness by End-User, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Usage, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Usage, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Usage, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Usage, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Usage, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 56: North America Market Attractiveness by Usage, 2023 to 2033

Figure 57: North America Market Attractiveness by Application, 2023 to 2033

Figure 58: North America Market Attractiveness by Type, 2023 to 2033

Figure 59: North America Market Attractiveness by End-User, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Usage, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Usage, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Usage, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Usage, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Usage, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Usage, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End-User, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Usage, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Usage, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Usage, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Usage, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Usage, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Usage, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by End-User, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Usage, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Usage, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Usage, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Usage, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Usage, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Usage, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by End-User, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Usage, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by End-User, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Usage, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Usage, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Usage, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Usage, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Usage, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by End-User, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Usage, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by End-User, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Usage, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Usage, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Usage, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Usage, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Usage, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 209: East Asia Market Attractiveness by End-User, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Usage, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by End-User, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Usage, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Usage, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Usage, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Usage, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Usage, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by End-User, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Face Shield Market Forecast and Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Display Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Trays Market Size and Share Forecast Outlook 2025 to 2035

Medical Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Medically Supervised Weight Loss Services Market Size and Share Forecast Outlook 2025 to 2035

Medical Smart Drug Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Medical EMR Input Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Anti-Decubitus Air Mattress Market Size and Share Forecast Outlook 2025 to 2035

Medical Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Medical Biodegradable Magnesium Alloy Market Size and Share Forecast Outlook 2025 to 2035

Medical Holography Market Size and Share Forecast Outlook 2025 to 2035

Medical Antiseptics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA