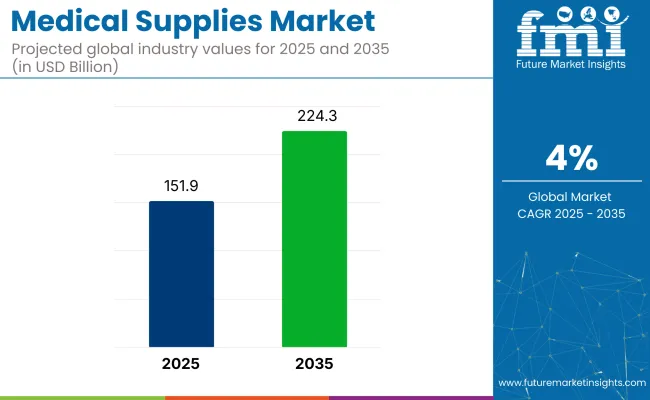

The medical supplies market is projected to grow from USD 151.9 billion in 2025 to USD 224.3 billion by 2035, reflecting a CAGR of 4% over the forecast period. Consistent hospital demand, rising outpatient care, and continued investment in diagnostic laboratories are key enablers of this growth.

Global supply chains have become more resilient following COVID-19 disruptions, prompting greater emphasis on stockpiling essential supplies, particularly personal protective equipment (PPE), sterilization consumables, and diagnostic kits.

Innovations in material science, infection-resistant coatings, and single-use devices are transforming how suppliers serve hospitals, clinics, and specialty care centers. Companies like Medtronic, BD, and Cardinal Health are leading investment in new sterilization technologies and integrated delivery systems to reduce the risk of hospital-acquired infections.

The industry holds a significant but specialized share within its parent markets. In the healthcare market, it accounts for approximately 5-7%, as medical supplies are critical to healthcare delivery, but they represent just one aspect of the broader healthcare sector.

Within the pharmaceuticals market, the share is around 2-3%, with supplies like IV sets and drug delivery devices being used alongside pharmaceuticals. In the medical devices market, its share is approximately 8-10%, as these supplies complement devices like diagnostic instruments and surgical tools.

Within the hospital supplies market, the share is higher, around 15-20%, as hospitals rely heavily on medical consumables and disposables. In the laboratory equipment and supplies market, the share is around 6-8%, with these supplies supporting diagnostic testing and research.

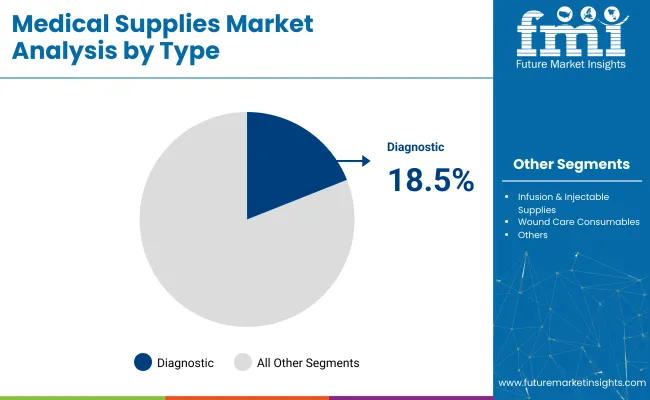

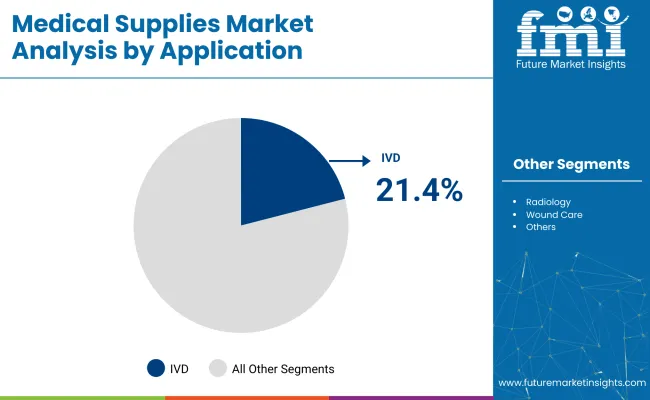

The industry is experiencing growth, driven by diagnostic innovation and infection control needs. Diagnostic supplies are expected to lead the product segment with 18.5% industry share, while in vitro diagnostics (IVD) will dominate the application segment with 21.4% industry share in 2025.

Diagnostic supplies are expected to capture 18.5% of the global industry in 2025. This category includes test kits, reagents, and consumables commonly used in hospitals, laboratories, and point-of-care settings. The segment’s growth is driven by the increasing demand for early disease detection, particularly for infectious diseases, cancer, and chronic conditions.

Companies such as Thermo Fisher Scientific, Abbott, and Roche Diagnostics are expanding their offerings through R&D and strategic distribution deals. Thermo Fisher's launch of faster immunoassay kits for respiratory virus detection in 2024 reflects ongoing innovation. Government programs in regions like India, China, and Latin America are promoting the adoption of rapid diagnostic tests.

In vitro diagnostics (IVD) are projected to capture 21.4% of the industry share in 2025, reflecting their critical role in modern healthcare. IVD tools are essential for identifying infections, metabolic disorders, and cancer, and their adoption has increased post-COVID-19, driven by the rise in preventive screening and home testing.

Companies like BD, Siemens Healthineers, and Bio-Rad are expanding their molecular and immunoassay portfolios to meet growing demand. National health programs in countries like India, South Korea, and the United Kingdom are funding decentralized diagnostic systems. Hospitals are integrating IVD tools into both centralized labs and near-patient settings, while mobile diagnostics and wearable health tools are accelerating data-driven healthcare.

The industry is growing due to the rising prevalence of chronic and infectious diseases, driving demand for advanced diagnostic and treatment products. However, challenges such as regulatory complexities, supply chain instability, and high operational costs are hindering industry expansion, particularly for smaller firms.

Rising Disease Prevalence and Diagnostic Investments Driving Industry Growth

The industry is expanding due to the increasing global burden of chronic and infectious diseases, which is driving higher demand for advanced medical supplies. Diagnostics, wound care, and infusion products are in high demand, fueled by early screening and surgical procedures.

Governments are investing in diagnostic laboratories and decentralized testing, particularly in rural areas. Companies like Medtronic, BD, and Thermo Fisher are enhancing R&D for faster, more accurate products, further supporting industry growth through advancements in digital integration and AI-assisted diagnostics.

Supply Chain Constraints and Compliance Complexity Restrain Industry Expansion

Despite strong demand, the industry is constrained by supply chain instability and regulatory complexities. Compliance with varying regional standards, such as those from the FDA, EMA, and CDSCO, often leads to delayed product approvals and higher operational costs.

Fluctuations in raw material costs and reliance on imported components contribute to price instability and inventory gaps. Smaller manufacturers face difficulties in scaling due to tight profit margins and fragmented supply systems, which slow down the availability of essential supplies in underserved regions.

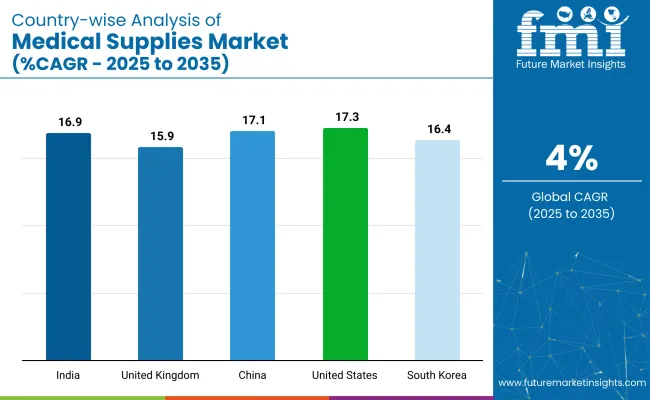

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 17.3% |

| United Kingdom | 15.9% |

| China | 17.1% |

| India | 16.9% |

| South Korea | 16.4% |

The industry demand is projected to rise at a 4% CAGR from 2025 to 2035. Of the five profiled countries out of 40 covered, the United States leads at 17.3%, followed by China at 17.1% and India at 16.9%, while the United Kingdom records 15.9% and South Korea posts 16.4%.

These rates translate to a growth premium of +333% for the United States, +328% for China, and +322% for India versus the baseline, while South Korea and the United Kingdom show strong but slightly slower growth.

Divergence reflects local catalysts: robust healthcare spending and technological advancements in the United States, increasing demand for these supplies driven by a growing population in China and India, and continued healthcare modernization and infrastructure development in South Korea and the UK

The industry in the United States is set to record a CAGR of 17.3% through 2035. High-volume procurement and next-gen innovation define industry expansion, supported by robust healthcare infrastructure and federal-level strategic stockpiling. Companies such as 3M, Medtronic, and Stryker dominate supply of PPE, infusion kits, and infection control products across hospitals and outpatient networks.

In 2024, Cardinal Health invested USD 150 million to expand PPE manufacturing in Ohio. AI-integrated diagnostics and remote monitoring tools are increasingly deployed in private healthcare settings. A strong regulatory framework allows rapid industry access for advanced consumables, positioning the USA as a hub for smart, compliant medical technologies.

Sales of medical supplies in the United Kingdom are projected to grow at a CAGR of 15.9% through 2035. NHS reform, procurement decentralization, and diagnostic innovation are key growth drivers. Companies like ConvaTec and Smith & Nephew are scaling recyclable, single-use devices that meet carbon-reduction mandates.

In 2024, BD expanded diagnostic manufacturing in the UK to address rising demand in cancer screening. NHS supply frameworks now encourage participation from SMEs offering digital supply tracking and predictive inventory tools. The Life Sciences Vision program is guiding biosensor rollout and at-home diagnostic access across regional care systems.

Demand for medical supplies in China is estimated to grow at a CAGR of 17.1% through 2035. Large-scale domestic manufacturing, MIIT-backed policy, and e-health expansion are shaping China’s rise as both a consumer and exporter of compliant medical consumables.

Firms like Mindray, Weigao, and Lepu Medical are investing in automated production of surgical kits, IVDs, and wound care items. Public-sector investment in rural health infrastructure is stimulating demand for low-cost, compliant supplies. Growth in online pharmacy platforms has fueled uptake of wearable respiratory and home-use devices. Cold-chain and smart-distribution systems are being scaled to manage biologics and temperature-sensitive kits.

The industry in India is projected to grow at a CAGR of 16.9% through 2035. Policy-backed manufacturing incentives and rising healthcare access are driving category expansion. Under the PLI scheme, local firms such as Poly Medicure and Trivitron Healthcare are scaling catheter, dialysis, and PPE production.

In 2025, the Ministry of Health launched a national diagnostics push targeting rural IVD integration. Digital programs like Ayushman Bharat and NDHM are incorporating consumables into e-claims frameworks. Low-cost respiratory and infection control items are being positioned for both domestic and export industries, making India a scalable and cost-effective global source.

Sales of medical supplies in South Korea are forecasted to grow at a CAGR of 16.4% through 2035. Digital innovation and global regulatory alignment are key industry enablers. Seegene, Osang Healthcare, and JW Medical are developing cloud-enabled diagnostics and robotic consumables.

In 2024, public funding supported production of smart wound dressings and home self-testing kits. Hospitals are integrating automated inventory systems with EMRs to improve procurement accuracy. South Korea’s exports of CE- and FDA-compliant surgical kits, radiology disposables, and lab reagents are expanding across Southeast Asia and the Middle East.

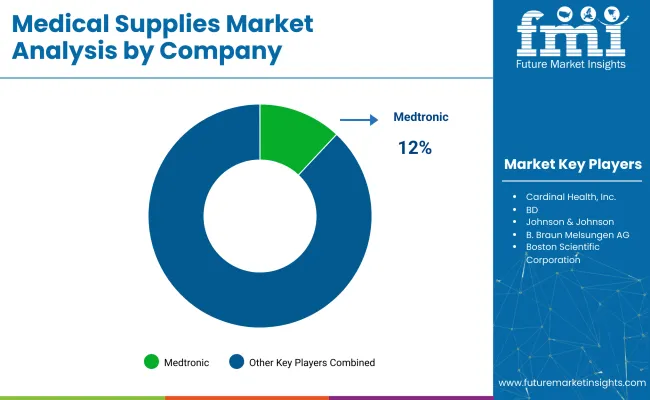

Leading Company - Medtronic Industry Share - 12%

The global industry features a competitive landscape with dominant players, key players, and emerging players. Dominant players such as Medtronic, Johnson & Johnson, and Baxter International lead the industry with extensive product portfolios, strong R&D capabilities, and robust distribution networks across healthcare, diagnostics, and surgical sectors.

Key players including B. Braun Melsungen AG, Boston Scientific Corporation, and Thermo Fisher Scientific offer specialized solutions tailored to specific applications and regional industries. Emerging players, such as Avanos Medical, ConvaTec Group Plc., and Fresenius Medical Care, focus on innovative technologies and cost-effective solutions, expanding their presence in the global industry.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Current Total Industry Size (2025) | USD 151.9 billion |

| Projected Industry Size (2035) | USD 224.3 billion |

| CAGR (2025 to 2035) | 4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Segments Analyzed - By Type | Diagnostic Supplies, Infusion & Injectable Supplies, Disinfectants, PPE, Sterilization Consumables, Wound Care Consumables, Dialysis Consumables, Catheters, Radiology Consumables, Others |

| Segments Analyzed - By Application | Radiology, Wound Care, Cardiology, Urology, Respiratory, Infection Control, IVD, Others |

| Segments Analyzed - By End User | Hospitals, Clinics, Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, the Middle East and Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Players Influencing the Industry | Medtronic, Cardinal Health, Inc., BD, Johnson & Johnson, B. Braun Melsungen AG, Boston Scientific Corporation, Thermo Fisher Scientific, Inc., Baxter International, Inc., Avanos Medical, Inc., 3M, Smith & Nephew, ConvaTec Group Plc., Abbott, Teleflex Incorporated, Fresenius Medical Care AG & Co. KGaA, Coloplast Group, Cook Medical, Merit Medical Systems, Stryker, Terumo Corporation |

| Additional Attributes | Dollar sales by product type, application, and end user, growing demand for infection control and wound care products, technological advancements in diagnostic and infusion supplies, increasing adoption of digital and automated medical supplies, regulatory impact on safety and quality standards, and demand for eco-friendly medical products. |

The industry is segmented by type into diagnostic supplies, infusion and injectable supplies, disinfectants, personal protective equipment (PPE), sterilization consumables, wound care consumables, dialysis consumables, catheters, radiology consumables, and others.

By application, the industry includes radiology, wound care, cardiology, urology, respiratory, infection control, in vitro diagnostics (IVD), and others.

In terms of end users, the industry is segmented into hospitals, clinics, and others.

The regional analysis covers North America, Europe, Asia-Pacific, Latin America, the Middle East and Africa.

The industry size is projected to be USD 151.9 billion in 2025 and USD 224.3 billion by 2035.

The expected CAGR is 4% from 2025 to 2035.

Medtronic is the leading company in the industry with a 12% industry share.

The IVD (In Vitro Diagnostics) segment is expected to dominate with a 21.4% industry share in 2025.

The United States is expected to grow the fastest with a projected CAGR of 17.3% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pre-Packaged Medical Supplies Market

Medical Silicone Radiopaque Vascular Ties Market Size and Share Forecast Outlook 2025 to 2035

Medical Indoor Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Medical Eye Shield Film Market Size and Share Forecast Outlook 2025 to 2035

Medical Far Infrared Therapy Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Latex Protective Suit Market Size and Share Forecast Outlook 2025 to 2035

Medical Activated Carbon Dressing Market Size and Share Forecast Outlook 2025 to 2035

Medical Coated Roll Stock Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Medical Pressure Mapping System Market Size and Share Forecast Outlook 2025 to 2035

Medical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Face Shield Market Forecast and Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA