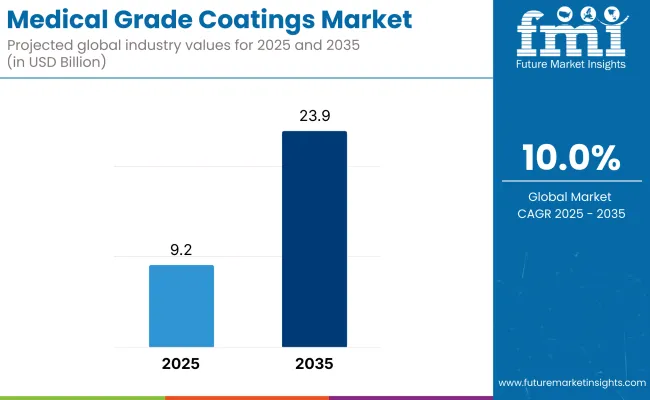

The medical grade coatings industry is expected to grow at a rapid pace, with an estimated value of USD 9.21 billion in 2025, expected to reach about USD 23.96 billion by 2035, at a CAGR of about 10.0%.

The demand is driven by the growth in healthcare and ongoing innovations in medical device technology.Among the key drivers of growth is the increase in minimally invasive procedures (MIS) globally. Lubricious and hydrophilic coatings play a specific critical role in catheter-based procedures, allowing easy passage through vascular systems. With the growing trend towards MIS to save time in hospital and reduce complications, the need for advanced coatings increases correspondingly.

The increasing use of implantable devices such as stents, orthopedic screws, and dental implants boosts the growth. Anti-thrombogenic, antimicrobial, and drug-releasing coatings are coated to facilitate integration and prevent post-surgery complications, making coated implants safer and more effective.

The industry is confronted with raw material compatibility issues, intricate application methods, and high development expenses. Coatings need to comply with stringent biocompatibility, adhesion, and sterilization requirements. These requirements can restrict formulation flexibility and increase time-to-market for new coating solutions.

Geographically, leadership is in North America with its well-established medical device industry, strong R&D expenditure, and positive regulatory landscapes. However, Asia-Pacific is expected to have the fastest growth, driven by healthcare infrastructure growth, increasing surgical volumes, and increasing medical tourism in India, China, and Thailand.Sustainability is also emerging as a priority, with companies focusing on solvent-free coatings and cleaner curing technologies.

These efforts complement the growing trend for cleaner manufacturing in an environmentally cleaner direction in the global medtech supply chain. The medical grade coatings industry is in a revolutionary era. With the convergence of material science, biocompatibility, and patient safety, coatings are crucial to the advancement of safer, smarter, and more advanced medical devices throughout the continuum of healthcare.

Market Metrics - Medical Grade Coatings Market

| Market Metrics | Value |

|---|---|

| Industry Size (2025E) | USD 9.21 billion |

| Industry Value (2035F) | USD 23.96 billion |

| CAGR (2025 to 2035) | 10.0% |

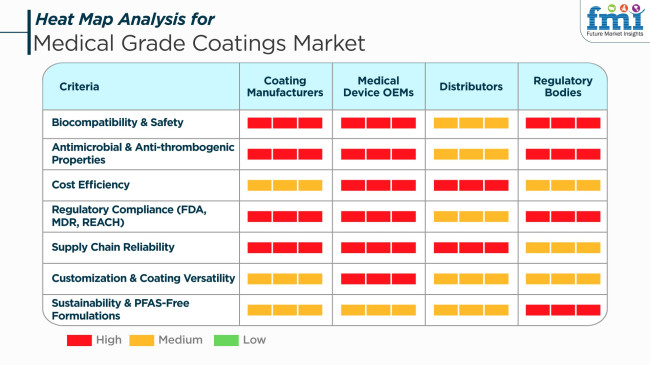

Medical grade coating is an important contributor to enhancing the performance, safety, and life of medical devices. Medical grade coatings lend properties such as biocompatibility, antimicrobial resistance, and low friction that are essential to a large number of medical uses.

They invest in research and development to design coatings that not only perform but also possess a good environmental performance, something that addresses the concerns of chemicals like PFAS.Demand for coatings that are easily accessible and can be supplied quickly to prevent interruptions in the manufacturing of medical devices and supplies.

Regulatory Agencies ensure adherence to regulations like FDA laws, the European Medical Device Regulation (MDR), and REACH. Regulatory agencies are key to ensuring the safety of patients and the environment by applying coatings to medical devices.In general, the medical grade coatings industry is typified by cooperative action among the stakeholders to produce and use coatings that satisfy performance specifications, meet environmental regulations, and respond to changing healthcare needs.

Grade Coatings Market - Stakeholder Priorities

Between 2020 and 2024, the industry advanced due to rising concerns over infection control and demand for minimally invasive procedures. Coatings such as antimicrobial and hydrophilic layers became standard on catheters, implants, and surgical instruments, helping reduce friction, improve comfort, and mitigate bacterial growth. Increased attention to hospital-acquired infections (HAIs) prompted hospitals to prefer devices coated with protective technologies. However, most coatings at the time focused on passive protection rather than active medical benefits.

From 2025 to 2035, the industry will have more dynamic and therapeutic applications.Coatings will evolve from protection shields to performance components - such as drug-delivery, biodegradable, or smart coatings that can be measured in real time.Innovation will be sustainability-based, where patient-related and biodegradable products will enter the mainstream.

Nano-coatings and bioactive materials will be the focus areas for next-generation medical devices. In addition, emerging healthcare industries and integration with digital health will propel this transformation globally.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The coatings were initially used to minimize friction and infection prevention on traditional devices like implants and catheters. | The uses will increase to include intelligent drug delivery, bioabsorbable devices, and regenerative implants where the coatings become a participating factor in healing and monitoring. |

| The focus was on antimicrobial, hydrophilic, and lubricious coatings for ease of use and infection control. | Attention will turn to intelligent, biodegradable, and nano-enabled coatings that offer functionality in addition to protection, such as therapeutic delivery and responsiveness to data. |

| There were efforts to reduce HAIs and optimize device function in traditional surgical and hospital settings. | Personalized medicine, smart health devices, and global emphasis on green and precision medical technologies will drive innovation. |

| Developed economies have high healthcare investment and tight regulatory requirements. | Emerging markets will see more rapid adoption on the basis of increased access to healthcare, local manufacturing, and harmonization of regulation. |

| A majority of the products had passive coatings with elementary antimicrobial properties. | Future-generation coatings will become active treatment agents - drug-delivering, environmental, and personalized according to patient needs. |

| The norm was traditional synthetic, solvent-based coatings, with minimal emphasis on being environment-friendly. | Factory-based producers will ensure that sustainability becomes an essential focus in the form of green chemistry, biodegradable or recyclable materials, and energy-conservative coating operations. |

There is a constant fluctuation in raw material prices, including polymers and metals used in coating formulations. Variability in these input costs can significantly impact production expenses, making it challenging for manufacturers to maintain competitive pricing structures and potentially affecting profit margins.

Stringent regulatory conditions represent significant threats to the medical grade coatings business. Compliance with variant regional regulations necessitates constant monitoring and adaptation. Failure to comply may result in legal penalties and loss of brand integrity, affecting industry share and consumer trust.

Supply chain interruptions, such as transportation delays or geopolitical tensions, may hinder the on-time delivery of finished products and raw materials. The interruptions might result in production stoppages and unfulfilled customer demand, negatively impacting sales and long-term business relationships.

The industry has growing competition and technological innovation. Firms need to invest in research and development to innovate and enhance product offerings on a continuous basis. If they fail to do so, they risk becoming obsolete and losing revenue share to tough competitors.

Reliance on major medical device markets implies that recessions can hamper the demand for medical coatings. The risk can be minimized by diversifying the base of customers for different medical uses.

In short, the medical grade coatings industry is subject to risks stemming from raw material price volatility, regulatory issues, supply chain dislocations, changes in technology, and industry-specific economic downturns. Forward-thinking approaches addressing such drivers are required to ensure that growth and competitiveness in this changing industry are maintained.

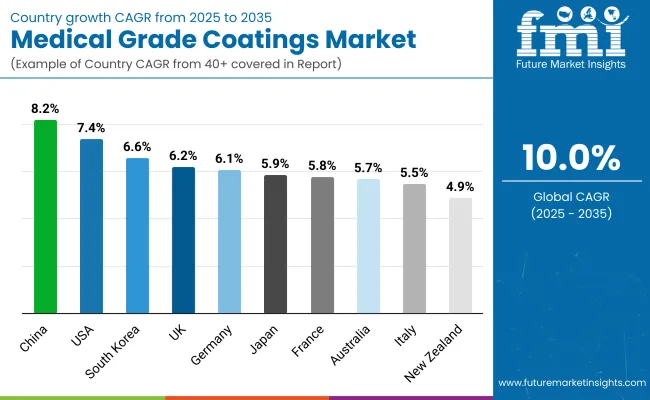

| Country | CAGR (%) |

|---|---|

| USA | 7.4% |

| UK | 6.2% |

| France | 5.8% |

| Germany | 6.1% |

| Italy | 5.5% |

| South Korea | 6.6% |

| Japan | 5.9% |

| China | 8.2% |

| Australia | 5.7% |

| New Zealand | 4.9% |

The USA medical grade coatings industry will register a growth of 7.4% CAGR in the period 2025 to 2035, driven by ongoing demand for advanced medical equipment and surgical equipment. The upsurge in minimally invasive treatments and implantable devices has necessitated demand for the adoption of high-performance coatings with antimicrobial protection, biocompatibility, and greater durability.

Leading industry companies such as Surmodics, DSM Biomedical, and Hydromer are investing in polymeric and hydrophilic coating technologies tailored to cardiovascular, orthopedic, and endoscopic industries. The favorable regulatory situation in the USA, coupled with continuing advances in healthcare manufacturing technology, continues the trend towards coatings of medical grade with stringent clinical specifications.

The UK is expected to expand at a 6.2% CAGR during the period between 2025 and 2035. Expansion is influenced by increasing investment in healthcare infrastructure, advancements in medical devices, and requirements for antimicrobial technology in hospitals. Increased focus on infection control and dependency on invasive devices also continue to drive the use of coating technology.

Companies such as Biocoat and Harland Medical Systems are making their presence felt in the UK by providing niche coatings for catheters, guidewires, and implants. The industry also derives strength from government-supported research initiatives and collaborations with research institutions, which are driving innovation of next-generation medical coating technologies.

France is likely to grow at a CAGR of 5.8% over the forecast period. The country's strong base in the manufacturing of medical devices, particularly cardiovascular and orthopedic, fuels steady demand for coatings to enhance device performance and patient safety.

Leading home and international firms are determined to expand their coating product offerings to counter regulatory compliance and material innovation. Developments in antimicrobial and lubricious coatings are especially significant in countering nosocomial infection problems. As a national initiative for healthcare modernization and medical technology exports, France continues to be a leading force in shaping Europe for the sale of medical-grade coatings.

Germany is expected to achieve a CAGR of 6.1% from 2025 to 2035. Germany, as a world hub for precision manufacturing and precision engineering of medical devices, has an extremely high demand for coating, which increases device performance, wear resistance, and compatibility with sterilization.

Major players like Freudenberg Medical and B. Braun are leaders in introducing coating technologies for catheters, surgery tools, and implantable products. Emphasis on research and complying with rigorous regulation standards are driving innovation in antimicrobial and hydrophilic pharmaceuticals. A well-established production system in Germany ensures the universal application of coating technology to high-value medical devices.

Italy is anticipated to grow at a CAGR of 5.5% from 2025 to 2035. As the number of manufacturers of surgical and diagnostic devices increases, the use of coatings for improved biocompatibility and surface modification continues to rise. Highly advanced metallic and polymer coatings are gaining interest from Italian manufacturers to meet specific clinical and regulatory requirements.

Collaborations with European material science companies and technology providers are making it easier for Italian businesses to adopt innovative solutions such as anti-thrombogenic and antimicrobial coatings. Local efforts at upgrading healthcare devices and improving the performance of medical devices make room for sustained industry growth.

South Korea will grow at a CAGR of 6.6% over the forecast period. The country's investments in high-end medical devices and biotechnology are fueling demand for high-quality coatings that enhance the safety and performance of devices in clinical applications.

South Korean businesses are taking advantage of nanotechnology and development in biopolymers to create coatings incorporating lubricity, biointegration, and infection control. Due to government support for medical innovation as well as export-oriented initiatives, South Korea is also becoming increasingly prominent as a leading player in the Asia-Pacific.

Japan is expected to grow with a CAGR of 5.9% during the period between 2025 and 2035. The country's leadership in diagnostic imaging, medical robots, and minimally invasive surgical procedures ensures constant demand for coating technologies that will enhance device performance and patient outcomes.

Japanese companies are spending on research and development of anti-bacterial, drug-eluting, and hydrophilic coatings for use in catheters, implants, and surgical devices. The adoption of coating technology into precision medical systems remains a priority, and it is supported by Japan's innovation drive and compliance with international regulatory standards.

China is expected to achieve the highest CAGR of 8.2% from 2025 to 2035. Rapid growth in domestic medical device manufacturing and increasing demand for advanced healthcare solutions are major factors driving market growth. Government policies aimed at increasing domestic capacity and improving healthcare quality are also contributing to driving market growth.

Leading Chinese and multinational corporations target hydrophilic, anti-fouling, and antimicrobial coatings to apply to bridge devices like stents, catheters, and surgical instruments. Scalable manufacture, economy of scale, and mounting regulatory unification with worldwide quality standards put China on track to become the global hub of medical coating technology.

Australia is anticipated to expand at a CAGR of 5.7% over the forecast period. A rise in the application of coated devices in cardiovascular, respiratory, and orthopedic therapy is driving the demand. The focus of the healthcare system on infection prevention and long-term compatibility of devices drives higher adoption of coating technologies.

Australian firms are forming partnerships with overseas coating suppliers to access high-specialty materials and processes. Regulatory focus on patient safety and performance benchmarking is propelling the application of biocompatible and functional coatings at hospital chains and medical device manufacturers across the country.

New Zealand's market for medical-grade coatings is going to expand with a CAGR of 4.9% during the period between 2025 and 2035. New Zealand's small but tech-savvy medical population is promoting the utilization of coatings within diagnostic equipment, catheters, and implantable devices. Ensuring healthcare innovation and regulatory compliance is the core of this low-key yet constant growth of the market.

International cooperation with international coating developers and universities enables the advancement of cutting-edge coating technology in response to local clinical needs. Emphasis on antimicrobial action and biocompatibility aligns with New Zealand's general policy of enhancing medical device safety and the healthcare outcomes of both private and public healthcare systems.

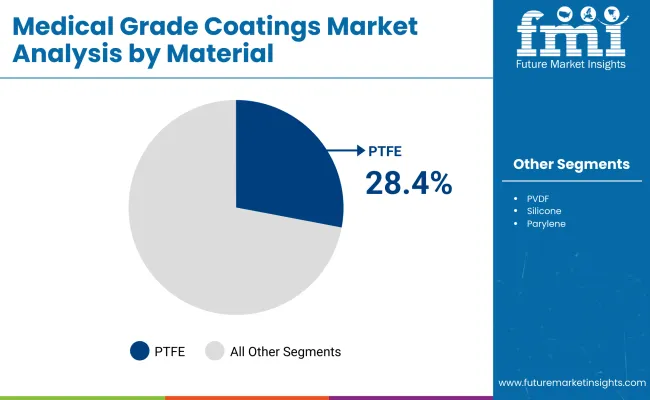

Medical-grade coatings are classified into their material types: polytetrafluoroethylene, PTFE, polyvinylidene fluoride, and PVDF, among the most used materials. Polytetrafluoroethylene is expected to capture the market for medical-grade coatings with an estimated market share of 28.4%, whereas Polyvinylidene Fluoride accounts for 22.1%.

For PTFE coatings, they are really preferred in the medical device field for their superior biocompatibility, lubricity, and chemical resistance. Such non-stick, low-friction coatings are applied to catheters, guidewires, surgical instruments, and needles, especially where it matters to get them in and through easily.

For instance, guidewires with PTFE coating are the norm in minimally invasive cardiovascular and neurological procedures. Leading companies like Precision Coating, Surmodics, and Biocoat, Inc., focusing on PTFE-based solutions, provide coatings that enhance the device's performance and decrease insertion trauma.

Conversely, PVDF enjoys high thermal stability, abrasion resistance, and chemical inertness, thereby making it recommended for long-term implantable devices and fluid-contact applications. They are employed in vascular grafts, membranes for hemodialysis, and filtration systems. PVDF coatings are especially treasured for their resistance to degradation through harsh bodily conditions and withstand repeated sterilization cycles. Therefore, companies like Arkema Group, Ensinger, and Kureha Corporation provide high-performance PVDF-based materials for medical-grade applications.

Both of these, PTFE and PVDF, are vital to enhancing the performance and durability of devices in a patient-safe manner. The era ahead has seen promising blue skies for high-end biocompatible coatings, being escorted by the emergence of technologies in less invasive devices and implantable technologies as regulatory stipulations increase and performance specifications rise. The further complications of medical technicalities requiring durable, low-friction surfaces will continue to secure the future position of these materials in the healthcare scene.

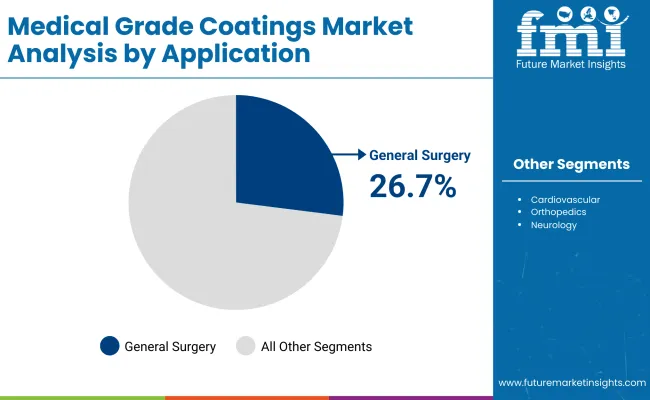

General surgery is projected to be the leading application by the year 2025, with an estimated 26.7% revenue share in the application segment, followed by the cardiovascular application segment, which holds a 24.5% share.

The leading application, general surgery, consists of surgical process tools and instruments that require the adoption of specialized coatings for performance enhancement, sterility, and durability. For example, surgical scissors, clamps, forceps, retractors, and scalpels, among others, are coated mostly with PTFE or hydrophobic silicone coatings to reduce friction and corrosion resistance and to ensure smooth interaction with tissues. These are spearheaded by companies like Precision Coating and Harland Medical Systems, which mainly provide customized PTFE and silicone-based coatings for reusable and single-use surgical instruments.

Out of these two application segments, the second largest is the Cardiovascular application segment since there is a growing demand for coated devices utilized in interventional cardiology and vascular procedures. The major focus for coatings under this application is toward lubricity improvement, resistance to thrombogenicity, and enhanced biocompatibility.

Guidewires, catheters, stents, and vascular grafts are some of the devices provided with hydrophilic and heparin-based coatings for insertion improvement, blood compatibility, as well as for risk reduction of clot formation. This specialty coating is also available for R&D specialists in large established organizations like Surmodics (USA), Biocoat Inc. (USA), DSM Biomedical (Netherlands), and technology partners including Abbott, Boston Scientific, and Terumo.

Apart from these two major segments, there are emerging applications such as orthopedic-urological and diagnostic kinds of applications, which are coming up quite strongly with the increasing number of minimally invasive procedures. For example, orthopedic implants use increasing titanium-based coatings meant for osseointegration, whereas hydrophilic coatings would be preferred in urological devices for the patient's comfort.

As the precision of techniques for performing surgeries and the complexity of devices evolve, growing demands for tailored coatings would be expected for both general and cardiovascular applications, thereby further consolidating leadership by these two segments in the industry.

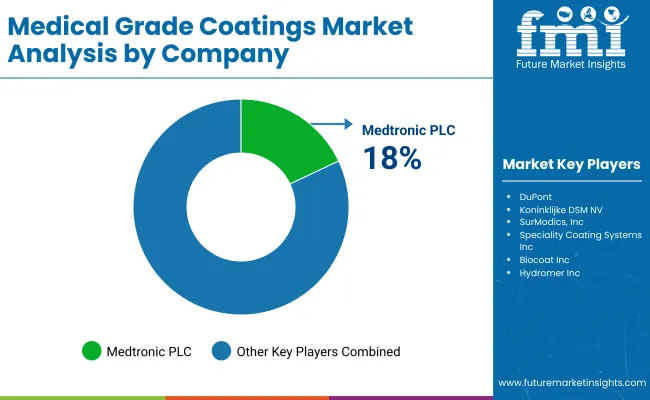

The industry is characterized by strong competition among international manufacturers of healthcare materials, specialized coating suppliers, and biomedical technology companies. The market share of major players, such as Medtronic PLC, DuPont, Koninklijke DSM NV, SurModics, Inc., and Speciality Coating Systems Inc., rests on advanced biocompatible coatings, antimicrobial solutions, and drug-eluting technologies. The prolongation of the device's lifetime decreased the threat of infection and improved surgical outcomes, providing these players with a competitive edge.

Regional and mid-sized players like Precision Coating Co. Inc., Biocoat Inc., and Covalon Technologies Ltd. add to the competitiveness by innovating hydrophilic and hydrophobic coatings for catheters, stents and implantable medical devices. Custom formulations and a focus on nanotechnology-based coatings consolidate their position in the market.

Emerging firms like Harland Medical Systems Inc., Hydromer Inc., and Medicoat, Inc. are advancing by developing next-generation surface modification technologies, including plasma coatings, bioactive coatings, and anti-thrombogenic solutions. These companies are thus distinguishing themselves by focusing on regulatory compliance, biocompatibility enhancement, and procedural complication reduction within medical applications.

Technological advances in polymer coatings, increasing demand for anti-fouling and lubricious coatings, and regulatory approvals for medical device coatings also contribute to the competitive environment. On another note, DuPont and Koninklijke DSM NV, for example, are continuing to expand their biocompatibility-related research through strategic collaborations with leading medical device manufacturers.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Medtronic PLC | 18-22% |

| DuPont | 14-18% |

| Koninklijke DSM NV | 12-16% |

| SurModics, Inc. | 10-14% |

| Speciality Coating Systems Inc. | 8-12% |

| Others (combined) | 30-40% |

| Company Name | Key Offerings and Activities |

|---|---|

| Medtronic PLC | Develops biocompatible coatings for implantable devices, ensuring longevity and reduced inflammatory response. |

| DuPont | Specializes in lubricious, antimicrobial, and anti-thrombogenic coatings for medical instruments and implants. |

| Koninklijke DSM NV | Focuses on biodegradable polymer coatings and drug-eluting technologies for cardiovascular and orthopedic applications. |

| SurModics, Inc. | Offers hydrophilic and anti-fouling coatings for minimally invasive surgical tools and vascular devices. |

| Speciality Coating Systems Inc. | Provides Parylene conformal coatings for high-precision medical electronics and implantable devices. |

Key Company Insights

Medtronic PLC (18-22%)

Medtronic focuses on biocompatible and durable surface changes for device performance improvement.

DuPont (14-18%)

A pioneer in antimicrobial and anti-thrombogenic coatings, ensuring the enhanced safety of medical devices and instruments.

Koninklijke DSM NV (12-16%)

Invests further in drug-eluting and biodegradable coatings with the aim of developing applications in orthopedics and cardiovascular therapy.

SurModics, Inc. (10-14%)

Hydrophilic coatings are specialized to enhance catheter efficiency and improve surgical precision in minimally invasive procedures.

Speciality Coating Systems Inc. (8-12%)

Enriches its portfolio through Parylene coatings with high-performance solutions for implantable medical devices.

Other Key Players

The segmentation is into PTFE, PVDF, Silicone, Parylene, Metals, and Others.

Key segmentation is into General Surgery, Cardiovascular, Orthopedics, Neurology, Gynecology, Dentistry, and Others.

The segmentation is into Hydrophilic, Hydrophobic, Antimicrobial, Drug Eluting, and Others.

The segmentation is into solvent-based, water-based, and powder coating, categorized by the application process and desired coating properties such as adherence, thickness, and finish.

Geographically, the report covers North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa (MEA).

The global industry revenue is estimated to be worth USD 9.21 billion in 2025.

Sales are projected to rise significantly, reaching USD 23.96 billion by 2035, driven by increasing demand for advanced medical devices and minimally invasive procedures.

China is expected to see a CAGR of 8.2%, supported by expanding healthcare infrastructure and local medical device manufacturing.

Polytetrafluoroethylene (PTFE) coatings are leading, offering excellent biocompatibility and reduced friction in catheters and guidewires.

Prominent companies include Medtronic PLC, DuPont, Koninklijke DSM NV, SurModics, Inc., Speciality Coating Systems Inc., Precision Coating Co. Inc., Biocoat Inc., Covalon Technologies Ltd., Harland Medical Systems Inc., Hydromer Inc., Medicoat, Inc., AST Products Inc., and Aculon Inc.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Kilo Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 4: Global Market Volume (Kilo Tons) Forecast by Material, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 8: Global Market Volume (Kilo Tons) Forecast by Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Formulation, 2018 to 2033

Table 10: Global Market Volume (Kilo Tons) Forecast by Formulation, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Kilo Tons) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 14: North America Market Volume (Kilo Tons) Forecast by Material, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 18: North America Market Volume (Kilo Tons) Forecast by Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Formulation, 2018 to 2033

Table 20: North America Market Volume (Kilo Tons) Forecast by Formulation, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Kilo Tons) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 24: Latin America Market Volume (Kilo Tons) Forecast by Material, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 26: Latin America Market Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Latin America Market Volume (Kilo Tons) Forecast by Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Formulation, 2018 to 2033

Table 30: Latin America Market Volume (Kilo Tons) Forecast by Formulation, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Kilo Tons) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 34: Europe Market Volume (Kilo Tons) Forecast by Material, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: Europe Market Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 38: Europe Market Volume (Kilo Tons) Forecast by Type, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Formulation, 2018 to 2033

Table 40: Europe Market Volume (Kilo Tons) Forecast by Formulation, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Kilo Tons) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 44: Asia Pacific Market Volume (Kilo Tons) Forecast by Material, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: Asia Pacific Market Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 48: Asia Pacific Market Volume (Kilo Tons) Forecast by Type, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Formulation, 2018 to 2033

Table 50: Asia Pacific Market Volume (Kilo Tons) Forecast by Formulation, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Kilo Tons) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 54: MEA Market Volume (Kilo Tons) Forecast by Material, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 56: MEA Market Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 58: MEA Market Volume (Kilo Tons) Forecast by Type, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Formulation, 2018 to 2033

Table 60: MEA Market Volume (Kilo Tons) Forecast by Formulation, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Formulation, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Kilo Tons) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 11: Global Market Volume (Kilo Tons) Analysis by Material, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 15: Global Market Volume (Kilo Tons) Analysis by Application, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 19: Global Market Volume (Kilo Tons) Analysis by Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Formulation, 2018 to 2033

Figure 23: Global Market Volume (Kilo Tons) Analysis by Formulation, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Formulation, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Formulation, 2023 to 2033

Figure 26: Global Market Attractiveness by Material, 2023 to 2033

Figure 27: Global Market Attractiveness by Application, 2023 to 2033

Figure 28: Global Market Attractiveness by Type, 2023 to 2033

Figure 29: Global Market Attractiveness by Formulation, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Material, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Formulation, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Kilo Tons) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 41: North America Market Volume (Kilo Tons) Analysis by Material, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 45: North America Market Volume (Kilo Tons) Analysis by Application, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 49: North America Market Volume (Kilo Tons) Analysis by Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Formulation, 2018 to 2033

Figure 53: North America Market Volume (Kilo Tons) Analysis by Formulation, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Formulation, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Formulation, 2023 to 2033

Figure 56: North America Market Attractiveness by Material, 2023 to 2033

Figure 57: North America Market Attractiveness by Application, 2023 to 2033

Figure 58: North America Market Attractiveness by Type, 2023 to 2033

Figure 59: North America Market Attractiveness by Formulation, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Material, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Formulation, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Kilo Tons) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 71: Latin America Market Volume (Kilo Tons) Analysis by Material, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 75: Latin America Market Volume (Kilo Tons) Analysis by Application, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 79: Latin America Market Volume (Kilo Tons) Analysis by Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Formulation, 2018 to 2033

Figure 83: Latin America Market Volume (Kilo Tons) Analysis by Formulation, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Formulation, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Formulation, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Formulation, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Formulation, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Kilo Tons) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 101: Europe Market Volume (Kilo Tons) Analysis by Material, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 105: Europe Market Volume (Kilo Tons) Analysis by Application, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 109: Europe Market Volume (Kilo Tons) Analysis by Type, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Formulation, 2018 to 2033

Figure 113: Europe Market Volume (Kilo Tons) Analysis by Formulation, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Formulation, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Formulation, 2023 to 2033

Figure 116: Europe Market Attractiveness by Material, 2023 to 2033

Figure 117: Europe Market Attractiveness by Application, 2023 to 2033

Figure 118: Europe Market Attractiveness by Type, 2023 to 2033

Figure 119: Europe Market Attractiveness by Formulation, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Material, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Formulation, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Kilo Tons) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Kilo Tons) Analysis by Material, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Kilo Tons) Analysis by Application, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Kilo Tons) Analysis by Type, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Formulation, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Kilo Tons) Analysis by Formulation, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Formulation, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Formulation, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Material, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Formulation, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Material, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Formulation, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Kilo Tons) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 161: MEA Market Volume (Kilo Tons) Analysis by Material, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 165: MEA Market Volume (Kilo Tons) Analysis by Application, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 169: MEA Market Volume (Kilo Tons) Analysis by Type, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Formulation, 2018 to 2033

Figure 173: MEA Market Volume (Kilo Tons) Analysis by Formulation, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Formulation, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Formulation, 2023 to 2033

Figure 176: MEA Market Attractiveness by Material, 2023 to 2033

Figure 177: MEA Market Attractiveness by Application, 2023 to 2033

Figure 178: MEA Market Attractiveness by Type, 2023 to 2033

Figure 179: MEA Market Attractiveness by Formulation, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Grade Polypropylene Market Size and Share Forecast Outlook 2025 to 2035

Medical-Grade Foil Market Size and Share Forecast Outlook 2025 to 2035

Medical Coatings Market Growth & Demand 2025 to 2035

Medical Grade Paper Market

Medical Silicone Radiopaque Vascular Ties Market Size and Share Forecast Outlook 2025 to 2035

Medical Indoor Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Medical Eye Shield Film Market Size and Share Forecast Outlook 2025 to 2035

Medical Far Infrared Therapy Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Latex Protective Suit Market Size and Share Forecast Outlook 2025 to 2035

Medical Activated Carbon Dressing Market Size and Share Forecast Outlook 2025 to 2035

Medical Coated Roll Stock Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Medical Pressure Mapping System Market Size and Share Forecast Outlook 2025 to 2035

Medical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Face Shield Market Forecast and Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA