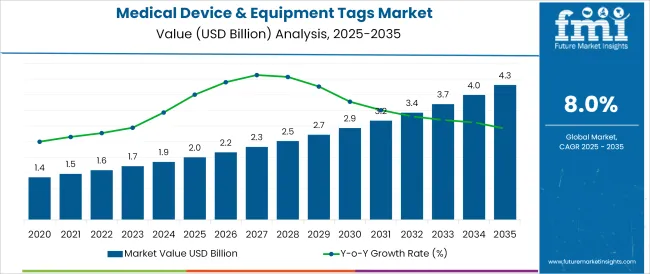

The Medical Device & Equipment Tags Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 4.3 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

The medical device and equipment tags market is undergoing steady expansion as healthcare providers, manufacturers, and regulators increasingly emphasize traceability, operational efficiency, and compliance. Rising demand for accurate asset tracking, sterilization assurance, and inventory management within hospitals and manufacturing environments has propelled the adoption of advanced tagging solutions.

Technological advancements in materials and data capture methods have further strengthened the appeal of durable, sterilizable, and intelligent tags. Regulatory scrutiny around patient safety, counterfeit prevention, and equipment maintenance has added momentum to the market, encouraging broader implementation.

Future growth is expected to be shaped by continued digitization of healthcare infrastructure, increasing procedural volumes, and enhanced integration of tagging systems with electronic health records and enterprise asset management platforms. Industry initiatives focused on reducing costs, minimizing errors, and meeting stringent sterilization and safety standards are paving the way for scalable, long term adoption.

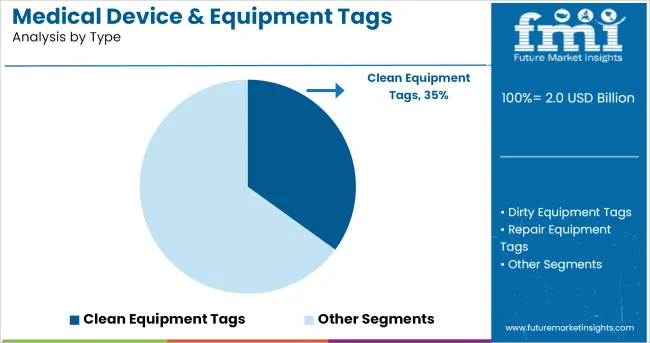

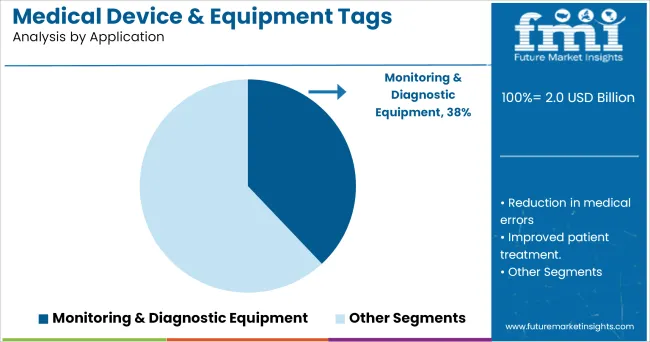

The market is segmented by Type and Application and region. By Type, the market is divided into Clean Equipment Tags, Dirty Equipment Tags, Repair Equipment Tags, Multipack Tags, and Others. In terms of Application, the market is classified into Monitoring & Diagnostic Equipment, Reduction in medical errors, Improved patient treatment., and Others.

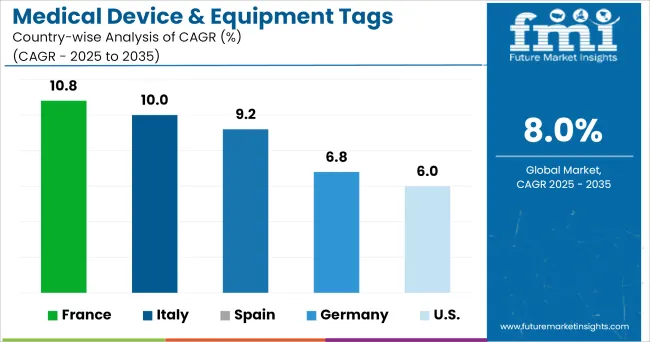

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, clean equipment tags are projected to hold 35.0% of the total market revenue in 2025, establishing themselves as the leading type segment. This leadership has been underpinned by the critical requirement for tags that can withstand rigorous sterilization processes without degradation, ensuring compliance with strict hygiene protocols.

Clean equipment tags have been designed with specialized materials and coatings that endure repeated exposure to high temperatures, chemicals, and moisture, making them indispensable in surgical and diagnostic environments. Their durability and ability to maintain readability over multiple sterilization cycles have reduced replacement frequency and minimized operational disruptions.

Adoption has been further driven by heightened awareness of infection control standards and the need to maintain accurate records of equipment usage and maintenance schedules, reinforcing the segment’s strong market position.

Segmenting by application, monitoring and diagnostic equipment is expected to capture 38.0% of the market revenue in 2025, ranking as the top application segment. This prominence has been driven by the increasing complexity and criticality of monitoring and diagnostic devices within healthcare facilities, where precise tracking and maintenance are essential.

Tags on such equipment have enabled healthcare providers to ensure accurate inventory management, timely calibration, and regulatory compliance. The need to minimize equipment downtime and enhance patient safety has encouraged widespread tagging of diagnostic instruments, imaging machines, and monitoring devices.

Furthermore, the integration of tags with asset management systems has improved visibility into utilization rates, maintenance histories, and location tracking, contributing to operational efficiency. The segment’s growth has been reinforced by the high frequency of use and the essential role of these devices in patient care delivery, cementing its leadership in the market.

The growing demand for medical equipment tags and medical barcode labels for easy identification of equipment cleanliness and repair status is creating new growth opportunities for medical device & equipment tags providers.

Medical device & equipment tags is offering a wide range of benefits such as patient identification, surgical instrument identification & sterilization, reduction in medical errors, better assessment of device performance, and others.

Continuous developments and implementation of new technologies such as unique device identification (UDI) and radio-frequency identification technology in healthcare sectors are creating growth opportunities.

Such technologies are providing various applications such as patient & staff identification, warehouse management solutions, lab specimen & medication labeling, location identification & wayfinding, laboratory vial, tray & rack identification and others.

China is the largest market for medical device & equipment tags, due to the strong presence of medical device & equipment tags manufactures and providers, in the Asia Pacific region. This is attributed to the high increase in demand for medical device & equipment tags for various end-users such as healthcare, medical facilities, clinical, and others.

Medical device & equipment tags offers different features such as mobile medical equipment, secure with adhesive backing strips, low-level disinfectants, surgical instrument tracking, and others. Hence, through the flexibility offered by Medical device & equipment tags vendors in the market can take the advantage of the accelerating opportunities in East Asia and South Asia & Pacific countries like India, China, Japan, and others.

France, Spain, and UK are creating potential growth opportunities for the growth of the medical device & equipment tags market owing to the rise in R&D funding for the development of RFID for medical device and surgical instrument tracking.

East Asia and South Asia region have an increasing number of manufacturing sectors hence the medical device & equipment tags is used to detect error and quality checks of products. Such major factors are driving the growth of medical device & equipment tags in East Asia and the South Asia region.

Key players such as

The key players strategies to improve expected product offerings, development, technical advances, and marketing position resulting from the acquisition, that are based on current expectations, estimates, beliefs, projections, assumptions, and forecasts about business and the markets in which medical device & equipment tags manufacturer operates.

For instance, June 2020, Cohealo launched SaaS solution for tracking medical equipment utilization. It enhanced the efficiency of the medical equipment by continuously monitoring their utilization and providing insights on how equipment can deployed in an optimal manner.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments.

The report also maps the qualitative impact of various market factors on market segments and geographies.

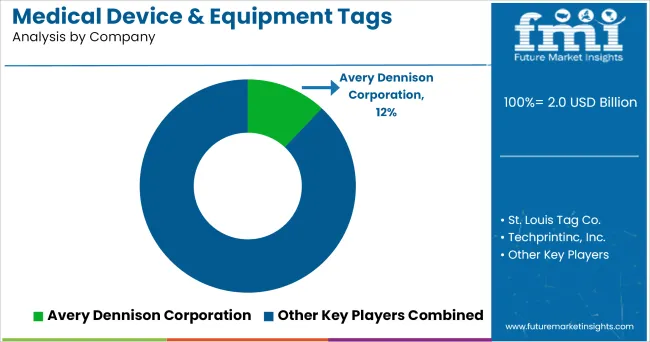

The global medical device & equipment tags market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the medical device & equipment tags market is projected to reach USD 4.3 billion by 2035.

The medical device & equipment tags market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in medical device & equipment tags market are clean equipment tags, dirty equipment tags, repair equipment tags, multipack tags and others.

In terms of application, monitoring & diagnostic equipment segment to command 38.0% share in the medical device & equipment tags market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Trays Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Technology Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Medical Equipment Covers Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Packaging Market Size, Share & Forecast 2025 to 2035

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Understanding Market Share Trends in Medical Device Packaging

Medical Device Analytical Testing Outsourcing Market Trends – Growth & Forecast 2024-2034

Medical Equipment Reimbursement Market Analysis – Trends & Industry Outlook 2024-2034

Medical Cleaning Devices Market Overview - Trends & Forecast 2025 to 2035

Medical EMR Input Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Protective Equipment Market - Growth, Innovations & Forecast 2025 to 2035

Durable Medical Equipment Rental Market Growth - Trends & Outlook 2025 to 2035

Cardiac Medical Device Market

Wearable Medical Device Market Size and Share Forecast Outlook 2025 to 2035

Portable Medical Devices Market Analysis - Growth & Forecast 2025 to 2035

Homecare Medical Devices Market Outlook – Industry Growth & Forecast 2025 to 2035

Aesthetic Medical Device Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Medical Far Infrared Therapy Device Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA