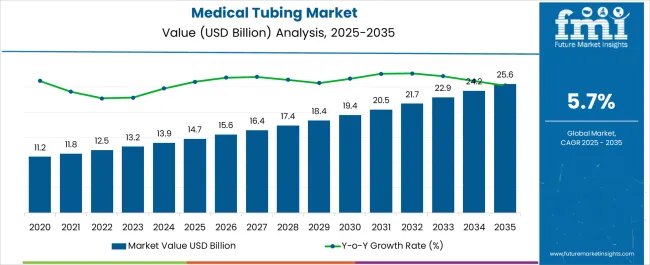

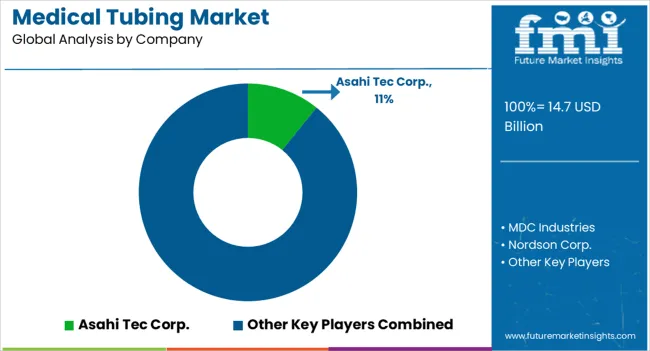

The Medical Tubing Market is estimated to be valued at USD 14.7 billion in 2025 and is projected to reach USD 25.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

| Metric | Value |

|---|---|

| Medical Tubing Market Estimated Value in (2025 E) | USD 14.7 billion |

| Medical Tubing Market Forecast Value in (2035 F) | USD 25.6 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The medical tubing market is experiencing strong growth, underpinned by rising demand for advanced medical devices, expanding healthcare infrastructure, and the growing prevalence of chronic diseases that require long-term treatment and fluid management solutions. Industry reports, regulatory updates, and corporate disclosures have emphasized the increasing adoption of medical tubing in applications ranging from drug delivery to minimally invasive procedures.

Biocompatibility, flexibility, and durability have become crucial product attributes, leading to investments in materials research and precision manufacturing. Hospitals and clinics are prioritizing high-quality tubing solutions to ensure patient safety, infection control, and regulatory compliance.

Additionally, innovations in extrusion technologies and surface modifications have enhanced tubing performance for specialized medical applications. Future growth will be shaped by the integration of antimicrobial coatings, the expansion of home healthcare, and increasing adoption of disposable medical devices, which together are expected to sustain steady demand across diverse clinical and diagnostic settings.

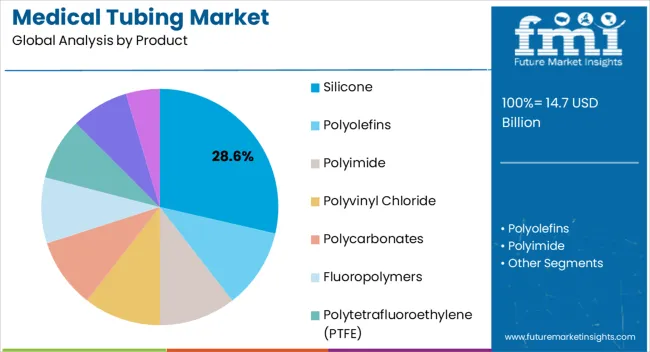

The Silicone segment is projected to account for 28.60% of the medical tubing market revenue in 2025, securing a leading share due to its superior material properties. Growth in this segment has been driven by silicone’s flexibility, thermal stability, and excellent biocompatibility, which make it suitable for a wide range of medical applications including catheters, feeding tubes, and implantable devices.

Industry publications have highlighted silicone’s resistance to kinking and ability to maintain structural integrity under varying temperature and pressure conditions, enhancing clinical reliability. Additionally, silicone tubing is chemically inert and compatible with sterilization methods such as autoclaving and gamma radiation, which supports its adoption in critical care and surgical environments.

Medical device manufacturers have increasingly favored silicone for its long lifespan and reduced risk of allergic reactions, further reinforcing its clinical acceptance. With continuous advancements in medical-grade silicone formulations, this segment is expected to maintain its leadership in product innovation and adoption.

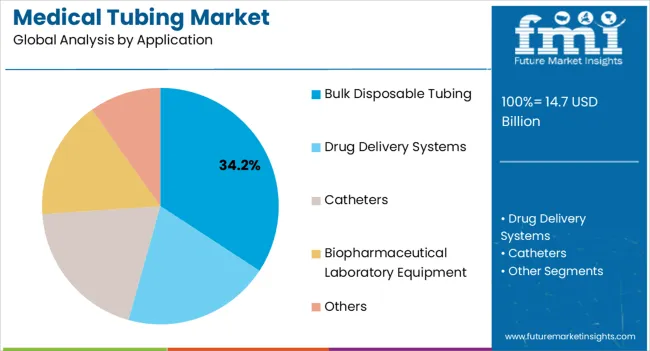

The Bulk Disposable Tubing segment is projected to capture 34.20% of the medical tubing market revenue in 2025, establishing itself as the dominant application category. This growth has been influenced by the rising demand for single-use medical devices that enhance sterility and minimize cross-contamination risks in healthcare settings.

Hospitals and outpatient centers have increasingly adopted disposable tubing in fluid transfer, IV administration, and diagnostic applications due to its cost-effectiveness and compliance with infection control protocols. Press releases and industry updates have highlighted expanded production capacities for bulk disposable tubing to meet global demand, especially in high-volume usage environments.

Additionally, disposable tubing simplifies hospital workflows by reducing the need for cleaning and re-sterilization, improving operational efficiency. The increasing focus on patient safety, combined with global healthcare policies promoting disposable solutions, has strengthened this segment’s position. As healthcare systems continue to prioritize infection prevention and operational efficiency, bulk disposable tubing is expected to remain the preferred choice across a wide range of medical procedures.

The global medical tubing market is likely to witness a CAGR of 6.0% in the assessment period. It recorded a CAGR of 7.7% in the historical period between 2020 and 2025.

Growing number of health-related applications that call for tubing solutions is a key motivator in the market. New treatments and procedures are being created as medical research progresses.

They mainly depend on the correct administration of gases, fluids, and drugs. These essential compounds are transported using medical tubing. They might help medical practitioners provide treatments more precisely and effectively.

Surging popularity of medical tubing can be attributed to the movement toward remote monitoring and home healthcare. Necessity for prolonged hospital stays has decreased as a result of technological improvements that allow patients to get health monitoring at home.

In March 2024, for instance, Medicover Hospitals inaugurated home healthcare services in India. It is a Sweden-based chain of hospitals. It aims to provide healthcare and accessibility to nurses & physicians at home for patients who are unable to physically visit the hospital.

Since patients can now maintain an improved standard of life while continuing to receive critical care, there is a greater demand for transportable medical supplies. These might help combine tubing for giving medications, infusion, and other medicinal purposes.

Its rising appeal is also fueled by the integration of tissue engineering and regenerative medicine interface with medical tubing. Medical tubing is set to be crucial in establishing controlled settings for cell cultures and allowing the flow of nutrients & growth hormones.

Researchers and physicians are investigating novel techniques to cultivating and transplanting tissues. Demand for customized tubing solutions made for these applications might rise as these innovative medical treatments gain popularity.

| Attributes | Factors |

|---|---|

| Latest Trends |

|

| Key Hindrances |

|

| Upcoming Opportunities |

|

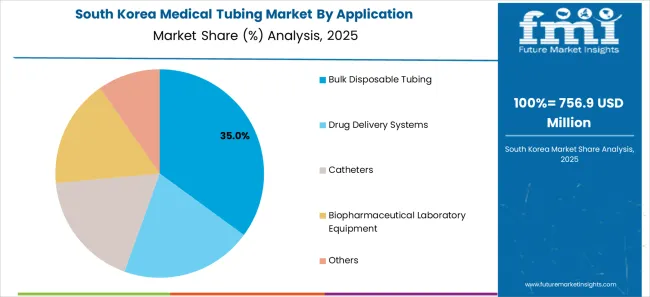

South Korea medical tubing market is projected to witness a CAGR of around 5.6% in the review period 2025 to 2035. It is likely to create an absolute dollar opportunity of USD 518.6 million in the same period.

Patients travel from every part of the world to South Korea in search of excellent medical treatment, turning the country into a center for medical tourism. Consequently, medical tubing is expected to gain traction across a wide range of businesses, including cosmetic surgery and advanced medical procedures.

South Korea-based health care providers need a consistent supply of premium medical tubing for a variety of operations. This would help them to serve international patients and keep its reputation as a destination for healthcare.

South Korea's aging population and rising chronic diseases are similar to those of several wealthy countries. Patients with chronic illnesses and elderly patients frequently need permanent treatment and medical services.

It might necessitate the application of medical tubing. Need for tubing equipment for observing patients, medication distribution, and other interventions has hence significantly increased.

In May 2025, a Memorandum of Understanding (MoU) was signed by the World Health Organization (WHO) and the Republic of Korea. This would help them to establish a worldwide biomanufacturing training hub.

The international training facility will assist all middle- and low-income countries in producing biological products. These include immunizations glucose, antibodies that are monoclonal, and cancer treatments.

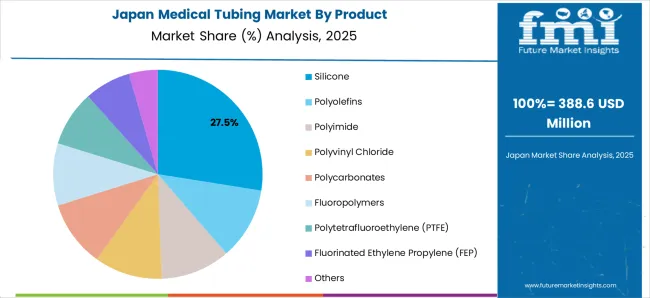

Japan medical tubing market is expected to rise at a CAGR of 5.9% in the evaluation period. It is estimated to exceed a valuation of about USD 25.6 billion by 2035.

Due to Japan's vulnerability to earthquakes and tsunamis, healthcare providers are emphasizing the importance of durable and portable medical equipment. Demand is also increasing as medical tubing becomes more recognized as a crucial element of disaster preparedness that can be easily and consistently set up in emergency scenarios.

In order to address issues with an aging population and rising healthcare expenses, the government has been putting money into medical facilities and adopting healthcare reforms. Promotional programs for telemedicine and home healthcare are part of these improvements. These changes might increase the demand for medical tubing systems that can be adapted to patient-centric care models and remote monitoring.

In February 2024, Japan took additional steps to loosen limits on the use of telemedicine, which is likely to enhance the country's healthcare system. Following COVID-19, a number of protective measures were announced.

They included a loosening of limits on online medical treatment and ability for doctors to conduct initial assessments or consultations with patients over the phone or online. Range of ailments that can be addressed virtually, as well as services covered by the national healthcare system were both expanded.

Considering that Japan is known for creating high-quality medical gadgets, the export sector for these products is booming. Increased manufacturing is required to meet both domestic and international demand.

It might be a result of medical tubing producers selling their goods to several international markets. The country's growing interest in the production of medical tubing is a result of this dual demand dynamic.

In terms of product, the silicone segment is anticipated to witness a CAGR of 5.8% in the forecast period. It recorded a CAGR of around 7.6% in the historical period from 2020 to 2025.

Outstanding biocompatibility of silicone medical tubing is one of the main factors propelling its popularity. Silicone is considered excellent for several medical applications.

They include implanted devices, catheters, and other devices that come into touch with biological fluids or tissues. It is well-tolerated by the human body and does not cause unpleasant responses.

In medical applications, silicone tubing delivers a vital mix of flexibility and toughness. It is simple to work with and might be bent without kinking.

It further helps in enabling precise positioning and simple movement during procedures. Due to its robustness, it can be used repeatedly, sterilized, and exposed to different medical compounds without degrading.

Since silicone tubing is frequently transparent, fluids flowing through the tube can be seen clearly. This openness is especially crucial while performing medical operations and interventions as good outcomes and patient safety depend on correct fluid monitoring and observation.

Integrity and effectiveness of silicone medical tubing are maintained across a broad temperature range owing to its superior temperature resistance. Additionally, it is resistant to a number of common chemicals and disinfectants used in healthcare facilities. Its usefulness for applications involving a range of medical chemicals and sterilizing techniques might be facilitated by this resistance.

Based on application, the bulk disposable tubing segment is anticipated to register a CAGR of around 5.7% in the assessment period. It expanded at a CAGR of 7.5% in the historical period.

On a broader scale, bulk disposable tubing offers cost benefits. Bulk tube purchases frequently have lower per-unit costs.

They are hence set to be an affordable option for companies and organizations that need a steady supply. This cost-effectiveness is especially advantageous for businesses that use a lot of tubing such as hospitals, research labs, and manufacturing operations.

Logistics in the supply chain are made simpler by purchasing disposable tubing in bulk. By maintaining a consistent and reliable inventory, businesses might reduce the need for frequent reordering and the risk of operational disruptions. This supply chain management effectiveness might boost productivity.

By decreasing packaging waste and requirement for superfluous packaging materials, bulk disposable tubing supports sustainability initiatives. Bulk packaging might help to lessen the carbon footprint related to single-use products. It is something that businesses are increasingly realizing is important.

Bulk disposable tubing availability guarantees that there will always be a sufficient supply on hand. As a result, there will be less downtime while awaiting new supplies. This seamless availability might benefit companies that depend on perpetual procedures or have time-sensitive demands, increasing operational efficiency.

Beyond the healthcare sector, bulk disposable tubing is used in different fields such as beverages, food, drug manufacturing, and research. Due to its adaptability, it is a desirable alternative for a diverse range of uses, including fluid transfer, sampling, and transportation of gases & chemicals.

Leading medical tubing manufacturers are exploring international markets to tap into growing healthcare sectors around the world. By expanding their reach beyond their home markets, they can reach new opportunities for growth and broaden their customer base.

Collaboration with other healthcare sector participants is on the rise, including hospitals, research institutions, and producers of medical devices. Manufacturers can learn about new demands and trends by collaborating and co-developing creative solutions. This might also help in ensuring that their products seamlessly interface with other medical devices.

Medical tubing producers are integrating sustainable principles into their business models as environmental concerns rise. This entails the use of environmentally friendly materials, reduction of waste during production, and design of goods that can be recycled properly. Sustainability efforts not only support global environmental goals but also enhance a company's standing in the marketplace.

For instance

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 14.7 billion |

| Projected Market Valuation (2035) | USD 25.6 billion |

| Value-based CAGR (2025 to 2035) | 5.7% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value (USD billion) |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, Italy, France, United Kingdom, Spain, Russia, GCC Countries, India, China, Japan, Australia |

| Key Segments Covered | Product, Application, Region |

| Key Companies Profiled | Asahi Tec Corp.; MDC Industries; Nordson Corp.; ZARYS International Group; Hitachi Cable America, Inc. |

The global medical tubing market is estimated to be valued at USD 14.7 billion in 2025.

The market size for the medical tubing market is projected to reach USD 25.6 billion by 2035.

The medical tubing market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in medical tubing market are silicone, polyolefins, polyimide, polyvinyl chloride, polycarbonates, fluoropolymers, polytetrafluoroethylene (ptfe), fluorinated ethylene propylene (fep) and others.

In terms of application, bulk disposable tubing segment to command 34.2% share in the medical tubing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plastic Fittings and Tubing for Pharmaceutical and Medical Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Face Shield Market Forecast and Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Trays Market Size and Share Forecast Outlook 2025 to 2035

Medical Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Medically Supervised Weight Loss Services Market Size and Share Forecast Outlook 2025 to 2035

Medical Smart Drug Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Medical EMR Input Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Anti-Decubitus Air Mattress Market Size and Share Forecast Outlook 2025 to 2035

Medical Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Medical Biodegradable Magnesium Alloy Market Size and Share Forecast Outlook 2025 to 2035

Medical Holography Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA