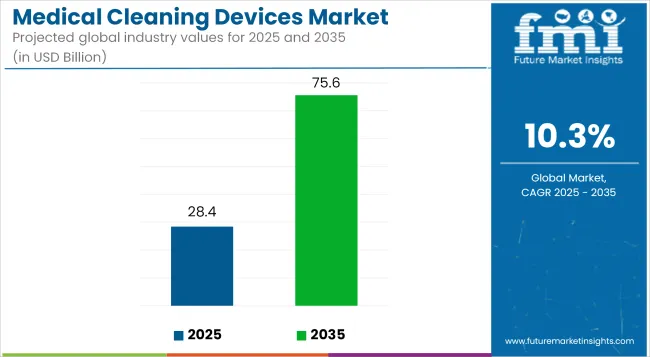

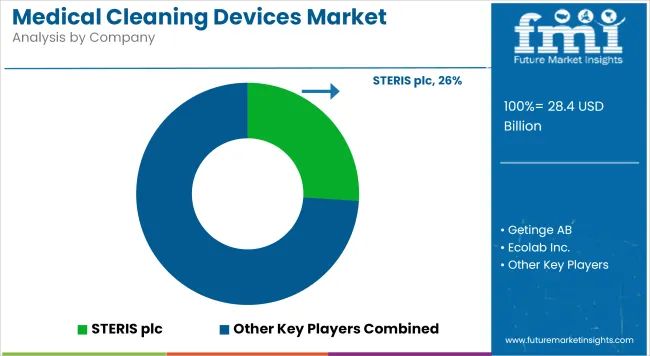

The global medical cleaning devices market is estimated to be valued at USD 28.4 billion in 2025 and is projected to reach USD 75.6 billion by 2035, registering a compound annual growth rate of 10.3% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 28.4 billion |

| Industry Value (2035F) | USD 75.6 billion |

| CAGR (2025 to 2035) | 10.3% |

The Medical Cleaning Devices Market is witnessing steady growth due to rising concerns over hospital-acquired infections (HAIs), stringent regulatory norms, and the global focus on patient safety. Healthcare providers are increasingly adopting advanced cleaning technologies such as washer-disinfectors and endoscope reprocessors to comply with hygiene standards.

Regulatory bodies like the FDA and WHO have intensified pressure on facilities to improve sterilization processes. Additionally, technological advancements such as smart monitoring are enhancing cleaning efficacy and reducing manual effort.

With the ongoing expansion of healthcare infrastructure in both developed and emerging markets, and growing surgical volumes, the demand for reliable, automated cleaning solutions is expected to strengthen, making this market critical to future healthcare delivery and operational excellence.

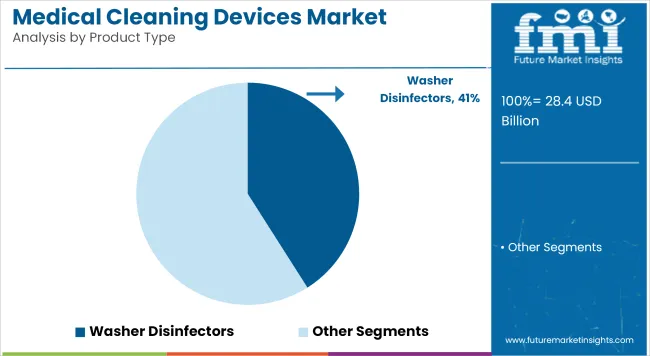

Washer disinfectors have emerged as the dominant product type in the medical cleaning devices market, accounting for approximately 41.0% of total revenue in 2025. Their growth has been driven primarily by stringent infection prevention protocols in hospitals and surgical centers. Enhanced global emphasis on surgical site infection (SSI) control has necessitated validated, automated cleaning cycles for reusable instruments.

As a result, washer disinfectors have been widely adopted to meet regulatory benchmarks set by institutions such as the FDA and WHO. Their ability to deliver high thermal disinfection, coupled with standardized and reproducible cleaning outcomes, has been widely favored over manual processes.

The growing volume of minimally invasive surgeries has also necessitated the cleaning of complex, delicate instruments, further reinforcing demand for programmable washer disinfectors. Adoption has also been encouraged by hospital administrators seeking to reduce human error and improve cleaning consistency across departments.

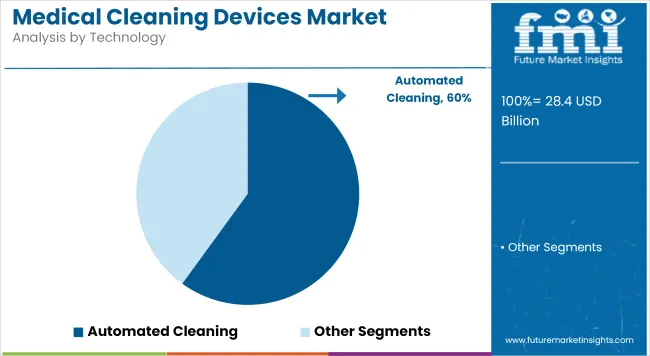

Automated cleaning systems have held the leading position in the market by technology type, commanding nearly 60.0% of revenue share in 2025. Their dominance has been attributed to the healthcare industry’s shift toward standardized sterilization and operational efficiency. As healthcare infrastructure expands, the need for fast, scalable, and reliable cleaning solutions has intensified, especially in high-volume hospital environments.

Automated systems have been preferred for their ability to reduce reliance on manual labor, mitigate cross-contamination risks, and ensure regulatory compliance. Clinical guidelines favoring validated reprocessing protocols have also reinforced their uptake.

The global labor shortage in healthcare settings has further encouraged medical institutions to invest in automated workflows. As infection control becomes more data-driven, automated cleaning systems have been positioned as indispensable assets for ensuring sterilization accountability and audit readiness.

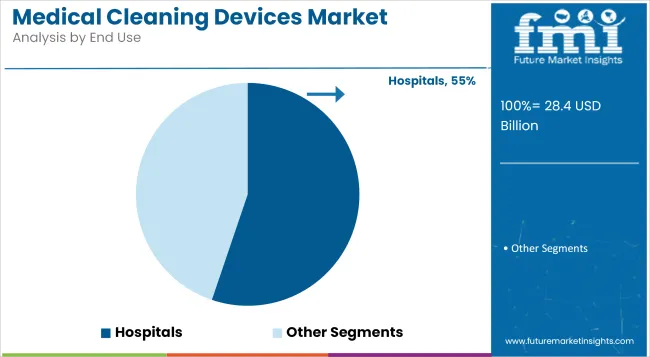

Hospitals have been identified as the primary end users in the medical cleaning devices market, contributing to 55.2% of total revenue in 2025. Their dominance has stemmed from the high volume of surgical and diagnostic procedures performed daily, which demand continuous and validated instrument reprocessing.

Infection control departments within hospitals are under mounting pressure to maintain zero-tolerance hygiene standards, particularly in critical care and surgical units. Comprehensive sterile processing departments (CSPDs) have been established across most hospital networks, which require industrial-grade cleaning devices such as washer disinfectors, AERs, and sterilizers.

The increased focus on multi-drug-resistant organisms (MDROs) and compliance with national and global disinfection standards has also driven the reliance on medical cleaning devices. Their ability to invest in large-scale, centrally managed reprocessing workflows has further reinforced their position as the dominant end-use segment in the market.

Stringent Regulatory Compliance and Standards

The market for medical cleaning devices is predicted to have a hard time owing to stringent regulatory frameworks with respect to the sterilization and disinfection of medical equipment. The FDA, EU MDR, ISO and other agencies set extremely high standards and regulations to protect patient safety the manufacturer have to ensure medicine is effective and safe.

Adapting to these changing regulations requires ongoing investment in research, testing, and certification procedures. To navigate the complexities of compliance seamlessly, companies must keep abreast of global regulations, invest in state-of-the-art compliance solutions, and have a stringent implementation of quality control measures.

High Costs and Limited Adoption in Developing Regions

However, medical cleaning devices typically involve heavy investment on high-tech elements, automated sterilization equipment as well as eco-friendly disinfection solutions. Challenges persist with high initial and operational costs, especially in health facilities in underdeveloped areas that operate with limited budgets.

Moreover, widespread adoption is impeded by a lack of awareness and infrastructure. Related to this, companies need to innovate on cost-effective manufacturing, flexible financing mechanisms, and awareness programs to ensure that they get market penetration in areas which are not traditional markets for diagnosis.

Rising Demand for Infection Control in Healthcare Settings

The increasing focus on infection prevention and patient safety drivers the market for advanced medical cleaning devices. Hospital-acquired infections (HAIs) are still a major issue in healthcare facilities, paving the way for healthcare environments to look for high-efficiency sterilization and disinfection solutions.

Favorable Government Initiatives The growing use of automated cleaning systems provides a significant opportunity, as well as the increased use of UV-C disinfection technology and the use of AI-powered sterilization monitoring systems. These companies need to innovate and create cleaning devices that are efficient, user-friendly, and exceeding their competitors.

Technological Advancements in Sterilization and Disinfection

Ultrasonic cleaning, hydrogen peroxide vapor sterilization, and robotic disinfection systems are just a few examples of innovation in medical cleaning technology that are reshaping the medical cleaning market for greater efficiency and effectiveness.

AI-powered monitoring systems, IoT-based sterilization tracking, and eco-friendly cleaning solutions are becoming more common in order to provide healthcare facilities with better control over infection prevention. The companies that invest in R&D, sustainability, and automation will win the race to satisfy the demand for next-generation medical cleaning devices.

The USA is a significant medical cleaning device market aided by stringent healthcare regulations and growing demand for infection control solutions. The increased rates of hospital-associated infections (HAIs) have resulted in the broad implementation of automated, high-efficiency cleaning machines.

The surge in research and development (R&D) by prominent medical device manufacturers is also driving market growth. Moreover, the rising establishments of healthcare facilities and surgeries also fuel the demand for advanced cleaning technologies. Key players in the market are leveraging product innovations, such as UV-based and ultrasonic cleaning systems, to improve compliance and efficiency.

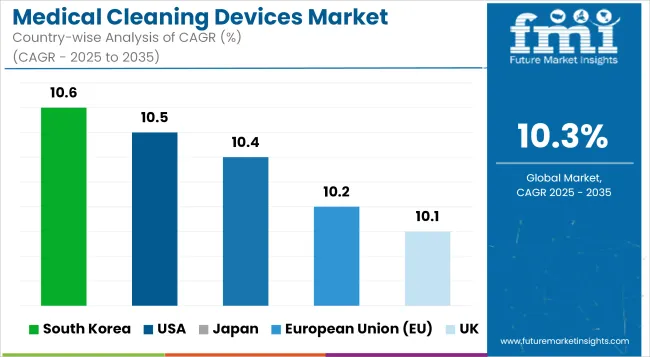

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 10.5% |

Another factor fuelling this is the rising awareness of infection control and prevention among the United Kingdom's healthcare industry, as well as stringent sanitation regulations. The healthcare provider's perspective. Demand for hygiene compliance has been robust which in turn pushes the market of cleaning devices, the latter of which is substantially supported by the National Health Service (NHS).

Automated disinfection systems (hydrogen peroxide vapor systems, robotic cleaning units) are finally gaining ground in hospitals and clinics. The increasing prevalence of chronic diseases that needs multiple surgical surgeries will also fuel demand for sterilization and disinfection devices. Leading manufacturing firms are leveraging technological innovations to offer sustainable cleaning solutions that are environmentally friendly and economical.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 10.1% |

The steadily growing European Union (EU) medical cleaning devices market is facilitated by stringent hospital hygiene and medical equipment sterilization regulations. Germany, France, and Italy are among the biggest contributors, with large investments in health-care infrastructure and infection control measures.

The growing geriatric population and rising surgical procedures are increasing the demand for sophisticated medical cleaning devices. Ultraviolet-C disinfection robots, ultrasonic cleaners and enzymatic detergents are quickly making their way into healthcare systems. Meanwhile, EU initiatives on sustainable healthcare practices are also nudging healthcare towards energy-efficient and environmentally-friendly cleaning technologies.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 10.2% |

The medical cleaning devices market in Japan is driven by the emphasis on technological innovation and high healthcare standards. Government initiatives to improve infection control have resulted in increased adoption of automated cleaning systems in hospitals across the country.

Robotic-assisted disinfection devices and new sterilization technologies, including plasma and ozone-based systems will start seeing more widespread use. Rising hospital admission rates, due to the increase in aged population further augment the demand for innovative medical cleaning solutions. Various global players have joined hands with local manufacturers, and a few of them have started their foray with advanced disinfection and sterilization equipment.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.4% |

The medical cleaning devices market in South Korea is growing owing to an increase in innovations in healthcare technology and government regulation to enhance hospital sanitation. As the country makes investments in smart hospital infrastructure, AI-powered and IoT-enabled cleaning systems are being increasingly adopted.

The increasing medical tourism has also led to an increased demand for better hygiene management. Players in the market are lot more into the development of sustainable and automated cleaning solutions such as, Touch-free Disinfection systems and High-performance sterilizers. Innovation and rapid market development are backed by the presence of large electronics and healthcare technology corporations.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.6% |

The Medical Cleaning Devices Market is characterized by intense competition, with companies striving to differentiate through innovation, regulatory compliance, and strategic partnerships. Key players are investing in advanced technologies, such as automated cleaning systems and AI-driven monitoring tools, to enhance efficiency and meet stringent hygiene standards.

The integration of IoT-enabled devices allows for real-time tracking and compliance reporting, addressing the growing demand for transparency in sterilization processes. Additionally, there is a notable shift towards eco-friendly and sustainable cleaning solutions, driven by environmental regulations and the need for cost-effective operations.

Companies are also expanding their global footprint through mergers, acquisitions, and collaborations to tap into emerging markets with increasing healthcare infrastructure. These strategic activities are collectively influencing market growth by fostering innovation, improving operational efficiency, and ensuring adherence to evolving regulatory requirements.

Key Development:

The overall market size for medical cleaning devices market was USD 28.4 billion in 2025.

The medical cleaning devices market expected to reach USD 75.6 billion in 2035.

Rising healthcare-associated infections, increasing surgical procedures, strict hygiene regulations, growing hospital infrastructure, and advancements in automated cleaning technologies will drive market demand.

The top 5 countries which drives the development of medical cleaning devices market are USA, UK, Europe Union, Japan and South Korea.

Regulatory classifications driving market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Face Shield Market Forecast and Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Trays Market Size and Share Forecast Outlook 2025 to 2035

Medical Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Medically Supervised Weight Loss Services Market Size and Share Forecast Outlook 2025 to 2035

Medical Smart Drug Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Medical EMR Input Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Anti-Decubitus Air Mattress Market Size and Share Forecast Outlook 2025 to 2035

Medical Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Medical Biodegradable Magnesium Alloy Market Size and Share Forecast Outlook 2025 to 2035

Medical Holography Market Size and Share Forecast Outlook 2025 to 2035

Medical Antiseptics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA