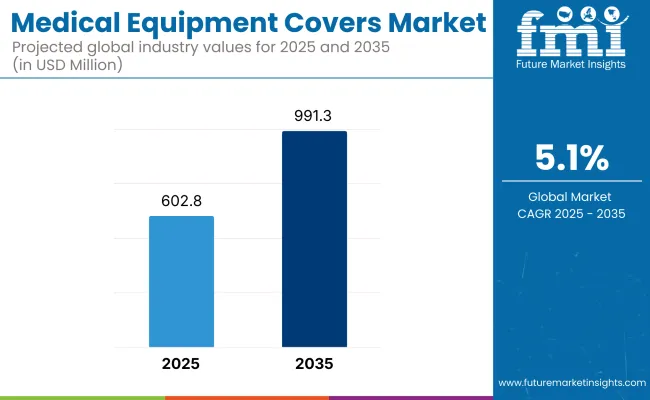

The global Medical Equipment Covers Market is projected to reach a valuation of USD 602.8 million by 2025 and USD 991.3 million by 2035. This reflects a decade-long incremental increase of USD 388.5 million between 2025 and 2035. The market is expected to expand at a compound annual growth rate (CAGR) of 5.1%, resulting in a 1.64X increase in total market value over the ten-year period.

| Metric | Value |

|---|---|

| Estimated Value in (2025 E) | USD 602.8 million |

| Forecast Value in (2035 F) | USD 991.3 million |

| Forecast CAGR (2025 to 2035) | 5.1% |

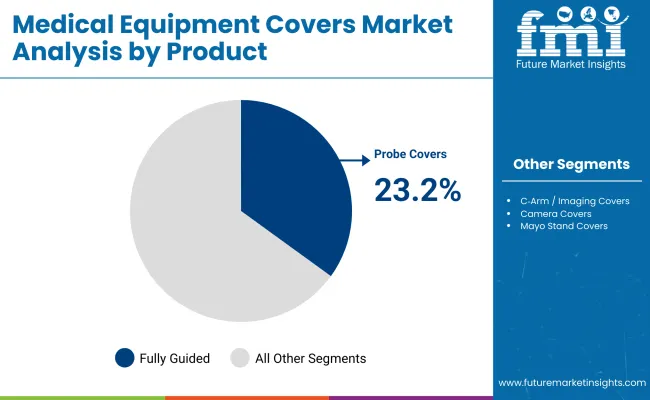

During the first five-year period from 2025 to 2030, the total market value is projected to expand from USD 602.8 million to USD 773.0 million, adding USD 170.2 million, which contributes to 43.8% of the total decade growth. The Probe Covers segment will remain dominant, holding around 23.2% share of the category by 2030 due to hospitals’ continued prioritization of infection control and contamination prevention during surgical and diagnostic procedures.

The Trolley/Chair Covers segment is expected to hold above 20% share, supported by increased patient mobility applications and ergonomic upgrades in clinical environments. C-Arm / Imaging Covers will maintain a strong foothold at approximately 17.2% share, driven by radiology unit demand.

The second half from 2030 to 2035 contributes USD 218.3 million, which is equal to 56.2% of the total growth, as the market jumps from USD 773.0 million to USD 991.3 million. This acceleration is powered by widespread adoption of diagnostic imaging protection solutions, especially across Asia and Europe.

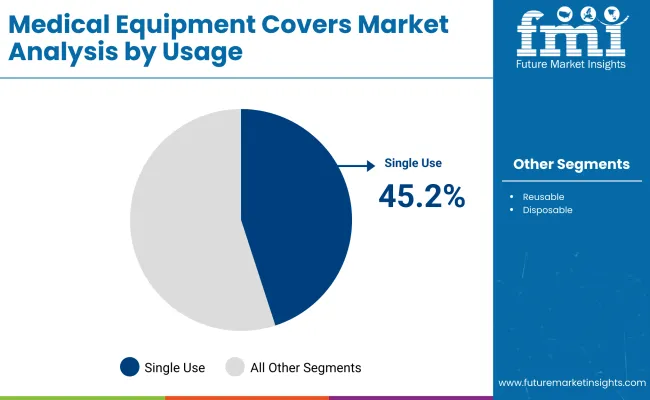

By the end of the decade, Probe Covers and C-Arm / Imaging Covers together are projected to capture a combined share of around 40.4%, as demand surges in both surgical and outpatient imaging settings. Single-Use formats are also likely to dominate usage trends, sustaining a market share of over 45%, led by stringent hospital hygiene protocols.

From 2020 to 2024, the overall Medical Equipment Covers Market grew from USD 474.8 million to USD 579.3 million. Leading manufacturers such as CIVCO Medical Solutions, AliMed, PDC together account for nearly 44.5% of global revenue through bundled sterile barrier kits and equipment-specific cover systems. Key strategies deployed by these players include antimicrobial material upgrades, OEM-aligned customization, and strategic hospital supply agreements to improve procedural efficiency and infection control compliance.

In 2025, the Medical Equipment Covers Market is expected to reach a value of approximately USD 602.8 million, driven by a shift from generic surgical drapes to procedure-specific single-use covers. Growth will be propelled by hospital investments in HAI (Healthcare-Associated Infection) reduction, workflow optimization, and increasing preference for disposable barrier solutions. Microscope Covers and Back‑Table Covers remain niche segments under 8% and 10% share, respectively, due to limited cross-functional use and slower adoption in mid-tier healthcare settings.

The market is segmented by product, usage, application, and end-user. Product includes Probe Covers, C‑Arm / Imaging Covers, Camera Covers, Mayo Stand Covers, Back‑Table Covers, Microscope Covers, Trolley / Chair Covers, highlighting the core elements driving adoption. Usage classification covers Single Use, Reusable, Disposable.

Application classification includes Surgical Infection Control, Diagnostic Imaging Protection, Equipment Sterilization/Storage, Field or Home Care Protection, and Other Applications. Based on End User, the segmentation includes Hospitals, Speciality Clinics, Ambulatory Surgical Centers, Diagnostic Imaging Centers, and Others. Regionally, the scope spans North America, Latin America, Western and Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

Probe covers are expected to retain a dominant position, contributing 23.2% of the Medical Equipment Covers Market in 2025, making them the leading product segment. Their sustained dominance stems from their essential role in ultrasound and interventional radiology procedures, where preventing cross-contamination between patients is critical. These covers are universally adopted across hospitals, diagnostic imaging centers, and outpatient facilities due to their low unit cost, high turnover rate, and procedure-specific usage.

The increasing global reliance on point-of-care ultrasound (POCUS) and portable imaging devices has further elevated demand. Regulatory bodies in the USA, EU, and Asia mandate probe sheathing in transvaginal, transrectal, and intraoperative imaging to mitigate HAI risks. Furthermore, probe covers are now being bundled with imaging device purchases or included in sterile procedure kits, creating strong pull-through demand and volume-based procurement patterns across both public and private healthcare institutions.

| Product | Market Share (%) |

|---|---|

| Probe Covers | 23.2% |

| C ‑ Arm / Imaging Covers | 17.2% |

| Camera Covers | 12.5% |

| Mayo Stand Covers | 10.2% |

| Back ‑ Table Covers | 9.5% |

| Microscope Covers | 7.36% |

| Trolley / Chair Covers | 20.2% |

Single-use covers are projected to dominate the Medical Equipment Covers Market in 2025, accounting for 45.2% of the total usage share. Their leading position is driven by the growing institutional focus on infection prevention, HAI reduction, and improved turnover efficiency in high-volume healthcare environments. Unlike reusable or semi-disposable formats, single-use covers eliminate the need for sterilization, saving both time and cost for hospitals and outpatient centers facing staff shortages and rising patient loads.

Additionally, compliance with international hygiene standards (e.g., CDC, WHO) mandates barrier protection during imaging and surgical procedures further encouraging single-use adoption. Hospitals and diagnostic labs also benefit from the consistent quality and traceability of single-use formats, especially in tender-based procurement systems. These factors, combined with expanded usage in emergency and ambulatory care, are reinforcing the segment’s leadership position across developed and emerging markets alike.

| Usage | Market Share (%) |

|---|---|

| Single Use | 45.2% |

| Reusable | 33.5% |

| Disposable | 21.3% |

Surgical infection control is set to lead the Medical Equipment Covers Market in 2025, capturing the highest application share of 37.2%. This dominance is primarily driven by rising global concerns over hospital-acquired infections (HAIs), which account for a significant burden on healthcare systems. Operating rooms, intensive care units, and surgical suites are the highest-risk zones, prompting hospitals to standardize the use of sterile, single-use covers for surgical equipment, probes, and tables.

Increasing procedural volumes particularly in orthopedics, cardiovascular, and general surgeries have further intensified the need for infection barriers. Regulatory mandates such as CDC surgical site infection (SSI) guidelines and WHO sterile protocol frameworks have made infection control an essential procurement priority. Moreover, bundled surgical kits now often include customized sterile covers, streamlining pre-op preparation while enhancing compliance. These factors position surgical infection control as the leading and most resource-critical application area in 2025.

| Application | Market Share (%) |

|---|---|

| Surgical Infection Control | 37.2% |

| Diagnostic Imaging Protection | 29.2% |

| Equipment Sterilization/Storage | 14.5% |

| Field or Home Care Protection | 11.5% |

| Other Applications | 7.7% |

The Medical Equipment Covers Market is experiencing sustained growth due to heightened global emphasis on infection prevention, surgical hygiene, and equipment longevity. A key factor accelerating market expansion is the rise in hospital-acquired infections (HAIs), compelling healthcare facilities to adopt single-use protective covers for probes, imaging devices, and surgical tools.

Additionally, increasing procedural volumes across diagnostic imaging and minimally invasive surgeries have led to widespread deployment of C-arm, camera, and Mayo stand covers. Hospitals are prioritizing ready-to-use, sterile barrier systems that reduce turnaround times and eliminate the need for in-house sterilization especially in outpatient and ambulatory surgical centers.

Furthermore, regulatory compliance with infection control protocols (e.g., WHO guidelines and national healthcare standards) has made cover usage mandatory in many regions. The growing shift toward procedure-specific kits, alongside technological integration with OEM equipment, is creating new demand pockets, particularly in Asia-Pacific and Europe, where healthcare infrastructure modernization is underway.

Regulatory Enforcement of Single-Use Infection Control Protocols

One of the most significant drivers accelerating demand in the Medical Equipment Covers Market is the tightening of global infection control protocols focused on eliminating cross-contamination in surgical and diagnostic environments. Hospitals, specialty clinics, and diagnostic imaging centers are under growing pressure from regulatory bodies such as the CDC, WHO, and national health authorities to transition toward single-use barrier systems.

These measures are particularly targeted at ultrasound-guided interventions, C-arm procedures, and operating room workflows, where reusable fabric covers previously dominated. With infection control being a core metric for accreditation by entities like The Joint Commission and European Centre for Disease Prevention and Control (ECDC), hospitals are integrating probe and trolley covers into their SOPs.

This regulatory shift is also leading to bundled procurement of OEM-compatible sterile covers, particularly for high-use assets like imaging equipment, mobile tables, and anesthesia carts. These developments are systematically reinforcing demand across both developed and emerging markets.

Low Awareness and Cost Sensitivity in Mid-Tier Facilities

Despite strong adoption in tertiary and private institutions, the market faces barriers in mid-tier and rural healthcare centers where cost sensitivity and low clinical awareness hinder procurement of equipment-specific sterile covers. Many of these facilities still rely on generic draping or in-house sterilized fabric covers, which are perceived as more economical.

However, these alternatives fail to meet modern compliance standards and often lead to higher HAI rates and procedural delays. A lack of structured training for staff on HAI transmission risks and the benefits of dedicated covers (e.g., for C-arms or back-tables) limits adoption.

Additionally, procurement processes in public hospitals often prioritize price over specificity, causing delays in product transitions. Vendors also face challenges in establishing distribution reach and inventory management efficiencies in non-urban zones, where limited cold-chain or sterile supply infrastructure can further deter market penetration. This financial and operational mismatch acts as a critical bottleneck in expanding cover use universally.

OEM-Aligned Kit Integration with Diagnostic & Surgical Devices

A growing trend transforming the Medical Equipment Covers Market is the integration of sterile covers directly into OEM-branded surgical and imaging kits. Manufacturers of ultrasound machines, C-arm units, and operating tables are now partnering with medical cover suppliers to co-develop form-fitted, procedure-specific sterile kits that are pre-packed and bundled at the point of device sale.

This trend is especially strong in North America, Japan, and Western Europe, where hospitals prefer time-saving, pre-validated kits that ensure regulatory compliance and minimize procedural setup time. Moreover, as outpatient imaging volumes grow and same-day surgical models expand, facilities are prioritizing standardized sterile workflows that reduce variability and staff burden.

This convergence is also being enabled by digital asset tracking systems, where covers are barcoded or RFID-tagged to sync with surgical instrument tracking software. As OEMs continue embedding covers into their aftermarket service models, procurement is shifting from standalone SKUs to contract-based bundled models, elevating long-term volume predictability for suppliers.

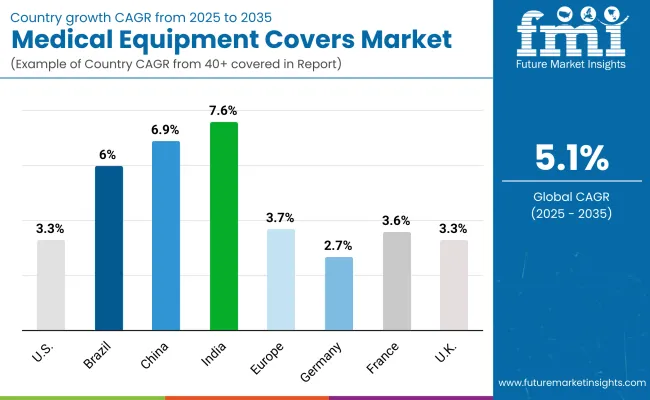

| Country | CAGR |

|---|---|

| USA | 3.3% |

| Brazil | 6.0% |

| China | 6.9% |

| India | 7.6% |

| Europe | 3.7% |

| Germany | 2.7% |

| France | 3.6% |

| UK | 3.3% |

Asia Pacific is emerging as the fastest-growing region in the Medical Equipment Covers Market, projected to grow at a CAGR of 6.2% between 2025 and 2030. Among its key markets, India is forecast to expand at a CAGR of 7.6%, fueled by the rapid expansion of tertiary care hospitals and stricter compliance with NABH and MoHFW infection control mandates, which have made the use of sterile, single-use equipment covers mandatory in operating and imaging departments.

South Korea, growing at 6.7% CAGR, is benefiting from its highly digitized healthcare infrastructure and strong government emphasis on infection-free outpatient care. High procedural throughput in diagnostic imaging centers and preference for single-use and trolley/chair covers are key growth contributors.

The region’s dominance stems from continued investment in Tier 1 and Tier 2 healthcare infrastructure, especially in Southeast Asia, and an increasing post-pandemic focus on infection prevention protocols. Government-backed hospital upgrades across India, Indonesia, and Thailand are prioritizing procurement of pre-sterilized, equipment-specific disposable covers to enhance procedural safety and operational efficiency.

Europe is expected to grow steadily at a CAGR of 3.7% through 2035. Germany is projected to grow at 2.7% CAGR, driven by ongoing automation initiatives in surgical and diagnostic units. France is estimated to expand at 3.6% CAGR, backed by strategic hospital investments under the “Ségur de la santé” reform, which includes funds allocated for surgical infection control improvements.

The UK is expected to register 3.3% CAGR, as NHS facilities intensify adoption of disposable and procedure-specific sterile covers to reduce SSIs. Harmonized infection control protocols across the EU and staff retraining programs continue to support steady product uptake.

North America remains a mature but regulation-driven market, with the USA projected to grow at a CAGR of 3.3% between 2025 to 2035. Growth is largely driven by the replacement of reusable fabric covers with single-use, OEM-compatible barrier systems in both surgical and diagnostic departments.

Facilities are aligning with CDC, AORN, and Joint Commission standards that emphasize sterile workflow optimization. The rising surgical case load in ASC and outpatient hospital settings, combined with growing financial penalties for HAIs, is prompting investments in pre-packaged sterile cover kits. Federal funding and modernization efforts under infrastructure stimulus plans are also supporting procurement of compliant sterile covering systems.

| Year | USA Berberine Market (USD Million) |

|---|---|

| 2025 | 187.8 |

| 2026 | 193.8 |

| 2027 | 200.0 |

| 2028 | 206.5 |

| 2029 | 213.3 |

| 2030 | 220.4 |

| 2031 | 227.6 |

| 2032 | 235.2 |

| 2033 | 243.1 |

| 2034 | 251.3 |

| 2035 | 259. 5 |

The Medical Equipment Covers Market in the USA is projected to grow at a CAGR of 3.3% between 2025 and 2035, driven by a national push to reduce hospital-acquired infections (HAIs) and comply with CDC, AORN, and Joint Commission standards. Hospitals and ambulatory surgical centers (ASCs) are replacing reusable fabric drapes with single-use, OEM-aligned sterile barrier covers to ensure patient safety and reduce reprocessing overhead.

Increased surgical case volume in outpatient settings is pushing demand for procedure-specific kits that include probe, C-arm, and trolley covers. Procurement decisions are increasingly influenced by infection control audits and cost-benefit evaluations favoring pre-sterilized disposables.

The Medical Equipment Covers Market in the United Kingdom is forecast to grow at a CAGR of 3.3% through 2035, supported by NHS modernization programs and increased pressure to reduce surgical site infections (SSIs). The shift toward single-use sterile consumables in surgical workflows has accelerated procurement of trolley, Mayo stand, and back-table covers.

Hospitals under the "New Hospital Programme" are prioritizing compliant equipment covers as part of broader infection control and sustainability mandates. Trusts are standardizing product usage across facilities to improve cost-efficiency and meet NHS Supply Chain guidelines.

The Medical Equipment Covers Market in Germany is projected to expand at a CAGR of 2.7%, driven by automation and hygiene compliance in sterile environments. Federal funding under the Krankenhauszukunftsgesetz (Hospital Future Act) is enabling upgrades to CSSDs, operating theatres, and diagnostic imaging centers.

German hospitals are increasingly specifying equipment-specific disposable covers (probe, camera, and C-arm) to reduce cross-contamination and meet DIN EN ISO standards for infection prevention. Rising demand for custom-fit, anti-fog, and antimicrobial barrier solutions is evident in university clinics and private hospital chains.

| Europe Country | 2025 | 2035 |

|---|---|---|

| Germany | 22.2% | 21.7% |

| UK | 17.5% | 17.2% |

| France | 14.4% | 14.1% |

| Italy | 11.9% | 11.7% |

| Spain | 8.7% | 8.5% |

| BENELUX | 9.3% | 9.1% |

| Nordic Countries | 7.2% | 7.1% |

| Rest of Western Europe | 8.7% | 10.6% |

The Medical Equipment Covers Market in India is projected to grow at a CAGR of 7.6%, making it one of the most dynamic and fast-evolving regional markets. This growth is driven by rapid expansion of multi-specialty hospitals, medical colleges, and diagnostic imaging centers across Tier 1 and Tier 2 cities.

With rising surgical volumes and increasing cases of hospital-acquired infections (HAIs), hospitals are integrating single-use sterile covers into their infection control protocols. NABH-accredited institutions are standardizing usage of probe and C-arm covers, particularly in OB/GYN and interventional radiology departments. Local suppliers are collaborating with global OEMs to offer cost-effective, procedure-specific disposable kits.

The Medical Equipment Covers Market in China is forecast to grow at a CAGR of 6.9% through 2035, supported by the government’s large-scale investment in infection control under the Healthy China 2030 roadmap. Class A and B hospitals are adopting OEM-specific probe, camera, and imaging covers to improve safety across diagnostic and interventional units.

The Ministry of Health has made the use of single-use infection control covers mandatory in public hospitals performing high-risk procedures. Domestic manufacturers are scaling production of pre-packaged sterile kits to meet hospital demand and align with central procurement policies.

The Medical Equipment Covers Market in Japan is expected to reach USD 23.5 million by 2025, growing at a CAGR of 4.0%. Growth is led by the high procedural volume in diagnostic imaging and Japan’s strict adherence to JSHP infection control protocols, which mandate disposable barrier use for surgical and imaging applications. Trolley/Chair Covers and Probe Covers dominate the product mix, as hospitals emphasize equipment surface hygiene and workflow efficiency in compact clinical environments.

Japan’s rapidly aging population has led to a sharp rise in same-day procedures and outpatient diagnostics, pushing hospitals to adopt single-use, equipment-specific covers that reduce setup time and labor dependency.

The Medical Equipment Covers Market in South Korea is valued at USD 16.9 million by 2025, growing at a CAGR of 6.7%. The country has one of the highest per capita diagnostic imaging volumes in the Asia Pacific, driving strong demand for probe, camera, and imaging covers. The Ministry of Health and Welfare (MOHW) has mandated strict HAI prevention protocols in public and private hospitals, leading to broader adoption of single-use and disposable sterile covers across high-turnover departments.

South Korea has also prioritized outpatient care expansion, with rapid growth in ambulatory diagnostic centers utilizing disposable trolley and Mayo stand covers to streamline operations.

The Medical Equipment Covers Market is moderately fragmented, with a mix of global giants, established mid-tier players, and emerging regional manufacturers competing across surgical and diagnostic cover applications. Leading companies such as CIVCO Medical Solutions, AliMed, PDC, Argon Medical and Steris Plc. collectively hold a significant share of the global market, driven by their expansive sterile barrier portfolios and longstanding partnerships with OEM imaging and surgical device manufacturers.

These companies are focusing on equipment-specific cover design, antimicrobial material innovation, and pre-validated disposable kits to ensure compliance with evolving infection control protocols across hospitals and ambulatory surgical centers.

Mid-sized firms like Tri-anim,, Ecolab Europe, Surgeine Healthcare, Paragon Medical, and AccuraMedizintechnik are targeting regional markets with custom-fit solutions, bulk procurement capabilities, and product lines tailored to radiology, OR, and outpatient procedural setups. Their competitive edge lies in flexible manufacturing and tender-based pricing strategies.

Emerging players, especially from Asia and Eastern Europe, are gaining traction through low-cost disposable formats, faster supply chains, and private-label production for international distributors. Across the board, companies are prioritizing product standardization, logistics scalability, and traceability features to maintain a competitive foothold in this hygiene-critical medical segment.

Key Development

| Item | Value |

|---|---|

| Market Value | USD 602.8 million |

| Product type | Probe Covers, C ‑ Arm / Imaging Covers, Camera Covers, Mayo Stand Covers, Back ‑ Table Covers, Microscope Covers, Trolley / Chair Covers. |

| Usage | Single Use, Reusable, Disposable. |

| Application | Surgical Infection Control, Diagnostic Imaging Protection, Equipment Sterilization/Storage, Field or Home Care Protection, and Other Applications. |

| Regions Covered | North America, Latin America, Western & Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Germany, France, UK etc. |

| Key Companies Profiled | CIVCO Medical Solutions , AliMed , PDC , Argon Medical , Tri- anim STERIS plc. , Primewear ® Hygine (India) Products Ltd. , Ecolab Europe , Surgeine Healthcare , DINA-HITEX, spol . s r.o . , ALLIANCE MEDIEQUIP PVT LTD , Paragon Medical , Spectrum Plastics Group Paragon Medical and Others |

| Additional Attributes | Dollar sales by application and regions, adoption trends of Automated Sterile Prep-Pack Stations, Rising demand in Biotech & Research Aseptic Use, Growing demand across Compounding Pharmacies and Biopharmaceutical Manufacturing |

The global Medical Equipment Covers Market is estimated to be valued at USD 602.8 million in 2025.

The market size for Medical Equipment Covers is projected to reach USD 991.3 million by 2035.

The Medical Equipment Covers Market is expected to grow at a CAGR of 5.1% during this period.

Key product types include Probe Covers, C-Arm / Imaging Covers, Camera Covers, Mayo Stand Covers, Back-Table Covers, Microscope Covers, and Trolley / Chair Covers.

The Surgical Infection Control segment is projected to command the largest share at 37.2% in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Indoor Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Medical Eye Shield Film Market Size and Share Forecast Outlook 2025 to 2035

Medical Far Infrared Therapy Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Latex Protective Suit Market Size and Share Forecast Outlook 2025 to 2035

Medical Activated Carbon Dressing Market Size and Share Forecast Outlook 2025 to 2035

Medical Coated Roll Stock Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Medical Pressure Mapping System Market Size and Share Forecast Outlook 2025 to 2035

Medical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Face Shield Market Forecast and Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Trays Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA