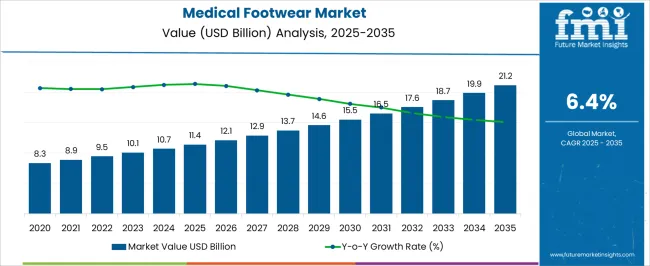

The medical footwear market is projected to experience consistent growth, expanding from USD 11.4 billion in 2025 to approximately USD 21.2 billion by 2035, reflecting a strong upward trajectory over the 16-year period. During the initial phase from 2020 to 2025, the market value rises from USD 8.3 billion to USD 11.4 billion, driven by increasing awareness of foot health issues and the growing prevalence of diabetes and orthopedic conditions that necessitate specialized footwear.

This period is characterized by rising consumer preference for comfort, support, and customized medical footwear solutions, supported by advancements in material technology and ergonomic design. The integration of digital foot scanning and 3D printing technologies further enhances product personalization, fostering market expansion.

Between 2026 and 2030, the market advances from USD 12.1 billion to USD 15.5 billion, supported by expanding geriatric populations and increased healthcare expenditure in developed and emerging economies. Innovations in antimicrobial materials, cushioning technologies, and lightweight designs contribute to enhanced user experience and broadened application in rehabilitation and sports medicine.

From 2031 to 2035, growth accelerates from USD 16.5 billion to USD 21.2 billion, fueled by rising investments in research and development, regulatory support for medical device approvals, and increasing adoption of preventive healthcare measures. The market is positioned for sustained growth through 2035, driven by evolving consumer needs, technological innovation, and expanding healthcare infrastructure worldwide.

| Metric | Value |

|---|---|

| Medical Footwear Market Estimated Value in (2025 E) | USD 11.4 billion |

| Medical Footwear Market Forecast Value in (2035 F) | USD 21.2 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The medical footwear market is experiencing accelerated expansion, supported by rising awareness of foot health, increased prevalence of chronic diseases, and demand for orthotic solutions in both preventive and rehabilitative care. Aging populations and sedentary lifestyles are contributing to a growing need for footwear that offers enhanced support, pressure distribution, and medical-grade cushioning.

Technological advancements in material science have improved the comfort, breathability, and antimicrobial properties of therapeutic footwear, making them suitable for prolonged use across various demographics. Further, health-conscious consumers are seeking functionally adaptive shoes that combine medical efficacy with design appeal.

Regulatory approval pathways for diabetic and orthopedic shoes have become more defined, encouraging manufacturers to scale production while maintaining compliance. With an increasing focus on wellness and the integration of health diagnostics into wearables, the future of medical footwear lies in its alignment with digital health ecosystems and personalized patient outcomes.

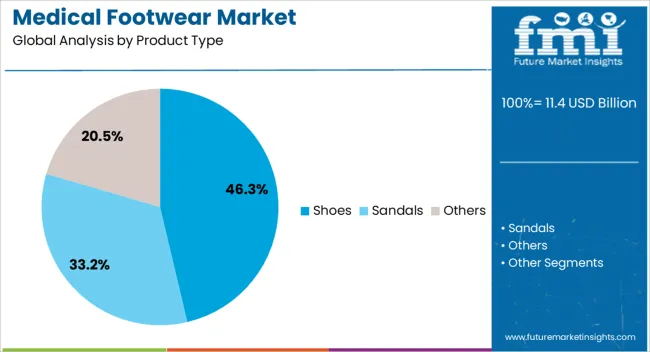

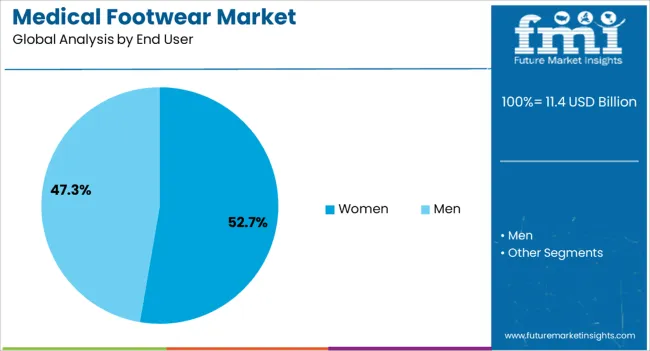

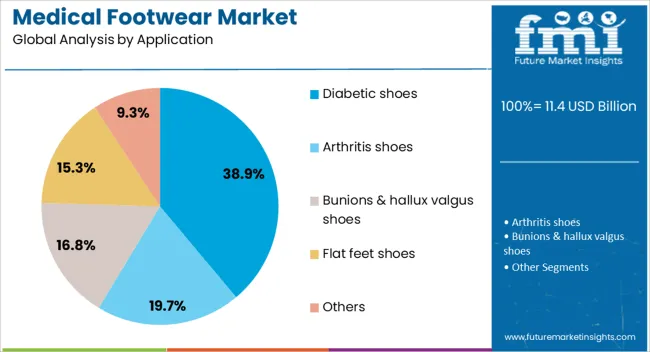

The medical footwear market is segmented by product type, end user, application, price, and geographic regions. By product type, the market is divided into Shoes, Sandals, and Others. In terms of end user of the medical footwear market is classified into Women and Men. Based on application, the market is segmented into Diabetic shoes, Arthritis shoes, Bunions & hallux valgus shoes, Flat feet shoes, and Others.

By price, the market is segmented into 50–100 USD, Less than 50 USD, and Above 100 USD. Regionally, the medical footwear industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Shoes are expected to dominate the medical footwear category with a projected 46.30% revenue share in 2025, positioning them as the leading product type. Their leadership is driven by broad applicability across multiple foot-related conditions, including plantar fasciitis, arthritis, and diabetic neuropathy.

Medical-grade shoes are designed with structured soles, cushioned insoles, and protective uppers that reduce friction and improve alignment features critical for managing foot pain and preventing complications. Greater product availability in casual, athletic, and formal styles has also expanded consumer adoption beyond clinical use.

Enhanced awareness through podiatric clinics, rehabilitation centers, and digital health platforms has elevated shoes as the first line of medical footwear intervention. Their compatibility with custom orthotics and regulatory classification as durable medical equipment further reinforce their market share.

Women are projected to account for 52.70% of the overall market revenue in 2025, making them the largest end-user group. This segment’s growth is being fueled by higher incidence rates of foot disorders among women, including bunions, heel pain, and arch-related issues exacerbated by non-supportive footwear.

Increased awareness of foot care in the context of overall wellness, particularly among women aged 40 and above, has contributed to the demand for medically approved footwear that blends therapeutic function with aesthetic design. Brand offerings targeted at women now feature enhanced adjustability, lightweight materials, and a wider range of sizing, which has improved accessibility.

Lifestyle shifts toward fitness and occupational mobility have further amplified the need for supportive footwear tailored specifically to female biomechanics. The segment’s lead is also strengthened by higher purchasing frequency and consumer preference for comfort-centric lifestyle adaptations.

Diabetic shoes are projected to lead by application, capturing 38.90% of the market share in 2025. Their prominence stems from the escalating global diabetes burden and the medical necessity of specialized footwear to prevent foot ulcers, infections, and amputations. These shoes are engineered with extra depth, seamless interiors, and pressure-relieving soles that cater to the unique needs of diabetic patients.

The rise in reimbursement coverage for therapeutic footwear in developed markets has significantly supported their clinical distribution. In addition, collaborations between diabetes care providers and orthopedic shoe manufacturers are enabling greater awareness and adoption across hospital networks, pharmacies, and digital health portals.

Regulatory mandates requiring physician prescription and periodic foot examinations for diabetic patients further entrench the segment's dominance. As chronic disease management becomes more holistic and patient-centered, diabetic shoes continue to be an essential tool in improving quality of life and reducing long-term treatment costs.

The medical footwear market is driven by rising foot health issues, consumer awareness of wellness, innovations in materials, and challenges related to cost and competition. These factors continue to shape the market’s growth trajectory, with increased demand expected in the coming years.

The growing prevalence of foot-related health issues, such as diabetes, arthritis, and plantar fasciitis, is a key driver for the medical footwear market. As chronic conditions increase globally, there is a rising need for specialized footwear designed to alleviate pain, prevent injury, and provide support. Diabetic footwear, in particular, is in high demand, as people with diabetes are more prone to foot complications like ulcers and neuropathy. This has led to an increase in the adoption of custom-fit shoes, orthotic insoles, and medical-grade footwear. The aging population, particularly in developed regions, also contributes to the rise in foot health problems, further boosting market growth.

Increasing consumer awareness of foot health and wellness is another significant factor influencing the market. As people become more informed about the importance of proper footwear for preventing injuries and managing medical conditions, there is greater demand for medical footwear. This awareness is supported by healthcare professionals who recommend medical shoes for individuals with specific needs, such as post-surgical recovery or for those with high-risk foot conditions. Moreover, health-conscious consumers are now prioritizing comfort and functionality in their footwear choices, particularly as lifestyle changes and fitness trends gain traction. The growing demand for wellness-focused products in the retail space is expected to continue fueling the medical footwear market.

The development of new, high-performance materials and improved design features is driving growth in the medical footwear sector. Footwear manufacturers are increasingly incorporating specialized materials, such as memory foam, gel insoles, and lightweight, breathable fabrics, to enhance comfort and support. These materials provide improved shock absorption, foot alignment, and cushioning, addressing specific medical needs. The growing focus on comfort without compromising style has led to the creation of medical footwear that is both functional and aesthetically pleasing. This has made medical shoes more appealing to a broader range of consumers, including those who previously viewed them as purely therapeutic, rather than fashionable.

Despite the growing demand for medical footwear, the market faces challenges related to competition and cost constraints. Established footwear brands are increasingly entering the medical segment, which raises competition for specialized manufacturers. This puts pressure on prices, making it challenging for some companies to maintain profitability while offering high-quality, affordable products. Additionally, the higher cost of medical footwear due to advanced features such as custom orthotics and durable materials can deter price-sensitive consumers. To remain competitive, manufacturers must balance innovation, comfort, and price, ensuring that their products meet both medical standards and consumer expectations for cost-effective solutions.

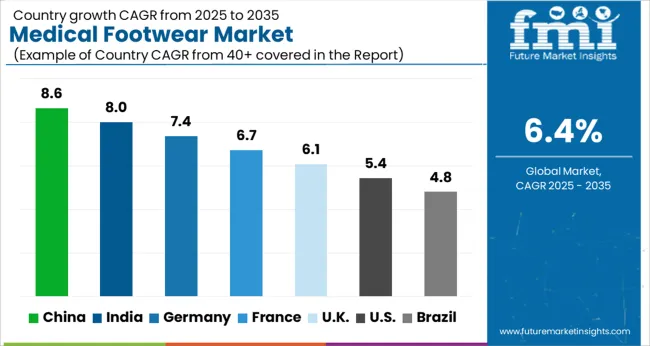

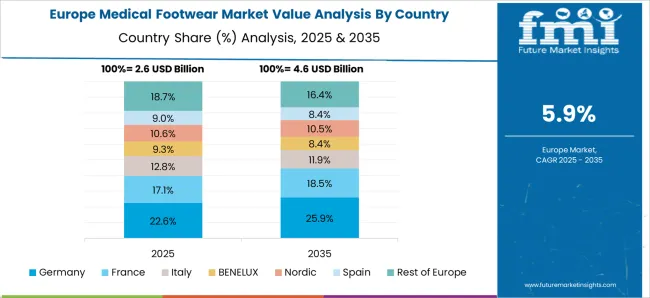

The medical footwear market is projected to grow globally at a CAGR of 6.4% from 2025 to 2035, driven by increasing awareness of foot health, rising incidences of diabetes and other foot-related conditions, and growing demand for comfort and therapeutic footwear. China leads with a CAGR of 8.6%, driven by rapid industrialization, urbanization, and a growing population suffering from diabetes-related foot conditions. India follows at 8.0%, supported by increasing healthcare awareness, rising disposable incomes, and a large diabetic population. France grows at 6.7%, fueled by a rising demand for orthopedic and therapeutic footwear, as well as an aging population.

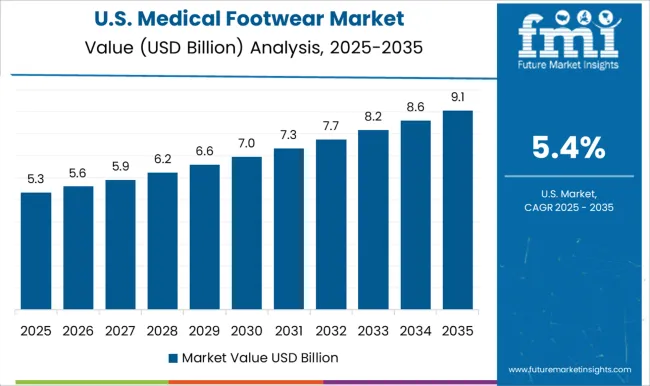

The United Kingdom achieves a CAGR of 6.1%, driven by increasing awareness of diabetic foot care and the rise of specialized footwear solutions. The United States records a CAGR of 5.4%, supported by growing consumer demand for both stylish and medically beneficial footwear. This growth trajectory reflects the increasing recognition of the importance of foot health and comfort, with medical footwear playing a key role in preventing and managing conditions like diabetes, arthritis, and other foot ailments.

The UK’s medical footwear market grew at a CAGR of 4.8% from 2020 to 2024 and is expected to rise to 6.1% during 2025-2035. The market’s earlier growth was steady, driven by increasing awareness of the importance of foot health, particularly among the aging population and those suffering from diabetes or other chronic conditions. However, the expected acceleration in the coming decade will be driven by greater consumer demand for therapeutic, stylish, and comfortable footwear. With the rise in lifestyle-related health conditions and a stronger focus on self-care and comfort, the demand for medical footwear is expected to increase substantially. Additionally, advancements in design and materials, as well as a greater availability of specialized footwear, will contribute to market growth. As the focus on health and wellness intensifies in the UK, medical footwear will see higher adoption rates, particularly in the orthotic and diabetic footwear segments.

China’s medical footwear market is projected to grow at a CAGR of 8.6% during 2025-2035, surpassing the global average of 6.4%. The market grew at a CAGR of 7.2% from 2020 to 2024, driven by China’s rapidly aging population, increasing awareness of foot-related health issues, and rising incidences of diabetes and other lifestyle diseases. The acceleration in growth in the coming decade will be attributed to China's efforts to modernize healthcare, increased disposable income, and a shift towards more comfortable and therapeutic footwear solutions. As the country’s healthcare system continues to evolve and more people seek products that promote overall wellness, demand for medical footwear will rise. Additionally, the increasing focus on preventative healthcare and self-care will contribute to growing market adoption.

India’s medical footwear market is expected to grow at a CAGR of 8.0% during 2025-2035, higher than the global average of 6.4%. The market grew at a CAGR of 6.5% from 2020 to 2024, driven by increasing awareness of foot health and the rise in lifestyle-related diseases like diabetes and obesity. The anticipated rise in the market is due to the growing middle class, urbanization, and the increasing awareness of the importance of foot care among the population. As India’s healthcare system continues to evolve and healthcare costs rise, medical footwear will become a more prominent solution for managing health conditions. The growth of the e-commerce sector and the increasing availability of specialty footwear will also support market expansion.

France’s medical footwear market is projected to grow at a CAGR of 6.7% from 2025 to 2035. The market grew at a CAGR of 5.8% from 2020 to 2024, driven by the aging population and increasing demand for specialized footwear solutions for people with diabetes and other foot ailments. France’s focus on healthcare and wellness, along with strong healthcare infrastructure, will contribute to the market’s expansion. The rise in demand for orthotic and comfortable footwear for medical conditions will further increase market adoption. Additionally, France’s commitment to wellness and preventative care, combined with increasing government initiatives to raise awareness of foot health, will also drive the market.

The USA medical footwear market is projected to grow at a CAGR of 5.8% during 2025-2035. The market grew at a CAGR of 4.9% from 2020 to 2024, supported by the rise in chronic health conditions such as diabetes and obesity, which require specialized footwear for foot health. The next decade will see stronger growth driven by increased awareness of foot health, the growing demand for orthotic and therapeutic footwear, and advancements in product design. Additionally, as the population ages and more people seek preventative care solutions, the adoption of medical footwear will rise. Increased availability of high-quality, comfortable, and affordable medical footwear will further drive the USA market’s growth.

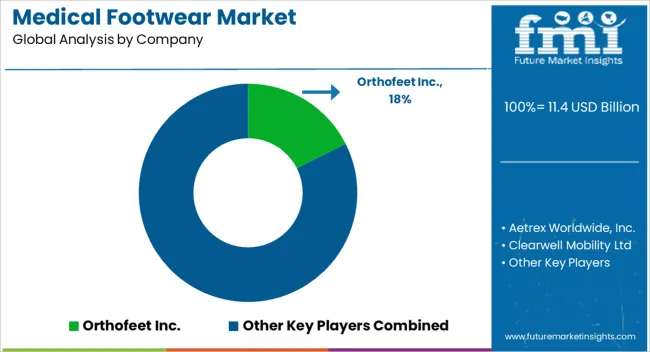

The medical footwear market features key players such as Orthofeet Inc., Aetrex Worldwide, Inc., and Dr. Comfort, each offering specialized products designed to address various foot health needs. Orthofeet Inc. leads the market with its innovative orthopedic footwear designed for conditions such as plantar fasciitis and diabetic neuropathy, emphasizing comfort, support, and custom orthotics.

Aetrex Worldwide, Inc. is known for its foot scanning technology and premium diabetic shoes, making it a prominent player in the wellness footwear sector. Dr. Comfort focuses on producing therapeutic footwear that caters to medical needs, particularly for individuals with diabetes, offering a range of shoes and insoles. Other significant players include Clearwell Mobility Ltd. and DARCO International, Inc., both of which specialize in medical-grade footwear for post-surgical recovery and mobility assistance. Clearwell Mobility Ltd. is recognized for its range of diabetic and orthopedic shoes, while DARCO International offers innovative solutions for foot-related medical conditions, including post-operative shoes and sandals.

Companies like Duna Srl, Drewshoe, Incorporated, and Foot Shop Limited also contribute to the market by providing high-quality, functional footwear designed for patients with specific medical needs. Manufacturers such as Gravity Defyer Corp. and Mephisto have broadened their offerings, focusing on shoes that combine medical functionality with style, appealing to a wider consumer base.

The rising demand for comfort and specialized foot care solutions, driven by an aging population and increasing awareness of foot health, has propelled these companies to expand their product lines and distribution channels. Competitive strategies include enhancing product technology, focusing on patient comfort, and partnering with healthcare providers to increase market reach and brand recognition. As the market continues to grow, these companies remain key players in shaping the future of medical footwear.

Dollar sales trends, market share of leading players, growth drivers in healthcare footwear, consumer preferences for comfort and medical functionality, regulatory impact, and future demand forecasts in key regions.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.4 Billion |

| Product Type | Shoes, Sandals, and Others |

| End User | Women and Men |

| Application | Diabetic shoes, Arthritis shoes, Bunions & hallux valgus shoes, Flat feet shoes, and Others |

| Price | 50–100 USD, Less than 50 USD, and Above 100 USD |

| Price | 50–100 USD, Less than 50 USD, and Above 100 USD |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Orthofeet Inc., Aetrex Worldwide, Inc., Clearwell Mobility Ltd, DARCO International, Inc., Duna Srl, Dr. Comfort, Dr. Foot Inc., Drewshoe, Incorporated, Foot Shop Limited, Gravity Defyer Corp., Horng Shin Footwear Co., Kinetec Medical Products Ltd, Mephisto, New Balance, and Watts Footwear |

| Additional Attributes | Dollar sales trends, market share of leading players, growth drivers in healthcare footwear, consumer preferences for comfort and medical functionality, regulatory impact, and future demand forecasts in key regions. |

The global medical footwear market is estimated to be valued at USD 11.4 billion in 2025.

The market size for the medical footwear market is projected to reach USD 21.2 billion by 2035.

The medical footwear market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in medical footwear market are shoes, sandals and others.

In terms of end user, women segment to command 52.7% share in the medical footwear market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.