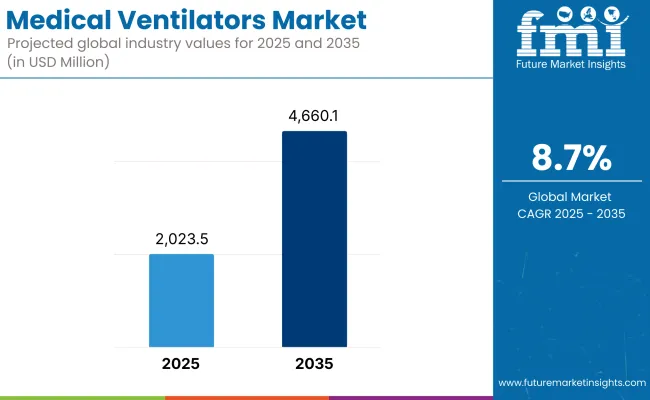

The global medical ventilators market is estimated to be valued at USD 2,023.5 million in 2025 and is projected to reach USD 4,660.1 million by 2035, registering a CAGR of 8.7% over the forecast period.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 2,023.5 million |

| Market Value (2035F) | USD 4,660.1 million |

| CAGR (2025 to 2035) | 8.7% |

The medical ventilators market has been shaped by sustained demand for advanced respiratory support solutions across critical care, emergency response, and perioperative settings. Heightened awareness of respiratory health and preparedness for pandemics has driven substantial investments in ventilator manufacturing capacity and technology upgrades.

Healthcare providers have prioritized procurement of devices with enhanced monitoring capabilities, integration with electronic health records, and improved patient safety features. Manufacturers have responded by developing versatile platforms capable of both invasive and non-invasive ventilation modes, addressing a spectrum of patient acuity levels. Hospitals have increasingly adopted ventilators with intelligent modes and closed-loop control algorithms to optimize oxygen delivery and weaning protocols.

Proposals for portable ventilators, smart respiratory sensors, and telemedicine-enabled remotely controlled ventilators improve patient care, portability, and ease of use. The emergence of home-based ventilator therapy, hybrid ventilation models, and integrated oxygen therapy solutions provides additional market prospects.

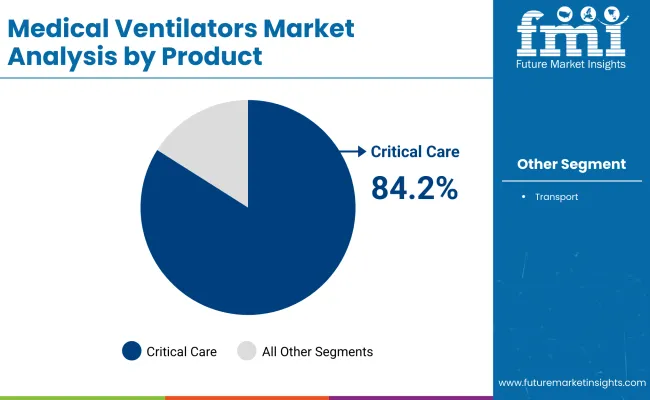

In 2025, Critical Care Ventilators is estimated to hold a revenue share of 84.2% which has been attributed to their essential role in managing severe respiratory failure and complex patient conditions. Advances in sensor technologies and closed-loop control systems have enhanced the safety and effectiveness of critical care ventilators, supporting clinician confidence in high-acuity environments.

Manufacturers have invested in developing modular platforms with multiple ventilation modes, ensuring adaptability across diverse patient populations and clinical scenarios. Procurement decisions have been influenced by regulatory standards and accreditation requirements that mandate the availability of advanced ventilator support capabilities.

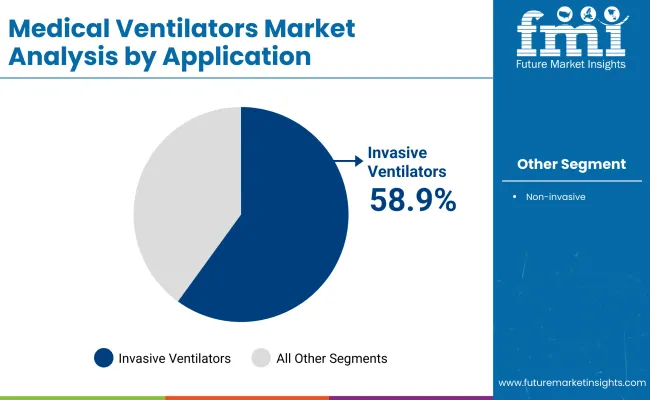

Invasive Ventilators is estimated to dominate the market with a revenue share of 58.9% has been attributed to their established role as the primary modality for managing acute respiratory distress and perioperative ventilation. Clinical protocols in intensive care and surgical units have consistently recommended invasive ventilation for cases requiring prolonged support or precise control of tidal volume and pressure parameters.

Technological improvements have been directed toward enhancing alarm systems, infection control measures, and integration with patient monitoring platforms. These factors collectively maintained invasive ventilators as the dominant technology segment, with continued growth expected as chronic respiratory disease prevalence increases globally.

Hospitals have accounted for 72.5% of market revenue, driven by their role as primary providers of advanced respiratory care and intensive monitoring. Adoption has been supported by sustained investment in critical care infrastructure, including dedicated ICU expansion and modernization of ventilator fleets.

Procurement strategies have prioritized devices offering comprehensive ventilation modes, integrated data management, and compatibility with hospital information systems. Regulatory and accreditation requirements have further reinforced hospitals’ role as the central hub for ventilator utilization.

High Costs and Access Limitations

Medical ventilators not only provide lung ventilation but also prevent death of patients; however, high cost, unavailability in developing countries, expensive use of advanced ventilators, and risks of ventilator-associated pneumonia (VAP) remain major challenges. Moreover, raw material sourcing issues for ventilator production in the supply chain also affect stability in the market.

AI-Powered Ventilation and Home-Based Respiratory Care

The growth of this market is driven by the increasing adoption of AI-powered respiratory monitoring, Portable home-use ventilators, and Autonomously controlled Smart ventilator technologies. Long-term market growth is anticipated to be fueled by developments in wireless remote-controlled ventilators, real-time oxygen saturation analytics, and hybrid models of respiratory therapy.

Furthermore, an increase in sustainable, energy-efficient ventilator activities and smart Intensive Care Unit (ICU) automation, as well as the provision of environmentally sound emergency health plans by certain governments, are also contributing to the rising demand for next-generation ventilators.

The USA will continue to dominate the medical ventilators market due to the high demand in critical care settings for respiratory support, the increase in prevalence of respiratory diseases, including COPD and ARDS, and an increase in investments in advanced technologies for life-support systems.

The growing demand further drives the market, need for portable and non-invasive solutions, as well as AI-integrated patient-monitoring systems. In addition, recent advances in high-flow oxygen therapy, variable-controlled ventilatory modes, and remotely-operated ventilators are leading to further improvements in patient outcomes. Telemedicine's growing role in critical care and the use of real-time data analytics in ventilator management are among trends shaping the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 9.0% |

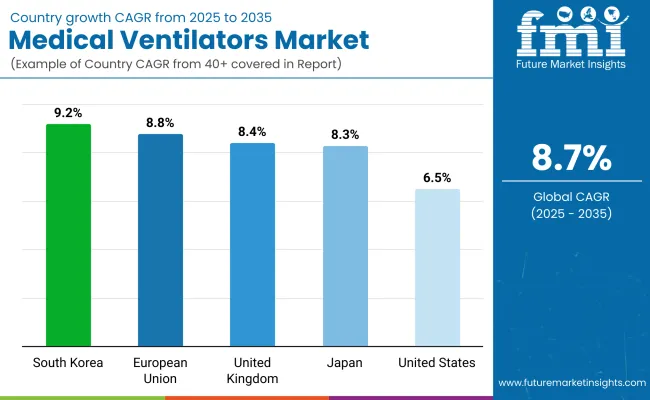

The UK Medical Ventilators market is poised to grow at steady rates over the forecast period due to the increasing investments in healthcare infrastructure, growing demand for home-based ventilation solutions, and increasing regulations on emergency preparedness for respiratory pandemics. Market adoption is propelled by the penetration of smart ventilators with remote connectivity and automated adjustment of oxygen levels.

Moreover, the growing application of compact, wearable, and battery-operated ventilators in long-term respiratory care settings is also driving the market growth. The movement toward AI-assisted ventilator management and predictive maintenance for hospital ICU equipment is additionally driving industry growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 8.4% |

The European Union medical ventilators market primarily includes Germany, France, and Italy, wherein Germany possesses the maximum market share in the medical ventilators market, owing to the prevailing growth in modernization of healthcare infrastructure, high penetration in the adoption of non-invasive ventilation, and increasing prevalence of chronic respiratory disorders.

The European Union (EU) is committed to advancing digital health transformation, embracing embedded artificial intelligence (AI), using it in areas like ventilatory support and making integrated patient monitoring systems more efficient, with the end goal of getting the technology to market faster.

Moreover, the industry's innovation is on a surge, owing to the development of precise oxygen delivery with sensor-based ventilator technologies and advancement in lung-protecting ventilation strategies. The increasing adoption of tele-ICU solutions and cloud-based ventilator fleet management in hospitals is also contributing to the market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.8% |

The growth of Japan’s medical ventilators market can be attributed to factors such as an increasing elderly population demanding high-efficiency ventilators, rising investments in developing AI-integrated respiratory support devices, and strong governmental funding for emergency medical preparedness.

The country’s leadership in robotic-assisted healthcare is spurring advances in automated ventilator control and real-time respiratory surveillance. Another trend in the industry is the advent of machine learning algorithms for optimizing the use of the ventilator and weaning protocols for patients. Additionally, the proliferation of compact, quiet, and energy-efficient ventilator models for use in homecare environments is likely to further fuel demand for ventilation devices in the coming years.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.3% |

The combination of the country’s focus on smart ventilation technology and remote patient monitoring systems is fuelling demand for next-generation ventilators. Furthermore, developing automated ventilator-tuning algorithms, real-time recording of oxygenation rates, and implementing IoT-based ventilator management systems are increasing market availability. This is further propelling the growth of the market for activities, such as the rise of ventilator rental services, as well as homecare ventilation solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.2% |

The medical ventilators market is anticipated to be pushed by rising needs for critical care respiratory care, technological improvements in ventilator technology, and the increasing incidence of respiratory ailments like COPD, asthma, and issues similar to COVID-19.

The market is growing steadily, with widening applications in hospitals, home healthcare, and emergency medical services. Some of the key trends that are driving the industry include AI-enabled ventilators, portable and homecare ventilators, and improved patient monitoring ability.

Key Development

In 2024, Air Liquide Medical Systems launched Monnal™ TEO, a new resuscitation ventilator offering its brand new ICU ventilator entirely designed and manufactured in France

In 2024, Mindray launched its new line of transport ventilators, the TV50 and TV80, at the 7th EuroAsia Conference.

The overall market size for the medical ventilators market was USD 2,023.5 million in 2025.

The medical ventilators market is expected to reach USD 4,660.1 million in 2035.

The demand for medical ventilators will be driven by increasing prevalence of respiratory diseases, rising demand for intensive care units (ICUs), growing aging population with chronic conditions, and advancements in portable and non-invasive ventilator technologies.

The top 5 countries driving the development of the medical ventilators market are the USA, China, Germany, Japan, and India.

The non-invasive ventilators segment is expected to command a significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Silicone Radiopaque Vascular Ties Market Size and Share Forecast Outlook 2025 to 2035

Medical Indoor Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Medical Eye Shield Film Market Size and Share Forecast Outlook 2025 to 2035

Medical Far Infrared Therapy Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Latex Protective Suit Market Size and Share Forecast Outlook 2025 to 2035

Medical Activated Carbon Dressing Market Size and Share Forecast Outlook 2025 to 2035

Medical Coated Roll Stock Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Medical Pressure Mapping System Market Size and Share Forecast Outlook 2025 to 2035

Medical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Face Shield Market Forecast and Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA