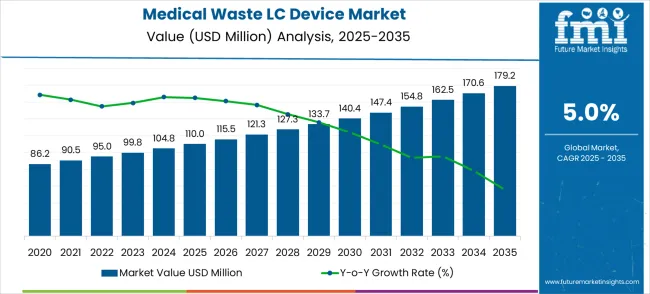

The medical waste liquid collection device market, valued at USD 110.0 million in 2025, is anticipated to reach USD 179.2 million by 2035, reflecting a CAGR of 5.0%. The early years, spanning 2025 to 2027, indicate a phase of foundational growth where adoption is primarily driven by healthcare facilities upgrading waste management systems to comply with evolving regulations. During this stage, the market demonstrates moderate expansion, with revenues gradually increasing from USD 110.0 million to around USD 121.3 million. This initial period highlights limited penetration in small and medium-scale hospitals and clinics, where budgetary constraints and lack of awareness restrict early adoption.

From 2027 to 2030, the market exhibits a steady upward trajectory, reaching approximately USD 140.4 million. This stage represents the transition toward broader acceptance across hospital networks and specialized medical facilities. Demand growth is fueled by stricter compliance standards, increased awareness of infection control, and growing concerns over hazardous liquid waste disposal. Despite consistent growth, the market begins to show early signs of saturation in mature regions, such as North America and Europe, where most healthcare providers have already implemented standardized liquid waste collection systems.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 110.0 million |

| Market Forecast Value (2035) | USD 179.2 million |

| Forecast CAGR (2025–2035) | 5.0% |

Between 2030 and 2033, the growth curve starts flattening slightly, indicating the approach of saturation points. By 2033, the market reaches nearly USD 162.5 million, with incremental gains coming from replacements, upgrades, and expansion in developing regions. The relatively modest CAGR of 5.0% underscores the limited scope for explosive expansion, focusing that growth is now concentrated in secondary markets where hospitals and clinics are modernizing infrastructure. The reliance on regulatory enforcement ensures a steady flow of demand, but high penetration in mature markets constrains accelerated growth opportunities.

By 2035, the market achieves USD 179.2 million, confirming that the saturation point in mature regions has largely been reached. The remaining growth is supported by aftermarket services, maintenance contracts, and incremental adoption in emerging markets. Market participants must focus on innovation in device efficiency, integration with automated waste management systems, and cost-effective solutions to sustain growth. The saturation point analysis illustrates a market that is stable and steadily expanding, with predictable revenue streams but limited potential for dramatic spikes, requiring strategic targeting of underpenetrated regions to maximize long-term value.

Market expansion is being supported by the increasing surgical procedure volumes across global healthcare systems and the corresponding need for safe, efficient liquid waste management solutions that protect healthcare workers and ensure regulatory compliance. Modern surgical environments require sophisticated waste collection systems that provide superior safety profiles while supporting operational efficiency and environmental protection. The excellent safety characteristics and automated operation of medical waste liquid collection devices make them essential components in contemporary healthcare facilities where infection control and worker safety are paramount.

The growing focus on healthcare worker safety and environmental protection is driving demand for advanced waste management technologies from certified manufacturers with proven track records of safety and regulatory compliance. Healthcare facilities are increasingly investing in automated liquid waste collection systems that offer reduced exposure risks and improved operational efficiency over manual waste handling methods. Safety regulations and environmental standards are establishing performance benchmarks that favor automated collection systems with demonstrated safety profiles and environmental benefits.

The market is segmented by device type, application, and region. By capacity specifications, the market is divided into small devices (capacity 1L~2L), medium devices (capacity 2L~5L), and large devices (capacity greater than 5L). Based on application, the market is categorized into operating room and other healthcare applications. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Medium capacity devices (2L~5L) are projected to account for 45% of the medical waste liquid collection device market in 2025. This leading share is supported by the optimal balance between collection capacity and operational practicality that medium-sized devices provide in most surgical environments. Medium devices offer suitable capacity for typical surgical procedures while maintaining manageable weight and handling characteristics, making them the preferred choice for general operating rooms, outpatient surgical centers, and specialty procedure suites. The segment benefits from versatility across multiple surgical specialties, cost-effective operation, and compatibility with standard medical facility infrastructure.

Modern medium capacity liquid waste collection devices incorporate advanced vacuum systems, automated sensing technologies, and safety shut-off mechanisms that ensure optimal performance while protecting healthcare workers from exposure to potentially infectious materials. These innovations have significantly improved operational efficiency and safety outcomes while reducing maintenance complexity through user-friendly design and reliable performance characteristics. The general surgery and specialty procedure sectors particularly drive demand for medium capacity solutions, as these applications require dependable waste collection that supports diverse surgical procedures without operational disruption.

The ambulatory surgery center and outpatient facility markets increasingly adopt medium capacity devices for applications where operational flexibility and cost-effectiveness are essential considerations. The integration of smart monitoring systems and predictive maintenance capabilities creates opportunities for enhanced operational reliability and reduced total cost of ownership, further accelerating market adoption as facilities seek efficient yet dependable waste management solutions.

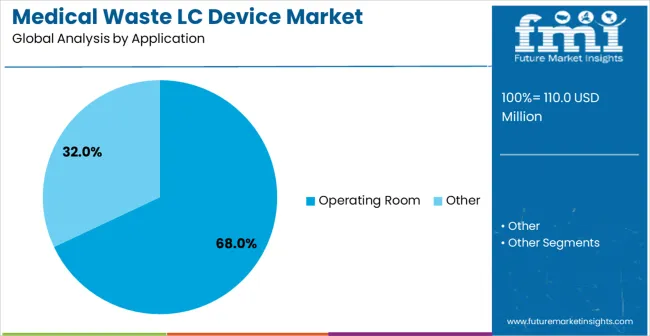

Operating room applications are expected to represent 68% of medical waste liquid collection device demand in 2025. This dominant share reflects the primary environment where significant volumes of liquid medical waste are generated during surgical procedures and require immediate, safe collection and containment. Operating rooms require specialized waste collection systems for surgical irrigation fluid management, blood and body fluid collection, and contaminated liquid waste handling. The segment benefits from increasing surgical volumes globally and growing complexity of surgical procedures requiring advanced waste management support.

Operating room applications demand exceptional reliability and safety performance to ensure uninterrupted surgical workflow and protection of surgical teams from exposure to potentially infectious materials. These applications require collection devices capable of handling variable liquid volumes, maintaining sterile environments, and operating continuously during extended surgical procedures. The growing focus on surgical safety and infection control drives consistent demand for proven liquid waste collection systems that demonstrate safety benefits and operational reliability. Major hospital systems and surgical centers contribute significantly to market growth as facilities invest in advanced waste management technologies to improve surgical outcomes and protect healthcare workers.

The trend toward minimally invasive surgical techniques and robotic surgery in operating environments creates opportunities for specialized collection systems designed for precision procedures with unique waste management requirements. The segment also benefits from increasing same-day surgical procedures and surgical center expansion requiring efficient waste management solutions that support high-volume operations.

The market is advancing steadily due to increasing surgical procedure volumes and growing recognition of healthcare worker safety importance in medical waste management. The market faces challenges including high initial equipment costs compared to manual collection methods, maintenance requirements for automated systems, and varying regulatory standards across different healthcare regions. Regulatory harmonization efforts and cost-benefit demonstration programs continue to influence adoption patterns and market penetration rates.

The growing deployment of IoT-enabled monitoring systems and automated safety features is enabling real-time waste volume tracking and enhanced safety protection in liquid waste collection applications. Smart sensors and monitoring systems provide continuous tracking of collection status while optimizing disposal scheduling and preventing overflow conditions. These technologies are particularly valuable for high-volume surgical facilities that require reliable waste management and comprehensive safety monitoring without manual intervention.

Modern device manufacturers are incorporating environmental friendly materials and energy-efficient operation systems that reduce environmental impact while maintaining superior waste collection performance. Integration of recyclable components and reduced energy consumption enables environmentally responsible waste management and significant sustainability improvements compared to traditional disposal methods. Advanced manufacturing techniques and green design principles also support development of cost-effective devices with extended service life and reduced environmental footprint.

| Country | CAGR (2025–2035) |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| Brazil | 5.3% |

| United States | 4.8% |

| United Kingdom | 4.3% |

| Japan | 3.8% |

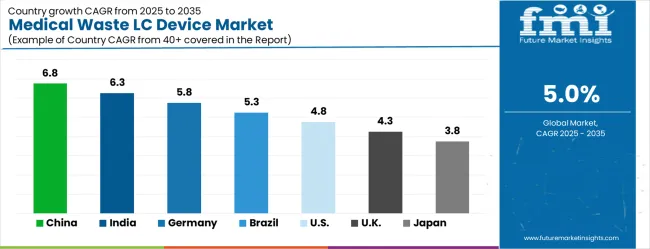

The market is growing rapidly, with China leading at a 6.8% CAGR through 2035, driven by massive healthcare infrastructure expansion, increasing surgical volumes, and growing focus on healthcare worker safety protocols. India follows at 6.3%, supported by expanding healthcare facilities and growing awareness of medical waste management importance in infection control. Germany records strong growth at 5.8%, focusing clinical safety standards, environmental regulations, and advanced healthcare facility management. Brazil grows steadily at 5.3%, integrating modern waste management systems into expanding healthcare infrastructure and surgical facilities. The United States shows moderate growth at 4.8%, focusing on safety regulation compliance and healthcare facility modernization. The United Kingdom maintains steady expansion at 4.3%, supported by NHS safety protocols and medical waste management initiatives. Japan demonstrates stable growth at 3.8%, focusing technological innovation and precision healthcare facility management.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

China is projected to grow at a CAGR of 6.8% from 2025 to 2035, driven by increasing hospital infrastructure, healthcare modernization programs, and stricter biohazard regulations. Rising awareness of infection control and safe disposal of medical waste has reinforced the adoption of liquid collection devices across urban and semi-urban hospitals. Large metropolitan healthcare centers in Beijing, Shanghai, and Guangzhou are emerging as major hubs due to concentrated patient volumes and advanced clinical operations. Domestic manufacturers are focusing on cost-effective, high-capacity collection systems, while collaborations with international suppliers are introducing advanced safety-compliant and automated devices. Integration of liquid collection systems into overall hospital waste management protocols is becoming standard practice, supporting consistent market expansion.

India is forecasted to grow at a CAGR of 6.3% between 2025 and 2035, supported by rapid expansion of hospitals, diagnostic centers, and urban clinics. The adoption of liquid collection devices is reinforced by regulatory mandates for biohazard disposal and infection control. Key adoption hubs include Maharashtra, Karnataka, and Tamil Nadu, where healthcare infrastructure is dense and patient volumes are high. Domestic suppliers are producing affordable devices suitable for varying hospital sizes, while international companies are providing technologically advanced automated systems. Integration of liquid collection devices into broader biomedical waste management strategies is driving procurement. Growing awareness among hospital administrators regarding contamination prevention is further boosting market demand.

Germany is expected to grow at a CAGR of 5.8% between 2025 and 2035, driven by advanced hospital infrastructure and strict biohazard management regulations. Hospitals and clinical research facilities require high-capacity, automated liquid waste collection systems to maintain hygiene and comply with safety standards. Adoption is concentrated in regions such as Bavaria, Baden Württemberg, and North Rhine Westphalia, which host large healthcare and research networks. German manufacturers are leading innovations in automated, sensor-based devices, while imports supplement highly specialized needs. Integration of liquid collection systems into hospital-wide waste management processes ensures efficiency and minimizes contamination risks. The focus on infection control and operational safety continues to sustain steady market growth.

Brazil is projected to grow at a CAGR of 5.3% between 2025 and 2035, driven by increasing hospital modernization programs and stricter public health regulations. Liquid collection devices are increasingly adopted in metropolitan hospitals and diagnostic laboratories to ensure compliance with biohazard protocols. São Paulo and Rio de Janeiro have emerged as leading adoption hubs due to concentration of advanced healthcare infrastructure. Domestic suppliers focus on cost-efficient devices suitable for large hospital networks, while international companies provide high-capacity automated solutions. Integration into hospital-wide biomedical waste management strategies reinforces adoption. Continuous efforts to improve infection control protocols across hospitals support the steady growth of the market in Brazil.

The United States is expected to expand at a CAGR of 4.8% between 2025 and 2035, influenced by hospital modernization, laboratory expansion, and strict federal regulations on biohazard management. Hospitals, research facilities, and diagnostic centers are adopting liquid collection devices with integrated safety features and automation to reduce contamination risks. Adoption is concentrated in states such as California, Texas, and New York, where healthcare infrastructure is highly developed. Domestic manufacturers focus on efficiency, ergonomics, and compliance, while imports supplement specialized high-capacity and automated solutions. Integration of liquid collection devices into comprehensive hospital waste management systems reinforces procurement and operational efficiency.

The United Kingdom is forecasted to grow at a CAGR of 4.3% between 2025 and 2035, supported by stringent biohazard management regulations and increasing hospital modernization initiatives. Adoption of liquid collection devices is concentrated in London, Manchester, and Birmingham, where healthcare facilities maintain high patient volumes and advanced clinical operations. UK-based suppliers focus on producing ergonomically designed and safe devices, while imports from Europe provide technologically advanced and automated solutions. Hospital administrators are integrating liquid collection systems into broader biomedical waste management protocols to enhance safety and operational efficiency. Continuous regulatory enforcement and infection control awareness are driving steady adoption across the country.

Japan is projected to grow at a CAGR of 3.8% between 2025 and 2035, influenced by advanced hospital networks, strict infection control protocols, and efficient waste management practices. Adoption of liquid collection devices is concentrated in Tokyo, Osaka, and Nagoya, where hospitals and research centers implement high-standard safety measures. Domestic manufacturers are producing precision-engineered, high-quality devices, while imports from Europe and the USA complement specialized needs. Integration into hospital-wide biomedical waste management programs ensures compliance and operational efficiency. The long-term outlook remains positive, supported by steady healthcare infrastructure upgrades and strong regulatory oversight of biohazard disposal.

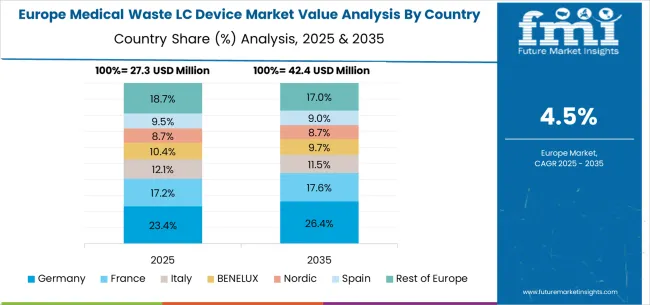

The medical waste liquid collection device market in Europe is projected to grow from USD 29.7 million in 2025 to USD 48.3 million by 2035, registering a CAGR of 5.0% over the forecast period. Germany is expected to maintain its leadership with a 31.8% share in 2025, supported by its comprehensive healthcare system and advanced medical facility management infrastructure. The United Kingdom follows with 18.2% market share, driven by NHS protocols and medical waste management initiatives. France holds 15.4% of the European market, benefiting from healthcare facility modernization and safety compliance programs. Italy and Spain collectively represent 21.3% of regional demand, with growing focus on healthcare worker safety and facility management applications. The Rest of Europe region accounts for 13.3% of the market, supported by healthcare development in Eastern European countries and Nordic medical facility systems.

The market is defined by competition among established medical device manufacturers, specialized waste management companies, and regional healthcare equipment suppliers. Companies are investing in advanced vacuum technologies, safety system innovations, regulatory compliance programs, and technical support capabilities to deliver safe, efficient, and reliable liquid waste collection solutions. Strategic partnerships, clinical validation, and geographic expansion are central to strengthening product portfolios and market presence.

Skyline Medical, operating globally, offers comprehensive liquid waste collection solutions with focus on automated operation, safety protection, and regulatory compliance support. Stryker provides advanced medical waste management systems with focus on surgical environment integration and operational efficiency. Cardinal Health, multinational healthcare provider, delivers comprehensive waste management technologies with focus on safety and cost-effectiveness. Bertin Technologies offers specialized waste collection equipment with advanced automation and monitoring capabilities.

Tesalys provides innovative liquid waste management systems with focus on environmental sustainability and operational excellence. Zhende Medical delivers regionally focused waste collection solutions with focus on Asian healthcare markets. Amsino MEDICAL offers comprehensive medical device solutions with waste management applications. Suzhou Riyuexing Plastic provides specialized manufacturing capabilities for waste collection systems.

Jiangsu Lifeng Biological Technology offers specialized waste management expertise and regional manufacturing capabilities across domestic and international healthcare markets.

The market underpins healthcare worker safety, infection control, environmental protection, and operational efficiency. With safety regulation mandates, environmental compliance requirements, and demand for automated waste management solutions, the sector must balance cost effectiveness, safety performance, and operational reliability. Coordinated contributions from governments, healthcare systems, manufacturers, safety organizations, and investors will accelerate the transition toward automated, safe, and environmentally responsible liquid waste management systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 110.0 million |

| Classification Type | Small Device (Capacity 1L~2L), Medium Device (Capacity 2L~5L), Large Device (Capacity Greater than 5L) |

| Application | Operating Room, Other |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, and other 40+ countries |

| Key Companies Profiled | Skyline Medical, Stryker, Cardinal Health, Bertin Technologies, Tesalys, Zhende Medical, Amsino MEDICAL, Suzhou Riyuexing Plastic, Jiangsu Lifeng Biological Technology |

| Additional Attributes | Dollar sales by device type and application, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established medical device manufacturers and specialized suppliers, buyer preferences for different capacity specifications and automation features, integration with advanced safety monitoring and environmental compliance technologies, innovations in vacuum systems and automated operation for enhanced worker protection and operational efficiency, and adoption of smart waste management solutions with IoT connectivity and predictive maintenance capabilities for improved facility management and safety outcomes. |

The global medical waste liquid collection device market is estimated to be valued at USD 110.0 million in 2025.

The market size for the medical waste liquid collection device market is projected to reach USD 179.2 million by 2035.

The medical waste liquid collection device market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in medical waste liquid collection device market are medium device (capacity 2l~5l), small device (capacity 1l~2l) and large device (capacity greater than 5l).

In terms of application, operating room segment to command 68.0% share in the medical waste liquid collection device market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Silicone Radiopaque Vascular Ties Market Size and Share Forecast Outlook 2025 to 2035

Medical Indoor Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Medical Eye Shield Film Market Size and Share Forecast Outlook 2025 to 2035

Medical Latex Protective Suit Market Size and Share Forecast Outlook 2025 to 2035

Medical Activated Carbon Dressing Market Size and Share Forecast Outlook 2025 to 2035

Medical Coated Roll Stock Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Medical Pressure Mapping System Market Size and Share Forecast Outlook 2025 to 2035

Medical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Face Shield Market Forecast and Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Medical Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Medically Supervised Weight Loss Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA